The following points highlight the techniques used to manage foreign exchange risk. The techniques are: 1. Doing Nothing 2. Pre-Emptive Price Variation 3. Risk Sharing 4. Maintaining a Foreign Currency Bank Account 5. Transfer Pricing 6. International Forfaiting 7. Discounting of Bills of Exchange 8. Money Market Operations and a few others.

Technique # 1. Doing Nothing:

This method suggests that the firm should not involve in a transaction which exposes the firm to risk or make sure that the firm does not suffer if it necessitates to enter into such transaction. In transactions involving foreign exchange, the movement of exchange rates on either direction is common. The firm should take the advantage of favourable situations to smooth out the adverse fluctuations. It is only unlikely events or those that would lead to a major disaster for the firm that would be worth insuring against.

Technique # 2. Pre-Emptive Price Variation:

When there is expected variation in foreign exchange rate, either party may ask for an adjustment of price variation in the invoice amount or contract price. But in practice, this would possible only for the strong party who is in a position to dictate terms to the other. The fluctuations in exchange rate can be incorporated while setting the value of contract. Such price variations may be considered in highly competitive situation in overseas markets.

Technique # 3. Risk Sharing:

It is a contractual arrangement between the buyer and seller who agree in advance to share any fluctuations in foreign exchange rate movements. This method suggests the establishment of long-term relationship between the parties. If the fluctuations exceed the desired levels, the parties may renegotiate for sharing.

Technique # 4. Maintaining a Foreign Currency Bank Account:

The exporting firms can maintain separate bank accounts for each currency in which it transacts and delay the conversion into home currency until favourable situation to take place. The major drawback of this method is that liquidity problems arise if funds are kept for long time waiting for favourable situation.

Technique # 5. Transfer Pricing:

Under this method, the profits are transferred through an adjustment of invoice prices of transactions that take place between parent and subsidiary or between strong currency and weak currency subsidiaries. This mode of adjustment will not adversely affect the subsidiaries which are operating in a troubled economic environment.

Technique # 6. International Forfaiting:

It is a method whereby the exporter sells the export bills to the forfaiter and obtains cash. Money comes to the exporters even before the collection of exporter’s debts. Forfaiter, after having made payments to exporters become sole owners to collect the debts and assume full risks.

The bank guarantee provided by importer obviates the need to make a thorough check on creditworthiness of the importer. Only the guarantor bank’s standing needs to be verified besides the general economic scenario of the importing country.

Technique # 7. Discounting of Bills of Exchange:

The company which sells goods on credit, will normally draw a bill on the buyer who will accept it and sends it to the seller of goods. The seller, in turn discounts the bill with his banker. The banker will generally earmarks the discounting bill limit.

Technique # 8. Money Market Operations:

When a company has an outstanding foreign currency payable or receivable, it may choose to hedge against the currency risk by using the forward/money markets.

Example 1:

An exporter who invoices foreign customers in a foreign currency can hedge against the exchange risk by borrowing an amount equal to that in the foreign currency immediately. He will convert the foreign currency into domestic currency at the spot rate. Foreign currency loan will be repaid with interest out of the eventual foreign currency receipts from the customer.

Example 2:

A company which has to make a foreign currency payment in future. It can buy the currency now at spot rate and put it on deposit account. By maturing the deposit account, the principal and interest earned on it can be used for making foreign currency payment as and when it falls due.

Problem 1:

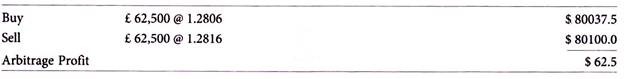

International Monetary Market an international forward bid for December 15 on pound sterling is $ 1.2816 at the same time that the price of IMM sterling future for delivery on December 15 is $ 1.2806. The contract size of pound sterling is £ 62,500. How could the dealer use arbitrage in profit from this situation and how much profit is earned?

Solution:

Arbitrage is the buying and selling of the same commodity in different markets. These transactions refer to advantage derived in the transactions of foreign currencies by taking the benefit of differences in rates between two currencies at two different centres at the same time or of difference between cross rates and actual rates.

The dealer can buy pound sterling at $ 1.2816 and can sell pound sterling at $ 1.2806 in International monetary market, and his arbitrage profit is calculated as follows:

... The dealer can make a profit of $ 62.5 through arbitrage operations.

Technique # 9. Money Market Hedge:

Money market hedge is of two types:

(a) Hedging payables, and

(b) Hedging receivables.

Hedging payables involve the following steps:

i. Borrow funds in home currency.

ii. Use them to purchase the foreign currency.

iii. Invest in foreign currency for the period after which the foreign currency payable due.

iv. Use the proceeds to make the payment.

v. Repay the borrowed amount together with interest.

Hedging receivable involves the following steps:

1. Borrow funds in the foreign currency for the period after which the receivable is due.

2. The amount to be borrowed should be equal to the amount of the receivable as discounted by the prevailing rate of interest.

3. Convert the borrowed amount into home currency and use it till the receivable arrives,

4. If the home currency funds cannot be used gainfully in the enterprise itself, invest them to earn interest.

Technique # 10. Secured Exchangeable Bonds:

A currency swap shifts the foreign exchange risk to a counterparty; a secured exchangeable bond shifts the currency risk to the investor by adding a currency swap option to the basic Eurobond. For the investor, the option to convert Eurobonds to rupee debt that offers rupees rates of interest will be in the money if the interest rate differential outweighs the risk of currency depreciation.

Such a conversion will, no doubt, hike interest costs, but it eliminates the foreign exchange risk. Offering the option can also lower the initial coupon rate e.g., Morgan Stanley used this instrument to raise over $200 million for an Indonesian company at a phenomenally-low coupon rate of 2%.

Technique # 11. Selling and Buying in One’s Own Currency:

Under this method, the company simply invoices all its supplies in its own currency. The exchange rate risk is not eliminated in this case, but transferred to the customer. This technique may keep the firm competitive with local industries, but may not be able to attract foreign customers and fails to tap overseas market for the company’s products and services.

To avoid the transaction risk, a firm can buy and sell goods and services in the currency of its own country, thereby the exchange rate risk is avoided or minimized. By trading in this way it would be transferring risk to the other party to the transaction. The bargaining strength of the parties will determine the user of this method.

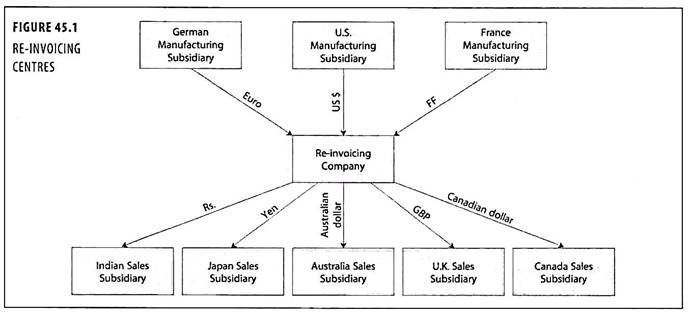

Technique # 12. Re-Invoicing Centres:

It is a widely used technique for centralization of exposures. Under this method the manufacturing subsidiaries ship directly to the sales subsidiaries, but bill to a separate entity, the re-invoicing company. The re-invoicing centres bills the sales subsidiaries in different currencies.

The risk of currency exposure is now concentrated only with re- invoicing company. The manufacturing subsidiaries will receive a stream of cash flow in their own currency without exposure to foreign exchange risks.

Technique # 13. Matching Receipts and Payments:

The foreign exchange rate risk can be eliminated or reduced, if the company which is having exposure to receipts and payments in the same currency. The company can offset its payments against its receipts if it can plan properly. This can be managed by operating a bank account in overseas to offset the transactions.

The basic requirement for a matching operation is the two-way cash flow in the same foreign currency is called ‘natural matching’. If the matching involves between two currencies whose movements are expected to run closely is called ‘parallel matching’. Matching can be applied to both third party and intercompany cash flows.

Example 1:

To mitigate translation risk, a company acquiring a foreign asset should borrow funds denominated in the currency of the country in which it is purchasing the asset, matching if possible the term of the loan to the expected economic life of the asset.

Example 2:

To mitigate the transaction risk, a company selling its goods in USA with prices denominated in dollars could import raw materials through a supplier that invoices in dollars.

Example 3:

An Indian exporter exports finished goods to US firm and he will also import the raw material and packing material from the US firms. Then the receipts and payments transactions can be offset at the origin itself by operating a bank account in US for convenience.

Technique # 14. Currency Diversification:

The basic principle of portfolio theory is that a diversified mix of commodities is less risky than a single commodity. So long as currency movements are not highly correlated, conducting transactions in multiple currencies will reduce the impact of a sudden and substantial depreciation in any one currency.

To protect from exchange rate risk, corporate will have to diversify their exposures by borrowing in different currencies or by importing from different countries. The firms will have to choose their borrowing currency carefully.

Technique # 15. Smoothing:

By adopting smoothing, a company can maintain a balance between fixed rate and floating rate borrowing. If interest rates are on rise, the advantage of relatively cheaper fixed rate loan will be cancelled out by the relatively cheaper floating rate loan. In situation of fall of interest rates, the relatively cheaper floating rate debt can cancel the high cost fixed rate debt. Therefore, the debt financing structure should consist of both fixed rate loans and floating rate loans.

Technique # 16. Leads and Lags:

A firm having exposure to pay foreign currency, can make payments in advance prior to due date called ‘leads’ to take the advantage of lesser rate of foreign currency. In such cases, the firm should consider the interest loss on opportunity to deploy funds elsewhere. If the firm delays the payments over the due date to take advantage of the exchange fluctuation it is called ‘lags’.

The technique used in this is to delay payment of weak currencies and bring forward payment of strong currencies. Under this method the timing of payments are changed with a view to take advantage of changes in the relative value of currencies involved.

Leading is making payments in advance of the due dates whereas lagging is delaying payments until after the due date. This requires the efficient forecast of foreign exchange price movements in advance.

The technique involves settling foreign currency accounts either at the beginning (leading) or at the end of the credit period (lagging). In case of lead payment, there is a cost in terms of interest forgone.

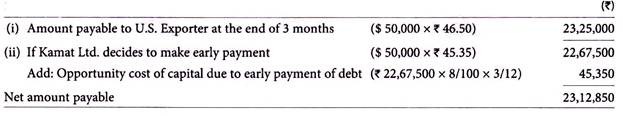

Problem 2:

Kamat Ltd. is importing a special equipment from US for an amount $ 50,000, payable in 3 months. The current spot rate US $ 1 45.35. It is expected that the dollar will strengthen against rupee in 3 month and the spot rate at the end of 3 month would be Rs.46.50. The borrowing cost from the company’s banker is at 8% p.a. Calculate the cash flow of the transaction.

Solution:

Net gain due to leads strategy = Rs.23,25,000 – Rs.23,12,850 = Rs.12,150

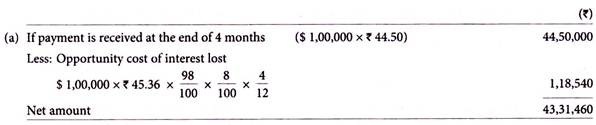

Problem 3:

Dowell Ltd. is supplying its goods worth $ 1,00,000 to US Importer, and the amount is payable after 4 months’ time. The current spot rate 1 $ is Rs.45.36. It is expected that the rupee will appreciate stronger in the next 4 months and would be quoted at Rs.44.50. The importer accepts to pay immediately if 2% cash discount is offered by Dowell Ltd. The current borrowing rate is 8% p.a. Advise.

Solution:

(b) If payment is received immediately, after allowing a cash discount of 2%

$ 98,000 x Rs.45.36 = Rs.44,45,280

Advise:

The net gain if amount received immediately is Rs.1,13,820. Hence, it is advised to ask the importer to pay immediately after deducting 2% cash discount.

Technique # 17. Netting:

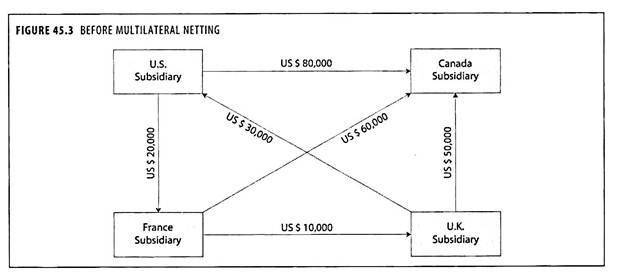

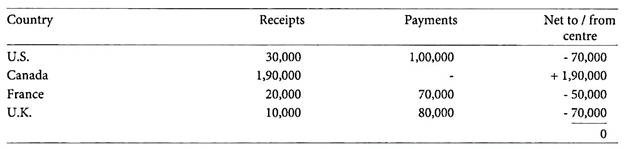

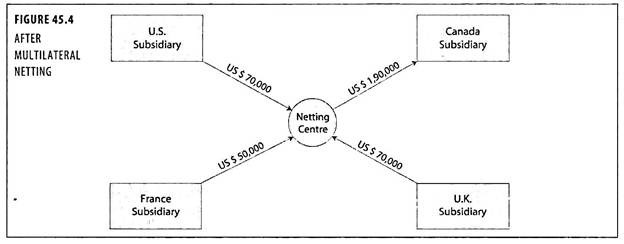

In case of MNCs, parent company and its subsidiaries periodically ‘settling up’ the net amounts owned or amount as a result of trade within the firm is called ‘netting’. The basic idea behind netting is to transfer only net amounts, usually within a short period. Instead of making each payment, incurring transaction costs, the net position between the two companies can be ascertained say, every three months and one payment only to be made by the company which is in the net debtor position.

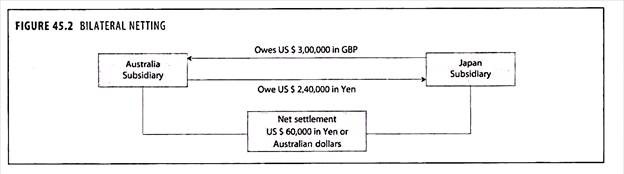

Bilateral netting is applicable where pairs of companies in the group net off their own positions regarding payables and receivables without the involvement of central treasury. Multilateral netting is performed by the central treasury where several subsidiaries interact with the head office.

Subsidiaries are required to notify the treasury of intra-organizational flows of receivables and payments. It is the function of central treasury department to net-off intercompany balances as far as possible and to issue instructions for settlement of the net balances.

Advantages:

1. Lower transaction costs as a result of fewer transactions.

2. Regular settlements may reduce in foreign exchange rate risk of group companies.

Technique # 18. Cross Currency Roll-Over:

The cross currency rollover contracts are contracts entered into, to cover the exchange rate risk on long-term liabilities. This cover is initially taken for a maximum of six months period but this cover is further extend to another six months and soon.

The benefit or loss, depending upon the forward premium or discount, is adjusted into the cover at the time of each rollover, obtained for a period not exceeding six months each time. Rollover for a maturity period exceeding six months is not possible since in the foreign exchange market, quotations beyond six months are not available.

Technique # 19. Arbitrage Operations:

Arbitrage is the buying and selling of the same commodity in different markets. A number of pricing relationships exist in the foreign exchange market, whose violation would imply the existence of arbitrage opportunities – the opportunity to make a profit without risk or investment.

These transactions refer to advantage derived in the transactions of foreign currencies by taking the benefit of difference in rates between two currencies at two different centres at the same time or of difference between cross rates and actual rates.

For example, a customer can gain from arbitrage operations by purchase of dollars in the local market at cheaper price prevailing at a point of time and sell the same for sterling in the London market. The sterling will then be used for meeting his commitment to pay the import obligation from London.

The types of arbitrage are given below:

1. Geographical Arbitrage:

It occurs when one currency sells for two prices in two different markets. To test for a geographical arbitrage opportunity, one can simply take the inverse of the price prevailing in one market and see if it matches the price quoted in another market.

2. Cross-Rate Arbitrage:

In a given market, exchange rates for currencies A and B and for currencies A and C imply an exchange rate called a cross-rate, between currencies B and C. If the rate implied for B and C does not match the actual rate between B and C in some other market, an arbitrage opportunity exists. To exploit arbitrage opportunity, one can trade only the exchange rates actually given.

Problem 4:

The following market quotes are available. Assume there are no transaction costs be possible, calculate arbitrage gains on Rs.10,00,000 from the middle rates given below:

Rs.76.200 = £ 1 in London

Rs. 46.600= $ 1 in Delhi

$ 1.5820 = £ 1 in New York

Solution:

Amount available for investment = Rs.10,00,000

Purchase dollars in Delhi with rupees = Rs.10,00,000/Rs.46.6 = $21,459

Then, purchase pounds in New York = $ 21,459/£ 1.582 = £ 13,564

Then, sell the Pounds in London = £ 13,564 x Rs.76.20 = Rs.10,33,577

Arbitrage gain = Rs.10,33,577 – Rs.10,00,000 = Rs.33,577

Technique # 20. Covered Interest Arbitrage:

The covered interest arbitrage exists when an arbitrage profit can be made. The process of borrowing in one currency and simultaneously investing in another with the exchange risk hedged in the forward markets is referred to covered interest arbitrage.

1. If domestic interest are higher than the foreign interest rates, an arbitraguer would do the following:

He would borrow in foreign currency, convert receipts to domestic currency at the prevailing spot rate, invest in domestic currency denominated securities (as domestic securities carry higher interest). At the same time he would cover his principal and interest from the investment at the forward rate.

At maturity, he would convert the proceeds of the domestic investment at prefixed domestic forward rate and payoff the foreign liability. The difference between the receipts and payments serve as profit to customer.

2. If foreign interest rates are higher than the domestic interest rates, an arbitraguer would do the following:

He would borrow in domestic currency, convert receipts to foreign currency at the prevailing spot rate, invest in foreign currency denominated securities (as foreign securities carry higher interest).

At the same time he would cover his principal and interest from this investment at the forward rate. At maturity, he would convert the proceeds of the foreign investment at the prefixed forward rate and payoff domestic liability. The difference between receipts and payments serve as profit to customer.

Cross Currency Option (CCO):

1. A person resident in India may enter into a CCO contract (not involving the rupee) with a bank in India to hedge foreign exchange exposure arising out of his trade, provided that in respect of cost-effective risk reduction strategies like range forwards, ratio-range forwards or any other variable by whatever name called, there shall not be any net inflow of premium. These transactions may be freely booked and/or cancelled.

2. CCO should be written on a fully covered back-to-back basis. The cover transaction may be undertaken with a bank outside India, an off-shore banking unit situated in a Special Economic Zone or an internationally recognized option exchange or another bank in India.

3. All guidelines applicable for cross currency forward contracts are applicable to CCO contracts also.

4. Banks desirous of writing options should obtain a one-time approval from RBI.