Capital budgeting is a process which helps enterprises in examining the financial implications of the long term investment projects. The decision of accepting or rejecting an investment project as part of a company’s policy depends upon the investment rate of return that such a project will generate.

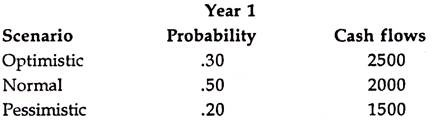

Capital budgeting is the process of evaluating and selecting investments in capital assets or fixed assets in a firm. Capital budgeting is vital in achieving the shareholders’ wealth maximisation objective of a firm.

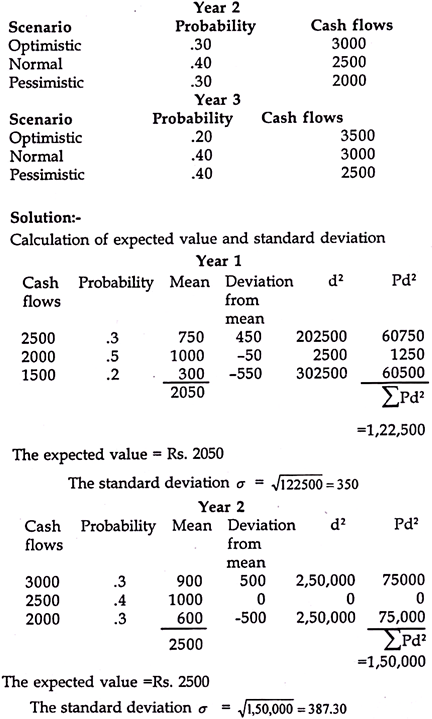

In recent years, there has been a lot of technical literature, including articles by Joel Dean, Ezra Solomon, Larie, Savage and Jack Hirshleifer. The term capital budgeting contains two words-capital, the relatively scarce, non-human resource of production enterprise, and budgeting thus indicating a detailed, quantified planning which guides future activities of an enterprise towards the achievement of its profit goals.

Capital budgeting may be defined as the decision-making process by which a firm evaluates the purchase of major fixed assets, including buildings, machinery and equipment. It deals exclusively with major investment proposals which are essentially long-term projects and is concerned with the allocation of the firm’s scarce financial resources among the available market opportunities.

ADVERTISEMENTS:

Contents

- An Overview of Capital Budgeting

- Introduction to Capital Budgeting

- Meaning of Capital Budgeting

- Definitions of Capital Budgeting

- Concept of Capital Budgeting

- Nature of Capital Budgeting

- Capital Budgeting Decisions

- Objectives of Capital Budgeting

- Characteristics of Capital Budgeting

- Importance of Capital Budgeting

- Significance of Capital Budgeting

- Kinds of Capital Budgeting Proposals

- Types of Capital Budgeting Decisions Taken by a Firm

- Techniques of Capital Budgeting

- Methods of Capital Budgeting

- Requirements of an Ideal Method of Investment Decision Making

- Stages Involved in Capital Budgeting Process

- Steps Involved in Capital Budgeting Process

- Capital Budgeting Decisions

- Analysis of Risk and Uncertainty under Capital Budgeting

- Complex Situations in Capital Budgeting

- Risk Analysis in Capital Budgeting

- Investment Decision

- Capital Rationing

- Appraisal of Capital Budgeting Proposals

- Fallacies in Analysing Capital Budgeting Proposals

- Fundamentals of Evaluating Foreign Projects

- Tax Implications on Capital Budgeting

- Capital Budgeting in Practice

- Problems in Capital Budgeting

- Limitations of Capital Budgeting

Capital Budgeting: Meaning, Definitions, Objectives, Importance, Types, Techniques, Methods, Process, Importance, Decisions, Risk Analysis and More…

Capital Budgeting – An Overview

Among the various finance functions, one of the most important decisions is pertaining to investment of funds for a long period of time. All enterprises are required to take a long term decision to sustain or to enhance their profitability.

These decisions are not taken very frequently by the organisation as they involve huge amounts of funds and the effects of the investment have bearing on the profitability for a long period of time.

Therefore, it is imperative for a financial manager to take these decisions very cautiously. According to Lynch, “Capital Budgeting consists in planning the development of available capital for the purpose of maximizing long term profitability of the concern.”

ADVERTISEMENTS:

Capital budgeting is a process which helps enterprises in examining the financial implications of the long term investment projects. The decision of accepting or rejecting an investment project as part of a company’s policy depends upon the investment rate of return that such a project will generate.

The rate of return generated by the project is influenced by other factors that are specific to the company as well as the project. For example, the acceptance or rejection of a social or charitable project is not solely based on quantitative return estimated in the process but also takes into consideration other issues such as contribution to foster goodwill and fulfillment of corporate responsibility norms.

Since Capital budgeting involves investment of a huge amount of funds, it is necessary to understand the risks and returns involved otherwise the finance manager would be criticized by its owners or shareholders. An imperfect or casual approach in measuring the effectiveness of these decisions would create difficulty for survival of enterprises.

Capital Budgeting – Introduction

Capital budgeting is the process of evaluating and selecting investments in capital assets or fixed assets in a firm. Capital budgeting is vital in achieving the shareholders’ wealth maximisation objective of a firm.

ADVERTISEMENTS:

In capital budgeting, we estimate the future cash flows and make the investment, only if the present value of cash inflows exceeds the investment’s cost or cash inflows yield a return equal to the required rate of return on the capital.

The capital budgeting may involve selecting investments in starting of business, modernisation of business, replacement of existing fixed assets, expansion of business or in diversification of business. Merger and acquisition is also a capital budgeting decision for the acquiring firm.

For example- investing in a cycle manufacturing unit involves a capital budgeting decision. Here, future cash flows are estimated and if they yield a return required to meet the cost of capital (the return required by those financing the project) the investment in the cycle manufacturing unit is desirable.

Capital budgeting may involve evaluating a number of projects simultaneously and selecting the most suitable from these projects.

ADVERTISEMENTS:

The cost of capital (the return required by those financing the project) and estimation of future cash inflows are two main considerations in making capital budgeting. The capital budgeting is also known as capital expenditure decision, capital expenditure management, management of fixed assets, long-term decision etc.

The finance manager of a firm is responsible to procure the required quantum of funds from different sources and invest the raised funds in various assets in the most profitable way. The investment of funds requires a number of decisions to be taken in a situation in which funds are invested and benefits are expected over a long period.

The finance manager is to determine the composition of assets of the firm. The assets of the firm are of two types i.e., fixed assets and current assets. The aspect of taking the financial decision with regard to fixed assets is called capital budgeting.

Capital Budgeting – Meaning

Palmer and Taylor state that probably more words have been written on the subject of capital budgeting in recent years than on any other subject relating to financial planning and control in business. Decades ago, economists Bohn-Bawerk, Wicksell and Irving Fisher laid the theoretical foundation for a sound economic approach to capital budgeting.

ADVERTISEMENTS:

In recent years, there has been a lot of technical literature, including articles by Joel Dean, Ezra Solomon, Larie, Savage and Jack Hirshleifer. The term capital budgeting contains two words-capital, the relatively scarce, non-human resource of production enterprise, and budgeting thus indicating a detailed, quantified planning which guides future activities of an enterprise towards the achievement of its profit goals.

‘Capital’ relates to total funds employed in an enterprise as a whole. The capital fund is increased by an inward flow of cash and decreased by an outward flow of cash and as such it is important for an enterprise to plan and arrange cash flows properly.

The power of the financial planning package lies in enabling borrowings to be arranged sufficiently in advance to reduce the danger of a liquidity crisis as also to provide substantiating documents for loan negotiations.

Capital budgeting then consists in planning the deployment of available capital for the purpose of maximising the long-term profitability (return on investment) of a firm. It refers to the process by which a firm determines where it should apply its comparatively limited financial resources.

ADVERTISEMENTS:

Capital budgeting may be defined as the decision-making process by which a firm evaluates the purchase of major fixed assets, including buildings, machinery and equipment. It deals exclusively with major investment proposals which are essentially long-term projects and is concerned with the allocation of the firm’s scarce financial resources among the available market opportunities.

It is a many-sided activity which includes a search for a new and more profitable investment proposal and the making of an economic analysis to determine the profit potential of each investment proposal.

The term ‘capital expenditure projects’ is broad enough to include those projects in which the net assets of a company are acquired by the issue of the capital stock of the acquiring company. Capital budgeting involves a long-term planning for making and financing proposed capital outlays.

Most expenditures for long-lived assets affect a firm’s operations over a period of time (years). They are large, permanent commitments which influence its long-run flexibility and earning power.

ADVERTISEMENTS:

It is a process by which available cash and credit resources are allocated among competitive long-term investment opportunities so as to promote the greatest profitability of a company over a period of time. It refers to the total process of generating, evaluating, selecting and following up on capital expenditure alternatives.

Definitions of Capital Budgeting

There are two types of expenditures generally made in a business viz. Capital Expenditure and Revenue Expenditure. Revenue expenditure is required for day to day operating requirements whereas Capital expenditure is incurred in making investment in fixed assets.

Following are some of its important definitions:

“Capital budgeting is long-term planning for making and financing proposed capital outlays.” — Charles T. Horngren

“Capital budgeting involves the planning of expenditures for assets the returns from which will be realized in future time periods.” — Milton H. Spencer

“Capital budgeting is concerned with the allocation of the firm’s source financial resources among the available opportunities. The consideration of investment opportunities involves the comparison of the expected future streams of earnings from a project with the immediate and subsequent streams of earnings from a project, with the immediate and subsequent streams of expenditure”. — GC. Philippatos,

ADVERTISEMENTS:

“Capital budgeting is acquiring inputs with long-term return”. —Richard and Green law “Capital budgeting consists in planning the development of available capital for the purpose of maximizing the long-term profitability (return on investment) of the firm.” — R. M. Lynch

Concept of Capital Budgeting

A business firm is created by entrepreneurs because they see an opportunity for profitable investment. They estimate the total requirement of funds to be invested in both long-term as well as short-term assets of the firm.

The efficient allocation of funds particularly in long-term assets by a firm is of vital importance for the realisation of its objective. In this era of globalisation, even the existing businesses face a lot of competition to survive in the volatile environment. Every firm has to meet the challenges coming up in its way.

Therefore, it has to adapt to the new technology, plants, machineries, products, methods etc. and have to incur capital expenditure for the purpose of surviving in this competitive environment.

Hence, every business, whether new or existing, has to invest a lot of its scarce funds in long-term assets. The investment decisions involving commitment of current funds of the firm in its long-term assets are known as capital budgeting or capital expenditure decisions, expenditure decisions.

Long-term assets are those which are used by the firm for a longer period, usually beyond one year. Therefore, investment in capital assets (long-term assets) benefits a firm over a longer period of time.

Nature of Capital Budgeting

Nature of Capital Budgeting:

1. Huge investments

ADVERTISEMENTS:

Capital budgeting requires huge investments of funds, but the available funds are limited, therefore the firm before investing projects, plan are control its capital expenditure.

2. Long-term

Capital expenditure is long-term in nature or permanent in nature. Therefore financial risks involved in the investment decision are more. If higher risks are involved, it needs careful planning of capital budgeting.

3. Irreversible

The capital investment decisions are irreversible, are not changed back. Once the decision is taken for purchasing a permanent asset, it is very difficult to dispose of those assets without involving huge losses.

4. Long-term effect

Capital budgeting not only reduces the cost but also increases the revenue in the long-term and will bring significant changes in the profit of the company by avoiding over or more investment or under investment.

Over investments leads to be unable to utilize assets or over utilization of fixed assets. Therefore before making the investment, careful planning and analysis of the project thoroughly is required.

Capital Budgeting Decisions

Broadly speaking, capital budgeting decisions are long-term investment decisions.

ADVERTISEMENTS:

They include the following:

1. Expansion Decisions

Decisions on matters such as acquisition of new machinery or building, addition of building and machinery etc. are taken on the basis of cost of investment and expected profits from goods produced.

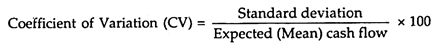

2. Replacement Decisions

A company may have to replace its existing old or obsolete machinery by new and latest model machinery. The use of new machinery may bring down operating costs and increase the volume of output. Decisions on such matters are taken on the basis of saving on account of decrease in operating costs and profits from additional volume produced by new plants.

3. Buy or Lease Decisions

The management may have to take decision on acquiring a fixed asset by purchasing it from the market or by arranging it on lease basis. Such decisions are taken by comparing the cost of funds required for the purchase of assets with the amount payable on lease.

4. Choice of Equipment

The management may have to select the best machine out of available several alternative machines. Decisions on such matters are taken by comparing the cost of different assets with their respective profitability.

5. Product of Process Improvement

ADVERTISEMENTS:

This concern with decisions on matters related to cost reduction or improvement in the quality of product by change in production processes. Decision on such matters is taken on the basis of a comparative study of cost of change and possible additional income or saving as a result of change.

Objectives of Capital Budgeting

The objectives of capital budgeting are:

1. To decide whether a specified project is to be selected or not.

2. To find out the quantum of finance required for the capital expenditure.

3. To evaluate the merits of each proposal to decide which project is best.

4. Improving quality of products and creating new demand.

ADVERTISEMENTS:

5. Expansion of existing business.

6. Diversification for survival particularly in competitive conditions.

7. Improvement of efficiency.

8. Meeting satisfaction of customers.

Characteristics of Capital Budgeting

Capital Expenditure for Long Period:

Capital budgeting entails heavy expenditure. Infact, this is a very important characteristic which explains the importance of capital budgeting decisions to a firm. Capital is sunk for a long period. This long-term commitment adds considerably to the risk of capital budgeting decisions.

Capital expenditure is the main link between the present and the future, for it is the principal means by which an industrial company tries to attain its long-term goals and objectives.

Because of its relationship with long-term profit planning, its disproportionately heavy impact on short-term profits and its high volume, capital expenditure should be planned and controlled. Decisions which involve the authorisation of capital expenditure projects are among the most important for the Boards of Directors and their managerial advisers.

Most capital expenditure schemes call for a permanent commitment of relatively large sums of money over a number of years. Capital expenditure is strategic investment of some magnitude and is of a non-routine nature; it has economic life and its benefits continue over a series of years.

From the standpoint of the stockholder and the consumer, capital expenditures are the principal bulwark against the seemingly endless progression of wage increase. From the standpoint of labour, capital expenditures are the basic economic source of future wage advances, for they embody the creative forward strides of advancing technology.

Finally, capital expenditures, both by their aggregate size and by their cyclical timing, have a great deal to do with the character of the economy as a whole, and therefore, with the government’s role in maintaining stability-

(i) Creative Search for Profitable Opportunities

The concept of the profit-making idea must be embodied in the capital facility. Profitable opportunities for the company’s invested capital must be turned up. A corporation’s future profitability and growth are linked to the soundness of its capital expenditure policy.

This calls for the need for clearly identifying the steps of a capital expenditure management programme. These steps then require to be integrated into a procedure to be used for the conduct of an organisation’s capital expenditure programme.

(ii) Long-range Capital Planning

To provide consistent benchmarks for proposal origination in all parts of the organisation, it is necessary to have some kind of a plan sketched for the future even though it is a tentative plan. Consider the words of Joel Dean, “Today’s capital expenditures make the bed that the company must lie in tomorrow. The capital expenditure budget embraces a company’s plans for replacing, improving and adding to its capital equipment”.

(iii) Short-range Capital Planning

The purpose of preparing a short-range capital budget is to force the operating management to submit the bulk of its capital proposals early enough to give the top management an indication of the company’s credit demands for funds.

(iv) Measurement of Project Worth

In order to permit an objective ranging of projects, the productivity of the proposed outlay will have to be measured properly.

(v) Screening and Selection

A screening standard should be set in the light of the supply of cash available for capital expenditures, the cost of money to the company, and the attractiveness of alternative investment opportunities.

(vi) Control of Authorised Outlays

Control has to be exercised by the top management in order to ensure that the facility conforms to specifications and that the outlay does not exceed the amount authorised. Once the capital expenditure is incurred, it is most difficult to change the course of expenditure. As capital assets are usually of limited specific use, the future needs of such assets should be carefully assessed.

(vii) Post Mortem

In order to preserve the integration of the estimates of projected earnings, a post-completion audit of the company’s performance should be effected.

(viii) Retirement and Disposal

A management’s responsibility for an investment approach ceases only when the facilities have been disposed of. The asset must be retained throughout its economic life until it virtually becomes worthless at the time of disposal.

(ix) Forms and Procedures

An effective system of capital expenditure control should be implemented with the use of specialised forms, written procedures etc. all tailored to the company’s needs.

(x) Economics of Capital budgeting

Good estimates of a rate of return of capital expenditure projects pre-suppose an understanding of the economic concepts that underlie sound investment decisions.

(xi) Increase the Breadth of Analysis Leading to Decision-Making

In evaluating capital expenditure decisions or a profit-plan, it has been fairly common to consider only a few alternative strategies or economic assumptions before reaching a decision.

(xii) Tool for Special Problems

More and more attention is being devoted by management to temporary and special problem situations.

(xiii) Understanding inherent Logic of the Financial System

As a by-product of financial modelling, some executives have found that the act of defining the logic and interaction of the financial system in developing the model is, in itself, a very important and revealing activity.

Forecasting:

As funds are committed over extended periods of time, there is a need for proper forecasting. A bird in hand is worth two in the bush. There is an element of uncertainty and risk which may lie in store for the future. All these factors have to be properly evaluated in the process of forecasting. A proper cost-benefit relationship should also be established.

Planning Asset Capacities:

A firm has to assess the capacities of the assets properly before arriving at its long-term decisions. Both under-capacities and over-capacities should be avoided. Moreover, the management should determine the timing and the quality of asset acquisitions.

Asset capacities have to be related to market factors, which may change over a period of time because of various cyclical fluctuations. A firm should, therefore, plan and fix the capacities of its assets in which long-term investment is going to be sunk.

Far-sighted judgement is an essential prerequisite of wise decisions bearing on capital expenditures. But much judgement, to be sound, should be based on an analysis of all the facts, many of which may be extremely technical and complex.

The top management needs an objective means of measuring the economic worth of individual investment proposals so that it may choose and select those which will have the most profound impact on a company’s long-run prosperity.

The real worth of an investment proposal may be traced to the credibility of the forecasts of the sales demand and production capacity which underpin the validity of the assessments and any miscalculation of these is likely to be of far greater consequence than the relatively marginal effects of errors caused by the use of a wrong rate of interest in discounting calculations.

Importance of Capital Budgeting

Importance of Capital Budgeting:

Importance # 1. Long-term Implications

A Capital budgeting decision has its effect over a long time span and inevitably affects the company’s future cost structure and growth. A wrong decision can prove disastrous for the long term survival of the firm.

It leads to unwanted expansion of assets which results in heavy operating cost to the firm. On the other hand, lack of investment in assets would influence the competitive position of the firm. So the capital budgeting decision determines the future density of the company.

Importance # 2. Involvement of Large Amount of Fund

Capital budgeting decisions need substantial amounts of capital outlay. This underlines the need for thoughtful, wise and correct decisions as an incorrect decision would not only result in losses but also prevent the firm from earning profit from other investments which could not be undertaken.

Importance # 3. Irreversible Decisions

Capital budgeting decisions in most of the cases are irreversible because it is difficult to find a market for such assets. Then the only way out will be to scrap the capital assets. So acquired and incur heavy losses.

Importance # 4. Risk and Uncertainty

Capital budgeting decisions are surrounded by a great number of uncertainties. Investment is present and investment is future. The future is uncertain and full of risks. Longer the period of project, greater may be the risk and uncertainty. The estimates about cost revenues profits may not come true.

Significance of Capital Budgeting

Significance of Capital Budgeting:

The significance of capital budgeting can be emphasized taking into consideration the very nature of the capital expenditure such as huge investment in capital projects, long-term implications for the firm, irreversible decisions and complications of the decision making.

The significance of capital budgeting can be summarized as follows:

(1) Indirect Forecast of Sales:

The investment in fixed assets is related to future sales of the firm during the lifetime of the assets purchased. It shows the possibility of expanding the production facilities to cover additional sales shown in the sales budget.

Any failure to make the sales forecast accurately would result in over investment or under investment in fixed assets and any erroneous forecast of asset needs may lead the firm to serious economic results.

(2) Comparative Study of Alternative Projects:

Capital budgeting makes a comparative study of the alternative projects for the replacement of assets which are wearing out or are in danger of becoming obsolete so as to make the best possible investment in the replacement of assets. For this purpose, the profitability of each project is estimated.

(3) Timing of Assets-Acquisition:

Proper capital budgeting leads to proper timing of assets-acquisition and improvement in the quality of assets purchased.

Due to the nature of demand and supply of capital goods, the demand of capital goods does not arise until sales impinge on productive capacity and such situations occur only intermittently. On the other hand, supply of capital goods with their availability is one of the functions of capital budgeting.

(4) Cash Forecast:

Capital investment requires substantial funds which can only be arranged by making determined efforts to ensure their availability at the right time. Thus it facilitates a cash forecast.

(5) Wealth-Maximization of Shareholders:

The impact of long-term capital investment decisions is far reaching. It protects the interests of the shareholders and of the enterprise because it avoids over-investment and under-investment in fixed assets.

By selecting the most profitable projects, the management facilitates the wealth maximization of the equity share-holders.

Kinds of Capital Budgeting Proposals

Kinds of capital budgeting proposals are given below:

1. Replacements

Worn-out, obsolete equipment should be replaced at an appropriate time.

2. Expansion

If the product is in great demand, a firm may think of expanding its activities. Expansion involves an addition of capacity to the existing production facilities. The proposal would then include capital widening decisions and assist in the dynamic growth of the firm. Qualitative efforts should be made to increase the existing utilisation of capacity.

3. Modernisation of Investment Expenditures

These are capital-deep decisions. They make it easier for a firm to reduce costs and may coincide with replacement decisions.

4. Strategic Investment Proposals

There are capital budgeting decisions which do not assume that the return would be immediate or be measured over a long period of time. Strategic investments may be defensive, offensive and mixed-motive decisions.

The vertical integration of a firm is an example of a defensive investment in which a continuous source of raw materials is assured. Horizontal and conglomerate combinations are offensive investments, for they ensure a firm’s internal and external growth respectively. Mixed motive investments are outlays on research and development programmes.

5. Diversification

Diversification means operating in several markets or from one market into another market. It may even amount to changing product lines. A firm resorts to diversification to ensure breakeven risks involved in different products lines.

6. Research and Development

Where technology is rapidly changing, research and development becomes a continuous activity for any firm. Usually, large sums of money are invested in ‘R & D’ activities which lead to capital budgeting decisions.

Harold Bierman and Seymour Smidt classify investments as follows:

(a) On the basis of the kinds of scarce resources used or required;

(b) According to the amount of each of the resources that are required;

(c) According to the way benefits from investments are affected by other possible investments;

(d) According to the form in which benefits are received;

(e) Whether incremental benefits are the result of lower costs or increased sales-whether they merely prevent a decline in sales or market share;

(f) According to the business activity to which they are most closely related.

They are of the opinion that no single scheme of classification is equally valid for all the uses or for all the companies. The essential task is to develop a classification system for investment that is appropriate to the activity of the business and the organisational structure of the particular company.

Types of Capital Budgeting Decisions Taken by a Firm

Capital budgeting decisions are concerned with a number of issues related to a firm. It may be set up of a new business, modernisation of business or the other.

The following types of capital budgeting decisions are taken by a firm:

1. Set up of new business

The setting up of a business involves large capital investment. The decision to start a business is simply a capital budgeting decision.

