Here is an essay on the ‘Working Capital Financing in India’ especially written for school and management students.

Essay # 1. Introduction to Working Capital Financing in India:

After determining the level of working capital, there comes the question of financing.

In the present day context the sources of finance for working capital may be categorised as:

(1) Trade credit.

ADVERTISEMENTS:

(2) Bank credit.

(3) Current provisions of non-bank short-term borrowings.

(4) Long-term services comprising equity capital and long-term borrowings.

However; in India the primary sources of financing the working capital are trade credit, and short-term bank credit, stated to have financed more than ¾ th requirements of working of Indian industry.

ADVERTISEMENTS:

Two other short-term sources of working capital finance are:

(i) Factoring of receivables.

(ii) Commercial papers.

Essay # 2. Meaning of Trade Credit:

It refers to the credit extended by the supplier of goods and services in the normal course of transaction/business/sale of the firm. According to trade practices cash is not paid immediately for purchases but after an agreed period of time. Thus deferred of payment i.e., trade credit represents a service of finance for credit purchases.

ADVERTISEMENTS:

There is however no formal/specific negotiation for trade credit. It is an informal arrangement between the buyer and the seller. There are no legal instruments/acknowledgements of debt which are granted on an open account basis. Such credit appears in the records of the buyer of goods as sundry creditors/accounts payable.

A variant of accounts payable is bills/notes payable. Unlike the open account nature of accounts payable, bills/notes payable represent documentary evidence of credit purchases and a formal acknowledgement of obligation to pay for credit purchases on a specified (maturity) date failing which legal/panel action for recovery will follow.

Note:

A notable feature of bills/notes payable is that they can be rediscounted and the seller does not necessary have to hold it till maturity to receive payment. However, it creates a legally enforceable obligation on the buyer of goods to pay on maturity whereas the accounts payable have more flexible payment obligations. Although most of the trade credit is on an open account as accounts payable, the suppliers of goods do not extend credit indiscriminately. Their decisions as well as the quantum is based on the consideration of factors such as earnings record over a period of time, liquidity position of the firm and post record of payments.

ADVERTISEMENTS:

Advantages:

Trade credit, as a source of short terms/working capital finance, has certain advantages. It is easily, almost automatically, available. Moreover, it is a flexible and spontaneous source of finance. The availability and magnitude of trade credit is related to the size of operations of the firm in terms of sales/purchases.

Example 1:

The requirement of credit purchases to support the existing sales is Rs. 5 lakhs/day. If the purchases are made on the credit of 30 days. The average outstanding accounts payable/ trade credit (finance) will amount to Rs. 1.5 crores (30 days × 5 lakhs).

ADVERTISEMENTS:

The increase in purchases of goods to support higher sales level to Rs. 6 lakhs will imply a trade credit finance of (30 days × 6 lakhs) = 1.8 crores.

If the credit purchases of goods decline, the availability of trade credit will correspondingly decline.

Note:

a. Trade credit is also an informal, spontaneous service of finance.

ADVERTISEMENTS:

b. Does not require negotiation and formal agreement.

c. Trade credit is free from the restrictions associated with formal/negotiated service of finance/credit.

Cost:

Trade credit does not involve any explicit interest charge. However, there is an implicit cost of trade credit. It depends on the credit terms offered by the supplier of goods.

ADVERTISEMENTS:

Suppose, the terms of credit are, 45 days net, the payable amount to the supplier of goods is the same whether paid on the date of purchase or on the 45th day means trade credit has no cost or it is cost free.

But, if the credit terms are 2/15, net 45 means there is discount for prompt payment, the trade credit beyond the discount period has a cost which is equal to –

= [(Discount/1 – Discount)] × 360 days/credit period – discount period)]

Then, explicit interest rate/cost,

= [(0.02/1 – 0.02) × (360/45 – 15)]

= [(0.02/0.98) × (360 – 30)]

ADVERTISEMENTS:

= [(0.0204) × (6)]

= 0.024 or 24%

Alternatively, the credit terms, 2/15 net 45, imply that the firm i.e., buyer is entitled to 2% discount for payment made within 15 days when the entire payment is to be made within 45 days. Since the net amount is due in 45 days, failure to take the discount means paying an extra 2% for using the money for an additional 30 days. If a firm were to pay 2% for every 30 days period over a year, there will be 12 such periods because 360/30 = 12. This amounts to an annual interest rate/cost of 24%.

If the terms of credit are 2/10, net 30 the cost of credit works out to 36.4%.

This means:

The smaller the difference between the payment day and the end of the discount period, the larger is the annual interest/cost of trade credit.

ADVERTISEMENTS:

Note:

a. The cost of trade credit is generally very high beyond the discount period. Firms should avail of the discount on prompt payment. If however, they are unable to avail of discount, the payment of trade credit should be delayed till the last day of credit (net, period and beyond without impairing their credit-worthiness.

b. A precondition for obtaining trade credit particularly by a new company is cultivating good relationship with suppliers of goods and obtaining their confidence by honouring commitments.

Essay # 3. Bank Credit:

Bank credit is the primary institutional source of working capital finance in India. In fact, it represents the most important source for financing of current assets.

Working capital is provided by banks in the following ways:

1. Cash credits/overdrafts (limit)

ADVERTISEMENTS:

2. Loans

3. Purchase/discount bills

4. Working capital term loans

5. Letter and Credit (LC)

1. Cash Credit/Overdrafts (Limit):

Under cash credit/overdraft form/arrangement of bank finance, the bank specifies a predetermined borrowing/credit limit. The borrower can draw/ borrow up to the stipulated credit/over draft limit. Within the specified limit, any number of drawls/drawings is possible to the extent of his requirements periodically. Similarly, repayments can be made whenever desired during the period.

ADVERTISEMENTS:

The interest is determined on the basis of running balance/amount actually utilized by the borrower and not on the sanctioned limit. However, a minimum i.e., commitment charge may be payable on the un-utilised balance irrespective of the level of borrowing for availing of the facility.

This form of bank financing of working capital is highly attractive to the borrowers because:

(i) It is flexible in that although borrowed funds are repayable on demand, banks usually do not recall cash advances/roll them over.

(ii) Borrower has the freedom to draw the amount in advance as and when required while the interest liability is only on the amount actually outstanding.

However, cash credit/overdraft is inconvenient to the banks and hampers credit planning. It was the most popular method of bank financing of working capital in India till the early 90s.

Note:

ADVERTISEMENTS:

With the emergence of new banking since the mid 90’s, cash credit cannot at present exceed 20% of the maximum permissible bank finance (MPBF)/credit limit to any borrower.

2. Loans:

Under this arrangement, the entire amount of borrowing is credited to the current account of the borrower or released in cash.

The borrower has to pay interest on the total amount. The loans are repayable on demand or in periodic installments. They can also be renewed from time to time.

As a form of financing, loans imply a financial discipline on the part of borrowers.

Note:

From a modest beginning in the early 90’s, at least 80% of MPBF/credit limit must now be in the form of loans in India.

3. Bill Purchased/Discounted:

This arrangement is of relatively recent origin in India. With the introduction of the New Bill Market Scheme in 1970 by RBI, bank credit is being made available through discounting of usance bills by banks.

The RBI envisaged the progressive used of bills as an instrument of credit as against the prevailing practice of using the widely-prevalent cash credit arrangement for financing working capital. The cash credit arrangement gave rise to unhealthy practices. As the availability of bank credit was unrelated to production needs, borrowers enjoyed facilities in excess of their legitimate needs. Moreover, it led to double financing.

This was possible because credit was taken from different agencies for financing the same activity. This was done, for example, by buying goods on credit from suppliers and raising cash credit by hypothecating the same goods. The bill financing is intended to link credit with the sale and purchase of goods and thus, eliminate the scope of misuse or diversion of credit to other purposes.

The amount made available under this arrangement is covered by the cash credit and overdraft limit. Before discounting the bill, the bank satisfies itself about the credit-worthiness of the drawer and the genuineness of the bill. To popularise the scheme the discount rates are fixed at lower rates than those of cash credit, the difference being about 1 – 1.5%.

The discounting banker asks the drawer of the bill i.e., seller of goods to have his bill accepted by the drawee (buyers) bank before discounting it. The later grants acceptance against the cash credit limit, earlier fixed by it on the basis of borrowing value of stocks. Therefore, the buyer who buys goods on credit cannot use the same goods as a source of obtaining additional bank credit.

The modus operandi of bill finance as a source of working capital financing is that a bill arises out of a trade sale-purchase transaction on credit. The seller of goods draws the bill on the purchaser of goods, payable on demand or after a usance period not exceeding 90 days.

On acceptance of the bill by the purchaser, the seller offers it to the bank for discount/purchase. On discounting the bill, the bank releases the funds to the seller. The bill is presented by the bank to the purchaser/acceptor of the bill on due date for payment. The bills can also be rediscounted with the other bank/RBI. However, this form of financing is not very popular in the country.

4. Term Loan for Working Capital:

Under this arrangement bank advance loans for 3-7 years repayable in yearly or half-yearly installments.

In compliance of RBI directions, banks presently grant only a small part of the fund based working capital facilities to a borrower by the way of running cash credit account, a major portion is in the form of working capital demand loan.

This arrangement is presently applicable to borrowers having working capital facilities of Rs.10 crores and above. The minimum period of WCDL which is basically non-operable account keep on changing. The WCDL is granted for a fixed term on carrying of which it has to be liquidated renewed or rolled over.

5. Letter of Credit (LC):

While the other forms of bank credit are direct forms of financing in which banks provide funds as well bear risk, letter of credit is an indirect form of working capital financing and banks assume only the risk. The credit being provided by the supplier himself.

The purchaser of goods on credit obtains a letter of credit from a bank. The bank undertakes the responsibility to make payment to the supplier, in case the buyer fails to meet his obligations.

Thus the modus operandi of letter of credit is that the supplier sells goods on credit/extents credit/finance to the purchaser, the bank gives a guarantee and bears risk only in case of default by the purchaser.

Mode of Security:

Banks provide credit on the basis of following modes of security:

a. Hypothecation:

In this mode of security, the banks provide credit to borrowers against the security of movable property, usually inventory of goods. The goods hypothecated, however, continue to be in the possession of the owner of these goods, i.e., borrower.

The rights of the lending bank (hypothecate) depend upon the terms of the contract between the borrower and the lender. Although the bank does not have physical possession of the goods, it has the legal right to sell the goods to realise the outstanding loan. Hypothecation facility is normally not available to new borrower.

b. Pledge:

It is a different mode of security from hypothecation, unlike in the latter; the goods which are offered as security are transferred to the physical possession of the lender.

An essential perquisite of pledge, therefore, is that the goods are in the custody of the bank. The borrower who offers the security is called a ‘Pawnon’ or pledger while the bank is called ‘Pawnee’ or pledgee.

The lodging of the goods by the pledger to the pledgee is a kind of bailment. Therefore, pledge creates some liabilities for the bank. It must take reasonable care of goods pledged with it. The term reasonable care means care which a prudent person would like to protect his property. He would be responsible for any loss or damage if he uses the pledged goods for his own purposes. In case of non-payment of bank loans the bank enjoys the right to sell the goods.

c. Lien:

The term lien refers to the right of a party to retain goods belonging to another party until a debt due to him is paid.

Lien can be of following two types:

(i) Particular lien

(ii) General lien

Particular lien is a right to retain goods until a claim pertaining to these goods is fully paid. General lien is applied till all dues of the claimant are paid.

Note:

Bank usually enjoy general lien.

d. Mortgage:

It is the transfer of a legal/equitable interest in specific immovable property for securing the payment of debt. The person who parts with the interest in the property is called mortgagor and the bank in whose favour the transfer takes place is the mortgagee. The instrument of transfer is called the mortgage deed.

Mortgage is thus, conveyance of interest in mortgaged property. The mortgage interest in the property is terminated as soon as the debt is paid. Mortgages are taken as an additional security for working capital credit by banks.

e. Charge:

Where immovable property of one person is by the act of parties or by the operation of law, made security for the payment of money to another and the transaction does not amount to mortgage, the latter person is said to have a charge on the property and all the provisions of simple mortgage will apply to such a charge.

The provisions are as follows:

(i) A charge is not the transfer of interest in the property through it is security for payment. But mortgage is a transfer of interest in the property.

(ii) A charge may be created by the act of parties or by the operation of law. But a mortgage can be created only the act of parties.

(iii) A charge need not be made in writing but a deed must be attested.

(iv) Generally, a charge cannot be enforced against the transferee for consideration without notice. In a mortgage, the transferee of the mortgaged property can acquire the remaining interest in the property, if any is left.

Regulation of Bank Finance:

Traditionally bank credit has been an easily assessable source of meeting the working capital needs of business firms. Indian banks have not been concerning themselves about the soundness or otherwise of the business carried out or about the actual end use of the loan. In other words they have been extending credit to industry and trade on the basis of security. This resulted in a number for distortions in financing of working capital by banks.

Consequently, bank credit has been subjected to various rules, regulations and controls. The RBI had appointed various committees to ensure equitable distribution of bank resources to various sectors of economy. These committees suggest ways and means to make the bank credit an effective instrument of industrialization.

Following are the recommendations of various committees:

1. The Dahejia Committee:

In September 1969, Dahejia Committee of the RBI pointed out in its reports that in the financing practice of banks, there was no relationship between the optimum requirements for production and the bank loan.

The general tendency with business was to take short-term credit from banks and use it for purposes other than production. The committee also pointed out that banks do not give proper attention to the financing pattern of their clients. Further, the clients resort to double financing or multiple financing of stocks.

The Dahejia Committee suggested that the banks should make an appraisal of credit applications with reference to the total financial situations of the client.

It also suggested that all cash credit accounts should be bifurcated in the following two:

(i) The hard core which would represent the minimum level of raw material, finished goods and stores which any industrial concern is required to hold for maintaining certain level of production.

(ii) The strictly short-term components which should be the fluctuating part of the account. This part would represent the short-term increases in inventories, tax, dividends and bonus payments.

The committee also recommended that to determine the hard core elements of cash credit accounts, norms for inventory levels should be worked out by the chamber of industry or by the Indian Bank Association.

It can thus be seen that the orientation towards project oriented and need based lending was first given by the Dahejia Committee. However, in practice the recommendations of the committee did not have more than a marginal effect on the pattern of bank financing.

2. Tandon Committee:

In July 1974, the RBI constituted a study group under the chairmanship of Mr. P. L. Tandon.

This study group was asked to give its recommendations on the following:

(i) What constitutes the working capital requirements of the industry and what is the end use of credit?

(ii) How is the quantum of bank advance to be determined?

(iii) Can norms be evolved of current assets and for debt equity ratio to ensure minimal dependence on bank finance?

(iv) Can the current manner and state of lending be improved?

(v) Can an adequate planning, assessment and information system be evolved to ensure a disciplined flow of credit to meet genuine production needs and its proper supervision?

The final recommendations of this committee regarding the approach of the banks towards the assessment of the working capital requirements of industrial units are very significant.

The major recommendations have been as below:

(i) Banks Finance Essentially for Meeting Working Capital Needs:

Bank credits is essentially intended to finance working capital requirements only, for other requirements, other sources have to be found.

Even for working capital requirements, same portion of the contribution must come from source other than bank finance, such as from owner’s own funds, plough back of surpluses and long-term borrowed funds.

With increased scale of operation and production the owner’s own state in the business should keep on rising. While it is not practicable to lay down absolute standards of debt equity ratio, each borrower should take appropriate steps to strengthen his equity base.

(ii) Working Capital Gap:

The study group has emphasised the concept of the working capital gap which represents the excess of current assets over current liabilities other than bank borrowing.

The maximum permissible bank finance shall be limited to 75% of this working capital gap. In other words, the balance of 25% will have to be provided by the borrower from equity and long-term borrowings.

For the purpose of arriving at the working capital gap, the current assets and the current liabilities will have to be estimated on the basis of the production plan submitted by the borrower. The level of inventories under raw materials, work-in-progress, finished goods, consumable stocks and also the level of receivables shall be projected on the norms prescribed by the study group.

(iii) Norms:

The borrowing requirement of any industrial unit basically depends on the length of the working capital cycle, from building inventories of raw material to getting the sale proceeds.

If norms of inventory and other current assets are laid down for different industries, the bank can easily work out the standard working capital required by a unit and sanction the advance accordingly.

The study group has, therefore prescribed norms for inventory and receivables for 15 industries. The industries covered by the report are cotton and synthetic textile, man-made fibres, jute, textiles, rubber products, fertilizers, pharmaceuticals, dyes and dyestuffs, basic industrial chemicals, vegetable and hydrogenated oils, paper, cement, consumer durables, automobiles and ancillaries, engineering ancillaries and components supplies and machinery manufacturers. The study group has not suggested any norms for the heavy engineering industry because each unit in this industry has certain special characteristics.

The norms for the various items are below:

(a) Raw materials – Consumption in terms of months.

(b) Stock-in-progress – Cost of production in terms of months.

(c) Finished goods – Cost of rules in terms of months.

(d) Receivables – Sales in terms of months.

(iv) Three Different Methods of Calculating the Borrowing Limit to Finance the Working Capital Requirements:

The group views the role of banker only to “supplement the borrower’s resources in carrying a reasonable level of current assets in relation to his production requirements”.

It proposes three progressive alternatives by which the banks may finance the working capital requirements of their industrial borrowers.

At the 1st stage the current assets may be worked out as per norms and the current liabilities (excepting bank borrowings) may be deducted therefrom. This amount would represent the working capital gap, 25% of which must be financed by the borrowers out of long-term funds. The maximum permissible bank borrowings would, therefore, be only 75% of the working capital requirements. Calculated as per the norms laid down regarding, inventories and receivables.

The committee suggests that as a 1st step, the banks may adopt this method of sanctioning advances. In case where the banks have already sanctioned advances higher than the requirements as calculated above, the excess should be converted into a term loan to be phased out gradually. Thus the committee does not support that the bank should finance excessive inventory buildup by industrial enterprises.

The 2nd alternative, the borrower will have to provide a minimum of 25% of total current assets from term funds (as against his providing 25% of working capital gap from long-term funds in the 1st alterative).

In the 3rd and the ideal method of calculating the borrowing limits, the group makes a distinction between core current assets and other current assets. Accordingly the total current assets need to be divided into these two categories.

The borrower should finance the entire core current assets plus minimum of 25% of the other current assets. The group feels that this classification of current assets and current liabilities be as per the accepted approach of the bankers.

The recommendations of the committee aim at reducing the reliance of the borrowers on the bank finance. Implementation of these recommendations would result in a better current ratio of the industrial borrowers. This would avoid unfortunate stringencies on account of lack of working capital as those faced by the industrial units in the recent years.

When the government had to enforce a strict credit squeeze in order to fight galloping inflation. There can be no two opinions on the fact that the industrial units must maintain a sound current ratio — something which can be achieved only if a good part of working capital in financed through long-term funds.

(v) Style of Credit:

The group also recommends a change in the style of credit i.e. the manner in which bank finances is extended to the borrower. It is mentioned that the present credit system of lending does not provide any controls to the bankers over the levels of advances in cash credit accounts. This results in a lack of credit planning. Therefore, the total credit limit of borrower should be bifurcated into two components; the minimum level of borrowing which the borrower expects to use throughout the year i.e., loan and a demand cash credit which would take care of his fluctuating requirements.

Both these limits should be reviewed annually. It is recommended that the demand cash credit should be charged slightly higher interest rate than the loan component, so that the borrower is motivated to take higher level of fixed component and a smaller limit of cash credit. This would enable the bankers to forecast the demand for credit more accurately.

(vi) Information System for Banks:

The following points may be noted in this regard:

(a) In order to ensure that the customers do not use the new credit facility in an unplanned manner the financing should be placed on a quarterly budgeting reporting system for operational purposes in the prescribed forms.

(b) Actual drawing within the sanctioned limit will be determined by the customer’s inflow and outflow of funds as reflected in the quarterly funds flow statements and the permissible level of drawing will be the level as at the end of the previous quarter plus or minus, the deficit or surplus shown in the funds flow statements.

(c) Variances are bound to arise in any budget of plan. The variances to the extent of say 10% should be permissible and beyond this, the banker and the customer should discuss the reason.

(d) Since projected funds flow statement would form the basis of determining the line of credit, the banker would be justified in laying down a condition that any material change, say beyond 10% of the figure projected earlier, would require his prior approval.

(e) From the quarterly forms the bankers will verify whether the operational results conform to earlier expectations and whether there is any divergence showing red signals.

(f) In addition to quarterly data, the large borrower should submit a half yearly proforma balance sheet and profit and loss account within two months from the end of the half year.

(g) Stock statement will be continued to be submitted but these will be improved. The basis of valuation in the stock statements and the balance sheet should be uniform. The stock should be reconciled in the stock statement sharing the opening and closing stocks, quantity-wise and value-wise.

(h) Stock inspection passes problems especially in large industries. In such cases there is no alternative to depending on financial follow up. Where a banker feels that detailed stocks verification is called for a regular stock audit may have to be arranged with the assistance of outside consultants.

3. Core Committee:

In April 1979, the RBI constituted a committee under the Chairmanship of Shri K.B. Chore to review the cash credit system of lending in its entirety. The committee submitted its report in Aug. 1979.

The main recommendations of the Chore Committee as accepted by RBI as follows:

(i) Enhancement of Borrower’s Contribution:

The committee had recommended that the Over dependence on bank credit by medium and large borrowers should be reduced by requiring them to enhance their contribution towards working capital.

For this purpose in assessing the permissible bank credit, the borrower should adopt the second method of lending recommended by the Tandon committee, according to which the borrowers contribution from own funds and term finance to meet the working capital requirements should be equal to at least 25% of the total current assets.

This would give a minimum current ratio of 1.33:1. Whenever borrowers are not in a position to comply with the above requirements, immediately the excess borrowing should be segregated and treated as working capital loan (WCTL) which could be made repayable in half yearly installments with the definite period and this period should not exceed 5 years in any case.

(ii) Compulsory Periodic Review of Cash Credit Limits and Submission of Quarterly Statements:

The committee recommended that in future cash credit limits of all the borrowers with working capital limit of Rs. 10 lakhs and over should be reviewed at least once a year compulsorily to verify the continued viability of the borrowers and to assess the need based character of credit limits. All the borrowers with working capital limits of Rs. 50 lakhs and over should submit quarterly statements compulsorily prescribed under the information system designed by the Tandon Committee.

(iii) No Bifurcation of Cash Credit into Demand Loan of Core Portions and Fluctuating Cash Credit Components:

The committee recommended that banks should no more bifurcate the cash credit accounts recommended by Tandon Committee into demand loan components and cash credit proportions and to maintain a differential interest rate between these two components. In case where the cash credit accounts have already been bifurcated steps should be taken to abolish the differential interest rate with immediate effect.

(iv) Separate Limits for Peak and Normal Non-Peak Level Periods:

According to this recommendation, the banks should fix separate limits wherever feasible for the normal non-peak level as also for the peak level credit requirements indicating the duration of these periods when the separate limits would be utilized by the borrowers,

(v) Drawal of Funds to be Regulated through Quarterly Statements:

With limits sanctioned for the peak level and non-peak level periods, the borrower should indicate before the commencement of each quarter the requirements of the funds i.e., operating limit during the quarter. Drawings less than or in excess of the operative limit so fixed (with a tolerance of 10% either way i.e., ± 10%) but not exceeding the sanctioned limit should be deemed to be an irregularity and appropriate corrective steps should be taken.

Note:

There recommendations of panel interest for deviation beyond the tolerance were not accepted by RBI.

(vi) Penalty for Default in the Submissions of Quarterly Statements:

For timely submission of quarterly statements, the committee recommended that if a borrower fails to submit these returns within the prescribed time limit banks may charge panel interest of 1% per annum on the total outstanding in the period of default in the submission of quarterly return.

At the same time, the borrower should be given notice that if default persist the account may be frozen without further notice at the bank’s discretion.

In spite of the levy of penal interest, if default persists, banks should review the positions and if it is satisfied that a stun action is necessary the operation of the account of such borrower may be frozen.

If the borrower has accounts with more than one bank, the decision taken by the bank to freeze the account be intimated to other banks concerned. As soon as advice is received by the other financing banks, they should ensure that no operations are allowed in such accounts with them.

(vii) Ad-Hoc or Temporary Limits:

The Committee recommended that a request for ad- hoc or temporary limits to meet unforeseen contingencies should be considered very carefully and allowed for a predetermined period through a separate demand loan or non-operatable cash credit account. Banks are allowed to charge additional interest of 1% per annum on these recommendations.

(viii) Encouragement for Bill Finance:

(a) Advance against Book Debts:

Generally, sales are financed by banks through purchase, discount of bills. The RBI has advised banks to replace cash credit against book debts by bill finances. Steps should be taken for review of such accounts and convert such cash credit limits into bills limit’s whenever possible.

(B) Drawee Bills:

The Committee has recommended that banks should earmark at least 50% of cash credit limits against raw material to manufacturing units for drawee bills only.

(c) Payment to Small Units:

With a view to ensure timely payment of the amount due to small suits the committee has recommended that publics sector undertakings and other large borrowers maintain control accounts and give precise information in their quarterly statements about dues to small units. On the basis of such information banks may take such steps as may ensure timely payments to small units. One such step may be stipulation that a portion of the credit limits for bills acceptance (drawee bills) will be utilized only for drawee bills of small-scale units.

Besides the above recommendations other recommendation of the course committee relate to:

(a) Relaxation in inventory norms.

(b) Devising check list of security of data at the operational level.

(c) Reducing delay in sanctioning credit limits.

(d) Taking up of communications system and procedure to ensure minimum time for the collection to instruments.

(e) Revision of plan of action by Banks in the light of new credit policy announced by the RBI from time to time and setting up a cell attached to the chairman’s office at the central office to attend such matters.

(f) Effective continuous monitoring of the credit portfolio of the key branches.

As regards the relative superiority of cash credit loans and bill system of lending, the committee found that not one system was superior to the other. The group, therefore, advocated the retention of the existing system of extending credit by a combination of the three systems of lending.

In brief, the Core committee recommended an amended system of lending, the adoption of which, would have the following beneficial effects:

(i) The pre dominant share of cash credit is total lending will be reduced.

(ii) Over dependence on bank borrowings will be reduced.

(iii) The ‘gap’ will be reduced.

(iv) Better planning consciousness and discipline among the borrowers will be fostered.

To achieve the objectives of the revised lending approach suggested by the committee, the quarterly information system (which had already been recommended by the Tandon Committee) was further strengthened and streamlined, through the following additional measures:

(i) Impossible of panel interest of 1% p.a. on the total outstanding for the period of default/

delay in submission of quarterly information statements,

(ii) Freezing the accounts of the borrower at the bank’s discretion in the case of persistent default.

(iii) Denial of fresh limits/additional facilities by the consortium bank in the case of borrowers who continue to default in submission of the quarterly information statements.

4. Jilani Committee:

In October 1993, another committee headed by Rashid Jilani, Chairman, Punjab National Bank also suggested an alternative to existing system of lending by way of cash credit for financing working capital requirements.

The committee had advocated a shift from a cash credit system to a loan system to ensure better cash management by banks. The committee has also suggested that the existing credit limits be bifurcated into two – a loan component corresponding to a company’s core credit requirements (this limit is to be determined by the current ratio) and a fluctuated credit limits.

The major recommendation of Jilani Committee may be summarised as below:

(i) The Committee has suggested bifurcation of the cash credit limit into a loan component also called the Core components and a fluctuating cash credit limit.

(ii) Identification of the loan component to be done on the basis of higher current ratio.

(iii) To raise the current ratio from 1.33 to 1.50 for existing companies with funds based working capital limits of Rs. 10 crores and more.

(iv) The shortfall in net working capital to be transferred to the loan account repayable after three to five years and for which the same rate of interest is to be charged.

(v) Borrowers with limit above Rs. 50 lakhs and below Rs. 10 crores should be subject to a minimum current ratio of 1.5 in a phased manner after 3 years.

(vi) Slip-backs in current ratio is to be allowed only at the discretion of the banks for genuine reasons.

(vii) Find use of funds, so granted needs to be monitored.

(viii) Government departments have been advised to accept bills drawn on them.

(ix) To reduce dependence on bank credit and increase reliance on long-term services.

Recent Changes in Maximum Permissible Bank Finance (MPBF):

Banks have always been important providers of funds in Indian scenario. Two important changes in credit policy have been effected in beginning of 1997.

They are:

(1) The concept of MPBF was recapped by the RBI and a new system was proposed by the Indian Bank Association (IBA) group. The MPBF was scrapped in order to facilitate need based working capital without sticking to age old policies which might have outlived their utility.

The salient features of new system are:

(A) For borrowers with requirements of up to Rs. 25 lakhs, credit limit will be computed after detailed discussion with borrower without going into detailed evaluation.

(B) For borrowers with requirements above Rs. 25 lakhs up to Rs. 5 crores. Credit limit can be offered up to 20% of the projected gross sales of the borrower.

(C) For large borrowers not selling in the above categories, the cash budget system may be used to identify the working capital needs.

However, RBI permits bank to follow Tandon/Core committee guidelines and retain MPBF concept with necessary modifications.

The cash budget approach has been widely criticised for its shortcomings like:

(a) It does not disclose the extent of changes in various current assets or current liabilities or profit.

(b) It does not keep track the movement of assets and liabilities.

(2) Earlier RBI has prescribed consortium arrangements for financing working capital beyond Rs. 50 crores. Now, it is not essential to have consortium arrangements. However, bank may themselves decide to form consortium so that the risks are spread.

To speed up credit decisions and building an environment dispensation to the mutual advantage of banks and borrowers. MPBF, as the basis of computation of fund based working limits by banks up to Rs. 1 crores, has ceased to be mandatorily applicable since early 1997. Banks have greater operational freedom to evolve their own methods to assess working capital needs of borrowers within the prudential guidelines and exposure norms.

While some banks continue to prefer the MPBF framework, alternative methods are being evolved/used by the other such as projected balance sheet (PBS) method to determine assessed bank finance (ABF) and turnover method on the lines of the assessment of the working capital limits of small borrowers/small-scale industries to determine short-term bank credit/finance (STBC/F). The main element of the turnover method are as below.

Turnover Method (TM):

The main features of the turnover method of assessing working capital needs/limits are as below:

(1) This method applicable to all borrowers for fund based/working capital limits up to Rs. 2 crores.

The limit fixed higher of:

(i) 20% projected gross annual sales turnover

(ii) Actual working capital needs

(2) A holding level of:

(i) 5 months (45% of gross sales).

(ii) For specified industries such as manmade textiles, fertilizers, food products and vegetables a level of 4 months (33.33% of gross sales).

(3) The inventory norms are applicable for current assets as a whole and not for individual components that is, materials, work in progress and finished goods. Margin on Letter of credit (LCs)/grantees are included as current assets as they are utilized for meeting current liabilities. The current liabilities would include annual maturity term liabilities also.

(4) While the required current ratio continues to be 1.33, a minimum of 1.20 may be allowed for industries with a high level of term-loan installment. In other words the current ratio would be 1.20 including annual maturing term liabilities as current liabilities and at least excluding such liabilities.

(5) Borrowers can draw the entire eligible finance as working capital limit without any distinction as to pre-sale or post-sale facilities.

(6) As unpaid stock element would be built into the margin retained by the bank on a current asset, there would be no distinction between unpaid and paid for (fully paid) stocks.

(7) Before release of any facilities, approval of controlling authorities for documentation and compliance with terms and conditions is necessary for advances upto specified limits.

(8) The new norms on financials of borrowers are:

a. Acceptable level of total outside liability (TOL)/tangible network (TNW), 3 except in special cases like NBFCs.

b. Interest coverage ratio at least 2 and

c. Borrowers operations result in profit every year.

(9) To expedite credit delivery:

a. Repeated and extensive ‘paper trail’ would be avoided and joint appraisal of all large advance proposals would be done.

b. For borrowers with good financials, the need to have audited balance sheet which is not less than 6 months old can be dispensed with.

Their credit limits would be assessed on the basis of their own financial budgets and the facility for a financial year would be made available before the commencement of that year. A checklist of essential information needs of the changed method of lending is suitably incorporated in the proposal for credit facilities. The application form has also been suitably modified, incorporating only necessary details.

(10) The present treatment of output receivables for computing NWC would continue.

(11) Domestic receivable other than deferred receivables outstanding for more than 6 months would be excluded from the computation of current assets.

(12) Combined limits of pre-sales and post-sales could be granted.

(13) Treatment of sundry creditors for the purpose of arriving at eligible bank finance could be changed.

(14) Verification of current assets changed to the bank should be done at least once annually by a reputed firm of chartered accountants.

(15) End – use of funds or absence of ‘diversion’ has to be monitored by looking at the movements in NWC. Any reduction in the level of NWC may be permitted for investment in fixed assets and/or prepayment of term debt, subject to the resultant current ratio being at acceptable levels.

(16) Borrower’s financial health would be monitored by looking at total liability/equity ratio, current ratio, profitability and interest coverage ratio.

(17) As the funds-flow statement gives more information about the sources and use of funds which are used in business activity, it would be used rather than the cash budget which would, however, continue to be used in highly seasonal industries such as sugar, tea, side units and so on. They reveal the profitability of the enterprise and the end-use of funds.

(18) The delivery system by splitting the total amount/limit as a demand loan and cash credit component would continue to be applicable as prescribed by the RBI from time to time.

Commercial Papers:

Commercial Paper (CP) is a short-term unsecured negotiable instrument, consisting of usance promissory notes with a fixed maturity. It is issued on discount on face value basis but it can also be issued in interest bearing form.

A CP when issued by a company directly to the investor is called a direct paper. Companies announce current rates of CPs of various maturities and investors can select those maturities which closely approximate their holding period.

When CPs are issued by security dealers/dealers on behalf of their corporate customers, they are called dealer paper. They buy at a price less than the commission and sell at the highest possible level. The maturities of CPs can be tailored within the range of specific investments.

Advantages:

A CP has several advantages for both the issues and the investors. It is a simple instrument and hardly involves any documentation. It is additionally flexible in terms of maturities which can be tailored to match the cash flow of issuer. A well-rated company can diversify its short-term sources of finance from banks to many market at cheaper cost.

The investors can get higher returns than what they can get from the banking system. Companies which are able to raise funds through CPs have better financial standing. The CPs are unsecured and there are no limitations on the end use of funds raised through them. As negotiable/transferable instruments, they are highly liquid.

The creation of the CP market can result in a part of inter-corporate funds flowing into this market which would come under the control of monetary authorities in India.

Indian CP Market:

The CPs emerged as sources of short-term financing in the early nineties. They are regulated by the RBI.

The main elements of the present framework are given below:

(1) CPs can be issued for period ranging between 15 days and one year.

Note:

Renewal of CPs is treated as fresh issue.

(2) The minimum size of an issue is Rs. 25 lakhs and minimum unit of subscription is Rs. 5 lakh.

(3) The maximum amount that a company can raise by way of CPs is 100% of the working capital limit.

(4) A company can issue CPs only if it has a minimum tangible net worth of Rs. 4 crores, a fund-based working limit of Rs. 4 crores or more, at least a credit rating of P2 (crisis), A2 (Iera), PR – 2 (care) and D – 2 (Duff and Phelps) and its borrow account is classified as standard asset.

(5) The CPs should be issued in the form of usance promissory notes, negotiable by endorsement and delivery at a discount rate freely determined by the issuer. The rate of discount also includes the cost of stamp duty (0.25% to 0.5%), rating charges (0.1 to 0.2%) dealing bank fee (0.25%) and stand by facility (0.25%).

(6) The participants/investors in CPs can be corporate bodies, banks, mutual funds, UTI, LIC, GIC, NRIs on non-repatriation basis. The Discount and Finance House of India (DFHI) also participates by quoting its bid and offer prices.

(7) The holder of the CPs would present them for payment to the issuer on maturity.

Effective Cost/Interest Yield:

As the CPs are issued at discount and redeemed at its face value, their effective, pre-tax cost/interest yield.

where Net amount realised = face value – discount – issuing and paying agent (IPA) charges, that is stamp duty, rating charges, dealing bank fee and fee for stand by facility.

Essay # 4. Factoring:

Factoring provides resources to finance receivables as well as facilities the collection of receivables.

Although such services constitute a critical segment of the financial services scenario in the developed countries, they appeared in the Indian financial scene only in the early 90’s as a result of RBI initiatives.

There are two bank-sponsored organization which provide such services:

(1) SBI Factors and Commercial Services Ltd.

(2) Canbank Factors Ltd.

Note:

The first private sector factoring company i.e., Foremost Factors Ltd. started operations since the beginning of 1997.

Definition of Factoring:

Factoring can broadly be defined as an agreement in which receivables arising out of sale of goods/services are sold by a firm (client) to the factors (a financial intermediary) as a result of which the tittle of the goods/services represented by the said receivables passes on to the factor.

Hence forth, the factor becomes responsible for all credit control, sales accounting and debt collection from the buyer(s). In a full service factoring concept (without recourse facility), if any of the debtors fails to pay the dues as a result of his financial inability/ insolvency/ bankruptcy the factor has to absorb the losses.

Mechanism of Factoring:

It is not just a single service, rather a portfolio of complimentary financial services available to clients i.e., sellers. The sellers are free to avail of any combination of services offered by the factoring organizations according to their individual recruitments.

Generally, factoring involves provision of specialised services relating to credit investigation, sales ledger management, purchase and collection of debts, credit protection as well as provisions of finance against receivables and risk bearing.

In factoring accounts receivables are generally sold to a financial institution (a subsidiary of commercial bank called factor) who charges commission and bears the credit risks associated with the accounts receivable purchased by it.

Its operation is very simple. Clients enter into an agreement with the ‘factor’ working out an factoring arrangement according to his requirements. The factor then takes the responsibility of monitoring follow up, collection and risk taking and provision of advances.

Note:

The factor generally fixes up a limit customer wise for the client, (seller)

Credit sales generate the factoring business in the ordinary course of business dealings. Realization of credit sales is the main function of factoring services. Once a sale transaction is completed, the factor steps into realise the sales. Thus the factor works between the seller and the buyer and sometimes with the sellers banks together.

Functions of Factors:

Depending on the type/form of factoring, the main functions of a factor, in general terms, can be classified into following five categories:

(1) Financing facility/trade debts.

(2) Maintenance/administration of sales ledger.

(3) Collection facility/of accounts receivable.

(4) Assumption of credit risk/credit control and credit restriction.

(5) Provision of advisory services.

1. Financing Trade Debts:

A unique feature of factoring is that a factor purchases the book debts of his client at a price and debts are assigned in favour of the factor who is usually cutting to grant advances to extent of 80% of assigned debts.

Where debts are factored with recourse, the finance provided would become refundable by the client in case of non-payment of the buyer. However, where the debts are factored without recourse the factor’s obligation to the seller becomes absolute on the due date of the invoice whether or not the buyer makes the payment.

2. Administration of Sales Ledger:

The factor maintains the client sales ledgers. On transacting a sales deal, an invoice is sent by the client to the customer and a copy of the same is sent to the factor. The ledger is generally maintained under the open-item method in which each receipt is matched against the specific invoice.

The customer’s account clearly rejects the various open invoices outstanding on any given date. Factor also gives periodic may be fortnightly, weekly depending on the volume of transactions, reports to the client on the current status of his receivables receipts of payments from the customers and other useful information.

In addition, the factor also maintains a customer wise record of payments spread over a period of time so that any change in the payment pattern can be easily identified.

3. Provision of Collection Facility:

Factor undertakes to collect the receivables on behalf of the client relieving him of the problems involved in collection, and enables him to concentrate on other important functional areas of the business. This also enables the client to reduce the cost of collection by way of savings in manpower, time and efforts.

The use of trained manpower with sophisticated infrastructural back-up enables a factor to systematically follow up and make timely demands on the debtors to make payments. Also, the debtors are more responsible to the demand from a factor being a credit institution.

Collection of receivables can be considered as the most important function of factor. He is generally not required to consult the client with regard to the collection procedure. But he may consult the client if legal action has to be initiated in case of non-payment and so on.

4. Credit Control and Credit Restriction:

Assumption of credit risk is one of the important functions of a factor. This service is provided where debts are factored without recourse. The factor in consultation with the client fixes credit limits for approved customers. Within these limits, the factor undertakes to purchase all trade debts of the customer without recourse.

In other words, the factor assumes the risk of default in payment by the customers. Arising from this function of the factor, there are two important incidental benefits accruing to the client:

(i) Factoring relieves the client of the collection work.

(ii) With access to extensive information available on the financial standing and credit-rating of individual customers and their track record of payment, the factor is able to advise the client on the credit-worthiness of potential customers leading to better credit control.

Operationally, the time of credit/credit limit up to which the client can sell to the customer depends on his financial position, his past payment record and the value of the goods sold by the client the customer.

An approach followed by the factors is to define the monthly sales turnover for each customer which will be automatically covered by the approved credit limit.

Example 2:

If the approved limit for a customer is Rs. 10 lakhs and the average collection period is 60 days, sales up to 5 lakh [10 × 30]/60 per month will be automatically covered.

Alternatively, some factors provide periodic reports to the clients on customer credit utilisation before any major sale is made. The credit-worthiness of customers is assessed by the factors on the basis of information from a number of services. Such as credit rating reports, if available, bank reports and trade references, analysis of financial statements on the basis of current ratio, quick ratio, net profit margin and return on investment (ROI), prior collection experience and customer visits.

5. Advisory Services:

These services are a spin-off of the closed relationship between a factor and a client. By virtue of their specialized knowledge and experience in finance and credit dealing and access to extensive credit-information, factors can provide a variety of incidental advisory services to their clients.

Advantages:

Factoring has several positive features from the point of view of the firm (client).

These advantages are as below:

(1) Impact on balance sheet.

(2) Reduction in current liabilities.

(3) Improvement in current ratio.

(4) Higher credit standing.

(5) Improved efficiency.

(6) More time for planning and production.

(7) Reduction in cost and expenses.

(8) Additional service.

1. Impact on Balance Sheet:

The impact of factoring on balance sheet of the client and its implications can be easily understood with the help of following illustration:

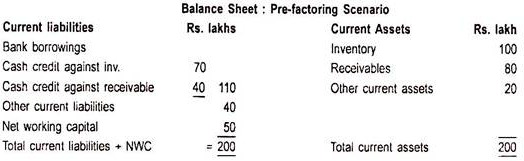

The requirement of NWC is Rs. 50 lakhs (CA – CL). As the borrower carries other current liabilities to the extent of Rs. 40 lakh he is eligible for maximum permissible bank finance (MPBF)/working capital limit of Rs. 110 lakh. This is bifurcated into cash credit limits of Rs. 70 lakh against inventory and Rs. 40 lakh against receivables, taking into account the stipulated margins for inventory and receivables and also the proportion of individual levels of inventory of Rs. 100 lakh and receivables of Rs. 80 lakh. Current Ratio = 1.33:1 on the basis of the above configuration, the borrower is eligible for working capital limits aggregating Rs. 110 lakhs under the second method of lending.

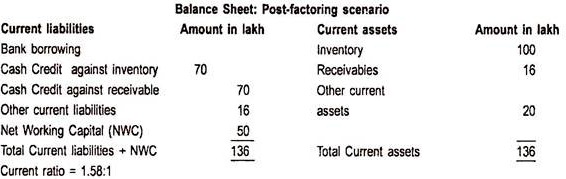

If the borrower decides to factor his debts. The factoring transaction is as follows- Receivables aggregating Rs. 80 lakh are purchased by a factor who makes pre-payment of 80% that amounts to Rs. 64 lakhs. He retains Rs. 16 lakhs i.e., factor reserve which will be repaid on payment by the customer.

The impact on the balance sheet will be as below:

Off Balance Sheet Financing:

As the client’s debts are purchased by the factor, the finance provided by him is off the balance sheet and appears in the balance sheet only as a contingent liability in the case of resource factoring.

In case of non-recourse factoring, it does not appear anywhere in the financial statements of the borrowers. The pre-payment of Rs. 64 lakhs made by the factor goes off the balance sheet getting converted into cash, leaving the balance of Rs. 16 lakhs in the balance sheet as due from the factor.

2. Reduction of Current Liabilities:

In the above example, Rs. 64 lakhs are the proceed of factoring which have liquidated the bank borrowings up to an extent of Rs. 40 lakhs. The balance of Rs. 24 lakhs can be used by the client for paying off other current liabilities comprising of trade creditors for goods and services, creditors for expenses, loan installments payable, statutory liabilities and provisions. The client may meet any of these obligations with the balance of Rs. 24 lakhs. The net effect is to reduce current liabilities by Rs. 64 lakhs.

3. Improvement in Current Ratio:

As the factoring is off the balance sheet it removes from the assets side the receivables factored to the extent of the prepayment made and on the liabilities side, the current liabilities are also reduced. The result is a desirable improvement in the current ratio from 1.33: 1 to 1.58: 1.

Note:

It can be said the effect of factoring is to improve the financial discipline of the firm.

4. Higher Credit Standing:

There are several reasons why factoring should improve a client’s standing with cash flow accelerated by factoring. The client is able to meet his liabilities promptly as and when they arise. The factors acceptance of the client’s receivables itself speaks highly of the quality of the receivables. In the case of non-resource factoring, the factors assumption of credit risk relieves the client, to a significant extent, from the problem of bad debts. This enables him to minimise his bad debt reserve.

5. Improved Efficiency:

In order to accelerate cash flow, it is essential to ensure the flow of critical information for decision making and follow-up and eliminate delays and wastage of man- hours. This requires sophisticated infrastructure for high level specialization in credit control and sales ledger administration.

Note:

Small and medium size units are likely to face a reserve constraint in this area.

Factoring is designed to place such units on the same level of efficiency in the areas of the business line planning, purchase, production, marketing and finance.

6. More Time for Planning and Production:

In any business concern, it is inevitable that a certain proportion of management time has to be diverted to credit control.

Large companies can afford to have special departments for this purpose. However, smaller units cannot afford it. The factor undertakes the responsibility for credit control, sales ledger administration and debt collection problems. Thus, the client can concentrate on functional areas of the business line planning, purchase, production, marketing and finance.

7. Reduction in Cost and Expenses:

Since the client need not have a special administrative set up to look after credit control, he can have the benefit of reduced overheads by way of savings on manpower, time and efforts.

With the steady and reliable cash flow facilitated by factoring, the clients have many opportunities to cut costs and expenses like making suppliers prompt payment and taking quality discounts, ordering for materials at the right time and at the right place, avoidance of disruption in the production schedule and so on.

8. Additional Source:

The supplier gets an additional source of funding the receivables which eliminates the uncertainty associated with the collection cycle. More importantly, funds from a factor are an additional sense of finance for the client outside the preview of bank credit.

Evaluation of Factor:

The distinct advantages of factoring notwithstanding, it does involve costs. The evaluation framework should be on a consideration of the relative costs and benefits associated with the two alternatives to receivables management.

These are:

(a) In house management by the firm itself.

(b) Factoring service.

(i) Recoursed.

(ii) Non recoursed.

The relevant costs and benefits associated with these are as follows:

(a) Cost Associated with In-House Management:

(i) Cash Discount.

(ii) Cost of funds invested in receivables.

(iii) Bad debts.

(iv) Last contribution on foregone sales.

(v) Avoidable costs of sales ledger administration and credit monitoring.

(b) Cost Associated with Recourse and Non-Recourse Factoring:

(i) Factoring commission.

(ii) Discount charges.

(iii) Cost of long-term funds invested in variables.

(c) Benefits Associated with Recourse Factoring:

These are in terms of costs associated with the in-house management alternative with the exception of bad debt loss.

(d) Benefits Associated with Non-Recourse Factoring:

The above plus the bad debt losses relevant to in house management of receivables.