The following points highlight the seven main approaches to the capital structure of a firm. The approaches are: 1. Net Income Approach 2. Net Operating Income Approach 3. WACC Approach (Traditional View) 4. Modigliani and Miller Approach (Modern View) 5. Debt-Equity Ratio Approach 6. EBIT-EPS Approach 7. Financial and NEDC Risks Trade-Off Approach.

1. Net Income Approach:

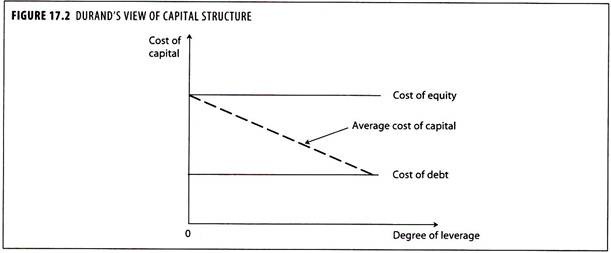

This approach is given by ‘Durand David’. According to this approach, the capital structure decision is relevant to the valuation of the firm. As such a change in the capital structure causes an overall change in the cost of capital and also in the total value of the firm. A higher debt content in the capital structure means a high financial leverage and this results in decline in the overall or weighted average cost of capital. This results in increase in the value of the firm and also increase in the value of the equity shares. In an opposite situation, the reverse conditions prevails.

Durand (1952) advocated this approach, according to him the average cost of capital will reduce with greater use of debt and the equity shareholders will not insist for higher return with increased levels of gearing caused by the use of increasing level of debt component.

It is also assumed that the lenders will also not insist for higher return with increasing levels of debt. Hence, the average cost of capital falls until the level of debt is reached since there is no upturn in the cost either equity or debt. The position of the above view is represented in figure 17.2.

Assumptions:

There are usually three basic assumptions of this approach:

I. Corporate taxes do not exist.

II. Debt content does not change the risk perception of the investors.

III. Cost of debt is less than cost of equity i.e., debt capitalization rate is less than the equity capitalization rate.

According to net income approach, the value of the firm and the value of equity are determined as given below:

Value of Firm (V) = S + B

Where, S = Market Value of Equity

B = Market Value of Debt

Where, NI = Net income available for equity shareholders

Ke = Equity capitalization rate

Problem 1:

Glamour Ltd. earned a profit of Rs.20 lakhs before providing for interest and tax.

The company’s capital structure is as follows:

(i) 4,00,000 equity shares of Rs.10 each and its market capitalization rate is 16%.

(ii) 25,000 14% Secured redeemable debentures of Rs.150 each.

You are required to calculate the value of the firm under ‘Net Income Approach’. Also calculate the overall cost of capital of the firm.

Solution:

Value of the Firm (V) = S + B

Where, S = Market value of equity

B = Market value of debt

Where, NI = Net income available for equity shareholders i.e. Rs. 14,75,000

Ke = Equity capitalisation rate i.e. 16% or 0.16

S = Rs. 14,75,000/0.16 = Rs. 92,18,750

Value of the Firm (V) = S + B = Rs. 92,18,750+ Rs. 37,50,000 = Rs. 1,29,68,750

2. Net Operating Income Approach:

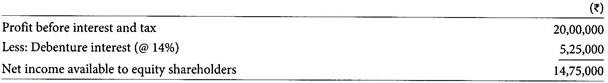

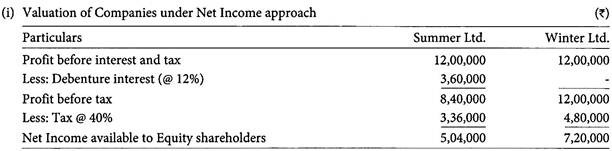

According to ‘Net Operating Income Approach (NOI)’, value of the firm is independent of its capital structure. It assumes that the weighted average cost of capital is unchanged irrespective of the level of gearing. The underlying assumption behind this approach is that the increase in the employment of debt capital increases the expected rate of return by the stockholders and the benefit of using relatively cheaper debt funds is offset by the loss arising out of the increase in cost of equity.

A change in proportion of various sources of finance cannot alter the weighted average cost of capital and as such, the value of firm remains unaltered for all degrees of leverage. Under this approach, optimal capital structure does not exist as average cost of capital remains constant for varied types of financing mix. NOI approach is opposite to the NI approach.

According to this approach, the market value of the firm depends upon the net operating profit or EBIT and the overall cost of capital, weighted average cost of capital (WACC). The financing mix or the capital structure is irrelevant and does not affect the value of the firm.

Assumptions:

The NOI approach is based on certain assumptions:

i. The investors see the firm as a whole and thus capitalize the total earnings of the firm to find the value of the firm as a whole.

ii. The overall cost of capital (Ko) of the firm is constant and depends upon the business risk which also is assumed to be unchanged.

iii. The cost of debt (Kd) is also constant.

iv. There is no tax.

v. The use of more and more debt in the capital structure increases the risk of the shareholders and thus results in the increase in the cost of equity capital (Ke).

The NOI approach believes that the market values of the firm as a whole for a given risk complexion. Thus, for a given value of EBIT, the value of the firm remains the same irrespective of the capital composition, and instead depends on the overall cost of the capital.

Where, EBIT = Earnings before interest and tax

Ko = Overall cost of capital

Value of Equity (S) = V – B

Where, V = Value of firm

B = Value of debt

Thus, financing mix is irrelevant and does not affect the value of the firm. The value remains same for all types of debt-equity mix. Since there will be change in risk of the shareholders due to change in debt-equity mix, therefore, Ke will be changing linearly with change in debt proportions. The NOI approach can be illustrated in figure 17.3 shows that the cost of debt and the overall cost of capital are constant for all levels of leverage.

As the debt proportion or the financial leverage increases, the risk of the shareholders also increases and thus the cost of equity capital also increases. However, the increase in cost of equity capital does not affect the overall value of the firm and it remains

same.

It is to be noted that an all-equity firm, the cost of equity capital is just equal to WACC. As the debt proportion is increased, the cost of equity also increases. However, the overall cost of capital remains constant because increase in cost of equity is just sufficient to offset the benefit of cheaper debt financing. The NOI approach believes that leverage has no effect on the WACC and the value of the firm. Hence, every capital structure is optimal.

Problem 2:

Jupiter Constructions Ltd. has earned a profit before interest and tax Rs.5 lakhs. The company’s capital structure includes 20,000 14% Debentures of Rs.100 each. The overall capitalisation rate of the firm is 16%. Calculate the total value of the firm and the equity capitalisation rate.

Solution:

Where, EBIT = Earnings before interest and tax i.e. Rs. 5,00,000

K = Overall capitalisation rate i.e. 16% or 0.16

V = 5,00,000/0.16 = Rs. 31,25,000

Value of Equity (S) = V – B

Where, V = Value of firm

B = Value of debt

S = 31,25,000-20,00,000 = Rs. 11,25,000

Verification:

The NOI approach can be verified by calculating the overall cost of capital of the firm as follows:

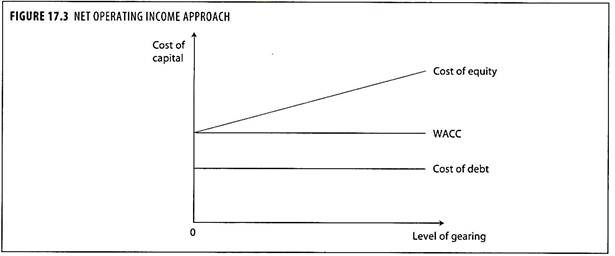

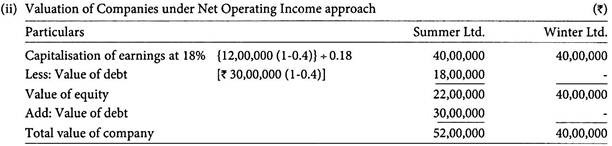

Problem 3:

Summer Ltd. and Winter Ltd. are identical in all respects including risk factors except for debt/ equity mix. Summer Ltd. having issued 12% debentures of Rs.30 lakhs, while Winter Ltd. issued only equity capital. Both the companies earn 24% before interest and taxes on their total assets of Rs.50 lakhs.

Assuming the corporate effective tax rate of 40% and capitalisation rate of 18% for an all-equity company.

Compute the value of Summer Ltd. and Winter Ltd. Using:

(i) Net Income approach and

(ii) Net Operating Income approach.

Solution:

Where, NI = Net income available to equity shareholders

Ke = Equity capitalisation rate

Summer Ltd. = 5,04,000/0.18 = Rs. 28,00,000

Winter Ltd. = 7,20,000/0.18 = Rs. 40,00,000

Market Value of Firm (V) = S + B

Where, S = Value of equity

B = Value of debt

Summer Ltd. (V) = 28,00,000 + 30,00,000 = Rs. 58,00,000

Winter Ltd. (V) = 40,00,000 + 0 = Rs. 40,00,000

3. WACC Approach (Traditional View):

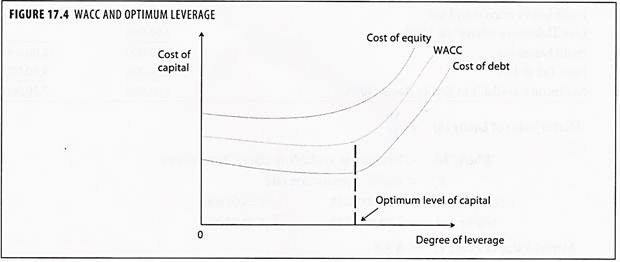

The cost of capital is interdependent on the degree of leverage. The lowest component in the cost of capital relates to the fixed interest bearing investments. Traditionally, optimal capital structure is assumed at a point where weighted average cost of capital (WACC) is minimum.

For a project evaluation, this WACC is considered as the minimum rate of return required from project to pay-off the expected return of the investors and as such WACC is generally referred to as the ‘required rate of return’. WACC is defined as the weighted average of the cost of various sources of finance.

Weight being the market value of each source of finance outstanding, cost of various sources of finance refers to the return expected by the respective investors. The debt component should be raised upto the level where the WACC of the firm is at the lowest which is called ‘optimum cost of capital’.

Till the optimum level reaches a firm can rise its debt component to minimise WACC and for increasing returns to the equity holders. After the optimum level, any further increase in debt increases the risk to the equity holders. Figure 17.4 shows that the cost of debt is lower than the cost of equity. Firms can borrow at low rate of interest in the beginning.

With the increase in leverage, lenders being to worry about the repayment of interest and principal and security available to them. The interest rate will be higher on additional loans. Therefore, average cost of debt begins to rise.

Simultaneously, when the equity holders will not much bother when the debt levels of the company are lower. But with increasing leverage, the equity holders are much concerned about the level of interest payments affecting the volatility of cash flow for equity. Then the equity holders demand for more rates of return for taking an additional risk. Thus, a combination of both the sources of finance, with the increase in leverage, the overall cost of capital will also start raising after the optimum level of gearing as shown in figure 17.4.

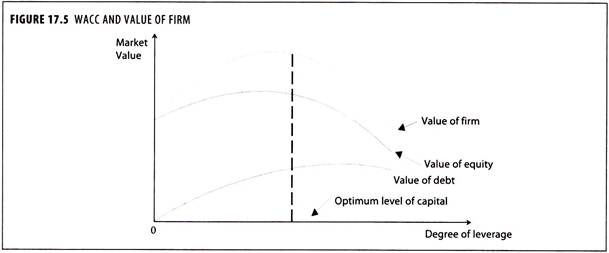

WACC is undoubtedly an important tool in determining optimal capital structure. To minimise the value of the firm as well as the market value of the stock, the firm should strive to minimise WACC. Thus considerable weight is placed on WACC for achieving the ultimate objective of increasing the stockholders worth by choosing an appropriate capital mix.

Other conditions, likely cash flow, ability of the firm to meet fixed charges, degree of leverage, fluctuations of EBIT and its likely impact on EPS for alternative methods of financing etc. should also be taken into consideration with due weightage for the purpose.

Figure 17.5 shows the impact of leverage on value of the firm. The value of the firm is maximum where the level of gearing for each firm at which the cost per unit of capital is at its lowest point. Therefore, a firm should identify and maintain capital structure at this optimum level.

4. Modigliani and Miller Approach (Modern View):

The traditional view of capital structure as explained in ‘weighted average cost of capital’ is rejected by the proponents Modigliani and Miller (MM) 1958. According to them cost of capital is independent of capital structure and there is no optimal value. According to them, under competitive conditions and perfect markets, the choice between equity financing and borrowing does not affect a firm’s market value because the individual investor can alter investment to any mix of debt and equity the investor desires.

MM argues that a company’s WACC remains unchanged at all levels of gearing, implying that no optimal capital structure exists for a particular company. MM supported their argument that capital structure was irrelevant in determining the market value of a company by using ‘arbitrage theory’.

According to them, a change in debt-equity ratio does not affect the cost of capital and the market value of the firm. The theory is based on perfect market conditions and without considering the corporate and personal taxation.

Assumptions of MM Theory:

The MM theory is based on the following assumptions:

I. The capital market is assumed to be perfect. The existence of perfect capital market implies that both individuals and investors can borrow unlimited amounts at the same rate of interest. There are no limits of borrowing.

II. The investors are free to buy and sell securities and are well informed about the risk and return involved in different securities. All securities are infinitely divisible.

III. There are no transaction costs. There are no brokerage or other transaction charges.

IV. The debt is less expensive than equity. Increase in debt level will cause to increase the cost of debt. The increased debt will increase the financial risk of the firm and expectations of the equity holders will be more. Thus the average cost of capital will remain constant for all levels of leverage.

V. There is no benefit to debt financing other than reduction in corporate income taxes due to tax shield of interest payments of debt.

VI. Interest rates are equal between borrowing and lending, firms and individuals.

VII. The capital markets are efficient. The information is cost less and readily available to all investors.

VIII. There are no personal taxes and corporate income taxes.

IX. All investors are only price takers. No individual can influence the market price of security by the scale of transactions.

X. The firm’s investment schedule and cash flows are assumed to be constant and perpetual.

XI. The firms can be grouped into ‘homogeneous risk classes’, such that the market seeks the same return from all member firms in each group. All the firms within that group will have the same business or systematic risk at different levels of gearing.

XII. The stock markets are perfectly competitive.

XIII. The investors are rational and expect other investors to behave rationally.

XIV. Investors formulate similar expectations about future earnings, which are described by a normal probability distribution.

XV. The average expected future operating earnings of a firm are represented by a subjective random variable. It is assumed that the expected values of the probability distributions of all investors are the same.

XVI. The dividend payout ratio is 100% i.e. there are no retained earnings.

MM Theory: No Taxation:

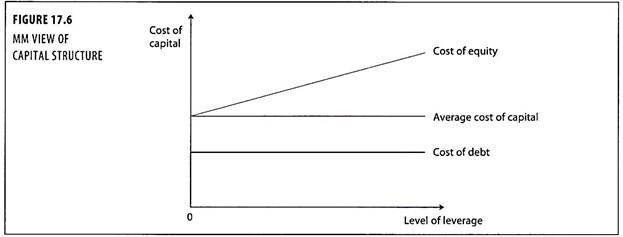

The debt is less expensive than equity. An increase in debt will increase the required rate of return on equity. With the increase in the levels of debt, there will be higher level of interest payments affecting the cash flow of the company.

Then equity shareholders will demand for more returns. The increase in cost of equity is just enough to offset the benefit of low cost debt, and consequently average cost of capital is constant for all levels of leverage as shown in figure 17.6.

In MM theory, the following symbols and their expressions are used:

Vu = Market Value of Ungeared Company i.e., Company with 100% equity financing.

Veg = Market Value of the Equity in a Geared Company.

D = Market Value of Debt in a Geared Company.

Vg =Veg +D

Ku = Cost of Equity in an Ungeared Company.

Kg = Cost of Equity in Geared Company.

Kd = Cost of Debt

MM Theory: Proposition I:

The first proposition of MM theory on capital structure reads as ‘the market value of any firm is independent of its capital structure, changing the gearing ratio cannot have any effect on the company’s annual cash flow’. It is determined by the assets in which the company has invested and not how those assets are financed.

The total market value of the firm and its cost of capital are independent of its capital structure. The total market value of a firm is given by capitalising the expected stream of operating earnings at a discount rate appropriate for its risk class.

The value of the geared company is as follows:

Vg = Vu

WACC is independent of the debt/equity ratio and equal to the cost of capital which the firm would have with no gearing in its capital structure.

Problem 4:

BKC Ltd. has profits before interest and taxes of Rs.3,00,000. The applicable tax rate is 40%. Its required rate of return on equity in the absence of borrowing is 18%. In the absence of personal taxes, calculate the value of the company in an MM world with no leverage.

Solution:

MM Theory: Proposition II:

The second proposition of MM theory asserts that ‘the rate of return required by shareholders increases linearly as the debt/equity ratio is increased i.e., the cost of equity rises exactly in line with any increase in gearing to precisely offset any benefits conferred by the use of apparently cheap debt’.

MM went on arguing that the expected return on the equity of a geared company is equal to the return on a pure equity stream plus a risk premium dependent on the level of capital structure. The equity holders of a geared firm expect a return equal to the expected return from the identical ungeared firm, plus a premium that is directly proportional to the level of gearing.

There is no optimum level of gearing. WACC will be identical at all levels of gearing. The rise in cost of equity due to increased level of gearing will precisely offset the low cost debt, at all levels of gearing. The WACC of a geared company is identical to the cost of equity of an ungeared company which is financed entirely by equity funds, which is determined by the risk free return plus premium for business risk of the company.

The premium for financial risk can be calculated as debt/ equity ratio multiplied by the difference between the cost of equity for an ungeared company and the risk-free cost of debt.

The cost of equity of a geared firm is calculated as follows:

By introducing debt in capital structure, the cost of equity raises linearly to offset the lower cost of debt directly giving a constant weighted average cost of capital irrespective of the level of gearing.

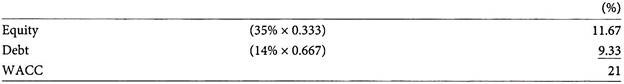

Problem 5:

ABC Ltd. has financed its project with 100% equity with a cost of 21%. This also the weighted average cost of capital of the company. XYZ Ltd. another company identical to ABC Ltd., has financed its capital structure with 2 : 1 debt-equity ratio. The cost of debt is 14%. Calculate the cost of equity of XYZ Ltd.

Solution:

As per Proposition II of MM theory, the cost of equity in the geared company Kg, is the cost of equity in the ungeared company Ku plus a premium for financial risk.

The WACC of geared company is same as the WACC of ungeared company.

MM Theory: Proposition III:

MM theory’s third proposition asserts that ‘the cut-off rate for new investment will in all cases be average cost of capital and will be unaffected by the type of security used to finance the investment’. The cut-off rate for investment purposes is completely independent of the way in which an investment is financed. This implies a complete separation of investment and financing decisions of the firm.

Problem 6:

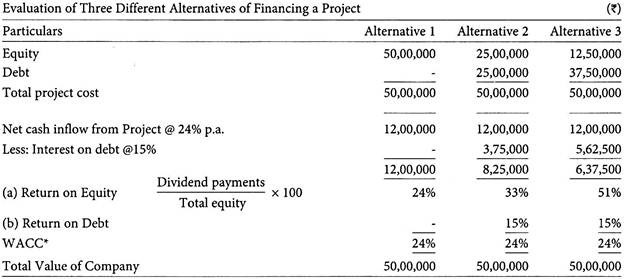

XYZ Ltd. intends to set up a project with capital cost of Rs. 50,00,000. It is considering the three alternative proposals of financing.

Alternative 1 = 100% equity financing

Alternative 2 = Debt-equity 1 : 1

Alternative 3 = Debt-equity 3 : 1

The estimated annual net cash inflow is @ 24% i.e. Rs.12,00,000 on the project. The rate of interest on debt is 15%. Calculate the weighted average cost of capital for three different alternatives and analyze the capital structure decision.

Solution:

*WACC = (Cost of Equity x % Equity) + (Cost of Debt x % Debt).

Note:

It can be observed from the above illustration that at different levels of leverage, the WACC is same and the value of firm will also be same.

MM Theory: Arbitrage:

The process of buying an asset or security in one market and selling the same in another market to derive benefit from the price differential is referred to as ‘arbitrage’. The word ‘arbitrage’ is a technical term referring to a situation where two identical commodities are selling in the same market for different prices, then the market will reach equilibrium by the dealers start buy at the lower price and sell at the higher price, thereby making profit.

The increase in demand will force up the price of the lower priced goods and increase in supply will force down the price of the high priced commodities. MM argue that the process of arbitrage will prevent the different market values for equivalent firms, simply because of capital structure differences.

If two firms with same level of business risk but different levels of gearing sold for different values, then shareholders would move from over valued firm to the under valued firm and adjust their level of borrowing through the market to maintain financial risk at the same level.

The shareholders would increase their income through this method while maintaining their net investment and risk at the same level. This process of arbitrage would derive the price of the two firms to a common equilibrium total value.

In arbitrage process the shareholders of a firm with low WACC will sell their shares and purchase shares of a company with higher WACC, by borrowing or lending, to maintain the same level of risk-return before and after. These transactions of arbitrage will bring in equilibrium which are temporarily out of equilibrium.

The arbitrage transactions are cost free. Through these cost less transactions, investors can increase their return without increasing their risk. The arbitrage in MM theory show that the investors will move quickly to take advantage and will make profit in an equilibrium capital market, then this would represent an arbitrage opportunity.

In arbitrage process the security prices adjust as market participants search for arbitrage profits. The security price will be in equilibrium, when the opportunity for arbitrage profits is exhausted.

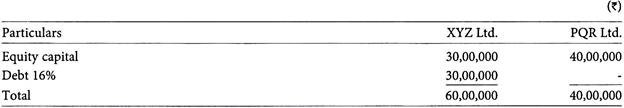

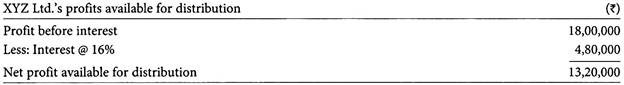

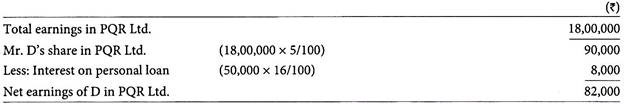

Problem 7:

The capital structures of XYZ Ltd. and PQR Ltd. are given below:

Both the companies are in the same class of business risk with earnings before interest of Rs. 18,00,000.

Mr. D. is holding an equity of 5% in XYZ Ltd.

Mr. D’s share in XYZ Ltd’s profits = 13,20,000 x 5/100 = Rs. 66,000

Mr. D noticed that PQR Ltd. with same level of business risk with equal earnings.

Mr. D sold 5% share for Rs. 1,50,000 (i.e., 5% of Rs. 30,00,000). He borrowed another Rs. 50,000 on interest @ 16% p.a. and invested Rs. 2,00,000 in PQR Ltd.’s shares and his share in PQR Ltd. comes to 5%.

Mr. D could increase his income by Rs.16,000 (i.e., Rs.82,000 – Rs.66,000) while maintaining total risk at the same level.

MM Theory: Criticism:

The MM theory is criticised for the following reasons:

I. In the real world, transaction costs exist. It is unrealistic to assume that broker commission, transfer fees and other transaction costs does not exist in trading of securities.

II. The existence of efficient and perfect capital markets is only hypothetical. But in reality the capital markets operate in weak and semi-strong form due to asymmetric information.

III. One of the important assumptions of MM theory is that corporate cost of borrowing does not increase with the level of gearing. But the debt providers demand for increased cost of debt for accepting higher levels of financial risk.

IV. MM theory assumes that interest rates are equal between individuals and corporates. But in practice, the debt funds available to corporate at cheaper rates as compared to individuals.

V. The borrowing and lending rates cannot be equal. It depends upon the risk-return perception of the lenders.

VI. MM theory ignores the important aspect of financing through retained earnings. In real world, corporates will not payout the entire earnings in the form of dividends.

VII. MM theory assumed that there are no bankruptcy costs. But the firm has to incur costs like legal expenses, loss of investment opportunities, if the company fails to meet its financial obligations.

VIII. A part of the corporate debt would be in the form of term loans from banks and financial institutions, and the investors cannot undo excessive leverage.

IX. Investors will not show much interest in purchase of low rated bonds issued by highly geared firms.

X. Corporate leverage and home made leverage are not perfect substitutes from the view of individual investor who is borrowing funds.

XI. MM theory was much criticised for the reason that it ignores the corporate taxation and personal taxation.

MM Theory: Corporate Taxation:

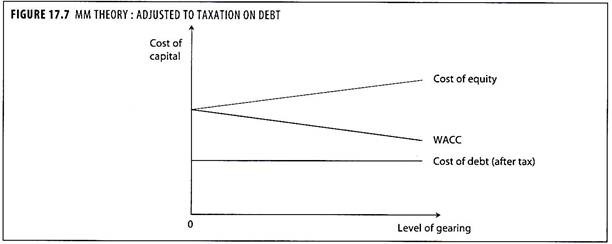

In our previous discussion, MM theory has ignored the tax relief on debt interest. MM has further modified their theory by considering tax relief available to a geared company when the debt component is existing in the capital structure. The tax burden on the company will lessen to the extent of relief available on interest payable on the debt, which makes the cost of debt cheaper which reduces the weighted average capital of the firm to the lower where capital structure of a company has debt component. This MM theory adjusted to taxation is shown in figure 17.7.

Weighted Average Cost of a Geared Firm

Kg = (Cost of Equity x % of Equity) + (1-T) (Cost of Debt x % of Debt)

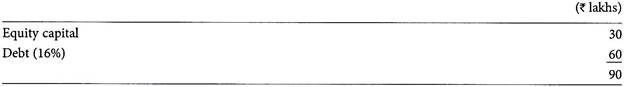

Problem 8:

Jupiter Ltd. has the following capital structure:

Corporate tax rate is 40%. The cost of equity is assumed to be 24%. Calculate the weighted average cost of capital of the company.

Solution:

Kg = (24% x 0.333) +(1 -0.40) (16% x 0.667) = 8% + 6.4% = 14.4%

Under the assumption of tax relief being available on debt interest, the total market value of the company is increasing function of the level of gearing.

Cost of Equity of Geared Company:

Where, T = Corporate tax rate

Kd = Pre-tax cost of debt

Now, refer back to Illustration 17.5 to adjust the WACC to allow for corporate tax. Let us assume the corporate tax is 40%.

The WACC adjusted to corporate tax of a geared firm is as follows:

MM theory assumes that the value of the geared company will always be greater than an ungeared company with similar business risk, but only by the amount of debt-associated tax saving of the geared company.

Value of Geared Company (Vg) = Vu + DT

When corporate taxation is introduced, the tax deductibility of debt interest creates value for shareholders via the tax shield, but this is a wealth transfer from taxpayers. The value of a geared company equals the value of an equivalent ungeared company plus the tax saving. With corporate taxation, the rate of return required by the geared company’s shareholders is less than that in the all equity company, reflecting the tax benefits. A further effect of corporate taxation is to lower WACC, which will fall continuously as gearing increases.

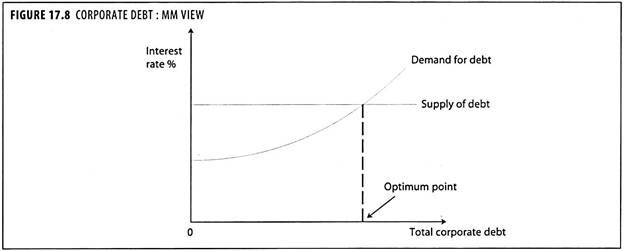

MM Theory: Personal Taxation:

MM theory considered only corporate taxes. It was left to a subsequent analysis by Miller (1977) to include the effects of personal, as well as, corporate taxes. He argued that the existence of tax relief on debt interest but not on equity dividends, would make debt capital more attractive than equity capital to companies.

The market for debt capital under the laws of supply and demand, companies would have to offer a higher return on debt in order to attract greater supply of debt. When the company offers an after personal tax return on debt at least as equal to the after personal tax return on equity, the equity supply will switch over to supply debt to the company.

It is assumed that, from the angle of the company, it will be indifferent between raising debt or equity as the effective cost of each will be the same and there is no advantage to gearing. Miller analyzed the total supply and demand for debt by a corporate sector. The corporate sector as a whole would be prepared to issue debt upto the point where the extra interest paid is exactly compensated for by the tax shield on the debt interest.

Suppliers of funds would be prepared to take up debt provided that they were compensated by a high return so that the after tax return on debt was at least equal to the after tax return on equity. Under the modern view of capital structure decisions, the favourable tax implications of borrowing will help reduce of average cost of capital even the levels of leverage increases. It is based on the assumption that interest payments on debt are allowed as a tax deduction whereas dividends on equity capital are not allowed for tax deduction.

5. Debt-Equity Ratio Approach:

Different studies, so far conducted, fail to reach unanimity as to the appropriate debt-equity ratio, but commonly suggested standard debt-equity ratio is 2 :1. The standard ratio may vary depending on the nature of the company. Low debt-equity ratio does not necessarily mean such dependence on collecting funds by equity issues. It may also be so due to increase in the retained earnings component of ‘equity’.

Again, it is equally pertinent to note that a highly profitable company may keep aside a sizeable portion of its profit in the reserve fund. It may help the company not to rely on external debt to meet further requirement of the funds and accordingly debt-equity ratio may appear to be at a low level.

The following points should be considered before selecting the firm’s debt-equity ratio as a measure for determining the capital structure:

I. There is an optimal capital structure where the marginal tax benefit is equal to the marginal cost of anticipated financial distress.

II. The debt-equity ratio depends on both the level and volatility of cash flows.

III. Survival of the firm is the top priority of any firm and hence the lower debt-equity ratio is preferable for high risk business firms.

IV. The trade cycles and industry cycles and other reasons may sometimes cause financial distress to the firm and hence the debt-equity ratio should be selected keeping in view the distress conditions which may occur in future.

V. In balancing debt-equity ratio, the first step always should be the increase of equity which gives more financial flexibility.

VI. Increasing equity can be used as a base to justify and sustain more debt.

The debt-equity ratio affects the firm’s cost of capital when a debt-equity ratio of a firm increases, its cost of capital will decline and vice versa. When a firm depends on higher debt, result in payment of interest to the suppliers of loan capital which will lower the amount of tax payable by the company, and simultaneously its overall cost of capital will also decrease.

But, any non-payment of principal and interest payments of the loans outstanding may result in bankruptcy costs.

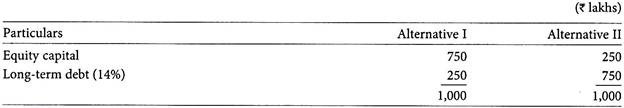

The impact of debt-equity composition on cost of capital is explained in the illustration given below:

Problem 9:

The capital structure of XYZ Ltd. is given below:

The firm’s corporate tax rate is 40%. It maintains a dividend of 18% on the equity capital. Compute the firm’s cost of capital and analyse its effect on capital structure of the firm.

Solution:

Analysis:

From the analysis of the above we can observe that when the debt-equity ratio is 1: 3, the composite cost of capital stands at 15.6%. When the debt-equity ratio altered to 3 :1, the firms cost of capital has drastically reduced to 10.8%. This is due to the advantage of tax shield and the supply of debt at cheaper cost than the equity capital.

Problem 10:

Two firms Preeti Ltd. and Mahati Ltd. are similar in all respects expect that Mahati Ltd. uses Rs.10,00,000 debt in its capital structure. If the corporate tax rate for these firms is 40%, what is value of Mahati Ltd. exceeds that of Preeti Ltd.?

Solution:

When corporate taxes are considered, the value of the firm that is levered would be equal to the value of unlevered firm increased by the tax shield associated with debt. Value of Mahati Ltd. would exceed the value of Preeti by Rs.4,00,000 (i.e. 0.4 x 10,00,000).

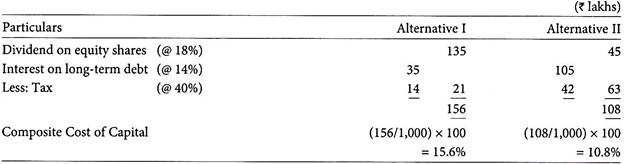

6. EBIT-EPS Approach:

It is one of the basic objectives of Financial Management to design an appropriate capital structure which can provide the highest EPS over the firm’s expected range of EBIT. EPS is a yard stick to evaluate the firm’s performance for the investors. The level of EBIT varies from year to year shows how successful the firm’s operation are.

EBIT- EPS approach is an important tool for designing the optimal capital structure framework of the firm. EBIT-EPS analysis is widely used by Finance manager because it provides a simple picture of the consequences of alternative financing methods, however more sophisticated techniques are available.

Financial Break-Even:

It is the minimum level of EBIT needed to satisfy all fixed financial charges i.e., interest and preference dividends. It denotes the level of EBIT for which the firm’s EPS just equals zero. If EBIT is less than financial break-even point, then EPS will be negative. But if the expected level of EBIT exceeds than that of break-even point, more fixed costs financing instruments can be inducted in the capital structure. Otherwise the use of equity would be preferred.

Financial Indifference Point:

When two alternative financial plans do produce the level of EBIT where EPS is the same, this situation is referred to as ‘indifference point’. In case, the expected level of EBIT exceeds the indifference point, the use of debt financing would be advantageous to maximize the EPS. The indifference point may be defined as the level of EBIT beyond which the benefits of financial leverage begins to operate with respect to earnings per share.

The indifference point between the two financing alternatives can be ascertained as follows:

Where, EBIT = Earnings before interest and taxes

t = Corporate rate of tax

I1 = Interest charges in Financing alternative 1

N1 = Number of equity shares in Financing alternative 1

I2 = Interest charges in Financing alternative 2

N2 = Number of equity shares in Financing alternative 2

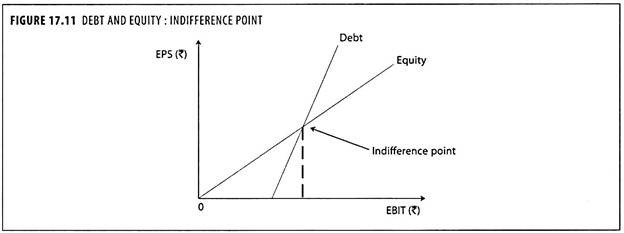

Problem 11:

American Express Ltd. is setting up a project with a capital outlay of Rs.60,00,000.

