This article throws light upon the top three types of cash flows for investment analysis. The types are: 1. Initial Investment 2. Operating Cash Flows 3. Terminal Cash Flows.

Cash Flow: Type # 1. Initial Investment:

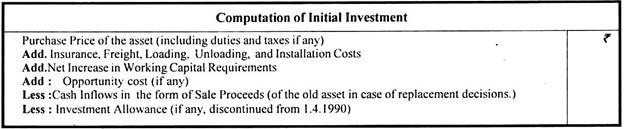

The initial investment is an outlay of cash that takes place in the initial period, t=0, when an asset is purchased. It comprises, primarily, of cost of the new asset to purchase land, building, machinery, etc. including expenses on insurance, freight, loading and unloading, installation cost and expenses on modification and repairs, etc. before the asset is put to use.

In addition to the cost of the asset, new investment in capital assets may also require increased investment in working capital, i.e. the excess of current assets over current liabilities. Thus, the net working capital increases are also added to the cost of the asset.

Further, if the new investment makes use of some existing facilities, the opportunity cost of the same should also be added to arrive at the amount of initial investment.

For example, if a firm proposes to invest in a machine to be installed at some surplus land of the firm, the firm should find out the opportunity cost of selling the land and add the game while calculating the initial investment.

In the same manner, in case of replacement decisions, the existing asset may be sold if the new asset is purchased. The sale proceeds of the discarded asset should, therefore, be deducted while determining the amount of initial investment.

Until recently a deduction (tax credit) under Income Tax Act equal to 25 percent of the cost of the asset was allowed as Investment Allowance in the period in which the asset was installed for production. Thus, it provided a benefit in the shape of tax shield to the firm and reduced the actual cost of the asset. However, the investment allowance has now, been discontinued from 1st April, 1990.

The computation of cash outflows, comprising the initial investment has been shown in the following table:

Cash Flow: Type # 2. Operating Cash Flows:

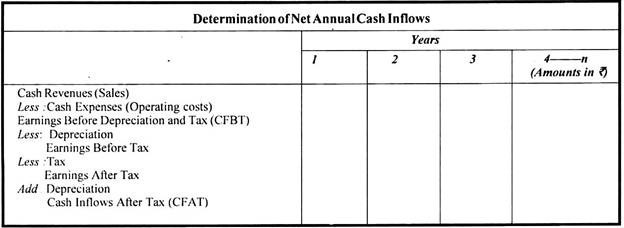

Every investment in capital assets is expected to generate future benefits in the form of net annual cash flows from operations. These annual cash inflows should be estimated on an after-tax basis. In simple words net annual cash flows refer to the annual net earnings (profits) before depreciation and after taxes.

Depreciation being a non-cash charge, is added back to the earnings before tax, but tax, being a cash expense, has to be deducted to determine the net annual cash flows.

The net annual cash flows can be determined as below:

NCF = Cash Revenues – Cash Expenses -Tax or, NCF = Net Earnings after Tax + Depreciation -Tax

The following table will be useful in determining net annual cash inflows:

Cash Flow: Type # 3. Terminal Cash Flows:

At the end of the economic life of a capital asset i.e. the last year when the asset is terminated, there is usually, some value in the asset left. The asset may be sold at that point of time as scrap or it may fetch some salvage value. This inflow to a firm in the last (terminal) year is called terminal cash flow.

Similarly, in the case of a replacement decision where an old existing asset is replaced with a new asset, the reduction in cost of the new asset, i.e. the sales value of the old asset, is the terminal cash flow of the asset replaced.

In addition to the salvage value of the asset, the firm may also recover the increased net working capital that was tied up in the initial year. Thus, this release of working capital should also be added to the salvage value of the asset to determine the terminal cash flows.