The main consideration in determining the dividend policy is the objective of maximisation of wealth of shareholders. Thus, a firm should retain the earnings if it has profitable investment opportunities, giving a higher rate of return than the cost of retained earnings, otherwise it should pay them as dividends.

It implies that a firm should treat retained earnings as the active decision variable, and the dividends as the passive residual.

In actual practice, however, we find that most firms determine the amount of dividends first, as an active decision variable, and the residue constitutes the retained earnings. In fact, there is no choice with the companies between paying dividends and not paying dividends Most of the companies believe that by following a stable dividend policy with a high pay-out ratio, they can maximise the market value of shares.

Moreover, the image of such companies is also improved in the market and the investors also favour such companies. The firms following this policy can, thus, successfully approach the market for raising additional funds for future expansion and growth, as and when required.

ADVERTISEMENTS:

It has, therefore, been rightly said that theoretically, retained earnings should be treated as the active decision variable, and dividends as passive residual, but the practice does not conform to this in most cases.

It has been observed that the managements of Indian firms believe that dividend policy conveys information about the current and future prospects of the firm and thus affects its market value. They do consider the investor’s preference for dividends and shareholder profile while designing the dividend policy. They also have a target dividend payout-ratio but want to pay stable dividends with growth.

Illustration 1:

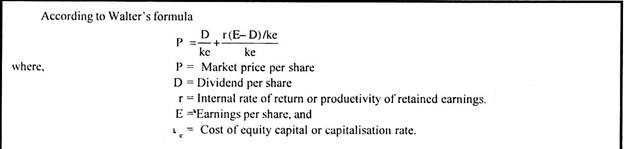

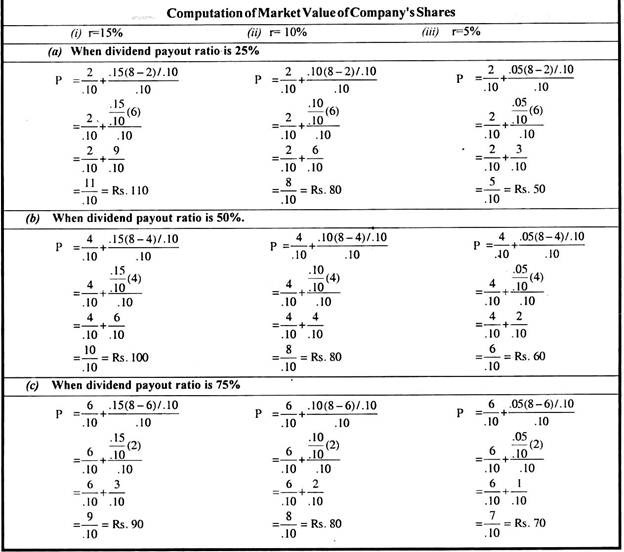

The earnings per share of company are and the rate of capitalisation applicable to the company is 10%. The company has before it an option of adopting a payout ratio of 25% or 50% or 75%. Using Walter’s formula of dividend payout, compute the market value of the company’s share if the productivity of retained earnings is (i) 15% (ii) 10% and (iii) 5%.

ADVERTISEMENTS:

Solution:

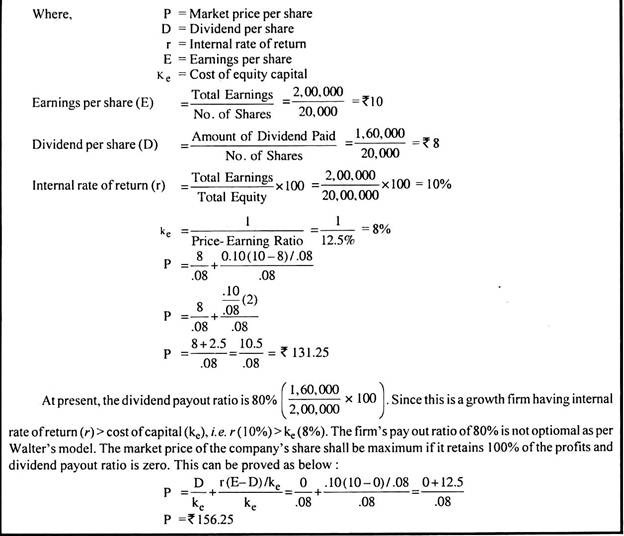

Illustration 2:

ADVERTISEMENTS:

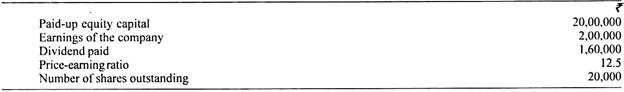

The following information relates to XYZ Ltd.:

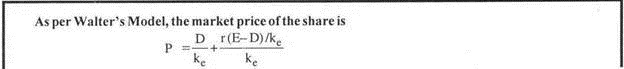

You are required to find out whether the company’s dividend payout ratio is optimal, using Walter’s Model.

Solution:

Thus, the firm can increase the market price of the share upto Rs. 156.25 by increasing the retention ratio to 100%, the optimal payout ratio for the firm is zero.

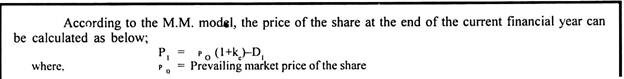

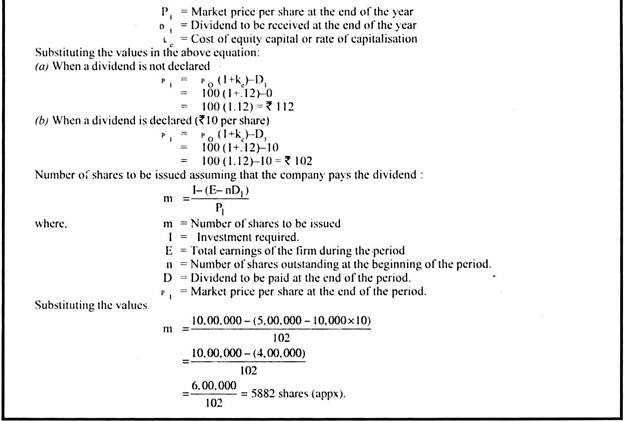

Illustration 3:

ABC Ltd. has a capital of Rs. 10 lakhs in equity shares of Rs. 100 each. The shares are currently quoted at par. The company proposes declaration of a dividend of Rs. 10 per share at the end of the current financial year. The capitalisation rate for the risk class to which the company belongs is 12%.

ADVERTISEMENTS:

What will be the market price of the share at the end of the year, if:

(i) A dividend is not declared?

(ii) A dividend is declared?

Assuming that the company pays the dividend and has net profits of Rs. 5,00,000 and makes new investments of Rs. 10 lakhs during the period, how many new shares must be issued. Use the M.M. model.

ADVERTISEMENTS:

Solution: