EFR is calculated with the help of following formula, when other ratios remain constant:

Where,

A/S = Total assets/Sales

ADVERTISEMENTS:

Total assets include both current assets and fixed assets

L/S = Current liabilities and provisions/Sales

S = Sales of current year

S1 = Projected sales of next year

ADVERTISEMENTS:

ΔS = Expected increase in sales over current year (S-S1)

M = Net profit margin

D = Dividend payout ratio

The expected changes in investments, miscellaneous expenditure and scheduled repayment of terms loans and debentures are assumed to be zero while computation of EFR, as above.

ADVERTISEMENTS:

Illustration:

The following information are available for Rainbow Ltd.:

Where,

ADVERTISEMENTS:

A/S = Current and fixed assets as a proportion of sales

ΔS = Expected increase in sales

L/S = Current liabilities, provisions and bank borrowings as a proportion of sales

M = Net profit margin

ADVERTISEMENTS:

S1 = Projected sales for the next year

D = Dividend payout ratio

There will be no change in the level of investments and no repayment of the term loans in the next year.

(a) Estimate the external funds requirement for the next year.

ADVERTISEMENTS:

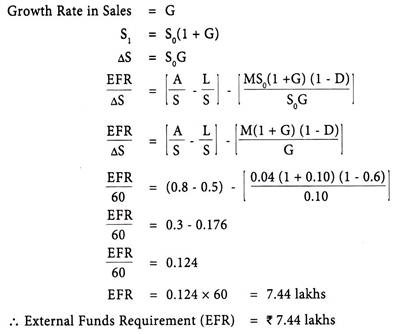

(b) Suppose the growth rate of net profit margin is 10% for Rainbow Ltd. for the next year in the above case, what then will be the external funds requirement?

(a) Estimation of the External Funds Requirement for the Next Year:

Where,

ADVERTISEMENTS:

A/S = Current and fixed assets as a proportion of sales = 0.8

ΔS = Expected increase in sales = Rs. 60 Lakhs

L/S = Current liabilities, provisions and bank borrowings as a proportion of sales = 0.5

M = Net profit margin = 0.04

S1 = Projected sales for the next year = Rs. 500 Lakhs

D = Dividend payout ratio = 0.6

ADVERTISEMENTS:

External Funds Requirement = [(0.8 × 60) – (0.5 × 60)] – [(0.04 × 500) (1 – 0.6)]

= 48 – 30 – 8 = 10

∴ External Funds Requirement = Rs. 10 lakhs

(b) Estimation of the External Funds Requirement for Next Year when Growth Rate of Net Profit Margin (G) is 10%: