This article throws light upon the top two objectives of financial management. The objectives are: 1. Profit Maximisation 2. Wealth Maximisation.

Financial Management: Objective # 1. Profit Maximisation:

Profit earning is the main aim of every economic activity. A business being an economic institution must earn profit to cover its costs and provide funds for growth. No business can survive without earning profit. Profit is a measure of efficiency of a business enterprise.

Profits also serve as a protection against risks which cannot be ensured. The accumulated profits enable a business to face risks like fall in prices, competition from other units, adverse government policies etc. Thus, profit maximisation is considered as the main objective of business.

The following arguments are advanced in favour of profit maximisation as the objective of business:

(i) When profit-earning is the aim of business then profit maximisation should be the obvious objective.

(ii) Profitability is a barometer for measuring efficiency and economic prosperity of a business enterprise, thus, profit maximisation is justified on the grounds of rationality.

(iii) Economic and business conditions do not remain same at all the times. There may be adverse business conditions like recession, depression, severe competition etc. A business will be able to survive under unfavourable situation, only if it has some past earnings to rely upon. Therefore, a business should try to earn more and more when situation is favourable.

(iv) Profits are the main sources of finance for the growth of a business. So, a business should aim at maximisation of profits for enabling its growth and development.

(v) Profitability is essential for fulfilling social goals also. A firm by pursuing the objective of profit maximisation also maximises socio-economic welfare.

However, profit maximisation objective has been criticised on many grounds. A firm pursuing the objective of profit maximisation starts exploiting workers and the consumers. Hence, it is immoral and leads to a number of corrupt practices. Further, it leads to colossal inequalities and lowers human values which are an essential part of an ideal social system.

It is also argued that profit maximisation should be the objective in the conditions of perfect competition and in the wake of imperfect competition today, it cannot be the legitimate objective of a firm. The concept of limited liability in the present day business has separated ownership and management.

A company is financed by shareholders, creditors and financial institutions and is controlled by professional managers. Workers, customers, government and society are also concerned with it. So, one has to reconcile the conflicting interests of all these parties connected with the firm. Thus, profit maximisation as an objective of financial management has been considered inadequate.

Even as an operational criterion for maximising owner’s economic welfare, profit maximisation has been rejected because of the following drawbacks:

(i) Ambiguity:

The term ‘profit’ is vague and it cannot be precisely defined. It means different things for different people. Should we consider short-term profits or long-term profits? Does it mean total profits or earnings per share? Should we take profits before tax or after tax? Does it mean operating profit or profit available for shareholders?

Further, it is possible that profits may increase but earnings per share decline. For example, if a company has presently 10,000 equity shares issued and earn a profit of Rs. 1,00,000 the earnings per share are Rs. 10. Now, if the company further issues 5,000 shares and makes a total profit of Rs. 1,20,000, the total profits have increased by Rs. 20,000, but the earnings per share will decline to Rs. 8.

Even if, we take the meaning of profits as earnings per share and maximise the earnings per share, it does not necessarily mean increase in the market value of shares and the owner’s economic welfare.

(ii) Ignores Time Value of Money:

Profit maximisation objective ignores the time value of money and does not consider the magnitude and timing of earnings. It treats all earnings as equal though they occur in different periods. It ignores the fact that cash received today is more important than the same amount of cash received after, say, three years.

The stockholders may prefer a regular return from investment even if it is smaller than the expected higher returns after a long period.

(iii) Ignores Risk Factor:

It does not take into consideration the risk of the prospective earnings stream. Some projects are more risky than others. The earning streams will also be risky in the former than the latter. Two firms may have same expected earnings per share, but if the earning stream of one is more risky then the market value of its shares will be comparatively less.

(iv) Dividend Policy:

The effect of dividend policy on the market price of shares is also not considered in the objective of profit maximisation. In case, earnings per share is the only objective then an enterprise may not think of paying dividend at all because retaining profits in the business or investing them in the market may satisfy this aim.

Financial Management: Objective # 2. Wealth Maximisation:

Wealth maximisation is the appropriate objective of an enterprise. Financial theory asserts that wealth maximisation is the single substitute for a stockholder’s utility. When the firm maximises the stockholder’s wealth, the individual stockholder can use this wealth to maximise his individual utility. It means that by maximising stockholder’s wealth the firm is operating consistently towards maximising stockholder’s utility.

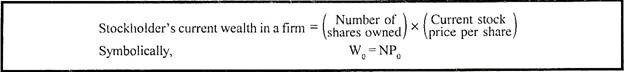

A stockholder’s current wealth in the firm is the product of the number of shares owned, multiplied with the current stock price per share.

Given the number of shares that the stockholder owns, the higher the stock price per share the greater will be the stockholder’s wealth. Thus, a firm should aim at maximising its current stock price. This objective helps in increasing the value of shares in the market.

The share’s market price serves as a performance index or report card of its progress. It also indicates how well management is doing on behalf of the shareholder.

We can conclude that:

However, the maximisation of the market price of the shares should be in the long run. The long run implies a period which is long enough to reflect the normal market value of the shares irrespective of short- term fluctuations.

While pursuing the objective of wealth maximisation, all efforts must be put in for maximising the current present value of any particular course of action. Every financial decision should be based on cost-benefit analysis. If the benefit is more than the cost, the decision will help in maximising the wealth. On the other hand, if cost is more than the benefit the decision will not be serving the purpose of maximising wealth.

Implications of Wealth Maximisation:

There is a rationale in applying wealth maximising policy as an operating financial management policy. It serves the interests of suppliers of loaned capital, employees, management and society. Besides shareholders, there are short-term and long-term suppliers of funds who have financial interests in the concern.

Short-term lenders are primarily interested in liquidity position so that they get their payments in time. The long-term lenders get a fixed rate of interest from the earnings and also have a priority over shareholders in return of their funds. Wealth maximisation objective not only serves shareholder’s interests by increasing the value of holdings but ensures security to lenders also.

The employees may also try to acquire share of company’s wealth through bargaining etc. Their productivity and efficiency is the primary consideration in raising company’s wealth. The Survival of management for a longer period will be served if the interests of various groups are served properly.

Management is the elected body of shareholders. The shareholders may not like to change a management if it is able to increase the value of their holdings. The efficient allocation of productive resources will be essential for raising the wealth of the company. The economic interests of society are served if various resources are put to economical and efficient use.

The following arguments are advanced in favour of wealth maximisation as the goal of financial management:

(i) It serves the interests of owners, (shareholders) as well as other stakeholders in the firm; i.e. suppliers of loaned capital, employees, creditors and society.

(ii) It is consistent with the objective of owners’ economic welfare.

(iii) The objective of wealth maximisation implies long-run survival and growth of the firm.

(iv) It takes into consideration the risk factor and the time value of money as the current present value of any particular course of action is measured.

(v) The effect of dividend policy on market price of shares is also considered as the decisions are taken to increase the market value of the shares.

(vi) The goal of wealth maximisation leads towards maximising stockholder’s utility or value maximisation of equity shareholders through increase in stock price per share.

Criticism of Wealth Maximisation:

The wealth maximisation objective has been criticised by certain financial theorists mainly on following accounts:

(i) It is a prescriptive idea. The objective is not descriptive of what the firms actually do.

(ii) The objective of wealth maximisation is not necessarily socially desirable.

(iii) There is some controversy as to whether the objective is to maximise the stockholders wealth or the wealth of the firm which includes other financial claimholders such as debenture-holders, preferred stockholders, etc.

(iv) The objective of wealth maximisation may also face difficulties when ownership and management are separated as is the case in most of the large corporate form of organisations. When managers act as agents of the real owners (equity shareholders), there is a possibility for a conflict of interest between shareholders and the managerial interests.

The managers may act in such a manner which maximises the managerial utility but not the wealth of stockholders or the firm.

In spite of all the criticism, we are of the opinion that wealth maximisation is the most appropriate objective of a firm and the side costs in the form of conflicts between the stockholders and debenture-holders, firm and society and stockholders and managers can be minimised.

Financial Management and Profit Maximisation:

The primary aim of a business is to maximise shareholders’ wealth. This can be done by increasing the quantum of profits. Financial management helps in devising ways and exercising appropriate cost controls which ultimately help in increasing profitability. The following elements are involved in maximising profits.

(i) Increase in Revenues:

For maximising its profits, a firm will have to increase revenue receipts. Revenues will go up only when sales increase. There should be all out efforts to increase the sales. All possible markets should be exploited so that demands for products increases.

This should be followed by increasing production for meeting increased demand. In a competitive economy, profits can be increased either by raising the price of products or by increasing the volume of sales. The second alternative will be more appropriate.

(ii) Controlling Costs:

Another way of increasing profit is to control or reduce costs. This will increase the margin of profit per unit. The costs may be controlled by controlling material wastages, increasing labour efficiency, reducing overhead cost by increasing production etc.

(iii) Minimising Risks:

A business operates under a number of uncertainties. Business is done with an eye on future which itself is uncertain and difficult to predict. There are many risks, both business and financial.

It is generally said, more the risk and more the gain. In spite of this, those financial decisions should be taken which will not involve more risks but at the same time may help in increasing profitability. A financial manager will have to balance the pros and cons of various decisions so that risk element is kept under control.