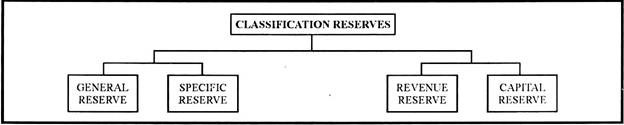

This article throws light upon the top ten types of reserves created by companies. The types are: 1. General Reserve 2. Specific Reserve 3. Revenue Reserve 4. Capital Reserves 5. Valuation or Assets Reserves 6. Proprietary Reserves 7. Liability Reserves 8. Funded Reserves 9. Sinking Fund Reserves 10. Secret Reserves.

Type # 1. General Reserve:

A general reserve is that part of the profits which is set aside to meet any future unknown contingency or emergency. It is also ‘Contingency Reserve’.

A general reserve may be credited:

(i) To meet the increasing demands of the business;

(ii) To stablise the economic conditions of the firm;

(iii) To meet unforeseen losses; and

(iv) To control the profits of the company.

Type # 2. Specific Reserve:

It is a reserve which is created of some definite or specific purpose i.e., Dividend “Equalisation Reserve, Reserve for Repair, Reserve for Outstanding Expanses, and Reserve for Building etc.

Type # 3. Revenue Reserve:

These reserves consist of un-contributed revenue gains consisting of profits made in the ordinary course of business. The funds of these reserves may be used to maintain a business or pay dividends. Revenue reserves are ‘Free Reserves’ that are available for distribution as profits.

Type # 4. Capital Reserves:

These reserves are not available for distribution among shareholders as dividends. They are created to strengthen the financial position of the company.

Capital reserves are built out of capital profits and not out of business profits, such as:

(a) Profit prior to incorporation;

(b) Premium on issue of shares or debentures;

(c) Profit on redemption of debentures;

(d) Profit on forfeited shares;

(e) Profit on sale of fixed assets; and

(f) Profit on revaluation of fixed assets.

Some other important types of reserves are discussed as below:

Type # 5. Valuation or Assets Reserves:

Valuation reserves are set up to offset the loss of value of some assets such as plant and machinery, accounts receivables, investments, marketable securities and patents and intangibles which have a limited life.

Such reserves are created with the following objectives:

(a) To restore the integrity of investments which they have suffered or loss in value;

(b) To recognise expenses this cannot be determined accurately;

(c) To reduce assets to their estimated realisable values;

(d) To provide for losses arising out of bad debts; and

(e) To provide for losses arising out of obsolescence.

Type # 6. Proprietary Reserves:

Proprietary reserves are elements of ‘padded surplus’ and are also referred to as surplus or ‘net worth reserves’.

They are a part of shareholders equity which may be set up for the following purposes:

(a) To provide cushion against future risks;

(b) To offset subjectivity in determination of profits;

(c) To reduce free surplus available for distribution to shareholders as dividends;

(d) To provide for future expansion and growth;

(e) To provide for repayment of debt; and

(f) To increase the real value of the firm.

There are many kinds of proprietary reserves, which include:

(a) Reserve for dividend i.e. Dividend Equalisation Fund;

(b) Reserve for contingencies;

(c) Reserve for working capital;

(d) Reserve for improvement; and

(e) Reserve for insurance, etc.

Type # 7. Liability Reserves:

These reserves may be provided for current as well as emergency liabilities. Current Liabilities are known and are sure to materialise but the extent of the liability or the amount due is not certain. Reserve for taxation is an important example of such reserves. Emergency liabilities, on the other hand, may be non-recurring which may be established through transfer from contingency reserves.

Type # 8. Funded Reserves:

A reserve does not mean cash or fund. It is merely a surplus appropriation that is included in shareholders’ equity. A fund is an actual asset in the form of cash or other investments. When the amount of reserve is invested in securities, etc., it is called funded reserve or ‘reserve fund’. A funded reserve protects the working capital position of the company and ensures the availability of funds as and when needed.

Type # 9. Sinking Fund Reserves:

A sinking fund is a fund built up by regular contribution/appropriation out of profits and the amount of interest on such contributions and the interest itself. The purpose of sinking fund may be either payment of a liability on a certain day in future or accumulation of funds to replace wasting assets.

Type # 10. Secret Reserves:

A secret reserve is a surplus which although exists in a business but is not disclosed in the balance sheet. The management, to be conservative, may write down the value of the assets below their fair value for the purpose of creating a secret or ‘hidden reserve’.

Secret reserves may be created by the simple method of showing profits at a figure much lower than the actual. When secret reserves exist, the financial position of the business is much better than what appears from the balance sheet.

Methods of Creating Secret Reserves:

Secret reserves may be created by any of the following methods:

(i) Writing off excessive depreciation;

(ii) Charging capital expenditure as revenue expenditure;

(iii) An understatement of income;

(iv) An undervaluation of closing stock;

(v) An undervaluation of assets;

(vi) An overstatement of liabilities;

(vii) Capitalising revenue receipts; and

(viii) Showing contingent liabilities as actual liabilities.

(ix) Sometimes secret reserves may arise themselves, e.g., increase in the value of assets.

Advantages of Secret Reserves:

(i) It is a means for stabilising dividends;

(ii) It ensures better financial position;

(iii) It helps to hide out profits from the existing and potential competitors;

(iv) It acts as a cushion during the rainy days, and save business from collapse; and

(v) It increases the actual capital employed in the business and improves the profitability.

Disadvantages of Secret Reserves:

(i) Balance sheet does not reveal the true and fair position of the business;

(ii) Investors cannot make their buying and selling decisions correctly;

(iii) Management can conceal its inefficiency;

(iv) It provides an opportunity to the management for manipulation and misuse of the company’s funds.