Everything you need to know about human resource accounting (HRA). Human Resource Accounting is a process of identifying and measuring data about human resources and communicating this information to the interested parties.

It involves measuring the costs incurred by an organisation to recruit, select, hire, train and develop Human Assets and also involves measuring the economic value of people in the organisation.

It is concerned with measurement of cost and value of people in the organisation. The basic philosophy underlying the Human Resource Accounting are – (i) that people are valuable resources of an organisation / or enterprise and (ii) information on investment and value of Human Resource is useful for decision-making in the organisation.

Learn about:- 1. Introduction to Human Resource Accounting (HRA) 2. Meaning of Human Resource Accounting (HRA) 3. Definitions 4. Aims and Objectives 5. Need and Purpose 6. Types 7. Approaches 8. Methods of Valuation 9. Calculation 10. Arguments 11. Benefits 12. Problems 13. Issues and Concerns 14. Present Practice and Consequences 15. HRA in India.

Human Resource Accounting (HRA): Meaning, Definition, Purpose, Approach and Limitation

Human Resource Accounting (HRA) – Introduction, Definition and Objectives

Financial accounting has developed various tools that largely measure activities and their results in such areas as profit, costs, production, etc. These tools also measure the value of various physical assets (land, building, machinery, etc.) as well as of various intangible assets (goodwill, patent, brand, etc.).

ADVERTISEMENTS:

However, financial accounting does not measure the value of human resources which can be 4 to 20 times of value of physical and financial assets of an organization. In order to bridge this gap, behavioural scientists have made attempts to measure the value of human assets.

An early attempt was made by Likert and Bowers. This attempt was further extended by others to give some concrete shape which has generated human resource/asset accounting.

Flamholtz, who has done considerable work in the area of human resource accounting, has defined it as follows:

ADVERTISEMENTS:

“Human resource accounting is accounting for people as an organizational resource. It involves measuring the costs incurred by business firms and other organizations to recruit, select, hire, train, and develop human assets. It also involves measuring the economic value of people to the organization.”

Like any other terminological conflict in HRM, many people have started using human capital accounting in place of human resource accounting. Human capital accounting has been defined as an attempt to place a financial figure on the knowledge and skills of an organization’s employees or human capital. In fact, in both the nomenclatures, approaches and techniques are same. Therefore, we shall use the more common term human resource accounting.

Human resource accounting is primarily involved in measuring various aspects related to human capital. Its basic purpose is to facilitate the effective management of human resources by providing information to acquire, develop, retain, utilize, and evaluate human resources.

The more specific objectives of human resource accounting are as follows:

ADVERTISEMENTS:

1. To provide cost-value data for managerial decisions regarding acquiring, developing, allocating, and maintaining human resources so as to attain cost-effective organizational objectives.

2. To provide information to monitor the effectiveness of human resource utilization.

3. To provide information for determining the status of human asset whether it is conserved properly; it is appreciating or depleting.

4. To assist in the development of effective human resource management practices by classifying the financial consequences of these practices.

ADVERTISEMENTS:

Human resources are the most valuable assets of an organization, and the ultimate success of any enterprise depends upon the skills, competence and knowledge of its employees. The human resources contribute a lot towards building the total wealth of an organization; therefore it becomes necessary to formulate a measure for evaluating the worth of the human capital.

But due to the peculiar nature of human beings, the value of the human capital cannot be measured in the same way the value of other assets can be measured. Human Resource Accounting (HRA) is the process of quantifying and measuring the value of the human resources. HRA can be defined as the assigning, budgeting, and reporting the cost of human resources incurred in an organization, including wages and salaries and training expenses.

It measures the costs incurred in order to recruit, hire, train and develop the personnel employed at various levels of the organization. HRA also evaluates the present economic value of the employees. An HRA report is prepared after calculating the costs incurred in acquiring and maintaining the employees and the value obtained from them.

Mr. Narayana Murthy, Chairman Emeritus of Infosys once said that – “Our assets walk out of the door each evening. We have to make sure that they come back the next morning.” In many ways what Mr. Murthy said made sense. The asset that daily moves out of the organization premises every evening is the human resource.

ADVERTISEMENTS:

And, an organization that attaches value to this precious asset shall always ensure that these assets come-back secured every morning. It is accentuated that the human element is the most important element in any corporate enterprise. However without truly determining the actual value of human resource, how can one even try to secure the same?

The need for Human Resource Accounting arises because the organizations can actually find out how valuable an individual is, as the intellectual assets of a company are often worth three or four times the tangible book value. Human Resource accounting (HRA) denotes this process of quantification/measurement of the Human Resource.

The American Accounting Association’s Committee on Human Resource Accounting (1973) has defined Human Resource Accounting as “the process of identifying and measuring data about human resources and communicating this information to interested parties”.

Human Resource Accounting (HRA) – Meaning

Human Resource Accounting is a process of identifying and measuring data about human resources and communicating this information to the interested parties. It involves measuring the costs incurred by an organisation to recruit, select, hire, train and develop Human Assets and also involves measuring the economic value of people in the organisation.

ADVERTISEMENTS:

It is concerned with measurement of cost and value of people in the organisation. The basic philosophy underlying the Human Resource Accounting is – (i) that people are valuable resources of an organisation / or enterprise and (ii) information on investment and value of Human Resource is useful for decision-making in the organisation.

Attempts to account the HR are not new. It was Rensis Likert who initiated research into HR accounting in the sixties. He stressed the importance of long-term planning of human resource’s qualitative variables that result in greater benefits in the long run.

The resource theory considers that the competitive position of an organization depends on its specific assets, which is the Human Resource. This explains why some firms are more productive than others under almost similar conditions. It is the human resource that makes all the difference.

According to American Accounting Association (1970) HR accounting is the human resource identification and measuring process and also its communication to the interested parties.

ADVERTISEMENTS:

Any resource will have two sides i.e., its assets value and the cost of procurement. HR is not an exception but curiously enough in the case of HR, only the procurement/maintenance cost is accounted in the balance sheet and not the asset valve.

Precisely stated, human resource accounting is the art of valuing, recording and presenting systematically the worth of human resources in the books of account of an organisation.

Human Resource Accounting (HRA) – Definitions

Human Resource Accounting is the process of developing financial assessments for people within organisation and society and the monitoring of these assessments through time. It deals with investments in people and with economic results of those investments.

Thus, it essentially involves- (a) measurement and valuation of human resources, and (b) communicating the relevant Information to management and external users.

Stephen Knauf defined HRA as “the measurement and quantification of human organisational inputs, such as recruiting, training, experience and commitment.”

Eric Flamholtz explained human resource accounting as accounting for people as organisation resources. It is the measurement of the cost and value of people for the organisation.

ADVERTISEMENTS:

Human Resource Accounting may also be defined as the measurement and reporting of the cost and value of people as organisational resources. It involves accounting for investment in people and their replacement costs, as well as accounting for the economic values of people to an organisation.

Objections against the Treatment of People as Assets:

There are several objections to the treatment of people as assets in accounting sense but they have been by and large over-ruled.

They are:

(i) The first objection is that the people are not owned by the organisation like other physical properties. It is true that people cannot be regarded as slaves or chattels in a modern society. But, it does not imply that the potential benefits of skilled manpower should not be assessed.

There are many organisations where investment in physical non-human capital is negligible, and most of their earnings are derived from the skill and ability of experienced personnel. If the return on investment in any such organisation is calculated on the .basis of only physical, non- human capital, the rate of return would be unbelievably high.

ADVERTISEMENTS:

Take for instance, the organisations or consultants, architects and designers, trading firms. The human assets constitute their real and major earning base. The rate of return on investment in these cases, calculated with only gross fixed assets taken as denominator, would show unrealistic scores if the value of human assets is not included.

(ii) Another argument is that there is no assurance or future benefits from human resources. This argument is also not tenable. When fixed assets like plant and machinery are procured, the cost incurred is the estimated potential value of the benefits likely to be derived. Uncertainties of changes in technology and production process and premature obsolescence of machinery are taken into account while assessing their potential benefits and service life. There is no reason why human assets should not be amenable to the same treatment.

(iii) One more objection to human resource accounting is that it may not be recognised by tax laws. This objection again cannot be sustained. In practice, even now the profit and loss accounts prepared on the basis of existing conventions and concepts have to be redrawn for tax accounting purposes. It should thus be possible to overcome the difficulty of tax laws by incorporating the value of human resources in the financial statements, while accounting for tax purposes may be separately taken care of.

Some definitions of HRA:

1. The American Accounting Association’s Committee on Human Resource Accounting- “The process of identifying and measuring data about human resources and communicating this information to interested parties.”

2. Eric Flamholtz- “The measurement and reporting of the cost and value of people in organizational resources.”

ADVERTISEMENTS:

3. Woodruff- “Human Resource Accounting is an attempt to identify and report investments made in human resources of an organization that are presently not accounted for in conventional accounting practice. Basically it is an information system that tells the management what changes over time are occurring to the human resource in the business.”

4. Davidson and Well- “A term used to describe a variety of proposals that seek to report and emphasize the importance of human resources—knowledgeable, trained and loyal employees in a company earning process and total assets.”

5. Stephen Knauf- “The measurement and quantification of human organizational inputs such as recruiting, training, experience and commitment.”

HRA involves not just the measurement of costs involved with acquiring employees, but also the qualification of the economic value of the people in an organization. In many countries, furnishing of information regarding HRA by organizations is a common practice though this trend is yet to catch up in India.

Since proving HRA related information is not a legal requirement in India, there are only few companies which do it. However, some companies like Bharat Heavy Electricals Ltd (BHEL), Steel Authority of India Ltd. (SAIL), Oil and Natural Gas Commission (ONGC), etc. provide HRA information in their annual reports.

Human Resources Accounting (HRA) – Aims and Objectives

Human resources accounting aims at:

ADVERTISEMENTS:

(i) Increased managerial awareness of the value of human resources.

(ii) Better decisions about people, based on improved information system.

(iii) Creation of accountability on the part of management for its human resources.

(iv) Developing new measures of effective manpower utilisation.

(v) Enabling a longer time horizon for planning and budgeting.

(vi) Better human resource planning.

Human Resources Accounting (HRA) – Need and Purpose

The need for human resource accounting arose primarily as a result of the growing concern for human relations management in industry since the Sixties of this century. Behavioural scientists concerned with the management of organisations pointed out that the failure of accountants to value human resources was a serious handicap for effective management.

ADVERTISEMENTS:

(i) One of the most important aspects of the business manager’s job is the use of resources to achieve the immediate and long-run goals of the organisation. This requires resources information of many kinds. The human beings constitute an important asset for an organisation. Without people in an organisation physical and financial resources cannot be operationally effective. But no information about organisation’s human resources is available to managers in conventional accounting.

(ii) The measures of the income which are provided in the conventional statements do not accurately reflect the level of business performance. Expenses relating to the human organisation are charged to current revenue instead of being treated as investments to be amortized over the economic service life, with the result that the magnitude of net income is significantly distorted. For that reason conventional balance sheets fail to reflect the value of human assets and hence distort the value of the firm and the rate of return of investment. Distorted measures render assessment of firms and inter-firm comparison difficult.

(iii) Conventional treatment of investments on human resources may lead to the erosion of investor’s interest through management decisions harmful to the long-run success of an organisation and to the investors’ equity.

(iv) Traditional accounting involves treatment of human capital and non-human capital differently. While non-human capital is represented by the recorded value of assets, there is no record of human assets corresponding to the human capital of the organisation. But the human assets constitute a vital part of the total capital, in as much as productivity and profitability to business firms largely depend on the contribution of human assets. Two firms may be engaged in the same line of business, use identical physical assets and operate under similar market conditions, but the end results in term of growth and profitability may be quite different due to differences in their human assets. Since the value of human capital is ignored in traditional accounting practice, real assessment of the total value of a firm is not possible.

(v) Expenses incurred by a firm on recruitment, training and development of employees are treated as current costs and written off against current revenue in the conventional accounts. Expenses on employee welfare and amenities as well as incentive payments for improving efficiency are similarly treated under the presently system of accounting.

But, all these expenses are essentially of the nature of investment as the resulting benefits are more often derived over a period of time beyond one year. The conventional treatment of these expenses lead to a general inclination on the part of managers to keep down expenses on human development is welfare. The immediate saving in costs and the resulting profits are achieved neglecting the long-run impact of such a policy on the motivation and morale of the employees.

(vi) The impact of management decisions on human assets of the organisation cannot be clearly perceived if the value of human resources is not duly reported in the profit and loss account and balance sheet.

Purposes of Human Resources Accounting:

In the year 1971, renowned management expert Rensis Likert specified the following purposes of HRA:

(i) It furnishes cost/value information for making management decisions about acquiring, allocating, developing, and maintaining human resources in order to attain cost-effectiveness;

(ii) It allows management personnel to monitor effectively the use of human resources;

(iii) It provides a sound and effective basis of human asset control, that is, whether the asset is appreciated, depleted or conserved;

(iv) It helps in the development of management principles by classifying the financial consequences of various practices’.

Human Capital – Types (Intellectual Capital, Social Capital, Emotional Capital and Spiritual Capital)

Human resource accounting is in intangible form and is within the inside of human resources. Therefore, there may be different ways in which this can be classified. There are four types of human capital- intellectual capital, social capital, emotional capital, and spiritual capital. Let us briefly discuss these to identify how these contribute to individual effectiveness.

1. Intellectual Capital:

The first element of the human capital is intellectual capital which can be defined at individual level as well as at organizational level. At the level of individual, it refers to his knowledge, skills, and expertise. It may be in the form of specialized knowledge, tacit knowledge and skills, cognitive complexity, and learning capacity.

At the organizational level, intellectual capital consists of both the stock of knowledge, skills, and expertise that members of the organization collectively possess, and the knowledge and expertise that may be embedded in or owned by the organization including patents, information technology based knowledge systems, or specialized processes of work.

Ghoshal observes that “in the recent past, much management attention has been paid to this issue of intellectual capital, and rightly so. Knowledge rather than money is increasingly becoming the key competitive differentiator — certainly in service industries like consulting, investment banking, IT services, and so on, but also in manufacturing-based businesses like pharmaceuticals, consumer electronics, and electrical machinery.”

2. Social Capital:

Social capital is the second element of human capital. It is derived from the network of relationships, both internally and externally. From organization’s point of view, social capital relates to the structure, quality, and flexibility of the human networks which can be created through cohorts, joint training in which people get to know each other, job rotation through different departments and functions, long-term employment, and internal culture.

The other aspect of social capital is external — built on the relationships with external forces like customers, suppliers, government agencies, etc. However, building external relationships and working on these does not involve taking undue advantages for furthering the interest of the organization. It is used in the context of trustworthiness.

3. Emotional Capital:

Emotionality is one of the five big personality dimensions that affect job performance. In order to develop high level of emotional maturity in people for better performance, psychologists started work on it.

One of them, Daniel Goleman, coined and popularized the term emotional intelligence which refers to “emotional awareness and emotional management skills which provide the ability to balance emotion and reason so as to maximize long-term happiness.”

Emotional capital constitutes this emotional intelligence. Thus, emotional capital is the value of emotional awareness and emotional management skills of employees of an organization. Like intelligence quotient (IQ), emotional intelligence is also expressed in terms of emotional quotient (EQ). EQ emerges from mind’s status of a person and not from his brain. Thus, it is a psychological phenomenon.

Therefore, IQ and EQ are different phenomena. However, both are not mutually exclusive. A person may be high on both IQ and EQ or low on both. Persons with high EQ are high on self-awareness, self-control, autonomy, confidence, focus, purposefulness, integrity, and motivation.

In today’s context, emotional intelligence is being perceived as the most important element in a person’s success. For example, while comparing IQ and EQ, Goleman suggests that while 20 per cent success is contributed by IQ, the remaining 80 per cent success is determined by EQ. It is now widely believed that emotional intelligence rather than IQ may be the true measure of human intelligence.

Emotional intelligence plays role in the following areas:

i. For filling organizational positions with different types of jobs requiring different levels of EQ.

ii. Improving quality of work life by adopting rationality in unusual situations like organizational change, stress, criticisms, or similar such events.

iii. Developing credibility of persons as they make consistent decisions by using their rationality.

iv. Effective communication through use of appropriate emotions.

v. Conflict resolution by not involving emotionally in any conflict.

vi. Increased leadership effectiveness because of ability to regulate emotions, emotional facilitation of thinking, and ability to express emotions appropriately.

4. Spiritual Capital:

Spiritual capital has been recognized as the latest ingredient of human capital. It has emerged out of workplace spirituality. Therefore, first, let us discuss this concept. Spirituality, in general, is defined in religious term and is related to submission to God. However, workplace spirituality cannot be defined in such an abstract form but is defined in terms of recognition that people have inner life that nourishes and is nourished by meaningful work that leads to realize ultimate goal of life.

Organizations that practise spirituality are concerned with helping people to develop and reach their full potential. Many scholars have derived the meaning of spiritual capital from this theme and have defined it ‘what makes life meaningful’.

Operationally, spiritual capital is defined as individual dispositions that manifest as belief in something larger than self, a sense of interconnectedness, ethical and moral conscience, a drive to serve, and the capability to transfer these conceptualizations into behaviours and, ultimately, added value.

Spiritual capital in an organization has the following advantages:

i. It frees up higher order potential in individual.

ii. It encourages and enhances visioning.

iii. It recovers idealism and accountability.

iv. It encourages learning and new work paradigms.

v. It encourages participation and flattens hierarchy.

vi. It paves the way for organizational transformation.

vii. It achieves higher personal standards of excellence at ethics with less need for policing.

An HR practitioner has observed about the importance of EQ as such, “whereas with a high IQ, you may get hired, with a high EQ, you may get promoted. But this is a short-term perspective and long-term growth is linked to SQ.”

All these forms of human capital are not isolated rather these are interrelated. Therefore, while measuring human capital, all these must be taken together. Human resource accounting makes attempt to measure this capital.

Human Resource Accounting (HRA) – Approaches (Cost Approach, Economic Value Approach and Non-Monetary Methods)

There are different angles to HRA, regarding components of costs, investment and value related to employees of an organization. There are two approaches to assign monetary values to these aspects, the cost approach and the economic value approach. The cost approach involves the expenditures incurred by a company regarding an employees like costs of recruitment, selection, placement, training and development, etc.

On the other hand, the economic value approach regards employees as assets and measures the economic value added by the employees to the organization’s total worth. It aims to measure the benefits created by HR.

I. The Historical Cost Method:

According to this method, all the costs incurred in recruitment, selection, placement, training and development of employees are taken into account while evaluating the value of human resources. Some of these costs are direct costs like salaries while costs in terms of time spent in training and development are indirect costs.

This method is simple and easy to understand, though it suffers from many demerits; the biggest one being that since training and development costs are taken into account while valuing employees, highly skilled employees requiring lesser training will be valued lower than those requiring more training.

II. The Opportunity Cost Method:

This method calculates what would have been the returns if the money spent on HR was spent on something else. It was Hekimian and Jones who had advocated this method, also known as the Market Value Method.

This is not a very objective method and therefore is only used for internal reporting. One serious limitation of this method is that it totally disregards the fact that well-trained employees can be easily hired from outside sources, and it would be difficult to measure the opportunity costs related to them.

III. The Replacement Cost Method:

Replacement cost refers to the costs that would have to be incurred if the existing employees were to be replaced by identical ones. When an employee leaves the organization, costs of recruiting, selecting, placing and training the new employee would have to be incurred in order to replace him.

The replacement costs can be viewed from two angles: personal replacement costs and positional replacement costs. Personal replacement cost is the cost that would have to be incurred to replace an employee with a substitute who can provide the same set of services that the employee being replaced might have rendered at various positions he would have occupied during his tenure.

Positional replacement costs are the costs incurred to replace the set of services rendered by an employee in a particular position. This takes into account the position the employee is currently holding as well as the future positions expected to be held by him. The major weakness of this method is that it is highly subjective.

2. The Economic Value Approach:

I. Flamholtz’s Model of Determinants of Individual Value to Formal Organizations:

According to Flamholtz, the value of an individual to an organization is determined by the services he is expected to render. The current value of an employee is the present worth of the services that he is likely to render to the organization in future.

As an employee moves from one position to another within the organization, the set of services provided by him changes. While calculating the current value of the individual, the present cumulative value of all the possible services that may be rendered by him during his tenure with the organization is taken.

There are two dimensions to this value:

(i) Expected conditional value- This is the worth that could be possibly realized from the services of an individual over the period of his productive work life in the organization.

(ii) Expected realizable value- The expected realizable value depends upon the expected conditional value of an employee and the probability that the individual will remain in the organization for the duration of his productive work life. Since the employees may leave the organization any time they wish, it is important to ascertain the chances of their turnover.

II. Flamholtz’s Stochastic Rewards Valuation Model:

This model considers the movement of employees in an organization through various roles. This process of progressing through organizational states is called a stochastic process. The stochastic rewards valuation model measures a person’s expected conditional value and expected realizable value.

In any organization, employees generate value as they move along organizational roles and render a set of services in different capacities. It is presumed that any employee would move from one state to another over a duration of time; in this model the separation of an employee from his workplace is also considered a state. This is a very sophisticated and complex model that requires extensive information for determining the value of individuals.

III. The Lev and Schwartz Model:

According to this model, the value of human resources is calculated as the present value of estimated future earnings discounted by the rate of return on investment (cost of capital).

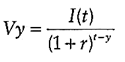

The mathematical formula for calculation of value of human resources is as follows:

Where,

V = the value of an individual ‘y’ years old.

I(t) = the individual’s annual earnings up to retirement.

t = retirement age.

r = a discount rate specific to the cost of capital to the company.

This is the most commonly used method for HRA used by most companies in India.

IV. Hekimian and Jones Competitive Bidding Model:

In this method, the managers bid against each other for the human resources already available in an organization. The highest bid is taken as the value of the employee. This is a highly subjective method as there are no set criteria to evaluate the employees. The value of an employee is based solely on the judgement of the managers.

The value of human resources can be measured by non-monetary methods as well. These methods may be used to supplement monetary methods.

I. Skills inventory – This is a simple listing of the education, knowledge, experience, skills of the organization’s human resources.

II. Performance evaluation methods – This includes methods like simple ranking method, paired comparison, check lists, graphic rating scales, etc.

III. Potential assessment – It refers to the identification of hidden skills, talents and abilities in a person which even he may be unaware of. It determines an employee’s capacity for promotion and advancement.

IV. Attitude measurements – These measurements assess employees’ attitudes towards their jobs, remuneration, work environment, etc. in order to determine their levels of satisfaction or dissatisfaction.

Human Resource Accounting (HRA) – Methods of Valuation with Formula

Human resources comprise of all those energies, skills, talents and knowledge of people, which are applied or which can be applied for the production of goods, and rendering of services. As such investment in human resources refers to all forms of investment directed to raise knowledge, skills, and aptitudes of the workforce of the organisation.

The various methods of measurements of costs and valuation of human resources are listed below:

(A) Historical Cost Method:

In this approach, actual costs incurred on recruiting, selecting, hiring, training and developing the human resources of an organisation are capitalised and amortised over the expected useful life of the human resources. Prof. Flamholtz refers to such costs as original costs of human resources when he says that ‘original cost of human resources, refers to the sacrifice that was actually incurred to acquire and develop people.’

Thus, a proper record of expenditure made on hiring, selecting, training and developing the employees is kept and a part of it is written off to the income of the next few years during which human resources will provide services. If the human assets are liquidated prematurely, the whole of the amount not written off is charged to the income of the year in which such liquidation takes place. If the useful life is recognised to be longer than originally expected, revisions are effected in the amortisation schedule.

The historical cost of human resources is very much similar to the book value of the other physical assets. When an employee is recruited by a firm, he is employed with the obvious expectation that the returns from him will far exceed the costs involved in selecting, training and developing him.

The value of human resources can be increased substantially by making investments in training in the same manner as the value of fixed assets is increased by making additions in them.

Such additional costs incurred in training and development are also capitalised and are amortised over the remaining life. The unexpired value is shown in Balance Sheet as investment in human resources. The method is simple. It meets the test of traditional principles of accounting, i.e., it is only an extension of the concept of proper matching of cost and revenue.

However, implementation of all this approach poses the following problems:

i. It only takes into account the acquisition cost of employees, ignoring altogether the aggregate value of their potential services.

ii. It is difficult to estimate the number of years over which the capitalised expenditure is to be amortised.

iii. What should be the rate of amortisation? Should it be increasing, constant or a decreasing rate?

iv. The economic value of human resources increases over time as the people gain experience. However, in this approach, the capital cost decreases through amortisation. How to reconcile the above discrepancy?

(B) Replacement Cost Method:

This method of valuation of human resources has been developed by Prof. Eric G. Flamholtz on the basis of concept of replacement cost first suggested by Mr. Likert. Replacement cost is a measure of the cost to replace a firm’s existing human resources. Rensis Likert and Pyle have suggested determination of the value of total human organisation on the basis of the assumption that new similar organisation has to be created from scratch.

They say “Suppose that tomorrow your firm had all of its present facilities everything but no personnel except the President; and he had to rebuild the human organisation back to its present effectiveness. How much would that cost? All costs would be included which are involved in recruiting, hiring, training and developing the replacement to the present level of proficiency and familiarities with the organisation. This should serve as the basis for replacement cost of the organisation from time to time.”

Hekimian and Jones have also advocated the use of replacement cost method when they say that, “in essence, we would value a human being at the estimated cost to us of replacing him with another person of equivalent talents and experience.” This approach incorporates the current value of an organisation’s human resources in its financial statements prepared at year end. But at the same time, it is at variance with the conventional accounting practice of valuing other assets.

Though current replacement costs method of valuing human assets is an improvement over the historical cost approach, yet it suffers from following drawbacks:

i. There may be no similar replacement for a similar certain existing asset. It is really difficult to find identical replacement of existing human resources in actual practice.

ii. The determination of a replacement value is affected by the incomplete information about human resources.

iii. Further, the valuation based on replacement cost lacks verifiability.

(C) Opportunity Cost Method:

This method of measuring value of human resources of an organisation is based on the economist’s concept of opportunity cost. For capital equipments and assets, Joel Dean has defined opportunity cost as “the most profitable alternative use… that is foregone by putting it to the present use.”

Hekimian and Jones suggest an opportunity cost approach to value the employees when they state that “this (opportunity cost) is the value of an asset when there is an alternative use of it.”

They have suggested a competitive bidding process for the scarce employee in an organisation. The employee is to be termed as scarce only when the employment is one division of an individual or group denies this kind of talent to other divisions. They have specifically excluded those of employees that can be hired readily from outside and thus do not recommend a bidding process for such employees.

Hence, opportunity cost of an employee in one department is calculated on the basis of offers (bids) made by other department for the employees working in this department in the same organisation. The authors of this approach believe that “a bidding process such as this is a promising approach towards- (i) optimal allocation of personnel and (ii) a quantitative base for planning, evaluating and developing human assets of the firm.”

However, this approach has narrowed down the concept of opportunity cost by restricting it to the ‘next best’ use of the employees within the same organisation. Moreover, it has specifically excluded from its purview the employees which are not scarce and are not being ‘bid’ by other departments.

It emphasised that this system of ‘competitive bidding’ is likely to result is lowering the morale and productivity of the employees, which are not so covered under this process.

Further, a person may be an expert for one department and not so for the other department. He may be valuable for the department in which he is working (and thus command a high value) and hence, may have a lower price in the bid by the other department. Thus, the total valuation of human resources based on the competitive bid price may be inaccurate and misleading.

(D) Standard Cost Method:

In this method, standard costs of recruiting, hiring, training and developing per grade employee are developed and established and made up-to-date every year. The standard cost so arrived at, for all persons are treated as the value of human resources for accounting purposes. This is an easy method for implementation and the variances produced should be analysed and would form a useful basis for control.

(E) Current Purchase Power Method:

Under this method, the historical cost of investment in human resources is converted into current purchasing power of money with the help of index numbers. The standard cost method and the current purchase power method also suffer from all the drawbacks of the replacement cost method except that they are simplest in calculation.

(F) Economic Value Method:

The present value of a portion of the firm’ future earnings attributable to human resources will be the value of human resources.

The important and widely used model for valuation is Lev and Schwartz which is explained below:

Discounted Present Value of Future Earnings Method:

The model of measurement of human capital suggested by Brauch Lev and Aba Schwartz is based on the economic concept of human capital. Capital is defined as a source of income over a period of time and its worth is the present value of future incomes discounted by a certain rate.

Irving Fisher, one of the originators of human capital theory, states that “the value of capital must be computed from the value of its estimated future net income not vice versa.”

However, a close look at the definition of capital and its valuation shows that Fisher does not talk of human or non-human capital separately. However, the valuation of human capital is an important as that of non-human capital because human beings have the productive capacity and in one form, which wealth can be held.

According to Lev and Schwartz, the value of human capital represented by a person of age is the present value of his remaining future earnings from his employment.

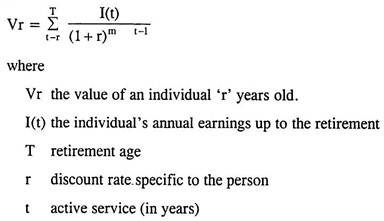

They have given the following formula for calculating the value of an individual:

Lev and Schwartz are of the opinion that “the determinations of the total value of a firm’s labour / human force is a straightforward extension” of the measurement of the value of individual. They have divided the whole labour force into certain groups as unskilled, skilled, semi-skilled, technical staff, managerial staff etc., and in accordance with different age groups.

Average earning profiles for different classes and age-groups are prepared for each group of personnel separately and present value of human capital is calculated in accordance with the above formula. The aggregate present value of the different groups of personnel will represent the capitalised future earnings of the firm as a whole.

They have advocated the use of “cost of capital” rate for the purpose of discounting the future earnings of the employees for arriving at their present value.

Thus, in brief, the model identifies an individual’s expected economic value to the organisation to his future earnings for his remaining active service life. His future expected income stream is discounted by an appropriate rate to arrive at the present value of his services. This method, however, suffers from the following weaknesses.

However, the model suffers from the following deficiencies:

1. A person’s value to an organisation is not determined entirely by the person’s inherent qualities, traits and skills but also by the organisational role in which the individual is placed. Moreover, the individual’s skill and knowledge are not valuable to an organisation in the abstract form. They are valuable only when such qualities serve as a means to achieve the organisational goals.

2. The model also does not take into account the possibility of an individual leaving the organisation for reasons other than death or retirement. It may be stated here that people quit organisations for a variety of reasons.

3. The assumptions of the model that people will not make role changes during their career with the organisation also seems to be unrealistic. In the organisations, employees are quite often transferred to other departments and their role also changes when they are transferred.

Human Resource Accounting (HRA) – Calculation

Basically HRA can be calculated through two methods- cost-based analysis and value-based analysis.

The cost-based approach focuses on the cost parameters, which may relate to historical cost, replacement cost, or opportunity cost. The cost component entails from the time the recruitment begins and ends when the employer terminates the services of the employee. The cost of acquiring talent, engaging, training and remunerating is calculated at various levels.

‘The value of an object, in economic terms, is the present value of the services that it is expected to render in future. The value-based approach suggests that the value of human resources depends upon their capacity to generate revenue. Similarly, the economic value of human resources is the present worth of the services that they are likely to render in future. This may be the value of individuals, groups or the total human organization.’

The method for calculating the economic value of individuals may be classified into monetary and non-monetary methods.

Under the economic value approach, we shall discuss the Lev and Schwartz Model employed by Indian organizations. According to this model, the value of human capital embodied in a person who is ‘y’ years old, is the present value of his/her future earnings from employment and can be calculated by using the following formula-

Where,

E (Vy) = expected value of a ‘y’ year old person’s human capital

T = the person’s retirement age

Py (t) = probability of the person leaving the organisation

l(t) = expected earnings of the person in period I

r = discount rate

The basic theme of Lev, Schwartz model is to compute the present value of the future direct and indirect payments to their employees as a measure of their human resource value. Companies adapt this model to their practical requirements by making necessary alterations, assumptions and use different discount rates for ascertaining the present value of future cash flows.

Few organizations, that recognize the value of their human resources, and furnish the related information in their annual reports in India, are: Infosys, Bharat Heavy Electricals Ltd (BHEL); the Steel Authority of India Ltd. (SAIL), the Minerals and Metals Trading Corporation of India Ltd. (MMTC), the Southern Petrochemicals Industries Corporation of India (SPIC), the Associated Cement Companies Ltd., Madras Refineries Ltd., the Hindustan Zinc Ltd., Engineers India Ltd, the Oil and Natural Gas Commission, Oil India Ltd., the Cement Corporation of India Ltd. etc.

This method of accounting is basically oriented towards measuring changes in the employees’ value rather than employers’ gains from the employees. Unless the employees’ payments are directly linked to employee productivity or the company performance, the changes in the value of employees will not reflect the changes in the employees’ contribution.

Infosys has estimated the value of its human resources of 91,187 employees, including both delivery and support staff at Rs.98,821 crore for fiscal 2008. This represented a growth a 72 per cent growth over the previous year’s Rs.57,452 crore, when the company had a headcount of 72,241 employees. The IT major has used the Lev and Schwartz model to compute the value of its human resources.

The evaluation is based on the present value of the future earnings of the employees and on the assumptions that employee compensation includes all direct and indirect benefits earned both in India and abroad. It also considered the incremental earnings based on group/age and discounted the future earnings at 13.32 per cent (14.97 per cent in the previous year), the cost of capital for computing the HR value.

The company reported a substantial jump in the education index of its employees for fiscal 2008 at 2,51,970 up from 2,03,270 in the previous year, reflecting the rising quality of its employees. The average age of the Infosys employees stood at 26 years in FY07, the same as in the previous years.

Human Resource Accounting (HRA) – Arguments in Favour and against

The issue of Human Resource Accounting has always been debated hard and there have been arguments both in favour and against regarding its practical utility and effectiveness.

Argument in Favour of Human Resource Accounting:

The various arguments favouring human resource accounting are:

1. HRA helps to justify human resource as assets in an era of knowledge-based economy.

2. Attaches numerical monetary-equivalent to the true-value of human assets in an organization.

3. Facilitates HR decision-making. HRA provides the HR professionals and management with information for managing the human resources efficiently and effectively. Such information is essential for performing the critical HR functions of acquiring, developing, allocating, conserving, utilizing, evaluating and rewarding in a proper way.

These functions are the key transformational processes that convert human resources from ‘raw’ inputs (in the form of individuals, groups and the total human organization) to outputs in the form of goods and services.

4. It also helps the management to understand the long-term cost implications to such decisions. HRA indicates whether these processes are adding value or enhancing unnecessary costs.

5. HRA helps institutional investors in making a more informed financial decision.

6. Finally, in an era where performance is closely linked to rewards and, therefore, the performance of all groups/departments/functions needs to be quantified to the extent possible, HRA helps in measuring the performance of the HR function as such.

Arguments against Human Resource Accounting:

As far as the statutory requirements go, the Companies Act, 1956 does not demand furnishing of HRA related information in the financial statements of the companies. The Institute of Chartered Accountants of India too, has not been able to bring any definitive standard or measurement in the reporting of human resources costs.

Some of the limitations to human resource accounting are:

1. Absence of demonstrated usefulness (Rhode et al).

2. Lack of evidence of HRA from financial viewpoint.

3. Lack of commonly accepted norm regarding intangible assets.

4. Inconclusive links between HRA, KM processes and organizational performance.

5. Lack of industry standard and hence every industry has to devise its own standard.

Human Resource Accounting (HRA) – Benefits and Advantages

Benefits of HRA can be listed thus:

(i) The adoption of the system of HRA discloses the value of human resources. This helps in proper interpretation of Return on Capital Employed. Such information would give a long-term perspective of the business performance which would be more reliable than the Return on Capital Employed under the conventional system of accounting.

(ii) The maintenance of detailed record relating to internal human resources (i.e., employees) improves managerial decision-making specially institutions like direct recruitment versus promotions; transfer versus retention; retrenchment or reliving versus retention; utility of cost reduction programme in view of its possible impact on human relations and impact of budgetary control on human relations and organisational behaviour. Thus, the use of HRA will definitely improve the quality of management.

(iii) The adoption of the system of HRA serves social purpose by identification of human resources as a valuable asset which will help prevention of misuse and under use due to thoughtless or rather reckless transfers, demotions, layoffs and day-to-day maltreatment by supervisors and other superiors in the administrative hierarchy; efficient allocation of resources in the economy; efficiency in the use of human resources; and proper understanding of the evil effects of avoidable labour unrest/disputes on the quality of internal human resources.

(iv) The system of HRA would no doubt, pave the way for increasing productivity of the human resources, because, the fact that a monetary value is attached to human resources and that human talents, devotion and skill are considered as valuable assets and allotted a place in the financial statements of the organisation, would boost the morale, loyalty and initiative of the employees, creating in their mind a sense of belonging towards the organisation and would act as a great incentive, giving rise to increased productivity.

This is due to the fact that human resource accounting offers the following advantages:

1. It helps in giving valuable information to the management for effective planning and managing human resources.

2. It helps in measurement of standard cost of recruiting, selecting, and developing people and organization can select a person with highest expected realizable value.

3. Human resource accounting can change the attitude of managers completely, thereby, they would try to maximize the expected value of human resources and effective use of human resources in the organization.

4. It also provides necessary data to devise suitable promotion policy, congenial work environment, and job satisfaction to the people.

Human Resource Accounting (HRA) – Problems

There are certain operational problems in human resource accounting because it attempts to measure intangibles. Therefore, subjective factors may play crucial role.

Thus, the major operational problems involved in human resource accounting are of the following types:

1. There is no well-set standard accounting practice for measuring the value of human resources. In the case of financial accounting, there are certain specified standards which every organization follows. However, in the case of human resource accounting, there are no such standards.

Therefore, various organizations that undertake valuation of human capital use their own models. As a result, value of human capital of two organizations may not be comparable.

2. Valuation of human capital is based on the assumption that the employees may remain with the organization for certain specified period. However, this assumption may not hold true in today’s context because of increased human resource mobility.

3. There is a possibility that human resource accounting may lead to the dehumanization in the organization if the valuation is not done correctly or results of the valuation are not utilized properly.

4. There is also a possibility that trade unions may oppose the use of human resource accounting. They may want parity of wages/salaries and value of employees. However, many of these problems are of operational nature or of attitudinal nature. These may be overcome by developing suitable organizational climate and culture.

Human Resources Accounting (HRA) – Issues and Concerns

Human resources accounting (HRA) is an information system that tells the management what changes have been occurring in the HR department of the business over a period of time. HRA also involves accounting for investment in people, their replacement costs, and the economic value of people in an organization.

Organizations can assess how much they can earn from an individual as the intellectual assets of a company are often worth three or four times the tangible asset value. Human capital provides valuable expert services, such as consulting, financial planning, and assurance services, which are in great demand.

In India, very few companies, for example, BHEL, Infosys, and Reliance Industries, have implemented HRA. Infosys, which started showing human resource as an asset in its balance sheet, has been reaping high market valuations. NIIT has been following a similar method called economic value addition (EVA), which helps assess the real value of an employee in the company.

Indian organizations have invested substantially in defining and implementing various processes and systems with a view to handling three main aspects, that is, competencies, commitment, and culture.

Competencies are not restricted to individuals, but are spread over teams, departments, divisions, and small business units (SBUs). They provide the lead and competitive edge to the organization.

The commitment of the employee is a complex factor dependent upon a host of factors, such as reward and recognition, developmental and learning opportunities, mentoring and fault-tolerance levels, etc. in the organization.

Culture is represented by the values and norms articulated and practised by the organization. It improves motivational levels and the commitment of the employees, and helps in instilling a sense of pride amongst the employees. The various instruments used for culture building in the organization include climate survey, value clarification exercises, and vision/mission workshops.

Organizations that inculcate good HR practices reap several benefits. These practices drive organizational growth.

Human Resource Accounting (HRA) – Present Practice and Consequences

The current accounting practice, generally treats all costs related to human resources as of ‘revenue’ nature. The balance sheets do not disclose ‘human assets.’ All expenses incurred by the firm towards recruitment, training, development of human resources are charged against the revenue of the relevant accounting period in which they are actually incurred. This is done despite the fact that the benefits accruing from such expenses relate to several accounting periods.

The accountants argue that one is never sure about the realisation of future benefits from such expenses due to uncertainty of tenure of an employee. Hence, it is proper to treat such expenses as revenue expenses.

Although no separate head like “Human Assets” (i.e., human resources) appear on the balance sheet, accountants are not totally, unaware of the existence of the value of human resources. They indirectly recognise it in the process of valuation of goodwill along with several other factors.

They, however, also not favour periodic valuation of goodwill and its disclosure in balance sheet as part of the regular valuation process. They favour the amortisation of even the cost of purchased goodwill when profits are sufficient to permit it. Thus, the value of human resources is written off by amortisation of goodwill when it actually is increasing.

The measurement of inter-temporal results of business in terms of profit or loss is primarily based on the classification of all transactions into two groups- (a) Capital, and (b) Revenue. In between these two, some items of revenue nature are treated as “Deferred Revenue Items” to avoid distortions in the periodical results due to inclusion of extra ordinarily large sums of revenue nature.

On the other hand, some items of capital nature involving relatively small amounts, are treated as “revenue items” as a compliance with the “principle of materiality”. The items classified as “capital” are actually assets for the time being and they continue to appear on balance sheets of successive years till they are fully written off to profit and loss account through depreciation or amortisation. However, this is only a technique of inter-period allocations and in the long-run all capital items also become revenue items.

The current accounting practice, as it relates to human resources, generally treats all costs related to human resources as of “revenue” nature. Typical balance sheet of any business concern does not disclose “human assets”. All expenses related to recruitment, training, familiarisation and development of human resources are charged against the revenue of the relevant accounting period in which they are actually incurred.

This is done despite the fact that the benefits accruing from such expenses relate to several accounting periods. Accountancy is to justify the obvious violation of the “accrual principle” on grounds to adhere to the “principle of conservation.” They argue that one is never sure about the realisation of future benefits from such expenses due to uncertainty of the tenure of an employee. Hence, it is proper to treat such, expenses as revenue expenses.

It would be quite pertinent to note that although no separate head like “Human Resources” or “Human Assets”, appear on a balance sheet, accountants are not totally unaware of the existence of the value of human resources. They recognise it in the process of valuation of goodwill along with several other factors.

However, they do not favour periodic valuation of goodwill and its disclosure in balance sheet as part of the regular valuation process. On the contrary, they favour the amortisation of even the cost of purchased goodwill when profits are sufficient to permit it. Thus, the value of human resources is written off by amortisation of goodwill when it is actually increasing.

Consequences:

The consequences of the current accounting practice relating to human resources are multidimensional. Its policy and behavioural impacts are too significant to be ignored lightly.

They are listed below:

1. By charging the expenditure incurred on recruitment, training and development of human resources to current period’s profit and loss account, profits during that period are understated or losses overstated.

2. By not capitalising expenses relating to human resources, even when they are substantial the assets are concealed and net worth is understated to that extent.

3. By writing off goodwill when profits are rising, accountants create secret reserves.

4. Though physical assets are fully recorded under the existing system, human assets are ignored in the internal as well as external reports. This leads to faulty evaluations and decisions.

5. By not capitalising expenses related to human resources and by charging these expenses of recruitment, training and development of human resources to current periods profit and loss account, the balance sheet does not give a true and fair disclosure of the balance sheet’s contents.

6. By not valuing human resources, on the principles of accounting, depreciation (or appreciation) of human asset is ignored. Had there been any attempt to systematically measure and report the “depreciation” or appreciation of human resources, the quality of management would certainly improve.

Human Resource Accounting (HRA) in India

Under the constraints under which the financial statements are prepared under the Companies Act in India, there is no scope for showing any significant information about human resources in financial statements except the remuneration paid to them and the number of employees getting Rs 36,000 per annum or Rs 3,000 per month. But there is nothing to prohibit the companies to attach information about the worth of human resources and the results of their performance during the accounting period in notes or schedules.

In India, the concept of HRA is yet to gain momentum. Bharat Heavy Electricals is a pioneer in this direction. A few more organisations like Minerals and Metals Trading Corporation of India, Southern Petrochemical Industries Corporation. Oil and Natural Gas Commission and Neyvell Lignite Corporation are adopting this concept. But the concept is adopted as additional information.

The HRA attempt by MMTC is summarised here.

The following are the general considerations in the working of the HR concept by MMTC:

(i) Only internal human organisation (employees) is considered. External organisations like customers are not considered.

(ii) All categories of employees are included. The value of employee’s potential services is considered.

(iii) HR value is worked out on the Lev & Schwartz model.

(iv) A 12 per cent discount rate is adopted.

(v) Employees are classified according to age and pay scales under six categories — executives, supervisors, supporting technical staff, skilled artisans, unskilled and semiskilled workers and clerical staff.

(vi) Weighted average is calculated for each group on information of total number of employees at each incremental stage and in each grade.

(vii) Future number of employees is worked out on the basis of general promotion policy.

(viii) Employee considerations include direct and indirect benefits.

Human resource accounting in India has not become popular in the way in which it should be. Most companies show employee costs, measured in terms of amount of wages/salaries and of various perquisites which can be expressed in monetary terms, in their annual reports.

Besides these, they also show the number of employees category-wise. So far as valuation of human resources is concerned, only stray attempts have been made. For example, Infosys valued its human resources in 1995-96 which was Rs 184 crore, much more than its physical assets of Rs 84 crore and profit of Rs 93 crore.

Similarly, Balrampur Chini Mills valued its human resources at Rs 10.43 crore while BPL Limited valued its human resources at Rs 125.44 crore. Value of human resources in knowledge-based sectors like information technology, consultancy, electronic media, etc. is quite high.

The reasons for low importance given to human resource accounting in India are as follows:

1. In India, high importance to human resource management has been accorded only recently; earlier it was considered as fiddle. In such a situation, companies have accorded higher importance to more pressing needs of HRM rather than going for human resource accounting.

2. Many organizations do not realize the importance of human resource accounting. They hold the view that human resources are precious to them whether their value is measured or not. Therefore, the need for human resource accounting is not that important in managing human resources effectively.

3. There are certain operational problems in human resource accounting, particularly in valuation of human resources. In the case of physical and financial resources, there are generally accepted accounting principles (GAAP). In the case of valuation of intangible assets like goodwill, brands, patents, etc., there are consultants available.

However, in- the case of human resources, no such facility is available. As a result, companies show reluctance to human resource accounting.

4. Reporting of results arrived at in financial accounting is compulsory as per the legal requirements while there is no compulsion to report the results of human resource accounting. This makes companies reluctant to opt for human resource accounting.

The reasons and consequent scenario of human resource accounting should not be taken to mean that human resource accounting does not exist in India. It is followed by various companies in different forms.

For example, when a knowledge-based company like IT or business process outsourcing (BPO) company is acquired, much premium is paid for the quality of its human resources. The basis of paying such a premium is valuation of human capital. It may be mentioned that many companies in IT and BPO Sector have change hand in India.

Under the constraints of the Company Law in India, there is no scope for showing any significant information about human resources in the financial statements except remuneration paid to them (under Section 217 of the Company Law of India). Some companies in public sector and some in private sector have started giving information of their human assets, particularly their valuation. The concept of HRA is yet to gain momentum in India. However, beginning has been made.

The following companies do give information of their human assets by following a particular model of valuation of human resources.

These are:

1. Bharat Heavy Electricals Ltd.

2. Steel Authority of India Ltd.

3. Oil India Ltd.

4. Mineral & Metal Trading Corporation of India

6. Cement Corporation of India

7. Tata Motors Ltd.

8. Associated Cement Company (ACC)

9. Southern Petro Chemicals Industries Corporation

10. Infosys Technologies Ltd.