The ratio analysis is made under six broad categories as follows: 1. Liquidity Ratios 2. Leverage Ratios 3. Asset Management Ratios 4. Profitability Ratios 5. Operating Ratios 6. Market based Ratios.

Category # 1. Liquidity Ratios:

The liquidity ratios measure the liquidity of the firm and its ability to meet its maturing short-term obligations. Liquidity is defined as the ability to realize value in money, the most liquid of assets. It refers to the ability to pay in cash, the obligations that are due. The corporate liquidity has two dimensions viz., quantitative and qualitative concepts.

The quantitative aspect includes the quantum, structure and utilization of liquid assets and in the qualitative aspect, it is the ability to meet all present and potential demands on cash from any source in a manner that minimizes cost and maximizes the value of the firm.

Thus, corporate liquidity is a vital factor in business. Excess liquidity, though a guarantor of solvency would reflect lower profitability, deterioration in managerial efficiency, increased speculation and unjustified expansion, extension of too liberal credit and dividend policies. Too little liquidity then may lead to frustration, business objections, reduced rate of return, missing of profitable business opportunities and weakening of morale.

The important ratios in measuring short-term solvency are:

a. Current ratio,

b. Quick ratio,

c. Absolute liquid ratio, and

d. Defensive-Interval ratio.

a. Current Ratio:

This ratio measures the solvency of the company in the short-term. Current assets are those assets which can be converted into cash within a year. Current liabilities and provisions are those liabilities that are payable within a year.

A current ratio of 2 : 1 indicates a highly solvent position. A current ratio of 1.33 : 1 is considered by banks as the minimum acceptable level for providing working capital finance. The constituents of the current assets are as important as the current assets themselves for evaluation of a company’s solvency position.

A very high current ratio will have adverse impact on the profitability of the organization. A high current ratio may be due to the piling up of inventory, inefficiency in collection of debtors, high balances in cash and bank accounts without proper investment etc.

b. Quick/Liquid/Acid Test Ratio:

Quick ratio is used as a measure of the company’s ability to meet its current obligations. Since bank overdraft is secured by the inventories, the other current assets must be sufficient to meet other current liabilities.

A quick ratio of 1 : 1 indicates highly solvent position. This ratio serves as a supplement to the-current ratio in analyzing liquidity.

Problem 1:

If the Current ratio and Liquid ratio of a firm are 2.2 and 0.8 respectively and its Current liabilities is Rs.10 lakhs. Calculate the value of stock held by the firm.

Solution:

∴ CA = 2.2 x Rs. 10 lakhs = Rs.22 lakhs

Rs. 22 lakhs – Stock = 0.8 x Rs. 10 lakhs

Rs. 22 lakhs – Stock = Rs. 8 lakh

Stock = Rs. 22 lakhs – Rs. 8 lakhs = Rs. 14 lakhs

c. Absolute Liquid/Super Quick Ratio:

It is the ratio of absolute liquid assets to quick liabilities. However, for calculation purposes, it is taken as ratio of absolute liquid assets to current liabilities. Absolute liquid assets include cash in hand, cash at bank and short-term or temporary investments.

Absolute Liquid Assets = Cash in hand + Cash at bank + Short-term investments

The ideal absolute liquid ratio is taken as 1 : 2.

d. Defensive-Interval Ratio:

A firm’s ability to meet current financial obligation is dependent on the ability to generate daily cash requirements of the firm. The defensive-internal ratio is a measure of liquidity by comparing the liquid assets against projected daily cash requirement.

Where, Projected Daily Cash Requirement = Projected cash operating expenditure/No. of days in a year (365)

Liquid Assets = Cash + Marketable Securities + Debtors

Projected cash operating expenditure includes all estimated cash expenses excluding depreciation. The higher the ratio, more safety of short-term liquidity.

Problem 2:

The projected cash operating expenditure of a company for the next year 2015-16 is Rs.1,82,500. It has quick current assets amounting to 140,000. You are required to determine the defensive-interval ratio and comment.

Solution:

Projected daily cash requirement = Rs. 1,82,500/365 days = Rs. 500

Analysis:

A higher ratio indicates the better liquidity position to meet the daily operational expenses. In this case, the quick current assets are sufficient to meet operating expenses for 80 days.

Category # 2. Leverage Ratios:

The long-term financial stability of the firm may be considered as dependent upon its ability to meet all its liabilities, including those not currently payable.

The ratios which are important in measuring the financial leverage of the company is as follows:

a. Debt-Equity Ratio:

This ratio indicates the relationship between loan funds and net worth of the company, which is known as ‘gearing’. If the proportion of debt to equity is low, a company is said to be low-geared, and vice versa. A debt-equity ratio of 2 :1 is the norm accepted by financial institutions for financing of projects. Higher debt-equity ratio of 3 :1 may be permitted for highly capital intensive industries like petrochemicals, fertilizers, power etc. The higher the gearing, the more volatile the return to the shareholders.

The use of debt capital has direct implications for the profit accruing to the ordinary shareholders, and expansion is often financed in this manner with the objective of increasing the shareholders’ rate of return. This objective is achieved only if the rate earned on the additional funds raised exceeds that payable to the providers of the loan. The shareholders of a highly geared company reap disproportionate benefits when earnings before interest and tax increase.

This is because interest payable on a large proportion of total finance remains unchanged. The converse is also true, and a highly geared company is likely to find itself in severe financial difficulties if it suffers a succession of trading losses. It is not possible to specify an optimal level of gearing for companies but, as a general rule, gearing should be low in those industries where demand is volatile and profits are subject to fluctuation.

A debt-equity ratio which shows a declining trend over the years is usually taken as a positive sign reflecting on increasing cash accrual and debt repayment. In fact, one of the indicators of a unit turning sick is rising debt-equity ratio. Usually in calculating the ratio, the preference share capital is excluded from debt, but if the ratio is to show effect of use of fixed interest sources on earnings available to the shareholders then it is to be included. On the other hand, if the ratio is to examine financial solvency, then preference shares shall form part of the capital.

Problem 3:

Consider the following information relating to Shiva Ltd.: Networth Rs.250lakhs; Total assets Rs.600 lakhs; Long-term debt Rs.200 lakhs; Current liabilities Rs.150 lakhs. Calculate the debt-equity ratio of the company.

Solution:

b. Shareholders Equity Ratio:

This ratio is calculated as follows:

It is assumed that larger the proportion of the shareholders’ equity, the stronger is the financial position of the firm. This ratio will supplement the debt-equity ratio. In this ratio, the relationship is established between the shareholders’ funds and the total assets. Shareholders funds represent both equity and preference capital plus reserves and surplus less accumulated losses.

A reduction in shareholders’ equity signaling the over dependence on outside sources for long-term financial needs and this carries the risk of higher levels of gearing. This ratio indicates the degree to which unsecured creditors are protected against loss in the event of liquidation.

c. Long-Term Debt to Shareholders Net Worth Ratio:

This ratio is calculated as follows:

The ratio compares long-term debt to the net worth of the firm i.e., the capital and free reserves less intangible assets. This ratio is finer than the debt-equity ratio and includes capital which is invested in fictitious assets like deferred expenditure and carried forward losses. This ratio would be of more interest to the contributories of long-term finance to the firm, as the ratio gives a factual idea of the assets available to meet the long-term liabilities.

d. Capital Gearing Ratio:

It is the proportion of fixed interest bearing funds to equity shareholders funds:

The fixed interest bearing funds include debentures, long-term loans and preference share capital. The equity shareholders funds include equity share capital, reserves and surplus. Capital gearing ratio indicates the degree of vulnerability of earnings available for equity shareholders. This ratio signals the firm which is operating on trading on equity. It also indicates the changes in benefits accruing to equity shareholders by changing the levels of fixed interest bearing funds in the organization.

e. Fixed Assets to Long-Term Funds Ratio:

The fixed assets is shown as a proportion to long-term funds as follows:

This ratio indicates the proportion of long-term funds deployed in fixed assets. Fixed assets represents the gross fixed assets minus depreciation provided on this till the date of calculation. Long-term funds include share capital, reserves and surplus and long-term loans. The higher the ratio indicates the safer the funds available in case of liquidation. It also indicates the proportion of long-term funds that is invested in working capital.

f. Proprietary Ratio:

It express the relationship between shareholders’ net worth and total assets.

Net worth = Equity share capital + Preference share capital + Reserves – Fictitious assets

Total assets = Fixed assets + Current assets – Fictitious assets

Reserves earmarked specifically for a particular purpose should not be included in calculation of net worth. A high proprietary ratio is indicative of strong financial position of the business. The higher the ratio, the better it is.

g. Interest Cover:

The interest coverage ratio shows how many times interest charges are covered by funds that are available for payment of interest.

A very high ratio indicates that the firm is conservative in using debt and a very low ratio indicates excessive use of debt. Interest cover indicates how many times a company can cover its current interest payments out of current profits. It gives an indication of problem in servicing the debt. An interest cover of more than 7 times is regarded as safe and more than 3 times is desirable. An interest cover of 2 times is considered reasonable by financial institutions.

Problem 4:

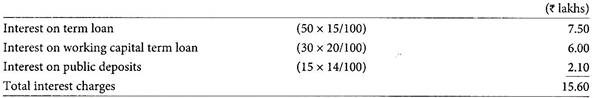

The company is presently working with EBIT of Rs.35 lakhs. Its outstanding current borrowings are:

15% Term loan = Rs. 50 lakhs

Working capital term loan from bank @ 20% = Rs. 30 lakhs

Public deposits accepted @ 14% = Rs. 15 lakhs

Calculate Interest coverage ratio.

Solution:

Interest coverage ratio= EBIT/Interest charges = 35/15.60 = 2.24

h. Debt Service Coverage Ratio (DSCR):

This ratio is the key indicator to the lender to assess the extent of ability of the borrower to service the loan in regard to timely payment of interest and repayment of loan instalment. It indicates whether the business is earning sufficient profits to pay not only the interest charges, but also the instalments due of the principal amount.

The ratio is calculated as follows:

A ratio of 2 is considered satisfactory by the financial institutions. The greater debt service coverage ratio indicates the better debt servicing capacity of the organization. By means of cash flow projection, the borrower should work DSCR for the entire duration of the loan. This will enable the lender to take correct view of the borrower’s repayment capacity.

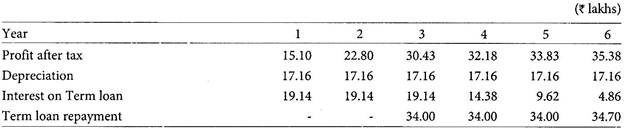

Problem 5:

The projected 6 years figures of a project is given below:

Calculate the Debt service coverage ratio of the project.

Solution:

i. Dividend Cover:

This ratio indicates the number of times the dividends are covered by net profit. This highlights the amount retained by a company for financing of future operations.

(a) Preference Dividend Cover:

(b) Equity Dividend Cover:

Category # 3. Asset Management Ratios:

Asset management ratios measure how effectively the firm employs its resources. These ratios are also called ‘activity or turnover ratios’ which involve comparison between the level of sales and investment in various accounts – inventories, debtors, fixed assets, etc. Asset management ratios are used to measure the speed with which various accounts are converted into sales or cash.

The following asset management ratios are calculated for analysis:

a. Inventory Turnover Ratio:

A considerable amount of a company’s capital maybe tied up in the financing of raw materials, work-in-progress and finished goods. It is important to ensure that the level of stocks is kept as low as possible, consistent with the need to fulfil customers’ orders in time.

Average Inventory = (Opening stock + Closing stock)/2

The higher the stock turnover rate or the lower the stock turnover period the better, although the ratios will vary between companies. For example, the stock turnover rate in a food retailing company must be higher than the rate in a manufacturing concern. The inventory turnover ratio measures how many times a company’s inventory has been sold during the year.

If the inventory turnover ratio has decreased from past, it means that either inventory is growing or sales are dropping. In addition to that, if a firm has a turnover that is slower than for its industry, then there may be obsolete goods on hand, or inventory stocks may be high. Low inventory turnover has impact on the liquidity of the business.

b. Inventory Ratio:

The level of inventory in a company may be assessed by the use of the inventory ratio, which measures how much has been tied up in inventory.

c. Debtors Turnover Ratio:

Debtors turnover, which measures whether the amount of resources tied up in debtors is reasonable and whether the company has been efficient in converting debtors into cash.

The formula is:

The higher the ratio, the better the position.

d. Debtors Collection Period:

Average debtors collection period measures how long it take to collect amounts from debtors.

The formula is:

The actual collection period can be compared with the stated credit terms of the company. If it is longer than those terms, then this indicates inefficiency in collecting debts.

Problem 6:

The annual credit sales of a firm amounts to Rs.12,80,000 and the debtors amount to Rs.1,60,000. Calculate the debtors’ turnover and average collection period respectively.

Solution:

e. Bad Debts to Sales Ratio:

It measures the proportion of bad debts to sales:

This ratio indicates the efficiency of the credit control procedures of the company. Its level will depend on the type of business. Mail order companies have to accept a fairly high level of bad debts, while retailing organizations should maintain very low levels of ratio. The actual ratio is compared with the target or norm to decide whether it is acceptable or not.

f. Creditors Turnover Ratio:

The term creditors include trade creditors and bills payable.

g. Creditors Payment Period:

The measurement of the creditor turnover period shows the average time taken to pay for goods and services purchased by the company.

The formula is:

In general the longer the credit period achieved the better, because delays in payment mean that the operations of the company are being financed interest free by suppliers of materials. But there will be a point beyond which delays in payment will damage relationships with suppliers which, if they are operating in a seller’s market, may harm the company. If too long a period is taken to pay creditors, the credit rating of the company may suffer, thereby making it more difficult to obtain supplies in the future.

h. Fixed Assets Turnover Ratio:

This ratio will be analyzed further with ratios for each main category of asset. This is a difficult set of ratios to interpret as asset values are based on historic cost. An increase in the fixed asset figure may result from the replacement of an asset at an increased price or the purchase of an additional asset intended to increase production capacity.

The ratio of the accumulated depreciation provision to the total of fixed assets at cost might be used as an indicator of the average age of the assets, particularly when depreciation rates are noted in the accounts. The ratio of sales value per square foot of floor space occupied is particularly significant for trading concerns, such as a wholesale warehouse or a departmental store.

i. Total Assets Turnover Ratio:

This ratio indicates the number of times total assets are being turned over in a year.

The higher the ratio indicates overtrading of total assets, while a low ratio indicates idle capacity.

Problem 7:

Reliance Ltd. has an ROA of 10% and a profit margin of 2%. Calculate the company’s total asset turnover.

Solution:

ROA = 10%

Profit margin = 2%

j. Working Capital Turnover Ratio:

This ratio is calculated as follows:

This ratio indicates the extent of working capital turned over in achieving sales of the firm.

k. Sales to Capital Employed Ratio:

This ratio is ascertained by dividing sales with capital employed.

This ratio indicates, efficiency in utilization of capital employed in generating revenue.

Problem 8:

The Board of Directors of Moulin Ltd. is dissatisfied with the last year’s ROE of 15%. If the net profit margin and asset turnover ratio remain unchanged at 10% and 1.25 respectively, by how much the asset to equity increase to achieve 20% of ROE?

Solution:

ROE = Net profit margin x Asset turnover ratio x Asset to Equity ratio

0.15 = 0.10 x 1.25 x Asset to Equity ratio

Asset to Equity ratio = 0.15/0.125 = 1.20

Again 0.20 = Net profit margin x Asset turnover ratio x Asset to Equity ratio

Asset to Equity ratio = 0.20/(0.10x 1.25) = 1.60

Increase in Asset to Equity ratio = 1.60 – 1.20 = 0.40

Category # 4. Profitability Ratios:

The purpose of study and analysis of profitability ratios are to help assessing the adequacy of profits earned by the company and also to discover whether profitability is increasing or declining. The profitability of the firm is the net result of a large number of policies and decisions. The profitability ratios show the combined effects of liquidity, asset management and debt management on operating results. Profitability ratios are measured with reference to sales, capital employed, total assets employed, shareholders funds etc.

The major profitability rates are as follows:

a. Gross Profit Margin:

The gross profit margin is calculated as follows:

or

The ratio measures the gross profit margin on the total net sales made by the company. The gross profit represents the excess of sales proceeds during the period under observation over their cost, before taking into account administration, selling and distribution and financing charges. The ratio measures the efficiency of the company’s operations and this can also be compared with the previous years results to ascertain the efficiency.

When everything is normal, the gross profit margin should remain unchanged, irrespective of the level of production and sales, since it is based on the assumption that all costs deducted when computing gross profit which are directly variable with sales.

A stable gross profit margin is, therefore, the norm and any variation from it call for careful investigations, which may be caused due to the following reasons:

I. Price Cuts:

A company need to reduce its selling price to achieve the desired increase in sales.

II. Cost Increases:

The price which a company pays its suppliers during period of inflation, is likely to rise and this reduces the gross profit margin unless an appropriate adjustment is made to the selling price.

III. Change in Mix:

A change in the range or mix of products sold causes the overall gross profit margin, assuming individual product lines earn different gross profit percentages.

IV. Valuation of Stocks:

If closing stocks are undervalued, cost of goods sold is inflated and profit understated. An incorrect valuation may be the result of an error during stock taking or it may be due to fraud.

The gross profit margin may be compared with that of competitors in the industry to assess the operational performance relative to the other players in the industry.

b. Net Profit Margin:

The ratio is calculated as follows:

The ratio is designed to focus attention on the net profit margin arising from business operations before interest and tax is deducted. The convention is to express profit after tax and interest as a percentage of sales. A drawback is that the percentage which results varies depending on the sources employed to finance business activity; interest is charged above the line while dividends are deducted below the line.

It is for this reason that net profit i.e., earnings before interest and tax (EBIT) is used. This ratio reflects net profit margin on the total sales after deducting all expenses but before deducting interest and taxation. This ratio measures the efficiency of operation of the company. The net profit is arrived at from gross profit after deducting administration, selling and distribution expenses. The non-operating incomes and expenses are ignored in computation of net profit before tax, depreciation and interest.

This ratio could be compared with that of the previous years and with that of competitors to determine the trend in net profit margins of the company and its performance in the industry. This measure will depict the correct trend of performance where there are erratic fluctuations in the tax provisions from year to year.

It is to be observed that majority of the costs debited to the profit and loss account are fixed in nature and any increase in sales will cause the cost per unit to decline because of the spread of same fixed cost over the increased number of units sold.

Problem 9:

Durga Farm Supplies has an 8% return on total assets of Rs.3,00,000 and a net profit margin of 5%. Calculate its sales.

Solution:

Total assets = Rs. 3,00,000

Return on total assets = 8%

Net profit margin = 5%

Net profit = Rs. 3,00,000 x 8/100 = Rs. 24,000

Sales = Rs. 24,000 x 100/5 = Rs. 4,80,000

c. Cash Profit Ratio:

Cash profit ratio measures the cash generation in the business as a result of the operations expressed in terms of sales.

Cash Profit = Net Profit + Depreciation

The cash profit ratio is a more reliable indicator of performance where there are sharp fluctuations in the profit before tax and net profit from year to year owing to difference in depreciation charged. Cash profit ratio evaluates the efficiency of operations in terms of cash generation and is not affected by the method of depreciation charged. It also facilitate interfirm comparison of performance since different methods of depreciation may be adopted by different companies.

d. Return on Total Assets:

This ratio is calculated as follows:

The profitability of the firm is measured by establishing relation of net profit with the total assets of the organization. This ratio indicates the efficiency of utilization of assets in generating revenue.

Problem 10:

Profit margin (net) of B.S. Ltd. is 7% while turnover is 3 times of its capital. What is the return on investment of the concern?

Solution:

e. Return on Shareholders Funds or Return on Net worth:

This ratio expresses the net profit in terms of the equity shareholders funds. This ratio is an important yardstick of performance for equity shareholders since it indicates the return on the funds employed by them. However, this measure is based on the historical net worth and will be high for old plants and low for new plants.

Net worth = Equity capital + Reserves and Surplus

The factor which motivates shareholders to invest in a company is the expectation of an adequate rate of return on their funds and periodically, they want to assess the rate of return earned in order to decide whether to continue with their investment. This ratio is useful in measuring the rate of return as a percentage of the book value of shareholders equity.

The further modification of this ratio is given below:

g. Return on Equity (ROE):

The ratio indicates:

(a) Measure of profitability,

(b) The efficiency in use of assets in achieving sales,

(c) Measure of leverage.

i.e. ROE = Net profit margin x Total assets turnover ratio x Total assets to Net worth

Problem 11:

Gemini Ltd. has total assets of Rs.60 crore and a debt-equity ratio of 0.5. Its sales are Rs.27 crore and it has total fixed cost of Rs.7 crore. If the company’s EBIT is Rs.6 crore, its tax rate is 40 percent and the interest rate on debt is 12 percent, calculate the ROE of Gemini Ltd.

Solution:

Total Equity + Total Debt = Rs. 60 crore

Total Equity = 60/1.5 = Rs. 40 crore

Total Debt = 60-40 = Rs. 20 crore

Interest on Debt = 20 x 12/100 = Rs. 2.40 crore

Net Income = (EBIT – I) (l -t) = (6 – 2.40) (1 – 0.40)

= 3.60x 0.60 = Rs. 2.16 crore

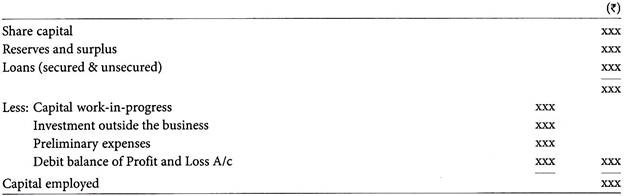

g. Return on Capital Employed (ROCE):

This ratio is also called as Return on Investment (ROI). The strategic aim of a business enterprise is to earn a return on capital. If in any particular case, the return in the long-run is not satisfactory, then the deficiency should be corrected or the activity be abandoned for a more favourable one.

Measuring the historical performance of an investment centre calls for a comparison of the profit that has been earned with capital employed. The rate of return on investment is determined by dividing net profit or income by the capital employed or investment made to achieve that profit.

ROI consists of two components viz- (a) Profit Margin, and (b) Investment Turnover, as shown below:

Or

It will be seen from the above formula that ROI can be improved by increasing one or both of its components viz- the profit margin and the investment turnover in any of the following ways:

(a) Increasing the profit margin,

(b) Increasing the investment turnover, or

(c) Increasing both profit margin and investment turnover.

The generalizations that can be made about the ROI formula are that any action is beneficial provided that it: (i) Boosts sales, (ii) Reduces invested capital, (iii) Reduces costs (while holding the other two factors constant).

Return on investment analysis provides a strong incentive for optimal utilization of the assets of the company. This encourages managers to obtain assets that will provide a satisfactory return on investment and to dispose of assets that are not providing an acceptable return. In selecting amongst alternative long-term investment proposals, ROI provides a suitable measure for assessment of profitability of each proposal.

The return on capital employed ratio is helpful in measuring the managerial performance in the following ways:

I. It helps in measuring the profitability of the firm.

II. The actual return on capital employed can be compared with the targeted rate of return.

III. It indicates how effectively the operating assets are used in earning return.

IV. It can be used as a sensitive gauge of profit making ability of the firm.

V. Divisional performance measurement can be done easily with ROI.

VI. It helps in making comparison of interdivisional and interfirm comparison.

VII. It focus the attention on efficiency of management in managing the investments.

VIII. It correlates the return with various assets used in the business.

Problem 12:

Vintex Ltd. has a target ROE of 20%. The debt equity ratio of the company is 1.2 and its pre-tax cost of debt is 12%. What ROI should the company plan to earn if its tax rate is 35%?

Solution:

ROE = [ROI + (ROI – r) D/E] (1 -t)

Where, ROE = Return on equity i.e. 0.20

ROI = Return on investment (?)

r = Cost of debt i.e. 0.12

D/E = Debt-Equity ratio i.e. 1.2

t = tax rate i.e. 0.35

By substituting we get,

0.20 = [ROI + (ROI – 0.12) 1.2] x (1 – 0.35)

0.20 = [ROI + 1.2 ROI – 0.144] (0.65)

0.20 = (2.2 ROI – 0.144) x 0.65

0.20 = 1.43 ROI – 0.0936

1.43 ROI = 0.20 + 0.0936

ROI = 0.2936/1.43 = 0.2053 or 20.53%

Category # 5. Operating Ratios:

The ratios of all operating expenses (i.e. materials used, labour, factory overheads, administration and selling expenses) to sales is the operating ratio. A comparison of the operating ratio would indicate whether the cost content is high or low in the figure of sales. If the annual comparison shows that the sales has increased the management would be naturally interested and concerned to know as to which element of the cost has gone up.

It is not necessary that the management should be concerned only when the operating ratio goes up. If the operating ratio has fallen, though the unit selling price has remained the same, still the position need analysis as it may be the sum total of efficiency in certain departments and inefficiency in others. A dynamic management should be interested in making a complete analysis. It is, therefore, necessary to breakup the operating ratio into various cost ratios.

The major components of cost are: material, labour and overheads.

Therefore, it is worthwhile to classify the cost ratio as:

Generally all these ratios are expressed in terms of percentage. Then total up all the operating ratios. This is deducted from 100 will be equal to the net profit ratio. If possible, the total expenditure for effecting sales should be divided into two categories viz., fixed and variable and then ratios should be worked out.

Category # 6. Market Based Ratios:

The market based ratios relates the firm’s stock price to its earnings and book value per share. These ratios give management an indication of what investors think of the company’s past performance and future prospects. If firm’s profitability, solvency and turnover ratios are good, then the market based ratios will be high and its share price is also expected to be high.

The market based ratios are as follows:

a. Earnings Per Share (EPS):

The objective of Financial Management is wealth or value maximization of a corporate entity. The value is maximized when market price of equity shares is maximized. The use of wealth maximization objective or net present value maximization objective has been advocated as an appropriate and operationally feasible criterion to choose among the alternative financial actions. In practice, the performance of a corporation is better judged in terms of its earnings per share (EPS).

The EPS is one of the important measures of economic performance of a corporate entity. The flow of capital to the companies under the present imperfect capital market conditions would be made on the evaluation of EPS. Investors lacking inside and detailed information would look upon the EPS as the best base to take their investment decisions. A higher EPS means better capital productivity.

EPS is one of the most important ratios which measures the net profit earned per share. EPS is one of the major factors affecting the dividend policy of the firm and the market prices of the company. Growth in EPS is more relevant for pricing of shares from absolute EPS. A steady growth in EPS year after year indicates a good track of profitability.

Problem 13:

Consider the figures available for ABC Ltd.

Net sales = Rs.2,400 lakhs

EBIT as % of sales = 10%

Corporate tax rate = 40%

Capital employed: Equity share capital (Rs. 10 each) Rs. 400 lakhs

10% Preference shares of Rs. 100 each Rs.250 lakhs

12% Secured debentures Rs. 180 lakhs

Calculate the EPS of the company.

Solution:

EBIT =Rs. 2,400 lakhs x 10/100 = Rs. 240 lakhs

Preference dividend = Rs. 250 lakhs x 10/100 = Rs. 25 lakhs

Interest on debentures = Rs. 180 lakhs x 12/100 = Rs. 21.6 lakhs

Number of equity shares = 40,00,000

b. Cash Earnings Per Share:

The cash EPS is calculated by dividing the net profit before depreciation with number of equity shares.

This is a more reliable yardstick for measurement of performance of companies, especially for highly capital intensive industries where provision for depreciation is substantial. This measures the cash earnings per share and is also a relevant factor for determining the price for the company’s shares. However, this method is not as popular as EPS and is used as a supplementary measure of performance only.

c. Dividend Payout Ratio:

Dividend payout ratio is the dividend per share divided by the earnings per share. Dividend payout indicates the extent of the net profits distributed to the shareholders as dividend. A high payout signifies a liberal distribution policy and a low payout reflects conservative distribution policy.

d. Dividend Yield:

This ratio reflects the percentage yield that an investor receives on this investment at the current market price of the shares. This measure is useful for investors who are interested in yield per share rather than capital appreciation.

e. Book Value:

This ratio indicates the net worth per equity share. The book value is a reflection of the past earnings and the distribution policy of the company. A high book value indicates that a company has huge reserves and is a potential bonus candidate.

A low book value signifies a liberal distribution policy of bonus and dividends, or alternatively, a poor track record of profitability. Book value is considered less relevant for the market price as compared to EPS, as it reflects the past record whereas the market discounts the future prospects.

f. Price Earnings Ratio (P/E Ratio):

The ratio indicates the market price of an equity share to the earnings per share. It measures the number of times the earnings per share discounts the market price of an equity share.

The ratio indicates how much an investor is prepared to pay per rupee of earnings. The ratio helps to ascertain the value of equity share, if the EPS and probable price-earning ratio of the industry to which the company belongs. The intrinsic value of share may be more or less than the market value which is influenced by company’s track record and dividend distribution policy, speculative trading, state of economy, efficiency of management, capital gearing etc.

Price-earning approach to share valuation is simple and more popular. This ratio reflects the market’s assessment of the future earnings potential of the company. A ratio reflects high earnings potential and a low ratio reflects the low earnings potential. The ratio reflects the market’s confidence on company’s equity.

Problem 14:

The capital of PQR Limited is as follows: 90% preference shares of Rs. 10 each = Rs.3,00,000; Equity shares of Rs.10 each = Rs.8,00,000.

Following further information is available:

g. Price to Book Value Ratio (P/BV Ratio):

This ratio measures the relationship between the accounting value of the firm’s assets and the market price of its stock. The ratio is calculated by dividing the stock price per share by the book value of share.

Generally, the higher the rate of return a firm is earning on its common equity the higher will be the P/BV ratio. In case of growth firms i.e. firms with high growth of sales and earnings will have this ratio higher than 1, for the reason that the potential future growth in earnings is reflected in the current stock price. Whereas the book value of equity share is based on historical costs and it does not consider the potential growth.