Here is a compilation of essays on ‘Strategic Management’ for class 11 and 12. Find paragraphs, long and short essays on ‘Strategic Management’ especially written for college and management students.

Essay on Strategic Management

Essay Contents:

- Essay on the Introduction to Strategic Management

- Essay on the General Approaches of Strategic Management

- Essay on the Historical Development of Strategic Management

- Essay on the Psychology of Strategic Management

- Essay on the Process of Strategic Management

- Essay on the Criticisms of Strategic Management

Essay # 1. Introduction to Strategic Management:

Strategic management is the art and science of formulating, implementing and evaluating cross-functional decisions that will enable an organization to achieve its objectives. It is the process of specifying the organization’s objectives, developing policies and plans to achieve these objectives, and allocating resources to implement the policies and plans to achieve the organization’s objectives.

Strategic management, therefore, combines the activities of the various functional areas of a business to achieve organizational objectives. It is the highest level of managerial activity, usually formulated by the Board of directors and performed by the organization’s Chief Executive Officer (CEO) and executive team. Strategic management provides overall direction’ to the enterprise and is closely related to the field of Organization Studies.

“Strategic management is an ongoing process that assesses the business and the industries in which the company is involved; assesses its competitors and sets goals and strategies to meet all existing and potential competitors; and then reassesses each strategy annually or quarterly [i.e. regularly] to determine how it has been implemented and whether it has succeeded or needs replacement by a new strategy to meet changed circumstances, new technology, new competitors, a new economic environment, or a new social, financial, or political environment.”

Strategic management is a combination of three main processes namely:

1) Strategy formulation,

2) Strategy implementation, and

3) Strategy evaluation.

1. Strategy Formulation Involves:

i. Performing a situation analysis, self-evaluation and competitor analysis: both internal and external; both micro-environmental and macro-environmental.

ii. Concurrent with this assessment, objectives are set. This involves crafting vision statements (long term view of a possible future), mission statements (the role that the organization gives itself in society), overall corporate objectives (both financial and strategic), strategic business unit objectives (both financial and strategic), and tactical objectives.

iii. These objectives should, in the light of the situation analysis, suggest a strategic plan. The plan provides the details of how to achieve these objectives.

This three-step strategy formulation process is sometimes referred to as determining where you are now, determining where you want to go, and then determining how to get there. These three questions are the essence of strategic planning. SWOT Analysis: I/O Economics for the external factors and RBV for the internal factors.

2. Strategy Implementation Involves:

i. Allocation of sufficient resources (financial, personnel, time, technology support).

ii. Establishing a chain of command or some alternative structure (such as cross functional teams).

iii. Assigning responsibility of specific tasks or processes to specific individuals or groups.

iv. It also involves managing the process. This includes monitoring results, comparing to benchmarks and best practices, evaluating the efficacy and efficiency of the process, controlling for variances, and making adjustments to the process as necessary.

v. When implementing specific programs, this involves acquiring the requisite resources, developing the process, training, process testing, documentation, and integration with (and/or conversion from) legacy processes.

3. Strategy Evaluation Involves:

Measuring the effectiveness of the organizational strategy.

Essay # 2. General Approaches of Strategic Management:

In general terms, there are two main approaches, which are opposite but complement each other in some ways, to strategic management:

i. The Industrial Organization Approach:

a. Based on economic theory deals with issues like competitive rivalry, resource allocation, Economies of scale,

b. Based on economic theory deals with issues like competitive rivalry, resource allocation, economies of scale,

c. Assumptions rationality, self-discipline behavior, profit maximization assumptions- rationality, self-discipline behavior, profit maximization assumptions – rationality, self discipline behavior, profit maximization.

ii. The Sociological Approach:

a) Deals primarily with human interactions.

b) Assumptions – bounded rationality, satisfying behavior, and profit sub-optimality.

An example of a company that currently operates this way is Google.

Strategic management techniques can be viewed as bottom-up, top-down or collaborative processes. In the bottom-up approach, employees submit proposals to their managers who, in turn, funnel the best ideas further up the organization. This is often accomplished by a capital budgeting process. Proposals are assessed using financial criteria such as return on investment or cost-benefit analysis. The proposals that are approved form the substance of a new strategy, all of which is done without a grand strategic design or a strategic architect. The top-down approach is the most common by far.

In it, the CEO, possibly with the assistance of a strategic planning team, decides on the overall direction the company should take. Some organizations are starting to experiment with collaborative strategic planning techniques that recognize the emergent nature of strategic decisions.

Essay # 3. Historical Development of Strategic Management:

i. Birth of Strategic Management:

Strategic management as a discipline originated in the 1950s and 60s. Although there were numerous early contributors to the literature, the most influential pioneers were Alfred D. Chandler, Jr., Philip Selznick, Igor Ansoff, and Peter Drucker.

Alfred Chandler recognized the importance of coordinating the various aspects of management under one all-encompassing strategy. Prior to this time the various functions of management were separate with little overall coordination or strategy. Interactions between functions or between departments were typically handled by a boundary position, that is, there were one or two managers that relayed information back and forth between two departments.

Chandler also stressed the importance of taking a future looking long term perspective. In his 1962 groundbreaking work Strategy and Structure, Chandler showed that a long-term coordinated strategy was necessary to give a company structure, direction, and focus. He says it concisely, “structure follows strategy.”

In 1957, Philip Selznick introduced the idea of matching the organization’s internal factors with external environmental circumstances. This core idea was developed into what we now call SWOT analysis by Learned, Andrews, and others at the Harvard Business School General Management Group. Strengths and weaknesses of the firm are assessed in light of the opportunities and threats from the business environment.

Igor Ansoff built on Chandler’s work by adding a range of strategic concepts and inventing a whole new vocabulary. He developed a strategy grid that compared market penetration strategies, product development strategies, market development strategies and horizontal and vertical integration and diversification strategies. He felt that management could use these strategies to systematically prepare for future opportunities and challenges. In his 1965 classic Corporate Strategy, he developed the “gap analysis” still used today in which we must understand the gap between where we are currently and where we would like to be, then develop what he called “gap reducing actions”.

