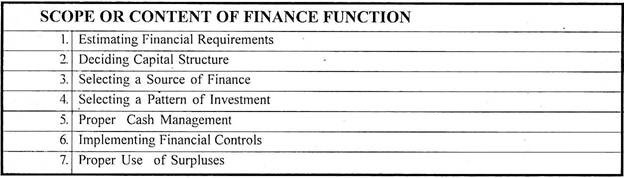

This article throws light upon the top seven features of financial management. The features are: 1. Estimating Financial Requirements 2. Deciding Capital Structure 3. Selecting a Source of Finance 4. Selecting a Pattern of Investment 5. Proper Cash Management 6. Implementing Financial Controls 7. Proper Use of Surpluses.

Financial Management: Feature # 1.

Estimating Financial Requirements:

The first task of a financial manager is to estimate short-term and long-term financial requirements of his business. For this purpose, he will prepare a financial plan for present as well as for future. The amount required for purchasing fixed assets as well as needs of funds for working capital will have to be ascertained.

The estimations should be based on sound financial principles so that neither there are inadequate nor excess funds with the concern. The inadequacy of funds will adversely affect the day-to-day working of the concern whereas excess funds may tempt a management to indulge in extravagant spending or speculative activities.

Financial Management: Feature # 2.

Deciding Capital Structure:

The capital structure refers to the kind and proportion of different securities for raising funds. After deciding about the quantum of funds required it should be decided which type of securities should be raised. It may be wise to finance fixed assets through long-term debts. Even here if gestation period is longer, then share capital may be most suitable.

Long-term funds should be employed to finance working capital also, if not wholly then partially. Entirely depending upon overdrafts and cash credits for meeting working capital needs may not be suitable. A decision about various sources for funds should be linked to the cost of raising funds.

If cost of raising funds is very high then such sources may not be useful for long. A decision about the kind of securities to be employed and the proportion in which these should be used is an important decision which influences the short-term and long-term financial planning of an enterprise.

Financial Management: Feature # 3.

Selecting a Source of Finance:

After preparing a capital structure, an appropriate source of finance is selected. Various sources, from which finance may be raised, include: share capital, debentures, financial institutions, commercial banks, public deposits, etc.

If finances are needed for short periods then banks, public deposits and financial institutions may be appropriate; on the other hand, if long-term finances arc required then share capital and debentures may be useful.

If the concern does not want to tie down assets as securities then public deposits may be a suitable source. If management does not want to dilute ownership then debentures should be issued in preference to shares. The need, purpose, object and cost involved may be the factors influencing the selection of a suitable source of financing.

Financial Management: Feature # 4.

Selecting a Pattern of Investment:

When funds have been procured then a decision about investment pattern is to be taken. The selection of an investment pattern is related to the use of funds. A decision will have to be taken as to which assets are to be purchased? The funds will have to be spent first on fixed assets and then an appropriate portion will be retained for working capital.

Even in various categories of assets, a decision about the type of fixed or other assets will be essential. While selecting a plant and machinery, even different categories of them may be available. The decision-making techniques such as Capital Budgeting, Opportunity Cost Analysis etc. may be applied in making decisions about capital expenditures.

While spending on various assets, the principles of safety, profitability and liquidity should not be ignored. A balance should be struck even in these principles. One may not like to invest on a project which may be risky even though there may be more profits.

Financial Management: Feature # 5.

Proper Cash Management:

Cash management is also an important task of finance manager. He has to assess various cash needs at different times and then make arrangements for arranging cash.

Cash may be required to:

(a) Purchase raw materials,

(b) Make payments to creditors,

(c) Meet wage bills;

(d) Meet day-to-day expenses.

The usual sources of cash may be:

(a) Cash sales,

(b) Collection of debts,

(c) Short- term arrangements with banks etc.

The cash management should be such that neither there is a shortage of it and nor it is idle. Any shortage of cash will damage the creditworthiness of the enterprise. The idle cash with the business will mean that it is not properly used.

It will be better if Cash Flow Statement is regularly prepared so that one is able to find out various sources and applications. If cash is spent on avoidable expenses then such spending may be curtailed. A proper idea on sources of cash inflow may also enable to assess the utility of various sources.

Some sources may not be providing that much cash which we should have thought. All this information will help in efficient management of cash.

Financial Management: Feature # 6.

Implementing Financial Controls:

An efficient system of financial management necessitates the use of various control devices.

Financial control devices generally used are:

(a) Return on investment,

(b) Budgetary Control,

(c) Break Even Analysis,

(d) Cost Control,

(e) Ratio Analysis

(f) Cost and Internal Audit.

Return on investment is the best control device to evaluate the performance of various financial policies. The higher this percentage better may be the financial performance. The use of various control techniques by the finance manager will help him in evaluating the performance in various areas and take corrective measures whenever needed.

Financial Management: Feature # 7.

Proper Use of Surpluses:

The uitlisation of profits or surpluses is also an important factor in financial management. A judicious use of surpluses is essential for expansion and diversification plans and also in protecting the interests of shareholders. The ploughing back of profits is the best policy of further financing but it clashes with the interests of shareholders.

A balance should be struck in using funds for paying dividend and retaining earnings for financing expansion plans, etc. The market value of shares will also be influenced by the declaration of dividend and expected profitability in future.

A finance manager should consider the influence of various factors, such as:

(a) Trend of earnings of the enterprise,

(b) Expected earnings in future,

(c) Market value of shares,

(d) Need for funds for financing expansion, etc. A judicious policy for distributing surpluses will be essential for maintaining proper growth of the unit.