The Indian foreign exchange market is predominantly transaction based, and corporate purchases and sales of foreign currency are based on an underlying position. An underlying position is the need to buy foreign exchange to meet an overseas commitment, or the need to sell foreign exchange because of receipts of foreign currency.

All foreign exchange transactions of Government of India are routed through the market (except for aid transactions). Trends in trading volumes in the foreign exchange market reflect the overall trend of economic growth. The US dollar is the principal foreign currency in the Indian spot and forward markets-more than 90% of turnover is in the rupee-dollar trade.

Size of the Indian Foreign Exchange Market:

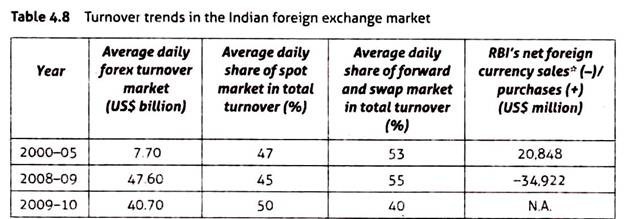

RBI data indicates that the daily average turnover in the Indian foreign exchange market rose almost ten-fold over a decade—from $5 billion in 1997-98 to $48 billion in 2007-08. Massive surge in capital inflows from 2003-04 onwards have led to a steep growth in foreign exchange turnover. There was more than a five-fold increase in the turnover in the foreign exchange market between 2000-05 and 2009-10 (Table 4.8). The proportion of turnover was more or less equal for spot deals and forward and swaps deals.

Foreign Exchange Settlement:

Settlement of foreign exchange transactions spans different time zones and payment systems. As a result, counter-parties assume various types of risks in the course of settlement. Internationally, the CLS Bank based in New York settles foreign exchange trades for the world’s biggest banks. It offers counter-party guarantee, thus eliminating Herstatt risk. CLS Bank is a private sector bank, with whom central banks link their real-time payment systems.

ADVERTISEMENTS:

It commenced foreign exchange settlement in September 2002. The bank gives other banks a payment schedule, according to which the latter have to make netted out payments throughout the day. As a result, banks manage their liquidity throughout the day, as foreign exchange payments have to be made according to the schedule.

Accepting the suggestion of the Sodhani Committee Report (1995), the RBI established the Clearing Corporation of India Limited (CCIL) in 2001. The CCIL is India’s first centralized clearing and settlement system for inter-bank foreign exchange transactions. It undertakes settlement of foreign exchange trades through multilateral netting and also offers counter-party guarantee. It has its own foreign exchange dealing platform called FX CLEAR.

It guarantees settlement of cash deals and TOM deals in the spot market. It signed a memorandum with EURCLEAR (a European foreign exchange clearing and settlement agency) for collaboration. It also has a reporting platform for interest rate swaps. In March 2010, it launched a foreign exchange swap dealing system (called FX SWAP) which guarantees settlement of forward trades. In addition to settlement of foreign exchange trades, CCIL also offers a foreign exchange trading platform with straight-through processing to facilitate US dollar/rupee deals by banks in India.

ADVERTISEMENTS:

On an average, CCIL daily settles over 3500 deals covering an average gross volume of around US$3.5 billion, representing over 80% of the market. Deal volumes and the number of deals settled by CCIL are a testimony to the growth of the Indian foreign exchange market. The total volume cleared in 2009-10 was $117,192 million compared to $24,600 million in 2002-03.The number of deals settled in 2009-10 was 1,767,898 compared to slightly over 200,000 in 2002-03.