Peter Drucker was a prolific strategy theorist, author of dozens of management books, with a career spanning five decades. His contributions to strategic management were many but two are most important. Firstly, he stressed the importance of objectives. An organization without clear objectives is like a ship without a rudder. As early as 1954 he was developing a theory of management based on objectives. This evolved into his theory of management by objectives (MBO).

According to Drucker, the procedure of setting objectives and monitoring your progress towards them should permeate the entire organization, top to bottom. His other seminal contribution was in predicting the importance of what today we would call intellectual capital. He predicted the rise of what he called the “knowledge worker” and explained the consequences of this for management. He said that knowledge work is non-hierarchical. Work would be carried out in teams with the person most knowledgeable in the task at hand being the temporary leader.

In 1985, Ellen-Earle Chaffee summarized what she thought were the main elements of strategic management theory by the 1970s:

a) Strategic management involves adapting the organization to its business environment.

b) Strategic management is fluid and complex. Change creates novel combinations of circumstances requiring unstructured non-repetitive responses.

c) Strategic management affects the entire organization by providing direction.

d) Strategic management involves both strategy formation (he called it content) and also strategy implementation (he called it process).

e) Strategic management is partially planned and partially unplanned.

f) Strategic management is done at several levels: overall corporate strategy, and individual business strategies.

g) Strategic management involves both conceptual and analytical thought processes.

ii. Growth and Portfolio Theory:

In the 1970s much of strategic management dealt with size, growth, and portfolio theory. The PIMS study was a long term study, started in the 1960s and lasted for 19 years, that attempted to understand the Profit Impact of Marketing Strategies (PIMS), particularly the effect of market share. Started at General Electric, moved to Harvard in the early 1970s, and then moved to the Strategic Planning Institute in the late 1970s, it now contains decades of information on the relationship between profitability and strategy.

Their initial conclusion was unambiguous. The greater a company’s market share, the greater will be their rate of profit. The high market share provides volume and economies of scale. It also provides experience and learning curve advantages. The combined effect is increased profits.

The studies conclusions continue to be drawn on by academics and companies today: “PIMS provides compelling quantitative evidence as to which business strategies work and don’t work” – Tom Peters. The benefits of high market share naturally lead to an interest in growth strategies. The relative advantages of horizontal integration, vertical integration, diversification, franchises, mergers and acquisitions, joint ventures, and organic growth were discussed. The most appropriate market dominance strategies were assessed given the competitive and regulatory environment.

There was also research that indicated that a low market share strategy could also be very profitable. Schumacher (1973), Woo and Cooper (1982), Levenson (1984), and later Traverso (2002) showed how smaller niche players obtained very high returns.

By the early 1980s the paradoxical conclusion was that high market share and low market share companies were often very profitable but most of the companies in between were not. This was sometimes called the “hole in the middle” problem. This anomaly would be explained by Michael Porter in the 1980s.

The management of diversified organizations required new techniques and new ways of thinking. The first CEO to address the problem of a multi-divisional company was Alfred Sloan at General Motors. GM was decentralized into semi-autonomous “strategic business units” (SBUs), but with centralized support functions.

One of the most valuable concepts in the strategic management of multi-divisional companies was portfolio theory. In the previous decade Harry Markowitz and other financial theorists developed the theory of portfolio analysis. It was concluded that a broad portfolio of financial assets could reduce specific risk. In the 1970s marketers extended the theory to product portfolio decisions and managerial strategists extended it to operating division portfolios.

Each of a company’s operating divisions were seen as an element in the corporate portfolio. Each operating division (also called strategic business units) was treated as a semi-independent profit center with its own revenues, costs, objectives, and strategies. Several techniques were developed to analyze the relationships between elements in a portfolio. B.C.G. Analysis, for example, was developed by the Boston Consulting Group in the early 1970s.

This was the theory that gave us the wonderful image of a CEO sitting on a stool milking a cash cow. Shortly after that the G.E. multi factoral model was developed by General Electric. Companies continued to diversify until the 1980s when it was realized that in many cases a portfolio of operating divisions was worth more as separate completely independent companies.

iii. The Marketing Revolution:

The 1970s also saw the rise of the marketing oriented firm. From the beginnings of capitalism it was assumed that the key requirement of business success was a product of high technical quality. If you produced a product that worked well and was durable, it was assumed you would have no difficulty selling them at a profit. This was called the production orientation and it was generally true that good products could be sold without effort.

Encapsulated in the saying “Build a better mousetrap and the world will beat a path to your door.” This was largely due to the growing numbers of affluent and middle class people that capitalism had created. But after the untapped demand caused by the Second World War was saturated in the 1950s it became obvious that products were not selling as easily as they had been. The answer was to concentrate on selling. The 1950s and 1960s is known as the sales era and the guiding philosophy of business of the time is today called the sales orientation. In the early 1970s Theodore Levitt and others at Harvard argued that the sales orientation had things backward.

They claimed that instead of producing products then trying to sell them to the customer, businesses should start with the customer, find out what they wanted, and then produce it for them. The customer became the driving force behind all strategic business decisions. This marketing orientation, in the decades since its introduction, has been reformulated and repackaged under numerous names including customer orientation, marketing philosophy, customer intimacy, customer focus, customer driven, and market focused.

iv. The Japanese Challenge:

By the late 70s people had started to notice how successful Japanese industry had become. In industry after industry, including steel, watches, ship building, cameras, autos, and electronics, the Japanese were surpassing American and European companies. Westerners wanted to know why.

Numerous theories purported to explain the Japanese success including:

a) Higher employee morale, dedication, and loyalty;

b) Lower cost structure, including wages;

c) Effective government industrial policy;

d) Modernization after WWII leading to high capital intensity and productivity;

e) Economies of scale associated with increased exporting;

f) Relatively low value of the Yen leading to low interest rates and capital costs, low dividend expectations, and inexpensive exports;

g) Superior quality control techniques such as Total Quality Management and other systems introduced by W. Edwards Deming in the 1950s and 60s.

Although there was some truth to all these potential explanations, there was clearly something missing. In fact by 1980 the Japanese cost structure was higher than the American. And post WWII reconstruction was nearly 40 years in the past. The first management theorist to suggest an explanation was Richard Pascale.

In 1981 Richard Pascale and Anthony Athos in The Art of Japanese Management claimed that the main reason for Japanese success was their superior management techniques. They divided management into 7 aspects: Strategy, Structure, Systems, Skills, Staff, Style, and Subordinate goals (which we would now call shared values). The first three of the 7 S’s were called hard factors and this is where American companies excelled.

The remaining four factors (skills, staff, style, and shared values) were called soft factors and were not well understood by American businesses of the time. Americans did not yet place great value on corporate culture, shared values and beliefs, and social cohesion in the workplace. In Japan the task of management was seen as managing the whole complex of human needs, economic, social, psychological, and spiritual.

In America work was seen as something that was separate from the rest of one’s life. It was quite common for Americans to exhibit a very different personality at work compared to the rest of their lives. Pascale also highlighted the difference between decision making styles; hierarchical in America, and consensus in Japan. He also claimed that American business lacked long term vision, preferring instead to apply management fads and theories in a piecemeal fashion.

One year later The Mind of the Strategist was released in America by Kenichi Ohmae, the head of McKinsey & Co.’s Tokyo office. He claimed that strategy in America was too analytical. Strategy should be a creative art. It is a frame of mind that requires intuition and intellectual flexibility. He claimed that Americans constrained their strategic options by thinking in terms of analytical techniques, rote formula, and step-by-step processes. He compared the culture of Japan in which vagueness, ambiguity, and tentative decisions were acceptable, to American culture that valued fast decisions.

Also in 1982 Tom Peters and Robert Waterman released a study that would respond to the Japanese challenge head on. Peters and Waterman, who had several years earlier collaborated with Pascale and Athos at McKinsey & Co. asked “What makes an excellent company?” They looked at 62 companies that they thought were fairly successful. Each was subject to six performance criteria. To be classified as an excellent company, it had to be above the 50th percentile in 4 of the 6 performance metrics for 20 consecutive years. Forty-three companies passed the test. They then studied these successful companies and interviewed key executives. They concluded in In Search of Excellence that there were 8 keys to excellence that were shared by all 43 firms.

They are:

a. A Bias for Action:

Do it. Try it. Don’t waste time studying it with multiple reports and committees.

b. Customer Focus:

Get close to the customer. Know your customer.

c. Entrepreneurship:

Even big companies act and think small by giving people the authority to take initiatives.

d. Productivity through People:

Treat your people with respect and they will reward you with productivity.

f. Value Oriented CEOs:

The CEO should actively propagate corporate values throughout the organization.

g. Stick to the Knitting:

Do what you know well.

h. Keep Things Simple and Lean:

Complexity encourages waste and confusion.

j. Simultaneously Centralized and Decentralized:

Have tight centralized control while also allowing maximum individual autonomy.

The basic blueprint on how to compete against the Japanese had been drawn. But as J.E. Rehfeld (1994) explains it is not a straight forward task due to differences in culture. A certain type of alchemy was required to transform knowledge from various cultures into a management style that allows a specific company to compete in a globally diverse world. He says, for example, that Japanese style kaizen (continuous improvement) techniques, although suitable for people socialized in Japanese culture, have not been successful when implemented in the U.S. unless they are modified significantly.

v. Gaining Competitive Advantage:

The Japanese challenge shook the confidence of the western business elite, but detailed comparisons of the two management styles and examinations of successful businesses convinced westerners that they could overcome the challenge. The 1980s and early 1990s saw a plethora of theories explaining exactly how this could be done. They cannot all be detailed here, but some of the more important strategic advances of the decade are explained below.

Gary Hamel and C. K. Prahlad declared that strategy needs to be more active and interactive; less “arm-chair planning” was needed. They introduced terms like strategic intent and strategic architecture. Their most well-known advance was the idea of core competency. They showed how important it was to know the one or two key things that your company does better than the competition.

Active strategic management required active information gathering and active problem solving. In the early days of Hewlett-Packard (H-P), Dave Packard and Bill Hewlett devised an active management style that they called Management by Walking around (MBWA). Senior H-P managers were seldom at their desks. They spent most of their days visiting employees, customers, and suppliers.

This direct contact with key people provided them with a solid grounding from which viable strategies could be crafted. The MBWA concept was popularized in 1985 by a book by Tom Peters and Nancy Austin. Japanese managers employ a similar system, which originated at Honda, and is sometimes called the 3 G’s (Genba, Genbutsu, and Genjitsu, which translate into actual place”, “actual thing and “actual situation”).

Probably the most influential strategist of the decade was Michael Porter. He introduced many new concepts including; 5 forces analysis, generic strategies, the value chain, strategic groups, and clusters. In 5 forces analysis he identifies the forces that shape a firm’s strategic environment. It is like a SWOT analysis with structure and purpose. It shows how a firm can use these forces to obtain a sustainable competitive advantage.

Porter modifies Chandler’s dictum about structure following strategy by introducing a second level of structure: Organizational structure follows strategy, which in turn follows industry structure. Porter’s generic strategies detail the interaction between cost minimization strategies, product differentiation strategies, and market focus strategies. Although he did not introduce these terms, he showed the importance of choosing one of them rather than trying to position your company between them. He also challenged managers to see their industry in terms of a value chain. A firm will be successful only to the extent that it contributes to the industry’s value chain. This forced management to look at its operations from the customer’s point of view. Every operation should be examined in terms of what value it adds in the eyes of the final customer.

In 1993, John Kay took the idea of the value chain to a financial level claiming ” Adding value is the central purpose of business activity”, where adding value is defined as the difference between the market value of outputs and the cost of inputs including capital, all divided by the firm’s net output. Borrowing from Gary Hamel and Michael Porter, Kay claims that the role of strategic management is to identify your core competencies, and then assemble a collection of assets that will increase value added and provide a competitive advantage. He claims that there are 3 types of capabilities that can do this; innovation, reputation, and organizational structure.

The 1980s also saw the widespread acceptance of positioning theory. Although the theory originated with Jack Trout in 1969, it didn’t gain wide acceptance until Al Ries and Jack Trout wrote their classic book “Positioning: The Battle for Your Mind” (1979). The basic premise is that a strategy should not be judged by internal company factors but by the way customers see it relative to the competition. Crafting and implementing a strategy involves creating a position in the mind of the collective consumer.

Several techniques were applied to positioning theory, some newly invented but most borrowed from other disciplines. Perceptual mapping for example, creates visual displays of the relationships between positions. Multidimensional scaling, discriminant analysis, factor analysis, and conjoint analysis are mathematical techniques used to determine the most relevant characteristics (called dimensions or factors) upon which positions should be based. Preference regression can be used to determine vectors of ideal positions and cluster analysis can identify clusters of positions.

Others felt that internal company resources were the key. In 1992, Jay Barney, for example, saw strategy as assembling the optimum mix of resources, including human, technology, and suppliers, and then configure them in unique and sustainable ways.

Michael Hammer and James Champy felt that these resources needed to be restructured. This process, that they labeled reengineering, involved organizing a firm’s assets around whole processes rather than tasks. In this way a team of people saw a project through, from inception to completion. This avoided functional silos where isolated departments seldom talked to each other. It also eliminated waste due to functional overlap and interdepartmental communications.

In 1989 Richard Lester and the researchers at the MIT Industrial Performance Center identified seven best practices and concluded that firms must accelerate the shift away from the mass production of low cost standardized products.

The seven areas of best practice were:

a) Simultaneous continuous improvement in cost, quality, service, and product innovation,

b) Breaking down organizational barriers between departments,

c) Eliminating layers of management creating flatter organizational hierarchies,

d) Closer relationships with customers and suppliers,

e) Intelligent use of new technology,

f) Global focus, and

g) Improving human resource skills.

The search for “best practices” is also called benchmarking. This involves determining where you need to improve, finding an organization that is exceptional in this area, then studying the company and applying its best practices in your firm.

A large group of theorists felt the area where western business was most lacking was product quality. People like W. Edwards Deming, Joseph M. Juran, A. Kearney, Philip Crosby, and Armand Feignbaum suggested quality improvement techniques like Total Quality Management (TQM), continuous improvement, lean manufacturing, Six Sigma, and Return on Quality (ROQ).

An equally large group of theorists felt that poor customer service was the problem. People like James Heskett (1988), Earl Sasser (1995), William Davidow, Len Schlesinger, A. Paraurgman (1988), Len Berry, Jane Kingman-Brundage, Christopher Hart, and Christopher Lovelock (1994), gave us fishbone diagramming, service charting, Total Customer Service (TCS), the service profit chain, service gaps analysis, the service encounter, strategic service vision, service mapping, and service teams. Their underlying assumption was that there is no better source of competitive advantage than a continuous stream of delighted customers.

Process management uses some of the techniques from product quality management and some of the techniques from customer service management. It looks at an activity as a sequential process. The objective is to find inefficiencies and make the process more effective. Although the procedures have a long history, dating back to Taylorism, the scope of their applicability has been greatly widened, leaving no aspect of the firm free from potential process improvements. Because of the broad applicability of process management techniques, they can be used as a basis for competitive advantage.

Some realized that businesses were spending much more on acquiring new customers than on retaining current ones. Carl Sewell, Frederick Reicheld, C. Gronroos, and Earl Sasser showed us how a competitive advantage could be found in ensuring that customers returned again and again. This has come to be known as the loyalty effect after Reicheld’s book of the same name in which he broadens the concept to include employee loyalty, supplier loyalty, distributor loyalty, and shareholder loyalty. They also developed techniques for estimating the lifetime value of a loyal customer, called customer lifetime value (CLV).

A significant movement started that attempted to recast selling and marketing techniques into a long term endeavor that created a sustained relationship with customers (called relationship selling, relationship marketing, and customer relationship management). Customer relationship management (CRM) software (and its many variants) became an integral tool that sustained this trend.

James Gilmore and Joseph Pine found competitive advantage in mass customization. Flexible manufacturing techniques allowed businesses to individualize products for each customer without losing economies of scale. This effectively turned the product into a service. They also realized that if a service is mass customized by creating a “performance” for each individual client, that service would be transformed into an “experience“. Their book, The Experience Economy, along with the work of Bernd Schmitt convinced many to see service provision as a form of theatre. This school of thought is sometimes referred to as customer experience management (CEM).

Like Peters and Waterman a decade earlier, James Collins and Jerry Porras spent years conducting empirical research on what makes great companies. Six years of research uncovered a key underlying principle behind the 19 successful companies that they studied: They all encourage and preserve a core ideology that nurtures the company. Even though strategy and tactics change daily, the companies, nevertheless, were able to maintain a core set of values.

These core values encourage employees to build an organization that lasts. In Built to Last (1994) they claim that short term profit goals, cost cutting, and restructuring will not stimulate dedicated employees to build a great company that will endure. In 2000 Collins coined the term “built to flip” to describe the prevailing business attitudes in Silicon Valley. It describes a business culture where technological change inhibits a long term focus. He also popularized the concept of the BHAG (Big Hairy Audacious Goal).

Aries de Geus (1997) undertook a similar study and obtained similar results. He identified four key traits of companies that had prospered for 50 years or more.

They are:

a) Sensitivity to the business environment – the ability to learn and adjust,

b) Cohesion and identity – the ability to build a community with personality, vision, and purpose,

c) Tolerance and decentralization – the ability to build relationships, and

d) Conservative financing.

A company with these key characteristics he called a living company because it is able to perpetuate itself if a company emphasizes knowledge rather than finance, and sees itself as an ongoing community of human being, it has the potential to become great and endure for decades. Such an organization is an organic entity capable of learning (he called it a “learning organization”) and capable of creating its own processes, goals, and persona.

Jordan Lewis finds competitive advantage in alliance strategies. Rather than seeing distributors, suppliers, firms in related industries, and even competitors as potential threats or targets for vertical integration, they should be seen as potential assistants or partners. He explains how mutual respect and trust is the cornerstone of this approach and describes how this can be fostered at the interpersonal relationship level.

vi. The Military Theorists:

In the 1980s some business strategists realized that there was a vast knowledge base stretching back thousands of years that they had barely examined. They turned to military strategy for guidance. Military strategy books such as The Art of War by Sun Tzu, On War by von Clausewitz, and The Red Book by Mao Tse Tung became instant business classics. From Sun Tzu they learned the tactical side of military strategy and specific tactical prescriptions. From Von Clausewitz they learned the dynamic and unpredictable nature of military strategy. From Mao Tse Tung they learned the principles of guerrilla warfare.

The Main Marketing Warfare Books Were:

a) Business War Games by Barrie Tames 1984.

b) Marketing Warfare by A1 Ries and Jack Trout, 1986.

c) Leadership Secrets of Attila the Hun by Wess Roberts, 1987.

Philip Kotler was a well-known proponent of marketing warfare strategy.

There were generally thought to be four types of business warfare theories.

They are:

a) Offensive marketing warfare strategies.

b) Defensive marketing warfare strategies.

c) Flanking marketing warfare strategies.

d) Guerrilla marketing warfare strategies.

The marketing warfare literature also examined leadership and motivation, intelligence gathering, types of marketing weapons, logistics, and communications.

By the turn of the century marketing warfare strategies had gone out of favor. It was felt that they were limiting. There were many situations in which non-confrontational approaches were more appropriate. The “Strategy of the Dolphin” was developed in the mid-1990s to give guidance as to when to use aggressive strategies and when to use passive strategies. A variety of aggressiveness strategies were developed.

In 1993, J. Moore used a similar metaphor. Instead of using military terms, he created an ecological theory of predators and prey (see ecological model of competition), a sort of Darwinian management strategy in which market interactions mimic long term ecological stability.

vii. Strategic Change:

In 1970, Alvin Toffler in Future Shock described a trend towards accelerating rates of change. He illustrated how social and technological norms had shorter lifespans with each generation, and he questioned society’s ability to cope with the resulting turmoil and anxiety. In past generations periods of change were always punctuated with times of stability.

This allowed society to assimilate the change and deal with it before the next change arrived. But these periods of stability are getting shorter and by the late 20th century had all but disappeared. In 1980 in The Third Wave, Toffler characterized this shift to relentless change as the defining feature of the third phase of civilization (the first two phases being the agricultural and industrial waves). He claimed that the dawn of this new phase will cause great anxiety for those that grew up in the previous phases, and will cause much conflict and opportunity in the business world. Hundreds of authors, particularly since the early 1990s, have attempted to explain what this means for business strategy.

In 1997, Watts Waker and Jim Taylor called this upheaval a “500 year delta.” They claimed these major upheavals occur every 5 centuries. They said we are currently making the transition from the “Age of Reason” to a new chaotic Age of Access. Jeremy Rifkin (2000) popularized and expanded this term, “age of access” three years later in his book of the same name.

In 1968, Peter Drucker (1969) coined the phrase Age of Discontinuity to describe the way change forces disruptions into the continuity of our lives. In an age of continuity attempts to predict the future by extrapolating from the past can be somewhat accurate. But according to Drucker, we are now in an age of discontinuity and extrapolating from the past is hopelessly ineffective. We cannot assume that trends that exist today will continue into the future. He identifies four sources of discontinuity: new technologies, globalization, cultural pluralism, and knowledge capital.

In 2000, Gary Hamel discussed strategic decay, the notion that the value of all strategies, no matter how brilliant, decays over time.

In 1978, Derek Abell described strategic windows and stressed the importance of the timing (both entrance and exit) of any given strategy. This has lead some strategic planners to build planned obsolescence into their strategies.

In 1989, Charles Handy identified two types of change. Strategic drift is a gradual change that occurs so subtly that it is not noticed until it is too late. By contrast, transformational change is sudden and radical. It is typically caused by discontinuities (or exogenous shocks) in the business environment. The point where a new trend is initiated is called a strategic inflection point by Andy Grove. Inflection points can be subtle or radical.

In 2000, Malcolm Gladwell discussed the importance of the tipping point, that point where a trend or fad acquires critical mass and takes off.

In 1983, Noel Trichy recognized that because we are all beings of habit we tend to repeat what we are comfortable with. He wrote that this is a trap that constrains our creativity, prevents us from exploring new ideas, and hampers our dealing with the full complexity of new issues. He developed a systematic method of dealing with change that involved looking at any new issue from three angles technical and production, political and resource allocation, and corporate culture.

In 1990, Richard Pascale wrote that relentless change requires that businesses continuously reinvent themselves. His famous maxim is “Nothing fails like success” by which he means that what was a strength yesterday becomes the root of weakness today, We tend to depend on what worked yesterday and refuse to let go of what worked so well for us in the past. Prevailing strategies become self-confirming. In order to avoid this trap, businesses must stimulate a spirit of inquiry and healthy debate. They must encourage a creative process of self-renewal based on constructive conflict.

In 1996, Art Kleiner (1996) claimed that to foster a corporate culture that embraces change, you have to hire the right people; heretics, heroes, outlaws, and visionaries .The conservative bureaucrat that made such a good middle manager in yesterday’s hierarchical organizations is of little use today. A decade earlier Peters and Austin (1985) had stressed the importance of nurturing champions and heroes. They said we have a tendency to dismiss new ideas, so to overcome this, we should support those few people in the organization that have the courage to put their career and reputation on the line for an unproven idea.

In 1996, Adrian Slywotsky showed how changes in the business environment are reflected in value migrations between industries, between companies, and within companies. He claimed that recognizing the patterns behind these value migrations is necessary if we wish to understand the world of chaotic change. In “Profit Patterns” (1999) he described businesses as being in a state of strategic anticipation as they try to spot emerging patterns. Slywotsky and his team identified 30 patterns that have transformed industry after industry.

In 1997, Clayton Christensen (1997) took the position that great companies can fail precisely because they do everything right since the capabilities of the organization also defines its disabilities. Christensen’s thesis is that outstanding companies lose their market leadership when confronted with disruptive technology. He called the approach to discovering the. emerging markets for disruptive technologies agnostic marketing, i.e., marketing under the implicit assumption that no one – not the company, not the customers – can know how or in what quantities a disruptive product can or will be used before they have experience using it.

A number of strategists use scenario planning techniques to deal with change. Kees van der Heijden (1996), for example, says that change and uncertainty make “optimum strategy” determination impossible. We have neither the time nor the information required for such a calculation. The best we can hope for is what he calls “the most skillful process”. The way Peter Schwartz put it in 1991 is that strategic outcomes cannot be known in advance so the sources of competitive advantage cannot be predetermined.

The fast changing business environment is too uncertain for us to find sustainable value in formulas of excellence or competitive advantage. Instead, scenario planning is a technique in which multiple outcomes can be developed, their implications assessed, and their likeliness of occurrence evaluated. According to Pierre Wack, scenario planning is about insight, complexity, and subtlety, not about formal analysis and numbers.

In 1988, Henry Mintzberg looked at the changing world around him and decided it was time to reexamine how strategic management was done. He examined the strategic process and concluded it was much more fluid and unpredictable than people had thought. Because of this, he could not point to one process that could be called strategic planning. Instead he concludes that there are five types of strategies.

They are:

a) Strategy as plan a direction, guide, course of action – intention rather than actual.

b) Strategy as ploy a maneuver intended to outwit a competitor.

c) Strategy as pattern a consistent pattern of past behaviors – realized rather than intended.

d) Strategy as position locating of brands, products, or companies within the conceptual framework of consumers or other stakeholders – strategy determined primarily by factors outside the firm.

e) Strategy as perspective -strategy determined primarily by a master strategist.

In 1998, Mintzberg developed these five types of management strategy into 10 “schools of thought”. These 10 schools are grouped into three categories. The first group is prescriptive or normative. It consists of the informal design and conception school, the formal planning school, and the analytical positioning school. The second group, consisting of six schools, is more concerned with how strategic management is actually done, rather than prescribing optimal plans or positions.

The six schools are the entrepreneurial, visionary, or great leader school, the cognitive or mental process school, the learning, adaptive, or emergent process school, the power or negotiation school, the corporate culture or collective process school, and the business environment or reactive school. The third and final group consists of one school, the configuration or transformation school, an hybrid of the other schools organized into stages, organizational life cycles, or “episodes”.

In 1999, Constantinos Markides also wanted to reexamine the nature of strategic planning itself. He describes strategy formation and implementation as an on-going, never-ending, integrated process requiring continuous reassessment and reformation. Strategic management is planned and emergent, dynamic, and interactive. J. Moncrieff (1999) also stresses strategy dynamics. He recognized that strategy is partially deliberate and partially unplanned. The unplanned element comes from two sources: emergent strategies (result from the emergence of opportunities and threats in the environment) and Strategies in action (ad hoc actions by many people from all parts of the organization).

Some business planners are starting to use a complexity theory approach to strategy. Complexity can be thought of as chaos with a dash of order. Chaos theory deals with turbulent systems that rapidly become disordered. Complexity is not quite so unpredictable. It involves multiple agents interacting in such a way that a glimpse of structure may appear. Axelrod, R., Holland, J., and Kelly, S. and Allison, M.A., call these systems of multiple actions and reactions complex adaptive systems. Axelrod asserts that rather than fear complexity, business should harness it.

He says this can best be done when “there are many participants, numerous interactions, much trial and error learning, and abundant attempts to imitate each other’s successes”. In 2000, E. Dudik wrote that an organization must develop a mechanism for understanding the source and level of complexity it will face in the future and then transform itself into a complex adaptive system in order to deal with it.

viii. Information and Technology Driven Strategy:

Peter Drucker had theorized the rise of the “knowledge worker” back in the 1950s. He described how fewer workers would be doing physical labor, and more would be applying their minds. In 1984, John Nasbitt theorized that the future would be driven largely by information companies that managed information well could obtain an advantage, however the profitability of what he calls the “information float” (information that the company had and others desired) would all but disappear as inexpensive computers made information more accessible.

Daniel Bell (1985) examined the sociological consequences of information technology, while Gloria Schuck and Shoshanna Zuboff looked at psychological factors. Zuboff, in her five year study of eight pioneering corporations made the important distinction between “automating technologies” and “infomating technologies”. She studied the effect that both had on individual workers, managers, and organizational structures. She largely confirmed Peter Duckers’ predictions three decades earlier, about the importance of flexible decentralized structure, work teams, knowledge sharing, and the central role of the knowledge worker. Zuboff also detected a new basis for managerial authority, based not on position or hierarchy, but on knowledge (also predicted by Drucker) which she called “participative management”.

In 1990, Peter Senge, who had collaborated with Arie de Geus at Dutch Shell, borrowed de Geus’ notion of the learning organization, expanded it, and popularized it. The underlying theory is that a company’s ability to gather, analyze, and use information is a necessary requirement for business success in the information age. (See organizational learning.)

In order to do this, Senge claimed that an organization would need to be structured such that:

a) People can continuously expand their capacity to learn and be productive,

b) New patterns of thinking are nurtured,

c) Collective aspirations are encouraged, and

d) People are encouraged to see the “whole picture” together.

Senge identified five components of a learning organization.

