After reading this article you will learn about the relationship between Risk and Return.

The entire concept of security analysis is built on two concepts of security: return and risk. To earn return on investment, investment has to be made for some period which in turn implies passage of time. Dealing with the return to be achieved requires estimate of the return on investment over the time period. Risk denotes deviation of the actual return from the estimated return.

The fact that the investors do not hold a single security which they consider most profitable is enough to say that they are interested not only in maximization of return but also minimization of risk. The unsystematic risk is eliminated through holding more diversified securities. Systematic risk, however, cannot be eliminated through diversification.

The investors increase their required return as perceived uncertainty increases. The rate of return differs substantially among alternative investments and because the required return on specific investments change over time, the factors that influence the required rate of return must be considered.

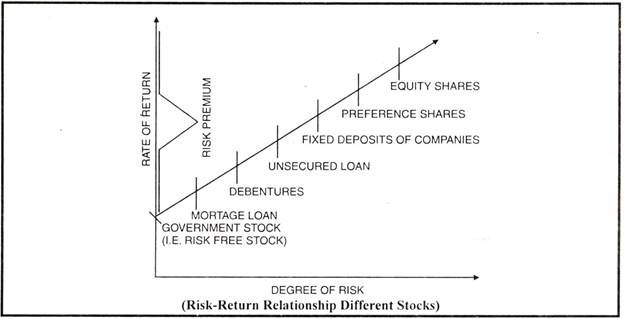

Alternative investment avenues with risk-return relationship are set out in the above figure. Investors would select investments that are consistent with their risk preferences. Some will consider low risk investments while others prefer high risk investments.