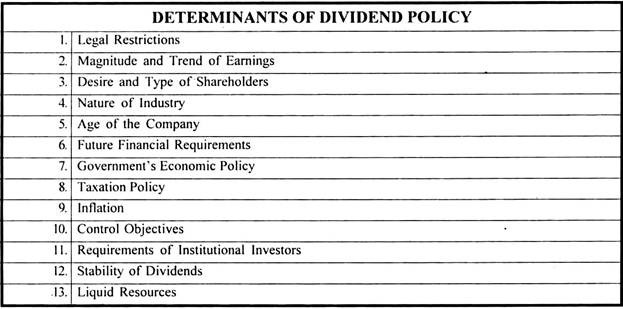

This article throws light upon the top thirteen determinants of dividend policy. The determinants are: 1. Legal Restrictions 2. Magnitude and Trend of Earnings 3. Desire and Type of Shareholders 4. Nature of Industry 5. Age of the Company 6. Future Financial Requirements 7. Government’s Economic Policy 8. Taxation Policy 9. Inflation 10. Control Objectives and Others.

Determinant # 1. Legal Restrictions:

Legal provisions relating to dividends as laid down in sections 93,205,205A, 206 and 207 of the Companies Act, 1956 are significant because they lay down a framework within which dividend policy is formulated.

These provisions require that dividend can be paid only out of current profits or past profits after providing for depreciation or out of the moneys provided by Government for the payment of dividends in pursuance of a guarantee given by the Government.

The Companies (Transfer of Profits to Reserves) Rules, 1975 require a company providing more than ten per cent dividend to transfer certain percentage of the current year’s profits to reserves. Companies Act, further, provides that dividends cannot be paid out of capital, because it will amount to reduction of capital adversely affecting the security of its creditors.

Determinant # 2. Magnitude and Trend of Earnings:

The amount and trend of earnings is an important aspect of dividend policy. It is rather the starting point of the dividend policy. As dividends can be paid only out of present or past year’s profits, earnings of a company fix the upper limits on dividends.

The dividends should, generally, be paid out of current year’s earnings only as the retained earnings of the previous years become more or less a part of permanent investment in the business to earn current profits. The past trend of the company’s earnings should also be kept in consideration while making the dividend decision.

Determinant # 3. Desire and Type of Shareholders:

Although, legally, the discretion as to whether to declare dividend or not has been left with the Board of Directors, the directors should give the importance to the desires of shareholders in the declaration of dividends as they are the representatives of shareholders. Desires of shareholders for dividends depend upon their economic status.

Investors, such as retired persons, widows and other economically weaker persons view dividends as a source of funds to meet their day-to-day living expenses. To benefit such investors, the companies should pay regular dividends. On the other hand, a wealthy investor in a high income tax bracket may not benefit by high current dividend incomes.

Such an investor may be interested in lower current dividends and high capital gains. It is difficult to reconcile these conflicting interests of the different type of shareholders, but a company should adopt its dividend policy after taking into consideration the interests of its various groups of shareholders.

Determinant # 4. Nature of Industry:

Nature of industry to which the company is engaged also considerably affects the dividend policy. Certain industries have a comparatively steady and stable demand irrespective of the prevailing economic conditions. For instance, people used to drink liquor both in boom as well as in recession. Such firms expect regular earnings and hence can follow a consistent dividend policy.

On the other hand, if the earnings are uncertain, as in the case of luxury goods, conservative policy should be followed. Such firms should retain a substantial part of their current earnings during boom period in order to provide funds to pay adequate dividends in the recession periods.

Thus, industries with steady demand of their products can follow a higher dividend payout ratio while cyclical industries should follow a lower payout ratio.

Determinant # 5. Age of the Company:

The age of the company also influences the dividend decision of a company. A newly established concern has to limit payment of dividend and retain substantial part of earnings for financing its future growth and development, while older companies which have established sufficient reserves can afford to pay liberal dividends.

Determinant # 6. Future Financial Requirements:

It is not only the desires of the shareholders but also future financial requirements of the company that have to be taken into consideration while making a dividend decision. The management of a concern has to reconcile the conflicting interests of shareholders and those of the company’s financial needs.

