Financial futures contracts were first introduced by International Monetary Markets Division of Chicago Mercantile Exchange in order to meet the needs for managing currency risks, and promoted by a galloping growth in international business. London International Financial Futures and Options Exchange (LIFFE), set up in 1982 had been dealing in currency futures, but have restricted their activity to interest rate futures. A currency futures contract is “a commitment to deliver a specific amount of a specified currency at a specified future date for an agreed price incorporated in the contract”.

A currency futures contract is an agreement to buy or sell a standardized quantity of specific foreign currency at a future date at a price agreed between two parties. Financial futures is a binding contract of a standardized nature, inter locking both buyer and seller into a particular rate.

A currency futures contract is a derivative financial instrument that acts as a conduct to transfer risks attributable to volatility in prices of currencies. It is a contractual agreement between a buyer and a seller for the purchase and sale of a particular currency at a specific future date, at a predetermined price.

A futures contract involves an obligation on both the parties to fulfil the terms of the contract. The fundamental advantage is hedging risks. In a currency futures contract, one of the ‘paid’ of the currencies is invariably the US $. That is, you can buy or sell a futures contract only with reference to the US$.

There are six steps involved in the technique of hedging through futures. These are:

1. Estimating target outcome (with reference to spot rate available on a given date)

2. Deciding on whether futures contract should be bought or sold

3. Determining number of contracts (this is necessary, since contract size is standardized)

4. Identifying profit or loss on target outcome

5. Closing out futures position

6. Evaluating profit or loss on futures.

Features of Currency Futures Contract:

The features of a currency futures contract are summarized below:

1. These are standardized marketable instruments traded in organized futures markets.

2. These contracts can be liquidated even before the contracted date.

3. These contracts are relatively inflexible and are traded only in major currencies.

4. For entering into these contracts, the parties should keep margins with the exchange.

5. These contracts are cheaper than forward contracts, requiring a small commission payable.

6. Only upfront payment is for the initial margin, with variation margin adjustments being met if the market moves against a counterparty.

7. The clearing house takes the credit risk on each counterparty.

8. Delivery dates are usually quarterly, but most contracts are closed out by buying/selling equal and opposite contracts before the delivery date.

Out of the two markets i.e., the capital market and the money market, the latter is more volatile and prone to risk of speculation. The need of the money market is felt in handling the short-term capital requirement. Currency futures and currency options are the latest innovation in international money market.

Currency future is just like any other future deal, where an agreement is entered to buy or sell a standard object of value on a future day at a rate (price) agreed between parties, through a transaction in an organized market.

The unique feature is that it is a future deal in a specific currency such currency futures are transacted on the floor of an organized future exchange. Generally, the prevailing rate of foreign exchange guides the pricing of currency future. However, practically such practice becomes a little too simple to justify the most interesting aspect of pricing of future.

The significant factors which help in deviating from the above theory of pricing may be attributed under four major heads:

1. Market rate variability

2. Standard size of contracts

3. Regulation imposed through exchange(s)

4. Volume of contracts

Exchange Traded Currency Futures:

The RBI has announced the introduction of currency futures on eligible exchanges. The central bank has, in principle, allowed banks and brokers as the first participants to start currency futures on eligible exchanges. As regards companies, the RBI has clarified that corporate accessing such products should make compulsory disclosures of un-hedged exposures and hedging in their annual accounts.

The companies can use such products only if they have an underlying rupee dollar positions or trades. Foreign institutional investors and nonresident Indians will be allowed hedgers in the currency futures market once the market stabilizes.

The boards of respective banks may have to be made specifically accountable for ensuring that risks taken by the bank, in currency futures markets, are properly assessed and are in proportion to the bank’s ability to withstand extreme shocks.

The RBI is of the view that banks, being regulated entities, will be allowed both as trading cum clearing members of their own account and clients account and also as professional clearing members to provide liquidity in the market. Brokers could be allowed on basis of multiple criteria like net worth, market reputation, regulatory framework, participation in the derivative segment.

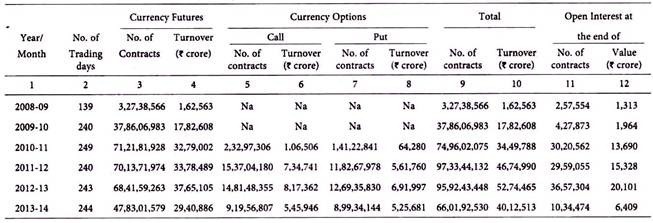

Trading Statistics of Currency Derivatives Segment at NSE: