This article provides a study note on Cash Flow for Investment Analysis:- 1. Conventional and Non-Conventional Cash Flows 2. Incremental Cash Flows 3. Determination.

Conventional and Non-Conventional Cash Flows:

When an initial cash outlay (outflow) is followed by a series of cash inflows of uniform or unequal amounts, it is called conventional cash flows. Most of the capital investment decisions follow this pattern. For example, a firm may invest Rs. 2,00,000 initially in a project at time zero and may expect to receive an annual cash inflow of Rs. 40,000 at the end of each year for 8 years.

The other example of conventional cash flows could be where a firm may invest say Rs. 5,00,000 initially and as a result may expect to receive cash flows of Rs. 1,00,000 at the end of first year, Rs. 1,50,000 at the end of second year, Rs. 2,00,000 at the end of third year, Rs. 1,00,000 at the end of fourth year and Rs. 80,000 at the end of fifth year.

Non-conventional cash flows on the other hand, refer to the cash flow pattern where not one but a series of cash outflows are followed by a series of cash inflows of equal or unequal amounts.

For example, a project may require an investment of Rs. 1,50,000 in the beginning of first year and another Rs. 30,000 at the beginning of second year followed by cash inflows of Rs. 30,000, Rs. 40,000, Rs. 70,000, Rs. 80,000 and Rs. 40,000 at the end of each of the first five years respectively.

Another simple example of non-conventional cash flows may be where a firm may purchase a machine for Rs. 1,00,000 initially at time zero and may expect to receive annual cash inflows of Rs. 25,000 each year for 5 years and then another cash outflow of Rs. 30,000 may be required for overhauling of the machine in the sixth year to generate further cash inflows of Rs. 20, 000 each year for next 5 years.

Incremental Cash Flows:

All investment decisions involve comparison of alternative proposals. In case of a single proposal, the comparison will be between investing in the project and not-investing in the project. However, in case of two or more proposals, the comparison will be between investing in one project or the other.

Single project proposals are evaluated on the basis of ‘absolute cash flows’, whereas, competing project proposals are evaluated on the basis of ‘relative or incremental cash flows.’ The term ‘incremental cash flows’ refers to the differential cash flows between the two proposals.

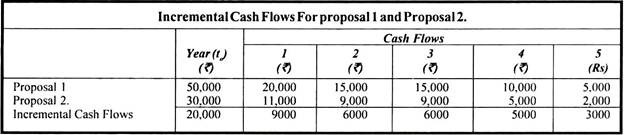

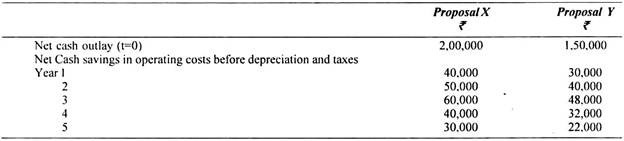

The following table illustrates the concept of incremental cash flows:

Determination of Cash Flows:

Illustration 1:

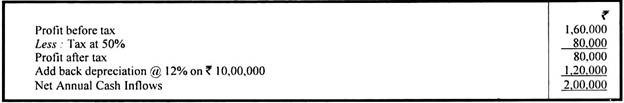

A project costs Rs. 10,00,000 and yields annually a profit of Rs. 1,60,000 after depreciation @ 12% p.a. but before tax of 50%. Calculate Net Cash Inflows of the project.

Solution:

Illustration 2:

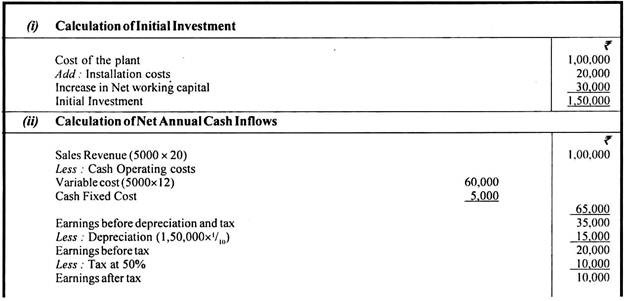

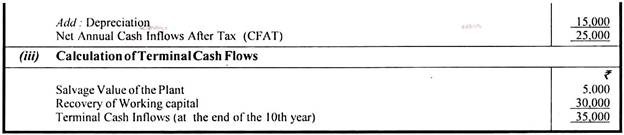

XYZ Ltd. is considering the introduction of a new product. The firm estimates that it can sell annually 5000 units of this product at Rs. 20 per unit. The cash variable expenses to manufacture and sell the product are estimated at Rs. 12 per unit. It will also involve cash fixed cost of Rs. 5,000 per annum.

The plant to manufacture the product is available for Rs. 1,00,000. Further, Rs. 20,000 will be needed for installation of the machine. The salvage value of the plant after its life of 10 years is estimated to be Rs. 5000. A working Capital investment of Rs. 30,000 would be required in the year of installing the plant.

The firm uses the straight line method (SLM) of depreciation on original cost of the asset ignoring salvage value of fixed assets.

Assuming the same depreciation as allowable under income-tax and 50% tax rate for this firm, you are required to calculate:

(i) Initial investment.

(ii) Annual Net Cash Flows, and

(iii) Terminal Cash Flows.

Solution:

Illustration 3:

A company has two mutually exclusive proposals competing with one another under consideration and provides you the following information.

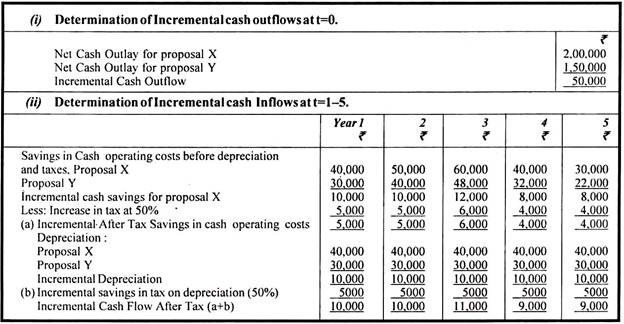

You are required to determine the incremental cash flows after tax assuming straight line method of depreciation, no salvage value and the firm’s tax rate at 50%.

Solution:

Illustration 4:

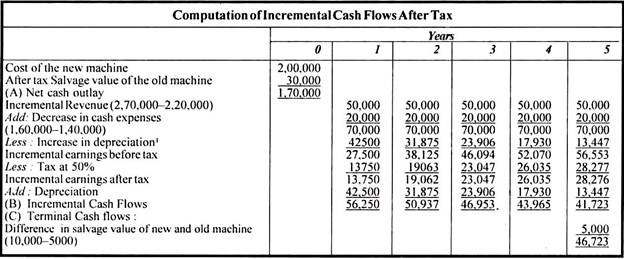

Himalya Ltd. is considering replacement of its existing machine by a new machine which is expected to cost Rs. 2,00,000. The new machine will have an economic life of 5 years and is expected to yield annual cash revenues of Rs. 2,70,000 and incur annual cash expenses of Rs. 1,40,000. The estimated salvage value of the new machine at the end of its economic life is Rs. 10,000.

The existing machine has a book value of Rs. 60,000 and can be sold for Rs. 30,000 today. It can also be used for another 5 years but is expected to generate annual cash revenues of Rs. 2,20,000 and involve cash expenses of Rs. 1,60,000 annually. The salvage value of the existing machine after 5 years is estimated at Rs. 5000.

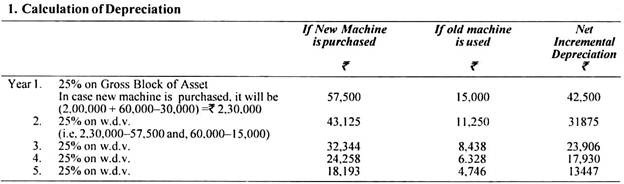

The company is in 50% tax bracket and can write off depreciation at 25% on gross block of the asset on diminishing balance method. You are required to compute incremental cash flows after tax.

Solution:

Working Notes:

1. Calculation of Depreciation