After reading this article you will learn about Capital Structure of a Company:- 1. Meaning of Capital Structure 2. Determinants of Capital Structure.

Meaning of Capital Structure:

According to Gerstenberg capital structure or financial structure of a company is the make-up or form or composition of capitalisation, i.e., the type of securities to be issued and the relative proportion of each type of securities in the total capitalisation.

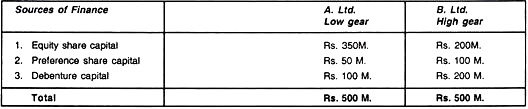

The ratio between the various types of securities to total capitalisation is called capital gearing — the ratio of fixed income securities (Preference Shares and Debenture Loans) to the total capital. Capital gearing is high if the proportion of non-equity capital is relatively high. Capital gearing is low if the ratio of non-equity capital to equity capital is relatively low.

Under low gearing of financial leverage we have greater proportion of equity capital. Under high gearing or financial leverage we have relatively smaller proportion of equity capital and larger proportion of fixed-income securities.

Modes of Finance:

While devising a sound capital structure, we have to lay more emphasis on the pattern of the capital structure, i.e., the relative importance to be given to the ownership resources or creditor ship resources.

In general the determinants of mode of finance are:

1. The volume of earnings expected.

2. Stability of earnings.

3. Predictability of earnings.

When is Loan Finance (or Debenture Capital) Desirable?

If anticipated earnings are well above interest and sinking fund needs, the earnings are stable, certain and regular and the success of the enterprise is assured, the business enterprise can certainly resort to loan or bond finance.

These conditions are usually specified for an established business concern and hence, in the capital structure of an established business concern, the proportion of borrowed capital to owned capital may be substantial; but for a new enterprise bond or debenture capital is undesirable because earnings are irregular or uncertain, goodwill is absent and borrowing may involve considerable financial burden.

A new company also is unable to pledge or mortgage its assets right from the beginning. Bonds are preferred when future earnings are certain, stable and regular.

When is Preference Share Capital Welcome in the Capital Structure?

If the success of the enterprise is reasonably assured and certainty of earnings is not too high, a company can secure preference share capital. Preference shares are suitable when the earnings are irregular but on an average we have a fair margin over the preference dividends.

Redeemable preference share capital is always welcome in the capital structure of a corporation and it is considered better than that of debenture capital, because there is no problem, of mortgage of assets and payment of dividends is not compulsory. Redeemable shares are considered good substitutes of debenture capital.

When is Equity Share Capital Desirable?

If earnings of the corporation are highly unpredictable, irregular, uncertain and fluctuating, equity share capital is always desirable. For a speculative business, risk of loss is considerable we have no immediate prospects of profitability.

Hence, such business can raise only equity share capital. An equity share of a prosperous company is better than a preference share of a doubtful company or a debenture of a bad company. Hence, in the final analysis much depends upon the financial position of a company and its earning power.

Bonds and preference shares have a greater appeal to the conservative investors and institutional investors like banks, insurance company, provident funds, etc., who may be legally debarred from going in for equity shares, Bonds and preference shares have also a special appeal in a deflationary period.

If investors demand safety, regularity and security of income and capital, bonds and preference shares are suitable, in our capital structure. Preference shares depend upon financial position, and earning power of the company. Bonds and debentures depend upon financial position, earning power and security offered by the corporation.

Equity shares are usually in demand during an inflationary or prosperous period because we have rising dividends and rising market value of shares. Equity shares alone are entitled to participate in the prosperity of business and equity shares of a growing company are always sold in the market at a considerable premium.

Thus, the choice of securities depends upon the volume, stability and predictability of earnings and the management on the basis of these three criteria will have to evolve a suitable proportion of variable income securities (equity shares) and fixed income securities (debenture and preference shares).

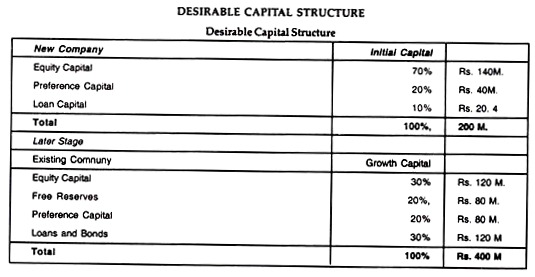

For a new corporation we must have 70 per cent equity share capital, and the balance, i.e., 30 per cent, may be in the form of preference share capital and loan capital.

In the case of an established corporation, demanding growth capital for further expansion, we have risk capital, i.e., equity share capital plus free reserves near about 50 per cent and the rentier capital, i.e., preference shares, debentures and loans about 50 per. cent of the total capital. The pattern of capital structure is usually the optimum combination of share capital and loan capital.

Determinants of Capital Structure:

Factors determining the capital structure or capital glaring or the proportion of securities or the factors affecting the composition of capitalisation are as follows:

1. Trading on the Equity:

Advantage of trading on the equity can be taken by an established corporation having stable earning power, assured cash inflow, large capital assets and high goodwill. If these conditions are satisfied, an existing corporation can secure growth capital by resorting to trading on the equity and in the capital structure of such a corporation we shall have greater and greater proportion of borrowed capital.

Of course, the equity debt ratio should be 1 : 2 and the earning interest ratio should be 2 : 1 to ensure financial stability and liquidity. When net fixed assets exceed net worth, we must have additional equity capital.

2. Nature of Enterprise:

A manufacturing concern has higher degree of risk of failure and competition to be faced from the rivals. It has to rely more on equity finance. A public utility concern is relatively stable and free from competition. It can rely more on the rentier capital i.e., preference shares or debentures.

3. Object of Finance:

If is a productive purpose and additional liability can be honoured out of enhanced earnings, borrowed funds will be welcome. On the other hand if it is

non-productive object, e.g., betterment expenditure, share issue or retained earnings should be preferred.

4. Control in Management:

Distribution of voting control is another important factor while devising a capital structure of a corporation. The promoters usually want to retain effective control over affairs of the new corporation.

Therefore, a part of the capital issue may be in the form of preference shares which are non-voting shares. Existing members of a corporation may also desire to retain control of the company while planning for further expansion.

Therefore, preference shares, bonds and loans and self-financing assume considerable importance as sources of finance for expansion, because these are very useful to avoid sharing of control.

If the existing corporation wants to bring i bout further issue to present members, the management has to offer further shares to the present members on a pro rata basis, primarily to maintain the distribution of voting control same even after a further issue of capital.

5. Attitude of the Investment Market:

If investors demand preference shares, we must have issue of preference share capital. The capital structure will have to be tailored to the moods and attitudes of investors prevailing at the time of issue of capital. Different types of securities have different selling points and satisfy different demands of investors.

6. General Level of Interest Rates:

If the interest rates are too high, for instance under the current economic situation, borrowing is costly and redeemable preferences shares may also be costly. Under such conditions, we have to think of issuing convertible preference shares or convertible debentures with lower dividend or interest rates.

We may also issue equity shares. Under tight money market condition self-financing for growth is always preferable. As a last resort, we may have to postpone our plans of expansion.

7. Business Cycle:

In the boom period or prosperity, we have equity shares in our capital structure while during recession or depression, we have to give preference to the debentures and preference shares. The state of the market affects not only the choice of the type of security to be issued, but also the interest rate on debenture issue, the fixed dividend rate on preference shares, and the price that will be secured by equity shares.

8. Government Taxation Policy:

Interest is considered as deductible expenditure in the income tax law. In order to take advantage of this concession, corporations are tempted to resort to borrowing instead of share capital. Dividends are not considered deductible expenses and they are paid out of profits after tax.

9. Period of Finance:

For short-term as well as for medium term finance, bank loan is the best source of finance. But for long-term or permanent finance the corporation should rely either on retained profits ploughed back into the business or it can issue redeemable preference shares or debentures.

Equity share capital also can be issued if the corporation is under-capitalized. If we want temporary increase in the share capital, redeemable preference shares are suitable.

Broadly speaking, in the capital structure of a new company in unproven field, the major source of finance will equity share capital. Existing companies with unstable earnings will also have to rely more and more on equity shares. If a corporation wants to avoid dilution of control, preference shares or debentures will constitute a major source of finance.

Well established companies having stable earning and assured profits can certainly have cheaper loan capital during prosperity and trading on the equity to the maximum extent. The best time for the floatation of company and raising of funds is a boom or period of prosperity.

In short:

The safety ratios to be maintained for sound capital structure are:

1. Equity-debt ratio 1:2.

2. Earnings-interest ratio 2:1.

3. Profit during lean years 1 1/2 times the interest charges.

4. Total loan capital on mortgage not exceeding 50 per cent of the depreciated value of assets covered by mortgage.

5. Total long-term debts under normal circumstances shall not exceed the net working capital, i.e., excess of current assets over current liabilities.

6. Current ratio, i.e., current assets divided by current liability should be: 2:1.

7. Acid-test ratio, i.e., quick ratio, is determined by dividing ‘quick assets,’ i.e., cash marketable investments and book debts, by current liabilities. It is a better measure of liquidity and it should be 1: 1.

Internal Factors:

1. Nature of Enterprise.

2. Object of Finances.

3. Control in Management.

4. Period of Finance.

5. Trading on the Equity.

6. Elasticity, Liquidity and Simplicity of Financial Structure.

External Factors:

1. Business Cycle, State of Trade.

2. Attitude to Investment and Money Markets

3. Government Policies — Taxation and Dividends.

4. Intelligent Forecasting of Various Contingencies,

5. Optimum use of available Scarce Financial Resources.