A call option give the buyer the right but not the obligation to buy a given quantity of the underlying asset, a given price known as ‘exercise price’ or ‘strike price’ on or before a given future date called the ‘maturity date’ or ‘expiry date’. A call option gives the buyer the right to buy a fixed number of shares/commodities in a particular security at the exercise price up to the date of expiration of the contract.

The seller of an option is known as ‘writer’. Unlike the buyer, the writer has no choice regarding the fulfillment of the obligations under the contract. If the buyer wants to exercise his right, the writer must comply. For this asymmetry of privilege, the buyer must pay the writer the option price, which is known as ‘premium’.

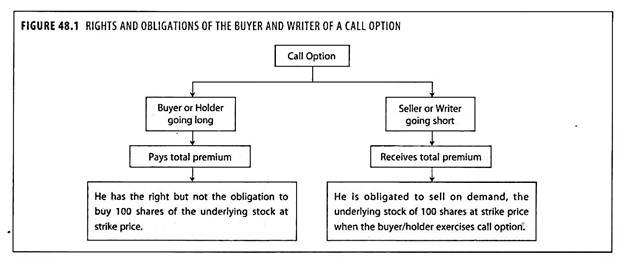

Rights and Obligations in Call Option:

The rights and obligations of the buyer and writer of a call option are explained in figure 48.1.

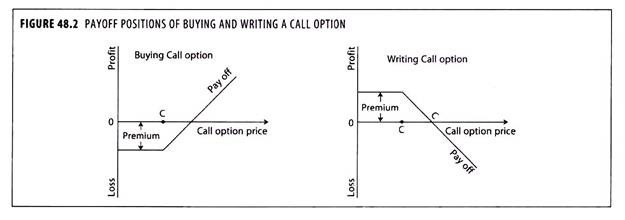

Payoff Positions in Call Option:

The payoff positions of buying a call writing a call are given in figure 48.2.

Buying a Call:

The buyer of a call option pays the premium in return for the right to buy the underlying asset at the exercise price ‘C’. If at the expiry date of the option, the underlying asset price is above the exercise price, the buyer will exercise the option, pay the exercise price and receives the asset.

This may then be sold in the market at spot price and makes profit. Alternatively, the option may be sold immediately prior to expiry to realize a similar profit because at expiry, its value must be equal to the difference between the exercise price and the market price of the underlying asset. If the asset price is below the exercise price, the option will be abandoned by the buyer and his loss will be equal to the premium paid on the purchase of call option.

Writing a Call:

The call option writer receives the premium as consideration for bearing the risk of having to deliver the underlying asset is return for being paid the exercise price. If at the expiry, the asset price is above the exercise price, the writer will incur loss because he will have to buy the asset at market price in order to deliver it to the option buyer in exchange for the lower exercise price.

If the asset price is below the exercise price, the call option will not be exercised and the writer will make a profit equal to the option premium.

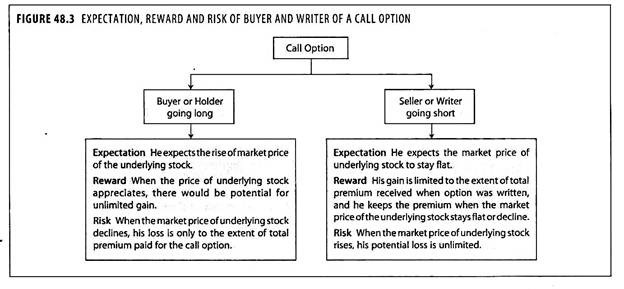

Expectations, Rewards and Risks in Call Option:

The expectations, rewards and risks of holder and writer of a call option are given in figure 48.3:

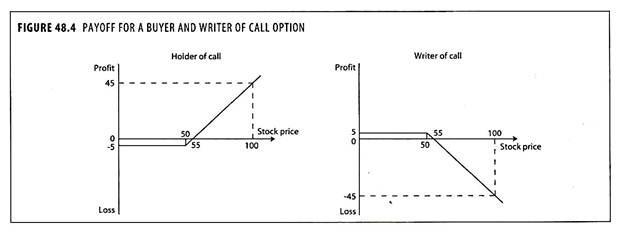

A profit from a call option is analyzed with the help of the following illustration:

Suppose the call is purchased for Rs.5 with an exercise price of Rs.50 as shown in figure 48.4. At maturity, if the share price is below Rs.50, the buyer of call option would not pay to exercise the call, as shares can be bought on the open market for less than the exercise price.

If the share price is above Rs.50, the buyer would pay to exercise the call and gain by the difference between the market price and the exercise price. At a price of Rs.45, the holder of the call loses by being able to purchase the share at Rs.50 and sell at Rs.45. The holder of the call benefits by being able to purchase the share at Rs.50 and sell at Rs.54, although the original price of the option at Rs.5 means there is an overall loss.

Only when the price is Rs.55 or greater, there is net profit to the buyer, and this could be unlimited. The position of the writer of the call and the mirror image of the purchaser is shown in figure 48.4.

If the share price is below Rs.50, the writer makes Rs.5 from the purchaser. For a price between Rs.50 and Rs.55, there is a partial loss in having to provide the stock at a price lower than the market price, and above Rs.55, the writer of call option faces a net loss.