In this article we will discuss about the Development Financial Institutions (DFIs) in India. Learn about:- 1. History of Development Financial Institutions (DFIs) 2. Role of Development Finance 3. Nature of Development Financial Institutions (DFIs) 4. Forms and Types of DFIs 5. Rationale of DFIs in India 6. Challenges before DFIs 7. List of Major Development Financial Institutions in India 8. Plan-Wise Assistance Sanctioned and Disbursed to DFIs in India 9. Problems of Development Financial Institutions in India.

Development Financial Institutions (DFIs) in India: Role, Objectives, List, Nature, Forms, Types, Functions and Problems

Development Financial Institutions (DFIs) in India – History of Development

Development Financial Institutions (DFIs) were established with the Government support for underwriting their losses as also the commitment for making available low cost resources for lending at a lower rate of interest than that demanded by the market for risky projects. In the initial years of development it worked well. Process of infrastructure building and industrialization got accelerated. The financial system was improved considerably as per the needs of projects.

Appraisal system of long term projects had also been strengthened due to improvement in availability of information and skills. Thus, the DFIs improved their appetite for risk associated with such projects. “The intermediaries like banks and bond markets became sophisticated in risk management techniques and wanted a piece of the pie in the long term project financing. These intermediaries also had certain distinct advantages over the traditional DFIs such as low cost of funds and benefit of diversification of loan portfolios”.

The government support to DFI was also declining due to fiscal reasons or building the market more competitive and efficient. Fiscal imperatives and market dynamics have forced the government to undertake reappraisal of its policies and strategy with regard to the role of DFIs in Indian system. However, it is important to note that our country has not achieved its development goals even then due to unavoidable circumstances like economic reforms we have started the restructuring process of DFIs after 1991.

Development Financial Institutions (DFIs) in India – Role of Development

Role of development finance may be evaluated in following ways:

(i) It is supposed to identify the gaps in efficacy of institutions and markets and act as a ‘gap-filler’.

(ii) It makes up for the failure of financial markets and institutions to provide certain kinds of finance to economic agents who are really interested to improve the working of economy.

(iii) It targets at economic activities or agents, which are rationed out of market. It motivates the agent to take risky business with venture finance.

(iv) It helps the funds seekers by providing concessional funds at lower rate of return. Social return of DFIs is quite high. Keeping these facts in mind central banking system also supports development financial institutions.

(v) It is specialized in nature and involved long term finance. It is exclusively meant for infrastructure and industry, finance for agriculture and small and medium enterprises (SME) development and financial products for certain sections of the people who needs funds for development perspectives.

Development Financial Institutions (DFIs) in India – Nature of Development

Diamond William (1957) defines development institutions as “an institution to promote and finance enterprises in the private sector”. According to Boskey Shirley, “The development banks are, institutions, public/private, which have one of their principal functions, as the making of medium and long term investment in the industrial projects”. According to Nyhart and Janssens development banks are ‘ those institutions, which provide general medium term and long-term financial assistance to a developing economy”.

The World Development Report (1989) defines, “financial intermediaries are those, which emphasis the provision of capital (loans and equity) for development. It may specialize in particular sector, for example, industry, agriculture or housing”.

Hook (1976), also suggests, that the development banks have two functions to perform i.e. banking and development.” As a banker, the development banks are expected to finance those projects, which are “Bankable”. A project is bankable if it is in the nature of self-financing.

Elaborating self-financing projects, Kane J.A. says that “a project is self- financing, if it is able to generate enough income within a specified period of time to (i) cover the cost of operations, (once the plants begin the operations), (ii) repay the principle and interest charges thereon and (iii) lease a residual profits enough to remain in the operations.”

It is specialized mode of extending development finance and it is generally called as development financial institution (DFI) or development bank. A DFI is defined as “an institution promoted or assisted by the government to provide development finance to sectors of the economy. The institution distinguishes itself by a judicious balance as between commercial norms of operation, as adopted by any private financial institution, and developmental obligations; it emphasizes the “project approach”.

A development bank is expected to upgrade the managerial and the other operational pre-requisites of the assisted projects. Its insurance against default is the integrity, competence and resourcefulness of the management, the commercial and technical viability of the project and above all the speed of implementation and efficiency of operations of the assisted projects. Its relationship with its clients is of a continuing nature and of being a “partner” in the project than that of a mere “financier”.

These definitions outlined the pervasive nature of the development banks. There are different types of promoters for DFIs. Some DFIs are found to be the government sponsored, others are privately owned, and still others are in both hands. These DFIs are engaged in providing different types of services. Promotional and entrepreneurial services are the main theme of these DFIs. These services carry a commitment towards faster growth and fulfilment of the aspirations of the economy.

Thus, the DFIs are necessary for long-term finance and other assistance for activities or sectors of the economy. In emerging sectors risks may be higher than that the ordinary financial system and they are unable to bear the risks involved. They have also been playing effective role in stimulating equity and debt markets by- (i) selling their own stocks and bonds; (ii) helping the assisted enterprises float or place their securities and (iii) selling from their own portfolio of investments.

In this way, “a development bank is intended to provide a necessary capital, enterprise, managerial and technical know-how as these are inadequate in developing economy like India. They also assist in building up the financial and socio-economic infrastructure, favourable to quick economic development. The emphasis on its various activities has shifted from one country to another according to its peculiar needs and circumstances. In some countries the stress has been on finance; in some others, on promotion; yet in others on technical skill and advice; and again elsewhere on economic planning itself.”

Development Financial Institutions (DFIs) in India – Forms and Types of DFIs in India

DFIs can be broadly categorised as all-India or state/regional level institutions depending on their geographical coverage of operation.

Functionally, all-India institutions can be classified as:

(i) Term-lending institutions (IFCI Ltd., IDBI, IDFC Ltd., IIBI Ltd.) extending long- term finance to different industrial sectors,

(ii) Refinancing institutions (NABARD, SIDBI, NHB) extending refinance to banking as well as non-banking intermediaries for finance to agriculture, SSIs and housing sectors,

(iii) Sector-specific/specialised institutions (EXIM Bank, TFCI Ltd., REC Ltd., HUDCO Ltd., IREDA Ltd., PFC Ltd., IRFC Ltd.), and

(iv) Investment institutions (LIC, UTI, GIC, IFCI Venture Capital Funds Ltd., ICICI Venture Funds Management Co. Ltd.). State/regional level institutions are a distinct group and comprise various SFCs, SIDCs and NEDFi Ltd.

Development Financial Institutions (DFIs) in India – Rationale of DFIs in India

The DFIs were set up in India on the following rationale:

(i) Improving Rates of Savings and Investment:

In initial years rate of capital formation was low. At the time of independence saving rate was around at 5 per cent of national income. India had a fairly diversified industrial base for a developing country, with a number of well-established industrial houses at the time of independence. So necessary guarantee was expected from the DFIs otherwise entrepreneurs and promoters would have not been able to generate resources from the market.

(ii) Infancy Stage of Capital Market:

The capital market was at infancy stage and industries had to depend on their own profits and banks for financing for further development programmes. That is why these funds institutions, investment institutions, other trusts, etc. has been declared as DFIs in terms of public financial institutions (PFI) under Section IV-A of Companies Act, 1956.

(iii) Risk Averse Commercial Bank:

Commercial banks were not interested in venture financing as they are quite risky one. DFIs are specialised financial institutions and well equipped in risky venture.

(iv) Arrangement of Loan in Foreign Currency:

Earlier, DFIs had access to lines of credit in foreign currencies from various multilateral and bilateral agencies at low rates of interest mainly for project financing. The Central Government had assumed all foreign currency risks due to fluctuation in the exchange rates.

(v) Specialized Credit Support System:

DFIs could sanction and disburse credit at fixed/assured rates spread over their borrowing rates till the early 1990. Moreover, under the existing industrial licensing policy system obtaining a license itself was taken as license to get credit from DFIs, without the investor going through the elaborate procedures normally associated with projected appraisal for credit sanction based on commercial judgment and viability.

(vi) Arrangement of Priority Sector Financing:

DFIs did not have competition in deploying their funds to public companies. However, some commercial banks had started providing term capital as priorities for investments in various sectors in the economy were given, along with targets set in successive plans.

(vii) Project Evaluation and Funding:

Some DFIs had also conducted economic potential surveys of regions or states and provided considerable support to a number of development projects. When project costs were high and could not be financed by one DFI, they formed loan consortia with commercial banks whereby DFIs could provide large sized loans thereby reducing the incidence of risks.

(viii) Coordinating Financing Agencies:

The DFIs were expected to work as conduits between the government/other financing agencies and the ultimate borrowers for an assured margin. They also acquired skills and expertise to study the viability and technical efficiency of projects which was called as the directly productive activities.

Development Financial Institutions (DFIs) in India – Challenges before DFIs

The DFIs are facing the following challenges:

(i) Problems in Mobilisation of Resources:

The DFIs have to mobilize funds from the market but they suffered from structural inflexibility as they did not have good network of branches all over the country. There are restrictions on the amount of funds that could float in the market. Now interest rates are quite competitive and these DFIs are not getting funds at competitive rates.

(ii) Problem of Competitive Interest Rate:

The DFIs have to also cut down their lending rates to levels set by commercial banks and also provide access to their funds as liberally as the banks without, a matching reduction in their own borrowing costs. The DFIs are not habitual of flexible interest rates and they are losing their business from the corporate sector.

(iii) Removal of Concessional Rate Regime:

DFIs’ access to borrowings from the Central Government at a highly concessional rate of interest was withdrawn in a phased manner, since the fiscal deficit which led to the external current account deficit. Since 1991 banking sector reforms have changed the business environment of DFIs.

(iv) Flexible Mode of Fund Generation:

DFIs access to short term sources of funds is quite limited. It is notable that Term deposits, certificates of deposits, term money borrowing inter-corporate deposits and commercial papers all put together are equivalent to their Net Owned Fund. Thus, it is inflexible as well as expensive for DFIs to generate fund in present scenario.

(v) Competitive Environment:

As part of banking reforms, bank was given considerable freedom to extend term loans, project finance etc. Earlier, it was exclusive domain of DFIs. Thus, DFIs are facing stiff competition from bank in disbursement of term capital.

(vi) Adverse Liquidity Position:

The merger in the 1990s of many domestic firms for improving competitiveness and introducing new technologies had also an impact on DFIs adversely, since some of the older firms that could not compete effectively could not stay in the market. Therefore they could not repay their dues on schedule, placing enormous pressure on the DFIs liquidity position.

(vii) Stringent Prudential Norm:

The severe strain on the financial position of the DFIs increased when the institutions were brought under the purview of regulation and supervision of the RBI. The regulation and supervision required the DFIs to comply with internationally recognized stringent prudential norms relating to asset classification, capital adequacy, provisioning and income recognition and standards relating to risk management of their portfolios and market exposures.

(viii) Discriminatory Government Support System:

Due to change in Government policy- there was adverse impact on the performance of DFIs. The NABARD, SIDBI and NHB continued to receive governmental support even after the shift in the policy regime. Remaining DFIs are not under the list of discriminatory government support.

Inspite of above problems, DFIs in general undertook a number of measures to reposition and reorient their operations as warranted by the competitive environment. Accordingly, a number of innovative non-traditional products and services were offered, viz., investment banking, stock broking, custodial services, technical advice, etc. with a view to reduce the risks by exploiting the economies of scale. They also established management teams to handle finances, market products, and reduce delays in decision-making, even though such initiatives entailed additional costs.

Development Financial Institutions (DFIs) in India – List of Major Development Financial Institutions in India

Nature and functions of major developmental financial institutions are given below:

Development Financial Institution # 1. Industrial Finance Corporation of India (IFCI Ltd.):

It is India’s first development finance institution, was set up in 1948 on July 1 under the Industrial Finance Corporation Act, 1948 as a statutory corporation to pioneer industrial credit to medium and large scale industries. The constitution of IFCI was changed in May 1993 from a statutory corporation to a company under the Companies Act, 1956 providing the institutions with greater flexibility to respond to the needs of the rapidly changing financial system as also greater access to the capital markets.

The operations of IFCI’s comprise project finance, financial services and corporate advisory services. It is providing long-term financial support to all the segments of the Indian industry, export promotion, import substitution, entrepreneurship development, pollution control, energy conservation and generation of both direct and indirect employment. It provides custodial and investor services, rating and venture capital services through its subsidiaries/ associate companies.

Development Financial Institution # 2. Industrial Credit and Investment Corporation (ICICI):

It was established in 1955. It facilitated industrial development in line with economic objectives of the time. It evolved several new products to meet the changing needs of the corporate sector. It provided a range of wholesale banking products and services, including project finance, corporate finance, hybrid financial structures, syndication services, treasury-based financial solutions, cash flow based financial products, lease financing, equity financing, risk management tools as well as advisory services.

It also played a facilitating role in consolidation in various sectors of the Indian industry by funding mergers and acquisitions. In the context of the emerging competitive scenario in the financial sector ICICI Ltd. had been integrated into a single full-service banking company as ICICI Bank in May 2002.

Development Financial Institution # 3. Industrial Development Bank of India (IDBI):

It was established on 1st July, 1964 under an act of Parliament as a wholly owned subsidiary of the Reserve Bank of India. In February 1976, its ownership was transferred to the Government of India and it was made as the principal financial institutions for coordinating the activities of institutions engaged in financing, promoting and developing industries in the country. Current shareholding of the Government of India is 58.47%.

Due to change in operating environment, Government of India decided to transform IDBI into a commercial bank. The IDBI (Transfer of Undertaking and Repeal) Act, 2003 was consequently enacted by Parliament in December 2003. The Act provides for repeal of IDBI Act, corporatisation of IDBI and transformation into a commercial bank.

The provisions of the Act have come into force from 2nd July, 2004 in terms of a Government Notification to this effect. The IDBI has already commenced banking business in accordance with the provisions of the new Act in addition to the business being transacted under IDBI Act, 1964.

Development Financial Institution # 4. Industrial Investment Bank of India Ltd. (IIBI):

It was set up in 1971 for rehabilitation of sick industrial companies. It was again reconstituted as industrial reconstruction bank of India in 1985 under the IRBI Act, 1984. With a view to converting the institutions, IRBI was incorporated under the Companies Act, 1956, as Industrial Investment Bank of India Ltd. (IIBI) in March 1997.

It offers a wide range of products and services, including term loan assistance for project finance, short duration non-project backed financing, working capital/other short term loans to companies, equity subscription, asset credit, equipment finance and investment in capital market and money market instrument.

Development Financial Institution # 5. Infrastructure Development Finance Company Ltd. (IDFC):

It was incorporated in 1997. It was conceived as specialized institutions to facilitate the flow of private finance to commercially viable infrastructure projects through innovative products and processes. Telecom, power, roads, ports, railways, urban structure together with food and agriculture-related infrastructure.

Besides, it assists the development of urban water and sanitation sectors. It has also taken new initiatives in the areas of tourism, health care and education. It provides assistance by way of debt and equity support, mezzanine structures and advisory services. It encourages banks to participate in infrastructure projects through take-out financing for a specific term and at a preferred risk profile.

Plan-Wise Assistance Sanctioned and Disbursed to DFIs in India:

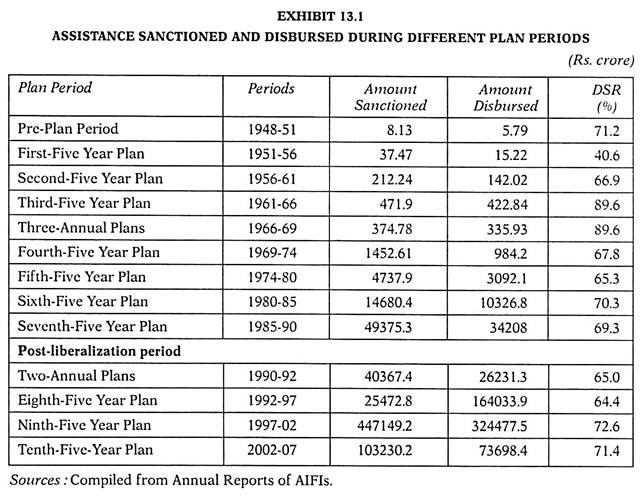

The DFIs in India are playing very important role in providing financial assistance to different sectors of the economy. The volume of sanctions aggregated to Rs.919655.9 crores and that of disbursements to Rs.651109.2 crores during 1948-2006. The disbursement to sanction ratio (DSR) stood at 70.7 per cent for the entire period of study. A plan- wise analysis of financial assistance sanctioned and disbursed by DFIs is presented in exhibit 13.1.

During the First five year plan, the volume assistance by DFIs recorded an increase of almost 4.6 and 2.6 fold respectively in sanctions and disbursements over the Pre-plan period (1948-51). This might be due to remarkable expansion in the operation of IFCI and the setting up of State Level Finance Corporations (SFCs) in some states of the country.

From Rs.37.47 crores, the sanctions increased to Rs.212.24 crores during the second five year plan and disbursement enhanced from Rs.15.22 crores to Rs.142.02 crores as compared to the first plan period. Moreover during the same period disbursement to sanction ratio (DSR) increased from 40.6 to 66.9.

It is important to note that the grant of financial assistance not only gathered momentum during Second plan period, but also it picked up the pace. It may be due to expansion in scope and coverage DFIs activities. For instance IFCI extended its assistance to hotels, introduced underwriting facility by providing guarantees for differed payments and foreign currency loans.

Similarly with foreign exchange crisis in 1957-58, foreign currency loans provided by ICICI became the main source of payment for imported equipment’s. Establishment of Refinance Corporation for Industry Ltd. (RCI) in 1958 is another significant cause for growth of assistance by DFIs.

