Learn how to calculate present value and discount factors of investment of a firm.

Calculation of Present Value:

It is a method of assessing the worth of an investment by inverting the compounding process to give present value of future cash flows. This process is called “discounting”. The present value of ‘P’ of the amount ‘A’ due at the end of ‘n’ conversion periods at the rate ‘i’ per conversion period.

The value of ‘P’ is obtained by solving the following equation:

Problem 1:

Ascertain the present value of an amount of Rs.8,000 deposited now in a commercial bank for a period of 6 years at 12% rate of interest.

Solution:

A = 8,000 x 1.97382 = Rs. 15,791

Problem 2:

Find out the present value of Rs.10,000 to be required after 4 years if the interest rate is 6%.

∴ An amount Rs.7,921 to be deposited into bank to get Rs.10,000 at the end of 4 years at interest rate of 6%.

Calculation of Discount Factors:

The exercise involved in calculating the present value is known as ‘discounting’ and the factors by which we have multiplied the cash flows are known as the ‘discount factors’.

Discount factor = 1/(1 + i)n

Where ‘i’ is the rate of interest p.a. and ‘n’ is the number of years over which we are discounting.

Discounted cash flow is an evaluation of the future cash flows generated by a capital project, by discounting them to their present day value. The discounting technique converts cash inflows and outflows for different years into their respective values at the same point of time, allows for the time value of money.

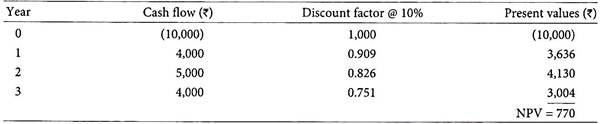

Problem 3:

A firm can invest Rs.10,000 in a project with a life of three years.

The projected cash inflow are as follows:

The cost of capital is 10% p.a. Should the investment be made?

Solution:

Firstly the discount factors can be calculated based on Rs. 1 received in with ‘i’ rate of interest in 3 years.

Since the net present value is positive, investment in the project can be made.

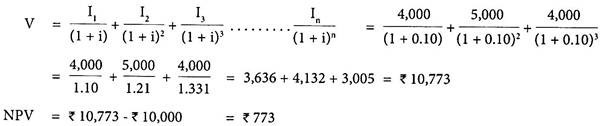

The present value of future cash flow can also be ascertained as follows:

Compounding Rate and Capitalising Rate:

The compounding rate is used in project evaluation to determine the present value of past investment/cash flow, whereas the capitalising rate is applied in the reverse process of discriminating present value of future cash flows. Both considers the time value of money.