Everything you need to know about the process of capital budgeting. Capital budgeting is a process by which companies assess how to fund operations and new ventures through movement and management of assets.

This involves a series of actions or steps taken to achieve best possible returns. This process involves the selection of those new investment proposals presented to a firm that will contribute most to the wealth maximization of the shareholders.

To continue to be successful, a firm may have to engage in a continual search for new investment proposals to add to its profit stream.

Process of Capital Budgeting: A Complete Guide

Process of Capital Budgeting – Proposing, Estimating, Determining, Implementing and Monitoring

The process of capital budgeting involves five tasks:

1. Proposing new projects

2. Estimating cash flows of projects

3. Determining whether projects are feasible

4. Implementing feasible projects

5. Monitoring projects that were implemented

Process # 1. Proposing New Projects:

New projects are continually proposed within the firm as various departments or divisions offer input on new projects to consider.

Process # 2. Estimating Cash Flows of Projects:

Each potential project affects the cash flows of the firm. Estimating the cash flows that will result from the project is a critical part of the capital budgeting process. Revenue received from the project represents cash inflows, while payments to cover the project’s expenses represent cash outflows.

The decision whether to make a capital expenditure is based on the size of the periodic cash flows (defined as cash inflows minus cash outflows per period) that are expected to occur as a result of the project.

Process # 3. Determining Whether Projects are Feasible:

Once potential projects are proposed and their cash flows estimated, the projects must be evaluated to determine whether they are feasible.

Specific techniques are available to assess the feasibility of projects One popular method is the net present value technique, which compares the expected periodic cash flows resulting from the project with the initial outlay needed to finance the project.

If the present value of the project’s expected cash flows is above or equal to the initial outlay, the project is feasible. Conversely, if the present value of the project’s expected cash flows is below the initial outlay, the project is not feasible.

In some cases the evaluation involves deciding between two projects designed for the same purpose. When only one of the projects can be accepted, such projects are referred to as mutually exclusive.

For example, a firm may be considering two machines that perform the same task. The two alternative machines are mutually exclusive because the purchase of one machine precludes the purchase of the other.

When the decision of whether to adopt one project has no bearing on the adoption of other projects the project is said to be independent. For example, the purchase of a truck to enhance delivery capabilities and the purchase of a large computer system to handle payroll processing are independent projects.

That is the acceptance (or rejection) of one project does not influence the acceptance (or rejection) of the other project. The authority to evaluate the feasibility of projects may be dependent on the types of projects evaluated. Larger capital expenditures normally are reviewed by high-level managers. Smaller capital expenditures may be made by other managers.

Process # 4. Implementing Feasible Projects:

Once the firm has determined which projects are feasible, it must focus on implementing those projects. All feasible projects should be given a priority status so that those projects that fulfill immediate needs can be implemented first. As part of the implementation process, the firm must obtain the necessary funds to finance the projects.

Process # 5. Monitoring Projects that were Implemented:

After a project has been implemented, it should be monitored over time. The project’s actual costs and benefits should be compared with the estimates made before the project was implemented. The monitoring process may detect errors in the previous estimation of the project’s cash flows.

If any errors are detected, the employees who were responsible for project evaluation should be informed of the problem so that future projects can be evaluated more accurately.

A second purpose of monitoring is to detect and correct inefficiencies in the current operation of the project. Furthermore, monitoring can help determine if and when a project should be abandoned (liquidated) by the firm.

Process of Capital Budgeting – Project Generation, Project Evaluation, Project Selection and Project Execution

Capital budgeting involves the following steps:

(i) Project Generation

(ii) Project Evaluation

(iii) Project Selection

(iv) Project Execution

Step # (i) Project Generation:

Generating the proposals for investment is the first process of capital budgeting. For an ongoing business concern, investment proposals of various types may originate at different levels within a firm.

The investment proposal may fall into one of the following categories:

(a) Proposals to add new product to the product-line, and Proposals to expand production capacity in existing product-lines.

(b) Proposals to reduce the costs of the output of the existing products without altering the scale of operation.

Generation of investment proposals may originate within the firm or outside the firm. Within the firm, it may come either from top, middle or bottom management. Sometimes, ordinary workers can also be considered as the source for generating such ideas.

Sales campaigning, trade fairs people in the industry, R/D institutes, conferences and seminars will also offer wide variety of innovations on capital assets, that could be taken up for the investment. It may be for a plant or machinery or new product, or new production techniques. The healthy firm must always keep a watch as these developments and must exploit such opportunities for the welfare of the business firm.

Step # (ii) Project Evaluation:

Project evaluation involves two steps:

(a) Estimation of benefits and costs

(b) Selection of an appropriate criterion to judge the desirability of the project.

The benefits and costs of the project is measured in terms of cash flows. The estimation of the cash inflows and cash outflows mainly depends on future uncertainties. The risk associated with each project must be carefully analysed and sufficient provision must be made for covering the different types of risks.

The role of the financial manager is very crucial here because he has to consult and seek the opinion of the executives (production marketing and purchase) before making a final decision. Proper coordination must be established in evaluating such proposals. Many at times the suggestions made by production department may not be suitable to finance and purchase manager.

Similarly, proposal made by finance and purchase manager may not be relevant or suitable to production manager. Therefore, each proposal must be scrutinized on the basis of its merits. If needed, it is advisable to seek expert advice on the matter. As far as possible, the criterion selected must be consistent with the firm’s objective of maximising its market value. The technique of time value of money may come as a handy tool in evaluation of such proposals.

Step # (iii) Project Selection:

No standard administrative procedure can be laid down for approving the investment proposal. The screening and selection procedures are different from firm-to-firm. In a real life situation all capital budgeting decisions are made by top management. However, the projects can scientifically be screened by middle level management in consulting with the head of the finance department.

Step # (iv) Project Execution:

Once the proposal for capital expenditure or investment is finalised, it is the duty of the finance manager to explore the different alternatives available for acquiring the funds. He has to prepare capital budget. He has to take sufficient care to reduce the weighted average cost of funds. The funds so mobilised must be carefully spent or deployed on capital assets or on the projects.

For the effective control over the flow of funds, he has to prepare periodical reports and must seek prior permission from the top management. Systematic procedure should be developed to review the performance of projects during their lifetime and after completion. The follow-up, comparison of actual performance with original estimates not only ensures better forecasting but also helps in sharpening the techniques for improving future forecasts.

Process of Capital Budgeting – Estimation, Benefits, Formula and Examples

Capital budgeting is a time consuming process requiring estimation of expected cash flows and applicability of decision criteria or technique for evaluation. There are three main steps in Investment decision process.

These steps are explained below:

i. Estimation of Cash Flows:

The cash flows associated with any project are forecasted. It involves estimation of a series of cash flows over a period of time. Due to the basic nature of capital budgeting decision and risk surmounting future, these future cash flows may not be equal or in the form of an annuity. Initially when an investment is made, outflow of cash takes place and then it is followed by the generation of revenue from the project’s activities. Thus, the first step in capital budgeting decision is to estimate the cash flows associated with that decision.

ii. Estimating Required Rate of Return and Calculating Present Values of Cash flows:

The cash flows for various years are not directly comparable. For example- suppose there is a project which costs Rs.50,000 and it would generate the net cash flows of Rs.25,000, Rs.20,000 , Rs.22,000 , Rs.25000 and Rs.30,000 for the five year’s economic life of the project. The cash flows which will be received in future cannot be just added to compute the total amount of revenue which is estimated to be earned by the project.

Therefore we use discounting technique to calculate present value of each of the future cash inflows so that they can be added together and we know total present value of cash inflows from the project.

This requires use of an appropriate discount rate, i.e. the required rate of return. This relevant discount rate is known as weighted average cost of capital or overall cost of capital. This appropriate discount rate is also known as ‘cut off rate’ or ‘hurdle rate’.

iii. Evaluation of Capital Projects by Using Some Technique:

Once we have computed the relevant cash flows and we have appropriate discount rate for the computation of their present values, we can proceed to use various capital budgeting techniques to make investment decision.

There are many techniques for evaluation of capital project such as Accounting rate of return, payback period, net present value, Internal rate of return etc. The common feature of all these techniques is cost benefit analysis.

If expected benefits exceed the cost then we accept the project otherwise not.

The most common and easiest way to make investment decision is to compare the investment or the cost of the project with the present value of the cash inflows to be generated by the project. Hypothetically assume that in above example, the present value of all the cash inflows for the five years is Rs.70,000.

Under this situation, the benefits in present value terms exceed the cost of undertaking the project which is Rs.50,000. More precisely, the net amount generated by the project is Rs.20,000, which is also known as Net Present Value (NPV). Thus a project is accepted when it has positive NPV, otherwise it is rejected.

Estimation of Cost and Benefits from the Project:

The first and the most important step of capital budgeting process is determination of cost and benefits associated with it so that a rational choice can be made about the acceptability of the capital project.

The cost and benefits of the project can be estimated on the basis of profit or cash flows.

We all know that in accounting ‘profit’ is the most important concept. A company is good in accounting terms if it is profitable. Extending the concept to a capital project we can say that a capital project is acceptable if it provides ‘profit.’ In general, Profit is the excess of revenue over cost. The amount of profit is calculated on the basis of accounting methods. It can be easily computed from the books of account maintained by the company and can also be estimated in advance.

However profit is not justified as a measure of benefits of the capital project due to the fact that it is a vague concept, it ignores timing of benefits, it ignores risk associated with benefits and it is highly dependent on the accounting policies being followed by the company.

These limitations are explained in detail below:

Limitations of ‘Accounting Profit’:

There are several reasons as to why Accounting Profit is not the appropriate measure of benefits from a capital project.

i. Profit is a Vague and Ambiguous Term:

Accounting profit is a vague or ambiguous term. There are various types of profits in accounting e.g. gross profit, net profit, profit before tax, profit after tax, operating profit etc. Therefore it is difficult to have a consensus on the term “profit”. Since it may mean different concepts to different people “accounting profit” may not be a good idea to evaluate a capital project’s benefits.

ii. Calculated on “Accrual Principle”:

The accounting profit is calculated on the principle of accrual concept. In accrual concept, revenues and expenditure are recognized at the time of incurring these amounts rather than when cash is received and paid. Thus it fails to reflect the true cash position of the company.

iii. Calculated by Considering Various Non-Cash Items:

The amount of profit is calculated after considering various non cash item such as depreciation. This might lead to a biased result. The total amount of capital expenditure is not charged to the profits in the same year. It understates the cash outflow of the company.

iv. Profit Depends Upon Accounting Policies of the Company:

Amount of profit will differ and can be manipulated by using different accounting methods or policies. This distortion in information is a limitation to correctly assess the wealth of the company and thereby the shareholders.

v. Inconsistent with the Objective of Shareholder’s Wealth Maximization:

The objective of financial management is NOT Profit maximization but Shareholder’s wealth maximization.

Hence using accounting profit to assess the benefits of a capital project goes against the primary objective of financial management.

We can state on the basis of above discussion that the profit does not show the true picture of financial position of the firm and hence should not be used as a measure of benefits of a capital project.

The relevant measure of estimating the cost and benefits of an investment proposal is to compute the cash flows. Cash is a precisely defined term and means same for everyone. The amount of cash flows is computed on the basis of all cash revenues and cash expenses ignoring all non-cash expenses.

An investment project involves cash flows at three points in time:

a. Initial Cash Outflow (Year 0 or Beginning of Year 1):

When a project is undertaken, the first cash outflow occurs which means investment in machine, equipment and other fixed assets. The amount which is paid to purchase fixed asset(s) or to start new project is the initial Cash Outflow. Once this investment is made, the project starts.

b. Subsequent Cash Flows [Year 1 to (N-1)]:

Once the project is started by making initial cash outflows, then the project is expected to generate some cash flows in subsequent years i.e. over the economic or useful life of the project or asset. These cash flows are primarily cash inflows.

In fact we can have two types of projects:

i. Conventional Projects:

In case of conventional projects initial cash outflow is followed by cash inflows only in subsequent years. For example if Project A requires initial investment of Rs.100000 and is expected to generate Rs.20000 p.a. as cash inflow over 15 years, then Project A is a conventional project.

ii. Non-Conventional Project:

In case of Non-conventional projects subsequent cash flow can be cash inflows as well as cash outflows. For example Project B requires investment in initial year as Rs.100000 and in fifth year Rs.50000 and another Rs.60000 at the end of 10th year. After initial investment it also provides cash inflows of Rs.20000 p.a. for next 15 years. Therefore project B is a non- conventional project because cash outflows occur not just in initial year but also in subsequent years.

c. Terminal Cash Flow (Year N i.e. the Last Year of the Project):

The final cash flow is termed as terminal cash flow which occurs at the end of the useful life of the project. The terminal cash flow generally involves the winding up of the project and realization of salvage value. Hence this cash flow will be slightly different from the cash flows of intermediate years.

Estimation of Cash Flows:

Various cash flows are estimated in the following manner:

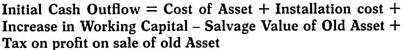

I. Calculation of Initial Cash Flows:

While calculating initial cash flows we consider three things:

i. Initial investment in fixed assets such as machine, equipment etc. This is the cost (or purchase price) of plant, machinery etc. It must be noted that the expenses in form of installation of the machine and transportation cost are also added to the cost of machine. The initial investment or cost of machine including related installation expenses are used for calculation of depreciation.

ii. Additional working capital, if any – It is also possible that the company now needs more cash; it is required to have more inventories etc. which can be clubbed together and termed as working capital. This additional requirement of funds for extra working capital is also an initial cash outflow. However no depreciation is charged on this amount.

iii. Salvage value of existing machine, if any – If we are replacing an existing or old machine then we may have some salvage value of that machine which can be realized by selling the old machine. Hence salvage value of the old machine is a cash inflow. This cash inflow arising due to sale of old machine will provide funds to the company and its cash outflow requirement will decline.

Further we can have profit or loss on the sale of existing machine which requires payment of tax or provides the benefit of tax savings as explained below:

a. Profit on Sale of Existing Asset / Machine:

The written down value or book value of the old machine is compared with the salvage value of the machine. When the salvage value is more than the book value or WDV, it will result in Short term capital gain (as per Income-tax Act, 1961, in case of depreciable assets). Now this gain will be taxed.

Hence payment of tax on the gain or profit of the sale of existing machine will be cash outflow. This cash outflow regarding tax on Short Term Capital Gain (STCG) will be subtracted from the cash inflow regarding salvage value to get Net Post Tax Salvage value of the existing machine.

b. Loss on Sale of Existing Asset / Machine:

On the other hand, if the salvage value is less than the book value or WDV, it will result in Short term capital loss (as per Income-tax Act, 1961, in case of depreciable assets). Now this loss will provide tax savings to the company. Hence the amount of tax saved will be cash inflow in the initial year. This cash inflow regarding tax savings on loss will be added to the cash inflow regarding salvage value.

This cost is compared with the benefits of the project which occur over a period of time. Therefore, once the amount of initial investment is known, the next step is to compute the subsequent annual cash flows associated with the project.

II. Calculation of Subsequent Annual Cash Inflows after Tax (CFATs):

The subsequent annual cash inflows after tax are calculated by subtracting the cash expenses from cash revenue of the company.

While calculating CFATs we follow the following principles:

i. Consider only Operating cash flows

ii. Consider only relevant cash flows

iii. Consider all Cash flows on Post Tax basis

iv. Consider only incremental cash flows

v. Consider opportunity cost but ignore all irrelevant costs such as sunk costs

vi. Cost savings and tax savings are considered as cash inflows

vii. Additional working capital requirement is cash outflow in the initial year (or year zero). In the last year of the project it is assumed that this working capital will be released and hence there will be cash inflow.

Treatment of Depreciation while Calculating Cash Flows:

Depreciation is a non-cash expense but tax deductible expense. Hence depreciation provides tax savings to the company which is same as cash inflow. Hence tax savings due to depreciation (which is termed as Depreciation Tax Shield) must be considered while calculating CFATs. The amount of depreciation tax shield is equal to the amount of depreciation (D) multiplied by the tax rate (T) i.e. (D *T).

However if we are given profit after depreciation and tax then we just need to add back depreciation amount to get CFAT.

This is explained below:

CFAT = Profit after Tax + Depreciation and other Non cash expenses

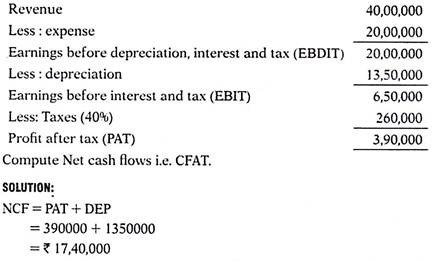

Example 1:

The following information is available with respect to the revenue and expenditure of X Ltd.:

Thus the amount of cash inflow generated in that particular year is Rs.17,40,000. It is assumed that sales is on cash basis and all expenses are paid in cash.

III. Computation of Terminal Cash Flows after Tax (CFAT):

Terminal year is the last year of the asset / project. Hence we calculate CFAT in terminal year just as discussed above. However since it is the last year of the project, we have at least three additional items i.e. salvage value of the asset which was purchased in the beginning of the project, tax or tax savings on the profit or loss on sale of the assets and release of working capital.

i. Depreciation:

Generally, we charge depreciation till last year of the asset’s life and then calculate capital gain (or loss) depending on the amount of salvage value.

However as per Income-tax Act, 1961, no depreciation is provided in terminal year if there is a single asset in the block of assets. Hence we MUST NOT DEDUCT depreciation in TERMINAL YEAR if there is a single asset and INCOME-TAX ACT, 1961 APPLIES.

ii. Salvage Value:

When the project is over at the end of its useful life then the asset is disposed of and the amount generated as salvage value is added to the cash flow amount.

Profit on sale of asset is computed as below:

a. When Depreciation is Charged Till Last Year:

In such a case, we compare salvage value with the WDV of the asset at the end of last year. If SV>WDV value at the end we have short term capital gain otherwise capital loss. Tax on this short term capital gain is computed by considering the given tax rate for Short term capital gain. If no such rate is given we can assume that this profit is taxed at normal tax rate. This amount of tax is then deducted while calculating CFAT.

Short term Capital Gain (Loss) on sale of depreciable asset in general = Salvage value – WDV at the end of last year

b. When Depreciation is not Charged in Last Year (as Per Income-Tax Act, 1961):

In such a case, we compare salvage value with the WDV of the asset in the beginning of last year. If SV>WDV value in the beginning of last year we have short term capital gain otherwise short term capital loss. Tax on this short term capital gain is computed by considering the given tax rate for Short term capital gain. If no such rate is given we can assume that this profit is taxed at normal tax rate. This amount of tax is then deducted while calculating CFAT.

Short term Capital Gain (Loss) on sale of depreciable asset as per Income-tax Act, 1961 = Salvage value – WDV value in the beginning of last year

c. Release of Working Capital:

If the project required additional working capital in the beginning then it is assumed that the same amount will be released at the end of the project’s life. Hence this amount is cash inflow in the last year. This amount is added to compute CFAT in the last year.

Hence, CFAT in the terminal year is calculated as below:

CFAT (Terminal Year) = CFAT as usual + Salvage Value -Tax on profit on sale of Asset + Release or recovery of working capital

Important Notes:

i. CFAT can be calculated in general (i.e. by considering depreciation in last year) or as per Income-tax Act (i.e. by not considering depreciation in last year).

ii. Please note that if there is ‘loss’ on sale of asset then tax savings are added in calculation of CFAT in terminal year.

iii. The amount of short term capital gain or loss on sale of asset is NOT added or subtracted, because it does not involve any cash inflow or outflow. It is ONLY the amount of salvage value which is added to last year’s cash inflows because salvage value provides cash inflow. Further tax paid on profit on sale of asset is deducted as it involves cash outflow while tax savings on loss on sale of the asset is deducted as it means cash inflow.

iv. It must be noted that as per Income-tax Act, 1961, depreciation is not provided on depreciable assets in the last year. Hence profit or loss on sale of depreciable asset is calculated by subtracting written down value in the beginning of last year from the salvage value of the asset.

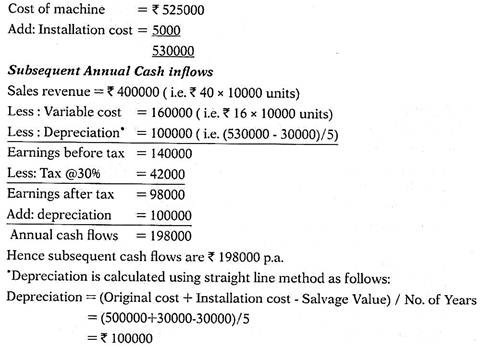

Example 2:

Find out the initial, subsequent annual and terminal cash flows from the following information:

Cost of machine = Rs.525000 Life = 5 years

Salvage value = Rs.30000, Tax rate =30%

Installation cost = Rs.5000, Sales price per unit = Rs.40

Expected Annual sales = 10000 units

Variable cost per unit = Rs.16

Depreciation is charged on straight line basis. Further assume that depreciation is provided till the last year and the rule of Income-tax Act does not apply.

Solution:

Initial Cash Outflow:

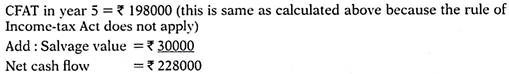

Terminal Cash Flows:

Hence in the last year cash inflow is Rs.228000. It must be noted that there is no profit or loss on sale of machine in the last year because book value and salvage value are same Rs.30000. Hence there is no tax effect in the last year due to sale of the machine.

Treatment of Special Items while Calculating CFAT or NCF:

There are some additional items which may arise in the course of the project.

These additional factors can be incorporated into the computation of cash flows associated with the investment proposals as discussed below:

1. Sunk Costs:

Sunk cost is the cost which is incurred in the past and cannot be changed now. It is the historical cost which has already taken place and any decision in future is not going to recover that cost. Sunk costs are not considered while calculating cash flows i.e. CFAT.

Suppose a firm conducts a market survey to assess the acceptability of a proposed product and incurs Rs.50000 as the cost of survey. Now whether the company decides to produce that product or not, Rs.50000 cannot be changed or recovered. Hence the cost of the market survey in this case is a Sunk Cost.

Treatment of sunk costs – Ignore, Do not consider while calculating cash flows.

2. Opportunity Costs:

It is the benefit which could have been derived from the next best alternative or option. Suppose a company has a building which can be either rented or used in the new project A. Thus building has alternate use that it can be given on rent. This amount of rent is the loss in revenue which results when we use the building for the new project A and this rent is foregone.

As this loss in revenue is the result of taking up the new project A, therefore it should be deducted from the revenues generated by the new project. Thus all opportunity costs should be the part of cash flow estimation analysis.

Treatment of Opportunity costs – Subtract all opportunity costs while calculating cash flows.

3. Allocated Overheads:

A business concern usually has some fixed costs which cannot be assigned to any specific business unit. These are the costs which will be incurred irrespective of the production process. When a new machine is purchased or a new project is undertaken, these should be ignored and not be the part of cash flow analysis. For example- suppose the allocated overheads are of Rs.45,000 and company has nine projects. This cost is allocated to these projects equally and each project is charged Rs.5000.

Suppose now firm takes up a new project and the number of projects increases to ten. Further it is stated that the amount of Rs.4500 (45,000/10) would be charged to each project. That is the new project is allocated an overhead cost of Rs.4500.

Now the question is whether this amount of Rs.4500 should be taken into consideration while computing cash flows of new project? These allocated overheads would be incurred whether we take up new project or not. Hence, it should not be taken into consideration while estimating the cash flows of the new project.

However, if due to new project, the amount of overheads increases to Rs.55,000 from the current level of Rs.45000 then under this situation, this additional amount of Rs.10,000 (55,000-45,000) needs to be subtracted while calculating cash flows from the project.

Treatment of Allocated overhead – Do not consider while calculating Cash flows. But consider if there is any increase in overhead expenses due to new project. In that case deduct only the Incremental Overheads.

4. Marketing Survey:

The cost of marketing survey is just like a Sunk Cost. When a firm undertakes a market survey before launching a new product, it involves time and cost. At the time of assessing the cash flows of the new project, this marketing survey expense should not be the part of cash flow analysis.

This expense is incurred in the past and cannot be changed whether we take up the new project or not.

Treatment of Marketing survey cost – Do not consider.

5. Financing Aspect of Investment Decisions i.e. Interest or Dividends:

When we calculate Net cash flow or Cash Flow After Tax (CFAT) we consider only operating cash flows. Financial cash flows or cash flows from financing decision are not considered. Interest and dividends are financial cash flows and hence are to be ignored or not considered while calculating Cash flows from a project. Interest cost if any is included in the cost of capital which is used as the appropriate discount rate for calculating present value of cash flows.

Treatment of Interest or Dividends – Do not Consider i.e. do not deduct while calculating cash flows.

Example 3:

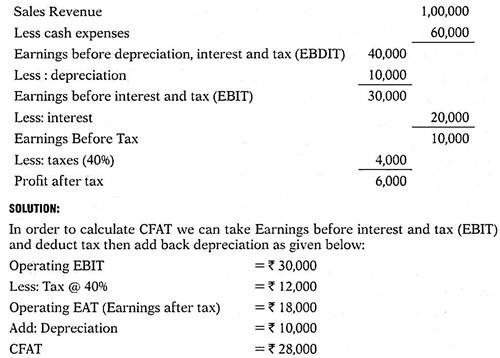

From the following information calculate CFAT (Cash flow after tax):

It must be noted that while calculating cash flows we consider only operating cash flows. Interest expense is a financial cost or cash flow from financing decision and hence must not be considered while calculating CFAT.

Process of Capital Budgeting: 6 Broad Phases and Steps

The process of Capital Budgeting may be divided into six broad phases/steps, viz., planning or idea generation, evaluation or analysis, selection, financing, execution or implementation and review.

Step – 1. Idea Generation:

The search for promising project ideas is the first step in the capital budgeting process. In other words, the planning phase of a firm’s capital budgeting process is concerned with articulation of its broad investment strategy and the generation and preliminary search of project proposals. Identifying a new worthwhile project is a complex problem. It involves a careful study from many different angles.

Ideas can be generated from the sources like, performance analysis of existing industries, examination of input and output of various industries, review of import and export data, study of the suggestions of financial institutions and developmental agencies, plans outlays and government guidelines availability, local materials and resources, new technological developments, analysis of economic and social trends, draw clues from consumption abroad, explore the possibility of reviving sick units, identity unfulfilled psychological needs, attending trade fairs, stimulate creativity for generating new product ideas among employees.

Step – 2. Evaluation or Analysis:

In the preliminary screening when a project proposal suggests that the project is prima facie worthwhile, then it is required to go for evaluation. Analysis has to done from the aspects like, marketing, technical, financial, economic and ecological analysis.

This phase focuses on gathering data, preparing, summarising relevant information about various alternatives projects available, which are being considered for inclusion in the capital budgeting process. Costs and benefits are determined based on the information gathered from all alternative projects.

Step – 3. Selection:

Selection or rejection of a project follows analysis phase. Projects are evaluated by using a wide range of evaluation techniques, which are divided into traditional (non-discounted) and modern (discounted). Selection or rejection of a project depends on the techniques used to evaluate and its acceptance rule.

The acceptance rules are different for each and every method. Apart from the use of techniques of evaluation there are few techniques available for measurement (range, standard deviation, coefficient of variation) and incorporation of risk (risk-adjusted discount rate, certainty equivalent, probability distribution approach and decision tree approach) in capital budgeting.

Step – 4. Financing the Selected Project:

After the selection of the project, the next step is financing. Generally, the amount required is known after selection of the project. Under this phase financing arrangements have to be made. There are two broad sources available such as equity (shareholders’ funds – paid-up share capital, share premium, and retained earnings) and debt (loan funds – term loans, debentures, and working capital advances).

While deciding the capital structure, the decision- maker has to keep in mind some factors, which influence capital structure. The factors are Flexibility, Risk, Income, Control, and Tax benefits (referred to by the acronym FRICT). Capital should consist of debt and equity.

Step – 5. Execution or Implementation:

Planning is paper work and implementation is physically implementing the selected project. Implementation of an industrial project involves the stages like, engineering designs, negotiations and contracting, construction, training, and plant commissioning.

Translating an investment proposal from paper work to concrete work is complex, time consuming and a risky task. Adequate formulation of the project, use of the principle of responsibility accounting and use of network techniques (PERT and CPM), are very much helpful for implementation of a project at a reasonable cost.

Step – 6. Review of the Project:

Once the project is converted from paper work into concrete work, then there is a need to review the project. Performance review should be done periodically, in which phase the actual performance is compared with the predetermined performance.

Capital budgeting is a process by which companies assess how to fund operations and new ventures through movement and management of assets. This involves a series of actions or steps taken to achieve best possible returns.

The capital budgeting process consists of five distinct but interrelated steps:

1. Determine Investment Proposals:

The primary step in capital budgeting is to compile investment proposals that may originate at different levels within a firm. The proposal may arise from top management or even from operating level management. For example sales executives from operating level may propose to the management to provide then with laptops that would help in doing their job efficiently, Production department may send a proposal for up gradation of plant and machinery. These proposals for new investment projects are made at all levels within a business organization and are reviewed by finance department.

2. Screening Investment Proposals:

Once the proposal are received from all level organisation, the finance department examine or screens with the possibility or intention of instituting the proposal if necessary. The various proposals received are critically reviewed in terms of cost of capital, expected returns from alternative investment opportunities and the assets’ life using different capital budgeting techniques. Proposals that require large investment are more carefully scrutinized than less costly ones.

3. Assessment of Investment Proposals:

Once investment proposal which passes through the preliminary screening stage they are now assessed in financially terms to determine if they maximize the profits of the firm in long term.

The following are the key considerations on which an investment proposal is assessed:

i. The benefit impact of an investment decision in the long run.

ii. The cost impact of an investment decision over time.

iii. The risk factors associated with an investment, both immediately and in the future.

Using criterion the finance department assess these parameters and reserves it decision based on firm’s objective of maximizing its market value.

4. Prioritizing Investment Proposals:

After thorough assessment of investment proposal on various parameters, the finance department in this step prioritizes investment proposals by ranking them. The rank is based on profit or economic consideration, investment proposal with less risk and more returns with long term benefits are given high priority for acceptance.

Sometime the proposals are also ranked on the basis of financial condition of the company, if proposal are very expensive it may not be suitable for the concern’s financial condition in situation like this proposals are rejected.

5. Decision Making:

The next in step in capital budgeting process is taking a final call on acceptance or rejection of investment proposal. The decision should be rational and based certain techniques, such as payback period (PBP), accounting rate of return (ARR), net present value (NPV), and internal rate of return (IRR). All these methods have some criteria that helps to create a set of decision rules that can categorize which projects are acceptable and which projects are unacceptable.

6. Implementation:

Following the decision, expenditures are made and projects implemented. Expenditures for a large project often occur in phases depending up nature of proposal. For example if the investment proposal is to set a manufacturing facility then the following process is involved (a) project and engineering designs, (b) negations and contracting, (c) construction. One of the important factor that need to be carefully evaluated in implementation phase is management of funds, funds for the purpose of project execution should be spent in accordance with appropriations made in the capital budget.

7. Review:

The final phase of capital budgeting is comparing actual results with the standard results. If any deviation is found corrective measures are taken into consideration.

Process of Capital Budgeting

The capital budgeting process involves the selection of those new investment proposals presented to a firm that will contribute most to the wealth maximization of the shareholders. To continue to be successful a firm may have to engage in a continual search for new investment proposals to add to its profit stream.

The product life cycle for a firm’s output consists of three phases. The first phase is called the experimentation stage, in which the production processes and other aspects of the product are refined and the product is introduced to the market. During the second stage, sales increase rapidly. They continue to grow until the third phase, the maturity stage, is reached, after which they start to decline.

If a firm is not looking for new products to supplement and eventually replace the income stream provided by present products, in time it will cease to exist. This is why the proper selection of new investment proposals is so important.

The selection of long-term investment are to be as important a strategy the firm as the selection of the proper liquidity balance and the proper funding mix. The selection of new investment proposals will have an impact on the firm’s profitability and the level of operating assets as well as the funding mix.

The new investments will not only influence the firm’s rate of return but will also have trade-off implications for risk. Financial management’s selection process provides a package of investment selections. Top management then evaluates the impact of the financial package on the goal structure of the firm.

If it meets the goal structure the package is initiated; if it does not, the basic underlying assumptions of the investment alternatives must be re-examined, and the whole loop starts again.

The capital budgeting process involves four different types of investment alternatives:

1. The firm can replace existing assets and thus reduce the cost structure of the firm.

2. The firm can provide new products or services that have been developed through its research and development efforts.

3. The firm can add new product or service lines by acquiring other firms.

4. The firm can evaluate other uses for funds, such as investing in the securities markets.

In any evaluation process, the first job is to evaluate the cost- benefit structure of a proposal. Revenue and expense forecasts must be made to determine the net revenue structure of the proposal. In addition, the proposal may necessitate enlargement of the asset base of the firm to support a new sales level.

In many instances, this will entail new asset investments. When this information is developed into a cash budget, the net cash flow structure of the project has been determined.

As important as development of the net cash flow data for a project is selection of the technique to be used to compare one project to another in terms of their ability to maximize the wealth of shareholders.

Once the net cash flows have been determined and the ranking method has been chosen, the ranking technique can be used to develop a measure of return and risk for each project. Under conditions of certainty, there is no measure of risk since all future net cash flows generated from a prospective investment are assumed to be known with certainty.

However, when future net cash flows are not known with 100 per cent certainty, the concepts of probability and utility theory can be used to assist management in outlining the trade-offs between the rate of return and the measure of risk for each proposal.

The risk structure that is apparent in any selection process basically revolves around what is termed business risk. When future cash flows are not known with certainty an error can arise in the selection of future sales or future costs associated with a project.

Management next must evaluate the risk-return trade-offs of the various investment proposals. Relevant inputs into the capital budgeting system will be the amount of rupees available to invest and the selection of an investment cutoff point.

The selection of an investment cutoff point is quite important, since the capital budgeting process does not always tell an analyst which projects to accept or reject. Rather, it presents the analyzed investments in an array of profitability as measured by the rate of return.

After all the elements of the capital budgeting system have been analyzed, a selection of investments is made and presented as the firm’s financial package. This subsystem then enters the main framework of financial management, leading to the part where the whole package is evaluated in terms of the goal structure of the firm.