The following points highlight the five main theorems on foreign exchange rate determination. The theorems are: 1. Law of One Price 2. Interest Rate Parity Theorem 3. Purchasing Power Parity Theorem 4. Fisher Effect 5. International Fisher Effect.

Theorem # 1. Law of One Price:

The law of one price asserts that when there are no significant costs or other barriers associated with moving goods or services between markets, then the price of each product should be the same in each market. The identical goods must sell at the same price in different markets, after adjusting for the exchange rate.

Problem 1:

The market rate of exchange between pound sterling and U.S. dollar is £1 = $ 1.84. A computer laptop sold in U.K. for £ 1,000 could not be sold for $ 1,500 in U.S. (i.e. £ 815) for long time. The traders of U.K. will import cheap priced laptops from U.S., tend to bring equilibrium of two prices, which will settle at £ 900 in U.K. and $ 1,656 in U.S.

Solution:

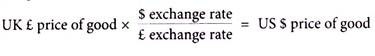

The law of one price states that, for tradable goods and services, the:

Theorem # 2. Interest Rate Parity Theorem:

The interest rates within a country are determined in the money market. The price of money depends on its supply and demand. Sometimes the governments of the country try to manage the interest rates. The demand for money depends on factors like level of investment, inflation, government borrowings.

The supply of money depends on factors like government policy, efficiency of financial institutions, customs and habits within the country. Interest Rate Parity is concerned with the difference between the spot exchange rate and forward exchange rate between two currencies.

There is a strong relationship between the forex market and money market. When all things being equal, the currency with higher interest rate will sell at a discount in the forward market against the currency with lower interest rate. The relative interest rates and expected change in interest rates will influence the exchange rates.

Suppose, if interest rates in India are higher than in U.S., investors will prefer to switch funds from U.S. to India and the dollars will be used to buy rupees, and the buying pressure should strengthen the rupee against U.S. dollar. The domestic economic policies influence domestic interest rates. The domestic interest rates will play an important role influencing the foreign exchange rates.

When currency and money markets are in equilibrium, and difference in interest rates available through investment in two separate locations should correspond to the differential between the spot rate and forward rate. The currency with higher interest rate will be sold at a discount in the forward market against the currency with the lower rate of interest.

The reason that these relationships hold is that operators in the money market are free to invest or borrow in the currency that offers them most favourable interest rates. When interest rate parity exists, the forward rate differ from spot rate by just enough to offset the interest rate differential between the two currencies.

The interest rate parity condition states that the forward premium or discount for a currency quoted in terms of another currency is approximately equal to the difference in interest rates prevailing between the two countries. The theorem states that, in equilibrium the difference in interest rates between two countries is equal to the difference between the forward and spot rate of exchange.

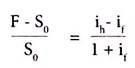

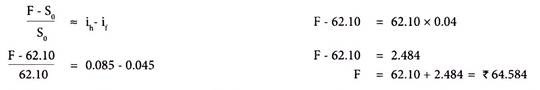

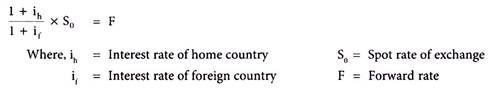

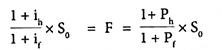

The interest rate parity relationship can be expressed in the formula given below:

Where, F = Direct quote for forward rate

S0 = Direct quote for spot rate

ih = Interest rate of home country

if = Interest rate of foreign country

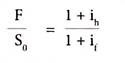

The above equation can be simplified as follows:

Problem 2:

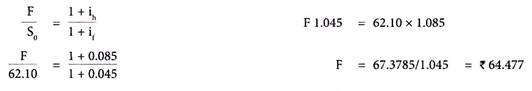

The current bank interest rate of U.S. and India are 4.5% and 8.5% respectively. The present spot market rate of exchange in 1 US $ is Rs.62.10. What would be the twelve month forward rate?

Solution:

... Current twelve-month forward rate of rupee against dollar is Rs.64.477

An approximation of Interest Rate Parity Relationship is given below:

The equilibrium relationship that operates under Interest Rate Parity Theorem can also be given in the following way:

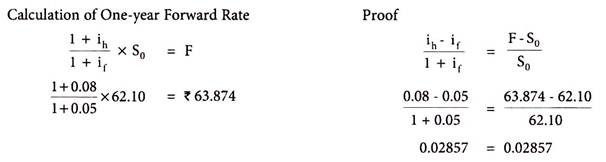

Problem 3:

On 1st April, 2016 the spot rate is $ 1 = Rs.62.10 and U.S. and India interest rates are 5% and 8% per annum respectively. What would be the expected one-year forward rate?

Solution:

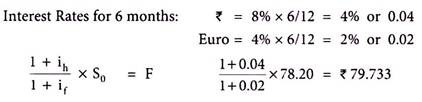

Problem 4:

An Indian exporter is due to receive Euros 1,00,000 in six months’ time for goods supplied. The company decides to hedge its currency exposure by using forward market. The short-term interest rate of U.K. and India are 4% and 8% per annum respectively. The spot rate of exchange is Euro 1 = Rs.78.20. Calculate the 6 months forward rate of Euro.

Solution:

Theorem # 3. Purchasing Power Parity Theorem:

The relative inflation rates of different countries will have impact on their currency exchange rates. The purchasing power parity theorem states that if the rate of inflation of Country A is greater than the rate of inflation in Country B, the rate of exchange of currency of Country A will fall against the currency of Country B.

For example, if the rate of inflation in India is higher as compared to U.S., then the relative exchange rate of Rupees to U.S.dollars is bound to be lower. The purchasing power parity theorem is based on law of one price. The theorem asserts that the differences in inflation rates between countries will affect the movements in the exchange rate.

The expected difference in the inflation rate would be expected to approximate to the expected change in exchange rates. It is assumed that the expected difference in inflation rates between two countries equals, in equilibrium, the expected movements in spot rates.

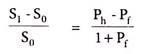

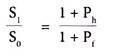

The exact relative purchasing power parity relationship is expressed as follows:

Where, S0 = Current (direct quote) spot rate

S1 = Expected future (direct quote) spot rate at time period 1

Ph = Inflation rate of home country

Pf = Inflation rate of foreign country

The above formula can be simplified as follows:

Limitations:

The limits to free trade of goods are many.

The larger limits are:

1. Import and Export Restrictions viz., quotas, tariffs, laws imposed by different countries make free trade difficult or impossible at times.

2. Travel Costs:

Expensive freight costs from one market to another market may cause a difference in the two market prices.

3. Perishable Goods:

These goods may not keep for long without extra care or cost being borne for them to sell in another market.

4. Location:

Utility of two real estates is not the same. Neither can two pieces of land qualify for exchange.

The above are the reasons for the anomaly noted in the purchasing power parity theory in practice. As a practical matter, a relative version of PPP has evolved, which states that the changes in the exchange rate over time is determined by the difference in the inflation rates of the two countries.

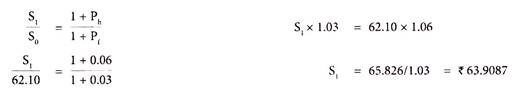

Problem 5:

It is expected the inflation rates in India and U.S. are 6% and 3% respectively. The present spot rate of US $1 is Rs.62.10. What will be the expected spot rate in twelve months’ time?

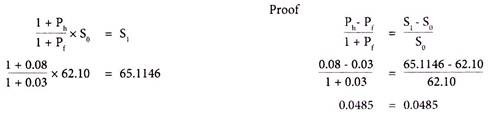

Solution:

... Expected spot rate in 12 months’ time would be Rs.63.9087 against 1 Dollar.

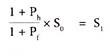

The formula given for purchasing power parity can be rearranged to give a method of predicting forward exchange rate as follows:

Problem 6:

The inflation rates of India and U.S. are 8% and 3% respectively. The spot rate between U.S. dollar and Indian rupee is $ 1 = Rs.62.10. Calculate twelve months forward rate.

Theorem # 4. Fisher Effect:

Irving Fisher (1930) in his book ‘The Theory of Interest’ established that in equilibrium lenders will receive a nominal rate of interest equal to real interest rate plus an amount sufficient to offset the effects of expected inflation. The real rate of return is the rate at which borrowing and lending in the financial markets are in equilibrium.

The real rate of return is equal to the real rate of growth in the economy, and it reflects the preference of market participants between present and future consumption. The rational lenders will expect consumption not only for waiting for their money, but also for the likely erosion of real purchasing power.

The real and nominal interest rates are connected by Fisher Effect as follows:

(1 + P)(1 + I) = (1 + M)

Where, P = Real interest rate

I = Expected general inflation

M = Market interest rate

Then, (1 + R) = (1+M)/(1+I)

The law of one price lead us to the conclusion that the real interest rate (ignoring inflation) should be the same in any country assuming deposits with a similar level of risk. If investors could move their funds freely from one country to another, they would move towards countries where they could expect to obtain the highest real rate of interest (nominal rate of interest less the inflation rate) with competition to attract funds, that would mean that the real rates of interest would move so that they were equal in all countries.

An investor would not leave money in a country that was paying lower real returns than could be obtained elsewhere. The difference in interest rates between two countries is equal, in equilibrium, to the expected difference in inflation rates between these countries. This, hypothesis is called ‘Fisher Effect’.

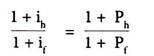

The equation representing Fisher Effect, if real interest rates are equal in all countries, then:

Where, ih = Nominal interest rate of home country

if = Nominal interest rate of foreign country

Ph = Rate of inflation of home country

Pf = Rate of inflation of foreign country

This model suggests that countries with high inflation tend to have high nominal rates of interest and countries with high interest rates tend to have high inflation rates. The Fisher Effect asserts that, with free movement of capital, the interest rates in a country should be equal to the international real rate of interest adjusted for the difference in the expected rate of inflation in that country compared with the inflation rate worldwide.

Problem 7:

The interest rates of India and US are 15% and 10% respectively and the inflation rates are same in both the countries. The investors will move their money from US to India.

If the inflation rate in India is expected to be 10% and in US it is only 4%. The investors can earn greater return in US. India would need to raise its nominal interest rates to 16% in order to prevent investors taking their funds out of country.

Theorem # 5. International Fisher Effect:

It is also called as ‘Open Fisher Theory’, which asserts that countries with higher rates of inflation will have higher nominal interest rates to provide adequate return to investors to combat inflation. The interest rate differentials should reflect the expected movement in the spot rate of exchange. The interest rate differences between trading partners are offset by the spot exchange rate changing over time.

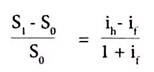

The International Fisher Effect relationship is expressed as:

Where, S1 = Expected future (direct quote) spot rate at time period 1

So = Current (direct quote) spot rate

ih = Nominal interest rate of home country

if = Nominal interest rate of foreign country

The relationship can be further simplified as follows:

Problem 8:

The interest rates of India and US are 8% and 5%. If the spot rate is $ 1 =Rs.62.10. Calculate twelvemonth forward rate.

Solution:

... Twelve-month forward rate = Rs.63.874

The International Fisher effect implies that the exchange rate is directly linked to nominal interest rates.

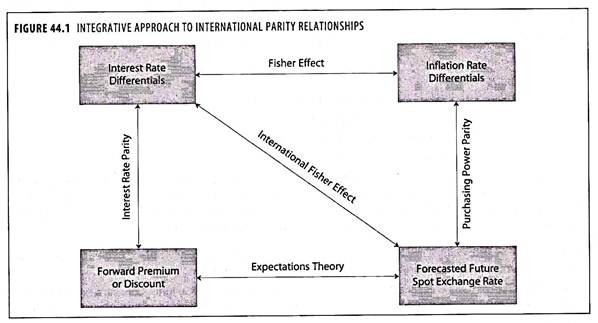

Integration of IRP and PPP Theorems:

Integrating the interest Rate Parity (IRP) theorem and Purchasing Power Parity (PPP) theorem, it can be expressed as follows: