Everything you need to know about the Types of Leverages as studied in Financial Management!

Leverage is of three types: 1. Operating Leverage, 2. Financial Leverage, and 3. Combined Leverage.

Types of Leverages as Studied in Financial Management

Types of Leverages – Financial, Operating and Combined Leverages (with Formula)

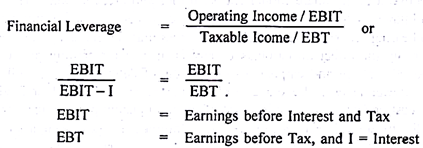

Type # 1. Financial Leverage:

Financial Leverage is a tool with which a financial manager can maximise the returns to the equity shareholders. The capital of a company consists of equity, preference, debentures, public deposits and other long-term source of funds. He has to carefully select the securities to mobilise the funds. The proper blend of debt to equity should be maintained.

The ratio through which he balances the mix of debt applied on the capital mix offers benefits to the equity shareholders is known as Trading on Equity. As the debt is associated with the cost of interest that can be directly charged to profit and loss account or charged against the profit can reduce the burden of income tax. The benefit so gained will be passed on to the equity shareholders. In such circumstances the EPS will be more.

ADVERTISEMENTS:

If the company prefers to raise the amount of debt instead of equity, it will lose the opportunity of charging the interest directly against the profit, as a result of this, it had to pay more tax to the government and in turn earnings available to equity shareholders would reduce. Hence, in other words, financial leverage refers to the use of fixed charge securities in the capitalisation of company to produce more gains for the equity shareholders.

Thus, the financial leverage signifies the relationship between the earning power on equity capital and rate interest on borrowed capital. If the earnings of the company has more amount of fixed cost of interest (which would arise due to more debt capital), the overall returns of a company get reduced and financial risk increases. This may be an unfavourable situation for business concern and practically not advocated. The more accepted ratio between debt to equity is 2:1. This ratio favours leverage effect on equity shares and would get higher percentage of earnings.

The two quantifiable tools, viz., operating and financial leverage are adopted to know the earnings per share and also which shows the market value of the share. (Price earning ratio by EBIT) Thus, financial leverage is a better tool compared to operating leverage. Change in EPS due to changes in EBIT results in variation in market price.

ADVERTISEMENTS:

Therefore, financial and operating leverages act as a handy tool to the analyst or to the financial manager to take the decision with regard to capitalisation. He can identify the exact relationship between the EPS and EBIT and plan accordingly. High leverage indicates high financial risks which would signal the finance manager to select the securities carefully.

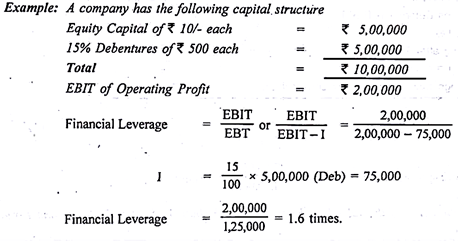

Type # 2. Operating Leverage:

There are two major classification of costs in the organisation. They are- (a) Fixed cost, (b) Variable cost.

The operating leverage has a bearing on fixed costs. There is a tendency of the profits to change, if the firm employs more of fixed costs in its production process, greater will be the operating cost irrespective of the size of the production. The operating leverage will be at a low degree when fixed costs are less in the production process.

ADVERTISEMENTS:

Operating leverage shows the ability of a firm to use fixed operating cost to increase the effect of change in sales on its operating profits. It shows the relationship between the changes in sales and the charges in fixed operating income. Thus, the operating leverage has impact mainly on fixed cost, variable cost and contribution.

It indicates the effect of a change in sales revenue on the operating profit (EBIT). Higher the operating leverage indicates higher the amount of fixed cost and reduces the operating profit and increases the business risks.

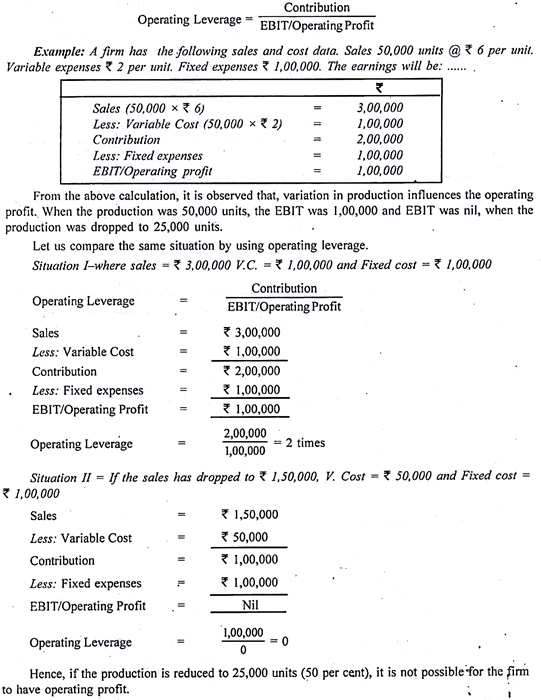

In the previous illustration, we have learnt that 25,000 units of production will not yield any operating profit or the company has reached the break-even. Any units which are produced beyond 25,000 units yields operating profits. Therefore, any increases in sales, fixed costs remaining same, increases operating profit. The increase in percentage operating income due to percentage, of increase in sales is called as “Degree of operating leverage”.

ADVERTISEMENTS:

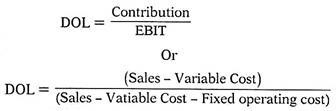

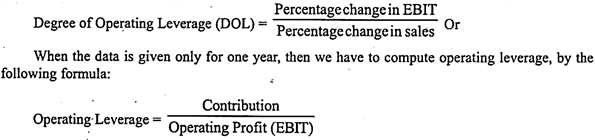

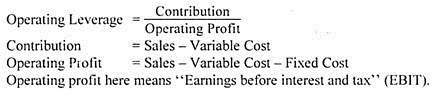

This is calculated as follows:

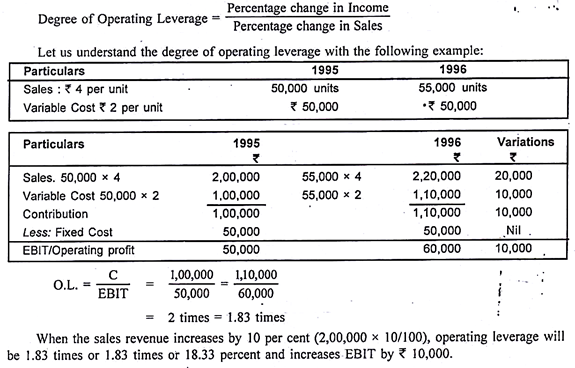

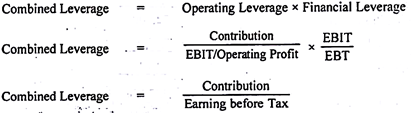

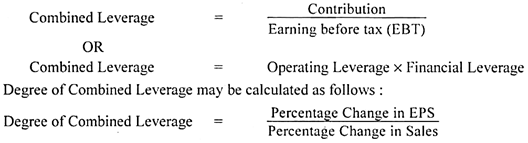

Type # 3. Combined Leverage:

This leverage shows the relationship between a change in sales and the corresponding variation in taxable income. If the management feels that a certain percentage change in sales would result in percentage change to taxable income they would like to know the level or degree of change and hence they adopt this leverage. Thus, degree of leverage is adopted to forecast the future study of sales levels and resultant increase/decrease in taxable income. This degree establishes the relationship between contribution and taxable income.

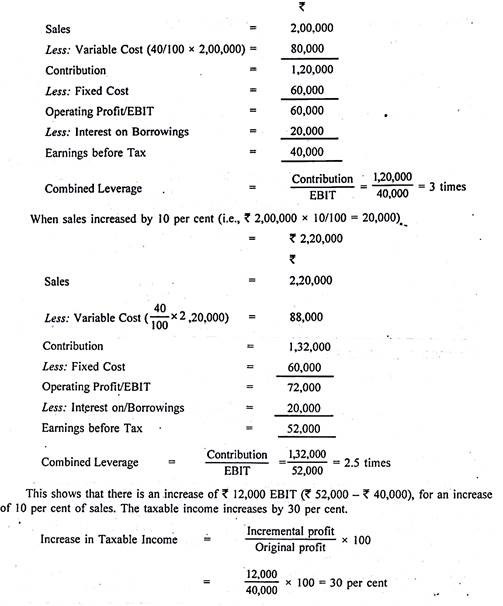

Example:

ADVERTISEMENTS:

A company, has a sales of Rs.2 lakh. The variable costs are 40 per cent of the sales and fixed expenses are Rs.60,000. The interest on borrowed capital is assumed to be Rs.20, 000. Compute the combined leverage and show the impact on taxable income when sales increases by 10 per cent.

Solution:

It should be observed that the leverage is ascertained from a particular sales point. When different levels of sales are adopted, different degrees of composite leverages are obtained. When the volume of sales increases, fixed expenses remains same, the degree of leverage falls. This happens because of existence of fixed charges in the cost structure.

ADVERTISEMENTS:

Significance of Operating and Financial Leverage:

These two leverages are used to know the impact on earnings per share and the price-earning ratio. As the financial leverage is more effective on EPS, it is popularly used than operating leverage. The different combination of debt to equity helps the management to maximise the earnings to the equity shareholders. This helps the management to achieve wealth maximisation in the long run.

Continuous increase in the size of the debt increases the financial risks. The majority of earnings will directly goes to meet the interest cost on borrowings. It adversely affects the overall performance of the organisation. Hence, he should evaluate the different mix of capital involving financial risk to the firm.

ADVERTISEMENTS:

Operating leverage is based on the principle of marginal costing, where BEP can be calculated at different level of sales. Any increase of sales beyond BEP sales will yield higher operating profit, (fixed cost remain constant). Any change in sales due to the change in operating cost results in higher operating profits. Therefore, operating leverage is said to be “First phase Leverage” which magnifies the profit due to change in sales volume.

The financial leverage is said to be a “Second phase Leverage” as it starts off at the point where the operating leverage stops. These two leverages are properly blended to have profit maximisation and wealth maximisation which are the two objectives of financial management.

Financial Risk:

Financial leverage not only maximises the returns to shareholders but also exposes a firm to high financial risk, (if it is unplanned). The theory says ‘leverage effect can be enjoyed only up to a particular point of time or stage’, (if all other things are favourable). If it crosses the expected line (more debt and less equity), increases the financial risk (interest burden) and ultimately it leads to insolvency. Capital structure only through equity is also not favourable to the company, as it reduces EPS. (Because of nonexistence debt capital). The entire earnings of the company will become taxable, as a result of this, it has to declare lower percentage of dividend, in the long run, and it would directly affect the market value of shares.

Business Risk:

Business risk is related to the investment decisions or assets mix of the firm. Business risk may be defined as the variability in return on assets. Such a variability is the result of internal and external environment, in which the firm has to operate. Given the environment in which firm has to operate, business risk is an unavoidable risk. Therefore, it is the basic duty of the financial executives to take both the risks in taking financial as well as investment decisions.

ADVERTISEMENTS:

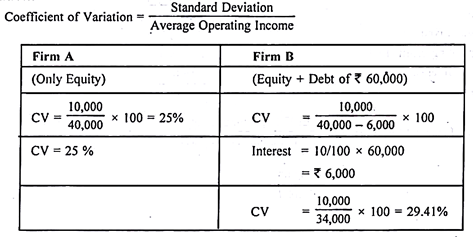

The first aspect of financial risk, viz., the relatively higher variability in the shareholders’ earnings can be measured by calculating coefficient of variation of the shareholders’ expected earnings. The coefficient of variation of the expected earnings from total assets, defined business risk.

Where (σ = standard deviation about the probability distribution of expecting earnings and X̅= average expected earnings). If the expected earnings of the firm and the expected earnings of the shareholders would be equal in the case of debt free firm. But the financial risk derived for a levered firm as the coefficient of variation of its shareholder’s earnings would be greater than that of an identical debt free firm.

Example:

The expected future average annual net operating incomes of firms A and B are Rs.40, 000 with the standard deviation of Rs.10, 000. First A is debt free while Firm A is debt free while firm B has 10 debentures of Rs.60, 000 ignoring taxation, ascertain which firm is risky from the shareholder’s point of view?

Since coefficient of variation of Firm B is greater than that of A, Firm B is more risky from the shareholder’s point of view.

Difference between Operating and Financial Leverage:

Operating Average:

1. Operating leverage is related to the investment activities (capital expenditure decision).

2. The fluctuation in the EBIT can be predicated with the help of operating leverage.

3. Financial manager uses the operating leverage to identify the items of assets side of the Balance.

ADVERTISEMENTS:

4. Operating leverage is used to predict Business risk.

Financial Average:

1. Financial leverage is more concerned with financial matters (Mixing of debt Equity in. Capital structure).

2. The changes of EPS due to D:E Mix is predicted by financial leverage.

3. The uses financial leverage to make decisions in the liability side of the Balance Sheet.

4. Financial leverage is used to analyse the financial risk.

Types of Leverages: With Features, Computations, Calculations and Application

1. Operating Leverage:

Operating leverage arises due to the presence of fixed operating costs in the cost structure of a company. Operating leverage is the use of fixed operating costs to magnify the effect of change in sales on operating profit. Thus, Operating leverage implies that a given % change in sales results into a more than proportionate change in the operating profit (Earnings Before interest and taxes or EBIT) of the company in the same direction.

ADVERTISEMENTS:

Operating Leverage measures the sensitivity of a company’s operating income to a given change in sales. A company will not have operating leverage if it does not have any fixed operating costs. At the same time the higher the fixed operating costs, the higher will be operating leverage.

Operating leverage is concerned with the capital budgeting decision of a company. This is because fixed assets give rise to fixed operating costs which in turn results into operating leverage.

Operating leverage gives rise to ‘Operating Risk’. Operating Risk or Business Risk is the risk of not being able to meet fixed operating costs. The higher the fixed operating costs, the higher will be operating leverage and the higher will be operating risk of the business.

Features of Operating Leverage:

Following are the features of operating leverage:

ADVERTISEMENTS:

i. It is concerned with fixed operating costs or fixed assets of a company.

ii. It measures the relationship between sales revenue and operating profit.

iii. It gives rise to operating risk or business risk in a business.

iv. It is higher in a manufacturing company having huge amount of fixed operating costs than a trading company which has less amount of fixed assets.

Computation of Operating Leverage:

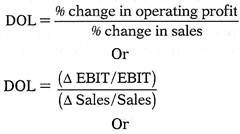

Degree of Operating Leverage (DOL) is the percentage change in a company’s operating profit (EBIT) resulting from a percentage change in sales.

Therefore, Degree of Operating Leverage (DOL) can be calculated as below:

i. Fixed operating costs are those operating costs which are independent of output. These costs remain constant irrespective of the production and sales data. The examples are—building rent, depreciation etc. Variable costs are costs which vary proportionately with output. Example – wages, utilities, materials etc.

ii. Contribution = Sales Revenue – Variable Costs.

iii. Earnings Before Interest and Taxes (EBIT) = Contribution – Fixed operating Costs.

Interpretation of Operating Leverage:

1. If DOL = 1 then a given % change in sales will result in the same % change in operating profit in the same direction i.e. 1% increase in sales will result in 1% increase in operating profit. Similarly 196 decrease is sales will result in 1% decrease in operating profit. In such a case there in effectively NO OPERATING LEVERAGE.

2. A company should have operating leverage only if its contribution margin is higher than its fixed operating costs. Otherwise it will result into more harm to the company.

3. If DOL > 1 for example if DOL =1.5 then 1% increase in sales will result in 1.5% increase in operating profit. Similarly 1% decrease is sales will result in 1.5% decrease in operating profit. In this case there is OPERATING LEVERAGE. The higher the value of DOL, the higher will be operating leverage.

4. Operating leverage is favourable when sales are increasing because then the operating profits will increase by a higher proportion. Operating leverage is unfavourable when sales are decreasing because then the operating profits will decrease by a higher proportion.

5. When comparing two or more companies, the company with the highest DOL is the company the profits of which are most “sensitive” to changes in sales.

Operating Risk (or Business Risk):

Operating risk is the risk of not being able to meet fixed operating costs like depreciation, rent etc. This risk is a function of the amount of fixed assets which involve fixed operating costs. The higher the proportion of fixed operating costs in the cost structure of a company, the higher will be operating risk.

Operating risk is also defined as variability in operating profits (EBIT) due to changes in sales. Hence there is a positive relationship between operating leverage and operating risk. The higher the operating leverage the higher is the operating risk of a company.

Significance of Operating Leverage:

If a company has higher degree of operating leverage, then even a small change in sales levels will have a significantly higher effect on EBIT in the same direction. A small increase in sales will significantly increase the operating profit (EBIT). At the same time, a small decrease in sales will also significantly decrease the operating profits (EBIT).

Therefore, a company should always try to avoid having higher operating leverage if it is not sure about the stability of its sales. If the sales are fluctuating and highly vulnerable then a high DOL condition is a highly risky proposition.

Applications of Operating Leverage:

Operating leverage is used for the following purposes:

i. For selection of Investment projects – A company should be careful while selecting investment projects. A company should select a project with lower operating leverage if all other things remain same.

ii. Operating leverage is important for long term profit planning and budgeting as one can easily compute the effect of a change in sales revenue on operating profit.

iii. DOL indicates operating or Business Risk of a company – Business Risk is the risk of not being able to meet fixed operating cost obligations. It can be measured as the variability of a company’s operating profit (EBIT). One of the main sources of variability in operating profits is change in sales which is very well captured by the degree of operating leverage. Hence degree of operating leverage in a way indicates the operating risk or business risk level of a company. The higher the DOL the higher will be business risk.

iv. Capital structure decision i.e. the mix of debt and equity capital, is also effected by the company’s operating leverage. Generally when operating leverage is high, companies should avoid excessive use of debt.

2. Financial Leverage:

Another type of leverage in financial management is ‘Financial Leverage’. Financial leverage arises due to the presence of fixed Financial Costs (such as interest) in the cost structure of a company. Financial leverage is the use of fixed Financial Costs to magnify the effect of change in operating profit (EBIT) on Earnings per share (EPS). Thus, Financial leverage implies that a given % change in EBIT results into a more than proportionate change in EPS (Earnings per share) of the company in the same direction.

Financial Leverage measures the sensitivity of a company’s EPS to a given change in its operating profit (EBIT). A company will not have Financial Leverage if it does not have any fixed Financial Costs. At the same time the higher the fixed Financial costs, the higher will be Financial Leverage. Fixed financial costs result from the use of debt capital in the capital structure of a company.

Therefore Financial Leverage is concerned with the capital structure decision of a company. This is because debt capital gives rise to fixed Financial Costs which in turn results into Financial Leverage.

Financial Leverage gives rise to ‘Financial Risk’. Financial Risk is the risk of not being able to meet fixed Financial Costs such as interest and hence it may force a company into bankruptcy. The higher the fixed Financial Costs, the higher will be Financial Leverage and the higher will be Financial Risk of the business.

Features of Financial Leverage:

Following are the features of Financial Leverage:

i. It is concerned with fixed Financial Costs or debt capital of a company.

ii. It measures the relationship between operating profit (EBIT) and earnings per share (EPS).

iii. It gives rise to Financial Risk in a business.

iv. It is higher in a company using high amount of debt.

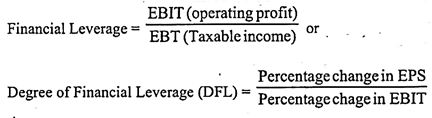

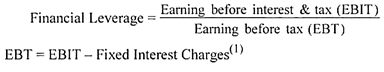

Computation of Financial Leverage:

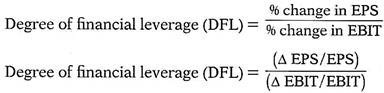

Degree of Financial Leverage (DFL) measures the percentage change in EPS for a given percentage change in operating income or earnings before interest and taxes (EBIT).

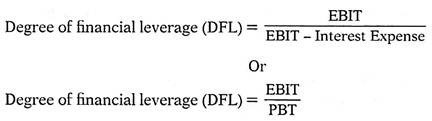

When there is No Preference Dividend then the following formula can also be used for the calculation of DFL:

Important Note:

However when there is preference dividend as well, then it is better to use the first formula. This is because while interest expenses are tax deductible, preference dividend is not tax deductible in nature. Hence earnings available to equity shareholders get reduced further by the amount of preference dividend which is fixed.

i. Fixed Financial costs are those Financial Costs which are to be paid irrespective of the amount of profit or loss. These costs remain constant irrespective of the amount of operating profits. The examples are interest on bonds and debentures, interest on bank loans etc.

ii. EBIT = Sales Revenue – Variable Costs – Fixed operating costs.

iii. Earnings Before Taxes (EBT) = EBIT – Interest. EBT is also known as Profit before Tax (PBT).

Interpretation of Financial Leverage:

1. If DFL = 1 then a given % change in EBIT will result in the same % change in EPS in the same direction i.e. 1 % increase in EBIT will result in 1% increase in EPS. Similarly 1% decrease is EBIT will result in 1% decrease in EPS. In such a case there is effectively no financial leverage.

2. A company should have Financial Leverage only if its operating profit is higher than its interest costs. Otherwise it will result into more harm to the EPS of the company.

3. If DFL > 1, for example if DFL = 1.5 then 1% increase in EBIT will result in 1.5% increase in EPS. Similarly 1% decrease is EBIT will result in 1.5% decrease in EPS. In such a case there is FINANCIAL LEVERAGE.

4. The higher the value of DFL, the higher will be financial leverage.

5. Financial Leverage is favourable when operating profits are increasing because then the EPS will increase by a higher proportion. Financial leverage is unfavourable when operating profits are decreasing because then the EPS will decrease by a higher proportion.

6. When comparing two or more companies, the company with the highest DFL is the company the EPS of which is most “sensitive” to changes in operating profits.

7. A company should use high financial leverage if its ROI is higher than the cost of debt. In that case the effect on EPS will be magnified.

Financial Risk:

Financial risk is the risk of not being able to meet fixed financial obligations like payment of interest on debt. This risk is a function of the relative amount of long term debt that a company uses to finance its assets.

The higher the proportion of debt capital in the total capitalization of a company, the higher will be degree of financial leverage and the higher will be the probability of the company of not being able to service the debt capital, which in turn means higher financial risk.

Hence there is a positive relationship between financial leverage and financial risk.

Application of Financial Leverage:

Financial leverage emerges out of the capital structure decision of a company. A finance manager can decide whether the company should use more financial leverage or not. For deciding on whether to further use debt in the capital structure or not the finance manager should compare the cost of debt financing with the company’s average Return on Investment (ROI).

i. If ROI > Cost of Debt:

This implies that the company will earn a return on its invested debt capital which is more than the cost of those debt funds. Hence, use of debt will result in positive net benefits to shareholders and therefore more debt should be employed. This situation is also known as Favourable Financial Leverage or Trading on Equity.

ii. If ROI = Cost of Debt:

This implies that the company will earn a return on debt which equals the cost of those debt funds. Hence, use of debt will not provide any additional net benefit to shareholders. Instead use of more debt will only increase financial risk. Hence, more leverage should not be used.

iii. If ROI < Cost of Debt:

This implies that the company will earn a return on invested debt capital which is less than the cost of those debt funds. Hence, use of debt will result into net loss to the company and earnings to equity shareholders will decline. So in this case, company should not use any more debt.

Significance of Financial Leverage:

i. Financial leverage leads to more than proportionate increase in EPS if operating profits of the company are increasing. This provides additional benefits to equity shareholders. However, it can also cause a manifold decline in EPS when EBIT declines. So, it is important to use financial leverage judiciously.

ii. Debt is a cheaper source of funds than equity and preference capital. Hence, use of more debt reduces the overall or weighted average cost of capital (WACC) of the company. This contributes to the objective of shareholders’ wealth maximization.

iii. Most companies use WACC as discount rate in capital budgeting decisions. A reduction in WACC due to the use of financial leverage means that more projects will be profitable and can be selected.

3. Combined Leverage:

Operating leverage explains the business risk complexion of the company whereas financial leverage deals with the financial risk of the company. But what matters for a company is its ‘Total Risk’. Total risk of a company is captured by the ‘Combined leverage’ of the company. Hence, Combined Leverage is a measure of total risk of a company. Operating leverage shows the effect of change in sales revenue on EBIT and financial leverage shows the effect of change in EBIT on EPS.

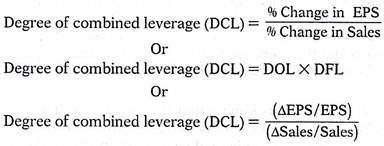

So, a company having both operating leverage and financial leverage will have to see the effect of change in sales revenue on its EPS. Combined leverage shows the effect of change in sales revenue on EPS of a company. Combined leverage is calculated as the multiplication of Operating leverage and Financial Leverage.

Interpretation of Combined Leverage:

i. If DCL = 1 then there is no combined risk of the company.

ii. If DCL > 1 then there is combined risk. Let us assume that DCL = 2.25 then it means that 1% increase or decrease in sales revenue will result into 2.25% increase or decrease in company’s EPS. In a generalised way we can say that if DCL = K then an X% increase or decrease in Sales will produce a K*X% increase or decrease respectively in EPS. For Example – If DCL = 4, then a 1% increase in sales will result in a 4% increase in EPS.

iii. DCL measures the total or combined risk of a company. Total or combined company risk is the variability in EPS. Total company risk = business risk X financial risk. Thus risk in a company is multiplicative in nature and not additive.

iv. Combined leverage or combined risk can be managed by managing operating leverage and financial leverage. If a company has higher operating leverage then it should use low financial leverage so that combined leverage does not increase manifold. If a company has lower operating leverage then it may afford to have higher financial leverage.

v. A company with relatively high level of DCL is seen as riskier than a company with less combined leverage, as high DCL means more fixed costs to the company.

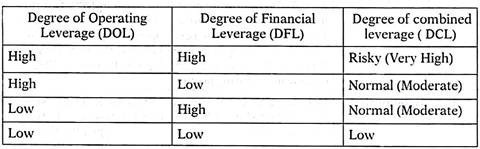

The impact of different combinations of operating and financial leverage on combined leverage is shown in the Table:

Types of Leverages – Operating Leverage, Financial Leverage and Combined Leverage (with Formula)

There are three types of leverages, such as- (1) Operating leverage, and (2) Financial leverage. (3) Combined Leverage.

Now let us discuss the different types of leverages in detail.

1. Operating Leverage:

Operating leverage is present anytime in a firm when it has operating (fixed) costs regardless of the level of production. These fixed costs do not vary with sales, they must be paid regardless of the amount of revenue available. Hence, operating leverage may be defined as the firm’s ability to use operating costs to magnify the effects of changes in sales on its earnings before interest and taxes.

Operating leverage is associated with investment (assets acquisition) activities. Hence, operating leverage results from the presence of fixed operating expenses with firm’s income stream.

The operating costs are categorised into three- First – fixed costs, which do not vary with the level of production, they must be paid regardless of the amount of revenue available. For example, depreciation on plant and machinery, buildings, insurance, etc., Second- variable costs, raw materials, direct labour costs, etc. that vary directly with the level of production. Third – Semi-variable costs, which partly vary and partly fixed.

The degree of operating leverage may be defined as the change in the percentage of operating income (EBIT), for a given change in percentage of sales revenue. The degree of operating leverage at any level of output is arrived at by dividing the percentage change in EBIT with percentage change in sales.

Symbolically:

Operating leverage may be favourable or unfavourable. High degree of operating leverage indicates higher degree of risk. It is good when revenues are rising and bad when they are falling. Operating risk (business risk) is the risk of the firm not being able to cover its fixed operating costs. The larger the magnitude, the larger the volume of sales required to cover all fixed costs.

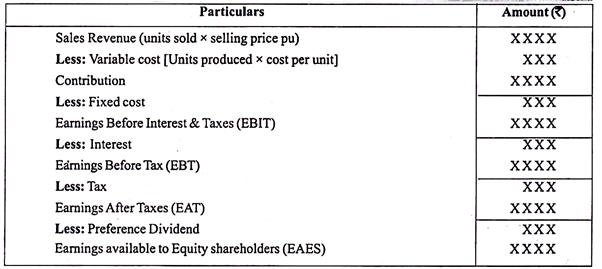

Before going to workout the problems, there is a need to know how to compute the earnings available to the equity shareholders from the sales revenue. The following format clearly gives a picture about the calculation of earnings available to the ordinary shareholders.

Applications of Operating Leverage:

i. It is helpful to know how operating profit would change with a given change in units produced.

ii. It will be helpful in measuring business risk.

2. Financial Leverage:

Firms may need long-term funds for long-term activities like expansion, diversification, modernisation, etc., Finance manager’s job is to raise the required funds with different composition of sources. The required funds may be raised by two sources – equity and debt. Use of various sources to compose capital is known as capital structure. The use of fixed charges, sources of funds such as debt and preference share capital along with the equity share capital in capital structure is described as financial leverage.

According to Lawrence, financial leverage is the ability of the firm to use fixed financial charges to magnify the effects of changes in EBIT on the firm’s earnings per share. In other words, financial leverage may be defined as the payment of fixed rate of interest for the use of fixed interest bearing securities to magnify the rate of return as equity shares. It is also known as “trading as equity”.

Hence, financial leverage results from the presence of fixed financial charges in the income statement. Financial leverage associates with financing activities. The fixed charges do not vary with the firm’s EBIT. They must be paid regardless of the amount of EBIT available to the firm. It indicates the effect on EBIT created by the use of fixed charge securities in the capital structure of a firm.

Financial leverage is computed by the following formula:

Financial leverage may be positive or negative, favourable leverage occurs when the firm earns more on the assets purchased with the funds, than the cost of their use and vice versa. Higher the degree of financial leverage leads to high financial risk. The financial risk refers to the risk of the firm not being able to cover its fixed financial costs. Hence, financial manager should take into consideration the level of EBIT and fixed charges while preparing the firm’s financial plan.

Application of Financial Leverage:

(i) It is helpful to know how EPS would change with a change in operating profit.

(ii) It is helpful in measuring financial risk.

3. Combined Leverage:

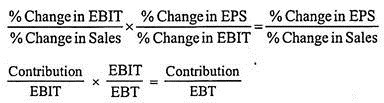

The operating leverage has its effects on operating risk and is measured by the percentage change in EBIT due to the percentage change in sales. The financing leverage has its effects on financial risk and is measured by the percentage change in EPS due to the percentage change in EBIT.

Since, both these leverages are closely related with the ascertainment of the firm’s ability to cover fixed charges (fixed operating costs in the case of operating leverage and fixed financial costs in the case of financial leverage), the sum of them gives us the total leverage or combined leverage and the risk associated with combined leverage is known as total risk. The degree of combined leverage may be defined as the percentage change in EPS due to the percentage change in sales.

Thus, the combined leverage is:

Types of Leverages – Operating, Financial and Combined

Leverage is of three types:

1. Operating Leverage,

2. Financial Leverage, and

3. Combined Leverage.

Type # 1. Operating Leverage:

Operating leverage may be defined as the tendency of the operating profit to vary disproportionately with the volume of sales. It occurs when a firm has fixed costs that must be paid regardless of volume of sales. In other words, with fixed costs, the percentage change in operating profits is greater than the percentage change in sales. This tendency is called operating leverage. The degree of operating leverage depends upon the proportion of fixed costs as compared to variable costs.

If the proportion of fixed costs is higher than the variable costs, it will have a higher degree of operating leverage. On the other hand, if the proportion of fixed costs is lower than the variable costs, it will have a lower operating leverage. In case of higher degree of operating leverage, the operating profits will increase at a higher rate as compared to the rate of increase in sales and vice versa.

Computation:

The operating leverage can be calculated as:

Operating leverage may be favourable or unfavourable. It will be favourable when contribution (i.e. sales less variable cost) exceeds the fixed cost and it will be unfavourable when contribution is lower than the fixed cost.

Degree of Operating Leverage:

The degree of operating leverage may be defined as the percentage change in operating profits resulting from a percentage change in sales.

Implications of Operating Leverage:

It can be said that higher is the operating leverage, higher will be the fluctuations in the operating profit as a result of change in sales. In case of high leverage, if the sale increases, operating profits will increase more than proportionately. On the other hand, if the sales decline, the operating profits will decline more than proportionately. Thus high leverage means exceptionally large operating profits in case of exceptionally large sales and exceptionally large losses in case of large decline in sales.

Significance of Operating Leverage:

The analysis of degree of operating leverage helps the financial management in making a number of financial decisions as follows:

(i) Selection of an Appropriate Technology of Production:

A firm with an automated production technology has to make large investment in fixed assets. As a result, its fixed costs and consequently operating leverage will be higher. On the other hand, if a firm employs labour intensive technology, the investment in fixed assets will be lesser and hence, its operating leverage will be lower. The financial manager has to make a choice between high operating leverage (i.e., automated production technology) and low operating leverage (i.e., labour intensive technology).

Choice between the two depends upon the behaviour of the sales volume of the firm in future. If the firm expects large volume of sales, it would be better to operate under high operating leverage and consequently the firm would choose automated production technology. On the other hand, if the firm expects lower sales volume, it should have lower operating leverage and the firm should choose labour intensive technology of production.

(ii) Fixation of Selling Price:

A firm with high operating leverage may sell its products at reduced prices because of presence of lower variable cost per unit. Reduction in prices leads to increase in the number of units sold which will adequately compensate the decline in profits due to decrease in selling prices. As a result, the profit of the firm will increase inspite of decrease in selling prices.

(iii) Useful in Understanding the Change in Operating Profit:

Analysis of operating leverage is useful to the financial manager in understanding the impact of change in sales on the level of operating profits of the firm. A firm having high operating leverage will have magnified effect on operating profits for even a small change in sales level. Higher operating leverage can dramatically result in increase in operating profits whereas a decline in sales may result in disappearance of operating profits and even give place to operating loss.

(iv) Measurement of Business Risk:

Degree of operating leverage is helpful in the assessment of business risk of a firm. Business risk is related to fluctuation in the operating profits. The higher the degree of operating leverage, the greater will be the fluctuations in the operating profits as a result of change in sales volume. Thus, higher degree of operating leverage implies higher business risk and vice versa.

Therefore, a firm should always try to avoid operating under high operating leverage because it is a high risk situation and even a small decline in sales can excessively reduce its operating profits. On the other hand, a firm should try to operate at a level where chances of loss due to decline in sales are minimized.

Type # 2. Financial Leverage:

Financial leverage arises on account of existence of fixed interest or fixed preference dividend bearing securities in the total capital structure of the firm. In other words, financial leverage is created on account of raising of capital from those sources on which fixed return has to be paid, such as debt and preference capital along with owner’s equity in the capital structure.

The fixed return or fixed charges payable on debt or preference capital do not vary with the earnings before interest and taxes (EBIT). They are to be paid regardless of the amount of EBIT. After paying fixed charges out of EBIT, the residual net income belongs to ordinary shareholders.