They are:

a. Personal responsibility, self-reliance, and mastery – we accept that we are the masters of our own destiny. We make decisions and live with the consequences of them. When a problem needs to be fixed, or an opportunity exploited, we take the initiative to learn the required skills to get it done.

b. Mental models we need to explore our personal mental models to understand the subtle effect they have on our behavior.

c. Shared vision the vision of where we want to be in the future is discussed and communicated to all. It provides guidance and energy for the journey ahead.

d. Team learning we learn together in teams. This involves a shift from “a spirit of advocacy to a spirit of enquiry”.

e. Systems thinking we look at the whole rather than the parts. This is what Senge calls the “Fifth discipline”. It is the glue that integrates the other four into a coherent strategy. For an alternative approach to the “learning organization”.

Since 1990 many theorists have written on the strategic importance of information, including J.B. Quinn, J. Carlos Jarillo, D.L. Barton, Manuel Castells, J.P. Lieleskin, Thomas Stewart, K.E. Sveiby Gilbert J. Probst, and Shapiro and Varian to name just a few.

Thomas Stewart, for example, uses the term intellectual capital to describe the investment an organization makes in knowledge. It is comprised of human capital (the knowledge inside the heads of employees), customer capital (the knowledge inside the heads of customers that decide to buy from you), and structural capital (the knowledge that resides in the company itself).

Manuel Castells describes a network society characterized by: globalization, organizations structured as a network, instability of employment, and a social divide between those with access to information technology and those without.

Stan Davis and Christopher Meyer (1998) have combined three variables to define what they call the BLUR equation. The speed of change, Internet connectivity, and intangible knowledge value, when multiplied together yields a society’s rate of BLUR. The three variables interact and reinforce each other making this relationship highly non-linear.

Regis McKenna posits that life in the high tech information age is what he called a “real time experience”. Events occur in real time. To ever more demanding customers “now” is what matters. Pricing will more and more become variable pricing changing with each transaction, often exhibiting first degree price discrimination. Customers expect immediate service, customized to their needs, and will be prepared to pay a premium price for it. He claimed that the new basis for competition will be time based competition.

Geoffrey Moore (1991) and R. Frank and P. Cook also detected a shift in the nature of competition. In industries with high technology content, technical standards become established and this gives the dominant firm a near monopoly. The same is true of networked industries in which interoperability requires compatibility between users. An example is word processor documents.

Once a product has gained market dominance, other products, even far superior products, cannot compete. Moore showed how firms could attain this enviable position by using E.M. Rogers five stage adoption process and focusing on one group of customers at a time, using each group as a base for marketing to the next group. The most difficult step is making the transition between visionaries and pragmatists. If successful a firm can create a bandwagon effect in which the momentum builds and your product becomes a de facto standard.

Evans and Wurster describe how industries with a high information component are being transformed. They cite Encarta’s demolition of the Encyclopedia Britannica whose sales have plummeted 80% since their peak of $650 million in 1990. Many speculate that Encarta’s reign will be short-lived, eclipsed by collaborative encyclopedias like Wikipedia that can operate at very low marginal costs.

Evans also mentions the music industry which is desperately looking for a new business model. The upstart information savvy firms, unburdened by cumbersome physical assets, are changing the competitive landscape, redefining market segments, and disinter mediating some channels. One manifestation of this is personalized marketing. Information technology allows marketers to treat each individual as its own market, a market of one. Traditional ideas of market segments will no longer be relevant if personalized marketing is successful.

The technology sector has provided some strategies directly. For example, from the software development industry agile software development provides a model for shared development processes.

Access to information systems have allowed senior managers to take a much more comprehensive view of strategic management than ever before. The most notable of the comprehensive systems is the balanced scorecard approach developed in the early 1990’s by Drs. Robert S. Kaplan (Harvard Business School) and David Norton. It measures several factors financial, marketing, production, organizational development, and new product development in order to achieve a ‘balanced’ perspective.

Essay # 4. The Psychology of Strategic Management:

Several psychologists have conducted studies to determine the psychological patterns involved in strategic management. Typically senior managers have been asked how they go about making strategic decisions. A 1938 treatise by Chester Bernard, that was based on his own experience as a business executive, sees the process as informal, intuitive, non-routinized, and involving primarily oral, 2-way communications. Bernard says “The process is the sensing of the organization as a whole and the total situation relevant to it. It transcends the capacity of merely intellectual methods, and the techniques of discriminating the factors of the situation. The terms pertinent to it are “feeling”, “judgments”, “sense”, “proportion”, “balance”, “appropriateness”. It is a matter of art rather than science.”

In 1973, Henry Mintzberg found that senior managers typically deal with unpredictable situations so they strategize in ad hoc, flexible, dynamic, and implicit ways. He says, “The job breeds adaptive information-manipulators who prefer the live concrete situation. The manager works in an environment of stimulus-response, and he develops in his work a clear preference for live action.”

In 1982, John Kotter studied the daily activities of 15 executives and concluded that they spent most of their time developing and working a network of relationships from which they gained general insights and specific details to be used in making strategic decisions. They tended to use “mental road maps” rather than systematic planning techniques.

Daniel Isenberg’s 1984 study of senior managers found that their decisions were highly intuitive. Executives often sensed what they were going to do before they could explain why. He claimed in 1986 that one of the reasons for this is the complexity of strategic decisions and the resultant information uncertainty.

Shoshanna Zuboff (1988) claims that information technology is widening the divide between senior managers (who typically make strategic decisions) and operational level managers (who typically make routine decisions). She claims that prior to the widespread use of computer systems, managers, even at the most senior level, engaged in both strategic decisions and routine administration, but as computers facilitated (She called it “deskilled”) routine processes, these activities were moved further down the hierarchy, leaving senior management free for strategic decision making.

In 1977, Abraham Zaleznik identified a difference between leaders and managers. He describes leadership leaders as visionaries who inspire. They care about substance. Whereas managers are claimed to care about process, plans, and form. He also claimed in 1989 that the rise of the manager was the main factor that caused the decline of American business in the 1970s and 80s. Lack of leadership is most damaging at the level of strategic management where it can paralyze an entire organization.

According to Corner, Kinichi, and Keats, strategic decision making in organizations occurs at two levels: individual and aggregate. They have developed a model of parallel strategic decision making. The model identifies two parallel processes both of which involve getting attention, encoding information, storage and retrieval of information, strategic choice, strategic outcome, and feedback. The individual and organizational processes are not independent however. They interact at each stage of the process.

Reasons why strategic plans fail:

There are many reasons why strategic plans fail, especially:

a. Failure to Understand the Customer:

i. Why do they buy

ii. Is there a real need for the product

iii. inadequate or incorrect marketing research

b. Inability to Predict Environmental Reaction:

i. What will competitors do

a. Fighting brands

b. Price wars

c. Will Government Intervene

d. Over-Estimation of Resource Competence:

i. Can the staff, equipment, and processes handle the new strategy

ii. Failure to develop new employee and management skills

e. Failure to Coordinate:

i. Reporting and control relationships not adequate

ii. Organizational structure not flexible enough

f. Failure to Obtain Senior Management Commitment:

i. Failure to get management involved right from the start

ii. Failure to obtain sufficient company resources to accomplish task

g. Failure to Obtain Employee Commitment:

i. New strategy not well explained to employees

ii. No incentives given to workers to embrace the new strategy

h. Under-Estimation of Time Requirements:

i. No critical path analysis done

i. Failure to Follow the Plan:

i. No follow through after initial planning

ii. No tracking of progress against plan

iii. No consequences for above

j. Failure to Manage Change:

i. Inadequate understanding of the internal resistance to change.

ii. Lack of vision on the relationships between processes, technology and organization

k. Poor Communications:

i. Insufficient information sharing among stakeholders

ii. Exclusion of stakeholders and delegates

Essay # 5. Process of Strategic Management:

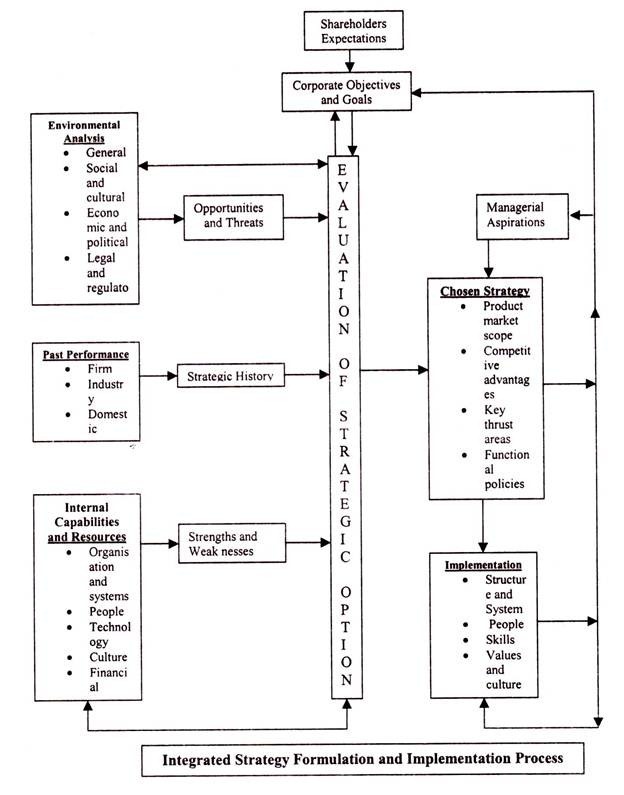

The strategic management process deals with both the formulation and implementation of specific corporate, business and functional strategies and policies with a view to achieving specific objectives and goals which the organisation has set for itself, duly taking into account:

(a) Environmental opportunities and threats,

(b) Stakeholders’ expectations,

(c) Internal resources and capabilities, and finally, and

(d) Managerial aspirations to excel.

The process is holistic in nature and focuses on strategic issues confronting the organization. Both formulation and implementation are integral parts of one single process and there is a continuous feedback loop to improve the effectiveness of individual processes, and hence, that of the overall organisation.

Figure highlights the inseparability of the strategy formulation process from the implementation process. It also indicates the iterative characteristic of the process at the strategy development phase, in which the evaluation of strategic options, prior to making the final choice, may lead to a review of the objectives and goals set initially or of the way opportunities, threats, strengths and weaknesses have been identified.

The iterative process is not only beneficial to bring out all the strategic vulnerabilities as well as the opportunities at the strategy development stage itself; it also helps in developing a shared consensus across the organisation in these areas. The development of such a consensus is an important output of the process and it facilitates the implementation of the chosen strategy.

The iterative process also operates at the implementation phase, where, depending on the performance achieved vis-a-vis corporate objectives, goals and functional standards, there arises a need to review the original objectives set or the strategy chosen.

The book follows as its central model this approach and describes the strategic management process as one continuous spectrum encompassing both strategy formulation and implementation, in which the evaluation and reformulation of strategy is an ongoing task based on:

(i) actual results achieved vis-a-vis targets set, and

(ii) changes taking place in the firm’s general and competitive environment.

Essay # 6. Criticisms of Strategic Management:

Although a sense of direction is important, it can also stifle creativity, especially if it is rigidly enforced. In an uncertain and ambiguous world, fluidity can be more important than a finely tuned strategic compass. When a strategy becomes internalized into a corporate culture, it can lead to group think. It can also cause an organization to define itself too narrowly. An example of this is marketing myopia.

Many theories of strategic management tend to undergo only brief periods of popularity. A summary of these theories thus inevitably exhibits survivorship bias (itself an area of research in strategic management). Many theories tend either to be too narrow in focus to build a complete corporate strategy on, or too general and abstract to be applicable to specific situations. Populism or faddishness can have an impact on a particular theory’s life cycle and may see application in inappropriate circumstances. See business philosophies and popular management theories for a more critical view of management theories.

In 2000, Gary Hamel coined the term strategic convergence to explain the limited scope of the strategies being used by rivals in greatly differing circumstances. He lamented that strategies converge more than they should, because the more successful ones get imitated by firms that do not understand that the strategic process involves designing a custom strategy for the specifics of each situation.