Here is an essay on the ‘Delisting of Shares’ for class 11 and 12. Find paragraphs, long and short essays on the ‘Delisting of Shares’ especially written for school and college students.

Essay on Delisting of Shares

Essay # 1. Introduction to Delisting of Shares:

The term “delisting” of securities means permanent removal of securities of a listed company from a stock exchange. Because of delisting, the securities of that company would no longer be traded at that stock exchange. Delisting may be compulsory or voluntary.

Delisting from Indian stock exchanges has become a major issue for the financial regulator and the finance ministry to tackle. Almost every shareholder/investor has faced a scenario of having shares of a company that is seeking delisting from the stock exchange.

Essay # 2. Types of Delisting:

i. Compulsory Delisting:

Compulsory delisting refers to permanent removal of securities of a listed company from a stock exchange as a penalizing measure at the behest of the stock exchange for not making submissions/comply with various requirements set out in the listing agreement within the time frames prescribed.

In such a case there is no provision for an exit route for the shareholders except that the stock exchanges would allow trading in the securities under the permitted category for a period of one year after delisting. In scenarios like mergers and amalgamations and under legal directions for sick companies under Bureau for Industrial and Financial Reconstruction, companies can be delisted.

The SEBI has asked the stock exchanges to set up a panel of experts to determine the fair value of shares of companies that may be delisted for non-compliance with the listing agreements. The promoter of the company, whose shares are delisted, shall be liable to compensate the investors by paying them the fair value, fixed by the panel of experts, as per the recent amendment.

ii. Voluntary Delisting:

In voluntary delisting, a listed company decides on its own to permanently remove its securities from a stock exchange. There are more companies today which seek delisting from stock exchanges due to various factors. There are several methods to delist from the Indian stock exchanges. Companies may upon request get voluntarily delisted from any stock exchange other than the regional stock exchange for the company, following the delisting guidelines.

In such cases, the companies are required to obtain prior approval of the holders of the securities sought to be delisted, by a special resolution at a General Meeting of the company. The shareholders will be provided with an exit opportunity by the promoters or those who are in the control of the management.

Companies can get delisted from all stock exchanges following the substantial acquisition of shares. The regulation state that if the public shareholding slides to 10 percent or less of the voting capital of the company, the acquirer making the offer, has the option to buy the outstanding shares from the remaining shareholders at the same offer price.

Essay # 3. SEBI (Delisting of Securities) Guidelines, 2003:

A committee set up by the Securities and Exchange Board of India (SEBI) in 2002 recommended a ‘reverse booking building’ process that would allow investors themselves to determine the price at which companies delisted their shares from the bourses. SEBI chose to accept the committee’s recommendation and in budget 2003, it adopted ‘reverse book building’ method for pricing open offers.

It addressed India Incorporated’s fears by mandating that the discovered price will be one at which the most number of bids are received. This eliminates the possibility of a few investors sabotaging the deal by bidding too high and it protects ignorant investors who may give away their shares too cheap.

SEBI (Delisting of Securities) Guidelines, 2003 provide an exit mechanism, whereby the exit price for voluntary delisting of securities is determined by the promoter of the concerned company which desires to get delisted, in accordance to book building process.

SEBI Guidelines provide the following process for delisting:

I. The exit price for delisting should be in accordance with the book-building process;

II. The offer price should have a floor price (a minimum base price) which will be the average of 26 weeks traded price and without a maximum price;

III. Market forces will determine the price above the base price. Stock exchanges will provide the infrastructure to ensure transparency whereby investors can see the prices on screens;

IV. To reduce risk of price manipulation, the scrip will be under watch by the exchanges.

Comprehensive provisions should include procedures governing the entire subject of delisting of securities of companies, and should cover cases in which companies on their own seek delisting of their securities from all or some of the stock exchanges, as well as those where the stock exchanges can compulsorily delist the securities of a company.

Reverse Book-Building Process:

The book-building process is the process of securing the optimum price for a company’s share. The issuing company decides the price of the security by asking investors how many shares and at what price they would be interested in which is adopted when an initial public offering or divestment is made.

In this reverse book building process the buying company asks the investors how many shares and at what price they would be interested in selling their shares? It is called the ‘reverse’ book-building process because the aim is to sell the shares (exit from the company) while in the case of the normal book-building the process is to buy the shares (and invest into the company). Reverse book-building process would provide the transparent and fair mechanism to price shares and would ensure investors’ participation in the whole delisting process.

The process which would be adopted is similar to that adopted in the initial public offering process where a book is kept open for a specific number of days. The details like floor price, methodology to be adopted for an acceptable price, period of open offer) will be disclosed when the book-building process commences through the appointment of a merchant banker. The floor price for the acquisition shall be specified but no ceiling price.

In case of infrequently traded securities, the offer price is as per Regulation 20(5) of SEBI (Substantial Acquisition and Takeover) Regulations. For this purpose, infrequently traded securities are determined in the manner as provided in Regulation 20(5) of SEBI (Substantial Acquisition and Takeover) Regulations.

Delisting so Far:

Delisting of Indian operations from Indian bourses by Multinational Corporation parents has gathered momentum since 1998. The buy-back of securities introduced to provide a reasonable rate for the underpriced shares, together with voluntary de-listing enabled a large number of multinational companies to buy securities from individual investors and de-list from Indian stock exchanges.

Till date, nearly 30 MNCs have already delisted their operations in India and are operating as 100 percent subsidiaries. Another 20 to 25 are in various stages of delisting process i.e., negotiating with Indian joint venture partners to buy out their stake, getting permission from Foreign Investment Promotion Board, increasing their shareholding either through open market operations or through various rounds of open offers.

This forcibly shunts out individual investors from many companies such as Cadbury, Otis, etc. The move to de-list from stock exchanges has caused much heartburn among investors and market analysts.

Delisting of the Indian operations has received a lot of flak from investors, especially from small scale investors. Retail investors feel that delisting has a narrowing effect on Indian stock market, given the dearth of good companies available for investment. At times, Indian investors are not averse to delisting per se, but serious doubts have been raised regarding the modus operandi in the whole delisting process.

By February 2005, the reverse book-building route had been adopted in a dozen cases (as per data on the National Stock Exchange website). Of these, as many as 10 companies had accepted the price sought by a majority of their shareholders. Of the 10 successful cases of reverse book building, data shows investors of seven companies have exited the stock at or near the reserve price fixed by the company.

These investors either believed that the reserve price was fair, or were simply happy to get out. Given the widespread investor anguish over the loss of investment opportunities due to companies delisting their shares, the data suggests investors have used their power to decide the exit price fairly maturely.

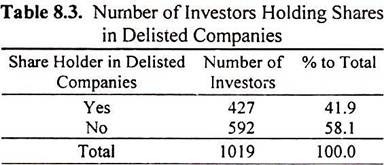

In this background the investors were enquired about their experiences with delisting of shares. The investors were enquired whether they hold shares of any delisted companies. Nearly 42% of the investors are shareholders in delisted companies.

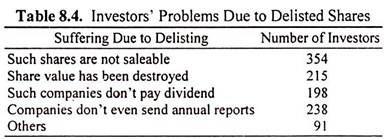

The ways in which these investors suffered due to delisting was further enquired.

Their responses are given in the following table:

Table 8.4 brings out the sufferings of the investors due to delisting of shares. Investors who are shareholders in delisted companies have selected more than one statement that expresses their concern. Many shareholders of delisted companies felt bad because those shares are not saleable.

Many of them also felt that those shares’ value has been destroyed; the companies do not pay dividend and they do not even send annual reports. In effect, those shares have become invalid assets.

Some comments from the investors are listed below:

a. The companies don’t even respond to any communication.

b. Whether the Company’s registered office is functioning itself a question?

c. Shares are not transferable to any demat account.

d. This system to be withdrawn. To call itself a public limited company, there should be a minimum percentage of public holding.

e. I do not know what to do with these shares?

f. No trace of the company.

Thus delisting of companies has caused hardships to the common investor. In the direction of reducing hardship to common investor, the Finance Ministry and SEBI have stipulated that public limited companies to be called so will henceforth maintain minimum public holding (non-promoter) level of 25 percent on a continuous basis.

Conclusion:

Buy-back of shares is permitted to return surplus cash to the shareholders, increasing underlying share value, supporting share prices during temporary weakness, and preventing or blocking hostile takeover, for reducing the number of shareholders to reduce the cost for servicing them, etc.

It seems that the investors were of the opinion that buy-back of shares does not benefit them. They opine that buy-back of shares helps promoters to increase their stake in the company and later it leads to delisting of shares from the stock exchanges.

The term “delisting” means permanent removal of securities of a listed company from a stock exchange. The buy-back of securities together with voluntary de-listing enables companies to buy securities from individual investors and de-list from Indian stock exchanges.

Nearly 42% of the investors are shareholders in delisted companies. The sufferings of the investors due to delisting of shares include those shares are not saleable, those shares’ value has been destroyed; the companies do not pay dividend and do not even send annual reports. In effect, those shares have become invalid assets of investors.