In this article we will discuss about:- 1. Introduction to the Dividend Policy of a Company 2. External Factors Affecting Dividend 3. Internal Factors 4. Dividend Decision and Tax Consideration 5. Approaches 6. Homemade Dividend 7. Establishing a Dividend Policy.

Contents:

- Introduction to the Dividend Policy of a Company

- External Factors Affecting Dividend

- Internal Factors Affecting Dividend

- Dividend Decision and Tax Consideration

- Approaches to Dividend Policy

- Homemade Dividend

- Establishing a Dividend Policy

1. Introduction to the Dividend Policy of a Company:

The concept of “Dividend Policy” implies that companies through their Board of Directors evolve a defined pattern of dividend payments which has a bearing on further action. In other words, the dividend policy of a firm refers to the views and practices of the management with regard to distribution of earnings to the shareholders in the form of dividends.

Dividends are paid out of profits. These could either be profits of the current year or the accumulated profits of the past. Dividends are paid quarterly, half yearly or annually. When paid quarterly or half yearly they are referred to as interim dividend. Dividend is expressed as a percentage of Face Value and is referred to as dividend rate.

When the dividend amount is expressed as a percentage of market price, it is called dividend yield, while expressed as a percentage of earnings is known as dividend payout. Hence, dividend yield is the ratio of dividend per share to market price per share and dividend payout is the ratio of dividend per share to earnings per share.

Dividend policy determines the division of Earnings between payment to shareholders and Retained earnings.

Dividend policy may be viewed as a:

(a) Long-term financing decision

(b) Wealth maximization Decision

2. External Factors Affecting Dividend:

1. General State of Economy:

In case, of uncertain economic and business conditions, the management may like to retain whole or large part of the earnings. To build up reserves to absorb future shocks. In periods of prosperity, the management may not be liberal in dividend payments because of availability of larger profitable investment opportunities. In periods of inflation, the management may retain larger portion of earnings to finance replacement of obsolete machines.

2. Trade Cycles:

Business cycles also exercise influence upon dividend Policy. Dividend policy is adjusted according to the business oscillations. During the boom, prudent management creates reserves for contingencies which follow the inflationary period. Higher rates of dividend can be used as a tool for marketing the securities in an otherwise depressed market. The financial solvency can be established and maintained by the companies in dull years if adequate reserves have been built up.

3. Government Policies:

The earnings capacity of the enterprise is widely affected by the change in fiscal, industrial, labor control and other government policies. Sometimes, government restricts the distribution of dividend beyond a certain percentage in a particular industry or in all spheres of business activity as was done in emergency. The dividend policy has to be modified or formulated accordingly in those enterprises.

4. Taxation Policy:

High taxation reduces the earnings of the companies and consequently the rate of dividend is lowered down. In India, dividends are not taxed in the hands of the investors but the firms have to pay DDT (Dividend Distribution Tax).

5. Legal Requirements:

In deciding on the dividend, the directors take the legal requirements too into consideration. In order to protect the interests of creditors and outsiders. The companies Act 1956 prescribes certain guidelines in respect to the distribution and payment of dividend. Moreover, a company is required to provide for depreciation on its fixed and tangible assets before declaring dividend on shares. It proposes that in any case Dividend should not be distributed out of capital. Likewise, contractual obligation should also be fulfilled, for example, by payment of dividend on preference shares in priority over ordinary dividend.

3. Internal Factors Affecting Dividend:

1. Nature of Business:

The nature of business has an important bearing on the dividend policy. Industrial units demonstrating stability of earnings may formulate a more consistent dividend policy than those having an uneven flow of income because they can predict easily their savings and earnings. Usually, enterprises dealing in necessities suffer less from oscillating earnings than those dealing in luxuries or fancy goods.

2. Age of Corporation:

Age of the corporation counts much in deciding the dividend policy. A newly established company may require much of its earnings for expansion and plant improvement and may adopt a rigid dividend policy while, on the other hand, an older company can formulate a clear cut and more consistent policy regarding dividend payouts.

3. Needs for Additional Capital:

Companies retain a part of their profits for strengthening their financial position. Such an income may be conserved for meeting the increased working capital requirements or for future expansion. It is difficult for small companies to raise finance for their needs of increased working capital for expansion programmes. In absence of other alternative these companies plough back their profits. Consequently they tend to distribute low dividend and retain a big part of profits.

4. Liquidity of Funds:

Availability of cash and sound financial position is also an important factor in dividend decisions. A dividend represents a cash outflow, the greater the funds and the liquidity of the firm the better the ability to pay dividend. The liquidity of a firm depends very much on the investment and financial decisions of the firm which in turn determines the rate of expansion and the manner of financing. If cash position is weak, stock dividend will be distributed and if cash position is good, company can distribute the cash dividend.

5. Ability to Borrow:

Well established and large firms have better access to the capital market than the new companies and may borrow funds from the external sources if need arises. Such companies may have a better dividend pay-out ratio. In contrast, smaller firms depend on their internal sources and therefore need to build up good reserves by reducing the dividend payout ratio to cover any obligation requiring heavy funds.

6. Past Dividends:

To a lesser extent the dividends declared during previous years must also be considered. Shareholders do expect that the company would not pay less than dividend paid in the past. Of course, if circumstances change, departure has to be made from the past trend. But generally directors are reluctant to reduce the previous year’s rate of dividend and if need be, they would try to maintain the rate of dividend, withdrawing from the past accumulated profit.

7. Distribution of Shareholdings:

If the company is closely-held, it is easy for the Board to postpone the dividend and transfer the entire profit to reserves. However, in case the shareholding is widely distributed, with a large number of shareholders, it would be difficult for the Board to take decision of reducing or suspending dividend. If shareholders are mostly from middle class group of society, they expect a higher and consistent rate of dividend and the directors cannot ignore the expectations of shareholders.

8. Attitude of Management:

The attitude of management has a considerable impact on dividend policy. The management with foresight and conservative attitude would declare lower dividend and major part of the profit would be kept to strengthen company’s financial position. A liberal management attitude would result in liberal dividend policy. Prudent management would tend to adopt a somewhat conservative dividend policy.

9. Time for Payment of Dividend:

The time for dividend payout is another consideration. There are peak times as well as lean periods of expenditure. Since, payment of dividend means cash outflow its desirable to distribute dividend at a time when needed least by the company. A prudent management should plan the payment of dividend to avoid cash outflow at a time when the undertaking is already in need of urgent finances.

4. Dividend Decision and Tax Consideration:

At present, there is no tax on dividends received by Indians from Domestic companies, but the companies are subject to Dividend Distribution Tax (DDT). A domestic company paying dividend will have to pay dividend distribution tax u/s 115-0.

The rate applicable for FY 2010-11 is 15% plus surcharge @ 1.125% plus education cess @ 2% plus Secondary Higher education cess of 1% of income tax resulting in a total of 16.60875%. The investors are also subject to Capital Gains Tax @ 15% + 3% Education cess if the shares are sold in short term (upto one year) but no tax if the shares are sold in long term (more than a year). The companies have to consider the tax implications while deciding the dividend policy.

5. Approaches to Dividend Policy:

I. Dividend Relevance Theories:

(A) Walter’s Approach:

Walter’s model supports the principle that dividends are relevant. The investment policy of a firm cannot be separated from its dividend policy and both are inter-related. The choice of an appropriate dividend policy affects the value of an enterprise. It can be explained with the following points, (where R-Return on investment, K-Cost of capital or required rate of return).

i. If R > K, the firm can earn higher return on their investment and the firm should retain the earnings. In such growth oriented firms, the optimum dividend policy would be to plough back the entire earnings.

ii. If R < K, the firm does not have profitable investment opportunities. In such firms, the optimum dividend policy would be to distribute the entire earnings as dividend. Here, the shareholders will stand to gain because they can utilize the dividends so received in channels which can give them higher returns.

iii. If R = K, it will not make any difference if the firm receives or distributes its earnings. Here, the value of the firm’s share would not fluctuate with change in the dividend rates.

Mathematical Formula:

Theoretical Market Value of Equity Share:

Po = [D + R/Ke (E – D)] / Ke

R = Return on investment

Ke = Cost of capital or required rate of return

D = Dividend per share

E = Earnings per share

Example 1:

A company has the following facts:

Cost of capital (ke) = 0.10

Earnings per share (E) = Rs. 10

Rate of return on investments (r) = 8%

Dividend payout ratio: Case A: 50% Case B: 25%

Show the effect of the dividend policy on the market price of the shares.

Solution:

Case A:

D/P ratio = 50%

When EPS = Rs.10 and D/P ratio is 50%, D = 10 × 50% = Rs.5

Case B:

D/P ratio = 25%

When EPS = Rs.10 and D/P ratio is 25%, D = 10 × 25% = Rs.2.5

Assumptions of Walter’s Model:

i. The firm does the entire financing through retained earnings. It does not use external sources of funds such as new debt or new equity capital

ii. The firm’s business risk does not change with additional investment. It implies the firms’ IRR and cost of capital remain constant

iii. The firm has a very long life

Criticism on Walter’s Model:

1. No External Finance:

It assumes that the firm’s investments are purely financed by retained earnings. So this model would be applicable only to all-equity firms.

2. Constant Rate of Return:

The assumption of r as constant is not realistic.

3. Constant Cost of Capital:

The assumption of a constant ke ignores the effect of risk on the value of the firm

(B) Gordon’s Dividend Capitalization Model:

Gordon’s Model suggests that the market price of a share is the present value of a growing perpetuity. As per this model, the market price of a share is the present value of future dividends, and the dividends are assumed to grow at a uniform rate forever.

Assumptions:

i. The firm is an all-equity firm. This means its capital consists of only equity shares. There exists no debt capital

ii. The firm uses only retained earnings for financing its investment programmes. No external financing is used.

iii. The Internal rate of return of the firm is constant (r)

iv. The capital cost of the firm is constant

v. The firm has an infinite life

vi. The firm has no corporate taxes

vii. The retention ratio once decided upon is constant (b)

viii. K is greater than growth rate where growth is the product of retention ratio and return on equity (g=br)

Formula:

i. Po = D1/K-g

D1 = Dividend received per share at the end of year 1

K = Cost of equity

g = Growth rate in dividends

Po = Current market price

ii. Alternatively, Po = E (1 – b) / Ke – br

E = Earning per share

b = retention ratio

r = required rate of return

Criticism:

Gordon’s Model suffers the same imperfections as the Walter’s Model. The assumption relating to 100% equity funding does not lead to maximization of wealth. The assumptions of constant rate of return and constant opportunity cost also do not hold good.

Example 2:

A company has invested Rs.500 lakhs in assets. There are 40 lakh shares outstanding. The par value per share is Rs.10. It earns a rate of 15% on its investment and has a policy of retaining 40% of the earnings. If the appropriate discount rate of the firm is 10%, what is the price of its share using the Gordon’s model? What will happen to the price of the share if the company has a payout of 70% or 20%?

Solution:

Case A:

Payout ratio = 40%

(i) Earnings = 500L × 15% = 75 L

(ii) EPS = Total earnings / No. of shares outstanding = 75L/40L = Rs.1.875

(iii) DPS = Dividend per share = EPS × (1-retention ratio) = 1.875 × (1-0.6) = Rs.0.75

(iv) g = br = 0.6 × 0.15 = 9%

(v) P0 = D1/ K-g = 0.75/0.10 – 0.09 = 75

Case B:

Payout ratio = 70%

(i) Earnings = 500L × 15% = 75 L

(ii) EPS = Total earnings / No. of shares outstanding = 75L/40L = Rs.1.875

(iii) DPS = Dividend per share = EPS × (1-retention ratio) = 1.875 × (1-0.3) = Rs. 1.3125

(iv) g = br = 0.3 × 0.15 = 4.5%

(v) P0 = D1/ K-g = 1.3125/0.10 – 0.045 = 23.86

Case C:

Payout ratio = 20%

(i) Earnings = 500L × 15% = 75 L

(ii) EPS = Total earnings / No. of shares outstanding = 75L/40L = Rs. 1.875

(iii) DPS = Dividend per share = EPS × (1-retention ratio) = 1.875 × (1-0.8) = Rs. 0.375

(iv) g = br = 0.8 x 0.15 = 12%

(v) P0 = D1/ K-g = 0.375/0.10 – 0.12

Po is negative, indicating that Gordon’s Model is inoperative when K < g.

