The business firms and the other business entities are guided by certain objectives. Profit maximization has been one the prime objectives of the private business enterprises. Later on, in recent times new theories of business firms have generated alternative objectives of firms. To be specific, the new theories lay stress on the role of managers and their behavioural pattern in deciding the price and output under Oligopoly.

Sales maximization model of Oligopoly is one of the objectives of a business firm apart from profit maximization. Besides there is an array of behavioural theories and managerial theories developed by Cyert and March, H.A.Simon, O.E.Williamson, and R. Marris and others which have added a new dimensions in addition to the traditional objective of profit maximization.

Managerial theories of the firm, as developed by William Baumol (1958), Robin Marris (1964) and Oliver E. Williamson (1966), suggest that managers would seek to maximise their own utility and consider the implications of this for firm behavior in contrast to the profit-maximising case. (Baumol suggested that managers’ interests are best served by maximizing sales after achieving a minimum level of profit which satisfies shareholders.)

Profit Maximization Objective:

The Objective of Profit maximization has been the prime objective of any business entity. In order to satisfy the objective the firm has to meet certain conditions.

The first-order condition requires that at the point where maximum profit is obtained, the marginal revenue (MR) must equal the marginal Cost (MC). Besides; the second-order condition requires that the first-order condition must be satisfied under the condition of decreasing marginal revenue (MR) and increasing marginal cost (MC). This implies that at the optimum point of profit maximization, marginal cost (MC) must intersect the marginal revenue (MR) from below.

Mathematically, the second condition requires that the second derivative of the profit function is expected to be less than zero. It can be concluded that maximum profit occurs where the first- and second-order conditions are satisfied.

Apart from the prime objective of profit maximization, the others alternative objectives of a business firm can be enumerated as below:

1. Objective of maximization of Sales revenue

2. Objective of maximization of the growth rate

3. Objective of maximization of manager’s utility function

4. Objective of making satisfactory rate of profit

Baumol’s sales revenue maximization model highlights that the primary objective of a firm is to maximize its sales rather than profit maximization. It states that the goal of the firm is maximization of sales revenue subject to a minimum profit constraint. It should be noted that by sales maximization Baumol does not indicate the maximization of the physical volume of sales but the maximization of the total revenue of sales, i.e., rupee value of the sales.

Prof. William Jack Baumol, an American Economist has hypothesized maximization of sales revenue. The rationale in the rear this objective is the dichotomy between management and ownership in large business corporations. This existing situation of dichotomy provides managers a chance to set their purpose other than profit maximization goal which most owner-businessmen pursue. Prof. Baumol thinks that the managers are more interested in maximizing sales rather than profits. So far as empirical validity of sales revenue maximization objective is concerned, factual evidences are debatable. Despite of criticism Baumol’s sales maximization model is a major alternative to profit maximization.

Baumol’s sales revenue maximization model highlights that the primary objective of a firm is to maximize its sales rather than profit maximization. It states that the goal of the firm is maximization of sales revenue subject to a minimum profit constraint. It should be noted that by sales maximization Baumol does not indicate the maximization of the physical volume of sales but the maximization of the total revenue of sales, i.e., rupee value of the sales.

Prof. William Jack Baumol, an American Economist has hypothesized maximization of sales revenue. The rationale behind this objective is the dichotomy between management and ownership in large business corporations.

This existing situation of dichotomy provides managers a chance to set their purpose other than profit maximization goal which most owner-businessmen pursue.

Prof. Baumol thinks that the managers are more interested in maximizing sales rather than profits owing to the following basic reasons:

(1) The increasing sales add prestige to the managers whereas under the objective of maximization of profits, the profits go into the shareholders’ pockets.

(2) There are sufficient grounds to understand that the performance and salaries of the top managers are highly correlated to sales.

(3) The financial and banking institutions consider sales of the firms to gauge their performance and inclined to finance the firms with rising sales.

(4) Under the situation of sales growing the personnel problems can be more suitably resolved. The employees at all the levels can be provided with higher emoluments when higher sales take place as higher sales would indicate better performance.

Even though Baumol has presented his theory with the help of a static and a dynamic model.

Baumol’s Sales Maximization Model without Advertising:

Baumol by sales maximization refers to maximization of total revenue. This does not mean the sale of large quantities of output, but refers to the increase in money sales (in rupee, dollar, etc.). Sales can increase up to the point of profit maximisation where the marginal cost equals marginal revenue. If sales are increased beyond this point, money sales may increase at the expense of profits. But the oligopolistic firm wants its money sales to grow even though it earns minimum profits.

Minimum profits refer to the amount which is less than maximum profits. The minimum profits are determined on the basis of firm’s need to maximize sales and also to sustain growth of sales. Minimum pro fits are required either in the form of retained earnings or new capital from the market.

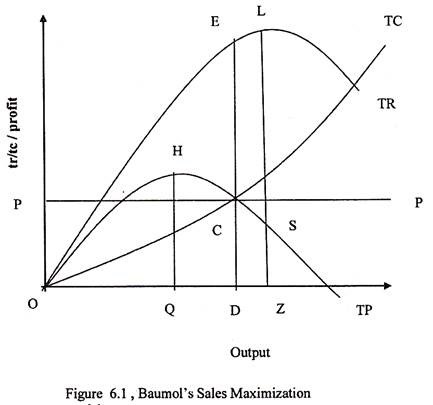

A simple representation of Baumol’s sales maximization model is portrayed in Figure 6.1 where the total Cost Curve is represented by TC curve, the total revenue curve is represented by TR. The total profit curve is represented by TP curve. The minimum profit constraint is represented by the line MP. In the model the firm at OQ level of output the firm maximizes its profit as reflected by the highest point H on the TP curve. But the aim of the firm in Baumol’s model is to maximize its sales rather than profits.

The sales maximization output of the firm is represented by the OK. Here the total revenue represented by ZL is the maximum at the highest point of TR curve. We can see that the sales maximizing output OZ is higher than the profit maximizing output OQ.

But as we know that sales maximization is subject to minimum profit constraint. Let us suppose that the minimum profit level of the firm is represented by the line PP’.

It is interesting and necessary to observe that the output OZ will not maximize sales while fulfilling the minimum profit constraint because the minimum profits OP are not being covered by total profits ZS. For sales maximization subject to minimum profit constraint, ‘i.e. firm should produce the level of output which not only covers the minimum profits but also attains the highest total revenue consistent with it. In our representation of Baumol’s model this level is represented by OD level of output where the minimum profits DC (=OP) are consistent with DE amount of total revenue at the price DE/OD, (i.e., total revenue/total output).

It can be pointed out that in Baumol’s model of sales maximisation the profit maximisation output (OQ) will be smaller than the sales-maximisation output OD, and price higher than under sales maximisation. The reason for a lower price under sales maximisation is that both total revenue and total output are equally’ higher while, under profit maximisation, total output is much less as compared to total revenue. Imagine if QH is joined to TR in Figure 6.1

Baumol’s Sales Maximization Model with Advertising:

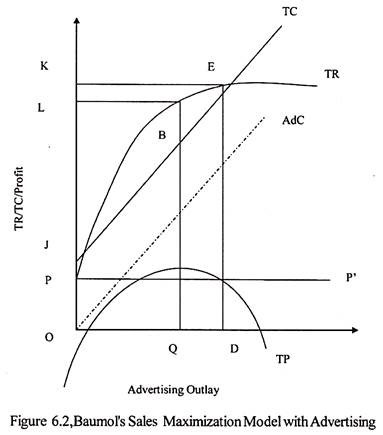

Next it would be wise on our part to explore how Baumol in his model has incorporated the impact of advertising. Prof. Baumol had exhibited that the condition of profit constraint under sales maximization is also effective in advertising. In this the model we can see that as represented in the Figure 6.2, expenditure on advertising has been plotted along the horizontal axis. Along the vertical axis the total revenue, costs and profit are plotted. The TR curve represents the total revenue.

As shown in the figure, the advertisement cost curve is depicted by the 45° line AdC. It is deemed that the other costs of the firm incurred on fixed and variable factors are independent of the advertising cost. Consequently, by adding a fixed amount of other costs equal to OJ to the AdC curve the total cost curve TC can be derived. The difference between the TR curve and the TC curve is portrayed by TP curve which means the total profit curve. The minimum profit constraint line is represented by PP’.

It can be seen from the figure 6.2 that the profit-maximizing firm spends OQ on advertising and its total revenue will be OL (=QB). On the other hand, given the profit constraint PP’, the sales- maximisation firm spends OD on advertising and earn OK (=DE) as the total revenue. Thus the sales-maximisation firm spends more on advertising (OD) than the profit-maximisation firm (OQ), OD > OQ and also earns higher revenue (DE) than the latter (QB), DE> QB, at the profit constraint PP’. Thus it will always pay the sales maximiser to increase his advertising outlay until he is stopped by the profit constraint.

Therefore in Baumol’s sales maximization model a sales maximiser would produce at higher level of output and would keep the prices lower as compared to the profit maximizing firm. The sales maximiser would spend more on advertising in order to earn larger revenue than the profit maximiser subject to the minimum profit constraint.

Baumol’s sales maximisation model has been criticized on the following major grounds:

(1) The model does not show how equilibrium in an industry, in which all firms are sales maximisers, will be attained. Baumol does not establish the relationship between the firm and industry.

(2) Another weakness of this model is that it ignores the interdependence of the prices of oligopolistic firms.

(3) The model ignores not only actual competition, but also the threat of potential competition from rival oligopolistic firms.

(4) Rosenberg has criticized the use of the profit constraint tor sales maximisation by Baumol.

Despite the above criticisms, sales maximization is an important goal of the business firms in the present day business world.

Marris’s Hypothesis of Maximization of Firm’s Growth Rate:

According to Robin Marris, managers endeavor to maximize firm’s growth rate subject to managerial and financial constraints. They seek to maximize balanced rate of growth of the firm.

Marris defines firms balanced growth rate (G) as follows-

Maximize G = Gd = Gc

Where,

Gd = growth rate of demand for firms product.

Gc = growth rate of capital supply to the firm.

The manager faces two constraints viz., the Managerial Constraint and the Financial Constraint.

The two growth rates according to Marris, are translated into two utility functions viz., Manager’s utility function and the Owner’s utility function.

Managers can maximize both their utility function and that of the owner’s by maximizing these variables. According to Marris, the managers will be able to do so because most of the variables of the manager’s utility function and those appearing in the utility function of the owners are strongly and positively correlated with the size of the firm.

Managerial utility maximization theory, advocated by American economist Oliver E Williamson, describes managers’ utility versus profit maximization in corporate environment, where management is separated from owners (shareholders). The theory states that the managers take decisions that prioritize their own utility maximization over principals’ profits provided the firm can generate minimum profit demanded by the principals to maintain managers‘ job security. The managers while pursuing the objective of utility maximization is subject to the constraint that the after-tax profits are sufficient enough to pay adequate dividends to the shareholders and other investments.

In the realm of both economics and in business economics profit maximization has been the prime objective of all business firms and the theories of firms. Oliver E Williamson, an American economist has developed managerial-utility-maximization theory as against profit maximization.

In modern times, especially in large firms there is a separation between the ownership and the management. The shareholders and managers are two separate groups. The profits of business firm go to the shareholders and managers are usually paid fixed salaries and remunerations. The shareholders’ groups wish for the maximum return on their investment. The managers are not expected to maximize profits as they don’t own the profit. The managers, on the other hand, are motivated by their self-interest and they maximize their own utility function. Thus Williamson’s theory is related to the maximization of the manager’s utility which is a function of the expenditure on staff and emoluments and “discretionary funds”.

The managers derive utility from a wide range of variables. One has to understand that the objective of maximization of Utility function of the managers is constrained by the condition that the after-tax profits should be large enough to pay acceptable dividends to the shareholders and also for the investments which are economically necessary.

Representation of Williamson’s Utility Maximization Model:

To pursue the goal of utility maximization, the manager has a utility function according to which the manager directs the firm’s resources. Utility of a manager is a function of three variables.

1. Monetary Expenditure on Staff- This variable includes the manager’s compensation package as well as spending on his subordinate staff. The manager desires to expand his staff and to increase their salaries. Such monetary expenditure on staff by managers is denoted by S.

2. Managerial Slack – This variable includes additional management perks such as expense accounts, private convenience, private cars, too many telephone connections and mobiles such expenditures are characterized as ‘management slack’, M.

3. Discretionary Investment – This variable refers to the amount of undistributed profit available for manager’s discretional investment or spending. The managers like to have “discretionary funds” for making investments and spending to promote company projects of his choice. Discretionary investments are denoted by D.

Thus, the manager’s utility function can be represented as U = f (S, M, D)

Where U represents the utility function, S represents the staff expenditure, M represents the management slack and D represents the discretionary investments. These decision variables (S, M, D) yield positive utility and the firm will always choose their values subject to the constraint, S > 0> M > 0, D > 0. It is also assumed that the law of diminishing marginal utility applies so that when additions are made to each of staff expenditure, management slack and discretionary investments, they yield smaller increments of utility to the manager.

Further, Williamson in his model regards price (P) as a function of output (X), expenditure on staff (S), and the state of environment which he calls ‘a demand shift parameter’ (e), so that –

P = f(X, S, e).

In order to formally represent Williamson’s model, Let us discuss the four different types of profits introduced by Williamson. They are actual, reported, minimum required and discretionary profits.

We can see that when R represents revenue, C represents total production costs and T represents taxes, then, actual profits πA = R-C-S

If the amounts of managerial slack or emoluments (M) are deducted from the actual profits, we get reported profits.

πR = πA =M=R-C-S-M

The minimum required profits, π0, are the lowest level of profits after paying taxes which the shareholders must receive in order to hold shares of the firm.

Since discretionary profits (D) are what remains with the manager after paying taxes and dividends to shareholders, therefore,

D = πR – π0 – T

To explain Williamson’s utility maximisation model diagrammatically, it is assumed for the sake of simplicity that U=f (S, D) so that discretionary profits (Dp) are measured along the vertical axis and staff expenditures (S) on the horizontal axis in figure 6.3

FC is the feasibility curve showing the combination of D and S available to the manager. It is also known as the profit-staff curve. We may also refer this to as discretionary profit curve for the convenience of understanding. UU1 and UU2 are the indifference curves of the manager which show the combination of D and S. To begin, as we move along the profit-staff curve from point F upwards, both profits and staff expenditures increase O till point P* is reached. P* is the profit maximisation point for the firm where S1P* is the maximum profit levels when OS1 staff expenditures are incurred.

But the equilibrium of the firm takes place when the manager chooses the tangency point E where his highest possible utility function UU2and the feasibility curve FC touch each other. Here the manager’s utility is maximised. The discretionary profits ODP (=S2E) are less than the profit maximisation profits S1P*.

But the staff emoluments are maximised. However, Williamson points out that factors like taxes, changes in business conditions, etc. by affecting the feasibility curve can shift the optimum tangency point, like M in the Figure. Similarly, factors like changes in staff emoluments, profits of stockholders, etc. by changing the shape of the utility function will shift the optimum position.

Criticisms:

1. Williamson’s managerial theory does not represent and incorporate the phenomena of interdependence in Oligopoly.

2. The managerial theory of Williamson does not explain the price and output in the situations where strong rivalry exists among the oligopolistic firms.

3. The model is not verified by ample evidences.

4. Williamson has lumped together staff and manager’s emoluments in the utility curve. The mixing up of non- pecuniary benefits of the manager makes the utility function ambiguous.

Despite the criticisms, O.E. Williamson in support of his utility-maximisation model has cited many evidences which are generally consistent with his model. Thus his theory cannot be empirically ignored and is important as compared with other managerial theories.