During the Third Five Year plan, the amount of assistance by all India financial institutions doubled in terms of sanctions and more than three times in terms of disbursements in comparison to the second plan. Three Annual Plans (1966-69) showed the sanctions and disbursements of Rs.374.78 crores and Rs.335.93 crores respectively, which is less than the third five year plan. During 4th plan total amount disbursed was Rs.984 crore against the sanctioned amount of Rs.1453 crore.

The financial assistance extended by the AIFIs became quite encouraging during Fifth- five year plan (1974-80) as the total sanctions amounted to Rs.4737.9 crores and disbursements to Rs.3092.1 crores with 65.3% utilization rate.

During the sixth and seventh five year plan (1980-90) assistance provided by DFIs recorded an increase of more than three times in comparison to their respective previous plans. While the aggregate of sanctions arrived at Rs.14680 crores at the end of sixth five year plan, it crossed Rs.49375 crores during the seventh five year plan.

However, the disbursement rate remained around 70% in both the plan periods. There was a plan – holiday for two years and two annual plans were introduced during 1990-92. During this period the sanctions and disbursement too remained higher than the reasonable utilization rate of 65%.

The Eighth five year plan (1992-97) showed an increasing trend, with the sanctions and disbursement reached at a considerable height of Rs.25472.8 crores and Rs.164033.9 crores respectively. It is a record, which is six times higher than the previous plan period.

During the Ninth Five year plan period (1997-02) the financial assistance of AIFIs to industrial sector was twice over the eighth five year plan. While sanctioned amount reached at Rs.447149.2 crores, the disbursement at Rs.324477.5 crores. Further from 64.4%, the disbursement sanction ratio rose to 72.6% during this plan period.

A significant acceleration in overall growth momentum across quarters was the hall mark of India’s economic resurgence during the Tenth five year plan (2002-07). Several policy directives for Development Financial Institutions (DFIs) were intended to facilitate the process of their transition to becoming banks for their sustained viability.

These included measures aimed at financial restructuring provision of regulatory relaxation for restructured investments of creditor’s banks as well as providing Government support and transfer of stressed assets of DFIs to asset reconstruction companies for managing their NPA levels.

Development Financial Institutions (DFIs) in India – Problems of Development Financial Institutions in India

Due to changed environment since 1991, the Development Financial Institutions (DFIs) were forced to reorient their lending strategies and activities towards realization of commercial viability and competitive efficiency.

Some of the major problems faced by DFIs in post reforms era are given below:

(i) Deregulated Market Environment:

Before the 1991 DFIs were operating in a protected market with the administered rate of interest on their loans, but after 1991, they have been forced to enter into the deregulated market environment. Now Market related rate of interest is the operational base for the DFIs.

(ii) Crisis of Creditability:

The DFIs is facing the crisis of creditability in the wake of economic liberalisation, globalization and changing business environment. The NPA of these DFIs is increasing and is adversely affecting their profitability.

(iii) Growing Competition in Financial Market:

The free market economy during the 1990’s also witnessed the keen competition for DFIs from the commercial banks, NBFCs and others. At present, the commercial banks are financing both short- term and long-term finance to the corporate sector so it has created a problem for the DFIs to increase and diversify their client base.

(iv) Easy Access to Capital Market:

The liberalisation and globalization process started in the Indian economy has revived the capital market and opened the door for the corporate sector to raise their resources directly from the market. The corporate sector is not interested in the financial assistance of DFIs.

(v) Competitive Interest Rates:

The DFIs have already entered into the capital market to raise their resources. These resources are generally raised with the market rate of interest that is higher than the previously administered rate of interest, so it results in an increase of their cost of borrowings. The DFIs are also being forced to reduce their lending rates due to competition.

(vi) Accountability to Stakeholders:

The increasing access of the DFIs to the Indian capital market has created a new type of problem for them with which they were not acquainted earlier. Thus, the management of most of the DFIs in this competitive economy is always on their toes because of this increasing accountability from the public and more specifically from their private shareholders. Now DFIs are required to accountable to their stakeholders for transparency and reporting.

(vii) Universal Banking System:

The concept of universal banking, which has been recommended by the Khan Committee, has put the DFIs into a fix. Now the concept of development banking is slowly going out of fashion. They have now converted into an NBFC or a universal bank.

Development Financial Institutions have been assigned a crucial role in the development of the country. They have played their role in the promotion of industrial units and entrepreneurial environment. However, due to change in economic environment since 1991 continuous dilution is occurred in their working. New economic policy of the government since 1991 has made some of the development financial institutions irrelevant in the present context of development.

Structural changes have been made in the role and objectives of some of the development financial institutions. Even today some of the financial institutions are still playing their role in proper perspective.