Here is an essay on ‘Secondary Market’ for class 11 and 12. Find paragraphs, long and short essays on ‘Secondary Market’ especially written for school and college students.

Essay on Secondary Market

Essay Contents:

- Essay on the Introduction to Secondary Market

- Essay on the Meaning of Secondary Market

- Essay on the Functions of Secondary Market

- Essay on the Secondary Market—Organisation

- Essay on the Secondary Market—Instruments

- Essay on the Status of the Indian Secondary Market for Equity

Essay # 1. Introduction to Secondary Market:

The Secondary market contributes to the growth and expansion of business and ultimately it benefit the economy and its people. It provides an ideal conduit through which enormous amounts of capital flows through the interconnected network of financial organizations to all corporate enterprises in the country.

It plays a pivotal role in the economy facilitating the flow of domestic and overseas investment funds to productive enterprises. The flow of investment funds into these enterprises is crucial to economic growth, job creation, and raising living standards. The secondary market in India has shown maturity in recent years by registering enormous growth in terms of the number of listed companies, market capitalization, market value of listed companies to gross national product, number of shareholders, and so on.

Essay # 2. Meaning of Secondary Market:

The initial offering of stocks and bonds to investors is by definition done in the primary market and their subsequent trading is done in the secondary market. The secondary market is the financial market for trading of securities that have already been issued in an initial private or public offering.

When people talk about trading on the stock market, they are generally referring to the secondary market, which involves brokers, market makers and an exchange providing a technical platform for trades to take place.

Once a newly issued stock is listed on a stock exchange, investors and speculators can easily trade on the exchange, as market makers provide bids and offers in the new stock. The companies and their shares are the subject of the trading, but they are not directly involved as participants.

According to Section 2(3) of the Securities Contract Regulation Act, 1956 “The Stock exchange has been defined as anybody of individuals whether incorporated or not, constituted for the purpose of assisting, regulating or controlling the business of buying, selling or dealing in securities.”

Essay # 3. Functions of Secondary Market:

a. Raising Capital for Businesses:

The Stock Exchange provides companies with the facility to raise capital for expansion through selling shares to the investing public. It allows for quick capital formation. It acts as a show piece of securities issued by corporate enterprises and government agencies.

It enables investors to know about the current market prices of various securities and decide about their investment. Thus it facilitates capital formation and in turn contributes to the development and promotion of the economy through accelerated industrial development.

b. Mobilizing Savings for Investment:

When people draw their savings and invest in shares, it leads to a more rational allocation of resources because funds, which could have been consumed, or kept in idle deposits with banks, are mobilized and redirected to promote business activity with benefits for several economic sectors such as agriculture, commerce and industry, resulting in a stronger economic growth and higher productivity levels.

In this way, it provides opportunity to all investors, both individual and institutional to invest their surplus funds into various financial instruments. Thus, stock markets assist in capital formation process in the economy.

c. Providing Market for Securities:

An important function of a stock exchange is to provide a continuous, ready, open and broad based market for securities. In this way liquidity, marketability and uniformity in prices is ensured for securities. The liquidity advantage of the stock exchange enables investors to sell and purchase the securities at their convenience.

Further it is also possible for them to sell their securities at the best quoted price and thus, convert their investments into cash at the shortest possible time. This advantage of ready market encourages investment of funds in industrial securities. The price quotations of securities in the stock exchanges enable suppliers of capital to know the real worth of the security from time to time.

d. Liquidity:

Liquidity is a factor influencing the investment decisions of individuals. It concerns with and purchase of securities, quickly easily and at reasonable prices. It is related with depth, breadth and resiliency of the market. Depth relates to buy and sell orders around the price at which a share is transacted and breadth refers to the adequate volume of orders and response of orders to price changes in scrip indicates its resilience.

The broad indicators of market liquidity are frequency of sales, narrow spread between bids and offers, and prompt execution of orders and minimum price changes between transactions as they occur.

e. Facilitate Growth of Companies:

Companies view acquisitions as an opportunity to expand product lines, increase distribution channels, hedge against volatility, increase its market share, or acquire other necessary business assets. A takeover bid or a merger agreement through the stock market is one of the simplest and most common ways to company’s growing by acquisition or fusion.

F. Redistribution of Wealth:

By giving a wide spectrum of people a chance to buy shares and therefore become part-owners (shareholders) of profitable enterprises, the stock market helps to reduce large income inequalities. Both casual and professional stock investors through stock price increases and dividends get a chance to share in the profits of promising business that were set up by other people.

As opposed to other businesses that require huge capital outlay, investing in shares is open to both the large and small stock investors because a person buys the number of shares he can afford. Thus, the Stock Exchange provides an extra source of income to small savers.

g. Corporate Governance:

Companies tend to improve on their management standards and efficiency in order to satisfy the demands of the shareholders and the more stringent rules for public corporations by stock exchanges and the government. Thus stock exchanges ensure better management practices in public limited companies than privately-held companies.

h. Provides Safety to Investors:

One of the fundamental functions of a stock exchange is to provide adequate safety to investors from fraud and manipulation caused due to activities of speculators, members, brokers, etc. The Securities Contract (Regulation) Act (SCRA), 1956 provides this safety. The SCRA contains rules and regulations relating to the listing of securities, admission of members, trading mechanism, disclosure of material information, transparency, delivery, penalties, etc.

The Securities Exchange Board of India (SEBI) also regulates the working of the stock exchanges with a view to provide safety to investors by periodically issuing guidelines on matters connected with securities trading.

i. Governments Raise Capital for their Projects:

Governments at various levels borrow money in order to finance their projects by selling securities known as bonds. These bonds can be raised through the Stock Exchange where members of the public and the financial institutions such as LIC, Banks, Provident Funds and Pension Funds institutions buy them, thus loaning money to the government.

The issuance of such municipal bonds obviates the need to directly tax the citizens to finance development. Stock exchanges act as platforms for mopping up public debt to execute the schemes of planned projects.

j. Barometer of the Economy:

At the stock exchange, share prices rise and fall depending, largely, on market forces. Share prices tend to rise or remain stable when companies and the economy in general show signs of stability and growth. The price movement of securities on a stock exchange indicates the state of health of not only industrial companies but also of the economy of the nation as a whole.

An economic recession, depression, or financial crisis could lead to a stock market crash. Therefore the movement of share prices and in general of the stock indices can be an indicator of the general trend in the economy. Thus stock market indices act as a barometer of the business conditions and progress of the business in the country.

Essay # 4. Secondary Market—Organisation:

A stock exchange, share market or bourse is a corporation or mutual organization which provides facilities for stock brokers and traders, to trade company stocks and other securities. It also provides facilities for the issue and redemption of securities, as well as, other financial instruments and capital events including the payment of income and dividends.

The organisation of the secondary market includes Stock exchanges, Stock brokers, sub-brokers, foreign brokers, trading and clearing members, custodial services, depository services and stock lending schemes. The regulatory framework of the stock exchanges and organisation set up have changed a lot with the introduction of reforms in the capital market.

Buyers and sellers include individual investors and institutional investors such as pension funds, insurance companies, mutual funds, hedge funds, investor groups, foreign institutional investors, banks, etc.

Essay # 5. Secondary Market—Instruments:

The securities traded on a stock exchange include- shares issued by companies, unit trusts and other pooled investment products and bonds. To be able to trade a security on a certain stock exchange, it has to be listed there.

According to the Securities Contract Regulation Act, 1956 the following securities can be traded at the stock exchange:

(a) Shares, scrips, stocks, bonds, debentures, debenture stocks or marketable securities of a like nature in or of any incorporated company or other body corporate;

(b) Government securities and

(c) Rights or interest in securities.

