The large and multinational companies often rely heavily on the international financial markets. Interest rates change continually which makes these markets extremely volatile. It is one of the responsibilities of the Treasurer to manage the interest rate risk of the firm and should able to identify the methods available for hedging interest rate risk.

An enterprise should be cautious about interest rates movements in the finance markets and should adopt right strategy to hedge the risk arising from interest rate fluctuations. A number of instruments have arisen in current financial markets which allow the treasurer to hedge interest rate risk like forward rate agreements, interest rate swaps, interest rate caps, interest rate floors, interest rate collars, interest rate ceiling, etc.

1. Forward Rate Agreement (FRA):

FRA is an agreement between two parties who wish to protect themselves against fluctuations in interest rates. The parties agree on an interest rate for a specific period of time on a specified principal amount. FRAs are an effective instrument for companies which have borrowed at floating rates of interest, and wish to hedge their interest rate risks.

The buyer of a FRA is a party wishing to protect itself against a rise in the interest rates, and the seller is a party insuring itself against a decline. The price of a FRA will depend on the slope of the yield curve – which, essentially, reflects interest rate expectations. Earlier, the FRA was confined to dollar-linked borrowings since the dollar was perceived to be more volatile than the European currencies.

However, FRAs now cover a wide selection of currencies and maturities. In an environment of increasing interest rate of volatility, a FRA helps a corporate crystallize its interest costs. Forward interest rates offer an opportunity to lock in for a future date and interest rates in a volatile rate environment. The difference between the actual rate on the date of the interest roll over and the contracted rate is settled between the client and the bank.

Borrowers use an interest rate forward to protect themselves from a rise in interest rates. This is suggested when the borrower expects interest rates to rise in the short-run but not in the long- run. The banks can offer FRAs linked to the LIBOR. Again, they have to ensure that such agreements are used purely as a liability management tool.

Example:

A Company enters into an agreement at 4.85%, then on the settlement date if the LIBOR is 5.85% the bank will pay to the company this 1% differential. On the other hand, if the LIBOR is 4.5%, then the company will have to pay to the Bank the differential of 0.35%. In an arrangement of this sort, the settlement is always made by payment of the differential amount. There is no commitment by either party to lend or borrow the specified amount.

Problem:

Kenwood Industries Ltd. has $ 5,00,000 foreign loan outstanding at an interest rate of 8% p.a. The interest rate is reset every six months and interest is payable at the end of six-month period on 30th September and 31st March. The treasurer expects that the interest rate of 9% p.a. will prevail for a period starting from 1st April to 30th September. He entered into a forward rate agreement for locking interest rate at 9% p.a.

What would be the financial implications if (i) rate of interest is at 10%, and (ii) rate of interest is 8.2%.

Solution:

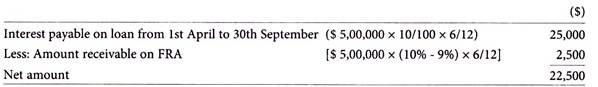

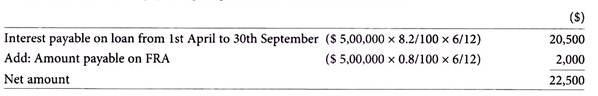

(i) If interest rate is set at 10%:

The net amount $ 22,500 payable, giving an effective rate of interest at 9%.

(ii) If interest rate is set at 7.2%:

2. Interest Rate Guarantee (IRG):

IRGs are true options in that they hedge the company against adverse interest rate movements, but allow it to take favourable movements. In taking a decision on whether to use IRG or otherwise, cost in respect of other alternatives, such as futures contract is also taken into account, and the most favourable alternative, which leads to the lowest cost, is chosen.

Our firm will have $ 10,00,000 in 3 months’ time, for a 6-month period. Nobody is sure what interest rates will prevail in the future. Some analysts think rates will increase, others feel they will fall. To protect the firm against the risk of reduced return on funds, we can use the forward rate agreements to protect the firm, but we know that if we use forward rate agreements now we will give up the possibility of benefiting from higher interest rates.

In these circumstances, IRG products can be very useful. An IRG is a product, which can be very useful in these circumstances. Basically, it is an option on a forward rate agreement. It allows us a period of time during which the firm have the right to buy a forward rate agreement at a set price.

The guarantee protects us against a fall in interest rates while giving us the freedom to enjoy a better return if rates increase. If firm want this guarantee the firm will need to pay a higher premium.

The price of IRG will depend on: the guaranteed rate, how long firm want the option for, and how often interest rates are changing. IRG hedges the interest rate for a single period of up to one year. Guarantee commission paid to the guarantor is comparable to option premium.

3. Interest Rate Caps:

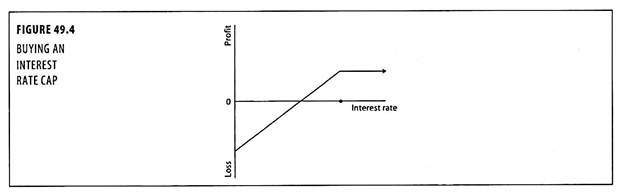

It is a contract giving the buyer the right, but not the obligation, to fix the rate of interest (the strike rate) for the entire term of a notional loan. The buyer pays a premium to the writer and, if the option is exercised on any of the specified settlement dates, is paid in cash an amount equal to the difference between the strike rate and the market rate on that settlement date (calculated on the notional loan).

A cap is effectively a strip of options. As with all options, the buyer only exercises a cap if it is in its interest to do so. Most caps are arranged to cover medium-term loans of two to five years, with the settlement dates matching the rollover dates on the cap buyer’s loan. The writer of the cap may or may not be the same bank or other financial institution as is providing the loan.

Caps can, of course, be used by speculators hoping to profit from a rise in the market rates, rather than by borrowers seeking to hedge the interest on a loan. Caps can be especially valuable if used together with a floating rate loan as an alternative to a fixed rate loan.

With a fixed rate loan there are usually penalties for early redemption, which may be avoided by taking out a floating rate loan and protecting against increased interest rates with a cap. The borrower also retains the ability to benefit if interest rates fall.

The buyer of an interest rate cap pays the seller a premium in return for the right to receive the difference in the interest cost on some notional principal amount any time a specified index of market interest rates rises above a stipulated ‘cap rate’.

The buyer bears no obligation or liability if interest rates fall below the cap rate. A cap resembles an option in that it represents a right rather than an obligation to the buyer. Caps evolved from interest rate guarantees that fixed a minimum level of interest payable on floating rate loans.

An interest rate is characterized by:

1. A notional principal amount upon which interest payments are based.

2. An interest rate index, typically some specified maturity of LIBOR.

3. A cap rate, which is equivalent to a strike or exercise price on an option.

4. The period of the agreement, including payment dates and interest rate reset dates.

The cap buyers typically schedule interest rate reset and payment intervals to coincide with interest payments on outstanding variable-rate debt. Interest rate caps cover periods ranging from one to ten years with interest rate reset and payment dates most commonly set either three or six months apart. If the specified market index is above the cap rate, the seller pays the buyer the difference in interest cost on the next payment date.

The hedged position shows how buying a cap limits the firm’s interest expense to a maximum amount determined by the cost of servicing the debt at the cap rate plus the premium paid for purchasing the instrument. An interest rate cap is an agreement between the seller and the borrower of a cap, to limit the borrower’s floating interest rate to a specific level for a specified time.

The cap provides protection against rising interest rates while retaining the opportunity to benefit from lower interest rates if the rates stay below the specified level. Essentially, the seller of the cap agrees to reimburse the borrower the cost of the LIBOR in excess of a specified rate on each payment date during the duration of the loan.

The borrower benefits from the downward movements in interest rates, and limits the upside risks. Interest rate swaps from floating rates to fixed rates lock on to a particular interest rate and, therefore, do not allow a corporate to benefit from favourable interest rate movements.

Since the cap is a series of options, the pricing will depend on the strike (cap) price, the difference between the cap rate and the LIBOR, the tenure of the cap, and the inherent volatility of the exchange rate of the currency in question.

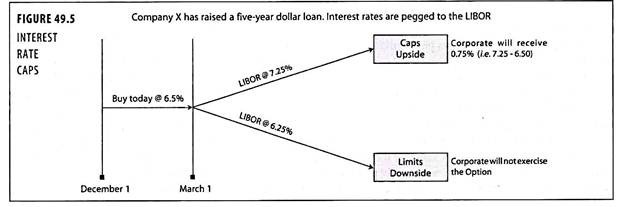

Example Company X has obtained a $20 million seven-year loan. The interest on the loan is payable on a six-monthly basis, and is pegged to the six-months LIBOR. To limit the maximum interest rate payable in a period without forfeiting the possibility of lower interest rates, the company decides to buy an interest rate cap option.

The cap strike rate of 6.5% is based on the US dollar six-month LIBOR, and the maturity period is the same as that of the loan. The company pays an upfront premium of 5.4% of the principal. If, on any date, the LIBOR is more than 6.5%, the company will exercise the option, and the banker will have to pay the corporate the difference.

4. Interest Rate Floors:

Variable rate investors are the typical users of Interest Rate Floors. They used Floors to obtain certainly for their investments and budgeting process by setting the minimum interest rate they will receive on their investments. By implementing this type of financial management, variable rate investors obtain peace of mind from falling interest rates and the freedom to concentrate on their aspect of their business/investments.

An interest rate floor enables variable rate investors to retain the upside advantages of their variable rate investment while obtaining the comfort of a known minimum interest rate.

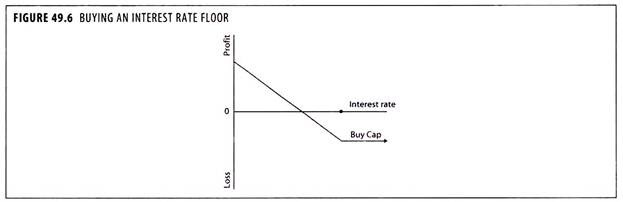

The buyer of an interest rate floor pays the seller a premium in return for the right to receive the difference in interest payable on a notional principal amount when a specified index interest rate falls below a stipulated minimum or floor rate. Buyers use floors to fix a minimum interest rate on an asset paying a variable interest rate indexed to some maturity of LIBOR.

A floor is an option-like agreement in that it represents a right rather than an obligation to the buyer. The buyer of an interest rate floor incurs no obligation if the index interest rate rises above the floor rate, so the most a buyer can lose is the premium paid to the seller at the outset of the agreement.

It is a contract giving the buyer the right, but not the obligation, to fix the rate of interest (the strike rate) for the entire term of a notional deposit. The buyer pays a premium to the writer and, if the option is exercised on any of the specified settlement dates, is paid in cash an amount equal to the difference between the strike and the market rate that day (calculated on the notional deposit).

A floor is effectively a strip of options. As with all options, the buyer only exercises a floor if it is in its interest to do so. Most floors are arranged to cover medium-term deposits of two to five years, with the settlement dates matching the rollover dates on the floor buyer’s deposit.

The writer of the floor may or may not be the same bank or other financial institution as is accepting the deposit. Floors can, of course, be used by speculators hoping to profit from a fall in market interest rates, rather than depositors seeking to hedge the interest on a deposit.

From the definitions, it will be seen that the difference between a cap and a floor is that the cap is purchased to hedge a loan (or to speculate in the hope of profit if market rates increase) and a floor is purchased to hedge a deposit (or to speculate in the hope of profit if market interest rates fall).

Caps and floors can be purchased in all major currencies, usually for US$ 0.5m or its equivalent upwards. As with all options, size of the premium to be paid upfront by the buyer depends on the terms of the contract.

5. Interest Rate Collars:

Options, including caps and floors, can guarantee either a minimum interest rate for a depositor or a maximum interest rate for a borrower, but allow the buyer to let the option lapse and simply deal in the market if that is cheaper. The buyer must, however, pay to the writer a cash ‘premium’ for the option contract.

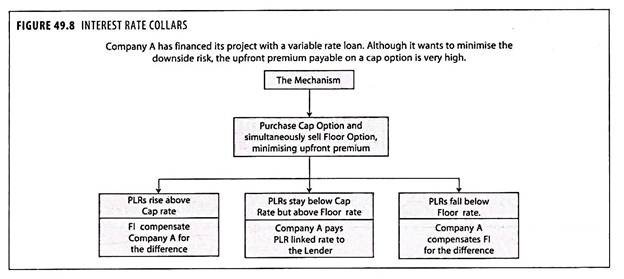

With an interest rate collar, the party wishing to hedge its exposure buys an option from a bank or other financial institution, and at the same date sells an option to that bank or another counter party, offering the respective premiums. The simultaneous sale and purchase by one party of options for same notional amount, term and rollover dates, but at different strike rates.

A collar is a combination of a cap and a floor. The party wishing, for example, to protect its interest rate exposure chooses for the option it is buying a strike rate that is the highest rate of interest it wishes to pay, and for the option it is writing (selling) a strike rate below which it accepts that it will not benefit.

The premium earned on the option being written (sold) is offset against the premium to be paid on the option being purchased, so that the net cost of the option being purchased is either reduced or eliminated (or can even leave a positive premium if that for the sale is higher than that for the purchase).

The two options can be with the same or different banks or other financial institutions. There are credit and settlement risks on the writer of each option. As with any option, the collar is not a commitment by either party to lend or to borrow the notional amount, and the only payments are for any net premium and the cash payments for differences at rollover dates.

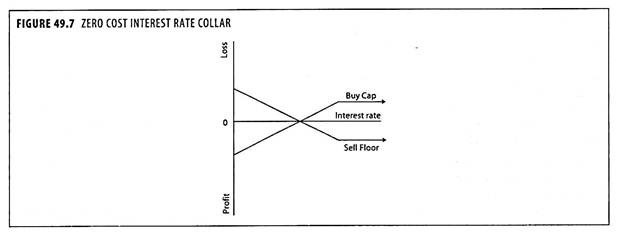

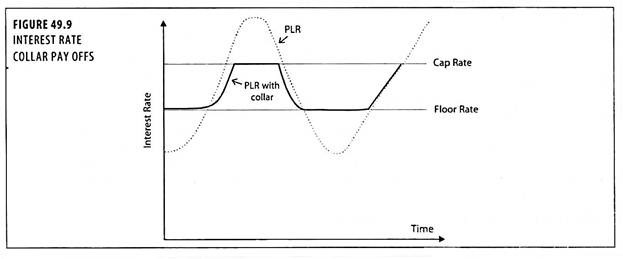

The buyer of an interest rate collar purchases an interest rate cap, while selling a floor indexed to the same interest rate. Borrowers with variable rate loans buy collars to limit effective borrowing rates to a range of interest rate between some maximum, determined by the cap rate, and a minimum, which is fixed by the floor strike price.

Hence, this instrument is called ‘collar’. To protect against a rise in the floating rate on a loan buying calls on FRA and selling puts on FRA with corresponding maturities is called a ‘zero cost collar’.

The purchased options protect against the interest rate rising and pays the premium for purchase of cap option. He will write the put option to protect against interest rate fall and receives the premium on floor option. The strategy to buy the cap and sell the floor such that the net premium is zero.

The purchased options will show a profit if interest rates rise. The premium from written options reduces the cost of the strategy and shows a loss if rates fall. An interest rate collar is an agreement between the seller of a collar and the borrower to limit the fluctuations in the borrower’s effective interest rate to a band between a specified ceiling rate and a floor rate.

It is a combination of an interest rate floor (the reserve of a cap) and an interest rate cap, which provides protection against rising interest rates but limits the gains when interest rates are falling. The upfront premia on cap options tend to be large. To reduce the cost of the hedge transaction, a limit is placed on the upside gains. As the corporate is assured of both maximum and minimum cash outflows for its future payment obligations by way of interest, the cost of funding is crystallized within an acceptable band.

Banks can now offer both interest rate caps and collars, but the net premium inflow to the corporate still has to be nonnegative.

Example:

Company X has to pay off a floating rate dollar loan. It wishes to insure against the upward movements of the interest rate, but the upfront premium on a cap option will result in a large cash outflow.

Therefore, the company decides to give away some of its possible gains by limiting the downward movement of interest rates, and creating a collar (band) for his loan. If the LIBOR moves above the collar, the bank will pay the corporate the difference. If the LIBOR dips below the collar, the corporate compensates the bank for the difference.

6. Interest Rate Ceiling:

Interest rate ceiling provides protection in a rising rate environment to borrowers of US Dollars who have floating rate debt. Thus, when the daily average of market rate is higher than ceiling, the bank will reimburse the difference to the client. On the other hand, the company can borrow at lower rates in a falling rate environment without any obligation to the bank.

The underlying credit agreement is not affected and need not be with the bank. The fee for this protection is 1 per cent per annum. Borrowers who have floating rate debt use ceilings to protect themselves from a rise in rates while leaving open the liability to benefit should rates actually fall. This product is superior to an interest rate swap into fixed rate debt. The borrower continues to access the lower end to the yield curve, while still being insured against a rise in interest rates.

7. Interest Rate Futures:

Interest rate future is a financial derivative based on an underlying security, actually a debt obligation that moves in value as interest rates change. That is, buying an interest rate futures contract will allow the buyer to lock in a future investment rate. When the interest rates scale up, the buyer will pay the seller of the futures contract an amount equal to the profit expected when investing at a higher rate against the rate mentioned in the futures contract.

On the flip side, when the interest rates go down, the seller will pay off the buyer for the poorer interest rate when the futures contract expires. According to experts, the interest rate futures market had priced the futures so that there is sparse room for arbitrage.

IRFs are an agreement to buy or sell an underlying debt security at a fixed price on a fixed day in the future, and the prices of these derivatives mirror the rise and fall in the yield of the underlying government bonds. Unlike overnight interest rate swaps, IRFs have to be traded on exchanges rather than over the counter.

The Securities and Exchange Board of India (SEBI) and the Reserve Bank of India have limited the maturity of IRF contracts between a minimum of three months and a maximum of 12 months. This time around, banks have been allowed to hedge interest rate risks as well as take bets on the rate trajectory.

Also, foreign institutional investors have been given access to the market. A company, or a bank, or a foreign institutional investor, or a non-resident Indian or a retail investor can trade.

Where can be traded?

It can be traded live in interest rate futures on the currency derivatives segment of the National Stock Exchange while you could also soon trade the contracts on the Bombay Stock Exchange once it is launched. The foreign exchange derivatives bourse of the newly launched Multi-Commodity Exchange MCX-SX is awaiting the regulatory approval to commence trading in the segment.

Contract Size and Quotation:

Globally, the interest rate futures are almost 25-30 percent of all derivatives in India the trading on the NSE will see a minimum contract size of Rs.2,00,000. As far as the quotation is concerned, it would be the same as the quoted price of GoI securities and with a count convention of 30/360-day. While the maximum tenor of the futures contract is 1 year or 12 months, usually it will have to be rolled over in three months – making the contract cycle span over four fixed quarterly contracts.

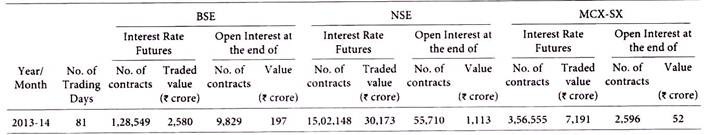

Trading Statistics of Interest Rate Futures at BSE and NSE:

8. Interest Rate Options:

Interest rate option is a derivative product through which lenders or borrowers in the floating rate interest contracts protect themselves against adverse movements in the interest rate. A borrower under a floating rate interest agreement protects himself against rise in the interest rate beyond a particular level. This is called the cap.

In the same way, a lender under a floating rate interest agreement protects himself against a fall in the floating rate of interest below a particular level. The seller of the contract is called option-writer to whom a premium is payable for writing the option.