Few examples of Fixed Income Investments available in India.

Fixed Income investments are a unique investment alternative in the sense that while on one hand it contains products that offer ‘fixed’ and predefined returns, on the other hand there are products which allow you to take some risk and earn returns based on the market movements. Contractual return products constitute that segment of the fixed income space where you know what you will earn right since the time you enter into the investment.

Contractual return products can be considered as the most conservative segment among all fixed income products. Fixed Income segment is considered to be the low-risk segment in the entire universe of investment options. Then within the fixed income segment, contractual returns present the lowest risk vis-a-vis market linked returns. It is important to note here that risk here means risk on fluctuation in market value. Other types of risk (for example credit risk) apply universally to all types of products.

Another important advantage of investment in contractual return products is that they are easy to compare. When you have a Term Deposit from a Bank offering an interest rate of 8% and another Term Deposit of a comparable maturity from a different Bank offering an interest rate of 9%, it is much easier for you to choose between the two.

Unless you doubt the credibility of the Bank offering the higher interest, you will choose that bank. However, when it comes to choosing between two different products offering market linked returns, your selection will be based on past returns and your expectation of the future returns.

That means you are marking a choice based on your view of the future returns and not the actual returns that you will get in the future. This is one of the areas that make market-linked return products riskier (more volatile returns) than contractual-return products.

Let’s now explore some of the contractual-return products available for investing within the fixed income space.

Example # 1. Term Deposits with Banks:

Term Deposits with Banks are the most widely used form of fixed income investments in India. So much so that you ask someone as to what he understands by the term fixed income security, and it’s quite likely that he says it means a fixed deposit.

By definition, Term Deposit means that they are a deposit with a bank for a fixed term. As such, you are not allowed to touch that money till the end of the specified term. Banks today offer deposits for a wide range of term periods-from as less as 7 days to as long as 10 years. The interest rate increases as the tenure of your deposit increases, unless a bank is offering a higher interest for a particular tenure.

As per the Reserve Bank of India (RBI) guidelines, interest on term deposit can be compounded at quarterly or longer period intervals. If a bank wishes to pay interest more number of times, say monthly, weekly or even daily, it can do so by discounting the quarterly interest amount. The interest rates quoted by Banks are, by convention, annual interest rates.

If the compounding frequency is annual, your effective interest rate will be the same as the quoted interest rate. However, if the compounding frequency it at less than annual intervals (say, quarterly or semi-annually), your effective interest rate will actually be higher than the quoted interest rate.

There are broadly two options to receive interest that you can opt for when choosing a fixed deposit – you can either choose an accrual option where the interest accrues to the value of the term deposit and is paid out to you at the time of maturity or you can opt to receive the interest at regular intervals.

The two options are very much similar to a cumulative interest-paying bond and a simple interest paying-bond respectively. Which option you choose largely depends on your needs. If you need the income from term deposits at regular intervals, select the regular interest paying option. But if you do not have any recurring income needs, you can increase your return by choosing the accrual option since your interest income gets automatically reinvested at the same rate.

Pre-Mature Withdrawal of Deposit:

As said before, you are usually not allowed to with draw your money before the maturity of the deposit. Banks are usually not allowed to refuse premature withdrawal of term deposits by an individual investor, how so ever large the deposit amount may be. Banks may however charge a penal interest on premature withdrawal of deposit in such case. Of course, whatever the bank policy, it is their duty to notify the investor in advance.

While penal interest rates are quoted by banks in advance, it is very important to understand how the penal interest is actually charged.

To get an understanding of the concept of penal interest, let us consider a case example:

1. Suppose an investor invests in a 5-year term deposit offering an interest of say 9%

2. At the end of the first year, the investor wishes to get out of his investment.

3. The penal interest quoted by the bank is say 0.5%.

4. The interest rate for a one year deposit at the time of making the investment was say 8%.

5. In this case, the penal interest of 0.5% will be applied to the then prevailing one year deposit rate of 8% and not the invested rate of 9%.

The reason for this is simple. Had the penal interest rate been applied to the invested rate of 9%, the investor would still have benefited since he would have earned a return higher than the one year deposit rate. To avoid this ‘back-door’ method of earning a higher interest rate, the banks apply penal interest rate on the prevailing rate for the period for which the deposit was actually invested.

Loan against Term Deposits:

If you need the money you invested in term deposits but do not want to withdraw it pre-maturely, you have another option. Most banks allow for a loan against term deposits. The deposit amount acts as collateral for the loan. Of course the rate of interest on such loans will be higher than the interest offered by the bank on the term deposit.

Deposit Insurance:

A plus-point of investing in Fixed Deposits is that your money with the bank is covered by insurance. The Deposit Insurance and Credit Guarantee Corporation (DICGC), a government owned undertaking provides this protection to the deposit holders. The idea is that in case there is a ‘run on the Bank’, you can make a claim with the DICGC in respect of your amount invested.

However, it is very important that we discuss here the limitations of this facility:

1. The DICGC Insurance cover is only up to a sum of Rs. 1 Lakh. The ceiling amount is per depositor.

2. The insurance is cumulative for both principal as well as interest due to you on the day of liquidation or cancellation of Bank’s license.

3. Deposits in different branches of the same bank are aggregated for the purpose applying the ceiling limit.

4. However, deposits in different banks are not counted in applying the ceiling limit.

5. Your total deposits with the bank (savings and other accounts included) are considered while applying the ceiling limit.

6. The insurance premium for such cover is paid by that bank. If the bank fails to pay insurance premium for 3-consecutive half year periods, the insurance cover may be withdrawn after giving public notice.

7. Deposit Insurance is compulsory as well as automatic for the bank and thus no bank can remain uninsured by the DICGC except those cooperative banks where the concerned State Governments are yet to pass the required legislation.

Thus, the point to draw home is that although such a facility exists, it would be insignificant if you have invested a large amount with a Bank. One possible way in which you can ensure that your entire deposit remains covered by this insurance, is that you can spread out your investment over different banks rather than investing it in only one Bank.

Recurring Deposits with Banks:

Recurring deposits are to contractual-return products what Systematic Investment Plans (SIPs) are to market-linked return products. It is a good option to induce financial disciple in the investor. It is also a practical way of building funds for a particular purpose. The interest rates offered on recurring deposits are more or less similar to those offered on term deposits of identical tenures.

Term deposits and recurring deposits cater to your different investment needs. If you have surplus funds which you do not need in the near future, keep them in term deposits. Term Deposits are the investment avenue to ‘park’ your surplus funds. On the other hand, if you do not have any surplus funds but intend to build up a sum to meet some specific requirement in the future, recurring deposit is for you.

Even if you do not have any planned future expenses but wish to bring about a discipline in your money matters, recurring deposits are a good option. It’s quite likely that you will spend your money carelessly if you do not have anything else to do with it. When you know that a portion of your earning has to be invested compulsorily, you are bound to think twice before you take out your wallet the next time.

Example # 2. NBFI Deposits:

Like Banks, quite a few Non-Banking Financial Institutions (NBFIs) and corporate entities also offer term deposits to investors.

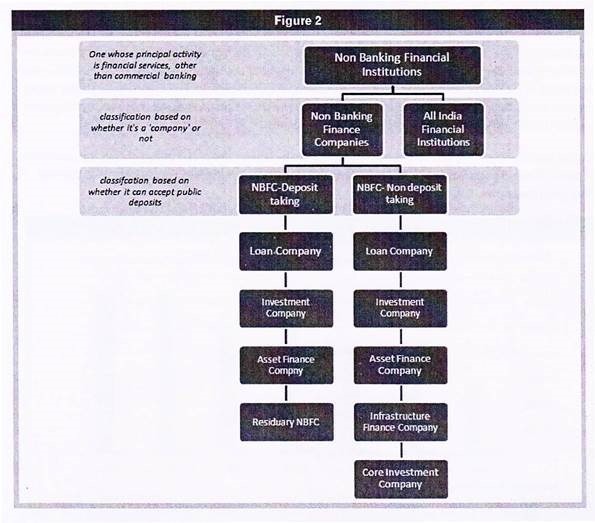

The Non-Banking Finance Companies (NBFCs) forms a major segment of the NBFIs. NBFCs are further classified into those that can accept public deposits (NBFC-Deposit taking or NBFC-D) and those than cant (NBFC-Non Deposit taking or NBFC-ND).

The entire structure of the NBFIs is shown in the graph below:

The basic lines of distinction between an NBFI and a Bank are:

a. You cannot open a savings or current account with an NBFC.

b. An NBFC cannot issue you a cheque book.

c. Deposits with NBFC are not covered by the DICGC Insurance.

These distinctions are from a regular investor perspective. Technically there would be many more differences between a bank and an NBFC. The small digression from the topic of deposits with NBFIs was only to help you understand that not all NBFCs are by default allowed to accept deposits from the public.

An NBFC may offer term deposits to investors for the same reason as a bank does – to mobilize funds for its activities. An NBFC will accept deposits from investors and loan it further. Term deposits act as a good long term source of funds for the NBFC.

The interest offered by an NBFC on term deposits will usually be higher than that offered by banks for a similar tenure. The excess interest is the risk premium – both technical as well as notional. NBFCs are perceived to be riskier than banks. Further, the oversight of the RBI on NBFC is comparatively lower than on Banks. NBFC deposits are also not covered by the DICGC insurance. All these factors together result in NBFCs offering a higher interest rates than banks.

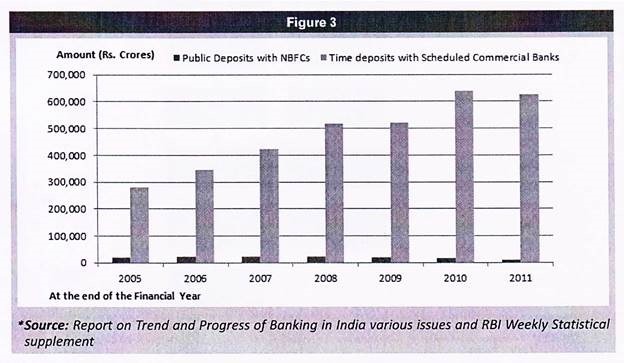

To give you an idea of the extent of deposits mobilized by NBFCs, the graph below shows the quantum of public deposits outstanding with NBFCs and the Deposits with the banking system as at the end of financial years from 2005 through 2011:

As can be seen above, the quantum of deposits with NBFCs is very small as compared to term deposits with the banking sector. Banks still continue to be the ‘top-of-the-mind-recall’ option when it comes to depositing your money.

As can be seen above, the quantum of deposits with NBFCs is very small as compared to term deposits with the banking sector. Banks still continue to be the ‘top-of-the-mind-recall’ option when it comes to depositing your money.

Example # 3. Corporate Deposits:

Like NBFCs, other corporate entities (Companies registered under the Companies Act, 1956) are also allowed to raise deposits from the public. The reason why a corporate may choose to accept deposits is similar to that for the NBFC. The interest rate offered by a corporate entity on its deposits will most certainly be higher than that offered by banks but will be lower than the lending rate applicable to the entity.

Thus a corporate entity may choose to accept deposits from investors if it can raise sufficient deposits at an interest rate which is lower than the rate at which it otherwise borrow funds from the market.

Both NBFCs and other corporate entities will utilize the deposit money for their business. While an NBFC will service the deposit from its lending and investment activities, other corporate entities will do so out of their business profits.

The rate of interest offered by an NBFC or a corporate entity will depend on its credit rating. Top rated entities may offer a lower rate of interest because the risk premium involved is comparatively lower than that in the case of lower rated entities. As you move down the rating scale, the interest rate offered will increase.

However, one must understand that the higher interest rate is at the cost of higher risks. You may choose an NBFC or a corporate entity over a bank to invest in term deposits for its slightly higher interest rate. But it is advisable to refrain from getting lured by very high interest rates and rather invest only in the top rated NBFCs and other corporate entities considering the safety of your money.

Example # 4. Public Provident Fund:

The Public Provident Fund is a scheme operated by the Central Government and which presents a good investment opportunity, especially because of its current tax effectiveness.

Some of the features of the scheme are as follows:

a. The interest rate is 8.6% compounded annually.

b. Interest is accrued at the end of each year.

c. Maturity period is 15 years.

d. The investment can be renewed after maturity in blocks of 5 years.

e. The total investment period (including the initial 15 years) cannot exceed 30 years.

a.Minimum investment amount Rs. 500/- per financial year.

b. Maximum Investment amount Rs. 100,000/- per financial year.

iii. Withdrawal:

The rules for withdrawal from a Public Provident Fund Account are a bit complex.

In a nutshell, the rules can be explained as below:

a. Withdrawal is allowed in and after the seventh financial year from the financial year in which the first investment was made.

b. The maximum amount that can be withdrawn is lower of 50% of the account balance at the end of-

(i) Fourth previous year from the year in which the withdrawal is made,

(ii) The previous year

c. Only one withdrawal can be made in one financial year.