This article will help you to maintain cost accounting records for your farm business.

Meaning of Cost Accounting:

In any business where production of goods, services, or processing of raw material is undertaken the maintenance of the cost of production is very crucial. In the field of crop production working out of the cost of production (cost of cultivation plus marketing cost which is calculated per unit of output) is very important.

The Government of India every year announces, as suggested by the committee of cost and prices, the procurement prices of major agricultural commodities which is based on the cost of production of these crop enterprises.

The individual farmers also use this exercise for making decision on crop or other enterprises for planning and budgeting of the farm as a whole. On the basis of cost and the probable returns they decide whether to continue with or drop that particular enterprise or increase the acreage under the same.

ADVERTISEMENTS:

These decisions are necessary for the success of farming. Similarly, in the livestock production calculation of cost for different livestock or poultry products and the working of cost per unit is necessary. The very survival of the farm business depends on the science of cost accounting.

Traditionally, the objectives of accounting was with record of transactions and events with two-fold purposes viz., the control over the property and asset of the firm and preparation of statements periodically to show up the results of operations and financing position. The statement were mere statement of profit or loss and was also accompanied by the balance sheet.

Accounting is now playing an increasing role in providing such information’s to the management as it is needed for planning and decision-making and control. Decision always relates to what has to be done on future, immediately or in the long run. The information needed for this purpose are both quantitative and qualitative.

The information provided must enable the management to exercise control over day to day operations and adherence to the plan of the management. This is also with a view of ensuring maximum efficiency.

ADVERTISEMENTS:

The control involves seeing two things: that the work which has to be done has been done without the loss of time and the cost incurred are not excessive and within the presented limits. This is for the best utilisation of resources.

Like traditional accounting the management accounting sees that the machine has been used properly for productive purposes but draws the plan in advance showing quality of goods that can be produced, the purchase to be made in respect of raw materials etc. for the purpose and other expenses to be incurred also the sales to be affected to its target.

Management accounting provides all the quantitative information’s to management to enable it to draw up plans to make decisions and to see that all members of the staff work according to what is expected of them.

Accounting is said to be the language of business and information about the business is conveyed to outsiders as well as to those inside through accounting statements. Account should be compiled in a manner to be intelligible by giving precise meanings to the figures.

Definition of Cost Accounting:

ADVERTISEMENTS:

Cost accounting means such an analysis of accounting and other information as to enable management to know the cost involved in each activity together with its significant constituents elements in order to arrive at proper decision.

Cost accounting is a set of accounts as well as systematically and accurately record apportionment of material used and labour employed in the manufacture of a certain commodity or a particular job so as to enable the management to know its cost of production and selling the various products per unit.

Advantages of Cost Accounting:

1. Measures efficiency and then maintains it and improves it.

2. Compares difference due to different materials used and methods adopted.

ADVERTISEMENTS:

3. Estimates for tenders and fixing.

4. For achieving operative efficiency.

5. Knowing causes of profits or losses.

6. Cost reduction improving organisation and effecting economy in methods and equipment and increasing productivity.

ADVERTISEMENTS:

7. Controlling leakages, wastages, both intentional or accidental.

8. An important, independent, reliable check on the accuracy of financial accounts.

The Essentials of Cost Accounting:

The limitations of financial accounting:

Whatever the limitations of financial accountings arc they are removed in cost accounting.

ADVERTISEMENTS:

1. Financial accounting does not measure efficiency or inefficiency of business.

2. Financial accounting does not provide information for a control over expenditure.

3. For proper pricing the financial accounting does not provide information.

4. In setting priorities in manufacture of goods for maximum profit the financial accounting is no help.

ADVERTISEMENTS:

5. Break even analysis is not possible by financial accounting.

6. Forecasting, planning, and budgeting, the modern tools in business, are not much helped by financial accounting.

7. Use of scarce resources demand avoidance of wasteful expenditure in this the financial accounting does not play much role.

Principles of Cost Accounting:

In fact, costing is an investment which is done where in the benefit exceeds the cost involved, otherwise it is not ventured.

1. Concerns adopting the cost analysis must design them to suit its peculiar problem.

2. It is helped by the financial book, if available, otherwise keep a separate system.

ADVERTISEMENTS:

3. Reasonable accuracy be adopted which is dependent on the nature of the industry concerned.

4. Cost information be collected when the work is on for necessary correction if needed—this is called continues costing and estimates of expenses is ascertained beforehand. Historical costing is referred to finding the cost when full and accurate information is available. Historical costing is useful in cost plus contract, where ultimate price will depend upon actual cost of production plus reasonable margin of profit.

5. Proper unit of costing be determined, per quintal or per litre, former in case of wheat or other grains and later for milk and other liquid produces like oil.

Methods of Cost Accounting:

There are mainly two methods viz., job costing and process costing.

Job costing:

The method comprises of ascertaining the cost for the work as a whole.

ADVERTISEMENTS:

Job costing may have many connotations:

(i) Job Costing:

As such when each job, comparatively small, is executed and its cost ascertained separately.

(ii) Contract Costing:

When the firm concerned is engaged on one or two big jobs (contract) only.

(iii) Single Output Costing:

ADVERTISEMENTS:

When the firm is engaged in producing only one product.

(iv) Operating Costing:

When the undertaking renders some services and does not produce or sell products.

From another point of view the following methods may be used:

(i) Departmental Costing:

Is used where a factory is divided into a number of departments and where, first, as cost of running a department is ascertained and then it is analysed to give the cost of goods and service produced there.

ADVERTISEMENTS:

(ii) Marginal Costing:

The determination of variable cost of producing a unit of output. While ascertaining cost per unit, fixed or constant expenses are not taken into consideration is of very great use in day to day decision-making.

(iii) Uniform Costing:

Is the name given to a common system of costing in all respects followed by a number of firms in the same industry. This helps in comparing the performance of one firm with that of the other.

(iv) Standard Costing:

It means determining cost beforehand on somewhat idealistic lines, then comparing the actual cost with standards costs, and ascertaining the reason for discrepancies. This helps control immensely.

ADVERTISEMENTS:

Process Costing:

Here stage by stage costing is done and each stage cost is added to ascertain the total cost.

Elements of Costing:

There are two:

(i) Direct cost.

(ii) Indirect cost.

Direct expenses is the one which can be conveniently allocated to a particular job or product. Direct expenses consist of, and is known as prime cost. These are:

(a) Direct materials.

(b) Direct labour.

(c) Direct expenses or charges.

Indirect expenses:

This cost is called as Overhead Cost. These are:

(a) Work or factory expenses.

(b) Office or administrative expenses.

(c) Selling or distributing expenses.

Direct and indirect expenses or costs make the total cost or the cost of production of a product or service.

Some Concepts:

(a) Cost of Conversion:

It means manufacturing cost less cost of direct materials and depreciation, but it includes normal losses of materials.

(b) Value Added:

Selling price less cost of material and depreciation. The material constituents of the total cost is the most substantial. For conveniences sake the material and store should be readily available. The cost economy is attained when material is purchased in bulk (as is needed) which will enable the information available for proper planning of the materials and new stock addition.

(c) Direct Labour:

Work allocation timing is done.

(d) Indirect Labour:

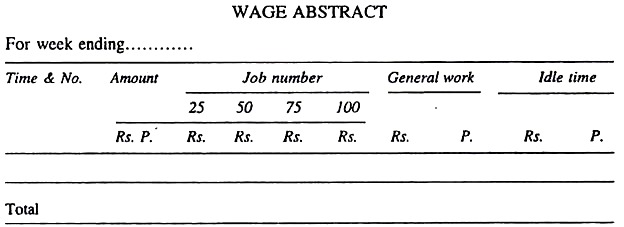

Here time allocation is not done but wage abstract is prepared for job allocation.

A sample of wage abstract is hereby presented:

The Idle Time:

Is the time wasted in inefficiency, distances, changes etc.

Besides, material and labour other direct cost are custom hiring of a tractor, machine hire for specific job, royalty paid out.

Indirect Costs:

These are categorized as:

(a) Factory Expenses:

Manager’s and supervisor’s salary, rent, insurance, (crop and cattle), rates (water cess), Light (poultry house), power (dairy plant), depreciation on machinery and equipments, social security of labour, inward-outward carriage, small value materials like nails, screw driver, stationery, telephone etc.

(b) Office and Administrative Charges:

Legal, rent, bank charges, audit fee etc.

(c) Selling and Distributive Expenses:

Salary of sales manager and his staff, travelling allowances and D.A., advertising, and show room, printing and stationary, bad debts, packaging, entertainment, telephone etc.