2. Modernisation

To remain in business, a firm may require modernisation from time to time. Modernisation may involve huge investment in long-term assets. Capital budgeting decisions are taken in such a case.

3. Replacement

A capital budgeting decision may be related to replacement of an existing machinery or equipment in a firm. The replacement of machinery or equipment may be needed on account of a number of factors, like to increase the efficiency, obsolescence, cost saving etc.

4. Expansion

A firm doing good business may be interested in expanding the production capacity to capture more market share. Capital budgeting is necessary to evaluate the expansion and decide about the execution of expansion.

5. Diversification

The existing firms may be interested in diversifying their business by introducing new product lines to increase their product base. Before executing any such move, a firm has to make a capital budgeting decision.

6. Acquisition

In an acquisition, one firm buys another one. This is different from buying machinery or starting a new firm. The same principles of capital budgeting are involved in acquisition analysis.

Capital Budgeting Techniques

The following are the techniques which are found to be in general use:

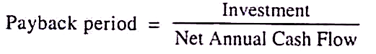

Technique # 1. Payback Method:

The payback method is based on the assumption that the degree of risk associated with the fixed asset is the length of time required to recover the investment from the firm’s cash flow. The payback period is defined as the length of time required for the stream of cash proceeds produced by an investment to equal the original cash outlay required by the investment.

This method is also known as the pay-out method:

Thus, the payback period is the length of time required to recover an initial fixed investment through returning cash flow. This flow includes both the depreciation recoveries and the net income after taxes.

The recovery of invested principal as rapidly as possible reduces the amount of capital devoted to a project. It also reduces the risk of possible loss of the capital.

Advantages:

(i) It is an important guide to investment policy,

(ii) It lays a great emphasis on liquidity,

(iii) The rate at which capital is recouped has a positive significance,

(iv) It is easy to understand, calculate and communicate to the other,

(v) The method enables a firm to choose an investment which yields a quick return on cash funds,

(vi) It enables a firm to determine the period required to recover the original investment with some percentage return and thus arrive at the degree of risk associated with the investment,

(vii) It emphasises the liquidity and solvency of a firm, which is undoubtedly an important consideration,

(viii) It is an adequate measure, with very profitable internal investment opportunities,

(ix) It weighs early returns heavily and ignores distant returns. It thus contains a built-in hedge against economic depreciation or obsolescence,

(x) When the payback index is used for ranking competitive projects, it has the advantage of eliminating any bias due to project size in terms of cost,

(xi) The method is quite the simplest of all the techniques used by the industry. It helps in the selection of those projects whose profits are high enough to repay the amount invested within a particular number of years,

(xii) Other than its simplicity, the main advantage claimed for the payback method is that it is a built-in safeguard against risk.

Disadvantages:

(i) It does not measure the profitability of a project,

(ii) The timing of the flow is not considered a vital factor,

(iii) The time value of money is ignored,

(iv) The rapidity of incoming cash flow is the only measure of desirability,

(v) The rate of expected return is considered in a haphazard manner.

(vi) There is no recognition of cash flow variation. One project may have a cash inflow of Rs.6,000 for the first year, Rs.8,000 for the second year and Rs.10,000 for the third year. The second project may have cash flow of Rs.10,000, Rs.8,000 and Rs.6,000 for three years respectively.

If both the projects involved net cash outlays of Rs.24,000, the payback period would be three years for each. It should be remembered, however, that the second project would yield more cash earlier and may, therefore, be considered more valuable. This situation is not properly handled under the payback method.

(vii) Inadequate effort is made either to ascertain the relative merit of alternative opportunities or to maximise profits,

(viii) It does not value projects of different economic lives. The economic life of a project is the life beyond the payback period. The payback method considers only the payback period of the proposals, and does not consider the period beyond that.

Infact, a project which has a longer life beyond the payback period is more economical than the one which enjoys a shorter life period beyond the payback period. One obvious shortcoming of the payback index is that most projects continue to generate the cash flow beyond the payback period; its exclusion from consideration may, therefore, create a wrong impression as to the relative desirability of several competing projects,

(ix) It does not consider income beyond the payback period and looks upon it as a windfall,

(x) It includes the cost of capital, does not relate to productivity, and emphasises only time dimensions,

(xi) It does not indicate how to maximise value and ignores the relative profitability of the project,

(xii) It is useful for certain firms only. Its generality, therefore, is severely constrained,

(xiii) It over-emphasizes liquidity and ignores capital wastage and the economic life of an asset,

(xiv) It is only a rule-of-thumb method. It is often difficult to judge objectively whether one proposed project is superior to another and, if so, by how much,

(xv) The payback concept does not reflect all the relevant dimensions of profitability. In especially risky situations, therefore, it is not sufficiently inclusive or payback sensitive enough to be used as a measure of investment worth,

(xvi) The method is often criticised on the ground that it does not take into consideration the concept of the cost of capital which is important for capital budgeting decisions,

(xvii) No allowance is made for taxation nor is any capital allowance made,

(xviii) It ignores the fact that projects may have different profit streams after the payback period is over, and may lead to serious under investment,

(xix) It may choose highly risky projects,

(xx) The method is not consistent with the objective of maximising the market value of the firm’s share. It would be consistent with this objective if share values were a function of the payback period of investment projects.

Corrections for Payback Method:

The defects of the payback method may be somewhat cured in the following ways:

i. Modified Payback Method

Profits earned after the payback period are considered.

ii. Reciprocal of Payback

The method is a close approximation of the ‘Time Adjusted Rate of Return’ (TRR), if the earnings are levelled and the estimated life of the project is somewhat more than twice the back period.

iii. Discounted Reciprocal Payback Method

When savings are not levelled, it is better to calculate the payback period by taking into consideration the present value of cash TRR (provided the estimated economic life of the asset is more than twice the payback period). The rate thus calculated slightly overstates the true returns.

The traditional methods (especially the payback method) are not easily preferred when there is a danger of obsolescence due to rapid technological developments and when there is a great shortage of funds and a long list of priority projects.

Big companies in India, however, like to adopt the payback method for the evaluation of capital expenditure proposals. Moreover, in spite of its limitations, if rightly understood, the payback method may serve as a useful screening device before more precise methods are applied.

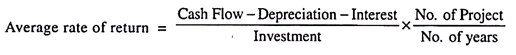

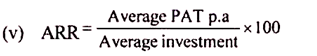

Technique # 2. Average Rate of Return:

Advantages:

(i) It selects alternative uses of funds,

(ii) It considers savings over the entire life of the project.

(iii) In addition to measuring the desirability of new investments on the basis of their relative cash flows, a comparison is made of expected profitability.

This is done with the average rate of return, which is a ratio of the yearly average net earnings after depreciation and taxes to the average investment.

Disadvantages:

(i) The differential timing of receipts is not considered,

(ii) It ignores the time value of funds.

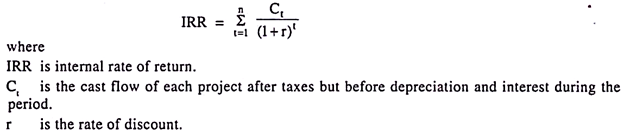

Technique # 3. Internal Rate of Return:

The internal rate of return is the rate which equates the present value of the expected future cash flows with the cost of the investment. The rate of discount is determined by the trial-and-error method to bring the present value of the projects close to the investment. Subsequently, the exact internal rate of return is estimated with the help of interpolation.

The discounted cash flow return is thus nothing but a true annual rate of return of the capital outstanding in the investment. The implicit discount rate-the expected rate of total return that equilibrates current price with a forecast dividend stream-is the single most important piece of information to have about a common stock.

Risk premiums and liquidity preference premiums play a pivotal role in explaining variations in the discount rate. Although these premiums are constantly changing, the effect of changes on the structure of implicit discount rates is systematic.

In particular, it is usually true that

(i) The higher the market risk of a stock, the higher the discount rate or expected return tends to be; and

(ii) The lower the market liquidity, the higher the discount rate or expected return tends to be.

Advantages:

(i) It measures the relative profitability of an investment on the basis of a single overall rate of return per year.

(ii) It diverges according to the goals of the firm. It can be used to accept a combination of projects.

(iii) It enables a firm to choose from among different alternatives.

(iv) It enables a firm to know the rate of return which it would receive discounted over a period of years required to recover the original investment.

(v) It restricts investment expenditure to the amount of funds internally generated by a firm. In its simplest form, it refers to the supply and cost of finance.

Disadvantages:

(i) Although a simple operation, the computation becomes quite tedious.

(ii) Accounting Information – It uses accounting information and does not explain the cash flow position.

(iii) Ignores Time Value of Money – It ignores the time of receipts and expenses. It does not make use of the time value of money in investment decisions.

(iv) Multiple Concepts of Investments – There is no full agreement on the accurate measure of the term ‘investment’. This rate of return, therefore, becomes unreliable.

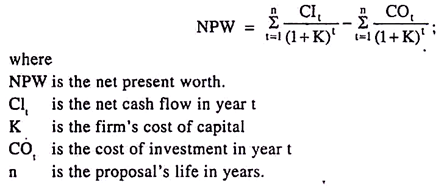

Technique # 4. Net Present Worth:

A business firm has a positive preference for the time factor. It prefers to present goods to the same quantity of commodities in the future. The present is here and now, and is more certain than the future.

The financial manager places a greater value on present funds than on future funds because:

(i) The additional income is available now rather than in the future;

(ii) There is a greater certainty associated with present assets;

(iii) Future receipts are only current estimates;

(iv) A risk is involved in future receipts.

There are two aspects of this problem. One is the annuity principle and the other is the present value of future income.

According to the annuity principle:

This method calculates the net present worth of the expected net cash flows of each project, which is obtained by discounting the net cash flows of each project by a discount rate which equals the firm’s cost of capital.

The net present value method is a classic economic method of investment appraisal. While it is favoured by a majority of economists, it has not found much support elsewhere. In business, the discounted cash flow method is generally preferred.

Net cash flows are the incremental cash receipts, less the incremental expenditures solely attributable to the decision to proceed with an investment.

The present value of an investment may be described as the investment without being financially worse off:

Solution:

It is obvious that the new project value of project X exceeds that of project Y by Rs.189.76. The management would naturally prefer project X to project Y, if the projects are mutually exclusive.

Advantages:

(i) The net present value method computes the discount rate at the cost of capital,

(ii) It is useful for simple ‘accept’ or ‘reject’ type;

(iii) The present value method is superior to other methods of evaluating the economic worth of investments,

(iv) The net present value method is generally accepted by economists. Hawkins and Pearce state that this method “is theoretically unassailable. If one wishes to maximise profits, the use of NPV always finds the correct collection of projects.”

(v) The concept of the present value of a series of cash flows is an important feature of the analysis of different investment potentialities. The net present worth technique analyses the merit or relative capital investments. It estimates the present value of their cash flows by using a discount rate equal to the current estimated percentage cost of capital.

Disadvantages:

(i) It gives the same decision for mutually exclusive projects as the discounted benefit-cost ratio.

(ii) It leads to confusing and contradictory answers for the ranking of complicated projects.

Technique # 5. Profitability Index:

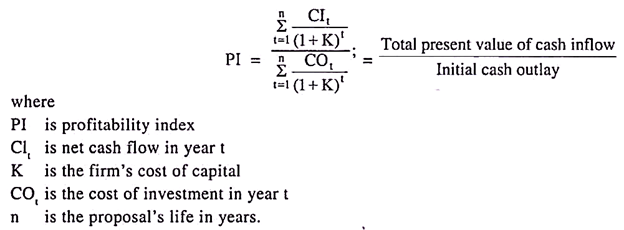

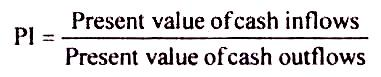

The profitability index is the relationship that exists between the present values of net cash inflows and the present values of cash outflows. It is possible to make use of a profitability index while comparing the relative merits of investments proposals and their ranking as to desirability. It relates the present values of net cash flows discounted at various rates of interest of capital cost to the capital expenditures required for a project.

Limitations:

(i) A profitability index of less than one does not indicate losses. It merely means that a firm’s cost of capital exceeds the rates of return. It should not, however, be concluded that the project will lose money, for there may be some other factors which may adequately overcome the slight difference between the cost of capital and the rate of return,

(ii) It is an index number and cannot be reduced to the rate of return,

(iii) It ignores the small percentage differences between projects.

Technique # 6. Adjusted Net Present Value:

This method assumes risk of possible insolvency and availability in earnings available to shareholders. For this purpose, the expected cash flow is substituted by the model cash flow. A financial executive should ascertain the probable distribution of the annual cash flows of the different projects.

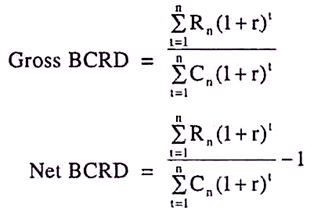

Technique # 7. Discounted Benefit-Cost Ratio:

This is a ratio of the present worth of all the future benefits to the present worth of the project outlay, both streams discounted at the same rate. This discounted benefit- cost ratio is the ratio of the present value of future benefits to the present value of the outlays.

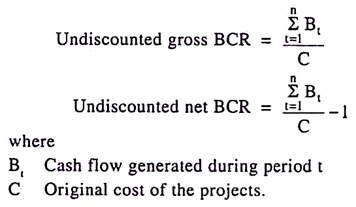

Technique # 8. Undiscounted Benefit-Cost Ratio:

Both benefits and costs are accounted without any discount for futurity, business risk or financial risk.

It is computed with the help of the following formula:

Technique # 9. Net Terminal Value:

Under this method, the cash inflows and outlays are compounded to some future terminal date. If the net terminal value is greater than zero, the project is accepted.

Technique # 10. Annual Benefit-Cost Ratio:

The discounted annual costs are converted into average annual outlays. The latter are compared to the average annual returns. If the gross ratio of annual benefits to the annual costs is greater than unity, the proposal is accepted.

Technique # 11. Net Costs Criterion:

It involves the minimisation of the average cost per unit of product reduced to the present values of the entire productivity of a firm- present and future. It relates directly the cycle of the product demand to the production and investment demand.

Technique # 12. Capital Allocation:

Capital allocation means the way a management arranges assets and claims against assets. The purpose is to achieve the maximum present value for its ownership.

Technique # 13. Cut-Off Point:

The cost of capital is the cut-off point for project selection. A management accepts all the projects with returns exceeding the cost of capital to cut-off, or rejects all those projects with returns exceeding life-time alternative investments-this may differ considerably, and the investor may have a time horizon which is different from any of these in general. What time horizon should be used in the decision rules has no one answer that would apply to all circumstances.

The discounted cash flow methods are sophisticated and can be used with great advantage.

Capital Budgeting Methods

The methods can be grouped into two categories as given below:

Method # I. Traditional (or) Non-discounting Methods

As the name itself suggests, these methods do not discount cash flows to find out their present worth.

There are two such methods available i.e.,

(i) Payback period method, and

(ii) the accounting or average rate of return method.

These are essentially rules of thumb that intuitively grapple with the trade-off between net investment and operating cash inflows.

Both these traditional evaluation criteria are discussed below:

1. Payback Period Method:

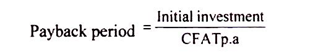

This method, sometimes called the payout or pay off or replacement period method, determines the length of time required to recover the initial outlay of a project.

In other words, it is the period within which the total cash inflows from the project equals the cost of investment in the project. The lower the payback period, the better it is since initial investment is recouped faster.

Procedure for computation of payback period:

(i) Ascertain the initial investment (cash outflow) of the project.

(ii) Ascertain the cash inflows (CFAT) from the project for various years.

(iii) Calculate the payback period as under:

(a) In case of uniform CFAT p.a.

(b) In case of differential CFAT for various years.

(i) Compute cumulative CFAT at the end of each year.

(ii) Find out the year in which cumulative CFAT exceeds initial investment.

(iii) Payback period = Time at which cumulative CFAT = Initial investment (calculated on time proportion basis).

(iv) Accept if the payback period is less than maximum or benchmark period, else reject the project.

Merits of Payback Period Method

(i) It is very easy to apply, calculate and interpret.

(ii) It is most useful when cost is not high and the capital project is completed in a short period.

(iii) It focuses on early return heavily and ignores distant returns. It, thus, contains a built-in edge against economic depreciation or obsolescence.

(iv) It is useful in evaluating those projects which involve high uncertainty.

(v) It considers the liquidity as well as solvency of a firm as a ‘Guiding principle’ in the capital budgeting decisions.

(vi) It gives an indication to a company facing shortage of funds to invest in projects with small payback periods. This is particularly useful when funds are difficult to obtain and a quick return is essential for rapid repayment.

Limitations of Payback Period Method

(i) This method fails to take into account the time value of money. All cash flows are treated and weighed equally regardless of the time period of their occurrence.

(ii) It does not measure the profitability of a project. It ignores the cash inflows beyond the payback period. Thus it is a biased indicator of economic value.

(iii) It does not differentiate between projects requiring different cash investments and thus it does not provide a meaningful and comparable criterion.

(iv) It does not indicate any cut-off period for the purpose of investment decision.

(v) A slight change in operation cost will affect the cash inflows and as such payback period shall also be affected.

(vi) Neither allowance is made for taxation nor is any capital allowance made.

Improvement in traditional approach to payback period

(a) Discounted Payback Period Method:

The payback period method discussed above can be reworked, taking into consideration the time value of money and the firm’s required rate of return, thereby overcoming one of the limitations of the undiscounted payback period method.

When payback period is calculated by taking into account the discount or interest factor, it is known as discounted payback period.

Procedure for calculation of discounted payback period

(i) Ascertain the initial investment (cash outflow).

(ii) Ascertain CFAT (profit before depreciation and after tax) for each year.

(iii) Ascertain the PV factor for each year and compute discounted CFAT (CFAT x PV factor) for each year.

(iv) Ascertain cumulative discounted CFAT at the end of each year.

(v) Ascertain the year in which cumulative discounted CFAT exceeds initial investment.

(v) Calculate discounted payback period at the time at which cumulative discounted CFAT = Initial investment.

(vi) Accept if discounted payback period is less than maximum/benchmark period, else reject the project.

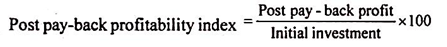

(b) Post pay-back Profitability:

One of the major limitations of the payback period method is that it neglects the profitability of investment during the excess of economic life period over the payback period of that investment.

Hence, an improvement over this method can be made by taking into account the returns receivables beyond the payback period. These returns are called post pay-back profits. If other things remain equal, the project which has the highest post pay-back profits is to be preferred.

The formula for calculating post pay-back profitability index is as follows:

(c) Payback reciprocal:

As the name indicates, it is the reciprocal of payback period. A major limitation of payback period method is that it does not indicate any cut off period for the purpose of investment decision.

It is, however, argued that the reciprocal of the payback would be a close approximation of the internal rate of return if the life of the project is at least twice the payback period and the project generates equal amounts of the annual cash inflow. In practice, the payback reciprocal is a helpful tool for quickly estimating the rate of return of the project provided its life is at least twice the payback period.

The payback reciprocal can be ascertained by using the formula given below:

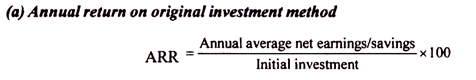

2. Accounting or Average Rate of Return (ARR) Method

ARR is the annualised net income earned on the average funds invested in a project. It is a measure based on the accounting profit (profit after depreciation and tax) rather than the cash flows and is very similar to the measure of rate of return on capital employed, which is generally used to measure the overall profitability of the firm.

The alternative formula for calculating the ARR is as follows:

where, Annual average net earnings=Average of the earnings (savings) after depreciation and tax over the whole of the economic life of the project.

Investment = Capital cost of the equipment minus salvage value of the old equipment

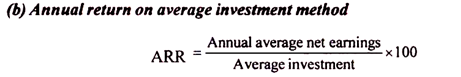

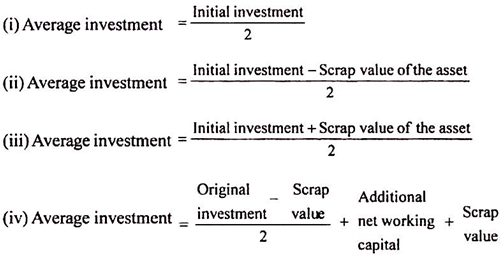

The amount of ‘Average investment’ can be computed in any of the following methods:

Procedure for computation of ARR

(i) Determine the average investment as given above.

(ii) Determine the profit after tax for each year: PAT=CFAT less depreciation.

(iii) Calculate the total PAT for N years, where N = project life.

(iv) Calculate average PAT per annum (Total PAT of all years / N years)

Merits of ARR Method

(i) It is very simple and easy to understand and to use.

(ii) It takes into consideration the total earnings from the project during its lifetime.

(iii) It places emphasis on the profitability of the project, rather than on liquidity as in the case of pay back period method.

(iv) It can be calculated by using the accounting data without another set of workings like cash flow etc.

Demerits of ARR Method

(i) It ignores the time value of money and considers the profit earned in the Ist year as equal to the profits earned in later years. It does not discount the future profits.

(ii) It does not consider the length of project life.

(iii) It ignores the salvage value of the proposal. In real sense, the salvage value is also a return from the proposal and should be considered.

(iv) It also fails to recognise the size of investment required for the project particularly, in case of mutually exclusive proposals, the two projects having significantly different initial costs, may have the same ARR.

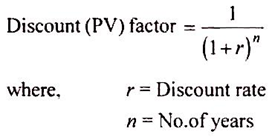

Method # II. Discounted Cash Flow (DCF) Methods (or) Time Adjusted Methods (or) Present Value Methods

The pay back period and ARR methods discussed above did not recognise the time value money i.e., a rupee today is considered more valuable than the one receivable after a year or two.

Discounted cash flow methods take into account the time value of money. The basic feature of discounted cash flow methods is that they are based on discounted cash flows.

Both cash inflows and cash outflows are discounted at a predetermined discounting rate to ascertain their present values. Usually, the discounting rate is the cost of capital rate of the firm. But it can be any other rate also. Discounting factors can be obtained from present value tables.

They can also be ascertained by using the following formula:

The second commendable feature of DCF methods is that they take into account all benefits and costs during the entire life of the project. Moreover, they use cash flows (i.e. CFAT) and not the accounting concept of profit (i.e., PAT).

The DCF methods are becoming increasingly popular day by day.

Following are the discounted cash flow methods :

1. Net Present Value (NPV) Method

2. Internal Rate of Return (IRR) Method

3. Profitability Index (PI)

1. Net Present Value (NPV) Method:

It is one of DCF methods in which both future cash inflows and outflows from a project are discounted at a cost of capital rate. This gives present value of cash inflows and outflows. The difference between the present value of cash inflows and outflows is called Net Present Value (NPV).

Procedure for computation of NPV

(i) Ascertain the total cash inflows of the project and the time periods in which they arise.

(ii) Calculate the present value of cash inflows i.e., CFAT x PV factor

(iii) Ascertain the total cash outflows of the project and the time periods in which they occur.

(iv) Calculate the present value of cash outflows i.e., cash outflows x PV factor.

(v) Calculate NPV = Present value of cash inflows – Present value of cash outflows

(vi) Accept the project if NPV is positive, else reject.

If two projects are mutually exclusive, the project with higher NPV should be preferred.

Merits of NPV Method

(i) It recognises the time value of money.

(ii) It uses the discount rate which is the firm’s cost of capital.

(iii) It considers all cash flows over the entire life of the project

(iv) NPV constitutes addition to the wealth of shareholders and thus focuses on the basic objective of financial management.

(v) Since all cash flows are converted into present value (current rupees), different projects can be compared on NPV basis, thus, each project can be evaluated independent of others on its own merit.

Limitations of NPV Method

(i) This method assumes that the discount rate i.e., the firm’s cost of capital is known. But the cost of capital is difficult to understand and measure in practice.

(ii) It may not give reliable answers while dealing with alternative projects under the conditions of unequal lives of projects.

(iii) Decisions arrived at may not be satisfactory when projects being compared involve different amounts of investment.

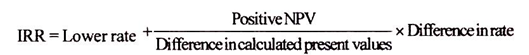

2. Internal Rate of Return (IRR) Method

IRR is the rate of return at which the sum of discounted cash inflows equal the sum of discounted cash outflows. It is the rate at which the NPV of the investment is zero. It is called internal rate because it depends mainly on the outlay and proceeds associated with the project and not on any rate determined outside the investment.

This method is also known as marginal rate of return method or time adjusted rate of return method. This method is generally employed when cost of investment and annual cash inflows are known, while the unknown rate of return (i.e., rate of cost of capital) is to be ascertained.

Procedure for computation of IRR

IRR is calculated according to two methods on the basis of tabular values.

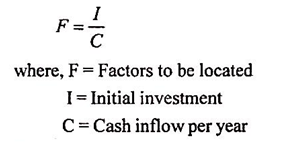

(a) When cash inflows are uniform for all the years:

In this case, the IRR is determined with the help of an annuity table showing the present value of Re. 1 received annually over ‘n’ years by adopting the following two steps :

Step (i) The factors to be located in the relevant annuity table is calculated by using the following simple equation:

Step (ii): The factor, thus, calculated is located in an annuity table on the line representing the number of years corresponding to the estimated useful life of the assets and the relevant percentage of the discount which represents IRR.

(b) When cash inflows are not uniform:

In this case, IRR is to be ascertained by trial and error process. In this process, cash inflows are to be discounted by a number of trial rates. Just to start, the average cash inflows of different years are to be found. Original investment is to be divided by this average cash inflows. This may be taken as a present value factor.

The rate can be ascertained from PV table for this factor and at this rate, the PV of cash inflows of several years are to be calculated, then total PV of cash inflows are compared with the original investment.

If the calculated PV of cash inflows is less than the original investment, the further interpolation will be carried on at lower rate. On the other hand, a higher rate should be tried if the PV of cash inflows is higher than the original investment.

This process continues till the P V of cash inflows and the original investment are equal or nearly equal.

However, the exact rate of return can be ascertained with the help of the following formula:

Accept or Reject criterion

Accept the project if the IRR is higher than or equal to minimum required rate of return. The minimum required rate of return is also known as cut off rate or firm’s cost of capital. While evaluating two or more projects, projects giving a higher IRR should be preferred.

Merits of IRR Method

(i) All cash inflows of the project, arising at a different points of time are considered.

(ii) Time value of money is taken into account.

(iii) Decisions are immediately taken by comparing IRR with the cost of capital.

(iv) It helps in achieving the basic objective of maximisation of shareholders wealth. All projects having IRR above the cost of capital will be automatically accepted.

Limitations of IRR Method

(i) Computation of IRR is quite tedious and it is difficult to understand.

(ii) Both NPV and IRR assume that the cash inflows can be reinvested at the discounting rate in the new projects.

However, reinvestment of funds at the cut-off rate is more appropriate than at the IRR. Hence, NPV method is more reliable than IRR for ranking two or more projects.

(iii) It may give results inconsistent with NPV method. This is especially true in case of mutually exclusive projects i.e., projects where acceptance of one would result in the rejection of the other.

Such conflict of results arise due to the following:

(a) Differences in cash outlays

(b) Unequal lives of projects

(c) Different pattern of cash flows

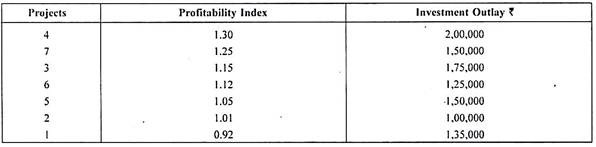

3. Profitability Index (PI) Method

This method is a variant of the NPV method. It is also known as the benefit cost ratio or present value index. It is also based on the basic concept of discounting the future cash flows and is ascertained by comparing the present value of cash inflows with the present value of cash outflows. It is calculated dividing the former by the latter.

Significance of PI

The PI represents the amount obtained at the end of the project life, for every rupee invested in the project at the initial stage. The higher the PI, the better it is, since the greater is the return for every rupee of investment in the project.

Accept or Reject Criterion

Accept the project if its PI is more than 1 and reject the project if the PI is less than 1. However if the PI is equal to 1, then the firm may be indifferent because the present value of inflows is expected to be just equal to the present value of the outflows.

In case of mutually exclusive projects, the project with highest PI should be given top priority, while the project with the lowest PI should be assigned lowest priority. The projects having PI of less than 1 are likely to be outrightly rejected.

Merits of PI Method

(i) It considers the time value of money.

(ii) It is a better project evaluation technique than NPV and helps in ranking projects where NPV is positive.

(iii) It focuses on maximum return per rupee of investment and hence is useful in case of investment in divisible projects, when funds are not fully available.

Limitations of PI Method

(i) The PI as a guide in resolving capital rationing, fails where projects are indivisible. Once a single large project with high NPV is selected, the possibility of accepting several small projects which together may have higher NPV than the single project is excluded.

(ii) Situations may arise where a project with a lower PI selected may generate cash flows in such a way that another project can be taken up one or two years later, the total NPV in such case being more than the one with a project with highest PI.

The PI approach thus cannot be used indiscriminately but all types of combinations of projects will have to be worked out.

Profitability Index Vs NPV Method Vs IRR Method of Ranking of Projects

In case, a firm has two or more projects competing for the same funds at its disposal, the question of ranking the projects arises. For a given project, PI and NPV methods give the same accept and reject signals.

However, if we have to select one project out of two mutually exclusive projects, the NPV method should be preferred. It is because of the fact that the NPV indicates the economic contribution of the project in absolute terms. As such a project which gives higher economic contribution should be preferred.

As regards NPV method versus IRR method, one has to consider the basic presumption behind the two. In the case of the IRR method, the presumption is that intermediate cash inflows will be reinvested at the same rate i.e., IRR, whereas in the case of NPV method, intermediate cash inflows are presumed to be reinvested at the cut off rate.

It is obvious that re-investment of funds at the cut off rate is more possible than at the IRR which at times may be very high. Hence, the NPVs being obtained from discounting at a fixed cut off rate are more reliable in ranking two or more projects than the IRR.

Capital Budgeting – Requirements of an Ideal Method of Investment Decision Making

Given below are the requirements of a good or ideal method of investment decision making:

1. It should be based on cash-flows rather than on profits or expenditure.

2. Cash flows to be covered over the entire expected life of the asset rather than few years only.

3. It should give the absolute value of gain or loss.

4. It should consider the time value of money.

5. It should indicate relative profitability between different alternatives so that a ranking can be made between different proposals.

6. It should indicate the degree of risk and the chances of getting profit or loss in a given situation.

There is probably no method which will possess all the above attributes but different methods do possess some of them.

Stages Involved in Capital Budgeting Process

Capital investment decisions are the part of the capital budgeting process, which is concerned with determining

(a) which specific project a firm should accept,

(b) the total amount of capital expenditure which the firm should undertake, and

(c) how the total amount of capital expenditure should be financed generally.

The following stages are involved in the capital budgeting process:

Stage # (i) Identification of investment proposals :

The capital budgeting process begins with the identification of investment proposals. The proposals may come from a rank and file worker of any department or from any line officer.

The department head collects all the investment proposals and reviews them in the light of financial and risk policies of the organisation in order to send them to the capital expenditure planning committee for consideration.

Stage # (ii) Screening the proposals:

After getting the proposals, the expenditure planning committee analyses all the proposals from various angles to ensure that these are in accordance with the corporate strategies or selection criterion of the firm and also do not lead to departmental imbalance.

Stage # (iii) Evaluation of proposals:

Evaluation of different proposals in terms of cost of capital, expected returns from alternative investment opportunities and life of the assets is the next step in the capital budgeting process.

Various methods such as pay back period, average rate of return method, NPV method, IRR method etc., are employed to evaluate the proposals.

Stage # (iv) Fixing priorities:

Once the evaluation process is over, only economic and profitable proposals are given a green signal to go ahead. But it is not possible to take up all the proposals simultaneously due to fund constraints.

In view of this, all the accepted proposals are ranked and priorities are given in the following order:

(a) current and incomplete projects are given first priority.

(b) safety projects and projects necessary to carry on the legislative requirements.

(c) projects for maintaining present efficiency of the firm.

(d) projects for supplementing the income, and

(e) projects for the expansion of the product line.

Stage # (v) Final approval:

Projects finally recommended by the committee are sent to the top management along with the detailed report, both of the capital expenditure and of sources of funds to meet them. The management affirms its final seal to proposals taking in view urgency, profitability of the projects and the available financial resources.

Stage # (vi) Implementing proposals:

When the proposals are finally selected, funds are allocated for them. Such a formal plan for the allocation of funds is called a capital budget. It is the duty on the part of the top management to ensure that funds are spent in accordance with the allocation made in the capital budget.

A control over such capital expenditure is very much essential and for that purpose, a monthly report showing the amount allocated, amount spent, amount approved but not spent should be prepared and submitted to the controller.

Stage # (vii) Follow up:

Finally, a system of following up the results of completed projects should be established. Such follow up comparison of actual performance with budgeted data will ensure better forecasting and will also help in sharpening the technique of forecasting.

Steps Involved in Capital Budgeting Process

The process of capital budgeting involves generally the following steps:

(1) Project Generation:

The generation of the proposals may fall under any of the following categories:

(a) Additions to the present product line.

(b) Expand the capacity of the existing product line.

(c) Proposals to reduce costs of the existing product line without affecting the scale of operations.

The generation of the projects may take place at the levels of top management or at the level of workers also. E.g. Proposal to replace old machine or to improve the production techniques may originate at the worker’s level also.

(2) Project Evaluation:

As in case of any types of decision makings, the capital budgeting decisions also have two faces. Firstly, estimation of the benefits and costs measured in terms of cash flows and secondly, selection of an appropriate criterion to judge the desirability of the projects.

It is necessary that the evaluation of the projects is done by impartial groups and experts in the field. Care must be taken to choose the criteria to judge the desirability of the projects and it should be consistent with the company’s basic objective to maximize the wealth.

Capital Budgeting Decisions

Criteria for Capital Budgeting Decisions:

Potentially, there is a wide array of criteria for selecting projects. Some shareholders may want the firm to select projects that will show immediate surges in cash inflow, others may want to emphasize long-term growth with little importance on short-term performance. Viewed in this way, it would be quite difficult to satisfy the differing interests of all the shareholders. Fortunately, there is a solution.

The goal of the firm is to maximize present shareholder value. This goal implies that projects should be undertaken that result in a positive net present value, that is, the present value of the expected cash inflow less the present value of the required capital expenditures.

Using Net Present Value (NPV) as a measure, capital budgeting involves selecting those projects that increase the value of the firm because they have a positive NPV. The timing and growth rate of the incoming cash flow is important only to the extent of its impact on NPV.

Using NPV as the criterion by which to select projects assumes efficient capital markets so that the firm has access to whatever capital is needed to pursue the positive NPV projects. In situations where this is not the case, there may be capital rationing and the capital budgeting process becomes more complex.

Note that it is not the responsibility of the firm to decide whether to please particular groups of shareholders who prefer longer or shorter term results. Once the firm has selected the projects to maximize its net present value, it is up to the individual shareholders to use the capital markets to borrow or lend in order to move the exact timing of their own cash inflows forward or backward.

This idea is crucial in the principal-agent relationship that exists between shareholders and corporate managers. Even though each may have their own individual preferences, the common goal is that of maximizing the present value of the corporation.

Alternative Rules for Capital Budgeting:

While net present value is the rule that always maximizes shareholder value, some firms use other criteria for their capital budgeting decisions.

Such as:

1. Internal Rate of Return (IRR)

2. Profitability Index

3. Payback Period

4. Return on Book Value

In some cases, the investment decisions resulting from the IRR and profitability index methods agree with those of NPV. Decisions made using the payback period and return on book value methods usually are suboptimal from the standpoint of maximizing shareholder value.

Features of Capital Budgeting Decisions:

1. It has the potentiality of making anticipated profits, because these decisions relate to fixed assets that represent the earning capacity of the firm. They enable the firm to generate finished goods that can ultimately be sold for profit.

2. It involves a high degree of risk. The future is uncertain and benefits from these investments are received in future years. Therefore an element of risk is involved in making these decisions.

3. Gestation period is high for these decisions, that is, the time lag between the initial investment, and expected returns.

4. These decisions have long term implications for the firm, because a failure to forecast correctly will lead to serious errors, which can be corrected only at considerable expense.

5. Capital investment is high for fixed assets, and the majority of firms have scarce capital resources.

6. Capital investment decisions once made, are not easily reversible without much financial loss to the firm, because generally, there is no market for second hand plant and machinery, and their conversion to other uses may not be financially feasible.

7. It is not often possible to estimate the costs and benefits related to a particular investment decision, because it is spread over a number of years. Similarly they are not logically comparable, because of the time value of money.

Analysis of Risk and Uncertainty under Capital Budgeting

Analysis of Risk and Uncertainty under Capital Budgeting:

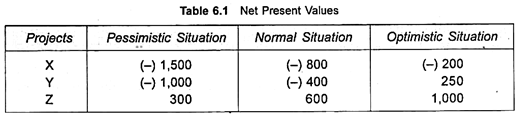

The various techniques of evaluating capital budgeting projects are based on the assumption that all the projects under consideration have the same degree of risk, neither higher nor lower.

The benefits expected from a project are measured in terms of future cash inflows. Future being uncertain, actual benefits may vary from the expected benefits. Hence, there is a risk and uncertainty attached to every expected benefit.

Risk is defined as the variability or deviations from the expected return of an investment decision. The degree of risk however may differ from one decision to another decision. The value of the firm is affected by the amount of risk assumed by a firm while accepting a new project.

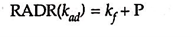

Hence, risk and uncertainty has to be measured and incorporated in capital budgeting decisions. This incorporation of risk and uncertainty will improve the quality of investment decisions.

Concept of Certainty, Risk and Uncertainty:

Certainty is a situation which arises when outcomes in terms of cash flows are known and determinate. For example, income from government bonds is certain and known. This is because of the sovereign guarantee attached to these bonds.

If Mr. A invests Rs. 80,000 in 5 year, 8% Government bonds then the return from these bonds @ 8% can be estimated precisely. As the return from government bonds are assumed to be certain and risk free, hence this outcome can be assigned a probability of 1. This indicates certainty of future benefits.

Risk is a situation when cash flows occurring are known with certain degree of probabilities and these probabilities are determinable. Risk situations are generally repetitive and possess a frequency distribution. But future events are not predictable with perfect knowledge.

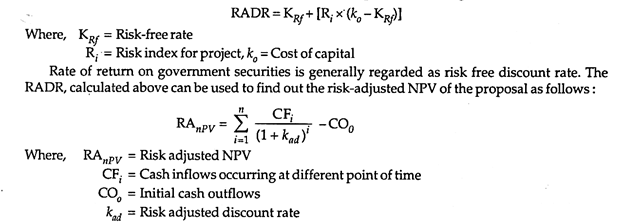

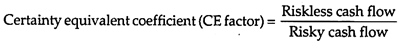

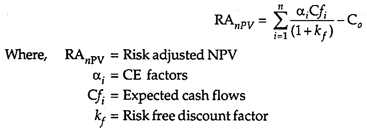

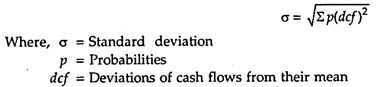

Uncertainty is a situation where an event is not repetitive and the probabilities attached to that event are not known. In such a situation no observation can be drawn from frequency distribution.