In this article we will discuss about the internal and external source of finance for Industries.

Internal Source of Finance:

1. Retained Equity Earnings:

This implies retaining the earnings of the shareholders for internal reinvestment. Every rupee retained is a rupee with-held from distribution to existing shareholders. While doing so, management must do something to maintain the interest of shareholders.

2. Depreciation Provisions:

Depreciation provisions represent the maintenance of a capital stock to replace the existing machinery when it becomes uneconomical to use. Depreciation provision is a major source of internally generated funds.

3. Deferred Taxation:

Due to the time-lag between the earning of profit and payment of the appropriate taxation, the funds, represented by the tax liability, are available for use.

4. Personal Funds Saved or Inherited:

In order to win confidence of external financiers, it is very necessary that the would-be owner must have assets of his own to invest in the firm.

External Source of Finance:

1. Savings:

People save a percentage of their salary for a ‘rainy day’. With the money thus saved, people purchase life insurance, buy stocks and bonds, buy shares or deposit in a bank. Thus saved money is made available to business enterprises for further use and investment. It may be said that almost all capital for investment in business and industry comes from savings of people.

2. Loans:

Money can be borrowed from the following sources for starting or expanding the business:

(i) Friends and relations,

(ii) Money lending institutions, and

(iii) Commercial and other banks, etc.

When money is borrowed, it becomes obligatory that the interest should be paid in time and the loan be paid back on the mutually agreed date.

3. Shares:

Funds are collected by issuing shares to public. The number of authorized shares that can be issued and the value of each share is specified. This is decided on the basis of the capital to be collected by issuing shares. Shares are issued for raising funds either when starting a new concern or when it is decided to expand and improve upon the existing one.

The main division of share capital is into:

i. Preference Shares:

Preference shares, as the name implies, have some preferential rights over other types of shares, e.g., dividend is first paid on preference shares and then on ordinary shares. Preference shares are entitled to a fixed dividend out of the profit. If the company faces a difficult period and is unable to pay dividends, quite possible, the preference shareholders may exert their powers and take over control from ordinary shareholders. This happens when the preference dividends are in arrears.

Preference shares may be further classed as:

(a) Cumulative Preference Shares:

They are entitled to a fixed annual dividend. If this full dividend cannot be paid in any year (because of less profits to company), the rest of deficit can be paid out of future profits, (i.e., profits of next year).

(b) Non-Cumulative Preference Shares:

They are entitled to a fixed annual dividend, but the shareholders cannot ask for arrears from future profits if in any year the company fails to make enough profits to pay fixed dividends for that year.

(c) Participating Preference Shares:

They are entitled to a fixed annual dividend plus something from the surplus left after paying dividend to ordinary shareholders.

ii.. Ordinary Shares:

Ordinary shareholders are generally paid a higher rate of dividend than that of preference shareholders but they carry greater risks. Dividend on ordinary shares is paid only after doing so on preference shares. There is no limit of dividend in case of ordinary shares. Ordinary shareholders may get very high rewards in one prosperous year of increased business and no dividend if the business encounters a difficult period. The ordinary shares may sometimes be called as Equity Shares or Equities.

iii. Deferred Shares:

Deferred shares are issued to founders or promoters of the business enterprise. Dividend on deferred shares is paid in the last, i.e., first of all, dividend on preference shares is distributed, then it is paid on ordinary shares and in the end whatever profit is left is shared by the deferred shareholders.

4. Debentures:

Business corporations having good record of earnings and favourable prospects of expansion, in search for outside (external) funds to support operations and growth, may raise capital by borrowing it on a formal document known as a Debenture. Debenture is a certificate of indebtedness issued by the corporation.

A fixed rate interest is paid on debentures and the amount is repayable after the stated number of years. The essential relationship between the company and the (bond) debenture-holder is that of debtor-creditor. Debentures are generally un-secured bonds which have no claim on any specific asset of the company but are backed by the earning power and general credit of the company as viewed by the investor.

For this reason, only companies with a very good profit record and a high financial standing can hope to sell unsecured bonds or debentures. The issue of debentures can be a very useful method of raising finance at reasonable cost.

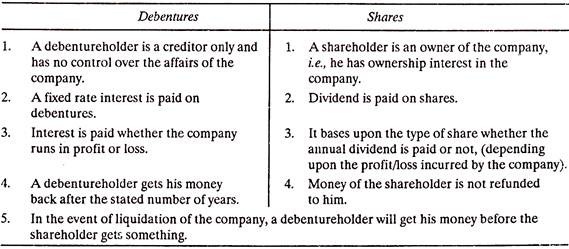

Characteristics of debentures and the difference from shares:

5. Corporate Bonds:

Corporate bonds are of two types:

i. Unsecured bonds or Debentures as discussed above, and

ii. Secured bonds, in which case some form of claim on the assets of the corporation is tied if the corporation fails to pay interest to the investor or does not return his money back after the stated number of years.

Mortgage bonds are examples of secured bonds.

6. Public Deposits:

Public may be asked to deposit their money directly with the company for a fixed long/short period ranging from half a year to seven years.

7. Taking in Partners:

Capital may be raised by adding partners in the business who are ready to invest in the firm.

8. Bank Loans:

Short term loans are easily available from commercial and other banks on reasonable interest rates.

9. Hire Purchase:

The hirer makes a deposit, he gets the machinery (goods), etc., he needs and then he pays a number of periodical money installments. At the end of a period when all the installments have been paid, the possession of the goods passes to the hirer.

10. Sale and Lease Back:

For getting funds, a company may sell some of its property to an investment company with a right to lease back at an agreed rent.

11. Equipment Leasing:

Many types of fixed assets such as land, equipment, machinery, etc., can be obtained on lease for a number of years on rental basis.

12. Profit Plowback:

The whole profit is not distributed to shareholders or owners as dividends, rather a portion of it is retained in the business and used to finance expansion and growth of the concern.

13. Credit Facilities:

A useful source of short-term finance is to obtain goods and services on credit.

14. Trade Credit:

Trade credit is the financial assistance available from other firms with whom the business has dealings. Most important are the suppliers of inventory which is constantly being replaced.

15. Special Institutions:

Finance may be obtained by borrowing from an

Insurance company;

Investment company;

Industrial development corporation, etc.