Behavioural Theory by Cyert and March:

Cyert and March has advocated a systematic behavioural theory of the firm. In a modern the large business management is separate from ownership. In this case, the firm is not considered as a single entity with the objective of profit maximization decided by a single decision-maker. In their approach Cyert and March considers the modern business firm as a group of individuals who are engaged in the decision-making process relating to its internal structure having multiple goals.

They considered the modern business firm as a complex organization in which the decision making process should be analyzed in variables that affect organizational goals, expectations and choices. They look at the firm as an organizational condition of managers, workers, shareholders, suppliers, customers and so on. Accordingly, the firm is supposed to have multiple goals. Cyert and March has referred to five different goals viz., production goal, inventory goal, sales goal, market share goal, and profit goal.

1. Production Goal:

The production goal represents in large part the demand of those coalition members who are connected with production. It reflects pressures towards such things as stable employment, ease of scheduling, development of acceptable cost performance and growth. This goal is related to output decisions.

2. Inventory Goal:

The inventory goal represents the demands of coalition members who are connected with inventory. It is affected by pressures on the inventory from salesmen and customers. This goal is related to decisions in output and sales areas.

3. Sales Goal:

The sales goal aims at meeting the demand of coalition members connected with sales, who regard sales necessary for the stability of the organisation.

4. Market-Share Goal:

The market-share goal is an alternative to the sales goal. It is related to the demands of sales management of the coalition who are primarily interested in the comparative success of the organisation and its growth. Like the sales goal, the market-share goal is related to sales decisions.

5. Profit Goal:

The profit goal is in terms of an aspiration level with respect to the money amount of profit. It may also be in the form of profit share or return on investment. Thus the profit goal is related to pricing and resource allocation decisions.

While taking the decisions regarding the price, output, and sales strategy the business firms are guided by the five goals. Cyert and March are of the opinion that although all goals must be satisfied in any organization, there is an implicit order of priority which is reflected in the way search activity takes place. If one of the goals is not met and the individual responsible for that is not satisfied, a search will be made for a means to meet that goal.

The aspiration levels of the individuals within the firm which determine these goals, change over time as a result of organisational learning. Thus these goals are regarded as the product of a bargaining- learning process in the organisational coalition. But it is not essential that the different goals may be resolved amicably. There may be conflicts among these goals. The organisational coalition is thus a coalition of conflicting interests.

The conflicting interests can be reconciled by the distribution of ‘side payments’ to members of the coalition. Side payments may be in cash or kind, the latter being mostly in the form of ‘policy side payments’ i.e., the right to take part in the policy decisions of the organisation. But the actual amount of total side payments is not fixed for the coalition but depends upon the demand of the members and on the form of the coalition. Demands of coalition members equal actual side payments only in the long run. But the behavioural theory focuses on the short-run relation between side payments and demands and on the imperfections in factor markets.

In the short run, new demands are being constantly made and the goals of the organisation are continually adapted, to a greater or lesser extent, to take account of these demands. The demands of the members of the organisational coalition need not be mutually consistent. But all demands are not made simultaneously, and the organisation can remain viable by attending to demands in sequence. A problem will arise when the organisation is not able to accommodate the demands of its members even sequentially, because it lacks the resources to do so.

Satisficing Behaviour:

Besides side payments, the conflicting goals of the organisation are resolved by subjecting them to a constant review. This is because ‘aspiration levels’ of coalition members change with experience. In fact, the aspiration levels change with the process of satisficing. Each person in the organisation has a satisficing level for each of his goals.

If these levels are reached, they will not seek for more. But if they are not achieved, the aspiration levels are revised downwards. If they are exceeded, the aspiration levels are raised upwards. In both situations, the satisfactory levels of performance are changed accordingly.

Organisational Stack:

A coalition is sound and workable if payments made to various members of the coalition are adequate. For this, enough resources are needed to meet all demands of members. This is ordinarily not possible because disparity arises between the total resources available to the organisation and the total payments required to maintain the coalition.

This difference between total available resources and total necessary payments is called organisational slack, by Cyert and March. Slack consists in payments to members of the coalition iii excess of what is required to maintain the organisation.

Many forms of slack exist when the organisation operates under market imperfections. The shareholders may be paid dividends in excess of what is required to keep them within the organisation. The customers may be charged lower prices so that they may stick to the products of the firm.

The workers may be paid wages in excess of what is needed to keep them in the firm. The executives may be provided with services and personal luxuries more than what is required to keep them. All such excess payments are slack expenditures for the firm which every member of the coalition obtains from time to time.

Thus “slack is typically not zero”, according to Cyert and March. Rather, it is positive. Some members of the coalition ordinarily obtain a greater share of the slack than do others. In general, those members of the coalition who are full-time, tend to get more stick than the other members.

Organisational slack plays a constructive role. It keeps the coalition in existence. It enables the firm in maintaining itself under ‘crisis’ type situation and to adjust itself to changes in external environment. The organisational slack serves as a cushion to absorb the shocks. Slack payments are increased during periods of flourishing business and decreased during periods of bad business. Thus organisational slack plays both a stabilising and an adaptive role.

Decision-Making Process:

The decision-making process in the Cyert-March model rests with the top management and the lower levels of administration. The top management sets the organisational goals and allocates the given resources to the various departments based on their share of the total budget of the firm.

The share of the budget depends on the bargaining power and the skill of each manager. The bargaining power is determined by the past performance of each department. In this process of allocation, the top management retains some funds to be allocated at its discretion at any time to any department.

The decision process at the lower levels provides various degrees of freedom of action to the administration. Once the budget share is allocated to each department, each manager has considerable discretion in spending the funds at his disposal. Decisions taken by managers are implemented by the lower level staff based on their experiences and the “blue print” rules laid down earlier.

The decision-making process also depends upon information’s and expectations formed within the organisation. Information is required to facilitate the decision-maker. Information is not a costless activity. Search activity is started whenever a problem arises because search helps to locate and collect information.

Information determines the aspirations (i.e., demands) of each department which, in turn, helps the top management in setting goals. Organisational expectations are related to the hopes and wishes of the decision-maker.

Given the information and expectations, the top management examines and decides upon the projects presented by the managers. It evaluates the projects on the basis of two criteria. The first is the budgetary constraint which is the availability of funds for the project. The second is an improvement criterion: Is the project better than the existing one? In making decisions, the top management follows the rule that leads to a better state in the future than it was in the past. The Cyert-March model of behaviourism is thus an adaptive rational system.

Cyert and March developed a simplified model to illustrate the key processes at work in an oligopolistic firm when it makes its decisions on price, output, costs, profits, etc. In this model, each firm is assumed to have three sets of goals- for profits, production and sales, and three basic decisions to make on price, output and sales effort in each time period.

It takes into consideration the firm’s environment at the beginning of each period which reflects its past experience. Its aspiration levels are modified in the light of this experience, and organisational slack is permitted. Using multiple regression analysis, it was found that price was sensitive to factors influencing increases and decreases in the amount of organisational slack, to feasible reductions in expenditure on sales promotion and to changes in profit goals. Each firm was assumed to estimate its demand and production costs and choose its output level.

If this output level does not yield the aspired level of profits, it searches for ways to reduce costs, re-estimate demand and, if required, to lower its profit goal. If the firm is prepared to lower its profit goal, it will readily reduce its price. Thus price was found to be sensitive to factors affecting costs due to the close relationship between prices, costs and profits.

Criticisms:

The behavioural theory of Cyert and March has been severely criticized on the following major grounds:

(1) The critics feel that the behavioural theory is specific a duopoly firm and fails as the theory of market structures.

(2) The theory does not consider either the conditions of entry or the effects on the behaviour of existing films of a threat of potential entry by firms.

(3) The behavioural theory explains the short-run behaviour of firms and ignores their long-run behaviour.

Despite these criticisms, the behavioural theory of Cyert and March is an important contribution to the theory of the firm which brings into focus ‘multiple, changing and acceptable goals’ in managerial decision-making.