Here is an essay on the ‘Buy-Back of Shares’ for class 11 and 12. Find paragraphs, long and short essay on the ‘Buy-Back of Shares’ especially written for school and college students.

Essay on the Buy-Back of Shares

Essay Contents:

- Essay on the Introduction to Buy-Back of Shares

- Essay on the Objectives of Buy-Back of Shares

- Essay on the Resources for Buy-Back of Shares

- Essay on the Procedure for Buy-Back of Shares

- Essay on the Buy-Back of Shares under Companies Act

- Essay on the SEBI’s Buy-Back Regulations

ADVERTISEMENTS:

ADVERTISEMENTS:

Essay # 1. Introduction to Buy-Back of Shares:

Shares bought back by a company from its shareholders are termed as buy-back of shares. Earlier, public limited companies were prohibited from purchasing their shares. However, companies have been permitted since October 1998 by the Companies Act to purchase/buy-back their own shares or other specified securities.

In pursuance of the amendments in the company law regulations in 1998, SEBI has formulated buy-back regulations for listed companies. Buy-back of shares is permitted in many parts of the world.

Essay # 2

. Objectives of Buy-Back of Shares:

ADVERTISEMENTS:

The main objectives of buy-back of shares are to:

(a) Increase promoters holding,

(b) Increase earnings per share,

(c) Rationalise the capital structure by writing off capital not represented by available assets,

ADVERTISEMENTS:

(d) Support market price of the share,

(e) Thwart any takeover bid or

(f) Pay surplus cash not required by business.

In fact the best strategy to maintain the share price in a bear run is to buy-back the shares from the open market at a premium over the prevailing market price. Buy-back is also used as a financial strategy by corporate for streamlining the capital structure, swapping equity for debt, as well as for reducing the number of shareholders to reduce the cost for servicing them, etc.

ADVERTISEMENTS:

Essay # 3.

Resources for Buy-Back:

ADVERTISEMENTS:

A Company can purchase its own shares from out of:

(i) Free reserves; Where a company purchases its own shares out – of free reserves, then a sum equal to the nominal value of the share so purchased shall be transferred to the capital redemption reserve and details of such transfer shall be disclosed in the balance-sheet; or

(ii) Securities premium account; or

ADVERTISEMENTS:

(iii) Proceeds of any shares or other specified securities. A Company cannot buy-back its shares or other specified securities out of the proceeds of an earlier issue of the same kind of shares or specified securities.

Essay # 4.

Procedure for Buy-Back:

(i) Where a company proposes to buy-back its’ shares, it shall, after passing of the special/Board resolution make a public announcement in at least one English National Daily, one Hindi National Daily and a Regional Language Daily at the place where the registered office of the company is situated.

(ii) The public announcement shall specify a date, which shall be “specified date” for the purpose of determining the names of shareholders to whom the letter of offer has to be sent.

ADVERTISEMENTS:

(iii) A public notice shall be given containing disclosures as specified in Schedule I of the SEBI regulations.

(iv) A draft letter of offer shall be filed with SEBI through a merchant Banker. The letter of offer shall then be dispatched to the members of the company.

(v) A copy of the Board resolution authorising the buyback shall be filed with the SEBI and stock exchanges.

(vi) The date of opening of the offer shall hot be earlier than seven days or later than 30 days after the specified date.

ADVERTISEMENTS:

(vii) The buy-back offer shall remain open for a period of not less than 15 days and not more than 30 days.

(viii) A company opting for buy-back through the public offer or tender offer shall open an escrow Account.

Essay # 5.

Buy-Back of Shares under Companies Act:

In India, the Companies Act 1956, before 31.10.1998, restricted buy-back under section 77. The only way was to follow the cumbersome and time-consuming process of reduction of share capital with the permissions of the shareholders and the court under section 100 to 104 of this Act.

However, Sections 77A, 77AA and 77B were introduced by the Companies Amendment Act 1999, which allowed buy-back and dispensed with the requirement of seeking sanction of the court.

Pursuant to section 77A, 77AA, and 77B, a company may buy-back its own shares and other specified securities provided, inter alia, that:

ADVERTISEMENTS:

(i) The buy-back should be authorised by the Articles of Association of the company;

(ii) It is to be made from the existing security holders on a proportionate basis, through open market, holding odd lots or purchasing securities issued to the employees pursuant to a scheme of stock option or sweat equity;

(iii) The sources of funds are free reserves, securities premium account, or the proceeds of any shares or other specified securities;

(iv) A special resolution has to be passed. The notice of the general meeting shall accompany an explanatory statement containing full disclosures;

(v) The buy-back should not exceed 25% of the total paid-up share capital and free reserves of the company and buy-back of equity shares in any financial year should not exceed 25% of the total paid-up equity share capital in that financial year;

(vi) The debt equity ratio should not exceed 2:1;

ADVERTISEMENTS:

(vii) All shares or specified securities for buy back are fully paid up;

(viii) The buy-back has to be completed within 12 months from the date of passing of the special resolution;

(ix) A Declaration of Solvency has to be made by the Board of directors, before buy-back, to the effect that they have made full inquiry into the affairs of the company and have formed an opinion that the company is capable of meeting its liabilities and will not be rendered insolvent within a period of one year from the date of the Declaration.

Such Declaration has to be signed by at least two directors, one of whom shall be managing director, if any. It has then to be filed with concerned Registrar of Companies and SEBI;

(x) Where shares have been bought back from free reserves, a Capital Redemption Reserve Account has to be created which would be equal to nominal value of the shares bought back. This Reserve can be used, among others, for issue of bonus shares;

(xi) The shares have to be extinguished and physically destroyed within 7 days after buy-back;

ADVERTISEMENTS:

(xii) No further issue of same kind of securities is permitted within 24 months of completion of buy-back except by way of bonus issue or discharge of existing obligations such as conversion of warrants, preference shares, debentures, etc.;

(xiii) The company has to maintain a register of securities bought back and file a return with the concerned Registrar of Companies and SEBI within 30 days of completion of buy-back;

(xiv) The company is not directly or indirectly allowed to purchase its own securities through subsidiaries or investment companies; and

(xv) Buy-back cannot be affected where there is default by the company in repayment of deposit or interest, redemption of debentures or preference shares, payment of dividend, or repayment of loan or interest to financial institution or bank.

Essay # 6.

SEBI’s Buy-Back Regulations:

The Securities Exchange Board of India (SEBI) has notified SEBI (Buy-Back of Securities) Regulations 1998 applicable for listed companies, and the Central Government issued Private Limited Company and Unlisted Public Ltd Company (Buy-back of Securities) Rules 1999.

ADVERTISEMENTS:

Under this law, a company is permitted to buy-back its shares:

(a) From the existing shareholders on a proportionate basis through the tender offer i.e., by means of offer document,

(b) From open market through stock exchanges, and book building process, and

(c) From shareholders holding odd lot shares.

1. Buy-back is not allowed through negotiated deals or spot transactions or private arrangements.

2. There is freedom to fix the price of shares for buy-back. In case of buy-back through tender offer including odd lot shares, the price will be fixed through the special resolution and there is no provision for fixing maximum price. In case of buy-back through stock exchanges and book building process i.e., from open market, the maximum price has to be fixed through the buy-back special resolution.

ADVERTISEMENTS:

The final price will be fixed accordingly. In book building, the merchant banker and the company will have to determine the price based on acceptances received from the shareholders. The final price will be the highest price accepted.

3. Promoters can sell their shares through tender offer and also through purchase offer of odd lots. They are not permitted to deal in shares on stock exchanges during the buy-back offer is open. The company is also not permitted to buy-back shares from them.

4. The Explanatory Statement to be annexed to the notice of general meeting should have details, as per Schedule I of the Regulations. It has to contain a confirmation from the Board of the company that they have made full enquiry into the affairs and prospects of the company and formed the opinion that the company is/will be able to pay its debts, meet its liabilities and will not be rendered insolvent;

The explanatory statement should also contain the following particulars:

(a) Necessity of Buy-back.

(b) Method.

(c) Maximum amount required and the source of funds.

(d) The maximum price per share and the basis of arriving at the buy-back price.

(e) The number of shares proposed to be bought back.

(f) Aggregate shareholdings of promoters and directors of promoters. Also the particulars of sale/purchase made by them during last six months preceding the date of Board meeting till the date of notice of general meeting.

(g) Intention of promoters to buy-back.

(h) A confirmation that there are no defaults subsisting in repayment of deposits, redemption of debentures, and term loans.

(i) A report of the auditors of the company, addressed to the Board, stating that they have inquired into the company’s state of affairs and the amount of permissible capital payments for the shares is properly determined in their view. Moreover, the Board has formed opinion of solvency of the company on reasonable grounds.

5. The contents of Public announcement and letter of offer (such letter is only required in case of tender offer) have also been prescribed and appearing in Schedule II and III of the Regulations, respectively. These require more or less the same details stipulated for explanatory statement plus further details such as price, cost of financing, audited financial information, listing and stock market data, the time table, management discussion and analysis on impact of buy-back, and so on.

6. Merchant bankers have to be appointed.

7. Special resolution has to be filed with SEBI and Stock Exchanges within 7 days from the date of passing the resolution.

8. A public announcement for buy back has to be made by way of publication in English, Hindi and regional newspapers after passing of special resolution but before buy back. It shall specify the record date.

9. The consideration will have to be paid in cash.

10. The company is not allowed to withdraw the offer after the offer document is filed with SEBI or public announcement is made.

11. No public announcement is permitted to be made during the scheme of amalgamation, compromise or arrangement.

12. The company has to appoint compliance officer and establish an investor service center.

13. The shares which are locked-in or which are non-transferable are not allowed to be bought back.

14. The share certificates will have to be extinguished and destroyed in presence of the merchant banker and the auditor within 7 days from the date of acceptance of shares. The details thereof and certificate will have to be given to stock exchanges and SEBI within 7 days of date of destruction.

15. Advertisement has to be given in the newspapers within 2 days of completion of buy-back.

Special Provisions for Tender Offer Route Including Buy-Back of Odd Lot Shares:

(i) Within 7 working days of public announcement, the company has to file with SEBI, a letter of offer through merchant banker. The declaration of solvency has also to be similarly filed. Any modification suggested by SEBI has to be incorporated in the offer document.

(ii) A record date has to be fixed for the purpose of determining who will be entitled to get the Letter of offer. It shall not be earlier than 30 days and not later than 42 days from the date of public announcement.

(iii) Letter of offer has to be dispatched to the shareholders, as on the record date, not before 21 days from its submission to SEBI.

(iv) The offer should open not earlier than 7 days and not later than 30 days after the record date.

(v) The offer should remain open for minimum 15 days and maximum 30 days.

(vi) The verification of offer has to be completed within 15 days from the date closure of offer.

(vii) An Escrow account is to be opened and deposited therein specified amounts/securities etc. as security for performance of obligation of the company.

(viii) A special account should be opened with the banker for – payment in respect of buy-back. The amount in the Escrow account has to be transferred to that account immediately after the closure of offer. The balance amount has also to be deposited.

(ix) The company should make payment to the shareholders in cash, within 7 days from the expiry of 15 days fixed for completion of verification.

Special Provisions for Open Market Operations through Stock Exchanges:

(i) Buy-back process is allowed to commence at least 7 days after the public announcement.

(ii) Buy-back operations may remain open up to 12 months from the date of the general meeting passing the special resolution.

(iii) A copy of the public announcement has to be filed with SEBI within two days of such announcement.

(iv) The details of the brokers and the stock exchanges through whom or which buy-back will be made will have to be disclosed in the announcement.

(v) Buy-back should be made only on stock exchanges with electronic trading facility and through order matching mechanism. ‘All or None’ order matching system be excluded.

(vi) The company and the merchant banker have to inform the stock exchanges and publish in newspaper the information about shares bought back. This has to be done on a daily basis.

(vii) The verification of shares has to be completed within 15 days from the date of payout.

