A commodity futures is a contractual agreement between two parties to buy or sell a specified quantity and quality of commodity at a certain time in the future at a certain price agreed upon at the time of entering into the contract on the commodity futures exchange.

The primary objective for any futures exchange is effective price discovery and efficient price risk management. An investment commodity is generally held for investment purposes whereas consumption commodities are held mainly for consumption purposes.

Gold and silver can be classified as investment commodities whereas oil and steel can be classified as consumption commodities. There are basically two markets present within the commodities markets, the cash market and futures market.

The cash market is the market for buying and selling physical commodity at a negotiated price. Delivery of the commodity takes place immediately. While the futures market is the market for buying and selling standardized contracts of the commodity at a predetermined price. Delivery of the commodity takes place during a future delivery period of the contract if the option of delivery is exercised.

The Foreign Currency Regulation Act (FCRA) defines commodities as every kind of moveable property other than actionable claims, money and securities. Commodity trading is the trading in commodity spot and derivatives (futures).

If any one takes a buy or sell position based on the future performance of agricultural commodities or commodities like gold, silver metals or crude, then it is done by trading in commodities derivatives.

Pricing of Commodity Futures:

The process of arriving at the figure at which a buyer buys and seller sells a future contract for a specific expiration date is called price discovery. The commodity exchanges acts as a focal point for all vital information relating to supplies, transportation, storage, exports, imports, currency values, interest rates etc.

All these information form the basis of quoting and adjusting bid prices by the buyers and sellers. The price at any particular moment is derived when the buyer’s price matches that of the seller. However, the price at the very next instant might vary due to the reflection and digestion of some new information by the buyer and/or sellers. This is called price discovery.

When an individual buyer needs an asset in the future he has two options:

(i) Buy the underlying asset today in the spot market and hold it till requirement

(ii) Buy it in the forward market

If option (i) is exercised the buyer incurs an initial outlay, hence involves opportunity costs. Besides he also incurs cost of storing the asset till the date of requirement.

If option (ii) is exercised, the seller is incurring the same till the date of requirement and hence would charge a higher price from the buyer to realise the cost of storage. This forms the basis of cost of carry model.

Futures price (using continuous compounding), after considering the storage costs is defined as:

F = (S + C)en

Where, F = Future price

S = Spot price

C = Present value of all storage costs

R = Annualised cost of financing

T = Time till expiration

The above formula depicts the relationship between the futures and the related spot price of a commodity. The difference between the two prices is called the basis. As a futures contract arrives the date of expiration, the two prices gradually converge, i.e. the basis moves towards zero.

If there remains any price difference on the date of expiry the traders by trying to exploit the opportunity of making gains by using the differences will either increase demand pressure or supply pressure (as the case may be) and will nullify the opportunity.

Objectives of Commodity Futures Contract:

The primary objective of futures contract on:

(a) Hedging,

(b) Speculation, and

(c) Price discovery and efficient allocation of resources.

a. Hedging:

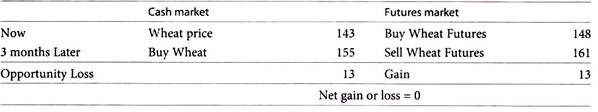

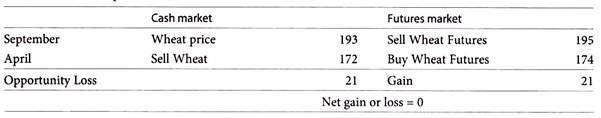

A Hedger seeks to protect themselves against price changes in a commodity in which they have an interest. They trade in future with an objective of reducing their risk. A hedge is a futures position that is roughly equal and opposite to the position the hedger has in cash market.

Example:

A farmer growing cotton is exposed to two kinds of risks:

Quantity risk – Quantity of cotton may be lower than expected quantity.

Price risk – Actual price of cotton may be less than expected.

Futures market enable the farmer to reduce his price risk by selling his cotton for future delivery by selling a future contract. If the future price of cotton is actually lower than agreed price, under the future contract, the farmer is protected from price.

Example:

In August 2016 Mr. Doshi, Rajkot based cotton trade receives order to deliver medium staple cotton of 130 candy in November, 2016. However, in November medium cotton staple price is expected to be low. To prevent himself from downward price movement he decides to trade in futures to hedge his price risk. In August 2016, he sells 5 contracts (26 candy each) of medium staple cotton contract on MCX @ Rs.21,600 per candy. He pay 3% of total value as margin with the exchange.

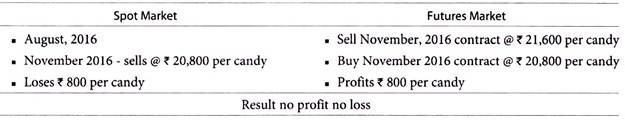

Case I:

By November, futures prices fall at Rs.20,800 per candy to Converge with spot market.

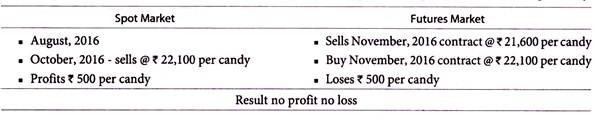

Case II:

Suppose, by November 2016, the futures prices rise to converge with the spot market @ Rs.22,100 per candy.

Example:

In August 2016, PCM Ltd. enters into a forward trade to import 260 candy of long staple cotton from USA. Delivery being scheduled in November, 2016. To protect himself from upward price movement risk, company decides to hedge, by buying 10 contracts (26 candy each) of long staple cotton November contract @ Rs.22,380 per candy. It pays 3% as margin.

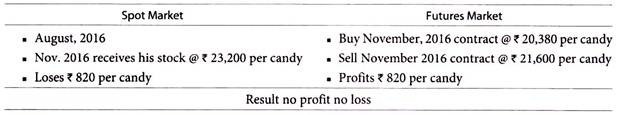

Case 1:

By November 2016, the futures prices rise to converge with spot market @ Rs.23,200 per candy.

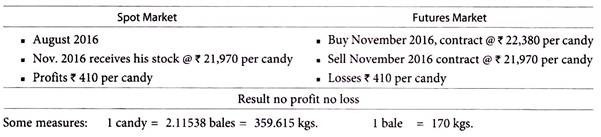

Case 2:

By November 2016, the futures prices fall to converge with the spot market @ 21,970 per candy.

Types of Hedge:

i. Long Hedge:

It requires taking a long position in futures contract. This strategy is appropriate when certain asset is to be purchased in the future and one is interested in locking the price now.

ii. Short Hedge:

This involves taking a short position in futures contract. This is applicable when the hedger already owns an asset and expects to sell it in future.

iii. Cross Hedge:

It is used to hedge price risk of different but economically related commodities.

b. Speculation:

Speculation is the opposite of hedging. A speculator holds no offsetting position in cast market and deliberately incurs price risk in order to reap its potential rewards. Speculation is all about taking position in the futures market without having the underlying speculators operate in the market with motive to make money.

They take:

Naked Positions – Position in any future contract

Spread Positions – Opposite positions in 2 future contracts. This is conservative speculative activity.

Speculators are those who willingly take price risks to profit from price changes in the underlying. Speculators provide liquidity and depth to the market. Speculators accept the risk that hedgers seek to avoid giving the market the liquidity required to service commercial hedge participants effectively by providing market with necessary bid and offers to implement a continuous flow of transactions.

Example:

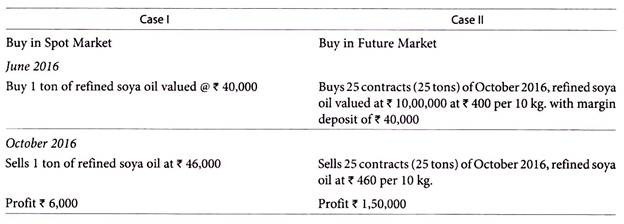

In June 2016, Mr. Deo a vegetable oil processor thinks that price of soya oil is expected to move up by October, 2016. He has idle cash of Rs.40,000 by which he can buy only 1 ton of soya oil from the spot market based on the ruling price of Rs.400 per 10 kg. He is not interested to take physical delivery. He buys 25 contracts (25 tons) of refined soya oil October, 2016 contract. He has to keep margin of 4% with the exchange.

The refined soya oil futures prices actually move according to his anticipation and rule at Rs. 460 per 10 kg. in October 2016, which gives him a profit of Rs.1,50,000 on his 25 tons buy position in futures which he squares up by selling contract on exchange.

c. Price Discovery:

Futures prices are a market consensus forecast about the price of the commodity in future. Though not exactly accurate, futures are the best available forecast of future price of a commodity. Future contract can be used by producers of the commodity to reduce the risk they run due to volatility in price of commodity.

As an example, the future price of wheat for delivery in nine months reveals information to the public about the expected futures spot price of wheat at the time of delivery. The price discovery function helps economic agents to plan their investment and consumption by providing information about future commodity price.