After reading this article you will learn about the Growth and Development of New Issue Market in India.

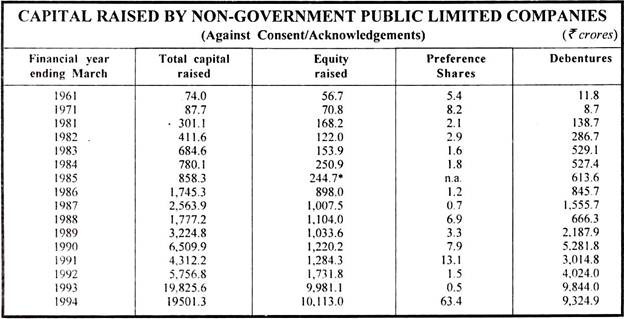

The new issue market in India is not fully developed as compared to other advanced countries like U.S.A., U.K. and Germany. But there has been tremendous growth in the sphere of new issue activity in India in the 1980s and 1990s. Table given below shows the trend in the amount of capital raised by non-government public limited companies on the new issues market in India.

The total amount of capital raised during 1961 was only Rs. 74.0 crores which increased to Rs. 87.7 crores during 1971 and to Rs. 301.1 crore during 1981. The amount of capital annually raised continued its increasing trend upto the year 1987. Then there was a temporary decline in the volume of capital raised during 1988.

The new issue (primary capital) market received an encouragement in the year 1976 in the form of a number of issues raised for the purpose of dilution of foreign equity holding under FERA. Subsequently the liberalisation of industrial and new capital issue policies in 1984-85 gave a real shot in the arm to the securities market.

Further the relaxation of norms relating to foreign investments and incentives provided by the government helped to sustain the impetus of growth in the market.

In the recent years, a number of new instruments such as PCDs, FCDs, PSBs and CCPs, etc. have been introduced in the securities market resulting into and upsurge in the new issue market. The securities scam during 1991 caused a temporary setback to the growing new issue market in India.

But the new economic policy of the Narasimha Rao government and the setting up of Securities and Exchange Board of India to promote orderly and healthy growth of securities market providing investor protection has to be regarded as one of the most important developments on the securities market of India in recent years.

As a result of these developments, the institutional investors and the mutual funds have gained importance, both in the primary as well as the secondary market.

Another recent development that took place in the market is the setting up of the Over-the Counter Exchange of Indian (OTCEI) which began its operations in 1992 permitting smaller companies to raise capital. During the year 1993, there has been a tremendous growth in the new issue activity resulting into Rs. 19,825 crores of capital raised by non-government public limited companies in India.

In 1994-95 and 1995-96, the new issues market remained subdued due to number of reasons, including political uncertainty.

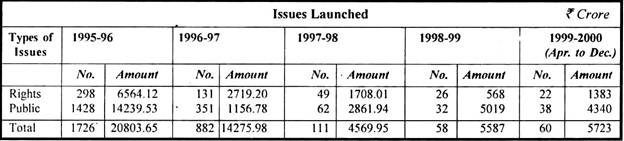

Despite the maintenance of pace of primary market reforms aimed at providing greater flexibility to the issuers and strengthening the criteria for the entry of first time issuers to the primary market, the downward trend in primary markets continued in the year 1996-97. The primary market was characterised by a reduced number of issues and lower amounts raised.

The capital raised through new issues during the period of April to December 1996, was down to Rs. 10,369.21 crore from Rs. 14,151.1 crore raised in the corresponding period of the previous year. In a similar trend, the number of issues fell from 1,132 in 1995 to 793 in 1996.

However, the average size of capital issues rose from 12.5 crore to Rs. 13.07 crore the main reasons behind this downtrend in the primary market issuance include the strict eligibility criteria introduced by SEBI and the general downtrend in the secondary market.

The down trend in the capital market continued in 1997-98 also despite the fact that SEBI took a number of measures designed to boost investor confidence. The primary market remained depressed with substantial decline in number of issues and amount raised.

Capital raised through new issues during 1997- 98 registered a steep decline to Rs. 4,570 crore from Rs. 14,276 crore in 1996-97. The number of issues also fell substantially to 111 in 1997-98 from 882 in 1996-97 and 1726 in 1995-96. The table given below depicts the issues launched from 1995-96 to 1999-2000.

During April-December, 1999, a sum of Rs. 5,723 crore was raised through public and rights issues from the primary market. This represented an increase of 46 per cent over the amount raised in the same period of the previous year. During this period, the proportion of resources raised through public issues declined to 75.8 percent from 89.6 per cent in the corresponding period of 1998-99.

The average issue size, however, remained unchanged at about Rs. 95 crore during April-December, 1999. The share of initial public offers (IPOs) increased from 7.8 percent to 31.9 percent, indicating improvement in the prospects of new/unlisted companies for resources mobilisation from primary market. Most of the resources mobilisation from primary market in 1999-2000 has been by the private sector.

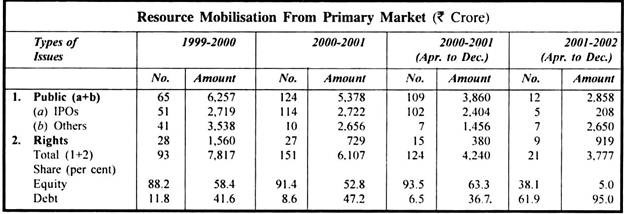

A number of initiatives were taken of further rationalise the Initial Public Offer (IPO) norms during the year 2000-2001.Despite these initiatives, the year witnessed a noticeable decline in resource mobilisation from the primary market.

During April-December, 2000, resource mobilisation through public and rights issues registered a significant decline by 25.9 per cent to Rs. 4,240 crore through 124 issues from Rs. 5,723 crore through 60 issues during the corresponding period of 1999-2000. However, resource mobilisation from public issues accounted for 91 percent of the total resource mobilisation from primary market as against 75.8 per cent last year.

Resource mobilisation through public and rights issues during the first nine months of 2001-2002 amounted to Rs. 3,777 crore, which constituted 89.1 per cent of the relatively modest amount of Rs. 4,240 crore raised during the corresponding period of the previous financial year.

Resource mobilisation through IPOs accounted for only 5.5 per cent of the total resource mobilisation during April-December 2001 compared to 56.7 per cent in the corresponding last year.

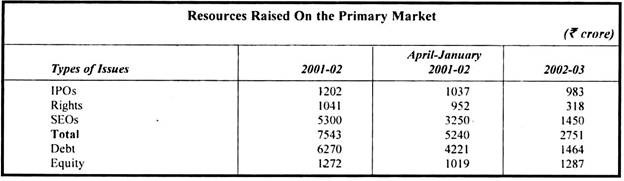

Table given below summarises the outcomes on the primary market in 2001-02 and in the first seven month of the year 2002-03. Public offerings are classified into Initial Public Offerings (IPOs), where a company goes public for the first time, Rights Issues, where a company sells additional shares to existing shareholders, and Seasoned Equity Offerings (SEOs), where a listed company sells shares to the public.

It is revealed that primary market activity in the first seven months of the year has been fairly subdued, compared with the low levels experienced in the previous year. There is a substantial scale of securities issuance taking place through the private placement route.

The private placement route has become a mechanism where securities can be placed with a few wholesale buyers of securities, without incurring the overheads of the public issue.

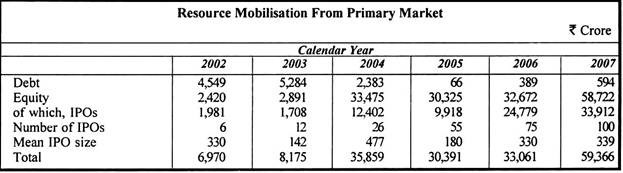

The volume of public issues rose by roughly five times to a level of Rs. 35,859 crore in 2004. Out of which equity issuance amounted to Rs. 33,475 crore. It was the highest ever level of public equity issuance in India’s history, over two times higher than the previous peak of 1995. The public debt market continued to remain at low levels. The means IPO size rose from Rs. 31 crore in 2001 to Rs. 870 crore in 2004.

A major development in the Indian primary market has been the introduction of “Screen based book building”, where securities are auctioned through an anonymous screen based system, and the price at which securities are sold is discovered on the screen.

This eliminates the delays, risks and implementation difficulties associated with traditional procedures. Resource moblisation through book building rose steadily from 25 percent of public equity offerings in 2001 to 53 percent in 2002, 64 percent in 2003 and 99 percent in 2004.

In 2005, Rs. 30,325 crore of resources were raised on the primary market of which Rs. 9,918 crore were made up by 55 companies which were listed for the first time (IPOs). The primary issuance of debt securities fell to a low of Rs. 66 crore in 2005 which reflects the far reaching difficulties of the debt market.

The primary capital market has remained upbeat during the year 2006 and 2007. The aggregate resource mobilisation in the market especially through IPOs and private placement was much higher in calendar year 2006 than during the previous year. The total equity issues mobilised in 2007 was Rs. 58,722 crore of which Rs. 33,912 crore was accounted for by the Initial Public Offerings (IPOs).

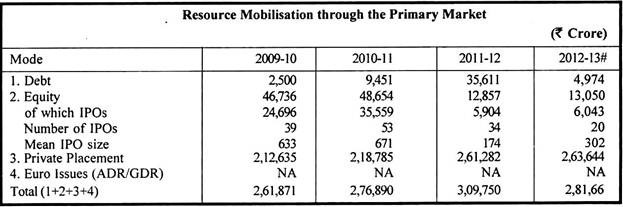

During financial year 2011-12 (up to 31 December 2011) resource mobilsation through the primary market witnessed a sharp decline over the year 2010-11 as shown in table given, below. The cumulative amount mobilised as on 31st December 2011 through equity public issues stood at Rs. 9,683 crore as compared to Rs. 48,654 crore in 2010-11.

The mean IPO size for year 2011-12 was Rs. 168 crore as compared to Rs. 671 crore in 2010-11. Further, only Rs. 4,791 crore was mobilised through debit issue as compared to Rs. 9,451 crore in 2010-11.

During financial year 2012-13 (up to 31 Dec., 2012) resource mobilization through primary market (equity issue) witnessed an upward movement. The cumulative amount mobilised as on 31 Dec. 2012 through equity public issues stood at Rs. 13,050 crore.

During 2012-13, 20 new companies [initial public offers (IPOs)] with resource mobilisation amounting to Rs. 6,043 crore were listed at the National Stock Exchange (NSE) and Bombay Stock Exchange) (BSE) with mean IPO size of Rs. 302 crore. However, in the public issue of corporate debt category, Rs. 4,974 crore was mobilised through debt issue in 2012-13 compared to Rs. 35,611 crore in 2011-12.