It has following two alternatives in financing the project cost:

Alternative 1 100% Equity finance

Alternative 2 Debt-equity ratio 2 : 1

The rate of interest payable on the debt is 18% p.a. The corporate rate of tax is 40%.

Calculate the indifference point between two alternative methods of financing.

Solution:

Alternatives in Financing and its Financial Charges

(1) By issue of 6,00,000 equity shares of Rs.10 each amounting Rs.60 lakhs. No financial charges involved, (or)

(2) By raising the funds in the following way:

Debt = Rs.40 lakhs

Equity = Rs.20 lakhs (2,00,000 equity shares of Rs.10 each)

Interest payable on debt = Rs.40,00,000 x 18/100 = Rs.7,20,000

Now we can calculate the indifference point of the above two financing alternatives as follows:

The EBIT at indifference point explains that the EPS for two methods of financing is equal.

7. Financial and NEDC Risks Trade-Off Approach:

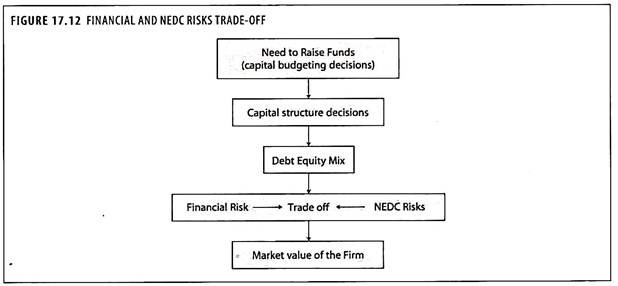

The firm’s decision to use or otherwise debt in the capital structure affects two types of risks, namely, Financial risk (FR) and Risks arising out of Non-employment of Debt Capital, called ‘NEDC risks’. The former risk arises out of the use of the debt capital, while the latter is the outcome of the use of only equity or more of equity and less of debt in the capital mix. A detailed description of these two risks and their graphical presentation are given in figure 17.12.

Assumptions:

The optimum capital structure based on financial and NEDC risks trade-off is based on the following assumptions:

I. There are only two sources of funds, namely debt and equity.

II. The total assets are constant.

III. The total financing of the company is given.

IV. EBIT/Operating Profits are constant.

V. Investors are rational.

VI. Servicing cost per share is higher than per debenture and both remain constant.

VII. Issue cost per share is higher than per debenture and both remain constant.

VIII. Market price and face value remain constant.

Financial Risks:

The financial risks arises on account of the use of debt in the capitalization plan. The debentures carry fixed obligations as to return on capital. Lack of ability to honour these fixed obligations increases the risk of liquidation. In addition, the use of debt also increases the variability of earnings available to equity holders.

NEDC Risks:

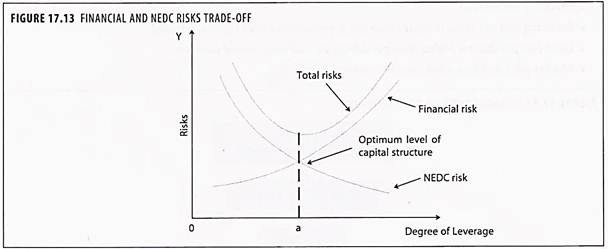

The financial executives have to manage not only financial risk but also risks arising out of non-employment of debt capital in the capital structure, called ‘NEDC Risks’. These risks vary inversely with the ratio of Debt to Total Capital (D/C Ratio). The greater the value of D/C ratio, the lower will be the NEDC risks and vice versa, other things being equal. The optimum capital structure is there at that point where the total risk/cost is minimum.

The components of NEDC risks are as follows:

I. The excessive reliance on equity source leads to the sacrifice of the opportunity of earning higher EPS on account of beneficial effects of financial leverage.

II. Financial plan should be compatible with retaining control. Existing managements are allergic to the very idea of loosing control over the affairs. The risk of loss of control increases with the increase in the proportion of equity to total capital and vice versa.

III. Generally the cost of floating debt is less than the cost of floating an equity issue. Flotation costs minimising firms should think of issuing less of equity and more of debt.

IV. Between debt and equity, the latter is more inflexible in nature. Equity shares cannot be redeemed during the life time of the company while debentures are redeemed at the end of maturity period.

V. Between debt and equity, the latter is more expensive to serve. Servicing costs are the costs incurred in distributing dividend/interest cheques, distribution of audited reports, meeting expenses etc. The total servicing cost varies with the amount of equity issue. Greater the amount of equity issue, higher would be the servicing costs.

Figure 17.13 depicts the trade-off between financial and NEDC risks in setting optimum capital structure.

In determining the optimum level of debt-equity combination, the Finance manager has to balance the financial and NEDC risk by minimising the total risk/costs.