Everything you need to know about the wage and salary administration. ‘Wage and Salary Administration’ refers to the establishment and implementation of sound policies and practices of employee compensation.

It includes such areas as job evaluation, surveys of wage and salaries, analysis of relevant organisational problems, development and maintenance of wage structure, establishing rules for administering wages, wage payments incentives, benefits including health insurance, profit sharing, wage changes and adjustments, supplementary payments, control of compensation costs and other related items.

Learn about: 1. Meaning of Wage and Salary Administration 2. Definitions and Concept of Wage and Salary Administration 3. Objectives 4. Elements 5. Principles 6. Aspects 7. Functions 8. Factor 9. Essentials 10. Components 11. Machineries Used for Fixation 12. Institutions 13. Components.

What is Wage and Salary Administration: Meaning, Objectives, Functions, Machineries, Institutions and Components

Contents:

- Meaning of Wage and Salary Administration

- Definitions and Concept of Wage and Salary Administration

- Objectives of Wage and Salary Administration

- Elements of Wages and Salary System

- Principles of Wage and Salary Administration

- Aspects of Wage and Salary Administration

- Functions of Wage and Salary Administration

- Factor Affecting Wages and Salary Administration

- Essentials of a Sound Wage and Salary Structure

- Components of Wage

- Machineries Used in the Fixation of Wage and Salary

- Institutions for Wage and Salary Fixation in India

- Components of Wage and Salary Administration in India

What is Wage and Salary Administration – Meaning

Wage and salary administration refers to the establishment and implementation of sound policies and practices of employee compensation. It includes such areas as job evaluation, development and maintenance of wage structures, wage surveys, wage incentives, profit sharing, wage changes and adjustments, supplementary payments, control of compensation costs and other related pay items.

The primary requirement of all the employees is an adequate wages and salaries which will commensurate with the responsibilities and duties involved. Wage constitute the income of the worker and his standard of living and social status depend upon the wages he earns on the other hand, the wage constitute the cost of production to the management

The most important thing that the W&S administration is to start with is to determine salary levels which are determined through the process of job evaluation. Having arrived at salary levels, the other obligations of the W&S administration are to – (a) design and maintain salary structure, (b) operate salary progression systems, (c) administer and control salary reviews and (d) design and operate other allowances.

A brief description of these obligations is as follows:

1. Salary Structure:

Salary structure of an organisation comprises its salary grades (or ranges) and its salary levels for a single job or group of jobs. It is the job evaluation that plays an important role in designing a salary structure into which all the jobs of an organisation can be appropriately graded based on their relative worth.

While designing a salary structure, it is essential to provide for internal equity as well as maintaining competitive rates of pay. A salary structure can be either of the following or even a combination of both.

i. Graded Salary Structure:

It has a sequence of salary grades, each having a defined minimum or maximum. There are two options, namely – (a) to cover all the jobs of the organisation by the same structure of salary ranges or (b) to design different structures for different levels or categories of jobs.

Each grade includes jobs of roughly the same value, and actual salary earned will depend on the performance or length of service of an individual. With regard to advancement through the structure, an individual has two options, that is, either by improving performance or by promotion.

In normal course, employees move steadily from the start of the grade to the maximum limit of the grade, unless they move to a better grade. This progression can be, for convenience sake, classified into certain zones, namely –

(a) Learning zone—an individual takes his/ her own time, depending on his/her competence, ability and experience, to familiarise himself/herself with skills, knowledge, attitude and so on needed to become fully conversant and competent for the job. It is known as learning zone,

(b) Qualified zone—having passed through the learning zone, an individual makes efforts to increase his/her capacity so as to improve his/her performance and efficiency. In this zone, in which the starting salary should match the market rates for the job, the mid-point of the grade should be such as is likely to be achievable by all competent employees. Thus, the mid-point in the grade should be higher than the market rate so that employees do not leave the organisation and would continue with it and

(c) Premium zone—in every organisation, there are some employees for whom appropriate promotion opportunities do not exist, despite their commendable and exceptional performance. Such outstanding employees are encouraged in this zone by rewarding them appropriately.

ii. Salary Progression Curves:

These curves are usually meant for professional, scientific or other highly qualified personnel, linking increases in their salary over a considerable long time to their increased maturity, expertise and experience. It is also possible to have more than one rate of progression to reward employees based on their potential and actual performance.

2. Salary Progression Systems:

These refer to increases in salary in relation to merit or performance. In it, salary ranges are divided into defined zones through which an employee passes while he/she progresses. There are incremental systems which differ in their rigidity and flexibility. While the former indicates the rates at which employees can progress as per merit or experiences, in the latter (flexible), management exercises its full discretion over the award as well as the size of increments with practically no guidelines.

In between the rigid systems and flexible systems, there are middle-ranged, semi-flexi systems. It is highly desirable and in the interest of employees as also of organisation to ensure that employees are correctly placed in their range according to their performance and potential.

3. Administration and Control of Salary Reviews:

While salary policies are executed, it is also necessary that salary costs against budgets are properly controlled because control is a vital element of salary administration. In salary budgets, it has to be estimated that how many people will be working at different levels of activities during the budgeted period and how much financial resources will be made available.

Another important thing in salary administration is salary reviews which can be either individual salary review or one annual review for all the staff, to decide on the merit increments. Then finally comes the fixing of salaries on appointment or promotion.

While control on starting salaries is an important issue, salary fixation on promotion also demands adequate attention. The increase in salary on promotion should be adequate, and it should leave enough scope to reward good performance in the new job.

4. Designing and Operating Other Allowances:

There are various forms of additional cash payments employers give to their employees over and above the basic salary in order to seek their commitment and active participation in the success of the enterprise, besides motivating them. This may be to compensate them for additional burden assigned to them or the like in the interest of the organisation. The reward may be in the form of bonus, medical facilities, holidays, sick pay, pensions and so on.

What is Wage and Salary Administration – Definitions and Concept

The wage and salary administration is difficult and important task before the management, these are probably the most vital factors in deciding the conditions of the employment Wages and salaries are not merely important determination of standard of living and the per capita income of the workers, but master key to achieve higher productivity and higher morale.

Amongst all the problems, the workers face, wage is the most pressing and persistent one. The efficiency of the workers and the standard of his living, the economic well-being of the workers. The cost of wages as an item of cost of production and the competitive strength of the industry, are all related to the problems of wages.

The term ‘wages’ has different connotations to the worker, the union leader and the management While the worker is concerned with his ‘take-home pay’ and its purchasing power, the union leader is apt to think of wages as “that which can be bargained about with the employer”, implying principally the schedule of rates of pay for different jobs in the plant. To the management, wages are a major item of cost which, in turn, depends on the amount produced by workers in the plant as well as how much they are paid.

Again in a restricted sense wages are defined “as a sum of money paid under contract by an employer to a worker for services rendered”. Wages, thus, constitute a contract income, fixed or settled, as between employers and employees.

From a broader new point, as the state is committed to the enlargement of the productive capacity of the community to increase national dividend from which all parties draw their sustenance and the state too its capacity for strength and social services, wages refer to that distributive share in the value produced by all economic activities that is allocated to payment for personal services, more particularly those of the group commonly considered as labour. Thus, wages are paralleled, in the economic process of distribution, by other shares known as rent and interest, allocated by the same mechanism to the owners of land and capital.

Definitions of Wage:

The wage is the remuneration paid by the employers to his employees. According to laissez faire policy, wage is the price paid to the worker for the services he has sold to the employer. If could be the contract income settled, between the employers and the employees But the commodity theory of labour is no more in reactive and so wage cannot be treated as mere price for the service paid to the employer.

It is a compensation paid to the worker in return for the contribution he makes for the achievement of the corporate objectives. At the same time wages do not include the prerequisites like travelling allowances, employees contribution to provident fund, value of housing accommodation, welfare amenities provided for the workers, gratuity payable on discharge overtime payments, family allowance etc.

Wages are usually paid in terms of money soon after the completion of certain amount of service like one day, one week, two week, and one month (monthly wages are called salary). The earnings may be expressed in terms of money called nominal wages or in terms of goods and services purchasable with money called Real Wages.

Wages in the widest sense mean any economic compensation paid by the employer under some contract to his workers for the services rendered by them. Wages, therefore, include family allowance, relief pay, financial support and other benefits. But, in the narrower sense, wages are the price paid for the services of labour in the process of production and include only the performance wages or wages proper. They are composed of two parts the basic wage and other allowance.

The basic wage is the remuneration, by a way of basic salary and allowances, by which is paid or payable to an employee in terms of his contract of employment for the work done by him. Allowances, on the other hand, are paid in addition to the basic wage to maintain the value of basic wages over a period of time. Such allowance includes holiday pay, overtime pay, bonus, and social security benefits. These are usually not included in the definition of wages.

According to Benham, “wages means the amount paid to the labour for his services to the employer”.

According to Yoder and Heneman, “wages are the compensation of wage earners, the numerous employees who use the tools and equipment for their employers to produce goods and services that are sold by their employers”.

According to P.M. Stohank, “wages is that labour’s remuneration which creates the utility”.

Thus, we see that wages are paid to the employees for their services in the process of production. Basically, there is no difference between wage and salary. Payments made to manual labour is generally called as wages, while money paid periodically (say monthly) to such employees whose output cannot be easily measured in units, such as clerical staff, supervisory staff or managerial personnel, is referred to as salaries. Salary also includes commission, bonus, fringe benefits, etc.

Salary:

As salary is a compensation to an employees for the personal services rendered on weekly, monthly or annual basis. Salary is usually associated with office employees, supervisors, managers and professional as well as technical staff etc.

What is Wage and Salary Administration – 14 Important Objectives

Wage and salary administration is a part of human resource management function. It is a vital area of HR activities. A company which introduces well defined/administered wage and salary package (compensation package) can be able to procure, utilize and retain competent and effective human resources. Developmental activities become smooth in such company. So, it is essential for the company to have sound, effective and rational wage and salary administration.

The objectives of compensation and administration programme are:

i. To ensure maintenance of equity in respect of payment of salary/wages in terms of equal pay for equal work.

ii. To establish a system of job analysis so that job description and job specification activities can be accurate and specific.

iii. To create a pool of talented, skilled and dynamic work force, so that they can deliver quality goods and services at reasonable cost.

iv. To make employees aware of wage and salary policies, procedures, practice, latest amendments (if any), so that they can make comparative study with other organizations to find out salient changes/variations if any.

v. To ensure effective control over all activities concerning wage/salary, welfare, social security, fringe benefit, incentive, bonus etc.

vi. To introduce a system for complying with provisions of law, statutes and for proper implementation of agreements, settlement in respect of compensation of employees.

vii. To make evaluation of jobs so that there cannot be any dissatisfaction amongst employees in respect of their wages / salaries and other benefits.

viii. To evaluate employee performance accurately for identification of performers and non-performers so, that steps can be taken to develop competencies for performance of present jobs and future jobs also.

ix. To develop mutual understanding, faith and confidence between employees and management through introducing fair and attractive compensation package.

x. To ensure maintenance of internal equity, external equity and individual equity in respect of providing compensation to employees.

xi. To establish cordial and healthy industrial relations as most of issues which arise out of wage and salary areas are given weightage.

xii. To make the employees happy, contented and committed through satisfaction of their physiological needs so that functioning of organization becomes smooth and undisturbed.

xiii. To develop a ‘culture of reciprocality’ among two parties (employer and employees) to contribute to each other through introduction of attractive compensation package.

xiv. To ensure organizational effectiveness by way of creating contented and committed workforce.

What is Wage and Salary Administration – 9 Elements Identified by Henderson

Wage and salary system should have relationship with the performance, satisfaction and attainment of goals of an individual.

Henderson identified the following elements of wage and salary system:

(a) Measuring the actual performance.

(b) Comparing the performance with the salary received.

(c) Finding out the dissatisfaction arising from unfulfilled needs and unattained goals.

(d) Evaluating the unsatisfied wants and unreached goals of the employees.

(e) Adjusting the salary levels accordingly with a view to enable the employees to reach unreached goals and fulfil the unfulfilled needs.

(f) Determining the effort necessary to achieve standards.

(g) Identifying the available salary opportunities, their costs, estimating the worth of its members of these salary opportunities and then communicating them to employees.

(h) Relating salary to needs and goals.

(i) Developing quality, quantity and time standard relating to work and goals.

What is Wage and Salary Administration – 9 Important Principles: Protection of Interests, Uniform and Consistent, Consistency in Planning and a Few Others

Principle # 1. Protection of Interests:

The wage policy should be developed by keeping in view the interests of all concerned viz. the employer, the employees, the consumers and the community as a whole. This is necessary to protect the interests of all these people.

Principle # 2. Uniform and Consistent:

The wage policy should be reduced to writing with a view to ensure uniformity and consistency in its application.

Principle # 3. Consistency in Planning:

The wage and salary plans should be consistent with the overall plans of the organisation. The wage and salary planning should be an integral part of the financial planning.

Principle # 4. Flexible and Adaptable:

The wage and salary plans should be flexible and adaptable to the changes in internal and external conditions of the organisation.

Principle # 5. Employee Participation:

The management should ensure that all the employees have come to know and have understood clearly the wage policy of the organisation. The representatives of the employees should be associated in the formulation and implementation the wage policy.

Principle # 6. Close Scrutiny:

The wage and salary decisions should be checked closely against the pre-determined standards.

Principle # 7. Simple and Quick Expeditious:

All the wage and salary plans should be simple and expedite administrative process quickly.

Principle # 8. Simple Organisational Set-Up:

Proper organizational set-up with complete satisfied information about all the employees should be developed for competition determination and administration.

Principle # 9. Periodical Review and Revision:

The wage policy and programmes should be periodically reviewed and revised so that it can conform to the changing needs of the organization.

What is Wage and Salary Administration – 5 Important Aspects: Economic, Sociological, Psychological, Political and Ethical Aspects

The question of compensation primarily involves economic considerations, but certain other aspects such as sociological, psychological, political and ethical also have their relevance.

1. Economic Aspects:

The economic issues are of utmost importance in wage and salary administration. Wages and salaries constitute an important element of cost of production. As a purchaser of labour services, the employer tries to obtain the greatest quantity and the highest quality for his money paid for the services. On the other hand, the worker tries to get the highest price for his services he is able to command.

“These transactions are supposed to set the price in terms of the demands of purchasers and the supplies of the sellers and to allocate the scare economic resource (labour) to the employment where it has most value.”

In these transactions, numerous considerations influence the decisions of both the buyers and the sellers of labour services. As a buyer of labour services, the employer has to know that labour is perishable in that, if today’s labour is not purchased today, it has no value tomorrow. Also, labour services are heterogeneous in character varying with person to person, time to time and different sets of circumstances.

The purchaser can only partially control the factors that influence the quantity of labour supplied. For example, he may be able to enhance the quantity and quality of labour supply through suitable human resources policies and plans. Like the supply of labour, the demand for labour is also variable. The purchaser buys labour services for producing goods and services for sale.

The employer’s demand for labour is derived from the demand for goods and services. A change in the demand for these goods and services also has a potent influence on the demand for labour.

The supplier of labour services also encounters difficulties in determining the price of his services. His knowledge of the market conditions is generally imperfect. The factors influencing his mobility, the employer’s human resources policies and practices, working conditions, supervision, union’s role, governmental regulations and a host of other factors add to the difficulties in regard to his decisions.

On account of the variability of both demands and supplies of labour, the purchaser encounters difficulties in fixing the price and the supplier in determining the price to be accepted. The complex task of establishing a balance is worked out by the labour market and the restrictive forces influencing market mechanism.

2. Sociological Aspects:

The pay received by a worker is also symbolic of his social status. “In many cases, the nature of social prestige is reflected in the type of job itself, yet monetary rewards associated with various jobs also, in part, symbolise social distinctions.” The amount of pay received by a worker has manifestations in family status, friendships and social interactions.

The establishment of wage relativities requires careful consideration of customary and traditional forces. In a caste-ridden society like that of India, dirty and disagreeable jobs often involving hard and unpleasant manual labour have traditionally been confined to the remuneration for the jobs falling low in the caste hierarchy and who have generally been poorly paid when compared to those performed by higher caste people.

Women’s wages have been another area where the influence of customary practices can be clearly discerned. The pay of jobs in the past and that being paid by other employers presently are also important areas of consideration in compensation. “The employer as an institution, the union as an institution and the action of groups operating within the restrictions set by custom and tradition have a strong influence on pay.”

3. Psychological Aspects:

Pay constitutes an important motivator to people by way of providing a means for satisfying needs. Although non-financial rewards also contribute towards motivating people at work, financial inducements play a very important role in motivating them. This is particularly true in organisations with poorly paid employees.

Compensation policy in an organisation requires to be designed in such a way so as to ensure that employees are able to see that their efforts towards the achievement of organisation’s objectives coincide with the accomplishment of their own goals. Psychological issues are also involved in the establishment of a balance between financial and non-financial incentives.

4. Political Aspects:

Compensation issues often involve political considerations in the form of power and influence. The influence of trade unions affiliated to political parties in power or of even strong unaffiliated unions is very often reflected in collective bargaining. Not infrequently, wage-bargains in unionised industries have influenced wage fixation in non-unionised industries also.

Similarly, strong employers or their organisations having the support of political party in power dominate wage negotiations. This has been particularly true in the era of globalisation all over the world. Even within a particular organisation, groups influence internal wage negotiations.

In many countries, government extensively interferes in the domain of wages and related matters, and curtails the freedom of the parties to decide compensation issues on their own. A particular mention may be made of minimum wage laws, establishment of tripartite wage boards, regulation of payment of bonus, provision of fringe benefits as a statutory requirement and governmental schemes of neutralisation for rise in prices.

5. Ethical Aspects:

In many cases, emphasis has to be laid on establishing fairness in wage relativities and reducing gross inequities in wage structure. Pay decisions are very often made to correct inequities and discrimination against employers, unions, groups and individuals. The question of establishing fairness often results in formulation of norms in matters of wages. Norms pertaining to “minimum wage”, “fair wage”, “living wage,” reckoning of differentials and women’s wages may be cited as examples.

What is Wage and Salary Administration – 10 Important Functions

A sound W&S administration is supposed to:

1. Recommend to top management the wage policies for the administration of wage programme

2. Recommend changes in the wage policies as and when required

3. Design and maintain salary structure

4. Design and operate other allowances

5. Operate salary progression systems department-wise and remove anomalies if there is any

6. Review W&S scheme

7. Ensure that activities of W&S administration are in line with the company policies

8. Ensure proper system of job description, job evaluation, job pricing and wage structure

9. Maintain internal and external relativities and individual worth in salary levels

10. Recommend to top management for its approval specific pay raises for executives above a specified limit.

What is Wage and Salary Administration – 11 Major Factors Affecting Wages and Salary Administration

1. The organisation’s ability to pay and the sustaining strengths;

2. Supply and demand of labour and levels of skills;

3. The prevailing market rate – government legislation on wages;

4. The cost of living- inflation rate;

5. Living wage concept;

6. Productivity;

7. Trade Union’s Bargaining power and judicial directions;

8. Job requirements, working conditions;

9. Managerial attitudes;

10. Psychological and Sociological factors; and

11. Levels of Skills available in the market.

Factor # 1. The Organisation’s Ability to Pay:

Wage increases should be given by those organisations that can afford them. Companies that have good sales and, therefore, high profits tend to pay higher wages than those which are running at a loss or earning low profits because of the high cost of production or low sales. In the short run, the economic influence on the ability to pay is practically nil.

All employers, irrespective of their profits or losses, must pay no less than their competitors and need pay no more if they wish to attract and keep workers. In the long run, the ability to pay is very important. During the time of prosperity, employers pay high wages to carry on profitable operations and because of their increased ability to pay.

But during a period of depression, wages are cut because funds are not available. Marginal firms and non-profit organisations (like hospitals and educational institutions) pay relatively low wages because of low or no profits.

Factor # 2. Supply and Demand of Labour:

The labour market conditions or supply and demand forces operate at the national, regional and local levels, and determine organisational wage structure and level.

If the demand for certain skills is high and the supply is low, the result is a rise in the price to be paid for these skills. When prolonged and acute, these labour-market pressures probably force most organisations to “reclassify hard-to-fill jobs at a higher level” than that suggested by the job evaluation. The other alternative is to pay higher wages if the labour supply is scarce; and lower wages when it is excessive.

Similarly, if there is great demand for labour expertise, wages rise; but if the demand for manpower skill is minimal, the wages will be relatively low. Mescon says- “The supply and demand compensation criterion is very closely related to the prevailing pay, comparable wage and on-going wage concepts since, in essence, all of these remuneration standards are determined by immediate market forces and factors.”

Factor # 3. Prevailing Market Rate:

This is also known as the ‘comparable wage’ or ‘going wage rate’, and is the most widely used criterion. An organization’s compensation policies generally tend to conform to the wage-rates payable by the industry and the community.

This is done for several reasons. First, competition demands that competitors adhere to the same relative wage level. Second, various government laws and judicial decisions make the adoption of uniform wage rates an attractive proposition. Third, trade unions encourage this practice so that their members have equal pay, equal work and geographical differences may be eliminated.

Fourth, functionally related firms in the same industry require essentially the same quality of employees, with the same skills and experience. This results in a considerable uniformity in wage and salary rates.

Finally, if the same or about the same general rates of wages are not paid to the employees as are paid by the organisation’s competitors, it will not be able to attract and maintain a sufficient quantity and quality of manpower.

Belcher and Atchison observe- “Some companies pay on the high side of the market in order to obtain goodwill or to insure an adequate supply of labour, while other organisations pay lower wages because economically they have to, or because by lowering hiring requirements they can keep jobs adequately manned.”

Factor # 4. The Cost of Living:

The cost-of-living pay criterion is usually regarded as an automatic minimum equity pay criterion. This criterion calls for pay adjustments based on increases or decreases in an acceptable cost of living index. In recognition of the influence of the cost of living, “escalator clauses” are written into labour contracts.

When the cost of living increases, workers and trade unions demand adjusted wages to offset the erosion of real wages. However, when living costs are stable or decline, the management does not resort to this argument as a reason for wage reductions. The cost of living index at certain places is higher than other cities or centres.

Factor # 5. The Living Wage:

This criterion means that wages paid should be adequate to enable an employee to maintain himself and his family at a reasonable level of existence. However, employers do not generally favour using the concept of a living wage as a guide to wage determination because they prefer to base the wages of an employee on his contribution rather than on his need. Also, they feel that the level of living prescribed in a worker’s budget is open to argument since it is based on subjective opinion.

Factor # 6. Productivity:

Productivity is another criterion, and is measured in terms of output per man-hour. It is not due to labour efforts alone, technological improvements, better organisation and management, the development of better methods of production by labour and management, greater ingenuity and skill by labour are all responsible for the increase in productivity.

Actually, productivity measures the contribution of all the resource factors – men, machines, methods, materials and management. No productivity index can be devised which will measure only the productivity of a specific factor of production.

Another problem is that productivity can be measured at several levels – job, plant, industry or national, economic level. Thus, although theoretically it is a sound compensation criterion, operationally many problems and complications arise because of definitional measurement and conceptual issues.

Factor # 7. Trade Union’s Bargaining Power:

Trade unions do affect rate of wages. Generally, the stronger and more powerful the trade union, the higher the wages are. A trade union’s bargaining power is often measured in terms of its membership, its financial strength and the nature of its leadership. A strike or a threat of a strike is the most powerful weapon used by it.

Sometimes trade unions force wages up faster than increases in productivity would allow and become responsible for unemployment or higher prices and inflation. However, for those remaining on the pay roll, a real gain is often achieved as a consequence of a trade union’s stronger bargaining power.

Factor # 8. Job Requirements:

Generally, the more difficult a job, the higher are the wages. Measures of job difficulty are frequently used when the relative value of one job to another in an organisation is to be ascertained. Jobs are graded according to the relative skill, effort, responsibility, and job conditions required.

Factor # 9. Managerial Attitudes:

Managerial attitudes have a decisive influence on the wage structure and wage level since judgment is exercised in many areas of wage and salary administration – including whether the firm should pay below average, or above average rates, what job factors should be used to reflect job worth, the weight to be given for performance or length of service, and so forth, both the structure and level of wages are bound to be affected accordingly.

These matters require the approval of the top executives. Lester observes, “Top management’s desire to maintain or enhance the company’s prestige has been a major factor in the wage policy of a number of firms. Desires to improve or maintain morale, to attract high-caliber employees, to reduce turnover, and to provide a high living standard for employees as possible also appear to be factors in management’s wage-policy decisions.”

Factor # 10. Psychological and Social Factors:

Psychological and social factors determine in a significant measure how hard a person will work for the compensation received or what pressures he will exert to get his compensation increased. Psychologically, persons perceive the level of wages as a measure of success in life; people may feel secure; have an inferiority complex, seem inadequate or feel the reverse of all these. They may not take pride in their work, or in the wages they get.

Therefore, the management in establishing wage rates should not overlook these things. Sociologically and ethically, people feel that “equal work should carry equal wages,” that “wages should be commensurate with their efforts,” that “they are not exploited, and that no distinction is made on the basis of caste, colour, sex or religion.” To satisfy the conditions of equity, fairness and justice, a management should take these factors into consideration.

Factor # 11. Skill Levels Available in the Market:

With the rapid growth of industries, business trade, there is shortage of skilled resources. The technological development, automation has been affecting the skill levels at a fast rate. Thus, the wage levels of skilled employees are constantly changing and an organisation has to keep its level up to suit the market needs.

What is Wage and Salary Administration – Essentials of a Sound Wage and Salary Structure

i. Wage payment system should be fair and justifiable to the workers and organization,

ii. Wage payment system should help in maximizing workers’ satisfaction and minimizing labour turnover.

iii. Wage payment system should assure minimum guaranteed wages to all workers.

iv. Wage payment system should assure equal pay for equal work.

v. Wage payment system should provide more wages to efficient and skilled workers.

vi. Wage payment system should follow government policy and trade union’s norms.

vii. Wage payment system should be simple and understandable to all the workers.

viii. Wage payment system should help in improving performance and productivity of the workers.

ix. Wage payment system should be flexible enough to suit the needs of the organization.

What is Wage and Salary Administration – Major Components of an Employee’s Wage: Basic Pay, Dearness Allowance, Incentive, Fringe Benefits and Annual Statutory Bonus

The wage or salary components of Indian employees depend on various factors such as paying capacity of employers, conditions of labour market and legal provisions.

The major components of an employee’s wage are:

1. Basic Pay

2. Dearness Allowance (D.A.)

3. Incentive

4. Fringe benefits

5. Annual statutory bonus

1. Basic Pay:

It is a wage paid over a period of time to the employees. Period of time could be monthly or fortnightly. The principles of various methods of regulation of pay serve as guidelines in determining basic pay. Besides these, the nature of job, experience needed and specific skill required to perform a particular job are also considered during the course of fixing of basic pay.

2. Dearness Allowance (D.A.):

D.A. is the second important component of wage packet paid to the employee which compensates the rise in prices of essential commodities. In other words, D.A. is paid to neutralize the effects of inflation. Now a days, the payment of D.A. has become an integral and essential part of the organizational wage system in India.

Generally three methods are applicable for the computation of D.A. in India:

(i) All India Consumer Price Index (AICPI) – The Labour Bureau Shimla, compute the AICPI from time to time considering the base 1960 = 100 points.

(ii) Time Factor – D.A. is linked to the rise in the AICPI is a related period instead of linking it to fortnightly or monthly fluctuations in index.

(iii) Point Factors – D.A. rises in line with a rise in the number of index points above a specific level.

3. Incentive:

Incentive plans are applicable to all the employees of the organisation but payable to only efficient and performer employees. Employees of higher skill and energy can earn extra wages by extra effort. Incentives are designed to stimulate human effort over and above the current efforts. It gives the employees a feeling of security, fair dealing and also ensures higher productivity and high wages. Both employer and employees share the benefit of time saved. It is the best example of win-win situation.

4. Fringe Benefits:

This refers to the extra amount paid to employees in addition to the normal wage or salary. They are applicable to all employees of the organisation and are not directly related to the performance of employees. Now a days, these fringe benefits become important part of a compensation package of employees.

These are house rent allowance, city compensatory allowance, medical allowance, home travel concession, medical and educational facilities, transport benefit, paid holidays, subsidies loan facilities such as – house construction and vehicle loan, provident funds, gratuity and pension funds and other benefits.

These benefits cost to the employer for which the wage earner does not do any specific work. The variation is also possible in fringe benefits from one organisation to another organisation and from one region to another region, depending upon the health of the organisation. These perquisites are provided to the employees in order to retain them and enhance their efficiency.

5. Bonus:

Bonus is a very important earning component of employees, besides wage or salary. The dictionary meaning of bonus is an addition payment amount of the employees beyond the normal wage or salary. According to Corpus Juris Se cundum, “Bonus is an allowance in addition to what is usual, current or stipulated; a sum given or paid beyond what is legally required to be paid to the recipient; something given in addition to what is ordinarily received by or strictly due to the recipient.”

It means bonus carries an idea of something uncertain and indefinite in addition to the normal wage or salary, paid to the employees after the close of financial year; under. The payment of bonus act, 1965, it has secured the legal right of the employee.

What is Wage and Salary Administration – Machineries Used in the Fixation: Fair Wage Committee, Tripartite, Wage Board and a Few Others

Wage and Salary are structured and fixed on the basis of several systems such as wage and salary survey conclusions, job analysis and job evaluation, theories related to compensation and the factors affecting compensation structures. The central government has also passed various acts such as the Minimum Wage Act, the Fair Wage Act, the Equal Remuneration Act, etc.

Later on, to minimize the rising disputes and establish control on the determination of wage/salaries, various committees, boards or commissions were constituted.

1. Fair Wage Committee

2. Tripartite or Bi-party negotiation

3. Wage Board

4. Pay Commission and

5. Tribunals to deal with the Disputes.

1. Fair Wage Committee:

Origin:

Fair Wage Committee was constituted in 1948 to examine the feasibility of assuring a minimum wage, fair wage and living wage in the context of the Articles 39 and 43 of the Fair Wage Bill put in Parliament in 1950.

According to the Fair Wage Committee, the fair wage is defined as:

“While the lower limit of the fair wage must obviously be the minimum wage, the upper limit is equally set by what may broadly be called the capacity of industry to pay”.

Between these two limits the actual wage will depend upon the consideration of:

i. Productivity of labour

ii. Prevailing rate of labour in the neighbouring industries

iii. The level of state or national income and

iv. Place of the industry.

The Government appoints this committee wherein the members are drawn from the Government, the employers and the judiciary to examine the feasibility of ensuring minimum wages.

After examining the facts, the committee defines the minimum wage and suggests the measures to ensure a fair earning to the workers. According to the Fair Wage Committee’s recommendations, the employer should ensure that the earner is able to support the self and the family (definition of “family” is given in the Act), not barely the essentials of clothes and shelter, but also a measure of frugal comfort.

2. Tripartite or Bi-Party Negotiation:

This is a mechanism to arrive at a mutually agreed structure between the employers and the employees. A compromise is reached through balancing the opposed strengths. When the problems are solved and settled between the employers and the employees, it is a collective or Bi-party negotiation, and when voluntary arbitration or adjudication is desired it becomes a Tri-party negotiation.

However, Wage Board recommendations and collective bargaining are the main machinery of this system of fixing the wages.

It originated in the writings of Sydney and Beatrice Webb, who related this term with the wage settlement process between the two parties, that is, the employers and the employees. The employee may be a representative or a union leader. Wages and wage related questions are the main issues of collective bargaining.

It is bi-party in nature, where representatives from the employers and the employee/unions form a board to discuss wage related issues and agreement is signed on the concluding remarks or agreement. However, the decisions are reached through arbitration.

The parties in collective bargaining consider and examine the detailed statistics of wage rate, earnings, and supplementary benefits, share of wages in the value-added economy and profitability of the industry.

In wage negotiations, the emphasis is laid on the following:

i. Output per man-hour

ii. Employee’s worth as compared to neighbouring industries

iii. Opportunities to earn more and payment system

iv. Performance based incentives and worth.

The positive outcome of collective bargaining is a productivity agreement.

Tripartite Negotiation:

The Wage Board is tripartite in nature and is a voluntary negotiation body set up by the Government after discussions between the employers and the employees to regulate the wages. Otherwise, the employers and the employees can voluntarily appoint an arbitrator and the issue can be discussed in front of the arbitrator to give a fair decision and to satisfy both the employers and the employees.

3. Wage Board:

Origin:

The concept of establishing a Wage Board is an outcome of the Second Five Year Plan of our country. The first non-statutory Wage Board was appointed for the cotton textile industry in March 1957, and subsequently Wage Boards were also appointed for Sugar, Cement, Tea, Coffee, Rubber plantation, Iron and Steel industry, etc. It is a statutory body established by the government to handle the disputes relating to the employers or the employees.

The Wage Board is tripartite in nature and is a voluntary negotiation body set up by discussions between the employers and the employees to regulate the wages. It consists of an equal number of representatives from the employers and the employees with an independent chairperson.

However, separate Wage Boards are set up for separate industries to fairly judge the equity concept. Each Board consists of one neutral chairperson, two independent members and two or three representatives from the workers. In addition, the Board nominates an economist and a consumer’s representative, both of whom are independent. The total numbers of representatives on this board vary from 7 to 9.

In evolving the structure of the Board, the Board has to consider the following:

i. The need of the industry in a developing economy

ii. The requirement of social justice

iii. The need of adjusting wage differentials.

The Board has to study various factors before making any recommendation. On the basis of the above criteria, the Wage Board examines the need based minimum wage, job evaluation, productivity criteria, socio-economic considerations, age legislation, need for incentives and employer’s capacity to pay to conclude their recommendations for basic pay, DA increase and other allowances.

It handles problems related to wage policy, regulations of payments, wage or salary (staff drawing less than 2500 pm) disputes and suggests guidelines for designing the compensation structures.

Wage boards may be provincial or regional. There are nearly 22 of them for different industries.

4. Pay Commission:

Origin:

Pay Commissions are the salary-fixing machinery of the central government for the employees of the public sectors and government employees. The First Pay Commission was appointed by the central government in 1946 under the Chairmanship of Justice Vardachariar.

The Commission has a team of economists, secretary/chairman of commerce and industries and representatives from relevant ministries under the Chairmanship of a retired judge.

The Government gives the directives according to which the Commission is to examine the possibilities and adequacy of any increase in the pay structure considering the impact of rising price indexes. The emphasis is laid on ensuring the work of deciding wages according to the needs of the workers /staff.

Various Commissions have been appointed from time to time in this context such as:

i. First Pay Commission in 1946 – In no case a worker’s pay should be less than a living wage.

ii. Second Pay Commission in 1957 – Recommended Rs. 80 as the minimum wage according to the All India Working Class Consumer Price Index.

iii. Third Pay Commission in 1970 – Gave an interim relief ranging from Rs. 15 to Rs. 45 per month and an entry pay for Class IV employees as Rs. 185 pm.

iv. Fourth Pay Commission in 1983 – Suggested pay scales from the lowest level to the top management level with drastic changes. (Rs. 750-900 at the lowest level to Rs. 9000 at the cabinet secretary level). It also raised the HRA by 10-15% to a flat rate of Rs. 150 to Rs. 1000 pm.

v. Fifth Pay Commission in 1986 – It raised the retirement age to 60, recommended a minimum rise of Rs. 75 pm HRA by 30% and salaries range as Rs. 2440 pm to Rs. 2600 pm. It also suggested abolition of over time, cut in gazetted holidays, 6 days working week, transport allowance and eligibility ceiling of Rs. 4500 on payment of bonus.

5. Tribunals:

Origin:

Since independence, tribunals have been the main instruments for the settlement of wage disputes. They are provisional along with the Supreme Court to settle the wage-related disputes based on an appeal to fair compensation.

Structure:

The Benches of the Labour Court, the Civil Court and the Supreme Court deal with these appeals for compensation dispute settlements.

The employee or the union, when not satisfied with the decisions of the employer, appeal to these tribunals which after examining the comparative rates, factors considered in the issues like reason for enhancement, decisions on previous cases, capacity of the employer to pay, status of the organization and consumer price index, formulate their judgements.

What is Wage and Salary Administration – Institutions in India: Pay Commission, Wage Boards, Adjudication and a Few Others

Wages and salary incomes in India are fixed through several institutions.

These are as follows:

1. Pay Commission

2. Wage Boards

3. Adjudication

4. Market Rate Analysis

5. Collective Bargaining

1. Pay Commission:

It is an administrative system that the Government of India set up in 1946 to determine the salaries of government employees. The first pay commission was established in 1946, and since then, every decade has seen the birth of a commission that decides the salaries of government employees for a particular time-frame.

The commission, besides looking into the pay structure, allowances and other benefits of the Central staff, has also been directed to recommend new pay structures for personnel of the armed forces and officers and employees of regulatory bodies set up under Acts of Parliament.

The commission will also look into the desirability and need to sanction interim relief, if any, till the time its recommendations are submitted and accepted by the Government.

2. Wage Boards:

The institution of wage boards has come to be widely accepted in India as a viable wage determination mechanism. The boards have been successful in fulfilling their primary object of promoting industry-wise negotiations and active participation by the parties in determination of wages and other conditions of employment.

Wage boards are set up by the Government, but in selection of members of wags boards, the government cannot appoint members arbitrarily. Members to wage boards can be appointed only with the consent of employers and employees.

The representatives of employers on the wage boards are the nominees of employers’ organization and the workers’ representatives are the nominees of the national center of trade unions of the industry concerned. The composition of wage boards is as a rule tripartite, representing the interests of labour, Management and Public.

Labour and management representatives are nominated in equal numbers by the government, with consultation and consent of major Central Organizations. These boards are chaired by government nominated members representing the public.

Wage board function industry- wise with broad terms of reference, which include recommending the minimum wage differential, cost of living, compensation, regional wage differentials, gratuity, hours of work, etc.

3. Adjudication:

Since independence adjudication has been one of the main instruments for settlement of disputes, improvement in wage scales and standardization of wages and allowances. If the collective bargaining and conciliation fail to bring any amicable settlement between labour and management then the cases may be referred for voluntary or compulsory arbitration. If any party is not satisfied with the award given by arbitrator may go to the Supreme Court. In such cases, the Supreme Court is the final arbiter.

Numerous wage disputes in many industries have been referred for adjudication to labour courts and tribunals during past ten decades. The High Courts and Supreme Court have also adjudicated upon such disputes. The awards given by these authorities not only helped in formulation of a body of principles governing wage fixation but laid foundation for present wage structure in many of major industries.

Some major legislations which govern the principles of wage fixation are as follows:

Minimum Wages Act, 1948, Payments of Wages Act, 1936, Equal Remuneration Act, 1976, Industrial Disputes Act, 1947, and Companies Act 1956.

4. Market Rate Analysis:

Market rate analysis is the process of collecting and comparing data on the rates and benefits provided for similar jobs in other organizations and the rates’ at which pay is increasing elsewhere. It is conducted by means of surveys that review published data and/or collect data from various sources.

Decision on levels of pay following market rate analysis will be guided by the pay policy of the organization or its market stance – that is, how it and its pay levels relate to market levels.

Objectives of Market Rate Analysis:

The objectives are stated below:

i. Obtain relevant, accurate, representative and up-to-date data on levels of pay and benefits for specified jobs within the organization,

ii. Maintain a competitive pay and benefit position in relation to the market place, thus enabling the organization to attract and retain people of the quality it needs,

iii. Inform decisions on levels of pay for individual jobs and pay brackets or scales for pay structure grades.

iv. Provide guidance on pay review decisions concerning any adjustments required to general or individual pay levels.

v. Support a market pricing approach to valuing jobs.

vi. Offer guidance on internal differentials by reference to the differentials in the external labour market.

5. Collective Bargaining:

Role of Collective Bargaining in Wage Determination:

Collective bargaining relates to those arrangements under which wages and conditions of employments are generally decided by agreements negotiated between the parties.

Broadly speaking the following factors affect the wage determination by collective bargaining process:

a. Alternate choices & demands

b. Institutional necessities

c. The right and capacity to strike

In a modern democratic society wages are determined by collective bargaining in contrast to individual bargaining by working.

In the matter of wage bargaining, unions are primarily concerned with:

a. General level of wage rates

b. Structure of wages rates (differential among occupations)

c. Bonus, incentives and fringe benefits, Administration of Wages.

What is Wage and Salary Administration – Components: Basic Wage/Salary, Dearness Allowance, Bonus and Fringe Benefits

Generally, wage and salary structure of an administration or a company depend upon several factors such as wage settlement, labour market situation, company’s nature and size etc. It consists of certain grades, scale and range of pay in each scale. Each scale has a minimum and a maximum limit. Pay structure also depend upon the length of service or performance of the employee.

Pay structure in India consists of the following components:

(1) Basic Wage/salary.

(2) Dearness Allowance (D.A.) and other allowances

(3) Bonus and other incentives

(4) Fringe benefit or perquisites.

Component # 1. Basic Wage/Salary:

The basic wage provides the – foundation of pay pocket. It is provided in ways, e.g. minimum wage, fair wage and living wage. Such wages are afforded according to mental and physical requirement of the job. It also depend upon the economic condition of the county and also the level of national income.

(1) Minimum Wage:

Minimum wage is that wage which is sufficient to cover the bare physical needs of a worker and his family. If an enterprise is unable to pay minimum wage to its workers, it has no right to exist.

(2) Fair Wage:

A fair wage is more than the minimum wage providing the bare necessities of life. It is a step toward the ideal of living wage.

Such wage depend on several factors like:

(a) The productivity of labour,

(b) Level of national income and its distribution,

(c) Employer’s capacity to pay,

(d) The prevailing rates of wages in the same occupation in the same region.

(3) Living Wage:

It is the wage that provides in addition to the necessities of life certain amenities considered necessary for the well-being of the worker in a particular society. It ensures a normal standard of life of the employee. There should be progressive improvement in the wage with improvement in the economic life of the nation.

Component # 2. Dearness Allowance and Other Allowances:

This allowance is given to protect the real wages of worker during inflation.

The following methods are used to calculate dearness allowance:

(i) Flat Rate:

In this method, D.A. is paid at a flat rate to all workers irrespective of his or her wage levels and regardless of changes in the consumer price index.

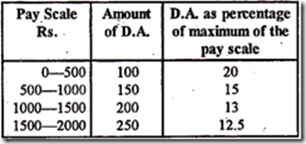

(ii) Graduated Scale:

By this method, D.A. increases with each slab of salary. Therefore, D.A. as a percentage of basic pay decreases steadily. As shown the Table –

(iii) Index Based D.A.:

By this method, a flat rate per point of index is prescribed so that all workers determine the same amount of D.A. irrespective of their pay scale.

(iv) D.A. Linked to Index and Pay Scale:

Under this method, a higher rate of D.A. is prescribed for lower pay scales and a lower rate for higher pay scales.

In addition to D.A. other allowances are also provided to the employee that are: Educational allowance, Bank allowance, Medical allowance, Tiffin allowance, House rent allowance, Car allowance etc.

Component # 3. Bonus:

Bonus is the share of the workers in the prosperity of an enterprise. It is an incentive to higher productivity. Bonus is provided to every employee who have drawing a salary not exceeding Rs.3.500 per month. And it is calculated on a salary of Rs.2,500 per month. Bonus rate is from 8.33 per cent to 20 per cent it is paid within 8 months from the closing of the accounting year.

An employee dismissed from service for fraud, theft, and misappropriation or violent behaviour is not entitled to bonus. The payment of Bonus Act, 1965 imposes a statutory liability upon an employer to pay bonus.

Component # 4. Fringe Benefits:

In addition to wages, salaries, allowances and bonus, employees are paid several benefits, which are called fringe benefits.

Such fringe benefits are:

(i) Payment without work – Sick leave, maturity leave, paid vacation etc.

(ii) Extra pay for time worked – Diwali bonus, profit sharing, unemployment compensation.

(iii) Health benefit – Accident, insurance, hospitalisation, life insurance, and sick benefits.

(iv) Security benefit – Unemployment, lay-off pay, insurance, holiday.

(v) Retirement benefit – Provident fund, gratuity ord.

(vi) Subsidized housing, transport, lunch, etc.

(vii) Medical care, child-care, educational and recreational facilities.

(viii) Stock option, interest-free loan, holiday, homes, etc.

In India wage or salary system is a sensitive and complex area of administration because wages exercise a significant influence on income distribution prices and industrial relations. But a sound and rational wage policy is necessary of reinsuring reasonable living standards to the working class and for full utilization of the country’s human resources. A sound wage system helps in prevention of employee exploitation.