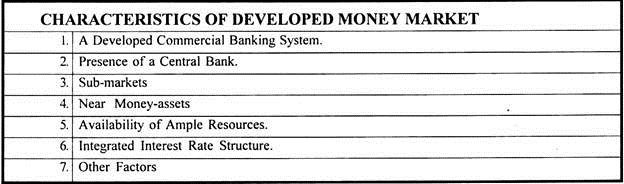

This article throws light upon the top seven characteristics of a developed money market. The characteristics are: 1. A Developed Commercial Banking System 2. Presence of a Central Bank 3. Sub-markets 4. Near Money-assets 5. Availability of Ample Resources 6. Integrated Interest-rate Structure 7. Other Factors.

Characteristic # 1. A Developed Commercial Banking System:

For a developed money market not only the banking system should be well-developed and organised, but the public should also have banking habits. These two things are complementary. The commercial banks are the most important suppliers of short term funds.

So their policy pertaining to loans, advances and investment would have its impact on the entire money market. S.N. Sen in his book ‘Central Banking in Undeveloped Money Market’ rightly calls them “the nucleolus of the whole money market”.

Thus for any developed money market, the foremost feature is well coordinated and well- integrated money market. Further, the commercial banks are intimately related to the central bank, so they provide a better link between the central bank and other components of money supply and borrowers, brokers, discount houses and acceptance houses.

In India we have organised and developed commercial banks but their activities are confined to urban areas only. As there are a large number of financial institutions working in their own ways, the interest rates charged differ from institutions to institution.

In India, there is an unorganised money market because of indigenous bankers, say money lenders in rural areas and Marwari and Multani in urban areas. Thus it is clear that money market is not well-organised or integrated because of less developed commercial banking system.

Characteristic # 2. Presence of a Central Bank:

In a developed money market, there is always an apex central bank. It means the central bank is both dejure and defcto the head of money and banking authority. A central bank is the lender of the last report. It means other member banks can borrow from the central bank during emergency. It is because of this reason that it is called guardian of the money market.

According to Prof. Sen, “It provides the ultimate liquidity without which a money market cannot function efficiently.” It is a very powerful bank to control money supply as per needs of the economy. The central bank is the reservoir of all types of funds short, medium and long term. It can definitely act in a more professional manner as compared to the government.

The central bank has a wider look to understand the economy and judging its monetary requirements. As per the needs of the economy, it can follow its monetary policy to suit the pre-designed objectives.

It is correctly stated that a strong central bank is as necessary a characteristic of the money market as the heart in the human body. Thus it is clear that a powerful central bank controls, regulates and guides the money market.

On the other hand, if the central bank cannot influence the money market, it means the money market is not developed. In India we find that the presence of indigenous bankers obstructs the adoption of an effective monetary policy or controls.

We known that for a well-developed money market the two conditions discussed above are necessary but not sufficient. Prof. S.N. Sen has pointed out that in Australia, both these conditions exist but Australian money market is not well-developed. It means besides these two characteristics, there are some other characteristics which are as under.

Characteristic # 3. Sub-markets:

A developed money market has the most developed and sensitive sub markets. The money market is a group of various sub-markets, each dealing in loans of various maturities. There will be markets for call loans, the collateral loans, acceptances, foreign exchange, bills of exchange and commercial and treasury bills.

If these sub-markets are non-existent or there is a less responsiveness to small changes in the interest an discount rates, it means under no circumstances a money market will be developed. These sub- markets are found in the London Money Market and the New York Money Market.

There must be a large number of dealers and bidders in different sub-markets. According to Professor S.N. Sen, “The larger the number of sub-markets, the broader and more developed will be the structure of the money market.” But besides it, the sub-markets must be integrated with each other.

It means that if the interest rate is high in one market, the borrowers will move to sub-markets where the interest rate is low. The lenders in this case will move to those sub-markets which can provide them higher interest rate. Thus it will facilitate the mobilisation of resources from one market to another.

In under-developed countries like India various sub-markets are either non-existent or not integrated. There is a lack of co-ordination and integration among different sub-markets. The interest rates in different sub- markets in India vary considerably.

The undeveloped money market does not possess all the important and essential sub-markets, particularly the bill market. However, in recent years greater integration in various markets has been observed.

Characteristic # 4. Near Money-assets:

In a developed money market, there is a large quantity and variety of financial instruments such as bills of exchange, treasury bills, promissory notes, short dated government bonds, etc. If the number of near money assets is more, the money market will be more developed.

The bills are drawn in a standard form and are accepted and discounted. The money market should have the regular supply of these assets. There should also be a large number of people desirous of buying and selling these credit instruments.

If the near-money assets or credit instruments are not available in sufficient number, the money market cannot be developed. It is the dealers in near money assets who actually infuse life into the money market.

Characteristic # 5. Availability of Ample Resources:

Another feature of a developed money market is the availability of ample resources. A developed money market has easy access to financial resources from both within and outside the country. The London Money Market attracts adequate funds from both sources, i.e., internal and external.

People in the foreign countries think it safe and profitable to invest money in highly liquid assets in the developed countries. It is the availability of cheap facilities for the remittance of funds from one place to another which has resulted in raising the resources. Availability of ample funds is essential for the smooth and efficient working of the money market.

So all the money markets aim at raising their resources. Underdeveloped money markets do not attract foreign funds because of political instability and absence of stable exchange rates. A pertinent point is that it is not a pre-requisite of a developed money market. A money market may be developed even if it cannot attract short term funds from foreign countries.

Characteristic # 6. Integrated Interest-rate Structure:

Another feature of a developed money market is that it has an integrated interest rate structure. The interest rates which prevail in different sub-markets are integrated with each other.

To clarify it, a change in the bank rate results in equi-proportionate change in the interest rates which exist in cases of different sub-markets. It is due to this structure of interest rates that the central bank can exercise control on the functioning of the money market.

Characteristic # 7. Other Factors:

There are many other factors which are responsible for the money market to be a developed one. The contributory factors are volume of international trade, bills of exchange, great industrial development, stable political condition, economic crisis, boom, depression, war, absence of discrimination, etc.

Thus from the above discussion it is clear that keeping in view the characteristics of a developed money market, it is only the London Money Market which can be called as the most developed money market.

Skyes in his book ‘The London Money Market’ compares it to a cart wheel, “whose axle is the bank of England and the hub of the wheel is represented by the joint stock banks, the spokes by the other types of banks and the rim by the discount houses”.

The central bank must keep close relationship with other parts of money market for an efficient working. Any characteristics missing from the above would be regarded as symbol of a less developed money market. Once these characteristics are found absent in toto, we can say that money market is undeveloped.

The features of an undeveloped money market thence can be stated as an unorganised commercial banking system, weak central bank, lack of credit instruments, non-existence of specialised sub- markets, diversified interest rates, etc. An undeveloped money market is a stumbling block in the way of monetary authority.