This article throws light upon the six main steps involved in computing lease rentals.

1. Determine the cost of the asset which includes the actual purchase price and expenses like freight, insurance, taxes and installation, etc.

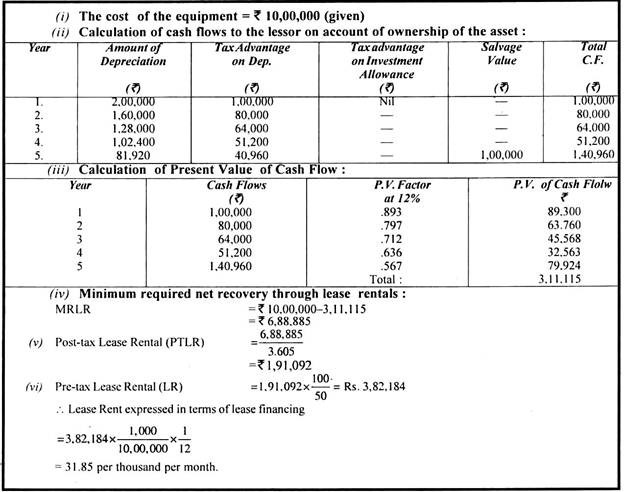

2. Determine the cash flows to the lessor on account of ownership of the asset. These include tax advantage provided by depreciation and investment allowance.

3. Calculate the present value of cash flows as determined in step 2.

4. Subtract the present value of cash flows of ownership advantage from the cost of the asset determined in step 1 so as to determine the minimum required net recovery through lease rentals.

5. Calculate the post-tax lease rentals by dividing the minimum required net recovery through lease rentals by present value factor of annuity.

6. Compute the pretax lease rentals by adjusting the post-tax lease rentals for the tax factor. The above method of computing lease rentals can be followed from the following illustration.

Illustration 1:

Sunny Leasing is considering to lease out an equipment costing Rs. 10,00,000 for five years, which is the expected life of the equipment, and has an estimated salvage value of Rs. 1,00,000. Sunny Leasing can claim a depreciation of 20% on w.d.v. of the asset but is not eligible for investment allowance.

The firm falls under a tax rate of 50% and the minimum post-tax required rate of return is 12%. You are required to calculate the lease rental which the firm should charge.

Note:

(1) Present Value Factor at 12% discount rate is as below:

Year 1 = .893; Year 2= .797; Year 3 = .712; Year 4 = .636 and Year 5 = .567

(2) Annuity Discount Factory at 12% for 5 years = 3.605.

Solution: