In this article we will discuss about the internal and sustainable growth rates of a firm.

Internal Growth Rate (IGR):

ICR is the maximum growth rate a firm can achieve without going for external financing. All the financing requirements are met internally from the internal accruals.

IGR can be expressed as follows:

Where,

ROA = Return on assets i.e. (PAT/Total assets)

b = Retention ratio i.e. (1 – Dividend payout ratio)

Assumptions:

The important assumptions in ascertaining IGR are as follows:

i. The dividend payout ratio or retention ratio should be as per the targeted rate.

ii. The increase in sales will cause increase in assets of the concern, in direct proportion.

iii. For achieving IGR, the firm does not require to raise equity capital or additional debt.

iv. To achieve IGR, the firm will finance its additional requirements only from retained profits.

v. The earnings after tax should be in direct proportion to sales.

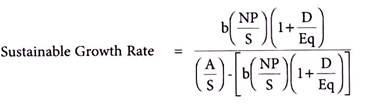

Sustainable Growth Rate (SGR):

SGR is the maximum growth rate which can be achieved by using both internal accruals, as well as, external debt without increasing the financial leverage. SGR is the maximum sales that can be achieved in a year based on target operating debt and dividend payout ratios.

Where,

b = Retention ratio or (1 – b = Dividend payout ratio)

NP/S = Net profit margin or Net profit/Sales

D/Eq = Debt-Equity ratio or Long-term debt/Shareholders equity

A/S = Assets to sales ratio

S = Annual sales

SGR is a powerful planning tool used for balancing of sales objective of the firm with its operating efficiency and financial resources. The lower the ratio, the more efficient utilization of assets.

SGR is a composite ratio which is subject to the following assumptions:

a. Net Profit Margin Ratio:

Net profit should be in constant proportion to sales achieved.

b. Assets to Sales Ratio:

Assets of the firm will increase directly in proportion to increase in sales.

c. Dividend Payout Ratio:

It should be according to target rate set for the firm.

d. Debt-Equity Ratio:

The firm has a target debt-equity ratio and it intend to maintain capital structure according to target set.

Another important assumption in calculation of SGR is that the firm does not intend to further equity since it is a costly source of finance.

SGR can be achieved in any of the following ways, without increase in further equity:

i. Increase net profit margin

ii. Decrease in proportion of assets to sales

iii. Decrease in dividend payout

iv. Increase in debt component proportionate to equity.

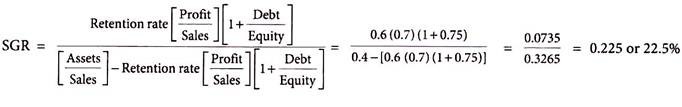

Problem 1:

X Ltd. requires Rs.0.40 of assets for every rupee of sales, retains 60% of net profit, has a net profit of 7%, and attempts to maintain 0.75 debt-to-equity ratio. Calculate the company’s sustainable growth rate.

Problem 2:

Black Berry has an equity capital of 12 million, total debt of 8 million and sales last year were 30 million:

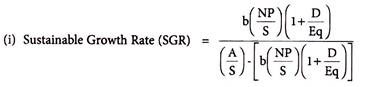

(i) It has a target Assets-to-Sales ratio of 0.667, a target Net Profit margin of 0.04, a target D.E. ratio of 0.667 and target earnings retention rate of 0.75. In a steady state, what is its sustainable growth rate?

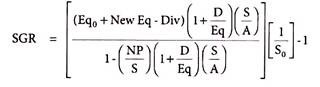

(ii) Suppose the company has established for the next year a target Assets-to-Sales ratio of 0.62, a target Net Profit margin of 0.05, and a target D.E. ratio of 0.80. It wishes to pay an annual dividend of 0.3 million and raise 1 million in equity capital next year. What is its sustainable growth rate for next year?

(Million = Million Rupees)

Solution:

Where,

b = Retention rate of earnings (1 – b is the Dividend Payout Ratio) i.e. 0.75

NP/S = Net profit margin (Net profit/Sales) i.e. 0.04

D/Eq = Debt – Equity Ratio i.e. 0.667

S = Annual Sales

A/s = Assets to Sales ratio i.e. 0.667

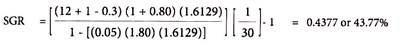

(ii) Sustainable Growth Rate for Next Year:

NP/S. D/Eq, S, A/S are the same as stated in (i) above

Where,

S0 = Most recent annual sales

Eq0 = Equity in the beginning

Here, A/s = 0.62, NP/S = 0.05, D/Eq = 0.80, Div=3m, New Eq = Rs.1m., SO= 30m.