Some of the frequently asked exam questions on business and corporate strategies are as follows:

Q.1. Give an outline of practical way to develop a master strategy of a firm.

Ans. A practical way to develop a master strategy is to:

1. Identify particular roles or ‘niches’ that are appropriate to a firm in view of competition and the firm’s resources.

ADVERTISEMENTS:

2. Develop various facets of the firm’s efforts and combine them to obtain synergistic effects.

3. Set up sequences and timing of changes that reflect firm’s capabilities and external conditions.

4. Provide for frequent reappraisal and adaptation to evolving opportunities in the environment, internal and external.

Q.2. What are the types of strategy-oriented appraisal that should be conducted while evaluating a new investment proposal. Give an outline of appraisal criteria, which you think to be of strategic importance, against each type.

ADVERTISEMENTS:

Ans. 1. Market Appraisal:

A strategist should be primarily concerned with two basic criteria:

(i) Aggregate demand of the proposed product or service in future; and

(ii) Market share of the proposed product or service in future.

ADVERTISEMENTS:

For the above, the strategist requires a wide variety of information and appropriate forecasting methods.

ADVERTISEMENTS:

Of them, the following are important:

(a) Consumption trends,

(b) Imports and exports,

(c) Structure of competition,

ADVERTISEMENTS:

(d) Elasticity of demand,

(e) Consumer behaviour—preferences and requirements, and

(f) Environmental constraints.

2. Technical Appraisal:

ADVERTISEMENTS:

A strategist is concerned with:

(a) Suitability of the production process,

(b) Appropriateness of plant and equipment,

(c) Optimality of the selected scale of operation,

ADVERTISEMENTS:

(d) Appropriateness of the proposed technology from the social point of view, and

(f) Adequacy of the treatment of effluents, etc.

3. Financial Appraisal:

A strategist, in this area, is concerned with three basic criteria:

(i) Financial viability of the proposal to meet the burden of servicing debt;

(ii) Satisfactory return on investment; and

ADVERTISEMENTS:

(iii) Risk-return trade off.

4. Economic Appraisal:

This refers to social cost benefit analysis. A strategist is concerned with judging a new project proposal from larger social point of view.

In such analysis, criteria should include:

(a) Assessment of direct economic benefits;

(b) Impact on income distribution in the society; and

ADVERTISEMENTS:

(c) Contribution capability of the proposal towards fulfilment of certain needs like self-sufficiency, employment, social order, etc.

In a word, strategy-oriented appraisal of a new investment proposal should ensure optimal considerations on: maximisation of profit, maximisation of earnings per share, maximisation of shareholders’ wealth and minimisation of risk from business point of view and social cost-benefit analysis from social point of view.

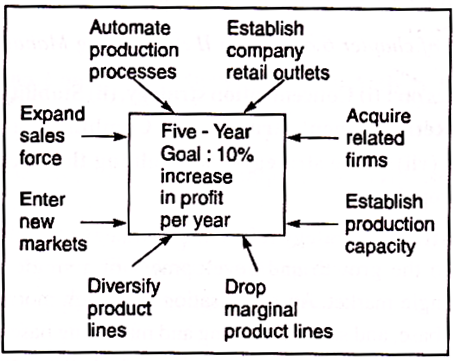

Q.3. Explain the term ’growth strategy’.

Ans. According to Ansoff and Stewart, ‘a growth strategy is one that an enterprise pursues when it increases its level of objectives upward in a significant increment, much higher than an extrapolation of its past achievement level. The most frequent increase indicating a growth strategy is to raise the market share and/or sales objective upward significantly’.

They are of the view that at least three reasons are dominant in the pursuit of a growth strategy:

(1) In volatile industries, growth is a necessity for survival;

ADVERTISEMENTS:

(2) To many executives, growth is equated with effective performance; and

(3) As an objective, growth is the most important one.

A company pursuing a growth strategy will always strive for better results every year than the previous year in the areas of production, sales, and profits.

‘In terms of corporate planning and policy, growth strategy is considered as a business decision, an investment decision, and a management challenge. A company following a growth strategy, in most cases, has certain strengths in its internal organisational set up.

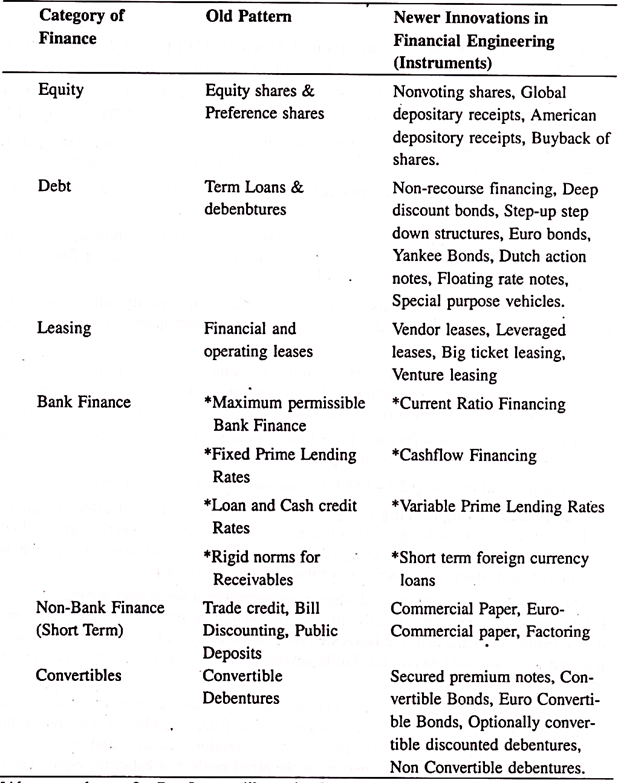

Q.4. What do you understand by the expression ‘corporate restructuring’?

Ans. Corporate restructuring refers to the process by means of which a firm makes an assessment and evaluation of itself at a point of time and alters what it owes and owns, and refocuses itself to specific tasks of performance for improvements.

ADVERTISEMENTS:

Such restructuring is usually radical in design and starts with an analysis of the business environment and the acceptance of the fact that revolution (or at best fundamental rethinking) is necessary for the survival of the corporation.

Corporate restructuring is sometimes termed as ‘business process re-engineering’ in the sense that it involves consideration of at least three important aspects:

(i) Business portfolio revaluation;

(ii) Financial engineering, and;

(iii) Organisational redesign

Through the process of restructuring, companies can

ADVERTISEMENTS:

(i) identify their core competences,

(ii) decide in which business areas they should continue to operate,

(iii) determine which sectors they should get out of,

(iv) choose their diversifications synergistically, and

(v) seek strategic alliances with transnational’s and even domestic companies.

Q.5. State the basic reasons as to why and when companies should go for restructuring.

Ans. There are basically six reasons why companies go in for restructuring:

1. The globalisation of business has compelled Indian companies to open new export houses to meet global competition. Global market concept has necessitated many companies to restructure because cost leadership only can withstand in the competitive global markets.

2. The changes in the fiscal and government policies like deregulation/decontrol have led many companies to search for newer markets and customer segments.

3. Revolution in information technology has made it necessary for companies to adapt new changes in the communication/information science for improving corporate performance.

4. Many companies have divisionalised into smaller businesses. Wrong divisionalisation strategy has led to revamp themselves. Product divisions which do not fit into the company’s main line of business are being divested. Fierce competition is forcing Indian companies to reorient themselves.

5. Application of the techniques of cost reduction and productivity improvement has necessitated downsizing of the workforce—both at works and managerial level.

6. Convertibility of rupee has attracted medium-sized companies to operate in the global markets.

Q.6. What are the broad areas that need restructuring?

Ans. In the following broad areas, corporate restructuring is needed:

1. Financial Restructuring:

This involves managerial decisions relating to acquisitions, mergers, joint ventures and strategic alliances. This also deals with restructuring the capital base and raising finance for new projects. [For details: see the topic on ‘Financial Engineering’.]

2. Technological Restructuring:

This involves investment in research and development activities and also alliances with overseas companies to exploit technological strengths.

3. Market Restructuring:

This involves decisions regarding the product/market segments—where the companies plan to operate based on their distinctive core competencies.

4. Manpower Restructuring:

This involves establishing internal structures and processes for improving the value-systems and capability of personnel in the organisation to favourably respond to changes. This also deals with certain strategic moves to organisation development and culture.

Q.7. How to manage brands in a company?

Ans. Companies that are efficient in developing and managing brands eventually reap rewards. ‘Strong brands can generate tremendous shareholder value’. Let us take the case of Coca-Cola.

Its market capitalisation is accounted for by its intangible assets, mainly the brand. On December 31, 1997, Coca-Cola’s market capitalisation was $ 165 billion, while its book value excluding goodwill was $ 16.2 billion. Almost 90 per cent of Coca-Cola’s value is intangible.

Brand management has mostly been considered an art, not a science. So managers require a business model that would determine and modify existing system behaviour.

The Framework:

Those firms seeking to manage brands effectively need to consider a new value management system which would help them to identify, quantify, and manage the complex system that underpins brand’s value.

The brand valuation system rests on three core ideas:

1. Brand value equals the net present value of its future cash flows, which are determined by future sales volumes and prices. This is also determined by the value of the option to create brand extensions. All basic branding decisions can be assessed by their impact on future cash flows.

2. Brand value depends on the brand’s key resources like product features, number of loyal customers, and sales outlets. It also depends on intangible resources like quality of retail display and staff morale. These factors, therefore, needs to be considered adequately.

3. These resources should evolve to interact and create a system containing time-delays and feedback loops.

Following the aforementioned ideas, the brand valuation system can be devised on the basis of the following parameters:

1. Identification of the factors contributing to the valuation of the brand.

2. Insight into interdependency of the various factors.

3. A software model which progresses from a simple qualitative processes to a complex quantitative model.

4. The model should also help in identifying revenue streams for each strategy and must reveal the impact of different management actions.

Incorporating such a brand management structure means a whole lot of fresh initiatives for the leader. The chief executive who believes in this model could use this dynamic model to communicate the strategy to everyone in the company.

According to Chris Cleaver “a true brand transcends product format and has a relationship with the consumer that has more to do with the beliefs the brand expresses than the product itself….Markets are changing dynamically, and the brand that is too closely associated with any particular product format or physical manifestation, and which does not use the power of that relationship to extend and evolve into new formats and markets, is probably destined to drop off the perch”.

The brands that have prospered are those that have retained the core ideas but reinterpreted themselves to appear relevant.

Q.8. What is ISO-9000 Certification? Discuss its importance as a business strategy.

Ans. ISO stands for International Organisation for Standardisation, originally established in 1987. For international trade, a common set of universally accepted quality standard is needed and some basic rules for quality systems from concept to implementation should be there.

ISO meets these objectives. ISO is an international series of generic quality standards and it was revised in August 1994. Its purpose is to establish common standards worldwide. Presently, more than seventy countries are its members.

ISO is a collection of standards, ranging from ISO-9000 to ISO-9004.

These are:

ISO-9000:

It is the guideline for selection and use of Quality Management and Assurance Standards.

ISO-9001:

It is the Quality System Model for Quality Assurance in Design Development of a product through production, installation and servicing.

ISO-9002:

It is the Quality System Model for Quality Assurance in the areas of production and installation of a product or service.

ISO-9003:

It is the Quality System Model for Quality Assurance in final inspection and test.

ISO-9004:

It is the Quality Management and Quality System Elements—Guidelines.

ISO-9000 standard, in the sphere of business practice and strategy, is considered important in the following ways:

(i) It enforces a link and communication between organisations;

(ii) It improves profitability by reducing quality cost and taking corrective actions where necessary;

(iii) It enhances the company’s position in the market through competitive attitude globally; and

(iv) It creates an environment of better motivation as the systems are improved rather than resorting to crisis management.

Q.9. Cost management, in a global, liberalised economy and competitive environment, has become a strategic priority for survival, growth, and profitability of a corporate body. —Against this background, discuss: (a) the relevance of costs, (b) cost information model, (c) cost control system, (d) cost reduction as a concept of re-engineering, and (e) the role of a cost accountant in the context of Indian situation:

Ans. (a) Relevance of Costs:

For the Government of India’s economic policies of liberalisation, the Indian economic environment has opened up enormous opportunities of growth for Indian companies. But the opportunities have also brought in severe competition.

Liberalisation:

The liberalisation process, which began mildly in 1977 and 1985, has been accentuated since 1991.

Its features in brief are:

(i) Most industries do not require a licence to enter;

(ii) Direct taxes, central excise and customs duties are being progressively reduced;

(iii) Money and capital markets are free, subject only to the regulations of Securities Exchange Board of India;

(iv) Infrastructure sectors of power, telecom, oil, gas, roads and ports are now open for Indian and foreign private investment; and

(v) Foreign investment is not just ‘allowed’ but actively encouraged.

Competition:

The central aim of liberalisation is to relaunch the sluggish Indian economy on a higher growth path. After a difficult period of structural adjustments in 1991-95, economy had shown a recovery since 1996. Multi-lateral, bilateral and independent research bodies world-wide are looking upon India as an emerging market, an Asian tiger, a locomotive economy and an economic super-power of the 21st Century.

The competitive scenario (in brief) looks like:

(i) In most industries, the existing players are planning (some have also planned) expansion;

(ii) Many industries are also attracting new players—Indian, foreign and joint ventures;

(iii) Multi-national companies with majority or substantial* holdings have brought in latest technology, brand names, and funds;

(iv) Imports of capital goods, intermediates and raw materials have posed a serious threat; and

(v) Mergers and acquisitions in the corporate world are creating bigger competitors with their economies of scale and scope.

In this liberalised, competitive economy, ‘costs’ have become relevant for Indian managements for:

(i) If a firm has to ‘optimise’ its performance, it should have to constantly search for improvements in all areas—including costs.

(ii) Those who are involved in exports markets have to have a serious concern for costs.

(iii) Profits will have to come not by raising prices but by controlling and reducing costs.

(iv) Profits cannot be made at low capacity utilisation as it gives an upward pressure on the break-even point.

(v) The supply capacity, with most industries in a competitive economy, being higher than demand calls for a low-cost criterion to bring in improvements in delivery and customer service areas.

(b) Cost Information Model:

There is no question of managing costs if a firm does not even know or take interest in costs.

The cost information model should cover the following aspects:

(i) Every aspect of business must be subjected to an assessment of at least the actual costs. For examples, projects, materials, labour, energy, maintenance, manufacturing, brand building, selling, distribution, R&D, HRD, etc.

(ii) The entire organisation must be provided with cost data relevant at each level, function and location:

(a) overall cost information to top/senior management,

(b) Function-wise costs to respective functional executives,

(c) Factory costs to junior executives, supervisors and workmen.

(d) Field costs to sales executives and sales force.

The very awareness of costs may trigger some innovative thinking and action.

(iii) Management at all levels should encourage people to take interest in current cost information and make their own comparisons with the past costs and competitors’ costs. Even if full financial data are not available, comparisons as to operating data and physical consumption data should be made.

(iv) It should also be emphasised that the aim is not to cut costs indiscriminately but to encourage a cost-benefit orientation. Are we getting sufficient ‘value’ for the cost being incurred? Or, conversely, for this level of ‘desired’ value, can we bring down the actual cost?

(v) Cost information should be disseminated not as a complaint or criticism but as a stimulus to innovation and ingenuity at worker, supervisor and executive levels.

The cost information model should also adopt the technique of ‘Activity Based Costing’ (ABC) which breaks down the work process into various activities and tries to work out costs for each of these activities.

Further, each of these activities is broken down into two components: Value-added (VA) components and Non-value added (NVA) components. NVA activities are typically those activities that the customers would not pay for.

Unnecessary copying, checking, correcting and overtime working due to idle etc. are the common ‘NVA’ activities. By collecting the total ‘NVA’- costs by process possible to prioritise improvement activities in the organisation.

The performance tan: need to be set for both of the ‘VA’ and ‘NVA’ components—with an aim to continually improve upon the ‘VA’ components and reduce and ultimately eliminate the ‘NVA’ components.

Thus ABC information can help management to anticipate the organisational effects of decisions. It can be used to guide strategic decisions on product design and engineering that will reduce future manufacturing and operating expenses.

(c) Cost Control Model:

The model of cost control system and process should embrace the following:

(i) The firm should have a norm or standard against which actuals can be compared, the variances analysed, and the corrective actions taken.

(ii) The ‘Standard’ or norm should be set keeping in view the competitive market. The 3Cs of pricing are needed to be ranked as Competition, Customer and Cost. In a dynamic market, competition sets the price. From that, after allowing a modest profit margin, the firm has to arrive at the ‘target’ cost. The costs of all elements have to be within this target cost.

(iii) Another ‘standard’ should also be set taking into account the past performance peaks attained during industrial peace and on account of availability of power supply and raw materials.

Management, through proper application of motivation strategies and practices at workmen, supervisory and managerial levels, should have to recapture those performance-efficiency-productivity peaks. This would result in lower cost standards.

(iv) Some idea or intelligence of what are the cost structures of the most efficient competitors (both existing and new) should have to be a ‘focus’ to do a benchmark for the firm’s standards.

(v) The firm should have to set the standards by having an analytical look at technical, engineering and theoretical parameters for all products and processes.

(d) Cost Reduction-Concept of Re-Engineering:

The third and most advanced stage of cost management is cost reduction. Cost reduction can be achieved by challenging the norms or standards themselves.

The concept of re-engineering in this area requires the following steps:

(i) Creating a culture, a set of values and mind-set in the organisation that all cost standards are not permanent but temporary, and that they must be subject to constant downward pressure.

(ii) Taking inter-firm comparisons and benchmarking global and considering world as ‘one market’.

(iii) Reducing not only labour costs but the major items like materials, energy and the more avoidable items like interest and administrative overheads.

(iv) Introducing cost reduction activity at the very project or design phase.

(v) Subjecting every new project of revamping, modernisation and on-site expansions to tighter standards.

(vi) Going in for international standards of erection time, cost, quality, and post- commissioning activity in greenfield projects.

(vii)Investing in design, research and development, value analysis, value engineering, training, suggestion and incentive schemes to deepen cost reduction.

(e) Role of a Cost Accountant:

Against the background of strategic cost management that has become so crucial to the survival, profitability and growth of Indian enterprises, a cost accountant’s role has also become crucial and multi-dimensional.

A cost accountant should:

(i) Act as a Resource Person that means, as an internal consultant to the line executives on how they can build the division/company into a cost leader.

(ii) Act as a Friend and Counsellor to the supervisors, and workmen on how they can measure, control and reduce costs at their levels.

(iii) Act as a Motivator that means, helping the executives and workmen to be the ‘trustees’ of the plant and equipment, materials, and money in their care, and not usurping the trustee role and alienate them.

(iv) Act as a Coordinator that’ means, helping the managers and executives in carrying out inter-firm cost comparisons and benchmarking with relevant domestic and global competitors.

(v) Act as an Advisor that means, adopting a positive approach in the pattern of expenses—not only asking why some expenses have been incurred but also asking why some other expenses like R&D, advertising, training not incurred for ensuring future cost competencies.

Q.10. What are the strategies required by a business to build a substantial competitive advantage?

Ans. According to Porter, a business can build a substantial competitive advantage by adopting one of the two strategies:

1. A differentiation of the product, or

2. A low cost strategy.

While this may be true in short-run; in the long-run the roots of competitiveness remain in core competencies and core capabilities. Core competence reflects the ability to build products/services most speedily with lower cost and higher added value and the ability to adopt new situations.

Differentiation of the products aims to offer additional value to the customers through offering tangible benefits such as superior customer service or such intangible benefits such as ‘glory’ by association with superior brand image at the same cost as its competitors.

A low cost strategy tries to achieve cost leadership through economies of scale and scope, cost reduction of non- value added costs, tight cost control and cost management and offers the same value at a lower cost.

In a global and competitive environment, technology and brands give a temporary advantage. Product differentiations—that is, its features and values—are quickly observed and imitated by the competitors. So, cost value edge becomes the most sustainable competitive advantage.

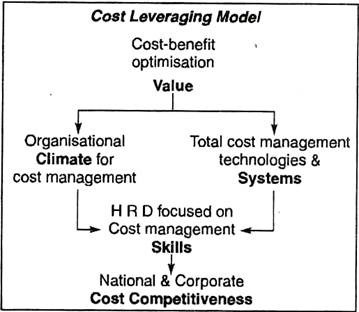

A model for leveraging cost for competitiveness is highlighted below to clarify the position:

In the model,

Value— requires the acceptance of cost management philosophy and internalisation of optimisation.

Climate — stresses the importance of proactively managing costs including cost consciousness, control and reduction via workmen and line management.

Systems — represent designing the framework for operationalizing the total cost management, with the architecture of hardware and software adapted to the firm’s need via familiarisation of inputs-outputs process.

Skills — require training related to TCM technology and attitudes to pursue cost control/reduction/optimisation in the face of newer competitive challenges.

Cost Competitiveness — represents the final stage to be achieved for the national and corporate levels.

Q.11. Explain the meaning and concept of synergy.

Ans. ‘Synergy’ is a term used to identify the condition where the combined effect of two or more courses of action is greater than the sum of the individual parts.

The concept of synergy can be explained symbolically as follows:

If a company A merges with company B, the value of the merged entity called AB is expected to be greater than the sum of the independent values of A and B, i.e.

V(AB) > V(A) + V(B)

where V(AB) = Value of the merged entity.

V(A) = Independent Value of Company A.

V(B) = Independent Value of Company B.

The greater value is ultimately expected to result into higher earnings per share for the merged entity. For example, let us assume that there are two pharmaceutical companies namely, company A and company B. Company A is strong in its marketing set up, while company B in its research and development and product innovation.

If these two companies come together, the sales and profitability of the combined company will be much higher than the sum of the individual sales.

Q.12. Classify ‘synergy’ into several types in terms of the components of the ROI formula.

Ans. We may think of the following classifications in respect of Synergy in terms of ROI:

1. Sales Synergy:

This can occur when products of combined firms use common distribution channels, common marketing efforts, common sales force or common warehousing Arrangement for tie-in-sales as the offers of a complete line of related products increases the efficiency and effectiveness of the sales staff and thereby raises the sales productivity of the combined entity.

Commonalities in the sphere of advertising campaigns, sales promotion, E-mail and Internet services, computer processing of sales orders, and past reputation of the individual firms can all have significant contribution margin for more or less the same amount of money spent. But, if the selling activities are decentralised (i.e., separate for each business unit), no sales synergy is gained.

2. Operating Synergy:

This can occur through higher utilisation of plant capacities and facilities and personnel, spreading of overhead on increased production, advantages of common learning curves and large-lot purchasing.

One common strategy for achieving operating synergy involves carefully limiting diversification to businesses having common marketing needs. But where the operating activities tend to differ widely from business to business, the task of achieving synergy is considerably difficult.

Let us take the case of Procter and Gamble. It has a number of products to sell to the consumers e.g., snack foods, cosmetics, detergents, etc. Because of different production facilities involved to produce them, very little manufacturing synergy is achieved. But most products go to the same consumer mass market through a common distribution channel. So, it could achieve synergy in the area of marketing operations.

3. Investment Synergy:

Investments in common tools and plants, common raw materials and supplies and transferability of research and development activities between the products of the combined entity can lead to attain this synergy.

4. Management Synergy:

Although not directly linked to the ROI formula, the factor of organisation and management aspects contributes greatly to the total effect. Competent senior-level management having a track-record of managerial ability and acumen can give effective guidance to the newly acquired venture and enhance the standard of performance of the combined enterprise.

This leads to synergy effect. Inter-business transfers of a few key management staff from successful units to less successful ones can achieve management synergy.

Q.13. Explain the term ‘Start-Up Synergy’.

Ans. ‘Start-up is the initial phase through which a firm goes through just after acquisition of a new-product-market area. With the start-up process, costs of plants and facilities and inventories do occur.

But certain other costs of intangible nature e.g., cost of learning a new type of business, setting up a new organisation design, new model of rules and procedures, hiring new skills and competences, paying for mistakes in developing organisational relationships and for early bad decisions made in unfamiliar business environment, and costs of gaining customer acceptance.

Although these are one-time costs, most of them are likely to put the firm at a disadvantage with respect to the established competitors in the market.

Thus, start-up in new business can have potentially positive and negative synergy. When a firm can successfully match its skills and resources, even with these start-up costs, to the requirements of new product-market area, then cost economies may result in any of the major functional areas.

This is ‘positive synergy. But whenever there is an organisation mismatch between the new requirements and skills and resources applied, the situation leads to ‘negative synergy’.

As stated in the foregoing paragraphs, two basic elements, ‘start-up’ costs and ‘start-up’ time, come to play a major role before the actual operation phase of the new business. Thus,

1. Cost savings plus time savings lead to a positive synergy in a competitive situation;

2. Whereas, high costs plus time delays lead to a negative synergy.

Further, with the criterion of start-up synergy, the basic yardsticks are:

1. Skills critical to success,

2. Common management skills,

3. Common organisational capacities,

4. Common equipment and premises, and

5. Timing advantages.

Q.14. What are the basic yardsticks for operating synergy criterion?

Ans. The following are the basic yardsticks for operating synergy criterion:

1. Potential for new joint product-market,

2. Sharing of facilities,

3. Sharing of overheads,

4. Economies of scale in direct costs,

5. Sharing of technology (R & D), and

6. Sharing of general management.

Q.15. What do you understand by functional synergy?

Ans. This refers to the synergistic effects that a firm can achieve in all or more areas of its key functions such as:

1. Product design and engineering

2. Process engineering and manufacturing

3. Marketing and distribution channels

4. Organisation structure and cohesiveness

5. Management processes

6. Expertise of key personnel

7. Financing and finance management and control.

Q.16. What do you understand by the term ‘Competitive Advantage’?

Ans. The expression ‘competitive advantage’ refers to those characteristics of unique opportunities that can isolate a firm within the field defined by product-market scope and the growth vector.

It seeks to identify particular properties of individual product-market scope which will give the firm a strong competitive position. It is, thus, a measure of an individual firm’s opportunities that offer an extra edge or promise over other firms dealing with the same business activity in a competitive market.

To put it differently—a firm while seeking competitive advantage must try to identify and exploit two-fold opportunities:

(1) In relation to characteristics of other products and markets, and

(2) Through the general characteristics of the competitive environment.

We know, Return on Investment is an efficient measure of business profitability. Using this concept, competitive advantage refers to any feature of a business firm that enables it to earn a high return on investment despite counter pressures from competitors.

Business strategy should be formulated and implemented with an eye towards developing such features that will ultimately determine a business’s competitive advantage.

Q.17. For a small competitor,’gaining market share is an expensive proposition’. Give your arguments.

Ans. At first glance to the given expression, the task appeared to be deceptively simple. To gain market share, a small competitor simply needs to enhance the relative attractiveness of its product or services to the prospective customers. Many approaches are available, including price reductions, increased advertising, higher product quality, better service, longer warranty, and so on.

Any one or more of the above actions are likely to be expensive, and they will tend to depress the business’s profitability in the short run.

Let us consider, a price reduction, for example. The price reduction will reduce the profit margin on each item sold and hence, the total income. Because any resulting increase in revenue rarely offsets this loss in the short run, the business’s profitability probably will decline.

A decline in profitability is especially likely if larger competitors match the price reduction. Further market-share gain will then come only through a second price cut by the small competitor, an action that may lead to a precipitous downward price spiral in the market. Unfortunately, the smaller competitor is least able to survive such a process since its costs are generally above the level of its larger competitors.

Product development to increase market share can be similarly costly. The time required to design, test, and market new products may run into years. A business realises little additional revenue during this period, yet it must spend considerable amount of money to sustain the development effort.

The inevitable result is reduced profitability in the short run. Because measures such as these are costly, a business employing them extensively is said to ‘buying’ market share.

Q.18 What are the drawbacks of product life cycle?

Ans. The drawbacks in respect of product life cycle model may be listed as follows:

1. The length of each stage varies from business to business, and it is sometimes not clear what stage of life cycle a business is in.

2. The evolution of a particular business unit may not occur in the usual S-shaped pattern.

[For example: (a) some businesses skip maturity, going from ‘growth’ to ‘decline’ (e.g. Synthetic fuels); (b) some mature businesses revitalise after a period of stagnation (e.g. motor cycles); (c) some businesses pass rapidly through the ordinarily slow ‘infancy’ stage (e.g. video games); and (d) some businesses show little sign of ‘decline’ over lengthy time periods (e.g. automobiles).]

3. The competitors can affect the shape and pace of the life cycle by their own behaviour.

4. The pattern of competition associated with each stage of the life cycle is not the same for every industry.

Q.19. What is merger? How can it be distinguished from consolidation?

Ans. Merger is a combination of two companies wherein one company loses its corporate existence. The surviving company (which is also called the amalgamated company) acquires both the assets and liabilities of the merged company (which is also called the amalgamated company).

That is why, mergers are called amalgamations in legal parlance. When two companies differ significantly in size, merger is the most appropriate term.

There may be three categories of merger:

(i) Horizontal,

(ii) Vertical, and

(iii) Conglomerate.

In fact, merger like acquisition is a part of a diversification strategy. Merger forces structural changes in business and management and creates a synergistic effect in many areas to achieve growth prospects.

A merger must be distinguished from a consolidation. Consolidation is a combination of two companies whereby an entirely new company is formed. Both the old companies cease to exist and shares of their common stock are exchanged for shares in the new company.

When two companies of approximately the same size combine, the term consolidation applies. The terms merger and consolidation tend to be used interchangeably, in commercial parlance, to describe the combinations of two companies.

Q.20. What are the advantages of takeovers and mergers?

Ans. The advantages of takeovers and mergers are as follows:-

1. Economies of scale:

Combination of two or more companies offers scope for larger volume of operations including R&D efforts.

2. Synergistic effects:

The sales and profitability of the combined company are likely to be much higher than the sum of their individual sales and profits.

3. Tax savings:

A healthy company acquiring a sick company, under certain conditions, can avail of income tax exemptions.

4. Growth and diversification:

Any of the schemes, if followed or adopted, may help in achieving these corporate objectives.

5. Surplus funds utilization:

Companies having surplus funds, through any of the schemes cited above, can invest in another company which is starved of the same.

In addition to the benefits outlined under (1) to (5) above, the following advantages accrue:

To the concerned companies:

6. Merger or takeover route may enable companies to avoid unhealthy competition.

7. Patent rights, technical knowhow, established brand names, etc. can be easily acquired through this process.

8. A merged entity enjoys higher debt capacity as its earnings are more stable than that possessed of by individual units. A higher debt capacity gives greater tax advantage and thus higher value of the firm.

9. Merger or takeover can effect economy in floatation cost of future equity, preference, and debenture issues.

10. Largeness in size and earnings may reduce the cost of borrowing.

To the national economy:

A merger or takeover can help in:

1. Disciplining the capital market;

2. Consolidation of capacities so as to reach minimum economic size that can prevent losses; and

3. Concentrating on core competencies and this way, large business groups may like to rationalise their portfolio of industrial units in the light of recent liberalisation policy of the Govt. of India.

Q.21. Write a short note on Indian joint ventures abroad.

Ans. In the recent years, there has been a development of Indian joint ventures abroad in collaboration with foreign firms in relation to the twin policy objectives of extending cooperation to developing countries and creating opportunities for this country in the export of capital goods, technology and know-how.

These ventures have been contributing to the progress of import substitution and industrialisation in the developing countries where they are primarily located. In the process, there has been increased exports of technology-intensive products from India. Even in terms of profitability, the performance of the joint ventures has shown significant improvement.

A region-wise analysis of such ventures in production discloses a marked preference by Indian entrepreneurs to invest in the neighbouring countries of South-East Asia, especially in ASEAN countries. India has joint ventures in Malaysia, Indonesia, Thailand, Singapore, Philippines, and Fiji and also in Sri Lanka, Nepal, and Afghanistan.

Q.22. Describe strategic approaches to acquisition in the form of a product-market matrix.

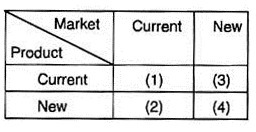

Ans. Strategic alternatives in a product-market matrix are as under:

Strategic approaches to acquisition in relation to the above matrix may be described in brief as follows:

1. Current product/Current market:

The acquiring firm may acquire an extra link in the chain—backward integration to control supplies, or forward integration to take on a further step in the distribution process.

2. New product/Current market:

A firm may acquire another firm so as to make the latter completely integrated with present operations.

3. Current product/New market:

An acquiring firm may buy a wholesaler in a new export market so as to provide easier means of entry.

4. New product/New market:

A firm may pursue complete diversification through acquisition of another firm in an entirely new field.

Q.23. What do you mean by ‘Strategic Change’?

Ans. The need to change is perpetual. Changing demands of stakeholders put increasing pressure on an organisation to stay in tune with the changing external environment.

How successful will the change be? This is determined by the extent to which an organisation responds/adapts to the need for change.

Strategic Change refers to:

1. An informed, participative process resulting in new ways of doing business that positions an entire organisation for success both today and tomorrow.

2. Fundamental changes in the way an organisation and the people in it operate on a daily basis.

Q.24. Explain the concept of real time strategic change.

Ans. Strategic planning is a formalised process and implemented by breaking down a goal into several steps. In contrast, strategic thinking is informal and a flash of intuition and creativity. Real time strategic change, thus, requires intuition and creative thinking in tune with the time when a change is needed in the strategic directions.

Rearrangement of old and established patterns, systems, and designs does not constitute real time strategic change. Something new and novel perspectives and combinations including innovations are expected in real time strategic change.

Real time strategic change refers to:

1. Simultaneous planning and implementation of individual, group, and organisation- wise changes.

2. ‘Real time’ emphasises the importance of current reality as a main driver throughout the process.

3. Everyone in the organisation who needs to make the change happen is involved in the large group gatherings.

Hence, real time strategic change means working through the real issues with the real people affected by them and getting real results.

Q.25. Write a brief note on charismatic leadership and strategy.

Ans. Where all other leadership styles produce little results, the charismatic style excels. And, in fact, the automobile industry itself has been a witness to the functioning of two most charismatic leaders in modern management histor—one was Henry Ford, and the other, in more recent times—Lee lacocca.

Lately, the studies on the subject of charismatic leadership in great depth reveal—the charismatic leader has an aura.

Such leader persuades people, not only subordinates and peers, but also the boss, the customers, suppliers, bankers, financiers, collaborators and other external stakeholders and interest-groups to do things they would rather not. People who come in contact with him simply get mesmerised. The study further observes that brain, toughness, vision, ambition, etc. are just commodities compared to charisma.

All charismatic leaders display five common features—some in lesser and, a few others, in a greater degree. These are: a remarkable ability to translate complex ideas into simple lucid messages through symbols, analogies, metaphors, and stories which very easily influence all grades of minds at different levels of the organisation.

In dealing with the critical issues—mostly non-traditional and non-conventional—in strategy implementation and management, the attributes of brain, vision, judgment, optimism, tenacity and risk-taking are important and ought to be pursued by the senior staff under a CEO. The CEO, with charismatic leadership, can storm these brains for generation of ideas by throwing up challenges to them.

Recent researches indicate that charismatic leader possess the behaviour strategies like:

(i) Focusing attention on specific issues of concern;

(ii) Concentrating on analysis, problems solution and action;

(iii) Communicating with empathy and sensitivity;

(iv) Demonstrating consistency and trust; and

(v) Expressing active concern for people.

Thus, it is noticed that the first three behaviours are task-oriented and the latter two are people-oriented and that the combined effect can help in strategy implementation and management.

Charismatic leadership is most suitable in the case of project management, start-ups, turnarounds, wherever a business is passing through a rapid unpredictable change, and—in the case of management—of inflated egos.

Q.26. What is meant by the terms ‘research’ and ‘development’?

Ans. Research:

Research is a planned experiment to review, analyse, and revise the accepted or established principles and conclusions wherever thought necessary, or to rectify already known facts of knowledge if required.

Research is classified into two broad types: Basic or fundamental, and Applied.

Basic research may be defined as research which is carried out in search for knowledge but without specific commercial objectives. When carried out by a firm, research may seek a discovery which will benefit the firm, although the discovery may not initially be tied to any particular objectives.

Applied research, on the other hand, is aimed to fulfil specific objectives. It is an intermediate activity between the discovery of the basic phenomenon (research) and the generation of final product or method. An applied research proposal must state—what is to be done, how it will be done, how much it ,will cost, and finally what results are expected to be.

Development:

Development is a phase next to research. In a development phase, the results of research activity are put to practical application so as to obtain production either by developing new or improved products, or new uses of current products or of methods or all.

Thus, development ‘is concerned with the technical non-routine activities associated with translating scientific knowledge into marketable products’ and also into methods or processes.

Development phase involves three stages:

1. Exploratory—involving prototype design,

2. Advanced—covering production design, and

3. Production—devoted to pilot manufacture.

Q.27. Is Research and Development (R & D) a single type of problem area?

Ans. Research and development activities should not be seen as one single type of problem area in a company, since the two activities are distinct—although there is a linkage between the two.

For some companies a measure of basic research is an essential, and for others applied research is important. There are still others who require little real research and emphasise on development work.

An ethical pharmaceutical company, for example, may have to accept a measure of basic research if it selects a strategy of developing new basic substance.

A generic manufacturer, producing only those ethical products which have come off patent, might only need the bare minimum of applied research. Again, a fast food manufacturer may concentrate mainly on the work of development—that is, developing new products to marketing specifications based only on known technologies.

Thus, the problems of planning and strategy making are different for each of these research and development areas rather than a single type of problem area.

Q.28. Discuss how the strategic planning process should provide the framework for Research and Development (R & D) planning and strategy.

Ans. For research and development planning and strategy, the strategic planning process should attempt to cover the following pertinent issues:

1. Adaptation or improvement of imported technology.

2. Process improvements and trouble shooting for on-going operations.

3. Development of alternate materials, import substitution.

4. Utilisation or up-gradation of waste products.

5. Energy conservation.

6. Effluent treatment.

7. Packaging—new methods and hygiene-friendly materials.

8. Product quality improvement, and technical services to customers.

9. New product development.

10. Analysis of competitors’ products, etc.

For R&D, the strategic planning process should provide the following framework:

1. Specifying the product or business area to which research is to be directed.

2. Setting priorities for research and/or development projects.

3. Assigning time targets for research and/or development, wherever feasible.

4. Setting the cost framework in terms of both revenue and capital requirements.

In essence, top management must assess the priorities for R & D work so that the strategic plan provides a clear indication of the most important areas or issues to which R & D effort should be directed.

Q.29. What are the distinctive features of Research and Development (R & D) activities?

Ans. The distinctive features of Research and Development (R & D) activities are as follows:-

1. Seemingly, basic or fundamental research has no immediate pay-off to its sponsor. But it is the fountain-head of new technology from long range point of view.

2. Every R&D objective must state—what is required, why it is required, and the benefits the project will bring.

3. Sizeable capital investment does not necessarily guarantee ultimate success of R & D program because of inherent risks.

4. In R & D management, two separate skills are involved:

(i) Scientific or technical, and

(ii) Managerial.

Traditional managerial skills are inappropriate for maximisation of scientific effort.

5. R & D activity for the most part is non-repetitive. So, very little guidance is available from past experience.

6. R & D is one of the least predictable of human activities and originates mostly from ideas.

7. R & D process often deals with intangibles which are difficult to be measured, correlated with, and evaluated against very tangible operational costs.

8. Measurement of relation between R & D input and output is inexact.

9. Various factors like unpredictable technical problems, uncertainty of the time cycle, etc. complicate the cost estimation of R & D activity.

10. R&D, being a collaborative effort, inter-personal skills in obtaining the cooperation of other departments are equally necessary for a successful activity plan.

11. R&D management calls for a culture distinctly suitable to its environment.

Q.30. Indicate how R & D strategy can be related to product-market matrix.

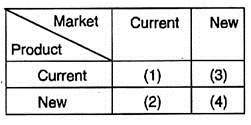

Ans. The strategic alternatives in a product-market matrix are as under:

The R&D strategy can be related to the above matrix in the following ways:

1. Current product/Current market:

The R&D cell may fulfil the obligations as to the existing product(s), specifications in detail necessary for today’s operations with a view to meeting existing demand in the market.

2. New product/Current market:

The R & D cell may develop new product(s) or new designs of product(s) by a change in a formulae or specifications, to be handled by the same sales force and purchased by the same consumers in order to exploit the current marketing opportunity.

3. Current product/New market:

The R & D cell may bring in marginal improvements in existing products through development of a new process so as to make them suitable to the customers in the market segments which have not been tapped so far.

4. New Product/New market:

The R & D cell may help in pursuing complete diversification through innovation of products in an entirely new field. In other words, R & D may be selected as the lynch-pin of a future diversification strategy.

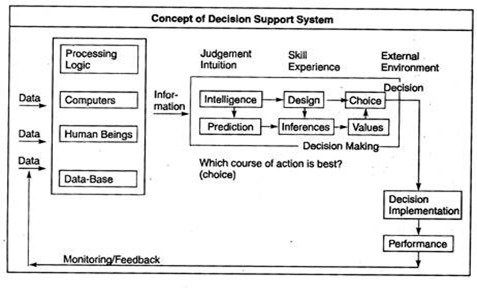

Q.31. Define and explain the concept of Decision Support System(DSS).

Ans. Decision support system has one primary purpose: to provide the manager with the necessary information for making intelligent decisions. The critical issue here is that a system is needed that converts raw data into information that management can actually use. A decision support system refers to that.

DSS can be described as: a wide variety of systems which have the direct objective of supporting managerial decision-making. Thus, a management information system (MIS) is a DSS if and only if, it is designed with the primary objective of managerial decision support.

A computerised data processing system is not a DSS-despite that it may, as a by-product, produce aggregated operating data that are useful to management in making decisions. Only those systems that have the direct and primary objective of supporting managerial decision making are considered decision support systems.

The concept of DSS can be shown in the diagram below:

Q.32. State the distinction between MIS and DSS.

Ans. A DSS is a specialised MIS designed to support a manager’s skills at all stages of decision making—identifying the problem, choosing the relevant data, making the decision, and evaluating the alternative courses of action.

A DSS must produce information in a form managers understand and at a time when such information is needed. Thus, DSS is an MIS, but an MIS is not always a DSS. Their purposes are different.

An MIS provides information, but DSS shapes that information to the needs of management.

Q.33. Discuss the factors that have resulted in the need for a comprehensive Decision Support Systems (DSS).

Ans. As organisations grow in complexity, managers depend more heavily upon various internal and external sources of information. Growing complexity also increases the number of points at which decisions must be made, ranging from individual decision makers at the lowest operating levels to strategic decision makers at the top.

Many firms have accounting information systems, marketing information systems, customer information files, etc. But beyond these, one important idea moves the decision support system (DSS).

The need for a comprehensive DSS has resulted from three factors:

(i) Importance of information in decision making:

A major purpose of a manager is to convert information into action through the process of decision making. This way, a manager and an organisation act as an information-decision system. The key to success in an effective planning and controlling functions lies in the information-decision system.

(ii) Mismanagement of current information:

The ability of organisations to generate information is really not a problem, since most are capable of producing massive data and details. The problem is: raw data and information are either insufficient or irrelevant for specific decisional phenomenon. Vital information is sometimes suppressed by subordinates or arrives long after it is needed.

Today, by contrast, managers often feel buried by the deluge of information and data that come to their desks. This deluge of information, much of which is not useful, has led to the mismanagement of current information. More is not always better. A DSS comes to play a great role in this regard.

(iii) Increased use of computers:

A manager’s qualitative decisions at the right time are now-a-days aided by computers. Yet, a manager is confronted with the problems of information losses, delays, and distortions. To enable such a manager to make swift and effective decisions, however, present management information system must be developed into more effective DSS.

Q.34. Highlight the problems or disadvantages of vertical integration as a strategic option with a case illustration.

Ans. While implementing ‘vertical integration’ as a strategic option, a strategist is faced with the following types of problems:

1. Technological problems:

With the rapid advancement of cutting-edge technology, the production process may change quickly—thereby necessitating the replacement of existing plants by sophisticated new ones. The huge costs associated with such switchovers from obsolete technologies increase with the increase in degree of integration.

2. Lack of competitive cost information:

The production unit of a firm becomes isolated from the external world and keeps the management almost in darkness regarding the competitive cost of raw materials.

3. ‘Exit’ problem:

Generally backward integration is more profitable than forward integration. But it may reduce the firm’s flexibility. Backward integration calls for investments in very specialised instruments and plants which are difficult to resell. This creates a barrier to exit if the firm wishes to leave the business.

4. Increase in ‘internal costs’:

With an increase in the size of a firm, managerial inefficiency becomes prominent. Vertical integration involves ‘influence costs’ when transactions are organised internally.

Such costs are:

(i) Direct costs associated with influencing activities (e.g., time spent by a divisional manager lobbying with the top management to change a decision that is unfavourable to his division), and

(ii) Costs of wrong decisions that arise from such activities. Vertically integrated firms are prone to influence costs while the smaller independent firms might avoid the same.

5. Problem of capacity utilization:

This problem arises specially for the seasonal products with moderately high seasonal variation in demand. This problem is somewhat related to the problem of capacity planning under demand fluctuation.

If installed capacity is based on maximum possible demand the problem of capacity under-utilisation increases the average cost of production.

If installed capacity is based on minimum demand, over-utilisation of capacity will increase the average cost of running the production system.

Even the capacity planning based on an average demand is no good a solution. This capacity planning problem becomes manifold under a largely integrated production system.

Case Illustration: NIRMA—will it Wash!

In 1998-99 Nirma invested Rs. 380 crore in Linear Alkalene Benzene (LAB) and Rs. 1000 crore in Soda Ash plants and increased their production capacities. LAB and Soda Ash, the basic raw materials, constitute nearly 70% of the total raw material cost of synthetic detergent.

The basic question is:

When LAB and Soda Ash are not in short supply in India, why has NIRMA invested?

The answer is three-fold (if we seek logic behind Nirma’s strategic option to vertical integration):

1. High price fluctuations of LAB are hard to absorb for a low-priced product like Nirma.

2. Adequate control over supplies is possible by increasing production.

3. Reduction in cost of production almost upto 55% of the raw materials is important, as Nirma caters the low-income group which is price-sensitive and least brand loyal.

Problems with Nirma:

All that Nirma did were in line with standard/stereotype strategic thoughts, it appears. Despite having so many theoretical advantages, its LAB plant could not help it to sail through.

The company could not make this LAB unit economical as it failed to utilise full capacity and in reality Nirma was in a dilemma with its excess capacity. To get rid of this situation, Nirma signed a deal with IPCL for an arrangement to sell 12% of its output and exported another 12%.

Message:

1. The most vulnerable threat to Nirma’s backward integration arose from the technology side. LAB was difficult to manage though is saved cost considerably. For this reason, even Hindustan Lever Ltd. gave up the idea after trying once with it.

2. Enzymes and another chemical called STPP had slowly substituted the use of LAB in the production of synthetic detergent.

Q.35. Suggest a suitable strategy to overcome the problems of vertical integration.

Ans. In order to overcome the cited problems, one researcher on strategy suggests for a ‘mixed strategy’ that strikes a balance between vertical integration and market exchange.

According to him, ‘Cosmetic’ Vertical Integration Strategy (CVIS) is suitable as it sharpens the effectiveness of vertical integration in two ways:

(i) Cost control and

(ii) Capacity utilisation and managerial efficiency.

By ‘cosmetic’, he conveys a strategy based on Contractual and Self Manufacturing for Efficiency, Timeliness, Independence, and Control. This approach suggests to have partial control over different stages of production either by setting up or by acquiring plants in forward as well as backward stages of operation with less than the required capacity.

Obviously, to meet the total demand, the firms will have to depend on independent firms.

According to Michael Porter, all functions that a firm performs can be done by independent economic units. A firm may go for market exchange strategy by buying from the suppliers at higher level of assembly line.

In fact, market exchange may be both forward and backward types. A firm should develop a mechanism for neutralising the threat from suppliers’ forward and backward integration before entering into large-scale market exchange.

The researchers, on this issue, suggests that CVIS can act as an excellent strategic weapon provided there is an optimal mix of vertical integration and market exchange; that is, the size of the upstream or downstream units to be acquired or set up.

Q.36. What are the typical problems encountered in designing and managing control systems for evaluation of strategy?

Ans. The basic problems encountered in designing and managing control systems for evaluation of strategy are:-

1. It is really a difficult task to determine norms or yardsticks for performance levels of certain services which are intangible by nature. There cannot be predetermined criteria as to ‘good’, ‘average’, ‘poor’ performance on account of divergent views even among conscientious mangers.

2. It is a difficult proposition to arrive at a consensus on the parameters used for measuring efficiency and effectiveness of strategy.

3. The data made available by the management are mostly improper due to lack of in-depth understanding with some of its members.

4. The performance standards, often set as a routine ritual, are invalid on account of inaccuracies, lack of vision, and contractions.

5. Control systems even if designed and thrust upon after an exhaustive study by the conscentions management may be considered unfair/inappropriate by the concerned staff.

6. “A strategy often takes years to unfold”. It is “typically not a neat, integrated package produced all at once”. It is, by nature, uncertain and subject to change. Control systems to take care of these aspects appear to be futile exercise.

7. Even if short-term performances can be measured, long-term aspects of a strategy are likely to remain beyond the ambit of a management control system.

Q.37. What is the logic for developing multiple scenarios before deciding on a specific strategy?

Ans. After establishing planning premises, management is in a position to formulate alternative strategies and tentative objectives for achieving the firm’s mission. In the process, the initially stated strategies and objectives may undergo modifications to increase their realism. Eventually they are solidified and different means for reaching them are developed.

The strategy formulation is complicated by the fact that a given set of planning premises may not be valid. Often only one set of premises is accepted, although another set is almost valid. What if markets do not continue to be strong during the planning period? What if there is another oil embargo? Perhaps one strategy is best if the premises are correct, while another runs a close second but is less hazardous if the firm’s best predictions prove to be wrong. It may be best if a firm can select a fail-safe strategy—one that is compatible with the premises that are most likely to be right but which will result in the least damage if they prove wrong.

The many unpredictable aspects of the future suggest the value of developing several scenarios, or descriptions of possible future operating environment. The formulation of three or four plausible scenarios is, thus, recommended (plausible meaning that the conditions described are likely to occur together). For example, doubledigit inflation, rapid economic growth, and a prolonged embargo on foreign oil may each be a possibility, but it is unlikely that they occur simultaneously. They should not, therefore, be part of the same scenario. The strategy most likely to achieve the firm’s mission is developed for each scenario.

Q.38. Prepare a statement of ‘Scenarios’ that could help develop and select strategies.

Ans. For the next three years, (i) All the firm’s markets will remain strong, allowing present sales trends to continue; (ii) Government measures will reduce foreign competition only slightly; (iii) Inflation will continue at an average rate of 10 per cent; (iv) Labour unions will exert pressures for wages hikes, which cannot be successfully resisted; (v) The costs of materials will increase at a 10 per cent rate; (vi) Because of rapid technological progress, the major threat from competitors will come from product innovation rather than from price-cutting or advertising; and (vii) Interest rates will increase as a government effort to control inflation.

Q.39. Differentiate between Futurology and Future Research.

Ans. Futurology, in a philosophical plane of thought, refers to the visions about the distant future, mostly concerned with different sectors of society. The futurologists, in this sense, are philosophers who forsee the future events and situations and sometimes signal either warnings or prospects about different aspects of social development/transformation. Futurology is, thus, concerned with views and ideas of penetrating and stimulating nature, and broadens the vision of a conscious mind.

Future research, on the other hand, is different. It is a kind of research undertaken or a model developed based on systematic analysis of current data and information. It attempts to visualise the shape of things to come and states about possible developments on a chosen field of activity from a long-term viewpoint.

Futurology might give direction about the vision for a company, whereas future research-based forecasts support and reinforce long-term policies and decisions of a company.

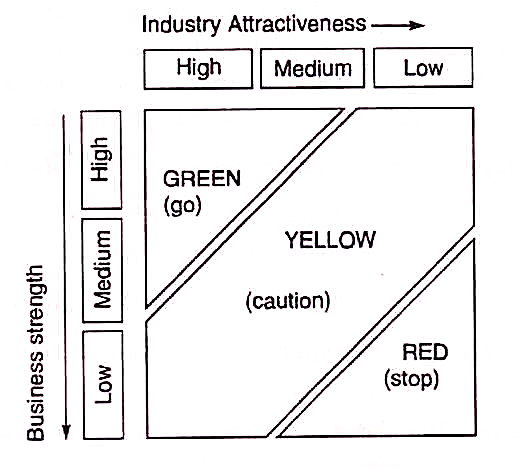

Q.40. Explain the terms : question mark, dog, cash cow, and star, as used in BCG matrix.

Ans. Question Mark : A BCG matrix classification for a strategic business unit that operates in a new and fast growing industry but considered a risky investment because of its small market share.

Dog : A BCG matrix classification for a strategic business unit in a slow-growth market with a small market share and offering little profit or possibility of recovery.

Cash Cow : A BCG matrix classification for a strategic business unit that is found to exist in a developed, slow-growth industry holding a dominant and large market share.

Star : A BCG matrix classification for a strategic business unit having a large market share in a rapidly growing industry and offers the promise of good growth and profits in future.

Q.41. Explain the scope of the terms: Direct investment entry strategy, foreign subsidiary entry strategy, situation analysis, groupthink, intertype competition, intratype competition, and export entry strategy, as used in strategic management practices.

Ans. Direct investment entry strategy:

This is referred to as the strongest commitment to becoming a multinational company when the management decides to begin producing the firm’s products abroad. This strategy enables the firm to maintain full control over its production, marketing and other key functions. Some of the foreign firms have used such strategy even in India in some of the product-market opportunities that have been allowed by the Indian Government in selected industries.

Foreign subsidiary entry strategy:

As exports increase in importance to a firm, the management may decide that it can justify its own foreign subsidiary. This decision usually involves joining with nationals in the foreign country to establish product and/or marketing facilities. It differs from direct investment in that some type of association is formed with a local firm or individual. This type of association usually takes the form of licensing or joint- venture arrangements. Licensing is granting the right to produce and/or market the firm’s product in another country to an outside firm. Joint-venture arrangements involve foreign investors forming a group with local investors to begin a local business with each group sharing ownership.

Situation Analysis :

It refers to an attempt to understand the environment in which the organisation’s efforts will be expended, an important phase of the strategic planning process. Before a well-managed organisation expends any effort, it conducts a situation analysis. This attempts to answer two questions for management: What should be done? What is possible to do? The situation analysis is usually conducted in two phases: the internal analysis and the external analysis. It is also called SWOT analysis.

Groupthink:

This refers to the phenomenon that occurs when a group believes that it is invincible, turns off criticism, attempts to bring non-complying members into line, and feels that everyone is in agreement.

Intertype competition:

This refers to a state of competition that occurs between different types of organisations and institutions. For example: Kellogg competes with Procter & Gamble for shelf space in supermarkets, and hospitals compete with private clinics for medical practitioners.

Intratype competition:

This refers to a state of competition that occurs between organisations in the same basic activity. For example, Premier Auto competes with Hindustan Motors for automobile customers. This is the form of competition that is described in economic studies.

Export entry strategy:

It is the simplest way for a firm to enter a foreign market by exporting. This strategy involves little or no change in the basic mission, objectives, and strategies of the organisation, since it continues to produce all of its products at home. The firm will usually secure an agent in the particular foreign market who facilitates the transactions with foreign buyers.

Q.42. What do you understand by management information system?

Ans. Management information system is an organised, structured complex of individuals, machines, and procedures for providing the management with pertinent information from both external and internal sources. It supports the planning, control, and operations functions of an organisation by providing uniform information that serves as the basis for decision making.

Q.43. What are the drawbacks of market share leadership as the means to gain competitive advantages.

Ans. The drawbacks of large market share as a route to gain competitive advantage may be as follows :

(i) The very features like scale economies, experience, and market power may create rigidities. They undermine an organisation’s ability to adapt to major environmental change.

(ii) Because of greater scale and integration, market leaders have more expensive and extensive facilities than their smaller rivals. Therefore, they generally have more to lose from any change that causes obsolescence to existing assets and/or methods of operation.

(iii) As regards experience, a market leader is usually further down the experience curve than any competitor in its industry. Experience advantage quickly disappears if a firm suddenly switches to a new product technology or production method since such a change places it at the top of a new experience curve. The cost position is in no better, and probably in worse, than other competitors who have adopted the new approach.

(iv) The size of the organisation itself may undermine the adaptiveness of market leaders. Large organisations have more hierarchical levels and employees than their smaller competitors. Consequently, they often require more time to reach decisions involving major change.

Market share leadership is thus a two edged sword. Although it may provide significant competitive advantage, it may also hinder an organisation’s ability to respond effectively to environmental change, causing it to lose its market to nimble competitors.

Q.44. What are the basic contents of a Decisions Support System (DSS)? State them.

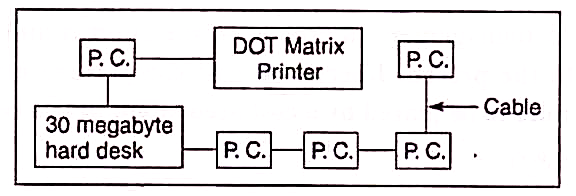

Ans. DSS consists of:

(1) Computer hardware,

(2) Computer software (programmes),

(3) Database on which the software is run to get the required tables and figures,

(4) Graphical and other displays, and

(5) Computer language

Q.45. Write in brief the different types of Decision Support System (DSS).

Ans. The types of DSS are as follows:-

(i) Personal support system :

It is a single user which interacts with a microcomputer for manipulating data. A microcomputer consists of a central processing unit which has one computer chip. Small business firms find it suitable.

(ii) Local area network (LAN):

It is a network of communications connecting various data-communicating devices within a small local area. Computers in the LAN network can share data files, printers, and software programmes.

A LAN looks like :

(iii) Commercial database services:

Certain organisations collect information, build up large database and sell them to other companies. The user requires an arrangement which allows computers to send and receive information over telephone lines, a password for retrieval of information; a telephone and mini, or microcomputer.

(iv) Time sharing systems:

In this, the user rents computer time from a vendor and other users share with one another the vendor’s resources.

(v) Integrated systems:

Integrated DSS links all managers at all levels of the organisation and needs a main-frame computer, a huge database, and suitable computer languages to retrieve information and model it as desired by the users.

(vi) Decision Insight Systems (DIS):

It is a software programme for managers who use desktop computers. In DIS, a problem is structured with huge amount of subjective information by asking the users to reply a set of questions based on the software programme.

Q.46. Distinguish between Above-the-line and Below-the-line Advertising.

Ans. Normal and common advertising messages through newspapers, periodicals, T.V., radio, bill boards fall under the category Of ‘above-the-line’. They are so, because they are of general nature and can reach the consumers and customers on a very wide scale. This is a pure form of advertising and at the same time, a passive approach to sales promotion.

On the other hand, door-to-door sales campaign, free samples distribution, sales contests, bonus stamps or coupons, product displays or demonstrations at show-rooms, etc. fall under the category of ‘below-the-line advertising’. In other words, ‘below-the-line advertising’ is an exercise in information, persuasion, and influence relating to marketing and sales; and consists of those activities that are designed to bring a company’s products or services to the favourable attention of consumers.

One thing is important to note that both forms are complementary to each other. Salesmanship (below-the-line advertising) attempts to convince customers for a decision in favour of products or services, whereas the above-the-line advertising is designed to educate and promote ideas regarding products or services.

Q.47. Write short notes on: (i) Concentration strategy, (ii) Stability strategy, (iii) Retrenchment strategy, (iv) Combination strategy, (v) Grand strategies, and (vi) Niche strategy—highlighting the circumstances when each of them is appropriate.

Ans. (i) Concentration strategy refers to the strategy of deployment of all resources possessed by a firm to the growth and development of a single product with a single technology and in a single market. An organisation with high morals, efficient operations, fairly good technology base, and sound financing and marketing bases finds success with this strategy. Possession of core competences in a single product allows even a small firm to have a significant competitive edge over its rivals. This strategy, during times of trade depression, offers a low-risk profile.

(ii) Stability strategy refers to holding relatively stable position in existing line or lines of business and even in mature markets. The circumstances cited under concentration strategy above help a firm to remain stable even when challenges are thrown up by large firms. This strategy presupposes the existence of a strong brand image of a firm’s product(s) and/ or services.

(iii) Retrenchment strategy is pursued by a firm when its very survival is at stake in a competitive situation of the market. Even a large firm resorts to this strategy when a particular line of business out of its total business portfolio fails to stand the basic economics and contribute anything to the market image of other lines of business. The strategic actions of divestment and liquidation come under this category.

(iv) Combination strategy is not a single and separate strategy, as the term implies. It refers to the adoption of multiple strategies in combination, depending on specific situations or likely events, usually by large and diversified firms. SWOT analysis of a firm with respect to product-market scope and environment gives rise to different situations, favourable or adverse, to adopt and pursue different strategies in combination and all at a time.

(v) Grand strategies are a broad term which includes the strategies of integration, diversification, acquisition, merger, or joint venture, etc. and also of operating strategies.