Special Provisions for Open Market Operations through Book Building:

(i) Buy-back has to commence at least 7 days after the public announcement.

(ii) An Escrow account has to be opened and deposit made before the public announcement. The law stipulated in this regard for tender offer route will apply.

(iii) A copy of the public announcement has to be filed with SEBI within two days of such announcement.

(iv) Public announcement will have to contain the detailed methodology of the process.

(v) Offer has to remain open for minimum 15 days and maximum 30 days.

(vi) Buy-back has to be made through electronically linked transparent facility. Moreover, number of bidding centers should be at least thirty and there has to be minimum one electronically linked computer terminal at all bidding centers.

(vii) The provisions of verifications of acceptance, opening of special accounts and payment of consideration will be the same as specified for the tender offer route.

Penalty:

If a company makes default in complying with the provisions the company or any officer of the company who is in default shall be punishable with imprisonment for a term which may extend to two years, or with fine up extend to fifty thousand rupees, or with both. The offences are, of course compoundable under Section 621A of the Companies Act, 1956.

The latest data suggests that buy back of shares through reverse book building, has not been much of a success. There are many factors such as lack of involvement of investors with physical shares in the price discovery process, confusion over the limit at which delisting is permitted and risk of misuse of system by persons bidding at abnormally high prices, which have resulted in limited participation of shareholders in the bidding process.

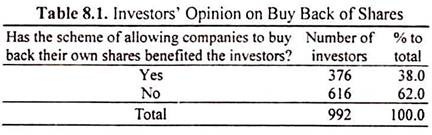

In this background the investors’ opinion on buy back of shares was collected. Table 8.1 presents their opinion.

The Table 8.1 reveals the investors opinion about the buyback of shares by listed companies. Thirty eight percent of the investors said that buy back has benefited investors and sixty two percent said otherwise. It seems that investors were of the opinion that buy back of shares does not benefit them.

The investors who were of the opinion that buy back benefits investors, were enquired about the ways in which the buyback of share benefits the shareholders?

Few of the comments of investors are listed below:

i. Company gives better than market price.

ii. It prevents shares from quoting too low in the stock market.

iii. Reasonable price—no broking charges and no risk.

iv. Price stability.

v. Companies reduce the shareholdings to the benefit of remaining shareholders.

vi. To increase shareholder’s return and/by providing a ‘support price’.

vii. Arbitrage opportunities. Sell at profit and reinvest in other company shares.

viii. It helps in the sale of illiquid stocks, providing an exit route.

ix. It gives a chance to the investor to get out of the company’s share.

x. This is not a right system. The promoters who have interest buy the shares at low price and delist the company shares.

xi. Even the promoters manipulate the loopholes and increase their stake.

xii. Benefited promoters to rig up the share price.

xiii. Eventually it leads to delisting of the company.

The comments are summarized as follows:

Through buy back ‘the company gives a better price than what is prevailing in the market’ is the opinion of some investors who gave their comments on the benefits of buy back to investors. Few investors saw it as an opportunity to exit from illiquid stocks and some of them also found an arbitrage opportunity in that by investing the realized amount in other stocks.

Other investors said that buy back helps in stabilizing the prices of the stock. However a large number of investors even though they said that buy back benefited investors, they pointed out buy back of shares help the promoters to buy their shares at low prices and eventually to delist the same from the market or it helps them to rig up the price of their shares to sell their personal holdings.

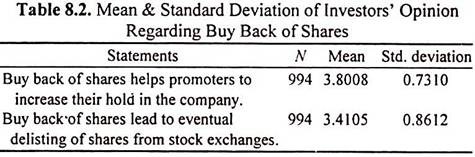

The investors’ level of agreement with the following statements ranging from strongly agree to strongly disagree was analysed. Table 8.2 presents the mean value and the standard deviation.

The Table 8.2 reveals that the investors are towards agreeing both the statements. This shows that investors opine that buy back of shares helps promoters to increase their stake in the company and later it leads to delisting of shares from the stock exchanges. The standard deviation is also small indicating that the investors are uniform in this opinion on buy back of shares. Thus, it can be summed up that investors do not see buy back of shares favourably.