Essay # 6. Status of the Indian Secondary Market for Equity:

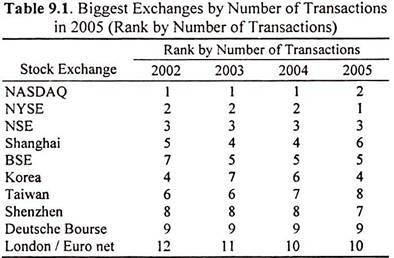

The trading intensity of Indian stock exchanges is impressive by world standards. Among the biggest exchanges, measured by the number of trades per calendar year, the National Stock Exchange (NSE) retained rank 3 in all the four years (Table 9.1).

The Bombay Stock Exchange (BSE) climbed from rank 7 to rank 5 between 2002 and 2003, and has stayed at rank 5 ever since. The Shanghai exchange lost ground, going from rank 4 to rank 6 in the latest year.

Returns from the Market:

Both Nifty (index of the top 50 stocks of the country) and the Nifty Junior (the second-tier index of the next 50 stocks) have delivered strong positive returns in the recent four-year period. From January 2002 to December 2005, the Nifty index went from 1,075 to 2,837, giving compound returns of 27.45 percent per year. From January 2002 to December 2005, the Nifty Junior index went from 1,349 to 5,541, giving compound returns of 42.36 percent per year.

The impressive returns on indexes through the recent four years have been associated with fairly stable Price to Earnings ratios. The bulk of the returns were obtained through growth in earnings of companies. At the end of calendar 2005, the market capitalisation of Nifty at Rs. 13.5 lakh crore and the Nifty Junior at Rs. 2.2 lakh crore, added up to Rs. 15.7 lakh crore or roughly two-thirds of the broad Indian equity market (2,540 companies with Rs. 24.7 lakh crore of market value).

Volatility:

The uncertainties associated with the general elections of 2004 resulted in elevated volatility in the January 2004 to December 2005 period when compared with the preceding two years. The volatility of the equity market in 2005 was at a low level.

While this partly reflected the end of the uncertainty associated with the general elections of 2004, the volatility was also lower than that in the preceding two years. In contrast, equity volatility globally was reduced. In particular, the US Standard & Poor 500 was a remarkably low volatility asset in the recent two years, with a weekly volatility of just 1.41 percent.

Liquidity:

The best measure of liquidity is the ‘impact cost’ which is inherent when doing transactions on the secondary market. A liquid market is one where the cost of transactions is low. The impact cost for purchase or sale of Rs.50 lakh of the Nifty portfolio has dropped steadily and sharply through the recent four years, from a level of 0.12 percent in 2002 to 0.08 percent in 2005.

Similarly, the impact cost for doing purchase or sale of Rs.25 lakh of the Nifty Junior index has dropped steadily and sharply through the recent four years, from a level of 0.41 percent in 2002 to 0.16 percent in 2005. These improvements suggest a substantial gain in liquidity on the Indian equity market in recent years. In addition, the gap between the liquidity of Nifty and that of Nifty junior has also dropped sharply.

This shows the percolation of liquidity beyond the top 50 stocks. These improvements demonstrate the success of the reforms programme on the equity market which has been undertaken from 1993 onwards. In absolute terms, these values are impressive by world standards.

Turnover in Stock Markets:

NSE and BSE cash segment turnovers added up to Rs. 23.9 lakh crore in 2005-06, and NSE and BSE derivatives turnover added up to Rs. 48.24 lakh crore with about 15.76 crore contracts during 2005-06. Both these values showed significant growth when compared with the previous year. The total equity market turnover went up from Rs. 43 lakh crore in 2004 to Rs. 60.2 lakh crore in 2005. This growth is partly mere arithmetic, for rupee turnover goes up commensurate with higher stock prices.

Demat Accounts:

In terms of the composition of market participants, the equity market continued to be dominated by retail investors. The number of depository accounts at NSDL continued to grow rapidly, with a rise of 21.9 percent in 2005, which corresponds to over 5,000 accounts being opened per working day.

In addition to NSDL, CDSL had 1,270,071 accounts as of 2005. The sum of NSDL and CDSL accounts stood at 85 lakh. The demat quantity at both the depositories touched 2.2 lakh million shares as of August, 2006 with NSDL accounting for 1.9 lakh million shares and CDSL accounting for the rest.