Learn how to calculate amortisation and sinking fund during valuation of a firm.

Calculation of Amortisation:

Amortisation is the gradual and systematic writing off of an asset or an account over a period. The amount on which amortisation is provided is referred to as “amortizable amount”. Depreciation accounting is form of amortisation applied to depreciable assets. Depletion is a form of amortisation in case of wasting assets. The gradual repayment or redemption of loan or debentures is also referred to as amortisation.

Sinking fund method and Insurance policy method are used for systematic writing-off of an asset or redemption of bonds and other long-term debt instruments. Present value of an annuity interest factors can be used to solve a loan amortisation problem, where the objective is to determine the payments necessary to pay off or amortise a loan.

Problem 1:

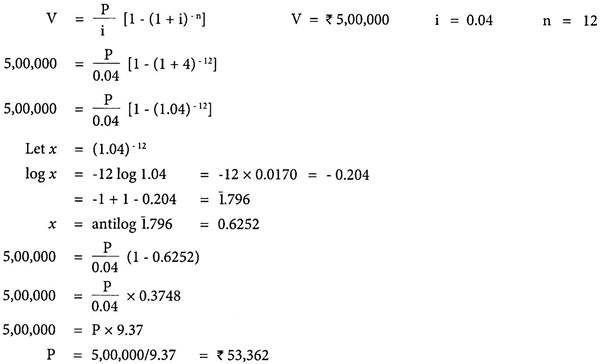

Mr. Balu has borrowed a loan of Rs.5,00,000 to construct his house which repayable in 12 equal annual installments the first being paid at the end of first year. The rate of interest chargeable on this loan is @ 4% p.a. compounded. How much of equal annual installments payable to amortise the said loan.

Solution:

Calculation of Sinking Fund:

It is a kind of reserve by which a provision is made to reduce a liability, e.g., redemption of debentures or repayment of a loan. A sinking fund is a form of specific reserve set aside for the redemption of a long-term debt. The main purpose of creating a sinking fund is to have a certain sum of money accumulated for a future date by setting aside a certain sum of money every year. It is a kind of specific reserve.

Whatever the object or the method of creating such a reserve may be, every year a certain sum of money is invested in such a way that with compound interest, the exact amount to wipe off the liability or replace the wasting asset or to meet the loss, will be available. The amount to be invested every year can be known from the compound interest annuity tables.

Alternatively, an endowment policy may be taken out which matures on the date when the amount required will be paid by the insurance company. The advantage of this method is that a definite amount will be available while in the case of investment of funds in securities then exact amount may not be available on account of fall in the value of securities.

After the liability is redeemed, the sinking fund is no longer required and as it is the undistributed profit, it may be distributed to the shareholders or may be transferred to the General Reserve Account.

Problem 2:

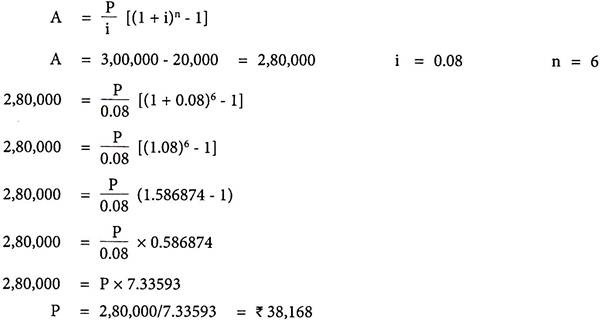

A machine costs Rs. 3,00,000 and its effective life is estimated to be 6 years. A sinking fund is created for replacing the machine at the end of its effective life time when its scrap realizes a sum of Rs.20,000 only. Calculate to the nearest hundreds of rupees, the amount which should be provided, every year, for the sinking if it accumulates at 8% p.a. compounded annually.

Solution:

For accumulation in sinking fund at compound rate we have: