The below mentioned article provides a format of cash flow statement.

Data Required in the Preparation of a Cash Flow Statement:

The following basic informations are required for the preparation of a cash flow statement:

a. Balance Sheets:

Balance sheets at the beginning and at the end of the accounting period indicate the changes that have taken place in assets, liabilities and capital.

ADVERTISEMENTS:

b. Profit & Loss Account:

The profit and loss account of the current period enables to determine the amount of cash provided by or used in operations during the accounting period after making adjustments from noncash, current assets and current liabilities.

c. Additional Data:

In addition to the above statements, additional data are collected to determine how cash has been provided or used e.g. sale or purchase of assets for cash.

Procedure in the Preparation of Cash Flow Statement:

ADVERTISEMENTS:

The procedure used for the preparation of a cash flow statement is as follows:

I. Net Increase or Decrease in Cash and Cash Equivalents Accounts:

The difference between cash and cash equivalents for the period may be computed by comparing these accounts given in the comparative balance sheets. The results will be cash receipts and payments during the period responsible for the increase or decrease in cash and cash equivalent items.

II. Calculation of the Net Cash Provided or Used by Operating Activities:

ADVERTISEMENTS:

It is by the analysis of profit and loss account, comparative balance sheet and selected additional information.

III. Calculation of the Net Cash Provided or Used by Investing and Financing Activities:

All other changes in the Balance sheet items must be analyzed taking into account the additional information and effect on cash may be grouped under the investing and financing activities.

IV. Preparation of a Cash Flow Statement:

ADVERTISEMENTS:

It may be prepared by classifying all cash inflows and outflows in terms of operating, investing and financing activities. The net cash flow provided or used in each of these three activities may be highlighted.

V. Ensure that the aggregate of net cash flows from operating, investing and financing activities is equal to net increase or decrease in cash and cash equivalents.

VI. Report any significant investing, financing transactions that did not involve cash or cash equivalents in a separate schedule to the cash flow statement.

Reporting of Cash Flows from Operating Activities:

ADVERTISEMENTS:

The purpose for determining the net cash from operating activities is to understand why net profit/loss as reported in the profit and loss account must be converted. The financial statements are generally prepared on accrual basis of accounting under which the net income will not indicate the net cash provided by or net loss will not indicate the net cash used in operating activities.

In order to calculate the net cash flows in operating activities, it is necessary to replace revenues and expenses with actual receipts and payments in cash. This is done by eliminating the noncash revenues and/noncash expenses from the given earned revenues and incurred expenses.

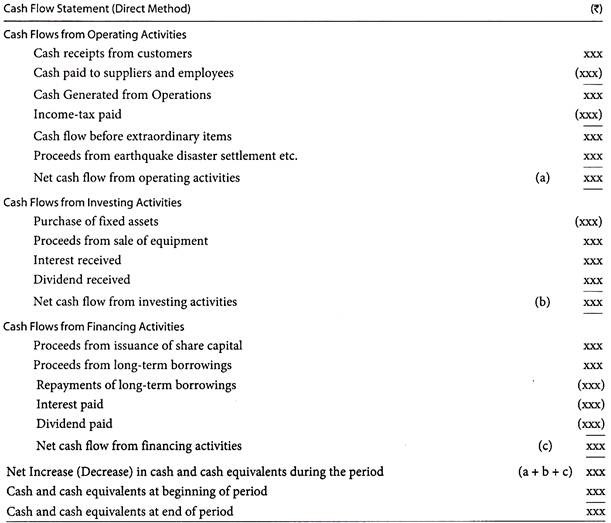

Direct Method:

Under direct method, cash receipts from operating revenues and cash payments for operating expenses are arranged and presented in the cash flow statement. The difference between cash receipts and cash payments is the net cash flow from operating activities. It is in effect a cash basis Profit and Loss account. In this case, each cash transaction is analyzed separately and the total cash receipts and payments for the period is determined.

ADVERTISEMENTS:

The summarized data for revenue and expenses can be obtained from the financial statements and additional information. We may convert accrual basis of revenue and expenses to equivalent cash receipts and payments. Make sure that a uniform procedure is adopted for converting accrual base items to cash base items.

Under direct method, items like depreciation, amortisation of intangible assets, preliminary expenses, debenture discount, etc. are ignored from cash flow statement since the direct method includes only cash transactions and noncash items are omitted. Likewise, no adjustment is made for loss or gain on the sale of fixed assets and investments.

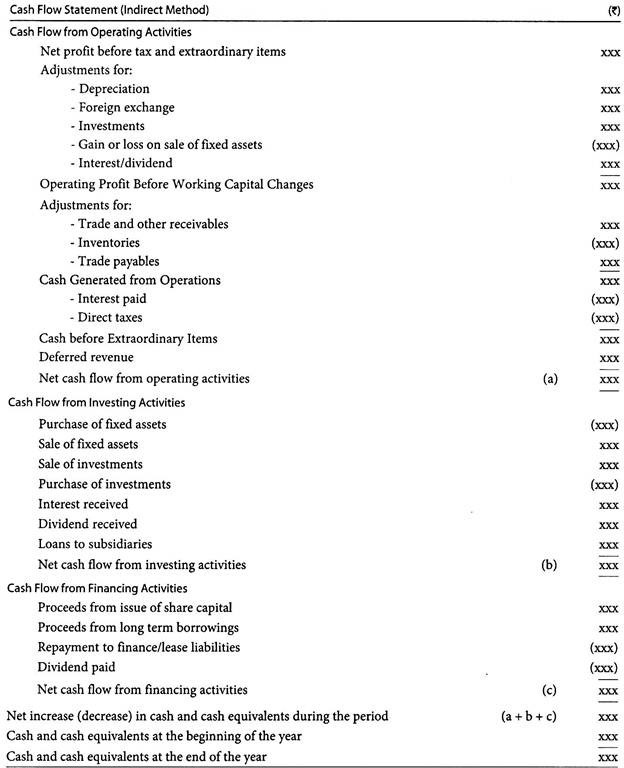

Indirect Method:

ADVERTISEMENTS:

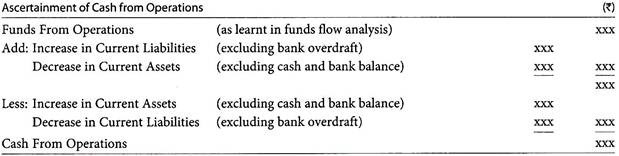

In this method the net profit (loss) is used as the base and convert it to net cash provided or used in operating activities. The indirect method adjusts net profit for items that affected net profit but did not affect cash. Noncash and non-operating charges in the profit and loss account are added back to the net profit while noncash and non-operating credits are deducted to calculate operating profit before working capital changes.

It is a partial conversion of accrual basis profit to cash basis profit. Necessary adjustments are made for increase or decrease in current assets and current liabilities to obtain net cash from operating activities.