This article throws light upon the top six concepts of value. The concepts are: 1. Book Value 2. Market Value 3. Going Concern Value 4. Liquidation Value 5. Replacement Value 6. True Concept of Value or Intrinsic Value.

Concept # 1. Book Value:

The book value of assets can be ascertained from the firm’s balance sheet which is prepared according to the accounting concepts and conventions. The assets are shown in the balance sheet at cost less depreciation.

No account is taken for the real value of the assets, which may change with the passage of time. The assets are generally recorded at cost. In case the convention of conservatism is used then assets are shown at cost or market price whichever is less.

The convention of conservatism is followed for current assets only and not for fixed assets. The value of intangibles is also included in the assets. The debts are shown on the outstanding values and no account is taken for interest or payment of principal amount.

The book value per share can be determined by dividing the common shareholders’ equity (capital plus reserves and surpluses) by the number of shares outstanding.

Concept # 2. Market Value:

The market value of an asset or security is the value at which it can be sold at present. It is argued that actual market prices are appraisals of knowledgeable buyers and sellers who are willing to support their opinions with cash. Market price is a definite measure that can readily be applied to a particular situation and it minimises the subjectivity of other methods in favour of a known yardstick of value.

Concept # 3. Going Concern Value:

In the valuation process the valuation of shares is done on the going concern basis. In a going concern, we assess the value of an existing mixture of assets which provide a stream of income. The going concern value is the price which a firm could realise if it is sold as an operating business.

The going concern value will always be higher than the liquidation value. The difference between these two values will be due to value of organisation, reputation etc. We may command goodwill if the concern is sold as a going concern.

For example, if the future maintainable profits of a firm are estimated to be Rs. 5,00,000 per annum and the expected normal rate of return (capitalisation rate) is 10%, the going concern value of the firm then would be:

5,00,000 × 100/10 = Rs. 50,00,000

Concept # 4. Liquidation Value:

If a firm decides to go out of business, it will sell its assets. After terminating the business, the amount which will be realised from sale of assets is known as liquidation value. Since the business will be terminated, the organisation will be valueless and intangibles will not fetch any price. The liquidation value will be the lowest value of a firm. Generally, the true value of the firm will be greater than the liquidation value.

The liquidation value is useful from the creditors’ point of view. If the concern is running then creditors will be paid out of cash inflows. On the other hand if the concern is terminated, the creditors will be paid out of the amount realised from various assets. The creditors will try to ensure that the realisable value of .the assets is more than their claims so that they get fully paid.

Concept # 5. Replacement Value:

The assets are shown on historical cost in the balance sheet. This cost may not be relevant in the present context. This problem may be solved by showing assets on replacement value basis. Replacement value is the cost which a firm will have to spend if it were to replace the assets under present conditions.

Though replacement value method is an improvement over book value concept but still it has certain limitations. It is very difficult to ascertain the present value of similar assets which the firm is using.

It may so happen that this type of assets may no longer be manufactured at present. This will create a problem of finding out the replacement cost of the assets. Moreover, it is not certain that the assets or business would be worth its replacement cost. The value of intangibles is also ignored in this method.

Concept # 6. True Concept of Value or Intrinsic Value:

A business enterprise keeps or uses various assets because they generate cash inflows. Value is the function of cash inflows and their timing and risk. When cash inflows are discounted at the required rate of return to account for their timing and risk, we get the fair value or the present value of the asset. In financial decision making such as valuation of securities, it is the present value concept which is relevant.

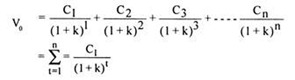

Symbolically:

where,

V0 = Value of the asset at time zero.

C1, C2, C3 = Expected cash flow in period 1, 2, 3, and so on.

K = Discount rate applicable to cash flows.

n = Expected life of the asset.

t = Time period.

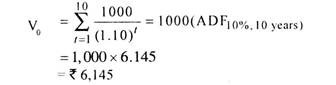

For example, an investor who uses a 10 percent discount rate would value an asset that is expected to provide an annual cash inflow of Rs. 1000 per year for the next ten years as being worth Rs. 6145, as calculated below: