Working capital refers to short-term funds that are needed to meet operating expenses. To quote Ramamoorthy, “It refers to the funds, which a company must possess to finance its day-to-day operations”. It is concerned with the management of the firm’s current assets and current liabilities.

It relates to the problems that arise in attempting to manage the current assets, current liabilities and their interrelationship that exists between them. If a firm cannot maintain a satisfactory level of working capital, it is likely to become insolvent and may even be forced into bankruptcy.

Working capital is the amount of funds required for meeting day-to-day expenses of the business. The firm starts with cash. It buys raw materials, employs workers and spends on expenditures like advertising etc.

Working Capital is defined as “excess of current assets over current liabilities and provisions” It is that part of the Capital which is required for the daily working of the business. It is Capital with the business worked over.

“Working Capital is the amount of funds necessary to cover the cost of operating the enterprise.” – Shubin

Working Capital: Meaning, Definition, Formula, Net Working Capital, How to Calculate Working Capital, Factors, Loans, Concept, Need, Factors,Significance, Components, Types, Classification, Principles and More…

Working Capital – Introduction and Meaning

Working capital management or current assets management is one of the vital parts of financial management. Working capital is concerned with short term finance or finance required for routine activities or operations. Effective and efficient management of working capital ensures the success of a business.

The inefficiency of management may lead to loss, which in turn leads to shut down of business operations. Hence, study of working capital management is not only limited to financial management but also to the overall management of the organization.

Working capital management involves deciding upon the amount and composition of current assets and the manner in which it is financed. The finance manager must take utmost care in determining the appropriate level of working capital.

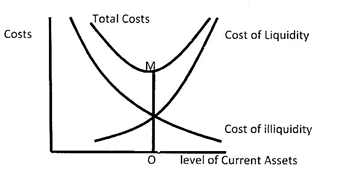

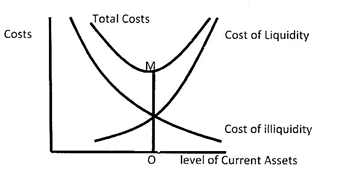

The greater the amount of working capital level maintained, the less the risk of running out of cash profitability will be less.

In case of lower levels of working capital, the profitability will be greater as the funds would be efficiently utilized but the danger of running out of capital to meet the requirements will be more. Thus, it is a closely related trade between profitability and liquidity.

Working Capital – Meaning

Working capital refers to short-term funds that are needed to meet operating expenses. To quote Ramamoorthy, “It refers to the funds, which a company must possess to finance its day-to-day operations”. It is concerned with the management of the firm’s current assets and current liabilities.

It relates to the problems that arise in attempting to manage the current assets, current liabilities and their interrelationship that exists between them. If a firm cannot maintain a satisfactory level of working capital, it is likely to become insolvent and may even be forced into bankruptcy.

Working capital is the amount of funds required for meeting day-to-day expenses of the business. The firm starts with cash. It buys raw materials, employs workers and spends on expenditures like advertising etc.

Even then it may not receive cash immediately if sold on credit. The firm will have to use its own cash before it gets back sales revenue and then the cycle can go on.

So the money or funds required to meet the expenditure until it gets back through sales revenue is called working capital and this much fund it has to keep. In simple words, working capital refers to that part of the firm’s capital which is required for financing short term or current assets such as cash, marketable securities, debtors and inventories.

Funds, thus, invested in current assets keep revolving fast and arc being constantly converted into cash and this cash flows out again in exchange for other current assets. Hence, it is also known as revolving or circulating or short term capital.

Working Capital – Definition

Working Capital is defined as “excess of current assets over current liabilities and provisions” It is that part of the Capital which is required for the daily working of the business. It is Capital with the business worked over.

“Working Capital is the amount of funds necessary to cover the cost of operating the enterprise.” – Shubin

‘Working Capital is also called as Circulating Capital’

“Circulating Capital means current assets of a Company that are changed in the ordinary course of business from one into another as for example from cash to inventories to receivables and receivables into Cash.” – Gerstenberg

“Stocks of materials, fuels, semi-finished goods including work-in-progress and finished goods and byproducts cash in hand and bank and algebraic sum of sundry creditors is represented by

(a) outstanding factory payment e.g. rent, wages on interest and dividend;

(b) Purchase of goods and Services;

(c) Short-term loans and advances and sundry debtors comprising amounts due to the factory on of account sale goods and Services and advances towards tax payment.” – Annual Survey of Industries (1961)

V.E Ramamoorthy has rightly pointed out that ‘working capital is one segment of capital structure of a business and constitutes an inter-woven part of the total integrated business system’.

Concept of Working Capital – Gross and Net Working Capital (With Illustration and Figure)

Working capital means the amount of funds required by an enterprise to finance its day to day operations. It is that part of the total capital which is employed in short term assets such as raw materials, accounts receivable, inventory, etc.

The concept of working capital are:

(i) Gross Working Capital:

It means the total value of current assets. Current assets are the assets, which are converted into cash within a period of one year. These include cash in hand, cash at bank, stock or inventory, bills receivable or short term investments.

Gross working capital is a financial concept. It does not reveal the true financial position of an enterprise. For example a borrowing will increase current assets but at the same time it will increase current liabilities. Thus, gross working capital = Total value of current assets.

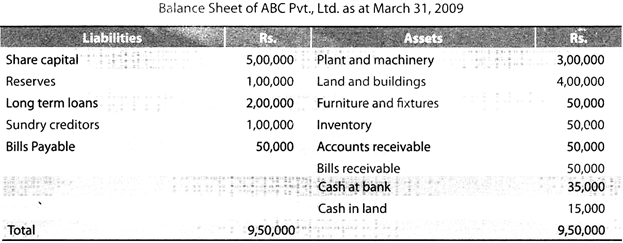

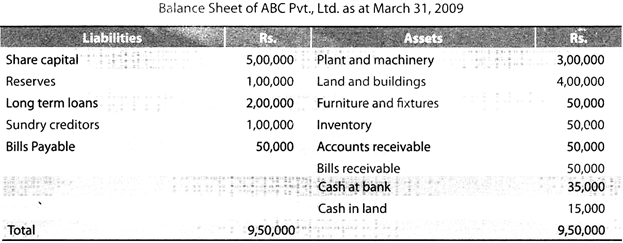

Illustration:

Gross working capital is:

Inventory + Accounts receivable + bills receivable + cash at bank + Cash in hand = 50,000 + 50,000 + 50,000 + 35,000 + 15000 = Rs. 2,00,000

Net working capital = Rs. 2,00,000 – (1,00,000+50,000) = Rs. 50,000

(ii) Net Working Capital:

It implies the excess of current assets over current liabilities. Current liabilities consist of accounts payable, bills payable, outstanding expenses. These liabilities are payable within a year.

It reflects the current financial position of the enterprise or the firm’s capacity to meet operating expenses and current liabilities. It represents that portion of the current assets which is financed through long term funds.

It is an accounting concept. Net working capital does not increase with every increase in gross working capital. Net working capital increases only when there is an increase in current assets without a corresponding increase in current liabilities.

Thus, net working capital = current assets – current liabilities

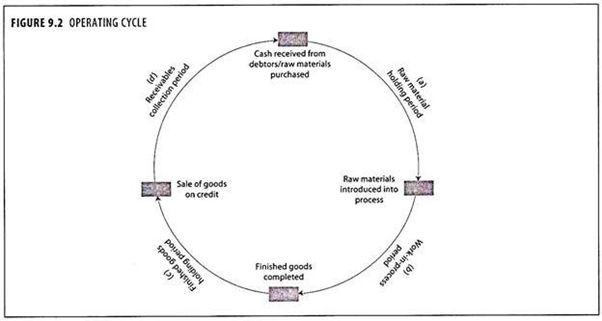

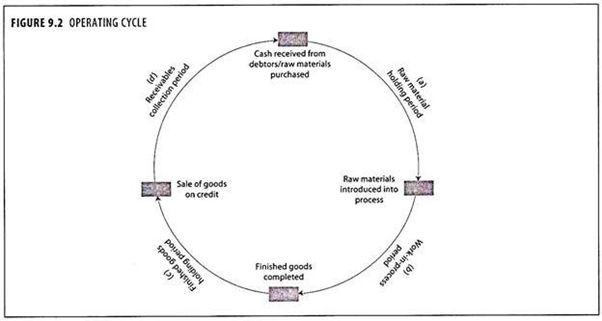

Working capital is required to bridge the time gap between production of goods and receipt of cash through sales.

This time gap is called operating cycle of the business. According to the American Institute of Certified Public Accountants operating cycle is the average time intervening between the acquisition of materials or services entering the process and the final cash realisation.

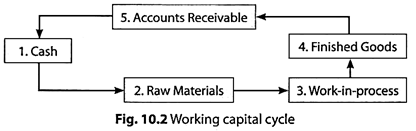

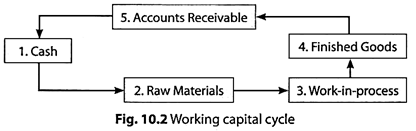

During the operating cycle, working capital keeps on circulating or revolving from one form to another. Therefore, working capital is also known as ‘circulating capital’ or ‘revolving capital’. The circulation of working capital during the operating cycle is shown in Fig 10.2.

It can be seen from Fig 10.2 that cash is used to buy raw materials. After processing raw materials get converted into work in progress and then, in finished goods. When finished goods are sold on credit accounts receivable or debtors arise. As soon as payments are received, debtors get converted in cash.

The operating cycle is also called the cash to cash cycle. Working capital is the total cash circulating in this cycle. It can be turned over or reused after completing the cycle. The cycle of working capital reveals that the process of working capital begins with cash and ends with cash. This cycle continues throughout the life of a business enterprise.

Need For Working Capital (With Cycle of Events)

Sales do not convert into cash instantly; there is invariably a time lag between the sale of goods and receipt of cash. There is, therefore, a need for working capital in the form of current assets to deal with the problem arising out of the lack of immediate realisation of cash against goods sold. Therefore, sufficient working capital is necessary to sustain sales activity.

“The continuity flow from cash to suppliers to inventory, to accounts receivable, and back into cash is what is known as the operating cycle.”

In other words, the term cash cycle/operating cycle refers to the length of time necessary to complete the following cycle of events:

1. Conversion of cash into inventory.

2. Conversion of inventory into receivables.

3. Conversion of receivables into cash.

The operating cycle, thus, creates the need for current assets (working capital). However, the need does not come to an end after the cycle is completed. It will continue to exist. To carry on business a certain minimum level of working capital is necessary on a continuous and uninterrupted basis.

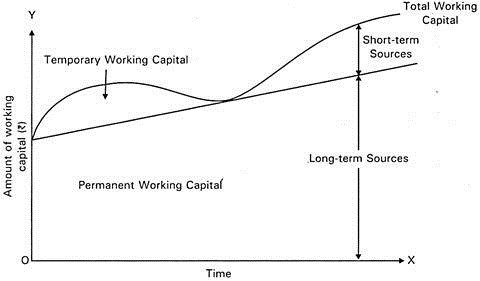

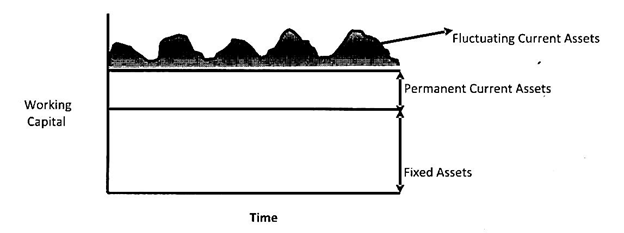

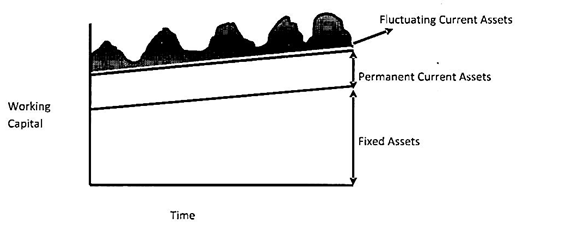

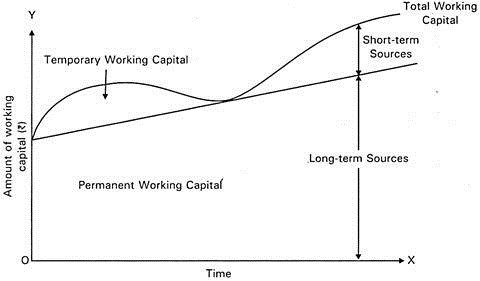

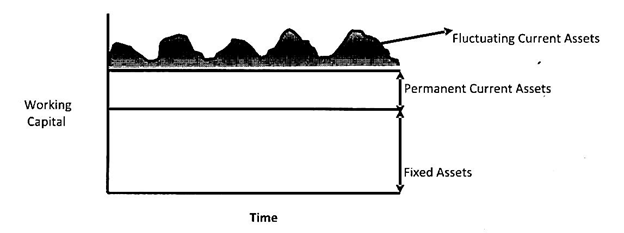

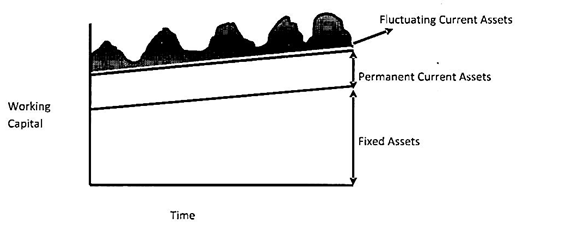

For all practical purposes, this requirement will have to be met permanently as with other fixed assets. This requirement is referred to as permanent or fixed working capital. Any amount over and above the permanent level of working capital is temporary, fluctuating variable working capital. This portion of the required working capital is needed to meet fluctuations in demand consequent upon changes in production and sales as a result of seasonal changes.

Factors Determining the Working Capital

How much working capital is required depends upon the nature of industries which varies from time to time. There are no set of rules or principles determining the quantity of working capital required for all concerns at any time. Various factors influence the determination of the extent of working capital required for any enterprise.

Factors Determining the Working Capital or Estimating of Working Capital are as follows:

Factor # 1. Size of the Firm:

The size of the firm in terms of it’s scale of operation is an important factor affecting the requirements of the working capital.

For example, a small scale organisation requires less amount of working capital whereas large scale organisation requires more amount of working capital.

Factor # 2. Nature of Business:

It is another factor affecting while estimating working capital. For example, trading firms require huge amounts of working capital and its investment on fixed assets is limited.

On the contrary, public utility undertakings like electricity, water supply, railways, etc., require a huge amount of fixed capital and require lesser amounts of working capital, because such services are provided only on a cash basis and funds are not tied up in debtors or inventories.

Factor # 3. Changes in Technology:

It relates to the manufacturing process that may influence working capital. The use of modernised machines requires less quantity of raw materials which results in the reduction of working capital.

Factor # 4. Production Cycle:

The time taken for converting raw materials into finished products is known as production cycle or manufacturing cycle.

Longer period of the manufacturing cycle requires more amount of working capital.

On the contrary a shorter period of manufacturing cycle requires less amount of working capital.

Thus a short period of manufacturing cycle helps for minimizing work-in- progress and wastage of time. Therefore the length of the production cycle should be kept minimum as far as possible.

Factor # 5. Business Cycle:

Business increases during the boom period and decreases during the period of depreciation.

During the boom period, sales increased rapidly and correspondingly the investment as inventories also increased requiring more working capital.

During depreciation periods like demand for the product declines reducing the level of inventories to be held and as a result working capital requirement also declines.

Even the working capital requirement depends on the seasonal fluctuations in demand.

For example, during the summer season, the demand for fans, air coolers etc., increases. In order to meet increasing demand for the product, a manufacturer has to arrange for additional working capital which is almost temporary in nature.

On the contrary during the rainy season sales decline. So, in such cases, a lesser amount of working capital is required by the manufacturer.

Factor # 6. Type of Industry:

A capital intensive industry is purely based on machines, requires more fixed capital and less working capital.

Whereas, a labour intensive industry based on manpower resources requires more working capital for the payment of salaries & wages etc.

Factor # 7. Rate of Turnover:

High rate of turnover requires less amount of working capital. For example bakery units may require less amount of working capital because bakery products are fast moving.

Whereas low rate of turnover requires a huge amount of working capital For example, TVS dealers, Refrigerator & Radio dealers require more amount of working capital because these items are slow moving.

Factor # 8. Credit Policy:

If the goods are sold on credit more amount of working capital is required, because its funds get blocked up in book debts and receivables. On the contrary, if the goods are sold on a cash basis, less amount of working capital is required.

Importance of Working Capital

Importance of Working Capital are as follows:

Importance # (a) Smooth Business Operations

Working capital ensures the regular and timely payment of wages and salaries, thereby improving the morale and efficiency of employees. Purchase of raw materials, overheads and other day-to-day financial requirements can also be met without any delays. This helps in an uninterrupted flow of production.

Importance # (b) Regular Supply of Raw Material

The payments to the suppliers of raw materials on time, ensure a regular supply of raw materials and continuous production.

Importance # (c) Enhances Goodwill

As a business concern is able to make prompt payments of its obligations, it helps in creating and maintaining goodwill.

Importance # (d) Improves Creditworthiness

A firm having adequate working capital is considered favorably by banks and financial institutions, thus making it easy for it to get credit.

Importance # (e) Ability to Case Crisis

It provides necessary funds to meet unforeseen contingencies and thus helps the enterprise to run successfully during periods of crisis. It also helps the business concern to pick up stock of raw materials, even during an economic depression.

Working capital is thus an important short-term investment for all businesses, regardless of their size. However, maintaining too much or too little of working capital can lead to degeneration of a going concern. The importance of adequacy of working capital is discussed in the following paragraphs.

Significance of Working Capital

Working capital is the life-blood of business and nerve-centre for all business activities. It is also regarded as the heart of business. If it becomes weak, the business can hardly prosper and survive.

This means that adequate and effective provision of capital will ensure the success of the business whereas its inefficient management is likely to lead to loss of profits and even to the ultimate downfall of what otherwise might be considered as a promising concern.

Investment merely in fixed assets only is not sufficient to run the business. Working capital or investment in current assets, however small it may be, is a must for the purchase of raw materials, etc., etc., for payment of bills and short-term debts and also for maintaining the fixed assets.

“The fate of large scale investment in fixed assets is often determined by a relatively small amount of current assets”. Working capital is regarded as the heart of a business. If it is weak, the business cannot prosper and survive, even though there is a large investment in fixed assets.

Moreover, the existence of working capital is not only a must for the business but it must also be in sufficient quantity. Inadequate or even redundant working capital is dangerous for the health of the business, It is said “while inadequate working capital is redundant working capital is a criminal waste”. Both the situations are unwarranted in a sound business organisation.

The significance of working capital can be ascertained from the following points :

Significance # 1. Feeling of Security and Confidence:

Adequate working capital creates a feeling of security and confidence among the proprietors or the managers of a business concern as they need not worry for payment of business expenditure, bills or creditors. It also creates a sense of security and loyalty among its creditors, business associates and employees.

Significance # 2. Solvency and Survival:

Adequate working capital with the firm is a must for maintaining solvency and survival of the firm as it enables the firm to meet the payment of bills etc., as and when they are due. Without sufficient working capital, production cannot be carried on continuously and business can never flourish particularly in these days of cut-throat competition.

Significance # 3. Good will and Borrowing Capacity:

Sufficient working capital enables the firm to make prompt payments in business and this will create goodwill of the firm and increase its borrowing capacity. A firm can raise funds from the market at competitive terms.

Significance # 4. Good Relations:

Maintenance of adequate working capital enables the firm to maintain good relations with banks and other financial institutions as well as trade creditors.

Significance # 5. Increase in Efficiency of Fixed Assets:

Adequate working capital increases the efficiency of the fixed assets as they can be used continuously and effectively with sufficient funds. Fixed assets cannot be used without working capital just like guns which cannot shoot without cartridges.

It is therefore often said that the fate of large scale investment in fixed assets is often determined by a relatively small amount of working capital.

Significance # 6. Research and Innovation Programmes:

A firm can undertake research programmes and innovation and technical developments provided it has sufficient funds on such programmes.

Significance # 7. Meeting Unforeseen Contingencies:

There are always ups and downs or booms and depressions in business, which many times occur suddenly or unexpectedly. A firm can meet any unforeseen contingencies if it possesses adequate working capital.

Significance # 8. Increased Profitability:

The profitability of a business concern depends, in no small measure, upon the right proportion of fixed capital and working capital. Every activity of the business directly or indirectly affects the current position of the firm and hence its working capital needs should be properly estimated and provided accordingly.

Significance # 9. High Morale:

The maintenance of adequate working capital improves the morale of the managers and it will also have a great psychological effect on them. This will result in their increased efficiency.

Thus, the need for adequate working capital for a business firm can hardly be emphasised. Just as circulation of blood in the human body is absolutely essential for maintaining health and life, similarly smooth flow of funds is absolutely essential to maintain the health of the firm in good condition.

Components of Working Capital

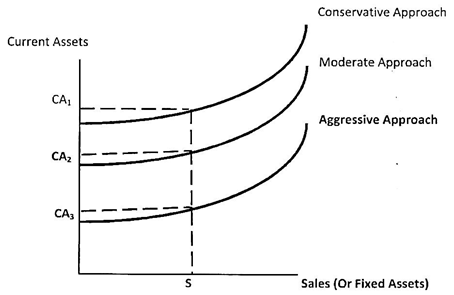

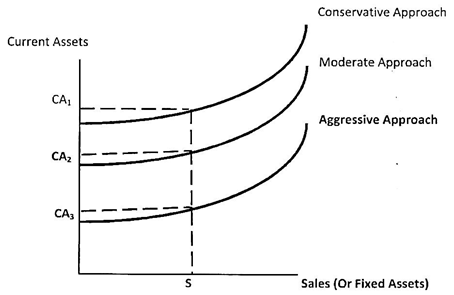

The five major components of working capital are raw materials, work-in-process, finished goods, receivables and cash. The management of working capital necessitates management of these five components.

Let us now look into these components:

Component # 1. Raw Materials:

An industrial unit needs to maintain a certain stock of raw materials to ensure uninterrupted production. Stocking is necessary because of uncertainty of availability, time lags between the placing of the order and actual delivery, sudden increase in demand, etc.

Inadequate stocking could lead to being out of stock which would result in stoppage of production, inability to meet delivery schedules, cancellation of orders, etc.

Thus, a balance needs to be struck between the expense of excessive stocking and the risk of running out of stock. Advance planning of inventory, adopting a suitable system of inventory control and an appropriate procurement policy would lead to an optimum level of inventory being maintained.

Component # 2. Work-in-Process:

On the basis of the sales plan, a suitable production plan could be drawn up so as to ensure optimum utilization of facilities, minimize inventory of work-in-process, and reduce wastage. Thus, a suitable production planning and control system must be evolved.

Component # 3. Finished Goods:

The stocking of finished goods would depend on expected sales, seasonal nature of sales, delivery schedules, length of the manufacturing process, expected spurts in demand, and the like. Finished goods represent both material cost and conversion charges. Hence, an unnecessary build-up of finished goods stock would cost more than that of other items of inventory.

Component # 4. Receivables:

Given the choice, every unit would prefer to sell its product through cash sales. However, due to prevailing trade practices in the industry, market conditions and other factors, the unit is often compelled to sell its goods on credit.

In certain circumstances, a unit may deliberately extend credit as a strategy for increasing sales. However, receivables give rise to certain costs such as the cost of carrying receivables, and bad debts losses.

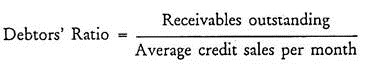

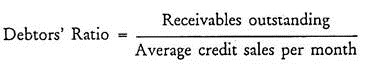

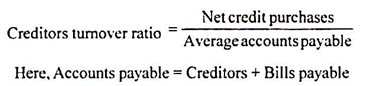

Thus, the objective of any policy on receivables would be to ensure that the growth rate of sales is greater than, or at least equal to, the rate of growth of receivables. The debtors’ ratio gives us the level of receivables held by a unit at any point of time.

Each firm could determine a projected level of receivables on the basis of projected sales, past experience and factors such as type of product, type of customers, size and standing of the unit as compared to its customers, seasonality of demand, possibility of offering cash discounts, market conditions and trade practices.

Once a projected level of receivables has been determined, a system of monitoring has to be evolved. The system should be such that the recording of information, routine follow-up and recovery can be handled by junior employees. A fortnightly, monthly or quarterly review of the level of receivables outstanding could be undertaken, depending on the need of the unit.

Component # 5. Cash:

Investment in cash is the most unproductive deployment of working capital funds. However, cash is essential for meeting current liabilities and other cash expenses like salaries, electricity, rent on time.

A suitable cash budget prepared in advance can enable the unit to plan its cash in-flow and out-flow, and thus optimize its investment in cash. Surplus cash could be invested in marketable securities.

Sound management of the various components of working capital would lead to a reduction in the working capital required for a specified level of activity and consequently, to cost reductions and increased profitability.

Types of Working Capital – Net, Gross, Permanent, Temporary or Variable, Balance Sheet, Cash and Negative Working Capital

Types of Working Capital are as follows:

Type # 1. Net Working Capital:

The net working capital is the difference between current assets and current liabilities. The concept of net working capital enables a firm to determine how much amount is left for operational requirements.

Type # 2. Gross Working Capital:

Gross working capital is the amount of funds invested in the various components of current assets.

This Concept has the following advantages

(a) Financial managers are profoundly concerned with current assets;

(b) Gross working capital provides the correct amount of working capital at the right time;

(c) It enables a firm to realize the greatest return on its investment;

(d) It helps in the fixation of various areas of financial responsibility;

(e) It enables a firm to plan and control funds and to maximise the returns on investment.

For these advantages, gross working capital has become a more acceptable concept in financial management.

Type # 3. Permanent Working Capital:

Permanent working capital is the minimum amount of current assets which is needed to conduct a business even during the dullest season of the year. This amount varies from year-to-year, depending upon the growth of a company and the stage of the business cycle in which it operates.

It is the amount of funds required to produce the goods and services which are necessary to satisfy demand at a particular point. It represents the current assets which are required on a continuing basis over the entire year. It is maintained as the medium to carry on operations at any time.

Permanent working capital has the following characteristics:

(a) It is classified on the basis of the time factor;

(b) It constantly changes from one asset to another and continues to remain in the business process;

(c) Its size increases with the growth of business operations.

Type # 4. Temporary or Variable Working Capital:

It represents the additional assets which are required at different times during the operating year – additional inventory, extra cash, etc. Seasonal working capital is the additional amount of current assets – particularly cash receivables and inventory which are required during the more active business seasons of the year.

It is temporarily invested in current assets and possesses the following characteristics:

(a) It is not always gainfully employed, though it may change from one asset to another, as permanent working capital does, and

(b) It is particularly suited to business of a seasonal or cyclical nature.

Type # 5. Balance Sheet Working Capital:

The balance sheet working capital is one which is calculated from the items appearing in the balance sheet. Gross working capital, which is represented by the excess of current assets, and networking capital, which is represented by the excess of current assets over current liabilities, are examples of the balance sheet working capital.

Type # 6. Cash Working Capital:

Cash working capital is one which is calculated from the items appearing in the profit and loss account. It shows the real flow of money or value at a particular time and is considered to be the most realistic approach in working capital management.

It is the basis of the operation cycle concept which has assumed a great importance in financial management in recent years. The reason is that the cash working capital indicates the adequacy of the cash flow, which is an essential prerequisite of a business.

Type # 7. Negative Working Capital:

Negative working capital emerges when current liabilities exceed current assets. Such a situation is not absolutely theoretical, and occurs when a firm is nearing a crisis of some magnitude.

Classification of Working Capital

Working capital is the amount of funds needed by an enterprise to finance its day to day operation. It is the part of capital employed in short-term operations such as raw materials, semi-finished products, and sundry debtors.

Three Important Classification of Working Capital are discussed below:

Classification # A. On The Basis of Time:

Working Capital may be classified into three important types on the basis of time:

1. Permanent Working Capital:

It is also known as Fixed Working Capital. It is the capital; that business concern must maintain at minimum level at all times. The level of Permanent Capital depends upon the nature of the business. Permanent or Fixed Working Capital will not change irrespective of time or volume of sales.

2. Temporary Working Capital:

The temporary or varying working capital varies with the volume of operations. It is the amount of capital which is required to meet the Seasonal demands and some special purposes. As seasons vary, temporary working capital requirement moves up and down. It can be further classified into Seasonal Working Capital and Special Working Capital.

a) Seasonal Working Capital:

The capital required to meet the seasonal needs of the business concern is called Seasonal Working Capital. During seasons, more production/sales take place resulting in larger working capital needs. The reverse is true during off-seasons.

b) Special Working Capital:

At times, additional working capital is required to meet the unforeseen events like floods, strikes, seasonal production and price hike tendencies contingencies. The capital required to meet the special exigencies such as launching of extensive marketing campaigns for conducting research, etc.

Classification # B. On The Basis of Concept:

On the basis of concept working capital can be classified or understood in the following dimensions:

1. Gross Working Capital:

Gross working capital is the total of all current assets. In other words Gross working capital reflects the total working resources of a company. It does not take into account liabilities; it simply indicates the total resources of a business.

Therefore, a grass working-capital figure doesn’t provide clear insight into a company’s financial situation to the investors as Gross working capital does not account for current liabilities.

GWC = CA

2. Net Working Capital:

Net Working Capital is the specific concept, which considers both current assets and current liability of the concern. Net working capital is the excess of current assets over current liabilities of a company which is why it is an important indicator of company’s financial health.

If the current assets exceed the current liabilities it is said to be positive working capital; if it is reverse, it is said to be Negative working capital. Thus, Net working capital is current assets minus current liabilities.

NWC= CA – CL

Classification # C. On the Basis of Operation:

Operating cycle reflects the average duration consumed between buying inventory and receiving cash proceeds from its eventual sale.

Working capital on the basis operating cycle can be classified in the following way:

1. Operating Working Capital:

A traditional measure of a company’s liquidity and potential for growth. Operating working capital is defined OWC= Inventories + Bills receivables – Bills payables.

Only the normal amount of operating sources of funds is included in calculations of operating working capital. Unusually long payment periods granted by suppliers should not be included as a component of normal operating working capital.

2. Non- Operating Working Capital:

Non-Operating Working Capital is the outcome of time differences between purchase and payment for capital expenditures, for non-recurring items, etc., a theoretical perspective, as it considers the total of all categories for items that cannot be classified anywhere else.

It includes amounts due on fixed assets, dividends to be paid, the short-term part of the restructuring provision, acquisition payables, interest receivable/payable, income tax receivable/payable, and borrowings and bank overdrafts.

Kinds of Working Capital on the Basis Time – Permanent and Temporary Working Capital

Kinds of Working Capital:

On the basis time, the working capital is divided into two parts such as:

1. Permanent Working Capital

2. Temporary Working Capital

Kind # 1. Permanent Working Capital:

The need for working capital or current assets fluctuates from time to time. However, to carryon day to day operations of the business without any obstacles, a certain minimum level of raw materials, work in progress, finished goods and cash must be maintained on a continuous basis. The amount needed to maintain current assets on this minimum level is called Permanent or Regular Working Capital.

Kind # 2. Temporary Working Capital:

Any amount over and above the permanent level of working capital is called Temporary, Fluctuating or Variable Working Capital. Due to seasonal changes, the level of business activities is higher than normal during some months of the year and therefore, additional working capital will be required along with the permanent working capital.

It is so because during peak season, demand rises and more stock is to be maintained to meet the demand. Similarly, the amount of debtors increases due to excessive sales. Additional working capital thus needed is known as temporary working capital because once the season is over; the additional demand will be no more.

Principles of Working Capital – Principle of Risk Variation, Cost of Capital, Equity Position and Maturity of Payment

The principles of working capital are as follows:

1. Principle of Risk Variation:

Risk arises in business when it is unable to meet its obligations or make payments when it is due. Huge investment made in current assets with less dependence on short term borrowings, increases liquidity and reduces risk but decreases the profitability.

On the contrary, less investment in current assets and greater dependence on short term borrowings increase risk, reduces liquidity and increases profitability.

Therefore, depending upon risk and profitability, the management has to change the size of their investment in working capital. A traditional management prefers to minimize risk by holding a higher level of working capital or current assets.

While a moderate management assumes greater risk by reducing working capital. Hence the goal of the management should be to establish a trade- off between profitability and risk.

2. Principle of Cost of Capital:

Cost of capital refers to the rate of return on investment. For raising working capital finance, various sources are employed wherein each source has a different cost of capital and disparity in the degree of risk.

Normally, higher the risk, lower the cost and lower the risk higher the cost. Therefore, the management should always try to achieve a proper balance between these two i.e., cost and risk.

3. Principle of Equity Position:

According to this principle, the firm’s equity position should be justified with the amount of working capital invested in each component. Every rupee invested in the current assets should contribute to the net worth of the firm.

The level of current assets can be measured with the help of two ratios:

i) Current asset as a percentage of total assets.

ii) Current asset as a percentage of total sales.

Thus a finance manager while deciding the composition of current assets, must consider the appropriate industrial averages.

4. Principle of Maturity of Payment:

According to this principle, efforts should be made by the firm to relate maturities of payment to its flow of internally generated funds. Maturity of payment should not have greater disparity as it would lead to greater risk.

Generally shorter the maturity schedule of current liabilities in relation to expected cash inflow, greater the inability to meet its obligations in time. However a margin of safety should be provided for short term debt payments.

Thus this principle states that the working capital should be raised from different sources so that the firm is able to repay them on maturity out of its inflow of funds. If the firm fails to repay on maturity, it would result in liquidation, though the firm is earning huge profits.

This implies that the firm’s ability to repay its short term debts depends not on its earnings but on the flow of cash into it.

4 Main Approaches of Working Capital – Matching, Conservative, Aggressive, Trade-Off between Hedging and Conservative Approach (With Figures)

There are four approaches of working capital are as follows:

Approach # (1) Matching Approach or Hedging Approach:

According to this approach, the expected life of the asset will be matched with the expected life of the source of funds raised to finance such asset. For example, if stock is to be sold in 30 days, a short-term loan for 30 days may be taken. According to this approach total working capital requirements are bifurcated into permanent working capital and temporary working capital.

Permanent working capital requirements should be financed by long-term sources while the temporary working capital requirements should be financed through short-term sources of funds. Using long-term financing for short term assets will be expensive because funds will not be put to use for the full period.

This approach is cheap in terms of cost because it involves short-term sources but it is risky as well as inconvenient because arrangement for short-term loans will have to be made on a continuous basis and there will be need to repay the short-term funds at frequent intervals. Also it may be difficult to borrow during stringent credit periods.

Under a matching approach, the liquidity is very low and the risk and profitability are high.

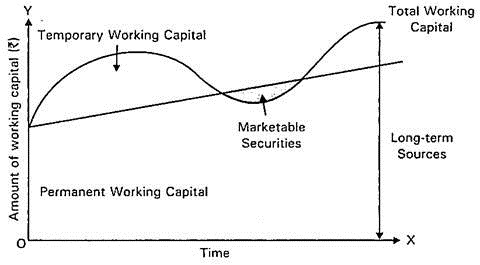

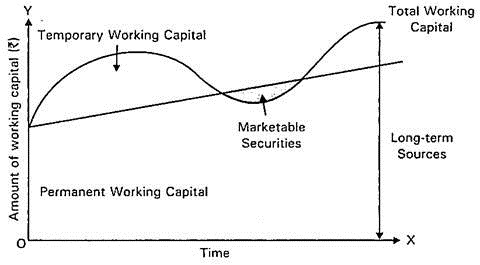

The hedging approach is shown in the figure given below:

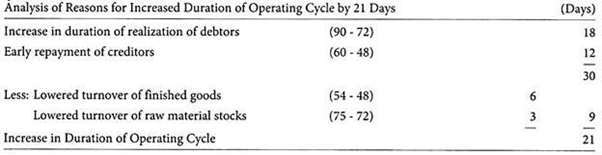

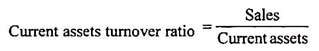

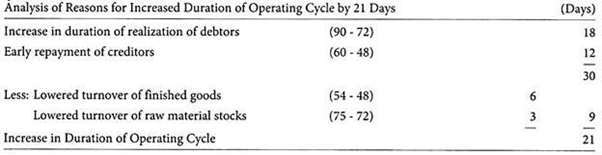

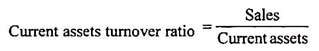

Approach # (2) Conservative Approach:

According to this approach, entire financial needs of a firm are financed through long-term funds. Short-term funds are used only in emergency situations. In the periods when the firm has surplus funds, the idle long-term funds are invested in tradable securities which will help the firm to earn some income. Because of higher liquidity in conservative approach, the risk is very low but the profitability is also low due to idle funds. Thus, it is a ‘low risk, low profits’ approach.

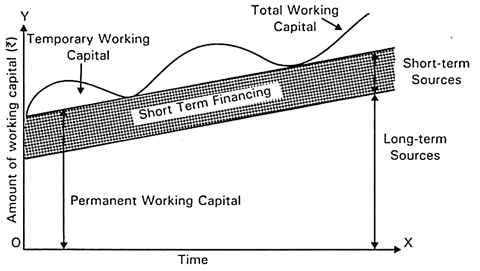

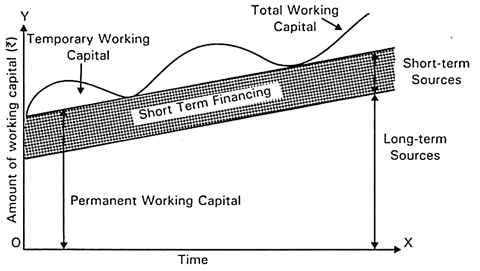

This approach is shown in the figure given below:

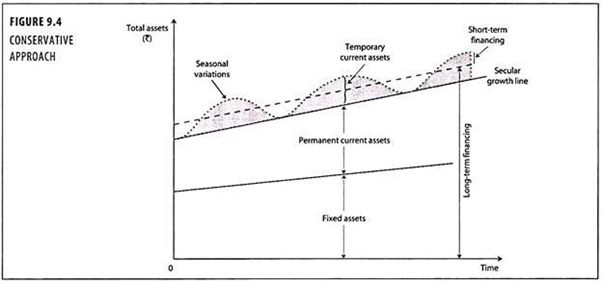

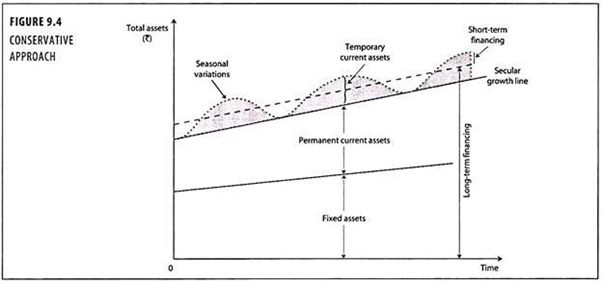

Approach # (3) Aggressive Approach:

This approach strikes a balance between a matching and conservative approach and provides a financing plan that lies between the two extremes. Under this approach, the firm decides to finance a part of the permanent working capital through short-term sources. Thus, under this approach short-term financing is more than the short-term financing in hedging approach.

This approach seeks to minimize excess liquidity while meeting short-term requirements but the firm runs the risk of illiquidity because current assets portfolio may not churn out cash flows fast enough to service rapidly maturing obligations.

Thus, this approach provides more liquidity than the matching approach but less liquidity than the conservative approach. On the other hand, the risk and profitability are lower than the matching approach but more than the conservative approach.

Aggressive approach is depicted in the figure given below:

Approach # (4) Trade-Off between Hedging and Conservative Approach:

It has been observed that the hedging approach is associated with low cost as well as high risk, while the conservative approach provides high cost and low risk. Obviously, neither approach by itself can help in efficient working capital management.

A trade-off between these two extremes can give satisfactory results. The trade-off could be assumed to be equal to the average of the minimum and the maximum monthly requirements of working capital during a period. The average working capital so obtained may be financed through long-term sources and the balance by short-term funds.

For example, if during a period, the minimum working capital required is Rs.5 lakh while the maximum requirement is Rs.6 lakh, the average level comes to Rs.5.5 lakh. The firm should finance Rs.5.5 lakh from long-term sources and raise extra capital, if required, through short-term sources.

Analysis of Working Capital – Ratio, Fund Flow and Budgeting Analysis

The concept of working capital has its own importance in a going concern, in the smooth running of business. It is useful both for financial management and for the executives of an undertaking.

A study of the causes of changes in uses and sources of working capital is necessary to observe, whether working capital is serving the purpose for which it has been created or not. This involves the basic approach to working capital analysis.

The analysis of working capital can be made either through:

1) Ratio analysis

2) Fund flow analysis or

3) Budgeting analysis.

The ratio analysis of working capital helps the management in checking upon the efficiency, with which the working capital is being used in the business.

Analysis # 1. Ratio Analysis:

Meaning:

Ratio analysis is the technique of the calculation of number of accounting ratio, from the data or figures found in the financial statements, the comparison of the accounting ratios with those of the previous years, or with those of other concerns engaged in similar line of activities, or with those of standard or ideal ratios and the interpretations of the comparison (i.e. drawing conclusions from the comparison of accounting ratios).

In short it is the technique of interpretation of financial statements, with the help of the accounting ratios derived from the financial statements.

Advantages of Ratio Analysis:

The various advantages of ratio analysis are as follows:

1. Ratio analysis simplifies the understanding of financial statements.

2. It helps in forming a precise idea about financial significance of the financial figures, by establishing a relationship between closely related financial health or condition of a business.

3. Ratio analysis is an instrument for diagnosing the financial health or condition of a business.

4. Ratio analysis are an useful instrument of management control, particularly in the area of sales and costs.

5. It facilitates inter firm comparison, by providing necessary information about costs, sales, profits, dividend etc.

6. Ratios are very helpful in establishing standard costing systems and budgetary control.

7. It is not only useful to the insiders (i.e. the management) but also to outsiders like creditors, investors etc.

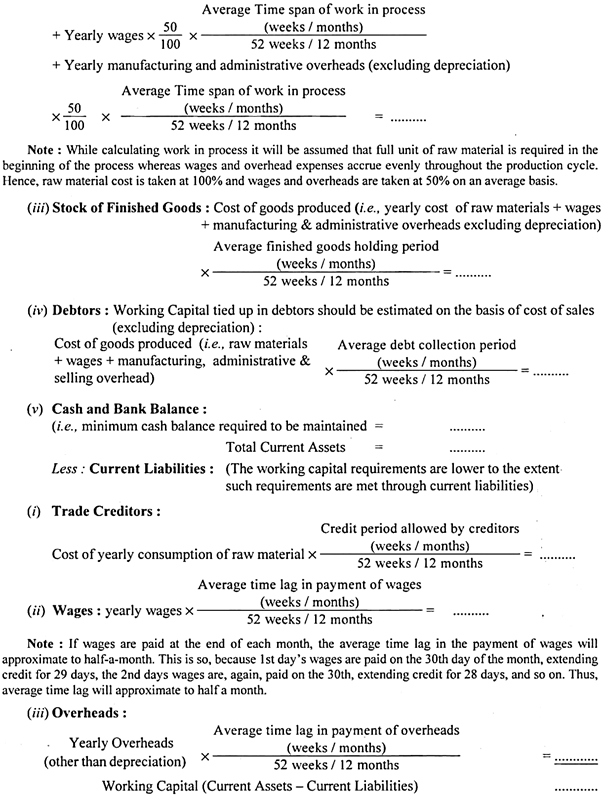

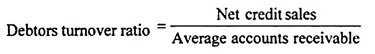

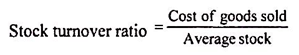

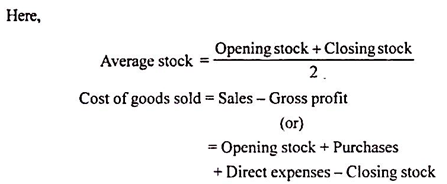

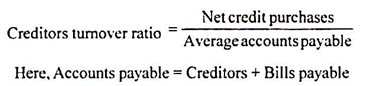

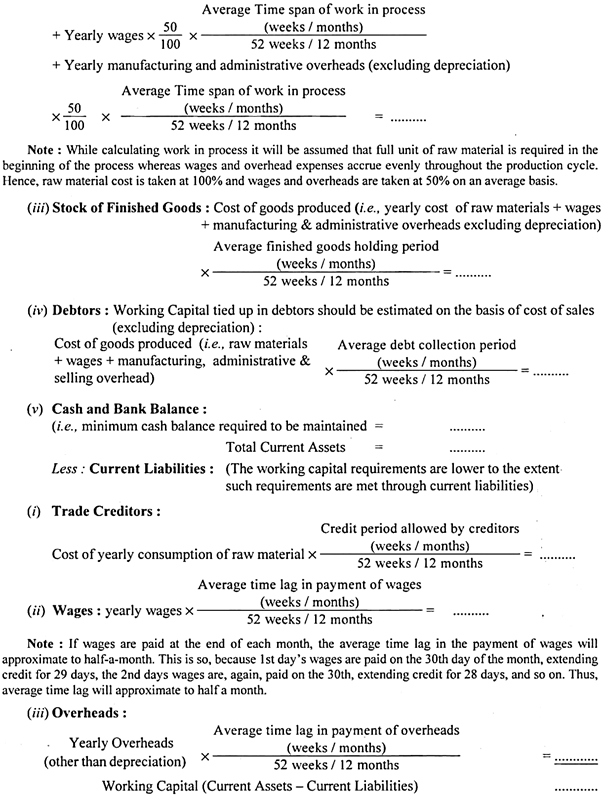

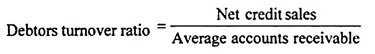

The most important ratios for working capital management are:

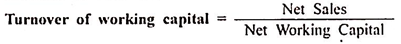

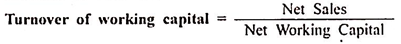

i) Turnover of working capital (net sales divided by the average net working capital) for a certain period say one year,

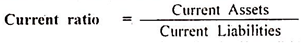

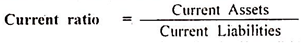

ii) Current ratio (current assets divided by current liabilities)

iii) Current debt to tangible net worth (current liabilities divided by tangible net worth).

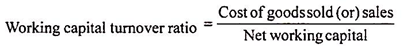

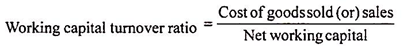

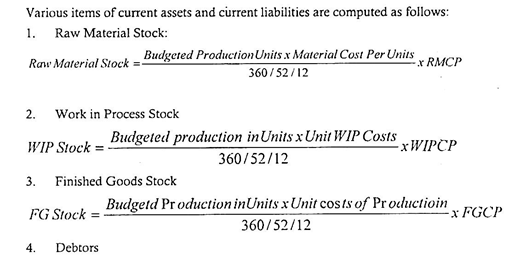

i) Turnover of Working Capital Ratio:

This ratio measures the rate of working capital utilisation and it is calculated as follows:

This ratio shows how many times the working capital turns over in trading transactions. It has an increasing trend over precious years, it shows that the working capital is now being used very efficiently or in other words, working capital is working harder than it worked in the past.

On the other hand if there is a decreasing ratio, one can reasonably follow that the company is not using the working capital, so efficiently as it should have been. It indicates relative inefficiency of management. Every business has to work out its ratio, which produces a reasonable combination of profitability and safety in the management or working capital.

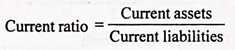

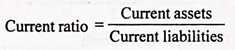

ii) Current Ratio:

Current ratio is the ratio between current assets and current liabilities of a business.

It is calculated as under:

Current ratio measures the ability of the company to pay off its short term debt, i.e. current liabilities. It reveals how efficiently a firm can meet the sudden demand, if at all arises to payoff all its short term creditors. It is therefore advisable that short term assets should be large enough to meet the sudden demands with some margin taking into consideration the liquidity of assets.

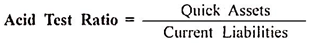

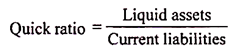

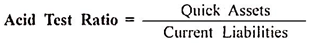

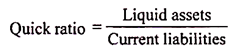

iii) Acid Test Ratio:

It is also called quick ratio. It is determined by dividing quick assets, i.e. assets which are most easily convertible into cash, by current ratio, as it gives no consideration to inventory which cannot be sold at fair prices immediately.

This ratio lays more emphasis on immediate conversion of assets in to cash. A quick ratio of 1:1 is usually considered favourable. The higher the quick ratio, the better the financial position.

It is calculated as under:

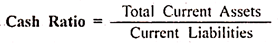

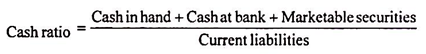

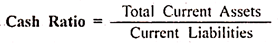

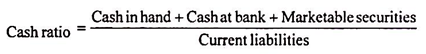

iv) Cash Ratio:

The relationship of current assets and cash balance (including bank balance) is called cash ratio. It may be determined by dividing the total current assets, by total cash. The ratio show availability of cash to meet the day-today requirements in relation to the total current assets.

Past experience may show the trend of the relationship of cash with current assets. If the ratio is higher than the average, it shows that funds are lying idle, contributing nothing to the business. It should be reduced to the average needs of the business.

It is calculated as under:

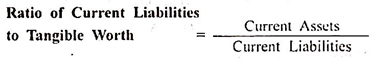

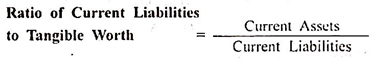

v) Ratio of Current Liabilities to Tangible Net Worth:

The ratio is worked out by dividing the current liabilities by tangible wealth. The ratio is helpful in finding out how much capital has been contributed by the short term creditors and how much by the owners. Higher ratio means greater risks to short term creditors.

It is calculated as under:

Analysis # 2. Funds Flow Analysis of Working Capital:

Funds flow analysis is the study of the sources of funds and their application in the business. The analysis shows how the funds in the business have been procured and how they have been employed.

By the use of this method, changes in the working capital between two dates can be very easily analysed, by studying the changes in each type of current assets and current liabilities as well as sources from which working capital has been obtained.

A more thorough analysis of current assets and current liabilities can be made by incorporating certain items from the income statements.

Analysis # 3. Budgeting Analysis:

Efficient working capital management is concerned with the careful measurement of future financial requirements and the formulation of plans to meet them.

For this purpose a working capital budget as a pail of the total budgeting process is prepared stating the future long term and short term working capital requirements and the sources to finance them.

The objective of working capital budget is to secure the proper utilisation of investment. At the end period budgeted figures and the relationship and establish separate standards for each element of cash, debtors and inventory. This technique can be provided the necessary information for any volume of business.

Thus the analysis of working capital is necessary for the effective management of working capital. The financial management must have close watch on the changes in different ratios and the funds flow position so that, necessary corrective actions may initiated effectively and speedily

Procedure for the Monitoring of Working Capital

Monitoring of working capital requires the following procedure:

(a) Monitoring of Components of Working Capital:

The finance manager should know the time as well as the amount of funds that have been blocked in different components of working capital like cash, receivables, inventory, loan and advances.

The operating cycles of these items need to be screened to assess whether these are at optimal level or not and to determine whether they conform to firm’s standards and industry norms or not. If there is any deviation, the reasons for the same should be analyzed for taking corrective measures.

(b) Calculating the Percentage of Funds Invested in Working Capital:

In most of the firms huge funds are invested in working capital. The finance manager should maintain a balance between the funds invested in fixed assets and working capital. The working capital ratios like current ratio (current assets to current liabilities), liquid ratio (quick assets to current liabilities), current assets to total assets and current assets to total sales indicate the extent of investment in working capital in relation to total assets.

The finance manager should continuously monitor these ratios and take note of the relationship between current and fixed assets of the firm as well as that of industry over a period of time. In general, current ratio is considered an important indicator of liquidity. A current ratio of 2 and liquid ratio of 1 is considered to be acceptable.

Any deviation in the percentages of these funds may be analyzed accordingly for taking corrective measures. The corrective measures may include raising additional funds, reducing order size, delay the payments of creditors, and improving collection procedures and so on.

(c) Recording Time Spent in Managing of Working Capital:

In most firms substantial time is spent by the finance manager in managing working capital. He should keep a track of time being devoted by the members of the finance department in managing working capital. This type of monitoring will give him an insight into the effective management of working capital.

To sum up working capital management aims at managing current assets and current liabilities so as to ensure its perennial adequacy in the firm. Working capital policies have a great impact on profitability, liquidity and structural health of an organization.

Working capital practices influence marketing, human resources, manufacturing and all other functions of an enterprise. The finance manager plays a crucial role in deciding the finance mix, monitoring and controlling the various components of working capital.

Preparing Statement of Changes in Working Capital (With Proforma, Illustration and Solution)

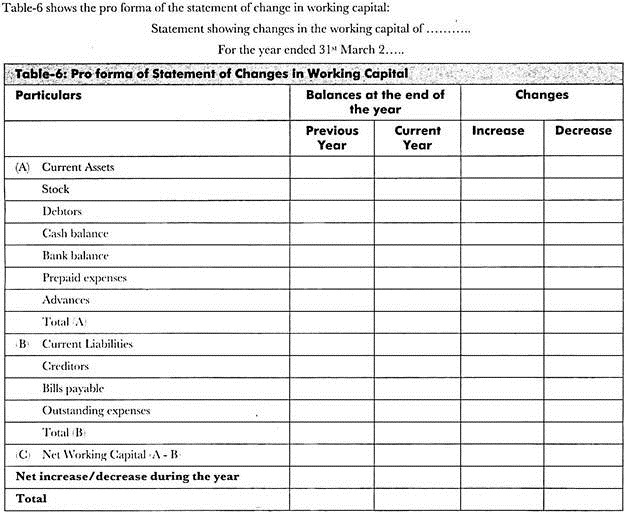

The preparation of a statement of change is the first and the foremost step for formulating funds flow statements. The statement of change shows the effect of changes in assets and liabilities on the working capital of an organization.

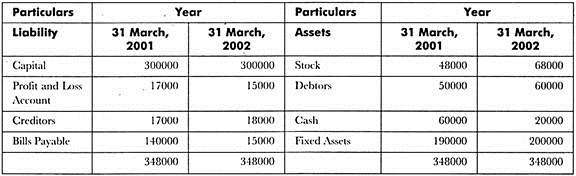

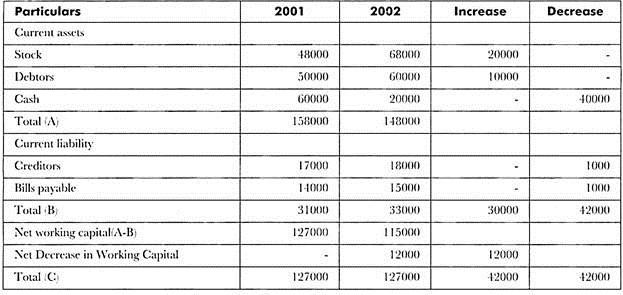

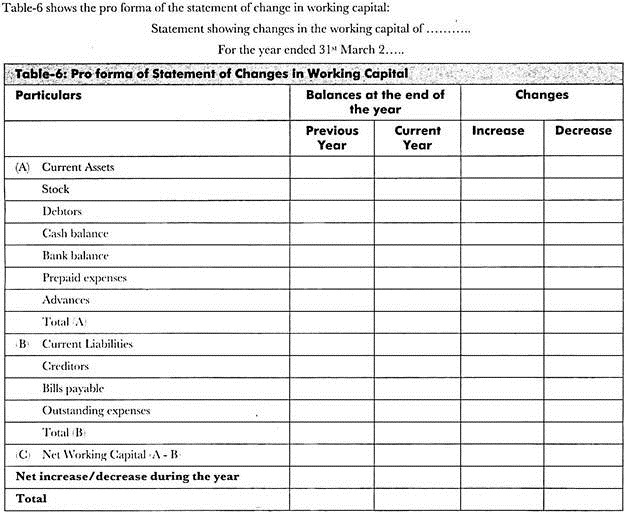

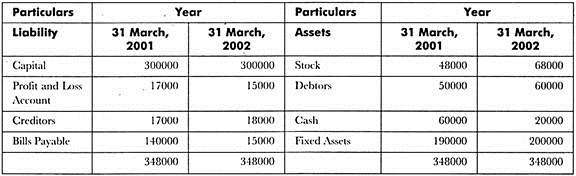

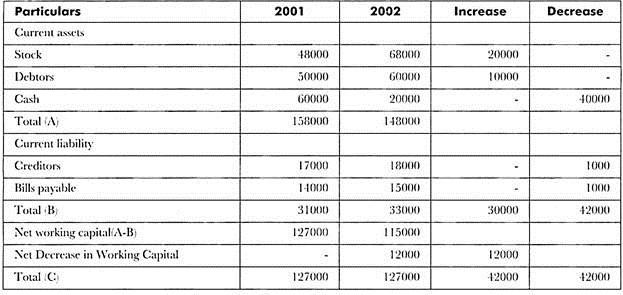

Table-6 shows the proforma of the statement of change in working capital:

The following principles should be kept in mind while preparing the statement of changes in working capital:

i. Increase in current assets increases the working capital

ii. Decrease in current asset decreases the working capital

iii. Increase in current liability decreases the working capital

iv. Decrease in current liability increases the working capital

Illustration:

Prepare a schedule of changes in the working capital from the following information:

Solution:

The solution to the given problem is as follows:

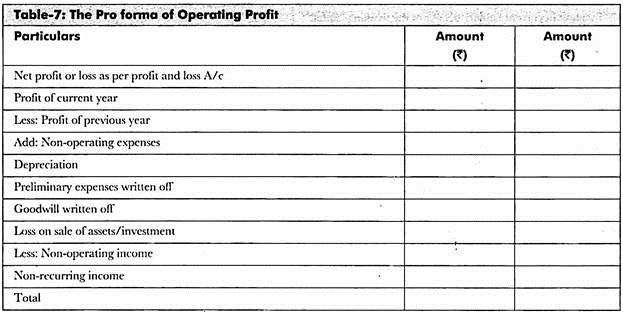

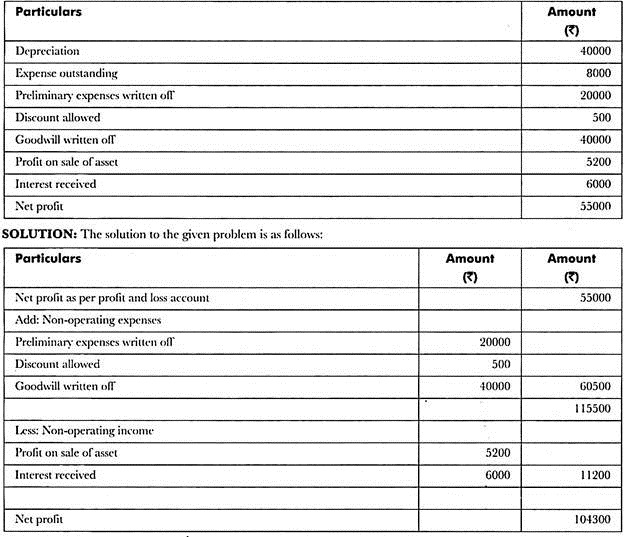

Calculating Operating Income:

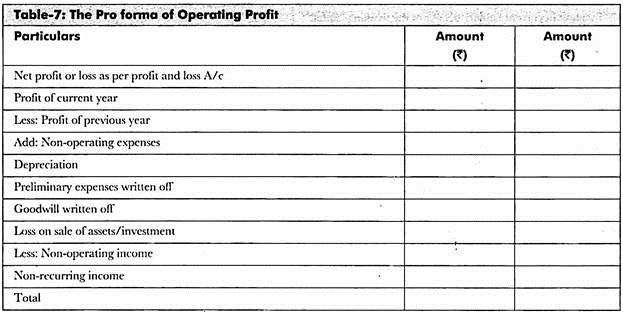

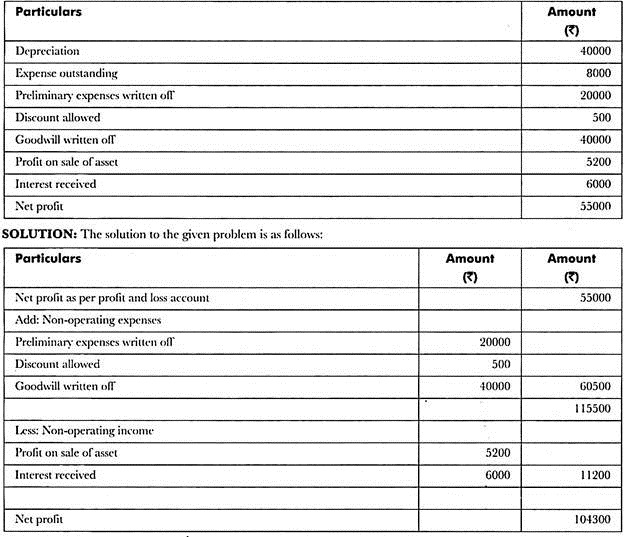

Operating activities are the activities that directly influence the production of goods and services. Examples of operating activities are procuring raw material and paying wages. The income generated from operating activities is known as operating income. The organization calculates operating income with the help of adjusted profit and loss accounts.

While calculating operating income, the income from non-operating activities is also considered. Non-operating activities arc the activities that do not directly help in producing goods and services. Examples of non-operating activities are selling fixed assets and charging depreciation.

Table-7 shows the proforma of calculating operating profit:

Illustration:

Calculate operating income by using the following information:

Zero Working Capital

In view of increasing competition in the world economy, greater emphasis is being placed on the concept of zero working capital. The concept of zero working capital signifies that the current assets of an organization should be equal to its current liabilities so as to avoid any excess investment in working capital.

Zero Working Capital = Current Asset = Current Liabilities

Or

Zero Working Capital = Current Asset – Current Liabilities = 0

The concept of zero working capital will certainly increase discipline in management of working capital. It calls for curbing the tendency of payments.

Working Capital – Operating Cycle: Meaning, Figure, Computation, Problems, Solutions, Reasons and Measures

Working capital is the life blood of any business, without which the fixed assets are inoperative. Working capital circulates in the business, and the current assets change from one form to the other. Cash is used for procurement of raw materials and stores items and for payment of operating expenses, then converted into work-in-progress, then to finished goods.

When the finished goods are sold on credit terms receivables balances will be formed. When the receivables are collected, it is again converted into cash.

The need for working capital arises because of the time gap between production of goods and their actual realization after sales. This time gap is technically called as ‘operating cycle’ or ‘working capital cycle’.

The knowledge of the operating cycle is essential for smooth running of the business without shortage of working capital. The working capital requirement can be estimated with the help of the duration of the operating cycle. The longer the operating cycle, the larger the working capital requirements. If depreciation is excluded from expenses in the operating cycle, the net operating cycle represents ‘cash conversion cycle’.

The length of the operating cycle is the indicator of efficiency in management of short-term funds and working capital. The operating cycle calls for proper monitoring of the external environment of the business. Changes in government policies like taxation, import restrictions, credit policy of the central bank etc. will have an impact on the length of the operating cycle.

It is the task of the Finance manager to manage the operating cycle effectively and efficiently. Based on the length of the operating cycle, the working capital finance is done by the commercial banks. The reduction in operating cycle will improve the cash conversion cycle and ultimately improve the profitability of the firm.

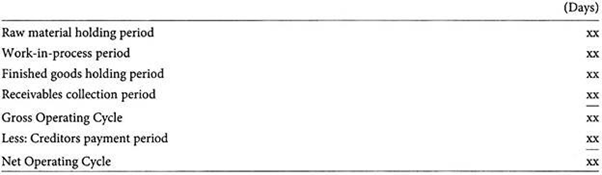

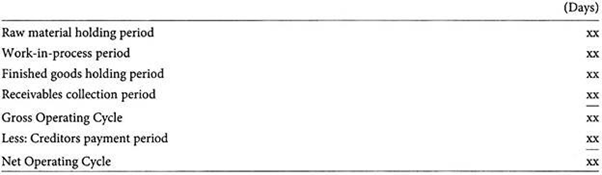

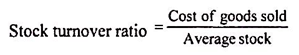

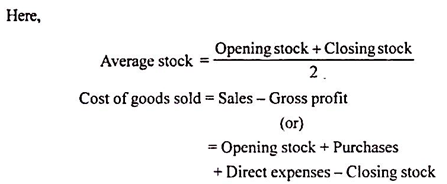

Computation of Operating Cycle Period:

The operating cycle of a company consists of a time period between the procurement of inventory and the collection of cash from receivables.

The operating cycle is the length of time between the company’s outlay on raw materials, wages and other expenses and inflow of cash from sale of goods. Operating cycle is an important concept in management of cash and management of working capital.

The operating cycle reveals the time that elapses between outlay of cash and inflow of cash. Quicker the operating cycle, less amount of investment in working capital is needed and it improves the profitability. The duration of the operating cycle depends on the nature of industry and the efficiency in working capital management.

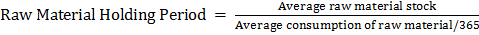

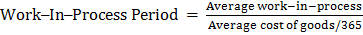

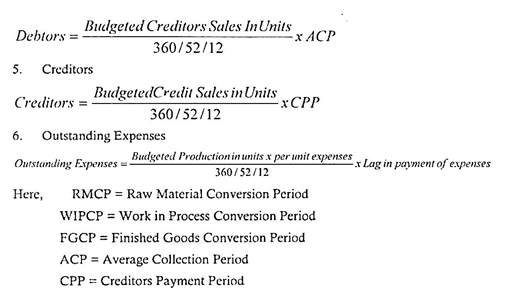

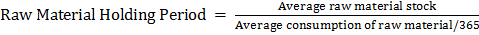

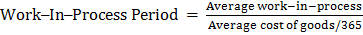

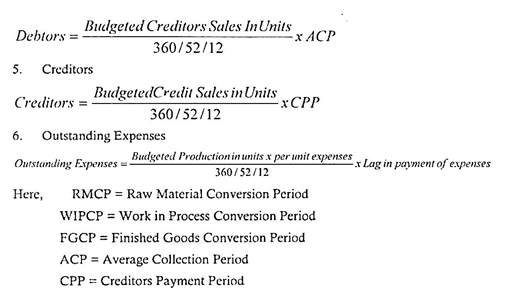

Now, the period of operating cycle can be ascertained as follows:

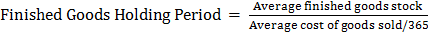

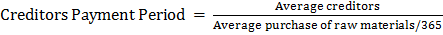

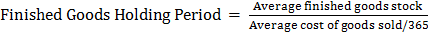

The above said periods are ascertained as follows:

Problem:

On January 1,2016, X Limited’s beginning inventory was Rs.4,00,000. During 2016, X Ltd. purchased Rs.19,00,000 of additional inventory. On December 31,2016 X Ltd.’s ending inventory was Rs.5,00,000. What is X Ltd.’s operating cycle in 2016, if it is assumed that the average collection period is 42 days ? (1 year = 360 days)

Solution:

Beginning inventory = Rs. 4,00,000

Purchases = Rs. 19,00,000

Ending inventory = Rs. 5,00,000

Average collection period = 42 days

Cost of goods sold = = 4,00,000 + 19,00,000 – 5,00,000 = Rs. 18,00,000

Inventory turnover = Rs. 18,00,000/Rs. 4,50,000 = 4

Average age of inventory = 365/4 = 91.3 days

Operating cycle = = 91.3 + 42 = 133.3 days

Problem:

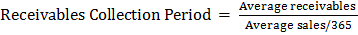

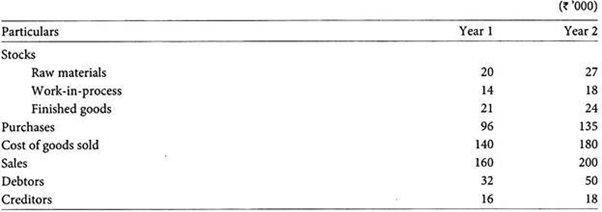

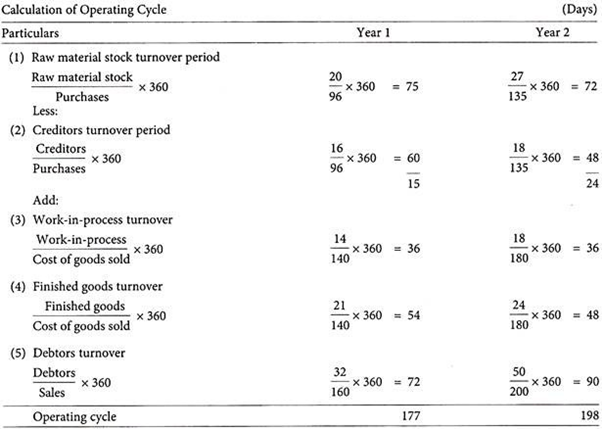

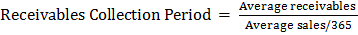

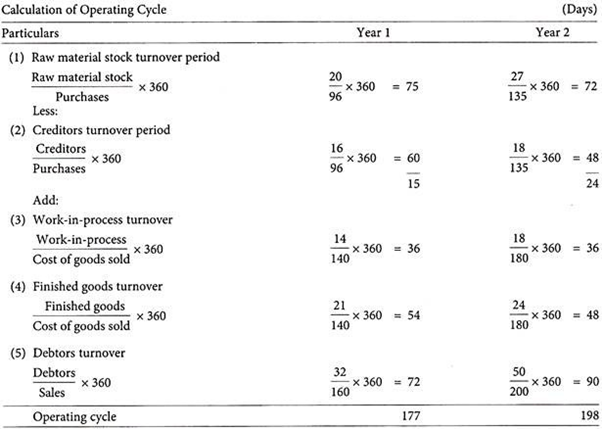

From the following data, compute the duration of the operating cycle for each of the two years and comment on the increase/decrease:

Assume 360 days per year for computational purposes.

Solution:

Reasons for Prolonged Operating Cycle:

The following could be the reasons for longer operating cycle period:

I. Purchase of materials in excess/short of requirements.

II. Buying inferior, defective materials.

III. Failure to get trade discount, cash discount.

IV. Inability to purchase during seasons.

V. Defective inventory policy.

VI. Use of protracted manufacturing cycle.

VII. Lack of production planning, coordination and control.

VIII. Mismatch between production policy and demand.

IX. Use of outdated machinery, technology.

X. Poor maintenance and upkeep of plant, equipment and infrastructure facilities.

XI. Defective credit policy and slack collection policy.

XII. Inability to get credit from suppliers, employees.

XIII. Lack of proper monitoring of the external environment etc.

Measures to Reduce Operating Cycle:

The aim of every management should be to reduce the length of operating cycle or the number of operating cycles in a year, only then the need for working capital decreases.

The following remedies may be used in contrasting the length of operation cycle period.

I. Purchase Management:

The purchase manager owes a responsibility in ensuring availability of the right type of materials in the right quantity of the right quality at right price on right time and at right place. These six R’s contribute greatly in the improvement of length of operating cycle. Further, streamlining of credit from supplier and inventory policy also help the management.

II. Production Management:

The Production manager affects the length of the operating cycle by managing and controlling the manufacturing cycle, which is a part of the operating cycle and influences directly. Longer the manufacturing cycle, longer will be the operating cycle and higher will be the firm’s working capital requirements.

The following measures may be taken like:

(a) Proper maintenance of plant, machinery and other infrastructure facilities,

(b) Proper planning and coordination at all levels of activity,

(c) Up-gradation of manufacturing system, technology, and

(d) Selection of the shortest manufacturing cycle out of various alternatives etc.

III. Marketing Management:

The sale and production policies should be synchronized as far as possible. Lack of matching increases the operating cycle period. Production of qualitative products at lower costs enhances sales of the firm and reduces finished goods storage period.

Effective advertisement, sales promotion activities, efficient salesmanship, use of appropriate distribution channels etc., reduce the storage period of the finished products.

IV. Credit Collection Policies:

Sound credit and collection policies enable the Finance manager in minimizing investment in working capital in the form of book debts. The firm should be discretionary in granting credit terms to its customers.

In order to see that the receivable conversion period is not increased, the firm should follow a rationalized credit policy based on the credit standing of customers and other relevant facts. The firm should be prompt in making collections. Slack collection policies will tie-up funds for a long period, increasing length of operating cycle.

V. External Environment:

The length of the operating cycle is equally influenced by the external environment. Abrupt changes in basic conditions would affect the length of the operating cycle.

Fluctuations in demand, competitors, production and sales policies, government fiscal and monetary policies, changes on import and export front, price fluctuations, etc., should be evaluated carefully by the management to minimize their adverse impact on the length of the operating cycle.

VI. Personnel Management:

The Personnel manager by framing sound recruitment, selection, training, placement, promotion, transfer, wages, incentives and appraisal policies can contrast the length of the operating cycle.

Use of human resources development techniques in the organization enhances the morale and zeal of employees thereby reducing the length of the operating cycle. Proper maintenance of plants, machinery, infrastructure facilities, timely replacement, renewals, overhauling etc., will contribute towards control of the operating cycle.

These measures, if adhered properly, would go a long way in minimizing not only the length of the operating cycle period but also the firm’s working capital requirements.

Optimal Level of Working Capital

Increasing the working capital means the liquidity risk will be low and the firm should be able to capitalize on opportunities of making higher sales by meeting supply commitments; but at a higher level of working capital investment the cash flows shall be negatively affected and this will impact the profitability of the firm.

Ideally then, the optimum working capital shall at a level where the benefits of having larger working capital exceed its associated costs.

Working Capital – Types of Financing Used by a firm to Meet Working Capital Requirements

A firm can use three types of financing to meet the working capital requirements as mentioned below:

1. Long-Term Financing:

Long-term financing is generally used by a firm to finance the permanent working capital requirements. The equity share capital, preference share capital, long-term debts from financial institutions, retained earnings are the sources of long-term finance of working capital. The cost of long-term finance is generally higher than short-term finance.

2. Short-Term Financing:

The short-term financing is preferably used by a firm to finance the flexible working capital requirements. The short-term finance is obtained for a period less than one year. The sources of short-term finance are working capital funds from banks, commercial paper, public deposits, discounting of receivables, etc.

3. Spontaneous Financing:

Spontaneous financing means the automatic sources of short-term funds arising during the normal course of business. These sources are not specifically taken by the firm. The sources of spontaneous income are credit from suppliers, outstanding expenses.

A firm can use any of the three approaches in devising the technique (a mix of long-term finance and short-term finance) to finance its current assets as explained below:

There is risk and cost/profit trade-off in all the three approaches:

1. Hedging Approach:

In a hedging (maturity matching) approach, each asset is offset with a financing instrument of approximately same maturity. All fixed assets and permanent current assets would be financed with long-term debt or equity, while short-term or seasonal variations in current assets would be financed with short-term debt.

The net working capital in this case will be equal to permanent current assets only. This will happen because current assets are matched with current liabilities. This approach has a minimum cost of networking capital, but it is a risky approach.

2. Conservative Approach:

In conservative approach, all the permanent current assets and some part of variable current assets would be financed with long-term finance, i.e., long-term debt or equity. In case the firm does not need variable current assets for some periods, the interest on the fund tied up for financing the variable current assets will be borne by the firm.

Thus, the cost of financing of current assets will increase if the firm adopts this approach. However, the firm will have minimum risk of having the shortage of funds for current assets. In all the three approaches, this approach is least risky, but will incur maximum cost.

3. Aggressive Approach:

In an aggressive approach, the firm finances all the current assets and some part of fixed assets as well with short-term finance. Since the cost of short-term finance is less than long-term finance, this approach costs minimum to the firm. But, the firm would incur maximum risk if this approach is implemented. There is a negative margin of safety in this approach.

There is a trade-off between risk and profitability in all the three approaches. If we compare the three approaches of mixing the long-term and short-term finances explained above to finance the assets of a firm, it is found that the matching approach has moderate risk and cost.

The aggressive approach costs least to a firm, but it is most risky. On the other hand, the conservative approach is least risky, but it costs maximum to a firm.

Working Capital – Strategies in Financing Working Capital: Conservative, Aggressive, Hedging and Zero Working Capital Strategy (With Figures, Problem and Solution)

Strategies in Financing Working Capital are as follows:

Strategy # i. Conservative Strategy:

A conservative strategy suggests not to take any risk in working capital management and to carry high levels of current assets in relation to sales. Surplus current assets enable the firm to absorb sudden variations in sales, production plans, and procurement time without disrupting production plans. It requires a high level of working capital and it should be financed by long-term funds like share capital or long-term debt.

Availability of sufficient working capital will enable the smooth operational activities of the firm and there would be no stoppages of production for want of raw materials, consumables. Sufficient stocks of finished goods are maintained to meet the market fluctuations.

The higher liquidity levels reduce the risk of insolvency. But lower risk translates into lower return. Large investments in current assets lead to higher interest and carrying costs and encouragement for inefficiency.

But conservative policy will enable the firm to absorb day to day business risks and assure continuous flow of operations. Under this strategy, long-term financing covers more than the total requirement for working capital.

The excess cash is invested in short-term marketable securities and in need, these securities are sold-off in the market to meet the urgent requirements of working capital.

Financing Strategy:

Long-term funds = Fixed assets + Total permanent current assets + Part of temporary current assets

Short-term funds = Part of temporary current assets

Strategy # ii. Aggressive Strategy:

Under this approach current assets are maintained just to meet the current liabilities without keeping any cushion for the variations in working capital needs. The core working capital is financed by long-term sources of capital, and seasonal variations are met through short-term borrowings. Adoption of this strategy will minimize the investment in net working capital and ultimately it lowers the cost of financing working capital.

The main drawbacks of this strategy is that it necessitates frequent financing and also increases risk as the firm is vulnerable to sudden shocks. A conservative current asset financing strategy would go for more long-term finance which reduces the risk of uncertainty associated with frequent refinancing.

The price of this strategy is higher financing costs since long-term rates will normally exceed short term rates. But when aggressive strategy is adopted, sometimes the firm runs into mismatches and defaults. It is the cardinal principle of corporate finance that long-term assets should be financed by long-term sources and short-term assets by a mix of long and short-term sources.

Financing Strategy:

Long-term funds = Fixed assets + Part of permanent current assets

Short-term funds = Part of permanent current assets + Total temporary current assets

Strategy # iii. Hedging Strategy:

Under this approach to financing working capital requirements of a firm, each asset in the balance sheet assets side would be offset with a financing instrument of the same approximate maturity. It is a method of financing where each asset would be offset with a financing instrument of the same approximate maturity.

With this approach, short- term or seasonal variation in current assets would be financed with short-term debt; the permanent component of current assets and all fixed assets would be met with long-term debt.

The basic objective of this method of financing is that the permanent component of current assets, and fixed assets would be met with long-term funds and the short-term or seasonal variations in current assets would be financed with short-term debt.

If the long-term funds are used for short-term needs of the firm, it can identify and take steps to correct the mismatch in financing. Efficient working capital management techniques are those that compress the operating cycle. The length of the operating cycle is equal to the sum of the lengths of the inventory period and the receivables period.

Just-in-time inventory management techniques reduce carrying costs by slashing the time that goods are parked as inventories. To shorten the receivables period without necessarily reducing the credit period, corporations can offer trade discounts for prompt payment.

The rationale for the policy is that if long-term debt is used to finance short-term needs, the firm will be paying interest for the use of such funds at times when funds are needed.

Financing Strategy:

Long-term funds = Fixed assets + Total permanent current assets

Short-term funds = Total temporary current assets

Strategy # iv. Zero Working Capital Strategy:

Working capital is the comparison of current assets to current liabilities. For most organizations, current assets exceed current liabilities and working capital therefore represents the liquid reserves for meeting current obligations.

Creditors prefer high levels of working capital since they are concerned about receiving payment. However, management prefers low levels of working capital since working capital earns an extremely low rate of return.

Some companies are now driving working capital to record low levels, so called zero working capital. By keeping working capital at zero, funds are released for many other opportunities. Zero working capital requires major changes in how an organization functions. One way to implement zero working capital is to have a demand-based organization.

Demand based organizations do everything only as they are demanded: fill customer orders, receive supplies, manufacture products and other functions are done only as needed.

The production facilities run 24 hours a day non-stop according to the demands within the marketplace. There are no inventories; everything is supplied immediately as needed. The end result of this demand driven organization is that little, if any, working capital is necessary to run the business.

The firm saves opportunity cost on excess investments in current assets and as bank cash credit limits are linked to the inventory levels, interest costs are also saved. There would be a self-imposed financial discipline on the firm to manage their activities within their current liabilities and current assets and there may not be a tendency to over borrow or divert funds.

Zero working capital also ensures a smooth and uninterrupted working capital cycle, and it would pressure the Finance managers to improve the quality of the current assets at all times, to keep them 100% realizable. There would also be a constant displacement in the current liabilities and the possibility of having overdues may diminish.

The tendency to postpone current liability payments has to be curbed and working capital always maintained at zero. Zero working capital would call for a fine balancing act in Financial Management, and the success in this endeavour would get reflected in healthier bottom lines.

Total Current Assets = Total Current Liabilities

or Total Current Assets – Total Current Liabilities = Zero

Problem:

‘Just Born’ is a newly formed firm providing garments for babies and children.

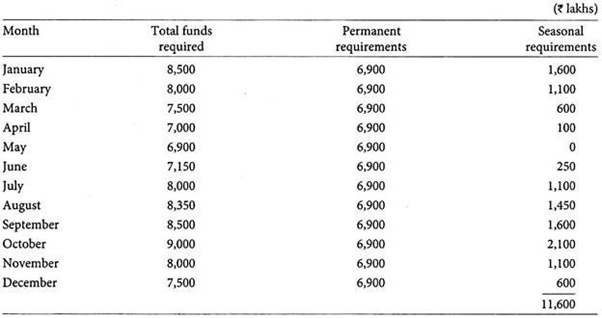

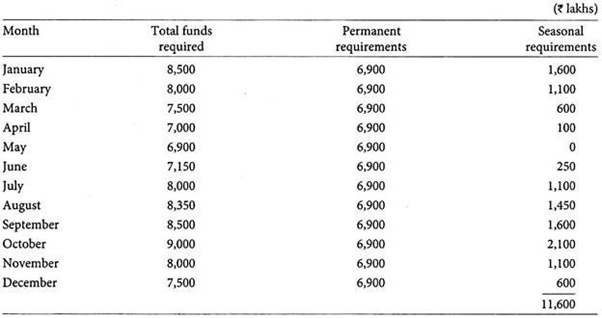

It has forecast its total fund requirements for the coming year as follows:

The firm’s cost of short-term and long-term financing is expected to be 10% and 15% respectively.

Calculate the cost of financing, using:

(i) Hedging approach,

(ii) Conservative approach, and

(iii) Trade-off approach.

Solution:

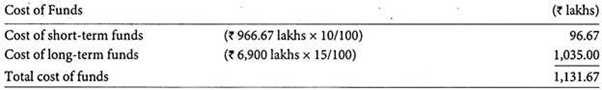

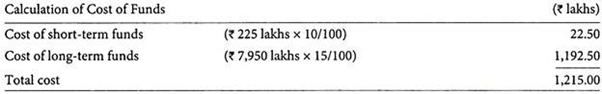

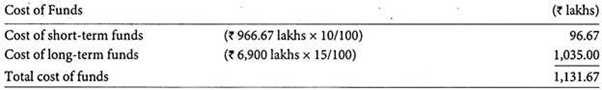

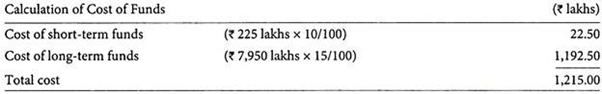

(i) Cost of Funds using Hedging Approach

Average annual seasonal term loan = Rs. 11,600 lakhs/12 months = Rs.966.67 lakhs

(ii) Cost of financing under Conservative Approach

= Annual maximum loan x Long-term rate of interest = Rs. 9,000 lakhs x 15/100 = Rs. 1,350 lakhs

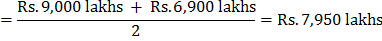

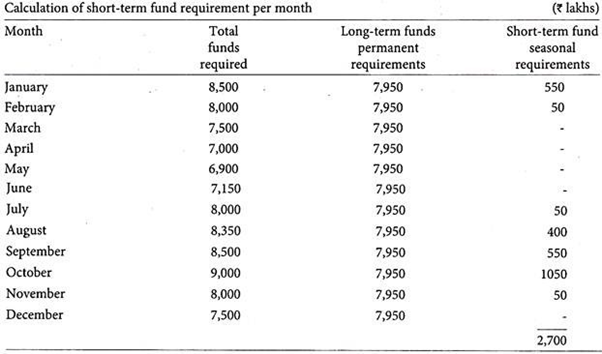

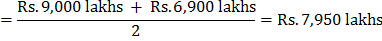

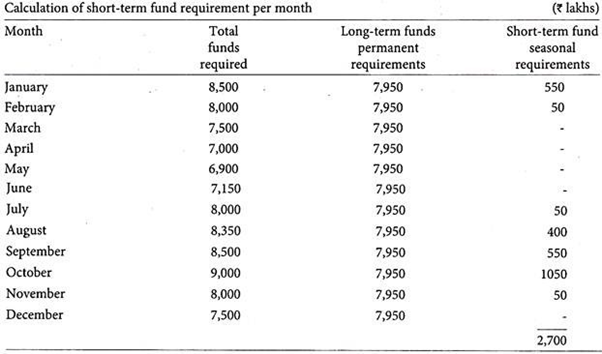

(iii) Cost of financing under Trade-off Approach

Requirement of long-term funds = Average of maximum funds and minimum funds

Average = 2,700/12 = Rs. 225 lakhs

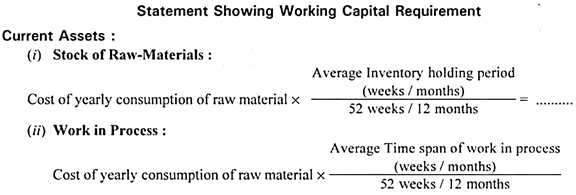

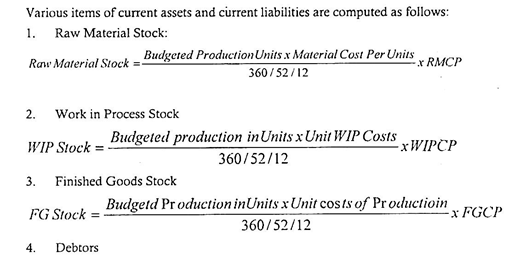

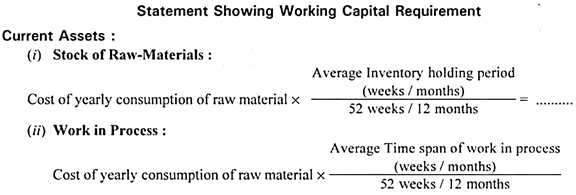

Working Capital – Techniques for Estimating Working Capital Requirements

An adequate working capital is a compelling necessity for a business enterprise. But the quantum of this adequacy changes from time to time. It is no problem for a business enterprise operating under a complete budgetary system to complete the desired quantum of working capital under the varying staulo or slightly changed economic conditions.

A business that does not have budgetary control system must use one of the following techniques for estimating the working capital requirements:

Technique # 1. Basic Questions Method:

Under the basic question method some idea of the amount of working capital could be by answering the following questions:

1. What are the usual sales terms? How many ‘days’ sales or production will have to be carried as accounts receivable?

2. What kind of raw material inventories will have to be carried and in what quantities?

3. How much of finished goods will have to be kept on hand at different points of the operating period?

4. How much of a reserve should be set aside to provide for unforeseen contingencies?

5. What is considered a normal bank balance to be kept on hand in order to discount all incoming bills and provide for the smooth functioning of the business?

6. What will be the shape of the dividend policy? If most of the earnings are going to be retained, it is not going to be necessary to resort to internal or external sources to provide for sufficient working capital.

Technique # 2. Ratio Method of Estimating Working Capital Requirements:

The ratio method of estimating working capital requirements consists of breaking down the individual items on the balance sheet into their fixed and variable elements and determining the ratio of each valuable element to a given amount of sales. Once the ratios are known, the working capital needs for any larger or smaller amount of sales could be predicted.

By subtracting the estimated needs from the expected flow of funds, the working capital that must be obtained from sources outside the business is determined.

Technique # 3. Cash Budget Method of Forecasting Working Capital Needs:

Under this method, the estimates of working capital requirements are obtained either by actually forecasting cash requirements or by developing balance sheet changes.

To arrive at the estimates of working capital requirements by the method of forecasting cash requirements, first of all the amount of expected sales is determined. Then cash requirements of a size equivalent to the cost of such sales are worked out. To this is combined a reflection of management policy during the period regarding inventories, capital expenditures, dividends and other items that require costs.

Thus such a forecast is merely a summation of cash income and cash outgo. The problem of hunting for the sources of working capital disappear in case the two balance each other. A forecast of monthly cash requirements should be prepared regularly in order to correctly estimate the working capital requirements by this method.

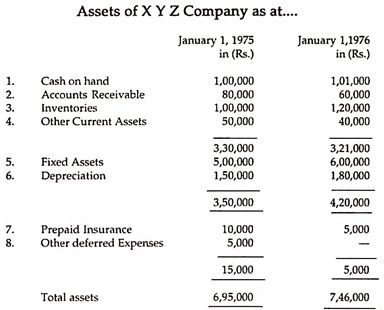

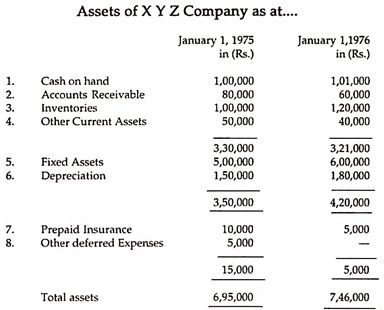

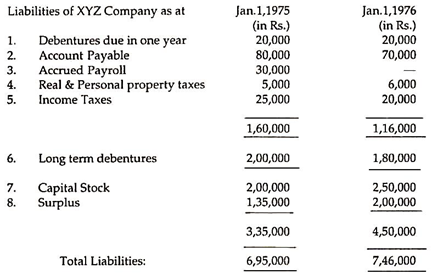

To estimate the cash requirements by the method of developing balance sheet changes, a balance sheet is taken and it is tried to determine what it will look like at the close of the period for which the forecast is being prepared.

This is explained by the following example:

Explanation of Changes:

1. This item will be the amount needed to balance the assets with the liabilities.

2. Sales are expected to be smaller in 1975 by Rs. 20,000 and therefore, the amount owing from customers will be smaller to an equal extent.

3. Inventories are expected to be the same in volume, but it is estimated that they will cost 20 per cent more.

4. A claim for Rs.10,000 against a Fire Insurance Company, which was carried as a current asset has been paid in full.

5. Additions worth Rs. 1,00,000 to fixed assets will take place in 1975.

6. During the year the company charged off 5 per cent depreciation.

7. Insurance policies had been written for two years and the amount applicable to 1975 had been written off.

8. Other deferred expenses which were carried on the balance sheet has now been written off to expenses.

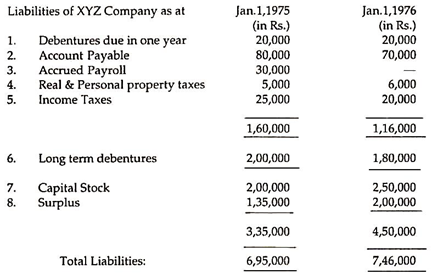

Explanation of Changes:

1. Debentures worth Rs. 20,000 have to be retired each year.

2. There will be a reduction of Rs. 10,000 in the amount of accounts payable.

3. The amount of accrued pay will be nil.