In this essay we will discuss about:- 1. Importance of Product Pricing 2. Product Pricing-Concern for Marketing Management 3. Outlines of Pricing Problem 4. Kinds of Pricing Problems or Decisions 5. Economic Theory in Product Pricing.

Essay on the Pricing of Products

Essay Contents:

- Essay on the Importance of Product Pricing

- Essay on the Product Pricing-Concern for Marketing Management

- Essay on the Outlines of Pricing Problem

- Essay on the Kinds of Pricing Problems or Decisions

- Essay on the Economic Theory in Product Pricing

Essay # 1. Importance of Product Pricing:

Pricing of goods and services is of very crucial importance not only from the view-point of the firm but also from the consumers and society. It determines the success of business, consumer satisfaction and efficient allocation of resources in the economy. It is a major element in ‘marketing mix’ and directly affects the earnings and creates sales revenue of a business firm.

Pricing policy must be formulated in order to achieve:

1. Survival of the firm,

2. Profits sufficient to cover cost of goods and to yield a return which will satisfy the shareholders and reinvest in business,

3. Market share,

4. Competitors’ strategy, and

5. Public image.

Essay # 2. Product Pricing-Concern for Marketing Management:

Before determining the pricing methods, the marketing management should:

1. Know the cost of goods and understand the factors that affect the cost of a unit of product both in the short-run and long-run (variable cost and fixed cost);

2. Gauge the nature of demand, whether it is elastic, inelastic or very elastic;

3. Analyse and study the nature of competition in the sense that the price should not be much above the competitor’s price nor much below it, because both lead to loss over a period.

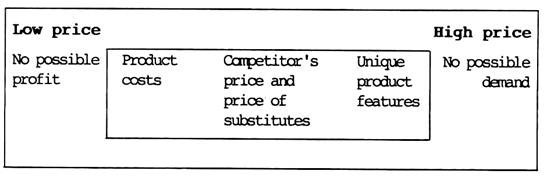

According to Philip Kotler, the actual price that is set must be a floor price to meet the competitors’ prices and unique product quality and features. Kotler further stresses that a company should resolve its pricing issue by selecting a pricing method that includes one or more of these considerations and that the pricing method will then hopefully lead to a specific price.

He illustrates these characteristics by the following diagram:

Essay # 3. Outlines of Pricing Problem:

The management’s pricing decisions are only one way in which a company can influence the sale of its products. Price is more than a multiplier to be applied to unit sales to determine sales promotion efforts.

A situation that seems to indicate a deficiency in the effectiveness of the sales force may actually have arisen because of a poor system of pricing. Conversely, a situation that seems to call for a raising or lowering of price may actually be remedied better by changes in the company’s methods of sales promotion. Thus, pricing is one of the factors that influence sales.

Essay # 4. Kinds of Pricing Problems or Decisions:

Pricing decisions are made in a wide variety of circumstances. An exhaustive list of pricing problems or decisions is difficult to be made.

However, the possible circumstances under which pricing decisions are generally made may be as follows:

1. A new product, related or unrelated, has been developed for addition to the product line.

2. A mass market exists but, difficult to be penetrated at existing prices.

3. A prospective buyer makes an offer to purchase a product at a specified price.

4. An opportunity arises to bid for a special order for a custom product to be manufactured according to the buyer’s ‘specifications or engineered to meet his specific requirements.

5. The historical profit statements indicate that same products, or all-products in the aggregate, have been yielding lower profits than management deems necessary for long-term survival of a company.

6. The marketing management reports that substantial losses in the volume of sales have occurred due to customer resistance to the existing prices.

In addition to the above short-listed pricing situations, the other problems of importance include:

(i) The determination of the discount structure for different categories of customers,

(ii) The relationships between the prices of substitute or complementary products or between the prices of different sizes or qualities of products of a particular type,

(iii) On-season and off-season differentials, and

(iv) Geographic structure of prices, and so on.

Essay # 5. Economic Theory in Product Pricing:

According to the microeconomic theory, the general approach to product pricing is that analysis for pricing is merely a special kind of incremental analysis. The optimum price is the price that will, yield the maximum excess of total revenues over total cost.

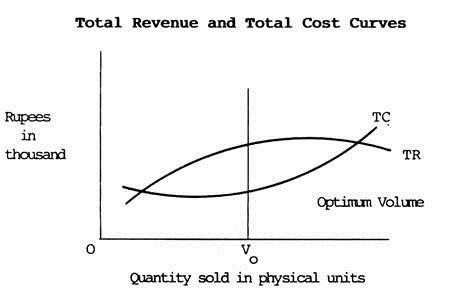

The economist uses the following diagram to illustrate this concept:

If an unlimited number of units of the product could be sold at the same price, the total revenue line (TR) would be a straight line rising from the zero point in the lower left-hand corner of this diagram. In most market situations, however, it is assumed that additional products can be sold only by reducing prices or increasing promotional effort per unit sold.

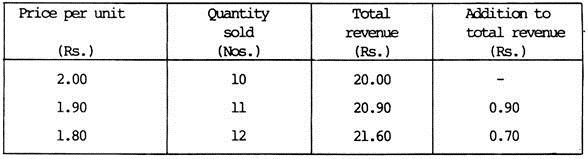

This means that although total sales revenue will increase as more and more units are sold, the rate of increase of total revenue will decline gradually as sales expand. For example, if 10 units can be sold at a price of Rs. 2, 11 units can be sold at a price of Rs. 1.90 and 12 units can be sold at a price of Rs. 1.80.

Expressing the same in a table, we get:

Lowering the price from Rs. 2.00 to Rs. 1.90 increases total revenue by Rs. 0.90; a further reduction to Rs. 1.80 increases total revenue by only Rs. 0.70. In the curve shown above, this falling off in the rate of increase in total revenue is represented by a gradual reduction in the steepness of the total revenue line as further price reductions become less and less effective in stimulating sales.