If a company has highly profitable investment opportunities it can convince the shareholders of the need for limitation of dividend to increase the future earnings and stabilise its financial position.

But when profitable investment opportunities, do not exist then the company may not be justified in retaining substantial part of its current earnings. Thus, a concern having few internal investment opportunities should follow high payout ratio as compared to one having more profitable investment opportunities.

Determinant # 7. Government’s Economic Policy:

The dividend policy of a firm has also to be adjusted to the economic policy of the Government as was the case when the Temporary Restriction on Payment of Dividend Ordinance was in force. In 1974 and 1975, companies were allowed to pay dividends not more than 33 per cent of their profits or 12 per cent on the paid-up value of the shares, whichever was lower.

Determinant # 8. Taxation Policy:

The taxation policy of the Government also affects the dividend decision of a firm. A high or low rate of business taxation affects the net earnings of company (after tax) and thereby its dividend policy. Similarly, a firm’s dividend policy may be dictated by the income-tax status of its shareholders.

If the dividend income of shareholders is heavily taxed being in high income bracket, the shareholders may forego cash dividend and prefer bonus shares and capital gains.

Determinant # 9. Inflation:

Inflation acts as a constraint in the payment of dividends. Profits as arrived from the profit and loss account on the basis of historical cost have a tendency to be overstated in times of rise in prices due to over valuation of stock-in-trade and writing off depreciation on fixed assets at lower rates.

As a result, when prices rise, funds generated by depreciation would not be adequate to replace fixed assets, and hence to maintain the same assets and capital intact, substantial part of the current earnings would be retained.

Otherwise, imaginary and inflated book profits in the days of rising prices would amount to payment of dividends much more than warranted by the real profits, out of the equity capital resulting in erosion of capital.

Determinant # 10. Control Objectives:

When a company pays high dividends out of its earnings, it may result in the dilution of both control and earnings for the existing shareholders. As in case of a high dividend pay-out ratio, the retained earnings are insignificant and the company will have to issue new shares to raise funds to finance its future requirements.

The control of the existing shareholders will be diluted if they cannot buy the additional shares issued by the company.

Similarly, issue of new shares shall cause increase in the number of equity shares and ultimately cause a lower earnings per share and their price in the market. Thus, under these circumstances to maintain control of the existing shareholders, it may be desirable to declare lower dividends and retain earnings to finance the firm’s future requirements.

Determinant # 11. Requirements of Institutional Investors:

Dividend policy of a company can be affected by the requirements of institutional investors such as financial institutions, banks insurance corporations, etc. These investors usually favour a policy of regular payment of cash dividends and stipulate their own terms with regard to payment of dividend on equity shares.

Determinant # 12. Stability of Dividends:

Stability of dividends is another important guiding principle in the formulation of a dividend policy. Stability of dividend simply refers to the payment of dividend regularly and shareholders, generally, prefer payment of such regular dividends.

Some companies follow a policy of constant dividend per share while others follow a policy of constant payout ratio and while there are some other who follows a policy of constant low dividend per share plus an extra dividend in the years of high profits.

A policy of constant dividend per share is most suitable to concerns whose earnings are expected to remain stable over a number of years or those who have built-up sufficient reserves to pay dividends in the years of low profits.

The policy of constant payout ratio, i.e., paying a fixed percentage of net earnings every year may be supported by a firm because it is related to the firm’s ability to pay dividends. The policy of constant low dividend per share plus some extra dividend in years of high profits is suitable to the firms having fluctuating earnings from year to year.

Determinant # 13. Liquid Resources:

The dividend policy of a firm is also influenced by the availability of liquid resources. Although, a firm may have sufficient available profits to declare dividends, yet it may not be desirable to pay dividends if it does not have sufficient liquid resources. Hence the liquidity position of a company is an important consideration in paying dividends.

If a company does not have liquid resources, it is better to declare stock-dividend i.e. issue of bonus shares to the existing shareholders. The issue of bonus shares also amounts to distribution of firm’s earnings among the existing shareholders without affecting its cash position.