After reading this article you will learn about Hire-Purchase:- 1. Meaning of Hire Purchase 2. Features of Hire Purchase 3. Legal Position 4. Method of Computing.

Meaning of Hire Purchase:

Hire purchase means a transaction where goods are purchased and sold on the terms that:

(i) Payment will be made in installments,

(ii) The possession of the goods is given to the buyer immediately,

(iii) The property (ownership) in the goods remains with the vendor till the last installment is paid,

(iv) The seller can repossess the goods in case of default in payment of any installment, and

(v) Each installment is treated as hire charges till the last installment is paid.

Features of Hire Purchase:

The main features of a hire purchase agreement are as below:

1. The payment is to be made by the hirer (buyer) to the hiree, usually the vendor, in installments over a specified period of time.

2. The possession of the goods is transferred to the buyer immediately.

3. The property in the goods remains with the vendor (hiree) till the last installment is paid. The ownership passes to the buyer (hirer) when he pays all installments.

4. The Hiree or the vendor can repossess the goods in case of default and treat the amount received by way of installments as hire charged for that period.

5. The installments in hire purchase include interest as well as repayments of principal.

6. Usually, the hiree charges interest on flat rate.

Legal Position of Hire Purchase:

The Hire Purchase Act, 1972 defines a hire purchase agreement as an agreement under which goods are let on hire and under which the hirer has an option to purchase them in accordance with the terms of the agreement and includes an agreement under which:

(i) Possession of goods is delivered by the owner there off to a person on a condition that such person pays the agreed amount in periodic payments, and

(ii) The property in the goods is to pass to such person on the payment of the last of such installments, and

(iii) Such person has a right to terminate the agreement at any time before the property so passes.” Section 3 of the Act provides that every hire purchase agreement must be in writing and signed by all parties thereto.

Rights of Hirer:

In addition to the usual right of terminating the agreement at any time before the property passes to him and returning the goods to the hiree, the Hire Purchase Act, 1972 has provided the following rights to the hirer:

(i) The hiree (vendor) cannot terminate the hire purchase agreement for default in payment of hire or due to an un-authorised act or breach of expressed conditions unless a notice in writing in this regard is given to the hirer. The period of notice will be one week where the hire is payable weekly or less than that interval and two weeks in other cases.

(ii) The right to repossess the goods will not exist unless sanctioned by the Court in the following cases:

(a) Where the hire purchases price is less than Rs. 15,000, one half of the hire purchase price has been paid

(b) Where the hire purchase is not less than Rs. 15,000, three fourth of hire-purchase price has been paid.

However this proportion in case of motor vehicles is as under:

(a) One half, where the hire purchase price is less than Rs. 5,000.

(b) Three fourths, where the hire purchase price is not less than Rs. 5,000 but less than Rs. 15,000.

(c) Three fourths or such higher proportion not exceeding nine-tenth where the hire purchase price is not less than Rs. 15,000.

(iii) The hirer has a right of receiving a statement from the owner against a payment of rupee one showing the amount paid by or on behalf of the hirer, the amount which has become due under the agreement but remains unpaid and the date upon which each unpaid installment became due, and the amount of each such installment and the amount which is to become payable under the agreement and the date or the mode of determining the date upon which each future installment is to become payable, and the amount of each such installment.

(iv) If the amount paid by the hirer till the date of repossession of the goods or the value of the goods on the date of repossession of goods exceeds the total hire purchase price the excess payment made by the hirer will be returned to the hirer by the owner of the goods.

The owner or vendor, for the purpose of calculating the value of the goods, has the right to deduct the reasonable expenses for repossessing the goods, for storing the goods, or repairing them, for selling them and for payment of arrears of taxes.

Method of Computing Installment under Hire Purchase:

Under Hire Purchase, interest is usually charged on a flat rate for the period of hire. We can calculate the amount of installment by adding the amount of principal (cost of the asset) and the total interest for the period, and further by dividing the total amount of payment to be made by the number of installments.

Say, an equipment costing Rs. 1,00,000 is sold on hire purchase on the terms that interest will be charged at 15% p.a. on flat rate basis and the payment is to be made in 5 equal year-end installments.

In the above example, the total Interest burden shall be Rs. 75,000 i.e. 1,00,000 × 15/100 × 5 and the yearly installment shall be 1,00,000 + 75,000/5 = Rs. 35,000

Method of Splitting H.P. Installment into Interest and Principal Repayments:

(a) First of all interest included in each installment is calculated on the basis that interest in each installment shall be in ratio of amounts outstanding. In case the installments are of equal amounts, we can apply the sum of digit method.

(b) We can determine the amount of principal repayment in the installment by deducting from it the amount of interest calculated in (a) above.

The following illustration explains the method of split of hire purchase installment into interest and principal repayments:

Illustration 1:

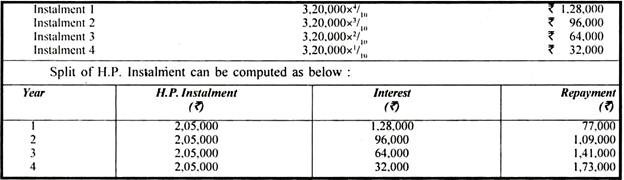

A company purchased an equipment costing Rs. 5,00,000 on hire purchase basis payable in 4 equal year end installments of Rs. 2,05,000 each. Split of the Installments into interest and principal repayments.

Solution:

In the above Illustration, the total amount payable is Rs. 8,20,000-5,00,000.

The interest can be allocated as below:

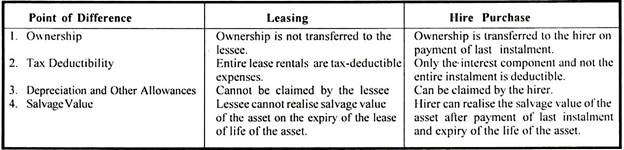

Leasing Versus Hire Purchase:

Both Leasing and hire purchase provide a source of financing fixed assets. However the two are not similar on many accounts.

The following points of distinction are worth consideration from points of view of the lessee and the hirer:

Selecting between Leasing and Hire Purchase:

If a firm has the choice of selecting between leasing and hire purchase, it should evaluate the financial viability of both the proposals by adopting the normal methods of capital budgeting. We would prefer the technique of comparison of the present values of net outflows after-tax from the two options. The option with lower present value of cash outflows implies lesser cost and hence should be selected.