The total cost line (TC), in the foregoing graph, is gradually becoming steeper as volume increases due to increasing difficulty of expanding output with a’ given set of productive facilities. As long as total revenue is climbing more rapidly than total cost, total profit will increase with increases in volute.

At some point, however, the two rates of climb will became equal, which means that the increase in total cost due to the addition of one more unit of volume is just equal to the increase in total revenue, or a zero increase in total profit.

The volume at which this occurs is indicated in the graph as Volume Vo at which the slopes of the two curves are equal and the curves are parallel. To the right of this point total cost is increasing more rapidly than total revenue, which means that any attempt to increase volume beyond Vo will reduce total profit. Vo, therefore, is the optimum volume, and the price at which this volume can be obtained is the optimum price.

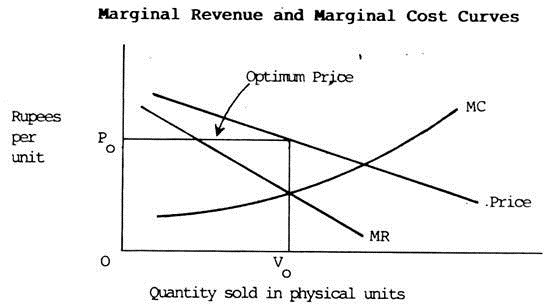

These relationships can also be expressed in terms of marginal revenue (MR) and marginal cost (MC). Marginal revenue (MR) is defined by economists as the increase in total revenue that results from the sale of one additional unit of product. In the previous example, the marginal revenue from sale of the 11th’ unit was Re. 0.90; from sale of the 12th unit it was Re. 0.70.

Similarly, marginal cost (MC) is the increment in total cost as a result of increasing volume by one unit. Marginal revenue and marginal cost at any volume are determined by measuring the rates of climb or slopes of the total revenue and total cost curves, respectively. (In mathematical terms, marginal revenue is the derivative of total revenue with respect to volume).

The marginal revenue and marginal cost curves are shown in the graph below:

The marginal revenue is less than price because a price reduction lowers the revenue from all units that would be sold at higher prices.

For example, if 10 units can be sold at a price of Rs. 2/= per unit and 11 units can be sold if the price is Rs. 1.90, the marginal revenue at a volume of 11 units is:

{(11xRs.1.90) – (10xRs.2)} = Rs.20.90 – Rs.20 = Re. 0.90.

The optimum price is determined by the intersection of the marginal revenue and marginal cost curves. Lowering the price below this level would increase revenues by less than it would increase costs. Raising the price above the optimum would decrease revenues by more than it would decrease costs.

Limitations of the Economic Theory Model:

Although this economic theory model illustrates the general nature of incremental profit approach to product pricing, it is very much oversimplified.

The limitations are:

1. The available data are seldom good enough to give management more than a rough idea of the shape of the revenue curve.

2. The revenues depend on many factors other than the company’s own price.

For example, company can seldom assume that its decision as to price will not induce retaliatory pricing decisions by the competing firms. The circumstances under which this assumption is valid are those of monopoly or monopolistic competition.

In an oligopoly market situation, the marginal revenue curve of the individual seller depends on the reactions’ of his competitors to changes in his selling prices.

If the oligopolistic seller finds that his competitors will raise their selling prices when he raises his and lowers their prices when he lowers his, then his revenue curve or ‘demand curve’ takes the same general shape as the demand curve for the market as a whole, except in so far as the product differentiation affects the price sensitivity of his sales.

If, on the other hand, he finds that his competitors will match his price reductions but will not follow his price increases, then a different situation arises. If one seller tries to raise his prices, his sales will fall off sharply as customers shift their purchases to other firms whose prices have not risen.

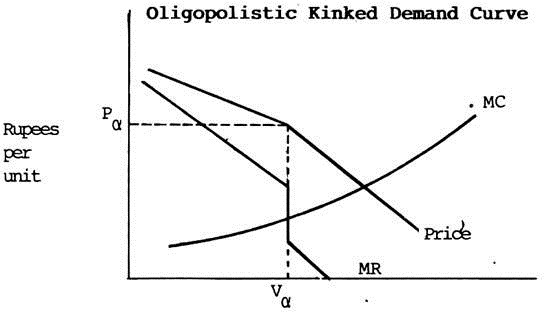

If he lowers his prices, on the other hand, his competitors will follow suit and the only source of increased revenue will be this ‘seller’s share of any general expansion of total industry sales. This effect is highlighted in the following graph, in which both the price curve or demand curve and the marginal revenue curve are interrupted or ‘Kinked’ at the sales volume (Vα) expected at the existing price (Pα).

Although marginal revenue at this volume may be greater than marginal cost (as in the graph above), any attempt to expand volume by price reductions will produce a substantial drop in marginal revenue. In this illustration, the reduced marginal revenue is less than the marginal cost; and thus the price reduction would be unprofitable.

A ‘Kink’ of this sort is likely to appear immediately only if most other firms in the industry are not operating at the limits of practical capacity. If capacity is fully utilised, then competitors might find it profitable to meet any price rise, which would eliminate the ‘Kink’.

If they do not raise their prices but cannot absorb any additional volume immediately, the ‘Kink’ effect will not be felt by the high-price seller until outside capacity has grown sufficiently to permit competitors, to take advantage of all the orders that are forthcoming at the existing prices.

If most sellers suspect the existence of a ‘Kink’ of the kind illustrated here and if they also assume that total industry sales are ‘inelastic’ or relatively insensitive to price reductions, then this is enough to explain why prices in many oligopolistic industries do not decline significantly during the period of idle capacity.