Gordon’s model asserts that the dividend decision has a bearing on the market price of the shares and that the market price of the share is favorably affected with more dividends.

(C) Graham and Dodd Model (also known as the ‘Bird In Hand Approach’):

Investors look to an immediate dividend as ‘a bird in hand’ and at the distant dividend as ‘two in the bush’.

According to this theory shareholders are risk averse and prefer to receive dividends in the present time period rather than future capital gains

Graham and Dodd established the relationship between the market price and dividends and devised the following formula:

P = m (D + E/3)

P = Price

m = multiplier

D = Dividend per share

E = Earnings per share

Assumptions:

i. Investors are rational

ii. Under conditions of uncertainty, they turn risk averse.

Criticisms:

The weights provided by Graham and Dodd are based on their subjective judgment and not derived from any empirical analysis.

(D) Lintner’s Model:

John Lintner based his model on a series of interviews that he conducted with corporate managers in the mid 1950s. His findings are relevant even today.

i. Companies tend to set long-run target dividends-to-earnings ratios according to the amount of positive net-present-value (NPV) projects they have available.

ii. Earnings increases are not always sustainable. As a result, dividend policy is not changed until managers can see that new earnings levels are sustainable. A manager is open to announcing a dividend of Rs.3 per share if last year too it was Rs.3 per share. But, he is hesitant if last year the dividend was Rs.2.5 per share. That’s because of the inherent fear that he may not be able to maintain the same levels in future.

iii. Managers increase dividends as the earnings increase but not in the same proportion. If earnings jump by 50%, dividends may be increased by 20%. Thus, the managers smooth the dividends with the adjustment factor.

iv. Managers are reluctant to make dividend changes that might need to be reversed. The dividend policy should be changed only when it can be maintained in future.

Thus, dividends are the weighted average of the past earnings.

D1 = DO + [(EPS × Target Payout) – DO] × AF

D1 – Dividend in year 1

D0 – Dividend in current year

EPS – Earning per share

AF – Adjustment Factor

Criticism:

i. The adjustment factor is an arbitrary number

ii. It does not give the market price of the share

(E) Radical Approach:

Unlike other approaches of dividend policy, it considers both corporate tax and personal tax. It also considers that dividends and capital gains may not be taxed at the same rate.

If the tax on dividend is higher than the tax on capital gains a company offering capital gains rather than dividends will be priced better. If the tax on dividend is less than the tax on capital gains, a company offering dividends rather than capital gains will be priced better.

Example 3:

Under the tax laws prevailing in India, dividends are taxed at 10% and capital gains at 20%. X Ltd’s current market price is Rs.100 and the expected market price one year later is 120. It pays no dividend. Y Ltd whose current market price is also Rs.100 proposes to pay Rs.20 by way of dividend. Assume that the two companies are equally risky. What will be their respective market prices if the after tax returns of the two companies are identical?

Solution:

i. Company X’s price is expected to go p by 20% and there are no dividends payable. Hence, the investor is expecting a pretax return of 20%

ii. Since the tax rate on capital gains is 20% the post tax return is 16% (20% less 0.2 of 20%)

iii. In the case of company Y since dividends are taxed at 10%, the after tax dividend is Rs. 18. To get a return of 16%, the current price will have to quote Rs. 18/0.16 i.e. 112.5 per share

iv. The market price of X Ltd is Rs.120 and that of Y Ltd is Rs. 112.5. X Ltd commands a higher market price

II. Dividend Irrelevance Theories:

(A) Modigliani – Miller (MM) Model:

The MM theory is based on the argument that declaration of dividends does not affect the market price of the share. As per this approach, the price of the shares of the firm is determined by its earning potentiality and investment policy.

In fact what is currently understood as the Modigliani-Miller Theorem comprises four distinct results from a series of papers (1958, 1961, 1963). The first proposition establishes that under certain conditions, a firm’s debt-equity ratio does not affect its market value.

The second proposition establishes that a firm’s leverage has no effect on its weighted average cost of capital (i.e., the cost of equity capital is a linear function of the debt-equity ratio). The third proposition establishes that firm market value is independent of its dividend policy. The fourth proposition establishes that equity-holders are indifferent about the firm’s financial policy.

As per MM approach, if a company retains earnings instead of giving it out as dividend, the shareholder enjoys capital appreciation equal to the amount of earnings retained. If the company distributes earnings by way of dividends instead of retaining it, the shareholder enjoys dividends equal to the amount by which his capital would have appreciated had the company chosen to retain its earnings. Hence, the division of earnings between dividends and retained earnings is irrelevant from the point of view of the shareholders.

Homemade Dividend:

It simply means creating a personal dividend policy and ensuring the desired cash inflow in a given period(s). For example, if the company is paying more dividend than the shareholder need (well, he may want a lesser dividend receipt due to tax implications), he can receive the dividend check and reinvest the money back in the company (by buying additional shares) or anywhere else (perhaps in a tax saving scheme). And if the company is paying him less dividend than he needs, he can make up for the shortfall by selling some shares.

Assumptions:

1. Perfect Market:

Capital Markets are perfect.

2. Rational Investors:

Investors behave rationally. Information is freely available to all of them and there are no floatation or transaction costs.

3. No Taxes:

There are either no taxes or there are no differences in the rates applicable to capital gains and dividends.

4. Fixed Investment Policy:

The firm has a fixed investment policy under which at year end, it invests a specific amount as capital expenditure.

5. No Risk of Uncertainty:

Risk of uncertainty does not exist. Further dividend and market price can be predicted.

6. No External Funds:

All investments are funded either by equity or by retained earnings.

According to MM Hypothesis, the market value of a share at the beginning of the period is equal to the present value of dividends paid at the end of the period plus the market price of the share at the end of the period.

Po = D1 + P1/ (1+Ke)

Or

P1= Po (1 + Ke) – D1

Po = Prevailing market price of a share

D1 = Dividend to be received at the end of the period one

P1 = Market price of share at the end of period one

Ke = Cost of equity capital

Computation of the number of new shares to be issued:

N1 × P1 = I – (E -ND1)

Or

N1 = I – (E-ND1) / P1

N1 = Number of shares to be issued

P1 = Price at which new issue is to be made

I = Amount of investments required

E = Total net profit of the firm during the period

ND1 = Total dividend paid during the year

Value of the firm = [(N + N1) P1 – (I – E)] / (1 +Ke)

E = Total earnings

N = existing number of shares

N1 = number of shares to be issued

Criticism of MM Theory:

1. No Tax:

MM approach assumes a ‘no tax’ situation which is far from reality. In fact, shareholders have to pay tax on capital gains as well as dividends, (though dividends are tax free in India, if received from a domestic company, but there is Dividend Distribution Tax paid by the company, which is ultimately an outflow from the earnings of the shareholders)

2. Floating Costs:

MM approach assumes no floatation costs whereas, there are various floatation costs like underwriting commission, etc. that a firm has to incur.

3. Transaction Costs:

MM approach assumes no transaction costs, where as a shareholder has to pay brokerage, STT – securities transaction tax, etc. while selling as well as buying shares.

4. Discount Rate:

MM approach assumes a single discounting rate for discounting the cash flows of different time periods. Uncertainty increases with the length of time. Shareholders prefer immediate dividends to future dividends.

5. Homemade Dividends:

The assumption that investor can switch between current dividends and capital gains is abstract. Stock prices tend to fluctuate wildly at the bourses. In a fluctuating market, investors looking for current income may be reluctant to sell a part of their shares; instead they would prefer to receive high dividends. Similarly, investors looking for low dividends will be hesitant to buy shares in such a market, instead they would prefer a low payout ratio. This makes it difficult for an investor to convert current income into equity and vice versa.

Example 4:

BPCL has 10 lacs equity shares outstanding at the beginning of the year. The current market price is Rs. 150 and the directors have recommended a dividend of Rs.8 per share. Equity shareholders expect a return of 12%.

(a) Apply MM model calculate the market price of the share when the recommended dividend is:

(i) Declared

(ii) Not declared

(b) If the investment budget is Rs.400 lacs and the anticipated profits are Rs.200 lacs compute how many new shares have to be issued if dividends are declared and if dividends are not declared

(c) Show that the declaration or non-declaration of dividends does not change the market value of the firm.

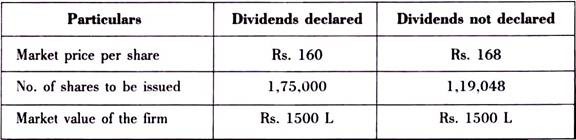

Solution:

Case I:

Recommended Dividend = Rs.8

(i) Compute P1 = Po (1 + Ke) – D1

P1 = 150 (1+ 0.12) – 8 = Rs. 160

(ii) Compute money available as retained earnings

Retained earnings = PAT – Dividend = 200 – (10 lacs × Rs.8 per share) = Rs.120 lacs

(iii) Compute money required through issue of equity capital

= Rs. 400 lacs – Rs. 120 lacs are retained earnings = Rs. 280 lacs

(iv) Raise money by issuing shares at P1

= Rs. 280 lacs / P1 = Rs. 280 lacs / Rs. 160 = 1,75,000 shares

(v) Compute NPo (present market value of the firm)

= 10 lac share × Rs. 150 per share = Rs. 1500 L

(vi) Verification by substituting in the formula:

Value of the firm = [(N + N1) P1 – (I – E)] / (1+Ke)

= [(10 L+1.75 L) 160 – (400-200)] / (1 + 0.12)

= Rs. 1500 L

Case II:

Recommended Dividend = Rs.0

(i) Compute PI = Po (1+Ke) – D1

P1 = 150 (1+ 0.12) – 0 = Rs. 168

(ii) Compute money available as retained earnings

Retained earnings = PAT – Dividend = 200 – (10 lacs × Rs. 0 per share) = Rs. 200 lacs

(iii) Compute money required through issue of equity capital

= Rs. 400 lacs – Rs. 200 lacs are retained earnings = Rs. 200 lacs

(iv) Raise money by issuing shares at P1

= Rs. 200 lacs / P1= Rs. 200 lacs / Rs. 168 = 1,19,048 shares

(v) Compute NPo (present market value of the firm)

= 10 lac share × Rs. 150 per share = Rs. 1500 L

(vi) Verification by substituting in the formula:

Value of the firm = [(N + N1) P1 – (I – E)] / (1 + Ke)

= [(10 L +1.19048 L) 168 – (400-200)] / (1 + 0.12)

= Rs. 1500 L

6. Establishing a Dividend Policy:

1. Constant Dividend Model:

Under this method, a fixed dividend rate is paid each year irrespective of the earnings. It could be Rs.3 per share irrespective of the earnings of the company. It does not mean that the dividends will never be increased in future. If the finance management is certain that they can sustain the new level of increased earnings, they may also declare a high dividend, and then maintain it as a constant dividend till a new sustainable level of earnings is reached.

2. Constant Payouts:

Here, the company adopts a fixed payout ratio year after year. For eg: this ratio could be say, 30% that means 30% of the earnings would be distributed in the form of dividends. If the EPS is Rs. 5 per share the Rs. 1.5 per share would be distributed as dividend.

3. Constant Dividend Plus:

Here, a fixed low dividend per share is always payable. An additional dividend per share in the form of either interim dividend or special dividend is then paid in years of good profits. When the earnings are not so good, the additional part is not paid

4. Residual Approach:

Under this method, dividends are paid out of the earnings after making provisions for money required to meet upcoming capital expenditure commitments. The company follows this kind of method, when the cost of external borrowing is more than internal funding.

5. Compromise Approach:

As per this method, a real world approach is followed by the management. It declares the dividend after considering many factors like – maintaining long term debt equity ratio, avoiding dividend cuts, maintaining target payout ratio, investment in projects with the retained earnings, if new equity is raised then other incidental expenses, etc.