Here is a compilation of essays on ‘Value-Based Management’ for class 10, 11 and 12. Find paragraphs, long and short essays on ‘Value-Based Management’ especially written for school and college students.

Essay on Value-Based Management

Essay Contents:

- Essay on the Meaning of Value-Based Management

- Essay on Value Measurement Techniques

- Essay on Customer Value Management (CVM)

- Essay on the Elements of Value-Based Management

- Essay on the Steps for VBM Implementation

- Essay on the Present Trend of VBM Practices

- Essay on the Models in Value-Based Management

1. Essay on the Meaning of Value-Based Management:

Value-Based Management is a practical concept that consists of value creation, value retention, and value enhancement of a business enterprise in a highly competitive environment characterised by market economy and others.

ADVERTISEMENTS:

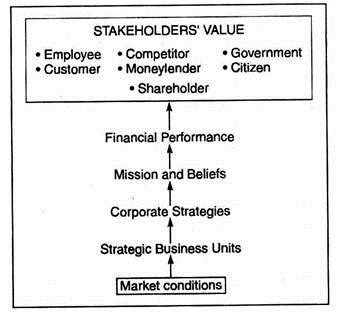

Following the chart it can be stated that a business can create/retain/enhance its value only by helping all the stakeholders (like employee, customer, competitor, money lender, government, citizen and shareholder), today and in future also.

It, therefore, transpires that the corporate responsibility is to meet the expectation of different stakeholders as discussed below:

An employee should be assured of his tenure of service and fair remuneration.

A customer should be provided with quality products/services at fair prices and terms.

ADVERTISEMENTS:

Competitors should not be victimised or elbowed out through unfair or restrictive practices.

Moneylenders should be paid off according to the contractual obligations.

The government should be assured that full taxes and dues are paid and that no social damage is done.

A citizen should be taken into confidence in that a company discharges its obligations effectively on a continuous basis.

ADVERTISEMENTS:

A shareholder should be assured of an increase in market capitalisation of his investment besides fair rate of dividend.

It is worthy to mention that there is a controversy involving conflict between the shareholders and other stakeholders. Many argue on the preferential treatment given to shareholders. There are counter-arguments that augmentation of shareholder’s value can alone lead to any increase in the value of other stakeholders.

Empirical evidence suggests that increasing shareholder value does not conflict with the long-run interest of other stakeholders. Copeland and others, in particular, argue that shareholders are only stakeholders who simultaneously maximise everyone else’s claim in seeking to maximise their own.

In this sense, shareholders’ value approach provides a strong base to value- creation, value-retention and value-enhancement processes that are fundamental to Value-Based Management.

2. Essay on Value Measurement Techniques:

The ultimate test of value creation is to ensure that some positive accretion in quantitative terms has taken place in the defined parameters of an organisation. Traditionally financial indicators are assumed to be the most important for argument being that improved financial performance would be automatic outcome of effective performance of a corporate.

ADVERTISEMENTS:

For judging the financial efficacy, the debate is: Should it be based on the accounting or cash flow accruals?

However, the following is the list of value measurement techniques, a brief discussion of which is made.

1. Economic Value Added (EVA) concept:

The financial performance has always been synonymous with profit and profitability. The indicators used have been gross or net profit margin (profit measured against turnover), Return on investment (ROI), Earnings per share (EPS), etc.

ADVERTISEMENTS:

In early 1990s, a new concept known as Economic Value Added (EVA) appeared on the scene. EVA measures whether operating profit earned by a unit is adequate compared to cost of capital.

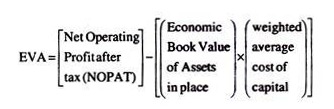

EVA is operationally defined by the formula:

a. Where NOPAT = Profits after depreciation and Taxes but before Interest.

ADVERTISEMENTS:

b. NOPAT thus represents the total pool of profits available on an ungeared basis to provide a return to lenders and shareholders.

c. Economic Book Value of assets in place is obtained after making adjustments of:

(i) Capitalised leases, convertible financial instruments, factoring of receivable, sale and lease back;

(ii) Brand equity, human potential, R&D; and

ADVERTISEMENTS:

(iii) Writing back provisions for deferred tax, doubtful debts.

4. Weighted Average Cost of Capital represents cost of equity as captured in the capital asset pricing framework, with due consideration of market value weights to book value weights.

(i) Operating profits to grow without employing more capital, i.e., greater operational efficiency;

(ii) Return on additional capital invested in projects in excess of cost of capital i.e., profitable growth; and

(iii) Capital released from activities that do not cover the cost of capital i.e., liquidate unproductive capital.

2. Adjusted EVA Concept:

Since EVA is computed from accounting based numbers, it is obvious that all the discrepancies implicit in accounting figures also affect EVA. If ROI overstates IRR, then EVA also gives an artificially inflated figure for shareholder value added.

ADVERTISEMENTS:

The concept known as Adjusted EVA which involves using current value of assets is, therefore, sometimes used to reduce these discrepancies. In other words, this methodology computes EVA based on current value of equity as compared to usual calculation based on the historical value of the same.

Similarly, the other related concept is known Refined EVA that uses market value of the firm at the beginning of the period instead of book value.

3. Cash Flow Return on Investment (CFROI):

CFROI, developed by Boston Consulting Group (BCG), is somewhat similar to long-term Internal Rate of Return (IRR).

This is arrived at by computing two parameters (as below) and establishing relationship between the two, and finally translating the same into an IRR:

(i) Inflation-adjusted free cash flows available to investors; and

(ii) Inflation-adjusted gross investment made by the owners.

4. Cash Value Added (CVA):

ADVERTISEMENTS:

This’ is quite similar to EVA concept except that it includes only cash items. It is computed based on the difference between the operating cash flow (OCF) and operating cash flow demand (OCFD).

i. OCF = calculated by adjusting for non-cash charges as well as working capital movement with profit before interest and taxes, and

ii. OCFD = average capital costs.

5. Shareholder Value Added (SVA):

This is the strategic approach of generating/augmenting Total Return to Shareholders.

Under SVA, the economic value of an asset is estimated by discounting forecasted cash flows by cost of capital.

This approach also shows at great length the prime value drivers that include : sales growth rate, operating profit margin, income tax rate, working capital/fixed capital investment, cost of capital, forecast duration, etc., and how they drive the shareholder value.

ADVERTISEMENTS:

One important feature is that properly designed performance measure and compensation arrangement that align the interests of managers with those of the shareholders are central to the value-creation process. It implies that shareholder value creation systems and processes should be aimed at reducing agency conflict within a corporate.

6. Balance Scorecard:

All the above approaches mainly aim at creating/augmenting shareholder value from financial perspectives. Balance scorecard (developed by Kaplan and Norton) emphasises the need to go beyond the traditional financial parameters.

It envisions to integrate vision and strategy with a view to building a balanced performance index based on the following aspects of business operations or activities:

(i) Financial dimension,

(ii) Customer perspective,

(iii) Internal business processes, and

ADVERTISEMENTS:

(iv) Organisational learning.

According to Kaplan and Norton, EVA, being a financial performance measure, falls under the category of the financial perspective of the balance scorecard.

3. Essay on Customer Value Management (CVM):

CVM combines the best of those approaches into a unique set of modern business tools that deliver bottom-line results.

These approaches are:

(i) Business direction planning:

ADVERTISEMENTS:

A strategic plan that is right for a company and industry situation. Techniques like scenario approach expose business managers to a range of alternatives so that they can respond quickly with the right actions.

(ii) Customer and economic value analysis:

The combination of customer value analysis techniques along with economic value analysis allows targeted improvement of customer service where it will have the greatest business benefit. Businesses are run minute by minute rather than on a monthly cycle. The availability of World Wide Web technology on the internet provides cost-effective ways of such value analyses.

(iii) Business and process innovations:

They are a kind of major surgery to a business. Substantial improvements in value for customers and investors through innovative business process design are nowadays possible through information technology. While continuous improvement and benchmarking techniques allow a firm to match its competitors, new systems and novel process innovation allow a firm to jump over the competition.

(iv) Golden thread process:

It is important to translate business goals into performance targets. The golden thread approach ensures this to be used in work areas and linked back to business goals. The reporting system ensures that data are turned into information and knowledge that drive the business.

(v) Information reporting and analysis:

The measurement of customer service performance and subsequent analyses allow a firm to improve and manage the business areas. The WWW technology within a company allows the creation of an internet or intranet web to give quick access to performance information. The selection of the right combination of paper and electronic reporting ensures that information will be used correctly.

To conclude, we can say that most customers want value for money through fulfilment of attributes and sub-attributes like easy to get hold of, responsiveness, right doings, follow ups, promptness, keeping promises, helpful attitudes, quality, etc.

4. Essay on the Elements of Value-Based Management:

The three key elements of VBM are:

1. Setting the long-term wealth augmentation of the shareholders as the paramount goal of the organisation,

2. Quantification of the shareholders’ money devoted to capital investments, product lines, strategic business units (SBU) and the entire corporation resulting in easy computation of value creation (return greater than the opportunity cost of capital), and

3. Using internal and external performance measurement of capital investments, product lines, SBU strategy and motivating managers in the pursuance of achievement of the goals set i.e., maximising shareholders’ wealth.

The elements stated above consider shareholders as the key source for VBM. But there is another view which considers stakeholders’ value to be the criteria for VBM.

Using this concept, the basic elements of VBM may be as depicted here next:

Translating all these element-wise activities, one may obtain various kinds of value creation drives within the company by the management which in turn help the management to perform better financially, the ultimate score sheet.

5. Essay on the Steps for VBM Implementation:

Some of the steps for successful VBM implementation are:

1. Establishing explicit and visible top management support,

2. Focusing on better decision making among all operating personnel,

3. Integrating the VBM approach with overall planning strategy of the corporate,

4. Customising the implementation strategy with the needs of a specific strategic business unit.

5. Ensuring (he availability of crucial data,

6. Providing standardised but simple ready-to-use management information system,

7. Linking incentives with value creation, and

8. Making the exercise a part of the organisational culture.

6. Essay on the Present Trend of VBM Practices:

Value-based management is more concerned with mind-set than any new strategic approach. There has been a strategic shift in many companies recognising value as value-in- aggregate of the company as a whole. The cases cited below exemplify the present trend.

1. Mission statement of Hong Kong and Shanghai Banking Corporation (HSBC):

“Managing for Value-HSBC into 21st Century.” HSBC would aim at outperforming average Total Shareholder Return (TSR) of the peer group of financial institutions with minimum objective of doubling shareholder value over-5-year period.

2. ICICI’s Chairman’s statement (Annual Report, 1998-99) focussed on maximisation of ‘shareholder value’. It states that this paradigm continues to be the driving force that enables ICICI to remain focussed on adding value to all the investors who have reposed faith in ICICI.

3. WIPRO (vide its statement in Annual Report, 1998-99) was recognised by the Institute of Chartered Financial Analysts of India for the highest shareholder value creation for the period 1993-98.

4. Corporate purpose statement of Hindustan Lever Ltd. has included a clause of long-term value creation for shareholders and employees.

5. Mission statement of Roof it Industries Ltd. (annual report 1999-2000) includes, among others,—

“We are committed to global standards of corporate transparency and increasing shareholder confidence in our collection ability. We are also committed to deliver value to our shareholders that is commensurate with our management depth and financial solidity.”

7. Essay on the Models in Value-Based Management:

1. 3 Cs Model:

This is one of the classical approaches of developing a strategic approach to developing and running a business. In this, three most critical factors in terms of which a business should define its role are (a) Customers, (b) Cost, and (c) Competitors.

The model essentially implies that whatever an organisation does or intends to do should be evaluated in terms of these critical value drivers:

What does the customer want?

What is the most appropriate price?

What are the competitors doing or are expected to do?

The answer to these questions should drive the company’s business strategy.

2. 7 Cs Model:

This is an extended version of 3 Cs Model.

The following essential and additional 4 Cs are considered for developing a business strategy:

(a) Context (that is, immediate business environment including the regulatory mechanism),

(b) Capital (that is, financial strength and competence of a unit),

(c) Capabilities (this includes knowledge, skills, and attitudes of people within the unit at various levels), and

(d) Channels (that means, the delivery and distribution mechanism).

3. 7 S Framework:

Developed out of interaction between strategic consultants (Mckinsey & Co.) and academicians, this framework speaks about various parameters/ attributes/ variables that drive or influence the business agenda of a company.

These 7 Ss influencing factors are:

(a) Strategy (i.e., business logic),

(b) Structure (i.e., organisational structure),

(c) Systems (i.e., processes and methodologies),

(d) Staff (i.e., quality conscious manpower),

(e) Skills (i.e., attributes),

(f) Style (i.e., management), and

(g) Super-ordinate goals (i.e., shared vision).

4. 9 Ss Framework:

In addition to the influencing factors listed in 7 Ss Framework, two more Ss are stated by Japanese consultant Shintaro Hori.

These two Ss are:

(a) Steering pattern (this denotes that the quality of top management and their ability- to provide leadership and vision are important); and

(b) Syndication (It signifies the extent of risk sharing, redefining the value chain of Michael Porter and alignment of assets/competencies within the organisation).

5. 8-Strategic Laws of Gravity:

In brief, these are:

(i) Primacy of correct business definition.

(ii) Economics of market control and leadership.

(iii) Value of incremental share to the leaders.

(iv) Importance of relative competitive position, performance, and investments.

(v) Inevitability of declining ‘experience curve’ costs and prices.

(vi) Objective of discouraging competitor investment.

(vii) Role of the broader industry value chain and profit pool.

(viii) Value of organisational investment.

6. PIMS:

It is Profit Impact on Marketing Strategies. PIMS analysis attempts to establish the profitability (that is, return on investment) of various marketing strategies. PIMS researchers, based on the study of 3000 firms, believe that 70% of relative profit performance of an organisation is basically derived from the criteria of competitive strength, market attractiveness and productivity.

The study also revealed that higher returns were possible through higher market share. And this correlation is attributable to three basic reasons:

(i) Economies of scale:

This enables a market leader to pursue low cost strategy and thereby to make higher profits;

(ii) Bargaining power:

A strong hold in the market provides overall business strength to deal with both buyers and suppliers; and

(iii) Managerial ability:

The market leaders often possess high-calibre managerial personnel.

This research further revealed that low market share does not mean poor returns because many small firms make reasonably high profits even with low market share.

Such firms that prosper possess the following elements at least:

(i) High-quality products associated with high prices,

(ii) Consciously avoiding extensions and growth and remaining small,

(iii) Lower costs per unit/service,

(iv) Small portion of the total market but profitable,

(v) Stable market,

(vi) Standardised products,

(vii) Close and satisfactory business relationship with large firms,

(viii) More repeat sales, and

(ix) Customer satisfaction with value added criteria, etc.

An argument against PIMS analysis is that it is more relevant to industrial goods markets where correlation between high market share and high return is usually strong.