The following article will guide you about determining the tax impact of your investment decision along with few important tips.

1. Interest:

The interest that you earn on bonds and debentures is ‘earned’ every year. You may or may not ‘receive’ it every year depending upon whether that bond or debenture is cumulative or not. Usually, you pay taxes on interest in the year in which you earn it. This means you pay taxes every year.

Assuming you intend to reinvest your returns, what you can reinvest is only the ‘net of tax’ return. The only exception to this rule is the small investors who invest in cumulative bonds or debentures and opt to offer their cumulative interest to tax in the year of receipt (i.e. at the time of maturity or sale). A business establishment would usually offer interest to tax in the year in which it accrues.

In sum, your annual tax drags down the total return on your investment over the holding period.

2. Capital Gains:

Returns on mutual fund investments in which you opt for growth option are taxed as capital gains. Assuming you are holding on to your investment for at least a year from the date of investment, your returns are taxed as long term capital gains. Long Term Capital Gains attract a concessional rate of 10% (20% if we choose to calculate gains by inflation indexing the cost).

If a listed bond/debenture is sold in the open market prior to maturity, but after completion of one year of holding period, any gains, after excluding any accrued interest from the last interest date till the date of sale (or from date of purchase/issue till the date of sale in case of a cumulative bond) would be taxed as long term capital gains.

An important point to note here is that you pay capital gains tax only when you actually realize the gains i.e. you sell your investment.

3. Dividend:

In case you have opted for the dividend option, the return that you earn on your mutual fund investment is paid out to you as dividend. You don’t have to yourself pay any taxes on your dividend income. The AMC will deduct tax at the applicable rate at the time of pay out. The tax rate currently is 27.038% for liquid schemes and 13.519% for non-liquid schemes.

Comparison of Tax Impact of these options on your Return:

Assuming you have Rs. 100,000 to invest today for a period of three years.

You have three options to choose from:

I. A Bond that offers 8% interest;

II. For the sake of simplicity, let’s assume there is a mutual fund that would yield 8% return over three years. (Note that this is for explaining the concept of tax impact only and not intended to claim a return-earning potential of any mutual fund in any way).

The two options in this case would be:

i. Growth option

ii. Dividend option

Interest on the bond is paid annually and the mutual fund dividend is also paid out annually.

Let’s also assume that you don’t need the annual interest and dividend flows to meet any expense. This is an important assumption since cash flow needs will obviously take precedence over saving taxes.

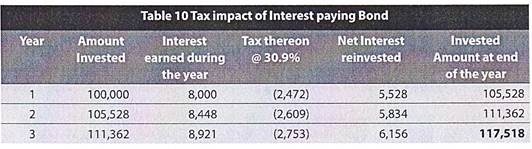

If you choose an investment option that pays annual interest, your investment will earn as follows:

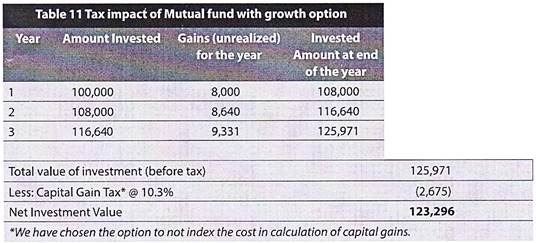

Instead, had you chosen a mutual fund with growth option, the investment of Rs. 100,000 you would have earned as follows:

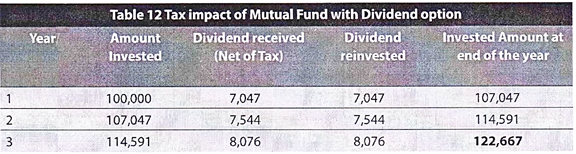

Now had you chosen a mutual fund with dividend option, you would have earned on your investment as follows:

Choosing a dividend option does not eliminate tax but puts onus on the mutual fund to deduct and pay that tax to the government on behalf of the investor.

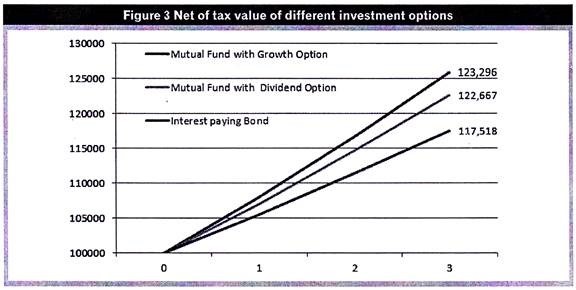

Thus, the investment value under various options after the three years holding would have been as below:

As is obvious from the chart above, your investment is worth most under the mutual fund growth option. It is obvious as to why.

If your investment was allowed to grow without any taxes, it would have been worth Rs. 125,971 after three years. Under the interest paying bond option, you pay taxes on your return each year. This reduces your reinvestment ability which in turn reduces your investment value. The same is the case with a mutual fund dividend option.

The reason why you earn more under this option than in the case of an interest paying Bond is because of the lower dividend tax rate and the fact that taxes are paid from the returns and only the net amount is paid out as dividend.

However, in the case of a mutual fund growth option, your investments are allowed to grow un-curtailed for all the three years. Thus your returns are reinvested most efficiently and you pay taxes only at the end of your investment horizon.

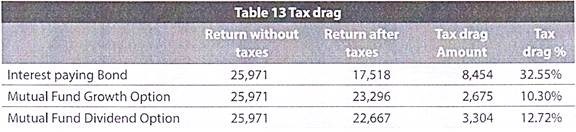

Concept of Tax Drag:

Tax drag is the extent by which taxes drag down your total return.

In our example above, the returns under the three options and the tax drag were as below:

Notice that tax drag is highest in the case of an interest paying bond – higher than even the tax rate of 30.9%. The tax drag in the case of mutual fund growth option is exactly equal to the tax rate.

The longer your holding period, the greater will be the tax drag (%) for an interest paying bond and Mutual Fund with dividend option. The tax drag for Mutual Fund with growth option will always be the capital gain tax rate, whatever is your holding period.

Investment options that require annual tax payments compound your returns as well as the impact of taxes. Investment options that are taxed at the end of the holding period allow for compounding of returns but not taxes.

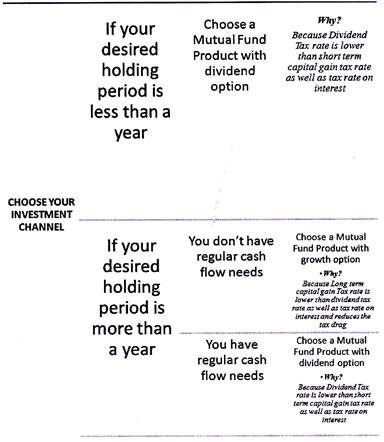

So, key take away here is:

Some Quick Tips…:

I. If you are holding a bond or mutual fund units for nine-ten months and wish to get out of the investment, wait! Let a year of holding be completed. Your sale in that case will be taxable as long term capital gains at a beneficial rate.

II. If you need periodic cash flows to meet certain expenses, invest a year early in a mutual fund growth option. After a year is complete, put a systematic withdrawal plan (SWP) request to the AMC as per your cash flow needs.

The result is that you will get your periodic cash flows and they will be taxed as long term capital gains at a beneficial rate. The only flip-side to this is that you may eventually deplete your principal if what you earn is less than what you withdraw.

III. If you are investing in growth option in Fixed Term Plans, March is the best month to invest. During the month of March, yields in money market instruments are usually on the higher side due to tightness in banking system liquidity. Further, most of the fixed term plans during this period have a term of little over a year so they are taxed beneficially as long term capital gains.