Financial leverage may be defined as the tendency of the residual net income to vary disproportionately with EBIT. In other words, the financial leverage indicates the change that takes place in the residual net income as a result of change in EBIT.

The ratio is expressed as follows:

Favourable and Unfavourable Financial Leverage:

Financial leverage may be favourable or unfavourable depending upon whether the earnings made by the use of fixed cost securities exceed the fixed cost which the firm has to pay on them. For example, if a company borrows Rs. 100 at 10% interest p.a., and earns a return of 12%, the leverage will be considered favourable. Unfavourable or negative leverage occurs when the firm does not earn as much as the cost of debt. Favourable financial leverage is also known as ‘trading on equity’.

Significance of Financial Leverage:

(i) Understanding Changes in Earning before Tax (EBT):

Financial leverage helps in understanding the changes in Earning before Tax (EBT) as a result of changes in Earnings before interest and tax (EBIT). For example, financial leverage of 2 means 50% increase / decrease in EBIT will result in 100% increase / decrease in EBT.

(ii) Planning of Capital Structure for the Firm:

The capital structure is concerned with the raising of long term funds, both from fixed cost funds and equity capital. Financial leverage helps the finance manager in devising an appropriate ratio between fixed cost funds and equity share capital. A high financial leverage means high financial costs and high financial risk. A finance manager must plan the capital structure in a way that the firm is in a position to meet its fixed financial costs.

(iii) Measurement of Financial Risk:

Financial leverage helps in measuring financial risk. High financial leverage implies high fixed financial costs and thus high financial risk and low financial leverage implies low fixed financial costs and low financial risk. The financial risk refers to the risk of the firm not being able to cover its fixed financial costs. If the firm cannot pay the fixed financial costs, it can be forced into liquidation.

(iv) Profit Planning:

Earning per share (EPS) is affected by the degree of financial leverage. High financial leverage can increase the EPS of a firm if the earnings before interest and tax (EBIT) is expected to increase in future. On the contrary, if EBIT is likely to decrease in future, the EPS would decline at a much faster rate as compared to the rate of decline in EBIT. Hence, by studying the relationship between EBIT and EPS changes, the firm can plan about the behaviour of EPS in future.

Limitations of Financial Leverage / Trading on Equity:

(i) Double-Edged Weapon:

Financial leverage is a double-edged weapon. It can be successfully employed only when the rate of earnings of the firm exceeds the rate of interest or preference dividend. For example, if a firm borrows Rs. 100 at 9% interest p.a., and earns a return of 12%, the balance of Rs. 3 p.a. will belong to the equity shareholders resulting in increase in earnings per share (EPS). However, if the firm could earn a return of only 6% on Rs. 100 employed by it, the equity shareholder’s loss would be p.a. resulting in a decline in EPS.

(ii) Increase in Risk and Rate of Interest:

Every rupee of extra debt goes on increasing the risk of the business and hence the rate of interest on subsequent borrowings also goes on increasing because subsequent lenders will demand higher rate of interest.

(iii) Harmful in Case of Fluctuation in Earnings:

High Financial leverage is beneficial only to the firms having regular and stable earnings. The reason is that interest on borrowings is a fixed burden on the firm and in case the earnings fall, the firm may not be in a position to meet its fixed interest burden.

(iv) Restrictions from Financial Institutions:

Financial institutions which have lent money to the firm may impose restrictions on the firm if it resorts to excessive financial leverage. The restrictions are imposed because of increased risk and to maintain a balance in capital structure of the firm.

Type # 3. Combined or Composite Leverage:

As explained, operating leverage measures the effect of change in sales level on the EBIT level. Thus, it explains the degree of business risk complexion the firm. Financial leverage measures change in earning before tax (EBT) on account of change in operating profits (i.e., EBIT). Thus, it explains the degree of financial risk. Both these leverages are closely concerned with the firm’s capability of meeting its fixed costs (both operating and financial). In case both the leverages are combined, the result will depict the effect of change in sales level on the earning before tax (EBT).

Therefore, combined leverage depicts the relationship between revenue on account of sales (i.e., contribution or sales less variable cost) and the earning before tax. In other words, it reveals the change in earning before tax on account of change in contribution.

It may be calculated as follows:

Significance of Combined Leverage:

(i) Understanding Changes in EPS:

Combined leverage explains the combined effect of operating leverage and financial leverage of a firm on its earnings per share (EPS). Thus, it explains the changes in EPS on account of changes in sales.

(ii) Assessment of Total Risk:

Combined leverage helps us in ascertaining the overall risk assumed by the firm. It depicts a combined effect of operating risk and financial risk on the EPS of the firm.

(iii) Helpful in Establishing a Proper Combination of Operating and Financial Leverage:

A high degree of operating leverage together with a high degree of financial leverage makes the position of the firm very risky. High operating leverage results from employing the assets for which it has to pay higher fixed costs and high financial leverage results from the use of large amount of debt capital.

In order to keep the overall risk under manageable limits, the firm will have to strive a proper combination of operating and financial leverage. For this purpose, a firm which has assumed high operating leverage should employ lower financial leverage and on the other hand, a firm which has assumed lower operating leverage can afford to employ a higher degree of financial leverage.