The following points highlight the four main products of currency derivatives. The products are: 1. Forward Contract 2. Futures Contract 3. Options Contract 4. Swaps.

1. Forward Contract:

Forward contracts are used by companies and individuals to hedge currency risk. In December 2003, the RBI permitted resident individuals to enter into forward contracts to hedge their foreign exchange risk. Resident Indians with foreign currency deposits face the risk that the rupee will appreciate against the foreign currency in which the deposit is denominated. ICICI bank was the first to offer such forward contracts to depositors, based on demand. Variants of the forward contract are the non-deliverable forward contract (NDF) and the option dated forward.

A non-deliverable forward (NDF) is a forward contract in which both parties decide on the forward rate, the currency pair, and the date of settlement. The NDF market evolved in countries in which there were currency controls. There are NDF markets for currencies of several Asian countries (Indonesia, Philippines, Korea and Taiwan), Eastern European countries and Latin American countries. Not all countries with capital controls have NDFs. There is no NDF market for the Malaysian ringgit or the Thai baht. Trading occurs in an offshore financial centre. Therefore, the NDF market escapes the regulatory control of the country whose currency is being traded.

The main features of an NDF are:

(i) The contract is for a notional amount and there is no delivery of currencies on the maturity date.

(ii) The contract is cash settled on the maturity date.

(iii) The fixing date is a day that is two business days before the settlement date.

(iv) The forward rate is compared to the spot rate for the currency pair on the fixing date. The difference between the spot price and the forward rate is multiplied by the notional amount.

(v) This amount is paid by one party to the other (usually in the US dollar) on the maturity date.

(vi) Two-way quotes are available from one week up to one year.

(vii) The AD imposes a penalty if the contract is cancelled by the other party.

(viii) A forward contract is different from a forward rate agreement (FRA). An FRA is entered into by two parties who want to protect themselves against future interest rate movements. The parties decide on a principal (say US $1 million) on which the interest rate should be calculated. This is called the notional principal. Suppose current interest rates are 9% p.a. The buyer of an FRA believes that interest rates will rise to 12%. So he agrees to pay a 10% interest rate on the notional principal. The seller of an FRA believes that interest rates are likely to fall to 8%, so he agrees to receive a 10% interest rate on the notional principal.

In an option dated forward contract, both parties decide to exchange a currency pair at a pre-determined price, but between two pre-determined dates. The contract makes allowances for shipment delays, or uncertainty in delivery. It is ideally suited to a corporate customer who has a foreign currency receivable or payable but is not clear on the exact date on which the receipt (or payment) is due.

2. Futures Contract:

Currency futures contracts on four currency pairs are available on the USE, NSE and MCX. Trading requires the opening of a currency futures account with a member of the concerned exchange. The NSE pioneered currency futures trading in August 2008. Its currency derivatives trading system, NEAT–CDS (National Exchange for Automated Trading-Currency Derivatives Segment) provides fully automated screen-based trading. The USE is India’s youngest exchange. It commenced trading in September 2010, and is India’s only dedicated currency derivatives exchange. The MCX is a commodities exchange that began offering currency derivatives in 2008.

The important features of currency futures trading in India are:

i. Currency futures are traded online and prices are displayed on real-time basis.

ii. Four currency pairs are traded on the NSE, USE, and the MCX—USD/INR, Euro/INR, Japanese Yen/INR and Pound sterling/INR.

iii. The method of quotation refers to the number of units of foreign currency in the currency pair. For the $/INR, €/INR and £/INR, the method of quotation is the exchange rate in Indian rupees for one unit of the foreign currency. But the method of quotation for the ¥/INR is Indian rupees for 100 ¥.

iv. The trading symbols on the NSE are – USD/INR, EUR/INR, GBP/INR and JPY/INR.

v. The NSE levies an extreme loss margin at 1% of the MTM value of an open position.

vi. Futures contracts are available for up to 12 months, in multiples of one month. A new contract is introduced each month.

vii. A contract with a maturity of 1 month is called a near-month contract and a contract with maturity of 11 months or 12 months is called a far-month contract.

viii. Contract size is the number of units of foreign currency in one futures contract. The contract size for the $/INR, €/INR and £/INR is 1,000 units of the foreign currency in the currency pair—for example, one contract of $/INR is for $1,000. But the contract size for the ¥/ INR is 100,000 units of the yen— so one unit of ¥/INR refers to yen 100,000.

ix. The settlement rate is the RBI reference rate two days prior to the settlement date. Contracts can be settled in two ways – (i) Contracts open at expiry are cash settled in Indian rupees, on the last working day (excluding Saturdays) of the expiry month. The final settlement price is the RBI reference rate on the last trading day of the futures contract, (ii) MTM settlement occurs at the end of each day. The daily settlement price on a trading day is the closing price of the futures contracts on that day.

x. Trading is online. The ICCL clears trades on the USE and the NSSCL clears trades on the NSE.

3. Options Contract:

The RBI granted permission to the NSE and USE for exchange-traded currency options on October 28, 2010. Residents of India were permitted to participate in this market, subject to RBI’s Exchange Traded Currency Options (Reserve Bank) Directions of July 2010. The currency options market is regulated by SEBI and RBI.

The RBI permitted banks to undertake exchange-based trading of currency options, subject to certain conditions:

(i) The bank should have a minimum net worth of Rs. 500 crores.

(ii) The bank has a minimum capital adequacy ratio of 10%.

(iii) The bank’s non-performing assets do not exceed 3%.

(iv) The bank should have earned profits in the preceding three financial years.

It also permitted banks to trade in currency futures. Banks in India can now undertake client-based trades, as well as proprietary trades in exchange-traded currency options. Banks could also undertake clearing of currency options and apply to the concerned stock exchange, to become trading members and clearing members.

Types of Options:

Specific combinations of options are known by different names. For example, in a 3-month call option, both parties may agree that the buyer has the right to exercise the option on the 1st and the 15th of each month of the 3 months. This is called a Bermuda option. It is a combination of a European and an American option. Similarly, a look back option gives the buyer the right to buy (or sell) at the lowest (or highest) spot price from inception of the contract to the date of maturity.

Other combinations are:

(i) The purchase of a call option, and the simultaneous sale of a call option, each with different strike prices but with the same maturity date, is called a bull spread.

(ii) The simultaneous purchase of an out of the money call option and an out of the money put option is called a collar.

(iii) The purchase of a put option and the simultaneous sale of a call option at different strike prices are called a cylinder.

(iv) The sale of two at the money call options and the simultaneous purchase of one in the money call option is called a butterfly. It can also be the purchase of two at the money call options, and the simultaneous sale of one in the money call option.

(v) The purchase of a call and a put with the same strike price and the same expiry date is called a long straddle.

(vi) The sale of a call and a put with the same strike price and the same expiry date is called a short straddle.

(vii) The purchase of a call option and a put option with strike prices that are equally out of the money, is called a long strangle.

(viii) The sale of a call option and a put options with strike prices that are equally out of the money is called a short strangle.

(ix) The purchase of foreign currency and the purchase of a put option on the currency, is called a protective put.

A break forward is a combination of a forward and an option. It is a forward contract on currencies that is attached to an option contract to do the opposite for the same currencies, at a different exchange rate. For example, a forward contract to buy US dollars and sell British Pounds at a specified forward rate (say $1.17/£), is attached to an option to sell US dollars and buy British Pounds at another rate ($ 1.19/£).

A kick in forward is an option which automatically becomes a forward contract when the spot rate reaches a particular pre-determined rate. Suppose the pre-determined rate is Rs. 39.55/$.The exercise price on a three-month call option entered into on 10th June, with a maturity date of 10th September, is Rs. 39.50/$. If the INR/USD spot rate reaches Rs. 39.55/ USD on 20 July, the contract becomes a forward contract.

An interest rate guarantee (IRG) is an option on a forward rate agreement (FRA). Since the buyer of an FRA expects interest rates to rise, he can enter into an IRG instead of directly entering into an FRA. He decides to buy the right to enter into an FRA 3 months later at a pre-determined interest rate for a pre-determined period (say 2 years). This is called a buyer’s IRG. Similarly the seller who believes that interest rates are likely to fall can enter into an IRG to sell an FRA in future. This is called a seller’s IRG. Note that in an IRG, the buyer (seller) does not have the obligation to enter into an FRA at the preset date in future.

Options Specifications on the United Stock Exchange (USE):

In the money, at the money and out of the money European call and put options on USD/ INR began trading at the end of October 2010.

i. The US dollar-Indian rupee spot rate is the ‘underlying’. The lot size is 1 contract. Each contract is for $1,000. The outstanding position is in USD.

ii. The option premium is in rupee terms and must be paid by the buyer to the exchange in cash, which in turn hands over the premium to the seller.

iii. Spot months are March, June, September and December. Each contract is traded up to two working days prior to the last business day of the expiry month at 12 noon. The exchange adopted the same holidays as those declared by FEDAI.

iv. The minimum tick size is Rs. 0.25.

v. The exchange levies an initial margin and an extreme loss margin. Both margins are deducted by the exchange online.

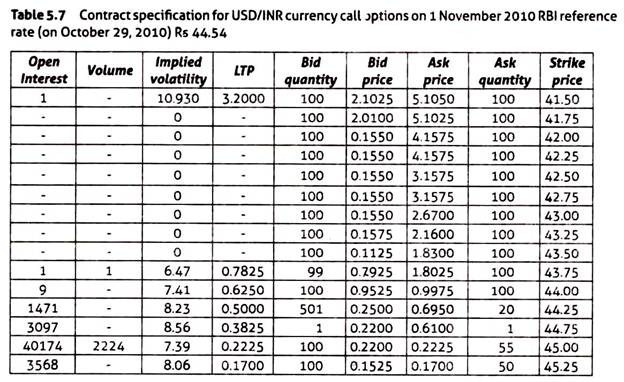

vi. Contracts are settled in cash in Indian rupees, on the last working day of the expiry month. On that date, all open ‘in the money’ contracts are assumed to have been exercised at the final settlement price. Table 5.7 shows the contract specifications for currency call options as per the RBI reference rate of October 29, 2010.

Reading Options Information:

At any point of time, a currency derivatives exchange publishes data on a number of call options contracts and put option contracts outstanding. Each options contract is identified by the spot month (the month of maturity). Thus, a June call options contract is one that matures in June. In May, the June contract is called the near month contract, and the August call options contract is called the far month contract. For each options contract (whether call or put), the data will specify the strike price and the option premium.

For each of the three spot months (June, July and August) there can be several call option contracts and three put option contracts with different strike prices, and different premiums:

1. An options contract in different spot months can have the same strike price.

2. For a given strike price, the option premium will increase as the spot month is farther into the future. Therefore, the option premium for a call options contract with a strike price of $1.06 can be $0.04 for spot June, $0.05 for spot July, and $0.06 for spot August. This is because the option premium is composed of two elements—the intrinsic value and the time value. The time value is higher for longer maturity contracts. As the maturity increases (whether for a call or a put option contract) the time value rises.

3. For a given spot month, the option premium decreases for a call options contract.

4. For a given spot month, the option premium increases for a put options contract.

Option Greeks:

Option Greeks (delta, gamma, theta, vega and rho) are symbols whose values are calculated for individual options, and a portfolio of options, using the currency pair’s spot price and the option premium. Theta is calculated for a portfolio of currency options, and vega is calculated for a portfolio of currency derivatives. Delta is the rate of change in the option price with respect to the spot price of the underlying currency pair.

Gamma is the rate of change in delta with respect to the spot price of the underlying currency pair. In a portfolio of currency options, theta is the rate of change of the portfolio’s value overtime. In a portfolio of derivatives, vega is the rate of change of the portfolio’s value with respect to the underlying currency pair’s volatility. Rho is the rate of change of the portfolio’s value, when interest rates change.

4. Swaps:

There are different types of swaps in the foreign exchange market. A coupon only swap is also called an annuity swap. Only the interest payments in two different currencies are exchanged and there is no exchange of principal.

A forward start swap is a deal which gets activated after a ‘deferral period’ mutually agreed upon by both parties. It is also known as a delayed start swap. For example A’ enters into a two-year swap deal with ‘B’ on January 10, 2011, with a deferral period of three months. The trade date is January 10, 2011. The two-year period is counted from April 10, 2011. The maturity date is April 10, 2013.

In a basis swap, counter-parties exchange the currencies in which they each pay floating rate of interest. For example A’ is paying a floating rate of interest in pounds at LIBOR +1.5 %, and ‘B’ is paying a floating rate of interest in Euros at LIBOR + 1.3 %.. ‘A’ swaps its pound payments of interest for ‘B’s euros payment of interest.

A spot-forward swap is a swap of a currency pair in the spot market and another swap (of the same currency pair) in the forward market. Both transactions are bilaterally negotiated by the same parties, and entered into on the same day. For example, a dealer buys $10 million in exchange for Euros in spot market from Bank XYZ. The swap of dollars for euros takes place immediately. The dealer simultaneously sells the $10 million in exchange for euros back to Bank XYZ in the forward market, for delivery three months hence. The swap occurs at a predetermined future date, three months later. This is a Spot-forward swap.

A forward-forward swap is a swap consisting of two deals in the forward market but with exchange of currencies at two different and pre-determined dates in the future. A dealer sells $10 million forward for delivery in one month at an exchange rate of €1.17/ $, and simultaneously buys $10 million forward for delivery in two months at an exchange rate of €1.16/$.

A cross-currency interest rate swap is the exchange of future interest payments and the currencies in which the interest payments are to be made. It is entered into to deal with currency mismatch. Perhaps a company had to raise a US dollar loan in the USA for its project in France, because it was cheaper to raise a loan in the home market (USA) than in France. But revenues from the project will be received in euros. To make the interest payments in the same currency as the revenue receipts, the company will choose an interest rate swap, and swap its dollar-denominated interest payments for euro-denominated interest payments.

A cross-currency interest rate swap enables both the parties to the contract to hedge exchange rate risk (caused by fluctuation of exchange rates during the period of the swap contract) and interest rate risk (caused by fluctuation of interest rates during the period of the swap contract).

Cross-currency interest rate swaps are of different kinds depending upon the structuring of the swap deal:

i. In a fixed for fixed swap, both parties pay a fixed interest rate. It. is fixed for fixed callable swap, when one of the parties has the right (but not the obligation) to cancel the swap after a certain date, or at a certain time.

ii. In a fixed for floating swap, one party swaps its fixed interest rate payment, for the other’s floating interest rate payment. If an upper limit is set on the floating interest rate, it is called a capped swap.

iii. In a basis swap, two parties exchange floating interest rate commitments. Each party has an existing floating interest rate payment linked to a different benchmark. The exchange is done to match the return on assets with the return on liabilities. It is also called a floating for floating swap. Suppose a company has assets that earn a return (in British pounds) linked to a three-month LIBOR, but has a liability on which it has to pay interest (in US dollar) linked to six-month LIBOR. It goes in for a cross-currency basis swap, by taking a British pound-denominated three-month LIBOR linked interest rate swap.

iv. A cross-currency swaption is an option on a swap. The buyer of a swaption buys the right but not the obligation to enter into a cross currency swap with the seller.

v. A contingent swap is one which is activated when interest rates reach a pre-specified level.

vi. In a reversible swap, one of the parties has the option to alter the payment basis (from fixed to floating) after a certain period.

vii. In a zero for floating swap, one party accepts the other party’s payments (in another currency) of a floating interest rate.

viii. In a puttable swap, the party that is paying a fixed rate of interest has the right but not the obligation, to cancel the swap on or after a certain date. It combines a swap with the buyer’s position in an options contract.

ix. In an extendable swap, the party that is paying a fixed rate of interest has the right but not the obligation to extend the swap for a pre-determined period. An example is a two- year swap agreement extendable for one year.